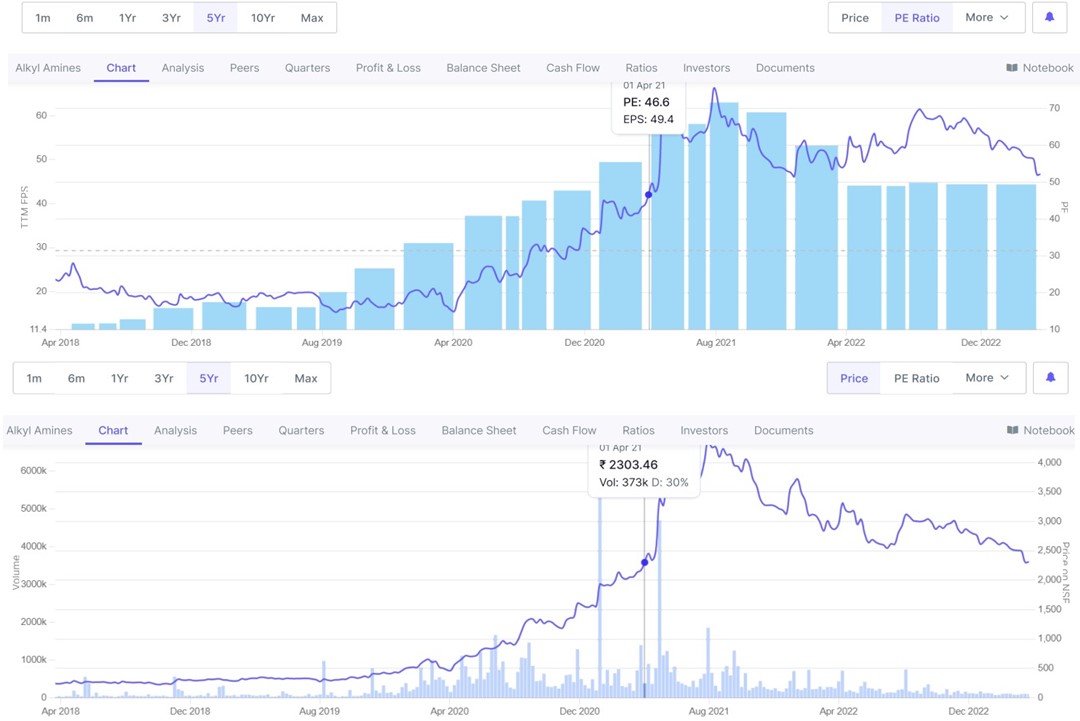

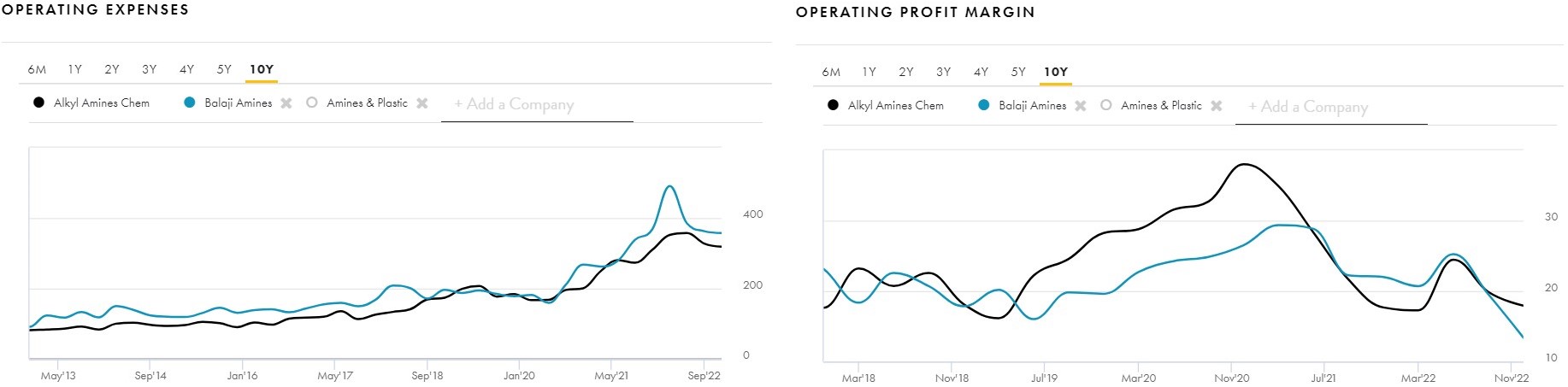

On 30th July 2021, Stock of Alkyl Amines was at its Life Time High of Rs. 4387. Almost 20 months later, company’s stock is now Trading at ~ Rs. 2310 whereas the Operating Profit Margins has Contracted from 35% to ~ 20% and the Net Profit Margins has Shrinked from 24% to ~ 13%, during these 20 months.

