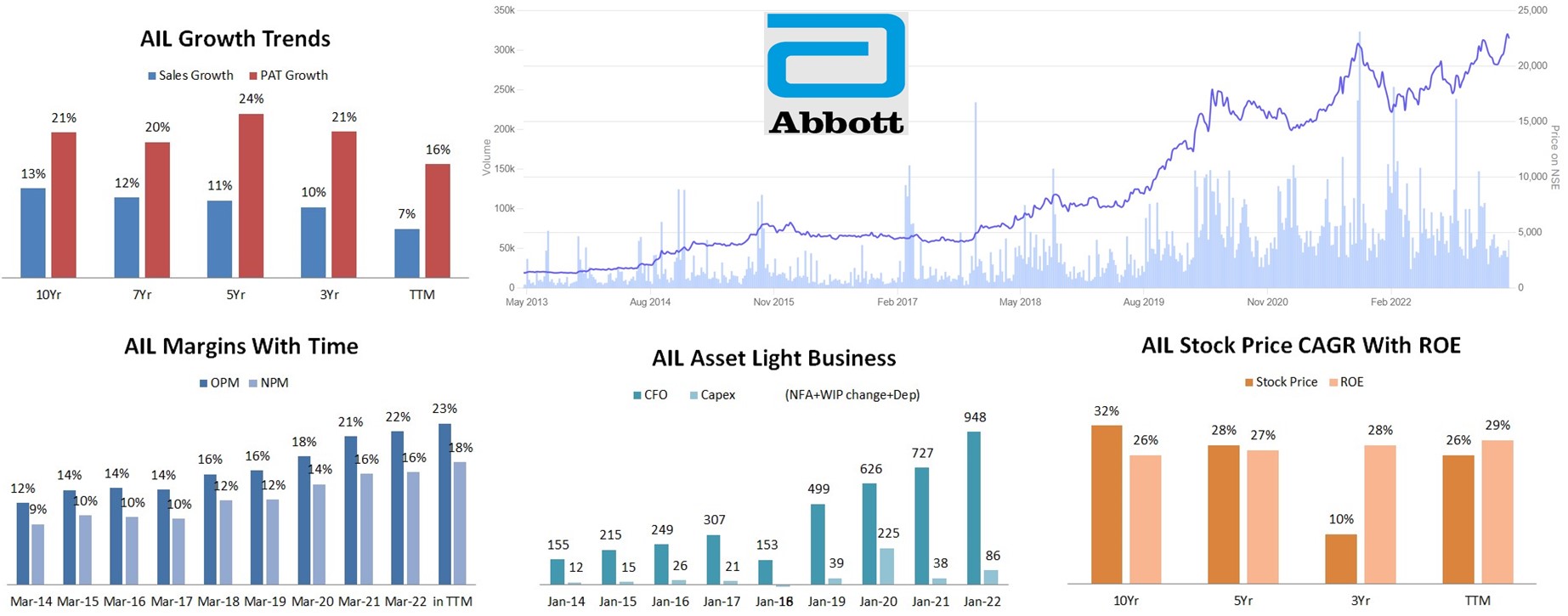

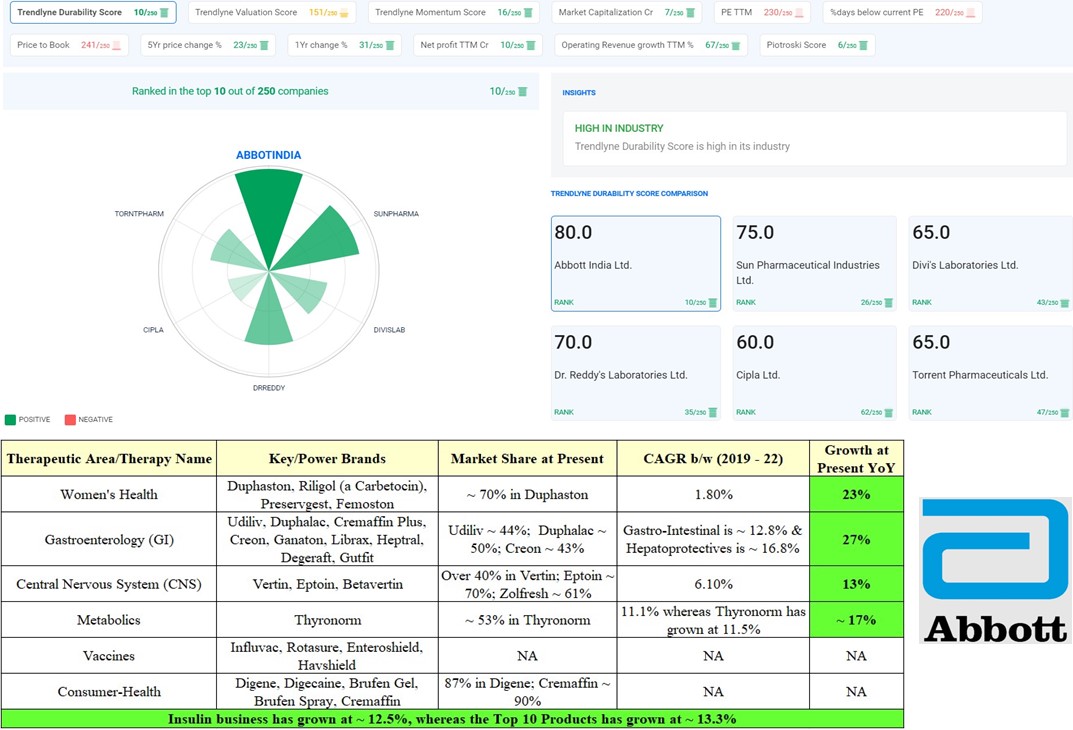

In last 10 years, Abbott India Ltd (AIL) Sales has Grown at ~ 13% CAGR whereas the PAT has Grown at 21% CAGR. Given the Consistency with which AIL has Improved its OPM & NPM in last 10 years, along with Capability to Generate Relatively Higher Free Cash Flow compared to its Competitors, Stock of the company has given returns at ~ 32% during the said period.

Abbott India’s Strategy To Become $1 Billion Revenue Company by 2025 – Challenges & The Growth Drivers

India ranks as one of the top countries in terms of pharmaceuticals production with ~3,000 drug companies and ~10,500 manufacturing units. According to IBEF, the Indian Pharmaceuticals Industry ranks 3rd worldwide by volume (10% share of production) and 14th by value (1.5% share).

