“There are Enterprises and then there are Disruptors! Disruptors who have the Vision to Think Beyond the Visible. They Ideate and Create Concepts, when Most are Selling Largely Commodity Products (albeit with tweaks in the name of value-addition). They Build the Market Size, when others are Jostling for the Market Space” – APL Apollo Tubes Ltd.

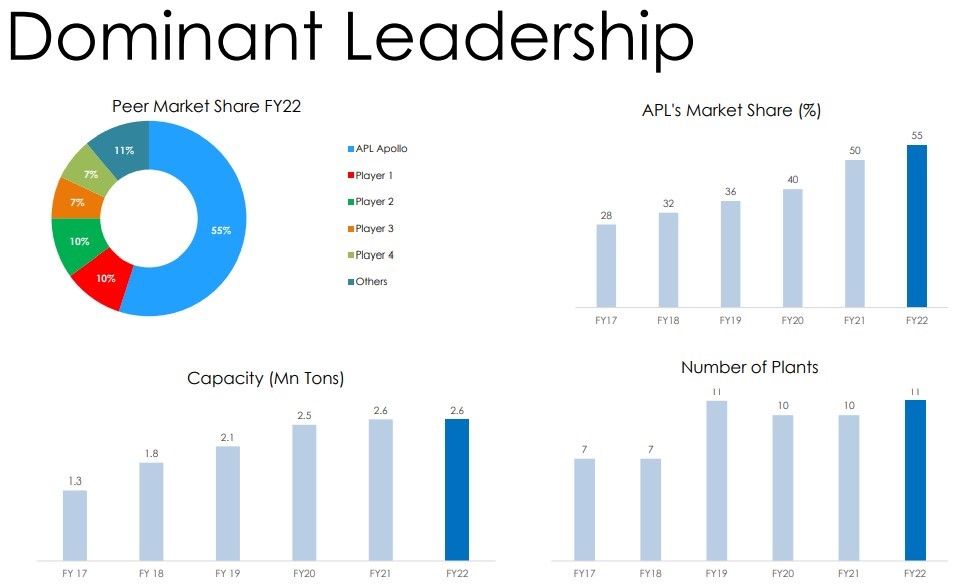

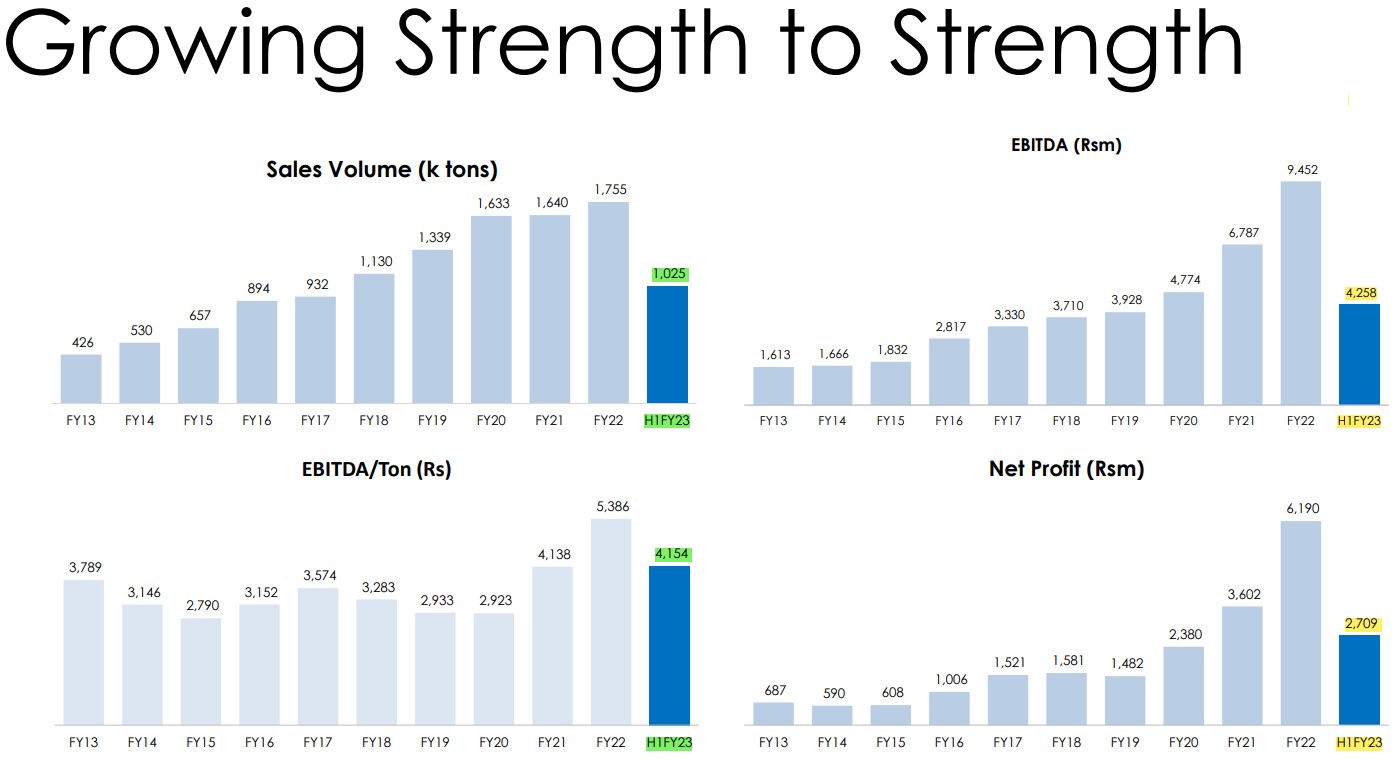

APL Apollo Tubes Ltd. has grown its Revenues at a CAGR of 25% in last 10 years, whereas its Profits have grown at a CAGR of 27% in the same period. Company has increased its Installed Structural Steel Capacity to ~ 31X in last 15 years.