Moreover EPS that used to be ~ Rs. 62.95 in TTM, as on 30th July 2021, has reduced to Rs. 44.32 in TTM as on 31st December 2022. As a result, the Stock Price has Fallen by ~ 48% from its Life Time High against an EPS Drop of ~ 29.6% and Still, the Investors of this Multibagger Share are Not in any hurry to go after buying the stock relentlessly!

So, what led to such lacklustre financial performance of the company and its stock?

So, What Has Been The Reason Behind The Margin Deterioration And PAT Degrowth Of Alkyl Amines Chemicals Ltd & How Will The Company Regain Its Lost Margins?

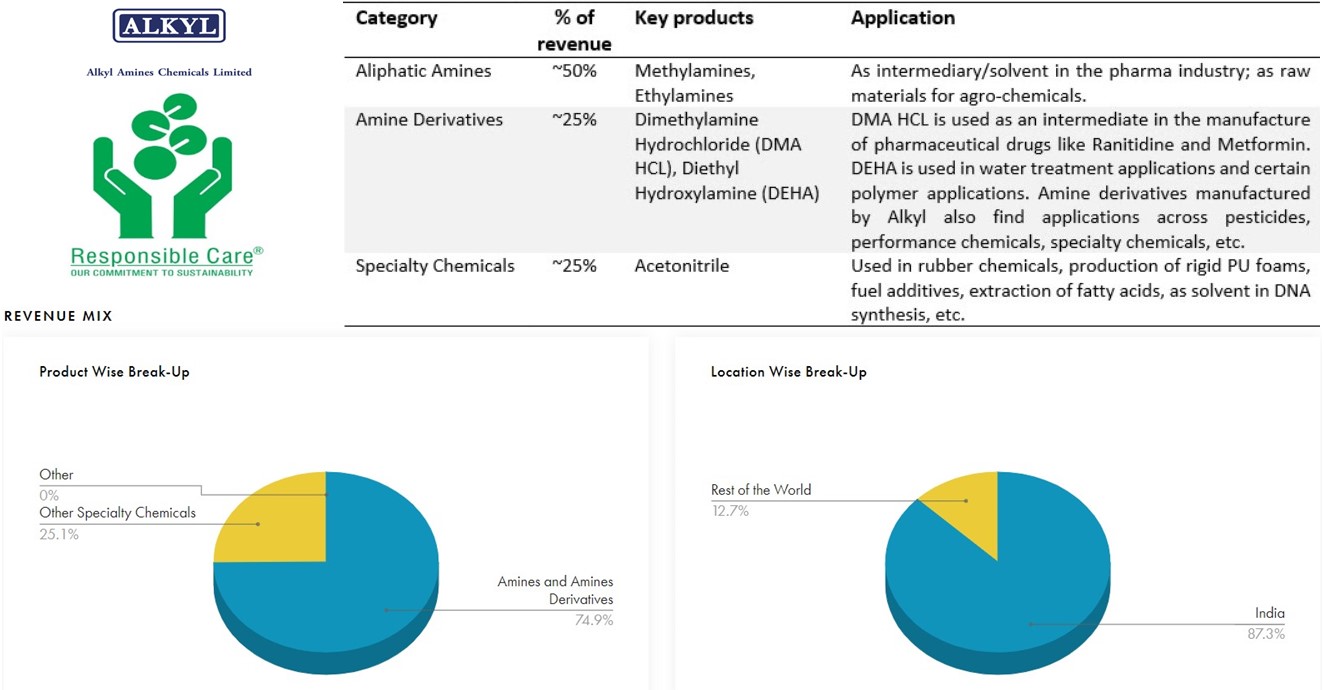

Alkyl Amines 60% to 70% Sales Revenue comes from the Pharmaceutical and Agro-chemical Industries. Besides, Pharmaceutical Companies constitute around Half of the AACL’s clientele, whereas ~ 25% of the company’s production goes as an ingredients for the Agro-chemicals, while the rest is mainly used in water treatment, rubber chemicals, textiles etc.

Alkyl Amines Chemicals Ltd (AACL) is one of the few companies Globally that are making Acetonitrile using Acetic Acid and Ammonia, instead of the Acrylonitrile route. They have their own Proprietary Formula to produce very High Purity Acetonitrile. AACL has ~ 40% share of the Domestic Market for Acetonitrile, which is used to make Pharmaceuticals, Rubber products, Pesticides, Acrylic Nail Removers etc.

During FY21 Acetonitrile realizations have risen from ~ Rs. (130 – 140) per kg to Rs. (270 – 280) per kg owing to Steep Rise in the Demand for various Amines including Acetonitrile, due to Covid19 Pandemic. Hence Alkyl Amines FY21 margins were extraordinary, compared to its Margins in FY22 and 9MFY23!

For the Larger period of FY22 and for almost whole of FY23, as the Covid19 induced Tailwind Disappeared, the Pharma Industry in India has undergone in a phase of Dull Growth due to No Longer Demand for the medicines related to Covid19 Treatment. Moreover, the Pharma Sector has also been facing Challenges related High Build-Up of Inventory, Export, and Supply Chain Related Issues, since last Year and a Half.