It contributes about 2% to India’s GDP and 8% of the countries merchandize exports. Indian pharmaceuticals hold an important place in the global supply chain, with over 50% of global demand for various vaccines, 40% of generic demand in the US and 25% of all the medicine in UK supplied by India.

Further, the sector has been historically resilient to economic shocks exemplified by the fact that drugs and pharmaceuticals was one of the two commodity groups that did not Degrow!

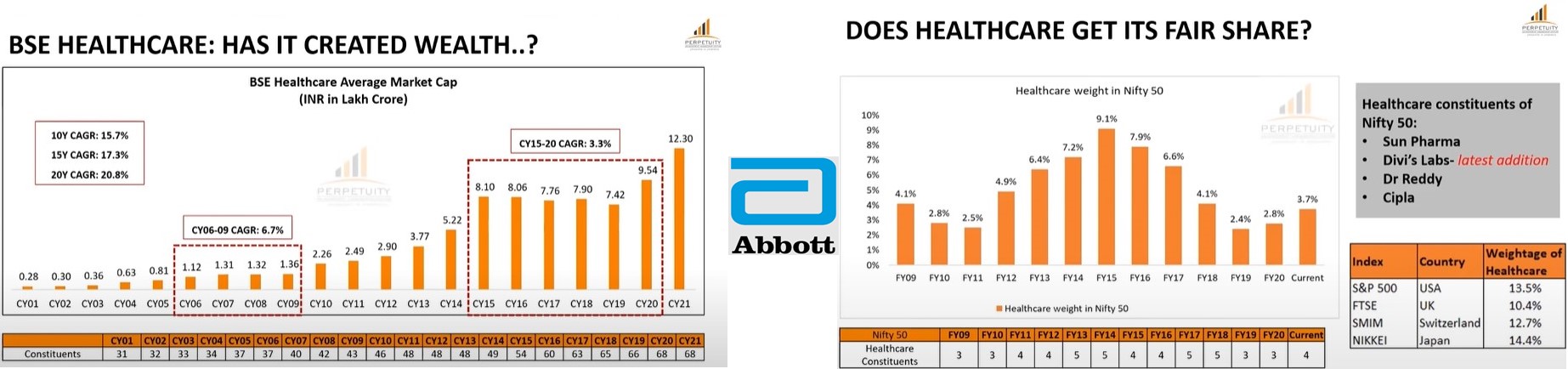

If we look at the S & P BSE Healthcare Index, whose Market Cap at present is ~ 13.51 Lac Crore, then one may observe that Drugs & Pharma Industry ( In short “Pharma”) constitutes ~ 11.05 Lac Crore (i.e., around 81.8% of the Whole Healthcare Index) and of 99 stocks in the Index, 75 are from the Pharma Industry.