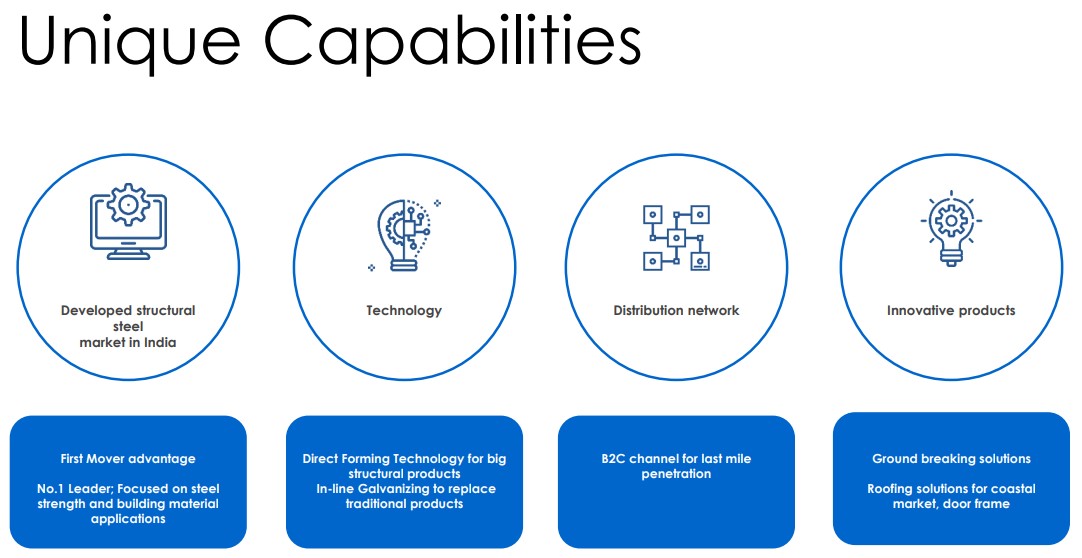

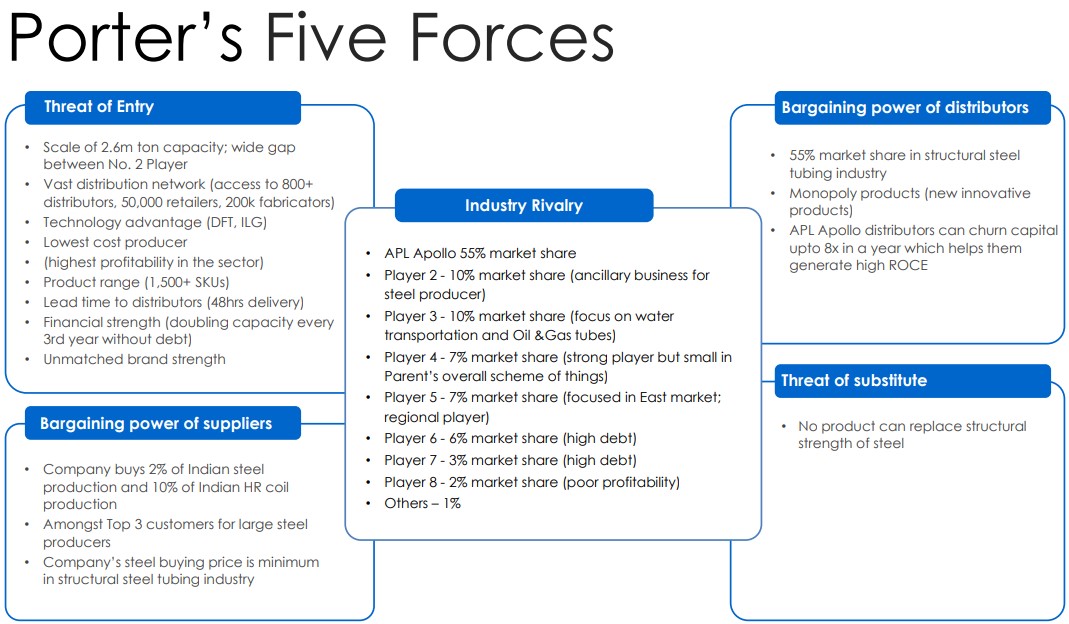

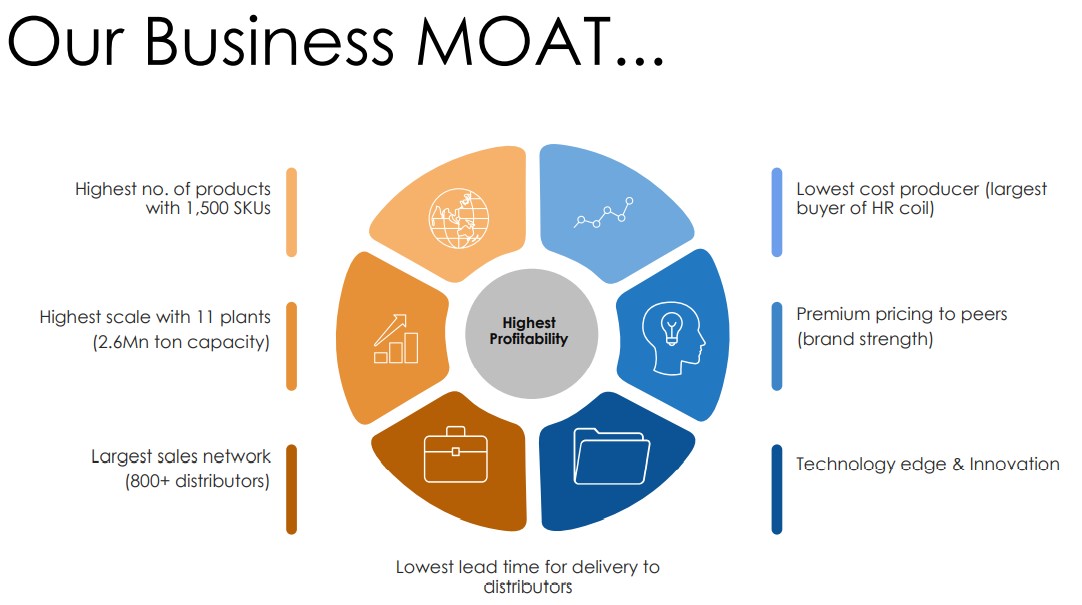

Due to its Bargaining Power with the suppliers, company’s steel buying price is Minimum in the industry and as such it is Lowest Cost Producer. It’s a rare B2C business which is growing that rapidly, owing to its Robust Network of 800+ Distributors, 50,000+ Retailers, 200K+ Fabricators which help the company to churn Capital upto 8X in a year that helps them to generate higher ROCE.