After-effects of these developments were also seen in the Volume and Value De-Growth’s of the Alkyl Amines Pharma-Centric Products.

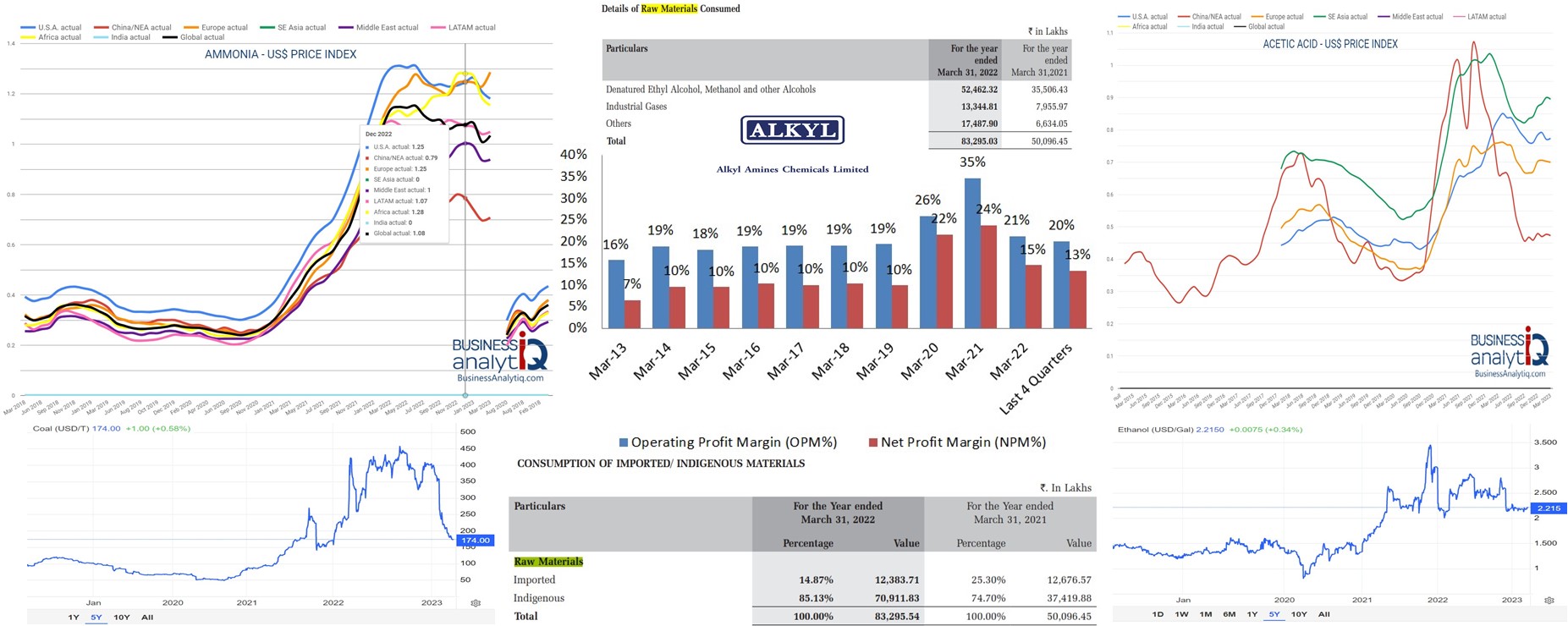

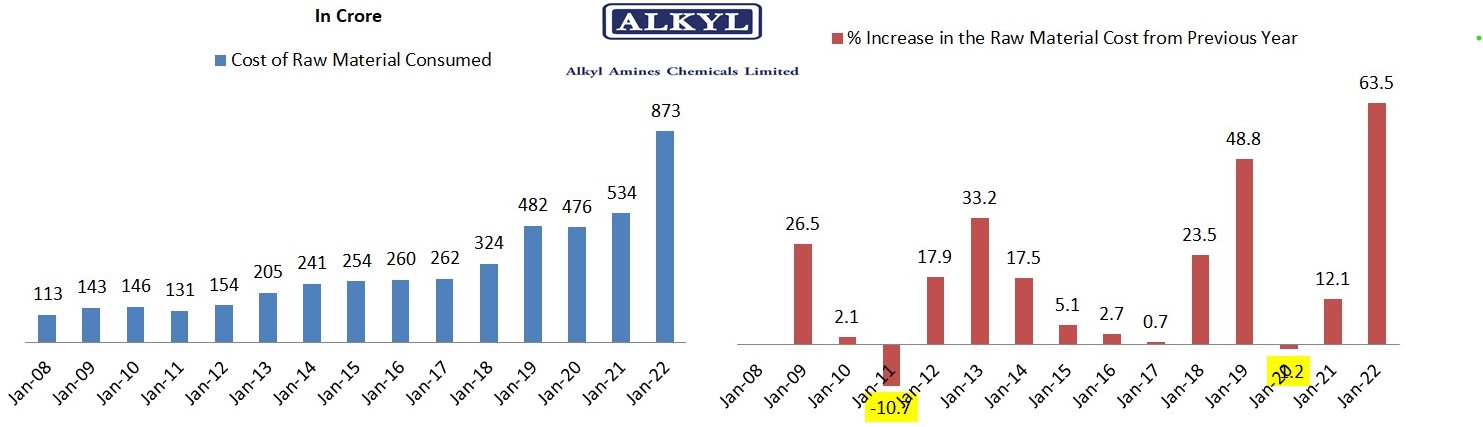

Besides, Substantial Increase in the Costs of various Raw Material (RM) of the company including Coal, Ammonia, Acetic Acid, Denatured Ethyl Alcohol, Methanol etc., along with an Increase in the Freight Charges of the Imported RMs, has put Unexpectedly Higher Pressure on the company’s margins, as mentioned above.