The BSE Healthcare Index on Longer Period has given Higher ROI (for e.g. if 10 Year CAGR is 15.7% than on 20 year period returns has been ~ 20.8%). In addition, Healthcare Index has given Negative returns b/w 2015 to 2019, but later the Index has started performing better again from 2020 due to Covid19 pandemic. Eventually out-performance came in 2021 and from 2022 onwards, the growth has been ~ 9.6% to 11%.

Clearly, the Index looks to Sustains this Growth Rate for few more years. This projection further gets complemented by the fact that the Healthcare Weightage in Nifty50 was at 15 year Low in 2019 and now it is on the ‘Catch Up’ trajectory like the one it had b/w FY11 to FY15.

Further, Revenue of the Pharma Sector comprises of:

1) – Domestic Market – which constitutes ~ 29%;

2) – US Generic Market – which constitute ~ 28%;

3) – API/CRAMS – which constitutes ~ 15% &;

4) – Others – which constitutes remaining ~ 28%

As per IQVIA, India’s Domestic Pharmaceuticals market (IPM) is estimated at Rs. 2,08,452 Crores in 2022 with growth of 9.5% vs 2021. Over the long-term, the market is expected to grow annually at ~ 9.2% till 2026.

IPM remains dominated by the branded generics which make up 80% of sales by value as per IQVIA.

Further, In terms of 10-year return (CAGR) only 2 companies are there with a Market Cap of above Rs. 5000 Crore that has given Higher Return compared to Abbott India Ltd (AIL), but these 2 companies has delivered Negative Free Cash Flow per Share compared to AIL’s FCF of Rs. 446.90 per Share. Moreover, Dividend per Share of these 2 companies are negligible compared to that of AIL.

Interestingly Only 1 company i.e. Sanofi India Ltd, out of all the 75 in the listed Pharma Industry, has given higher FCF & Dividend per Share compared to that of AIL, but its Stock returns were Just at 8.41% & 3.22% CAGR on 10 years & 5 years period respectively.

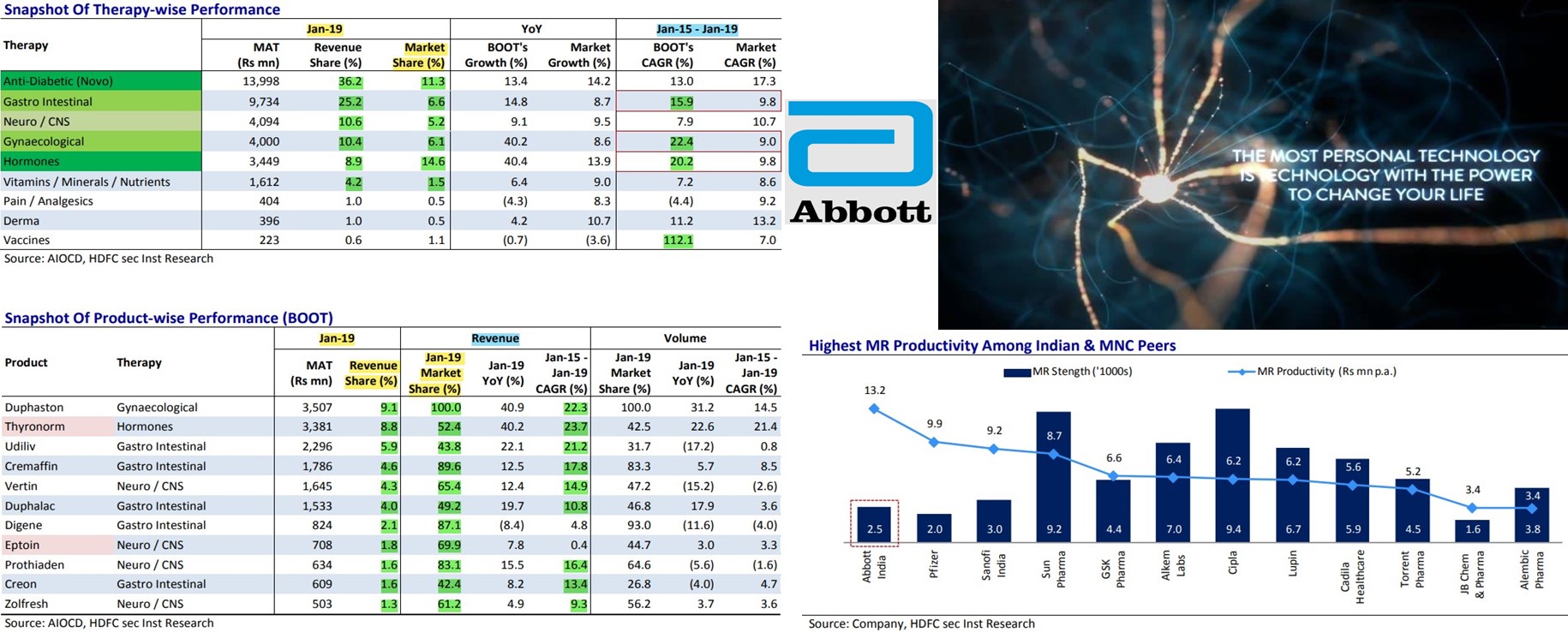

Out of the 3000 Drug companies in the IPM, 80% are Indian companies whereas 20% are MNCs and ~ (43% – 44%) Market Share is held just by the Top 10 companies. Abbott India Ltd is the only MNC in this League of 10 Companies (that’s some Consolidation to say the least) which is growing faster than the market.

How Abbott India Has Been Able To Perform So Extraordinarily In A Market, Which Has Been Traditionally Dominated By The Indian Companies?