Further due to Rising Interests Rates Globally, to Tame the Uncontrolled Inflation, Demand for Acetonitrile was Not as High as it was Expected earlier till June 2022, from the Industries like Auto, Textiles, etc. Hence, against the High Base of FY21 and then of FY22, Financial results of Alkyl Amines through all the quarters of FY23 were seems to be Subdued at least!

Story Behind The Phenomenal Growth Of Alkyl Amines In The Last Decade And Factors Which Will Drive & Sustains Its Growth Ahead From FY24 Onwards?

Despite the Headwinds which Alkyl Amines Business has faced in past 20 months, its 10 Years Sales and Net Profit has Grown at ~ 17% and 28% CAGR respectively, whereas on 5 years reference the Growth has been 25% and 35% CAGR respectively!

Reason Being –

1) – Company’s R & D Strengths led by its Technocratic Top Management and Well-established R & D Team, has Enabled AACL to Develop ~ 100 SKUs which is nearly 4x compared to the Closest Peer, as well as to Undertake the Product Innovations like Acetonitrile;

2) – Company’s Unwavering Focus on the Core Business resulting in Timely Deployment of New Capacities and Identification of New Product Opportunities; and

3) – Significant Entry Barriers in the Aliphatic Amines Industry, such as High Capital Costs, alongside Long Lead Times in obtaining the Government & Customer Approvals.

The Niche Business Of Alkyl Amines

Aliphatic Amines are Products derived from Ammonia (NH3) by displacement of H2 in the Ammonia Molecule by other radicals such as Methyl, Ethylene and Propanol. Apart from manufacturing basic aliphatic amines like Methylamines and Ethylamines, AACL has over the years also Successfully Diversified into Value Added Products like Amine Derivatives and Speciality Chemicals.

All these products find their Applications mainly as a Solvent and Intermediates in the End-User Industries like Pharma (61% of total usage as in FY20) and Chemicals like Agro (6%), Water Treatment (5%), Foundry (4%), Dyes (3%), Specialty chemicals (6%) etc.

Alkyl Amines Commercialised its First Ethylamines Plant in 1982 with the help of a technology collaboration with Leonard Process Company, USA. During its initial years, the Company enjoyed Significant Success in Ethylamines, Emerging as its Largest Producer in India. Later in early-mid 1990s, the company also forayed into another important aliphatic amine – Methylamines, and Amine Derivatives such as Dimethylamine Hydrochloride (DMA HCL) and Diethyl Hydroxyl Amine (DEHA).

Over the years, the Company has continued to Expand Capacity in Aliphatic Amines as well as Targeted New Products Particularly in Amine Derivatives and Specialty Chemicals. One of the big recent success for Alkyl has been its foray into Acetonitrile, where it has emerged as the Largest Indian Player due to its Unique Manufacturing Route. Today company have over 100 Products to offer and is a Global Leader in most of them including Synthetic Acetonitrile, DEHA, DMAHCL, Triethylamine etc.

Between April 2019 to March 2022, company has seen Significant Increase in Both the Volume Off-take as well as the Pricing for Acetonitrile. This Strong Demand has been complemented by the Newly Added Capacities of Methylamine at Dahej which came on to Stream simultaneously, along with company’s Improved Working Capital Cycle.

“When Volumes Goes Up, the Overhead Costs Comes Down. Further, Prudent Procurement and Management of Main Raw Materials such as Ammonia, Coal, and Ethyl Alcohol Helps us in Increasing the Earnings. We also do a lot of Operational efficiency in Plants with our own Research and Development,” says Kirat Patel, executive director at AACL – Source: (https://www.fortuneindia.com/long-reads/the-science-aficionado-at-alkyl-amines/109904)