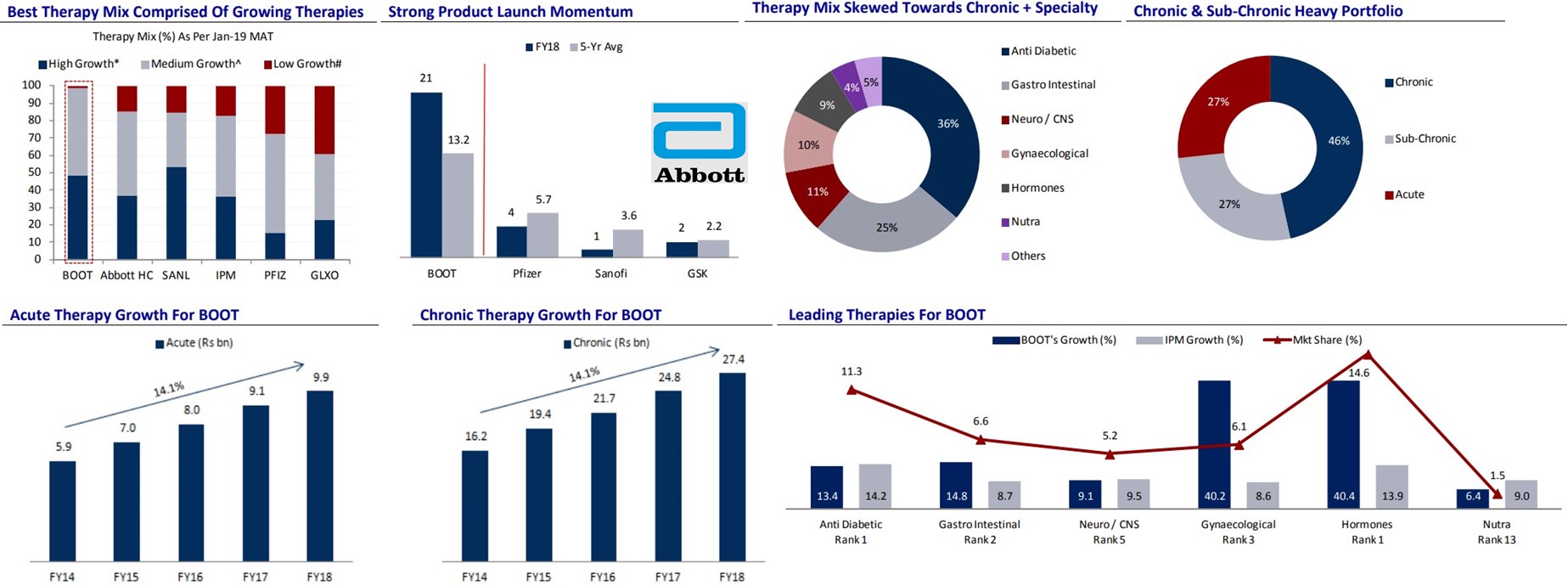

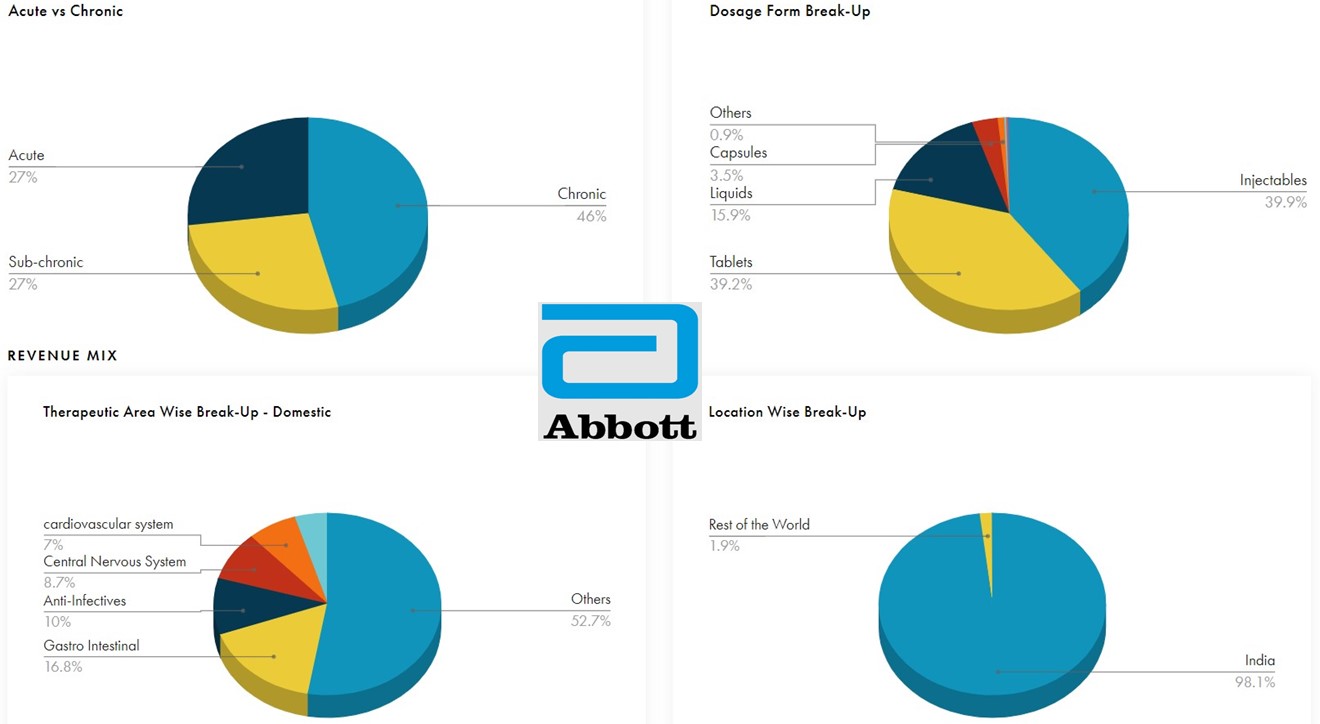

Abbott India operates in a Single reportable business segment i.e., “Pharmaceuticals”. The Company provides Products and Solutions across various therapeutic areas and most of which are either High Growth Or Medium Growth Therapies such as Women’s Health, Gastroenterology, Central Nervous System, Metabolics, Multi-Specialty, Vaccines, Consumer Health, etc.

Abbott India’s High Growth Broad Portfolio Mix of over 125 products (as of March 2022) has been consistently outpacing the Indian Pharma Market (IPM) growth.

Abbott’s Top 15 brands are Leaders (positioned either at #1 or #2) in their respective segments and contribute to over 80% in the Company’s core business.

To be more precise, company have some 60 odd brands in its portfolio (as on Sept. 2022) out of which:

1) – The Top 10 brands, each of which is a Mega-Brand of size over $ 15 million, give ~ 70% of the business to the company;

2) – The Next 10 Brands, each of which is a Second-Line Brand of size b/w $5 to $15 million range, gives another 20% of the business.

Therefore ~ 90% of the business comes from these Top 20 Brands combined , and the rest of the 40 Brands contribute remaining 10% of the business revenue.

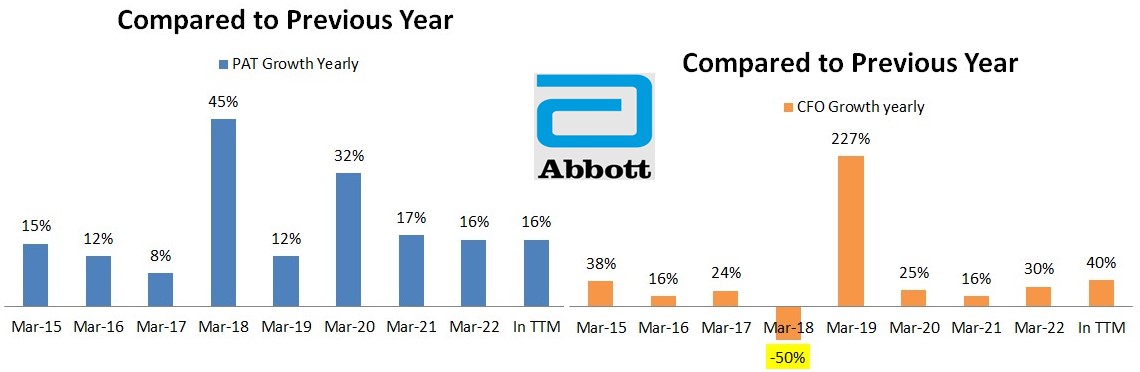

Over the years company have been continuously looking at the alternative to Improve the Effectiveness and Efficiency of its Operating Model, so as to not only grow faster than the market but also to grow its Bottom Line (PAT) Faster than the Top Line (Revenues).

Accordingly the company has consistently improved its Distribution Margin and Product Mix, while Reducing the Cost of Goods, and Optimizing the Pricing & Productivity. The aim of company has always been on how to improve the Returns on the Capital it deploys and thereby ensuring that it has more Operating Leverage, while growing faster than the market.

Further, company has also Discontinued some of the brands with Low Market Attractiveness, Low Size, and Low Distribution Margin.

Abbott India’s Dominating Market Share in its Top 10 High Growth Mega-Brands has been the key to its Phenomenal Success in the IPM, at-least so till Mid 2020, reasons being:

1) – One of the Highest Organic Revenue Growth in IPM;

2) – Chronic and Sub-Chronic Heavy Portfolio;

3) – Consistent New Product (Niche Generics) Launches every year;

4) – Highest MR Productivity among the Indian & MNC peers;

5) – Small Exposure (~ 15%) to NLEM (till 2019);

6) – Over 2/3rd of the Total Manufacturing is Outsourced to third party manufacturers. Hence Capex requirement is very Low, whereas Brand Leveraging is High;

7) – Till March 2019, company used to Re-invest ~ 70% of its FCF back into the Business. Hence, the ROCE had been ~ 38% to 41%. Later b/w 2020 to 2023, Abbott India has distributed Dividend that was ~ 87% of its CFO and 82% of its PAT, so the Re-investment has been dropped to ~ 13% of the CFO.

Abbott India Capability To Create Categories Around The Life Style & High Growth Chronic Diseases, And Then To Build Strong Brands Within These Categories

In absence of Strict Regulatory Body like US FDA in India, people always felt the need of Trust Worthy Brands instead of generic medicine, which could ensure the patient High Quality & Safe Drug with Proven Better Therapeutic Effect!

Abbott India realized this need much ahead of the time and given that the Size of Opportunity in the IPM & the Potential of Grow there was just Enormous, so the company has Strategically Targeted the High Growth Therapy Categories around the Life Style Diseases which are mostly Chronic in Nature and requires Life Long Treatment (i.e. Drug intake).

Given the Sustainability of the Category’s Growth was almost ensured here once the Brand is Established, therefore focus of the company was eventually shifted on Creating a Portfolio of Strong Brands within these Therapeutic Categories and to Expand these brands from Big to Mega-Brands, in terms of their Revenue Size and Market Share Gained within the Domestic IPM.

Abbott India consistently worked upon identifying the new opportunities and accordingly Launched new drugs either in the existing therapeutic category or created a new category to enter into the new therapeutic area, driven by the need-gaps in the healthcare pipeline.

Besides providing High-Quality & Safe Medicines, company also extended its value by providing solutions for better Patient Education, Faster Diagnosis, and Increased Medication Adherence. This is how the company aimed to Drive Differentiation for doctors and better outcomes for their patients, by engaging across the Continuum of Care!

Abbott’s robust distribution network of more than 8,600 stockists and 60 Lakhs retailers along with the 3,000+ member resilient sales force, has helped it to expand its reach to all the Metros and Tier-1 cities of the country.

Growth Drivers That Helped To Make Abbott India, What It Is Today

Govt. Initiatives like improvements in the Drug Registration Process, OTC Regulations Policy, Expansion of Ayushman Bharat, etc. (to know more, read: https://jyadareturn.com/divis-lab/), along with new age channels like E-Pharmacy and Pharmacy Chains, has also been the Growth Drivers for the company.

Besides, Diversification of the company’s multi-channel engagement models has helped it to Increase its reach to the Professionals, Build business across the traditional retail and institution channels, and explore the e-commerce avenues to expand access of its medicines.

With Branded Generics Dominating the Indian pharma industry, it was imperative for Abbott India to offer Competitive Advantage that provides Beyond the Pill Solutions. Company is pioneer in supporting its patients with solutions that helped them across the treatment journey in GI space along with Women’s Health, Vertigo, and Liver health space.