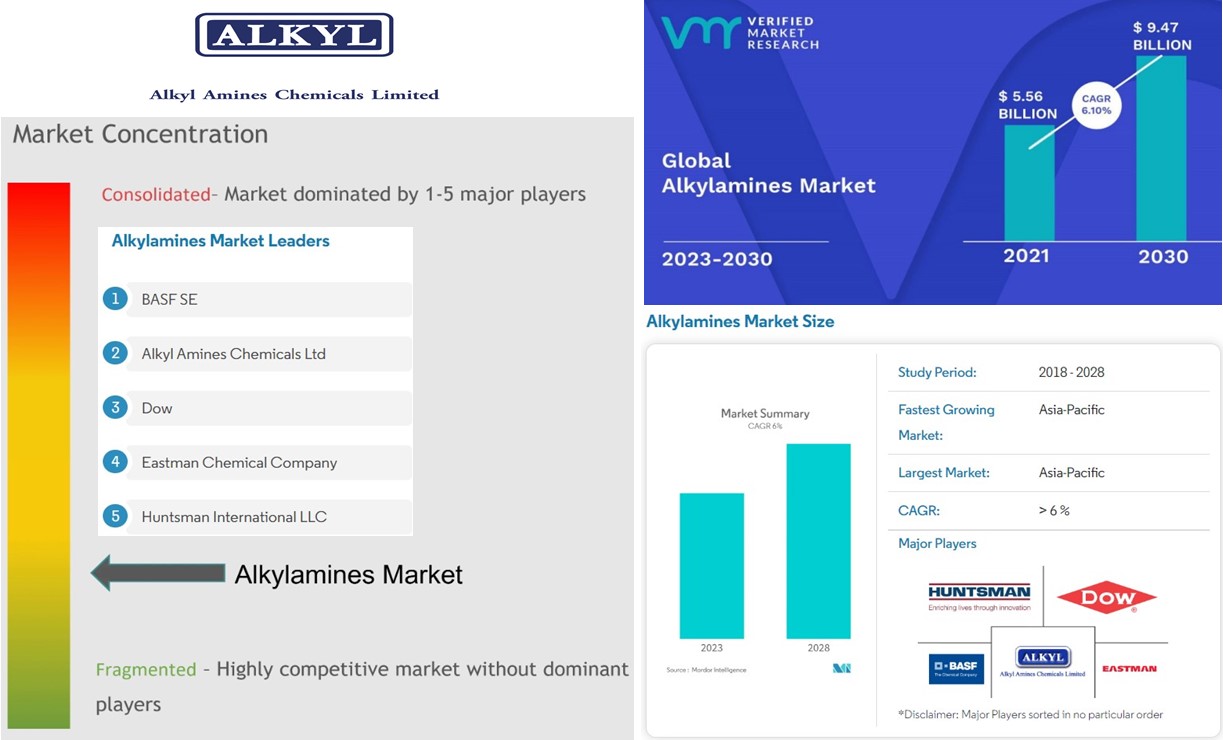

Balaji Amines and Alkyl Amines now accounts for > 90% Market Share of Aliphatic Amines and Amine-based Derivatives in India.

Consolidation of market shares in amines industry is not only prevalent in India but also in most of other countries too – for instance aliphatic amines market is Dominated by Only Handful of Big players like BASF, Dow, Eastman Chemical and Huntsman in USA and Europe.

The Consolidated Nature Of Alkyl Amines Industry In India & Globally

Consolidation is taking place globally in the world of Amines. Apart from 4 to 5 Big Players which mainly caters to their home markets in the U.S. and Europe, the industry Does Not Have too Many Global Players.

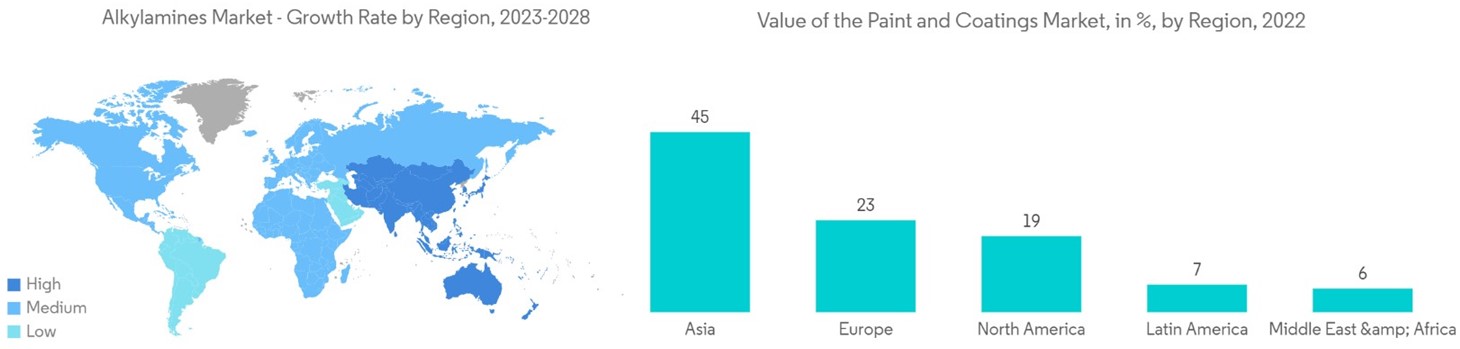

Historically, the segment has been growing at ~ 7 to 8% per annum and according to the Industry Analysts, the Alkyl Amines Market Globally is forecasted to reach $7.1 billion by 2026 and $ 9.47 billion by 2030, after growing at a CAGR of ~ 6.2% during (2021 – 2026) and then at ~ 6.1% during (2026 – 2030).

According to Industry Sources, the Factors which have played a role in shaping the Consolidated Nature of the Amines Industry Globally and More Particularly in India, are:

1) – Inherent Nature of the industry lends Significant Advantages to Incumbents over a New Entrant – Significant Initial Capital Investments (e.g., it requires over Rs. 100 crore to set up even a small amine plant) and Long Lead Time in Obtaining Environmental Clearances from the Government, and Product Approvals from the Customers, Presents Formidable Challenges for the New Entrants.

This places potential entrants at Disadvantage vs the Established incumbents such as Alkyl Amines, which have been able to Build Scale and Establish Strong Customer Relationships over the years. To be more precise, there appear to be 4 Formidable Barriers to Entry into this Sector:

i)- Capital Intensive Nature of the Business: Manufacturing amines that involve Hazardous raw materials like Ammonia, is a Complex Process requiring Significant Technical Know-How and Initial Investments.

Fixed Assets Turnover in the industry ranges just between (1.5 to 3x) even at the Optimum Capacity Utilisation and is Significantly Low at the Initial Stages of the ramp-up.

ii)- Requirement of Environmental Clearances: Given the Hazardous Nature of the industry, Governmental Approvals are Needed for putting up a new plant or even for the Brownfield Expansion, Beyond the Licensed Capacity of the existing plant.

On an average it takes ~ (1.5 to 2 years) to obtain Environmental Clearances and any Delays in obtaining the same (which can be quite frequent), Increases the Project Costs Further.

iii)- Lead Time in getting Approvals from the Customers: Given the products go (as a raw materials/intermediates) into the End-User industries like Pharma, the customers takes time to Derive Comfort on the product, as well as the manufacturing process.

Furthermore, there has to be meaningful Differentiation in either the Costs or the Product Features, for a customer to Switch from an Established Vendor, which again Raises the Ask for a New entrant.

iv)- Significant Efficiencies from Scale: The High Capital Investments Involved make operating at Meaningful Capacity Utilisation Critical, to generate respectable levels of Profitability.

Furthermore, there are a lot of efficiencies in operating as a continuous process rather than a batch process, which again is Dependent on having an Adequate Volume Base.

2) – The Incumbents have been Proactive in Setting up capacities and Identifying new product Opportunities, thus Shrinking the Space for New Entrants in an already Niche Industry – Aliphatic Amine is a Niche industry, accounting for less than 1% of the Broader chemicals industry globally as well in India.

After nearly 30 to 40 years of existence, Alkyl Amines and Balaji has put together generated revenues of Rs. 19.5 billion in FY20 indicating the Niche Size of the industry. Furthermore, both Alkyl as well as Balaji has been Proactive in Setting up Amines Capacities (sometimes ahead of the demand and thus getting Adversely Impacted in the Interim) and hence, Capturing the Benefits of the Expanding End-User industry and Opportunities in the Value Added Products.

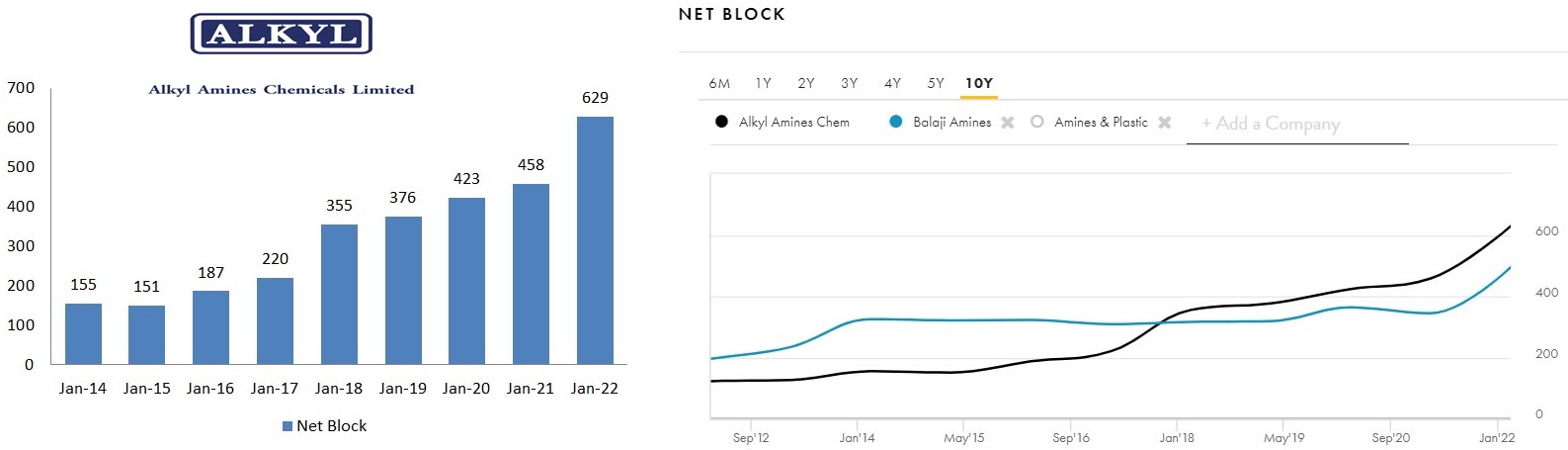

For instance, Alkyl Amines Net Block has risen by ~ 4.2x over FY (2015 – 22). This has left Little room for a new player, to develop a Credible Scale in an Already Niche Industry.