Abbott India Strategy To Become $1 Billion Revenue Company By 2025

Abbott India is aiming to grow its Top Line at ~ 15% to become $1 billion revenue company by 2025 and to achieve this milestone, the company has build a Strategy centered around:

1) – Portfolio – For its top 10 brands that constitutes “Mega-Brands” and the Next 10 brands* –

(*which are also from the very strong emerging therapy areas, with a very strong presence in the market backed by the strong medical marketing initiatives, and have a Potential for the Exponential growth in the future)

– Abbott India is aiming to build a Lifecycle Management around these 20 Brands to plug all the possible unmet needs w.r.t. to this group.

Simultaneously the company is also aiming to launch 75 New Products in the next 5 years, some of which will be targeting the molecules that are going Off Patent {i.e. Loss of Exclusivity (LOE)} across the therapy areas in the near future, while the rest will be from the existing related therapy areas.

Clearly Abbott India wants to Gain most from its Power Brands & Leading Therapies, where it is already having Strong Growth and Dominant Market Share!

2) – Geographical Expansion – Currently almost 70% of Abbott’s business comes from the Metros and Tier-1 cities. The company is now aiming to Expand into Tier-2 & Tier-3 cities also;

3) – Leveraging the New Engagement Channels – E-Pharmacy, Pharmacy Chains, and Multi-Channel Engagement Models to expand penetration and reach to Uncovered doctors and patients in the Uncovered geographies.

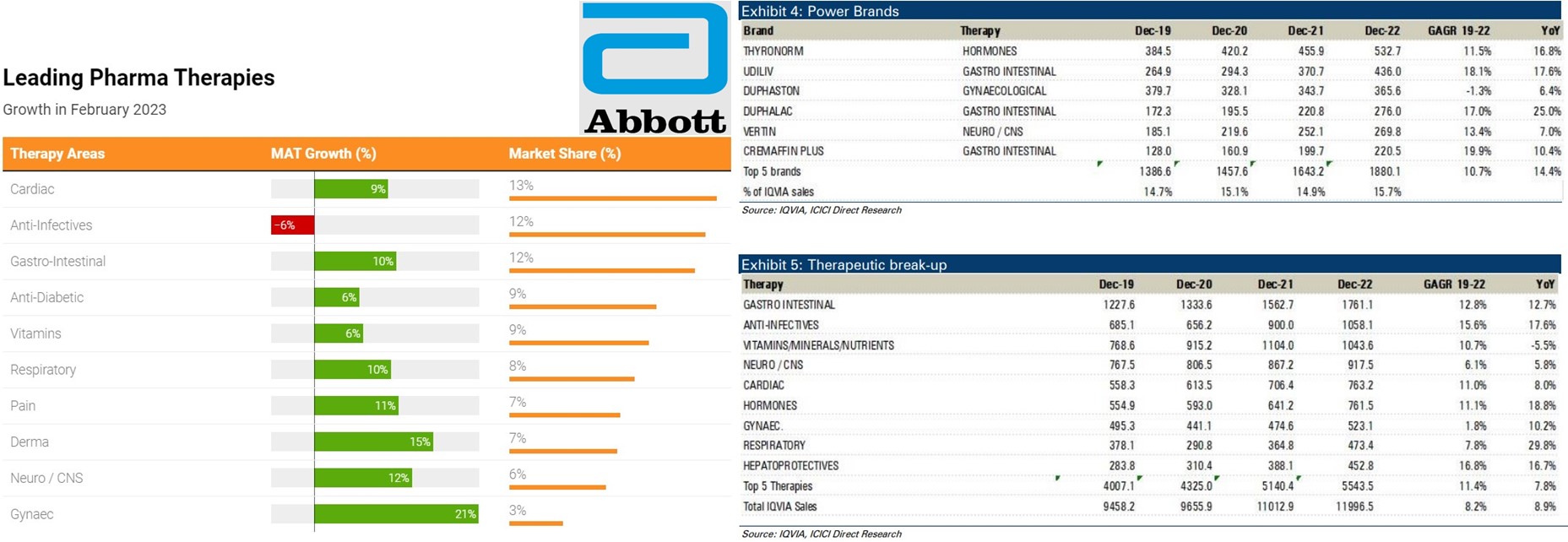

Abbott India reported revenue growth of 8.3% YoY in Q3FY23, which stood below the IPM growth of 12.0%. The said growth was majorly driven by the Sales Improvement in Key therapies such as Gastro-Intestinal (+12% YoY) and Hormones (+17% YoY).

Major Brands such as Udiliv and Cremaffin Plus grew by 17.6% and 10.4% YoY respectively, while other Brands such as Ryzodez and Duphalac grew by 35% and 25% respectively, though Vertin (in CNS) increased by just 7%.