3) – Company’s Technical Expertise And Strengths In R & D – Strong R & D Capability of Alkyl Amines, led by its Technocrat Top Management, is a Key reason for its Success. Company has an established R & D team of ~ 50 employees and the top management also Maintains Connect with academicians of various universities such as Institute of Chemical Technology (Mumbai) and IIT (Mumbai), which has been a Source of Important Product Ideas over the years.

As a result, Alkyl Amines has an Institutionalised Product Development Process. Every year, the company Creates a list of around 20 New Products. Within this list, a much Smaller Set of Products are Shortlisted for Commercialisation purpose.

Prior to which, various factors are given consideration as following:

i) – The Current and/or Potential Market Size for the Product;

ii) – Whether Alkyl Amines has or can have a Technical Edge in the Product or its Manufacturing Process;

iii) – Whether the products can have a Diversified Customer Base rather than Over-Dependence on 1 or 2 Customers;

iv) – Whether there is Fungibility surrounding the Products i.e., if the product Demand Drops, can another product be manufactured in the Same Facility; and

v) – Whether the product can be Scaled-Up Globally.

Hence once the products are Identified, the R & D team plays a Key Role in Developing the products to the Commercial Production Stage.

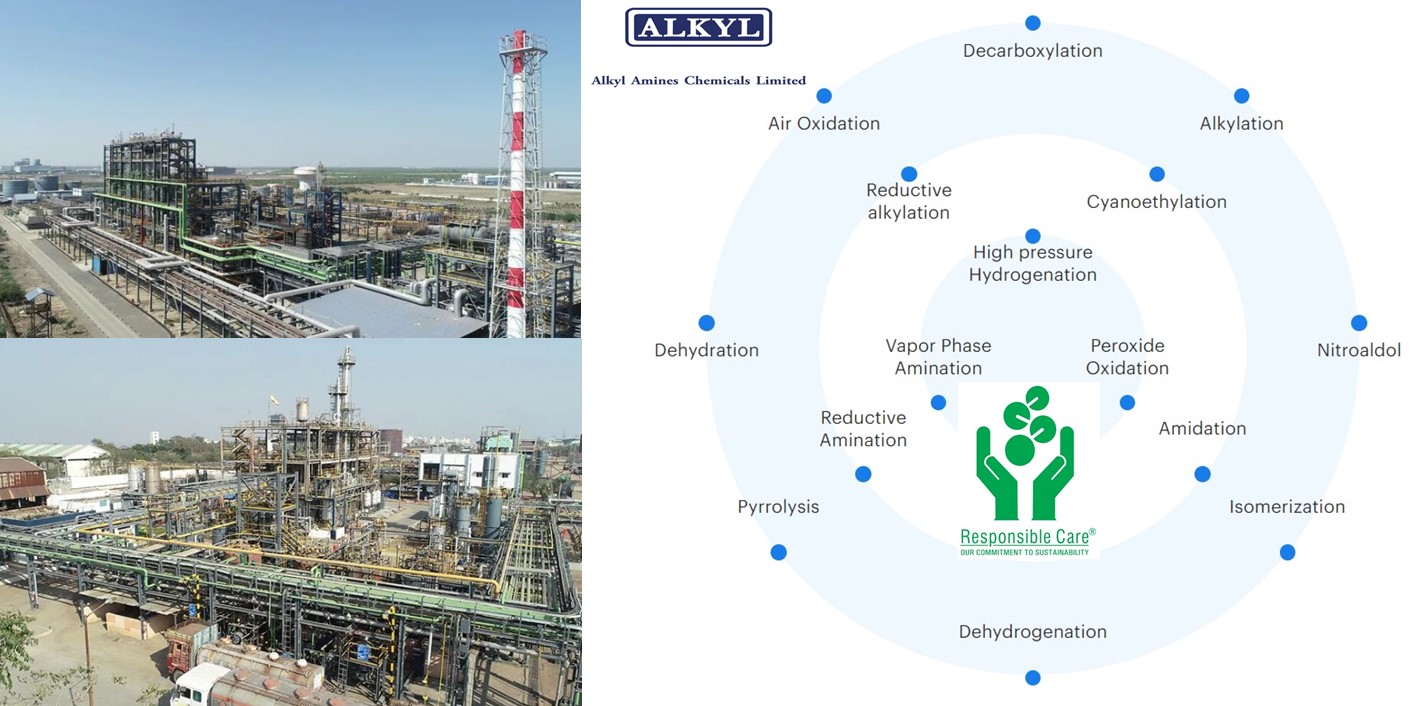

The Company R & D’s team not only focuses on the products but also on the Process Improvements and Developing the In-house Process Technologies. This has not only Improved the Yields but has also Reduced the Cycle Time, Cost, Effluent, Safety and Environmental Risks.