Vitamins and CNS segments reported De-growth of -5.5% and 5.5% respectively. Abbott India’s Major Brand in Gynecological therapy – Duphaston have been stabilized and grew by 6.5% YoY in Q2FY23 (Source: AIOCD).

Abbott India’s Duphaston was having 100% market share till 2019, after which Mankind has launched “Dydrogesterone” in competition with Duphaston, which not only resulted in the De-growth of Duphaston sales but Duphaston has also lost around 30% market share to around 41 other competitors (including Mankind) in the market.

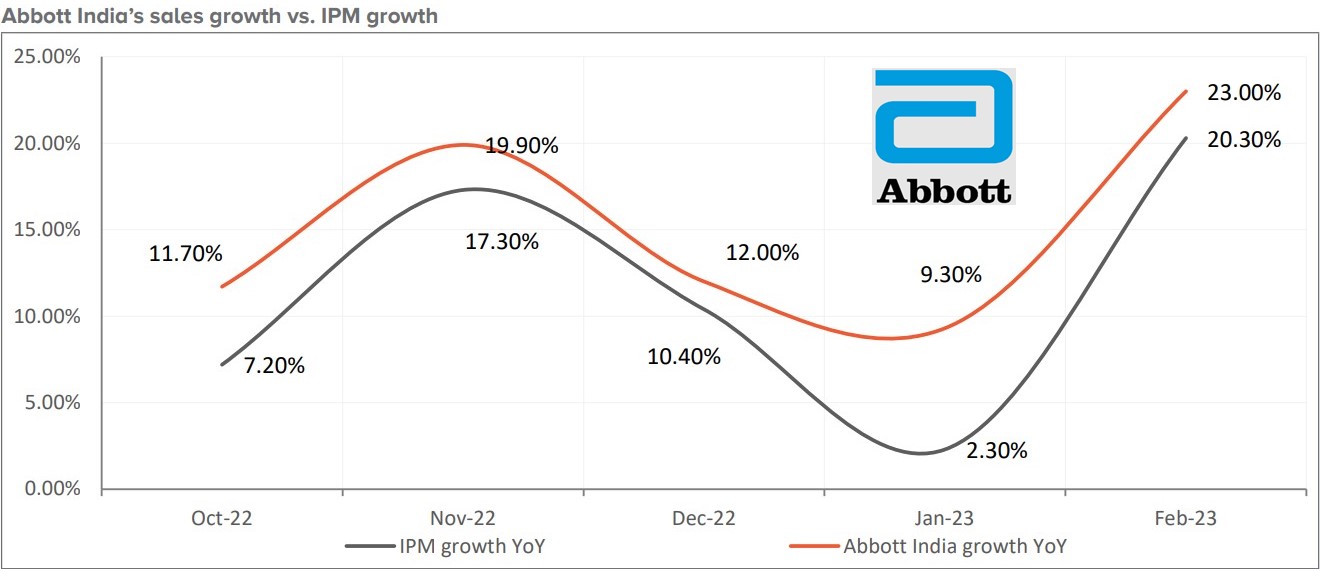

As per AIOCD’s data, in Feb 2023 Abbott India posted 23.0% YoY growth in India sales vis-a-vis IPM growth of 20.3% YoY for the same month. This indicates resilience of the company’s key brands across its focused therapy areas. The company intends to continue to gain the market share by striving to grow above IPM growth, as it enjoys Strong doctor prescription Stickiness.

Abbott India’s Strategy of ‘Beyond the Pill’ comprising Awareness, Diagnosis, Treatment, and Compliance for Consumers is expected to Deliver Continued Growth for the business.

Additionally, Abbott’s focus on Innovative Marketing and Brand-Building exercises besides foraying into the new-age channels such as Pharmacy Chains and e-Pharmacies has also supported in its above-IPM growth rate.

In addition to Sustained Pricing and New Product Growth, Volumes are also expected to pick up, which bodes well for the company. Moreover, being less exposed to Highly Regulated Markets like US, the Costs of Compliance/Hurdles are Insignificant and this augurs well for Abbott India.

Further, the gradual shifting of the company key products to the Goa plant from Third Party Manufacturers, would enable OPM expansion and it is also expected that the Stable Sales in the Duphaston brand and an Increase in the volume of the Thyronorm brand, may facilitate Abbott India to deliver Revenue and PAT Growth at CAGR of ~ 12% and 15.0% respectively over FY22 – FY25E.

It looks that AIL may reach $1 Billion Yearly Revenue by 2025 end, if that CAGR goes little higher to ~ 15%!