While the Company Initially relied on the Outside technology for Commissioning the plants, over the years it has developed Strong In-house Engineering Capabilities which has helped it in Bringing Down the Capital Costs Significantly.

Alkyl’s success in Acetonitrile through unique manufacturing process has been an important success for the company in the recent years. The common route for manufacturing Acetonitrile is its generation as a by-product during the Acrylonitrile (ACN) manufacturing process.

However, Alkyl Amines came up with a Unique Synthetic Route of Manufacturing Acetonitrile using Acetic Acid and Ammonia, as the Key Raw Materials.

During FY (2019-20) as the Automobile Production Declined (due to tepid demand), production of Acetonitrile under the common ACN route has also declined. This had Created Significant Demand-Supply Mismatch for the product, resulting in not only Significant Off-Take for the company’s Acetonitrile Route but also for the Increase in the Prices.

Consequently, the price of Acetonitrile has became more than double by Mid of 2021.

R & D has helped AACL to Stay Ahead of its Competition, given that the company now makes C1-C6 class of the Amines Value Chain, whereas Balaji and RCF are still behind in the C1-C2 Space.

Alkyl Amines Proprietary Route has Gained Recognition in recent years, as a Greener Route which can help the company to Sustain its Market Share!

4) – Relatively Stable Gross Margin Indicative of the Pricing Power – Despite Significant Volatility in the Prices of Raw Materials like Methanol (Crude based) and Ammonia, Alkyl Amines 3-year rolling Gross Margin has been Fairly Stable over a long period of time, Indicating its Strong Pricing Power in the industry.

5) – Prudent Capital Allocation – Company has maintained an unwavering focus on aliphatic amines and its adjacencies (Acetonitrile is technically not an amine-based product but uses a key similar raw material ammonia and has somewhat similar manufacturing set-up). Besides, Alkyl Amines has been Proactive in Setting up the Capacities as well as Identifying and Entering the New Products.

Consequently, company has Consistently High Reinvestment Rates ( > 60%) of its Free Cashflows. The cash Not Deployed in Expanding Capacities have been used to Bring Down the Debt Levels and for the payment of Dividends to the Shareholders.

Alkyl Amines Tailwinds For The Business & The Growth Drivers From FY24 Onwards

The Alkyl Amines Market Globally is forecasted to be Growing at over 6% during 2023 to 2030 and Asia-Pacific Market is expected to be Growing Faster than the rest of the world, given that the Asia-Pacific Region Consumes more than three-fourths of the World’s Total Alkyl Amines Produced.

Besides, the Growing Demand for the Amines Solvent for the End-User Industry Like Pharma, Paints & Coatings, Rubber, Paper & Pulp etc. will be the Primary Drivers for the Growth of companies like Alkyl Amines.

To know more about the Tailwinds for the Specialty Chemicals Sector, Read: (https://jyadareturn.com/specialty-chemicals-stocks-long-runway-of-growth/; https://jyadareturn.com/srf/; & https://jyadareturn.com/vinati-organics/)

Alkyl Amines Outlook For Growth In FY24 & Beyond

As of now, the company has an Overall Capacity for Producing ~ 200 tons of Methylamine per day and 75 tons of Ethylamine per day. By June 2023, another 100 tons per day Capacity for producing Ethylamine will be added, as the new Rs. 400 crore Aliphatic Amines plant at Kurkumbh will get commissioned by then.

Company has a capacity to produce ~ 35,000 tons annually of each, Amine Derivatives and the Specialty Amines, which are considered as High Value-Added Products and around 30% of the amines produced are consumed In-house to make these products, 15-20% of which are exported.

Besides that, the company also have 2 plants for producing Acetonitrile, one at Kurkumbh & another at Dahej, with the Total Capacity of ~ 30,000 tons annually.

The newly added capacity is mainly going to produce either the High-Value Amine Derivatives or the Import Substitute New Products and within next 3 to 4 years these products are expected to add ~ Rs. 600 crore to Rs. 800 crore in the Top Line.

Going Forward Cost of the Raw Material, which have Increased Unprecedentedly in the Last Year & a Half, are likely to remain Stable and the Pharma Industry may also overcome issues related to Export and Supply Chain Disruption by then.

Company has Strategically Planned to Launch 1 or 2 Niche Products, in every quarter or 6 months, for next 2 years. Given most of these 5 to 6 products are either High-Value Amines Derivatives or the Specialty Chemicals, hence there will not be any Competition, at least Not in the Domestic Market.

Therefore while the Top Line is expected to be Growing ~ by 20% to 25% in next 2 years, Bottom Line shall be Growing Higher than this.

Hence while the monopoly in these products will help the company to Sustain its Value Growth, Tailwind (as mentioned above) in the sector will Drive the Demand to ensure the Volume Growth for the Alkyl Amines Chemicals Ltd., so that it can regain its +25% Operating Margin and +20% Net Profit Margin!