With ~ 55% Market Share in the Structural Steel Tubing Industry, Multiple Competitive Advantages, and Ground Breaking Solutions with Innovative Range of 1500+ products under 14 Brands, Company is already on the Accelerated Growth Trajectory.

Tubular Technology, DFT (Direct Forming Technology) for Big Structural Products, ILG (In-Line Galvanizing) to replace traditional products, and Tailwinds for the sector which APL Apollo operates in, are going to be some of the key growth triggers which will ensure that this accelerated growth will sustain longer & beyond 2023 – https://jyadareturn.com/why-these-5-stocks-still-have-lots-of-potential-for-growth/

So, How did APL Apollo Tubes became The Structural Steel Disruptor & How it is Revolutionizing the Indian Construction Industry?

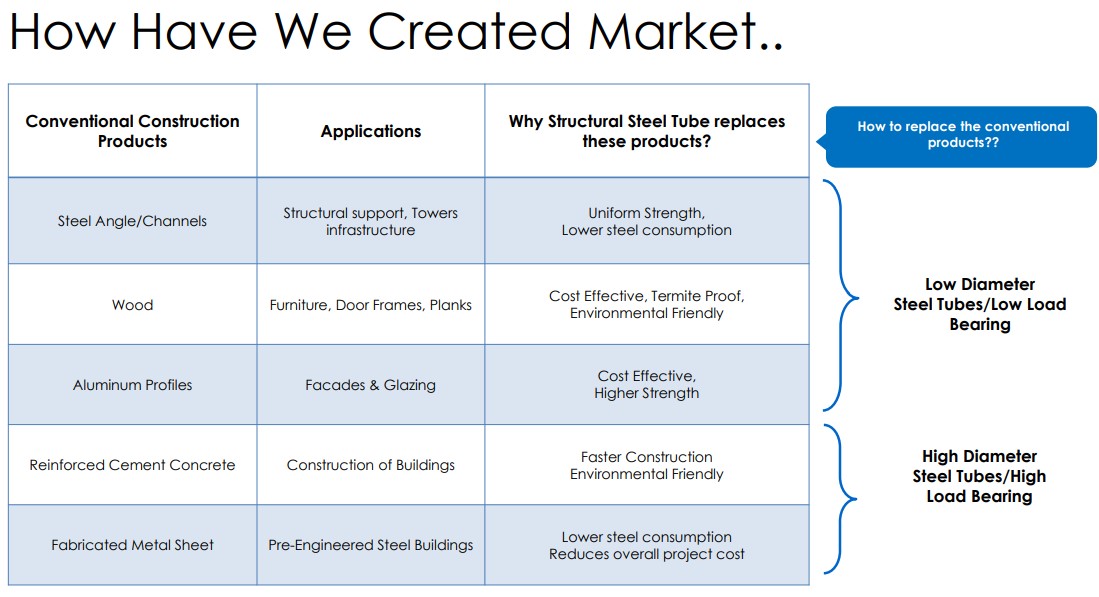

APL Apollo Tubes observed that Compared to the Conventional Construction Products, Structural Steel Tubes provides Multiple Benefits and hence the later may easily replace the former, as shown under:

Anticipating the Huge Potential for Business to Grow, APL Apollo Tubes started focusing on its

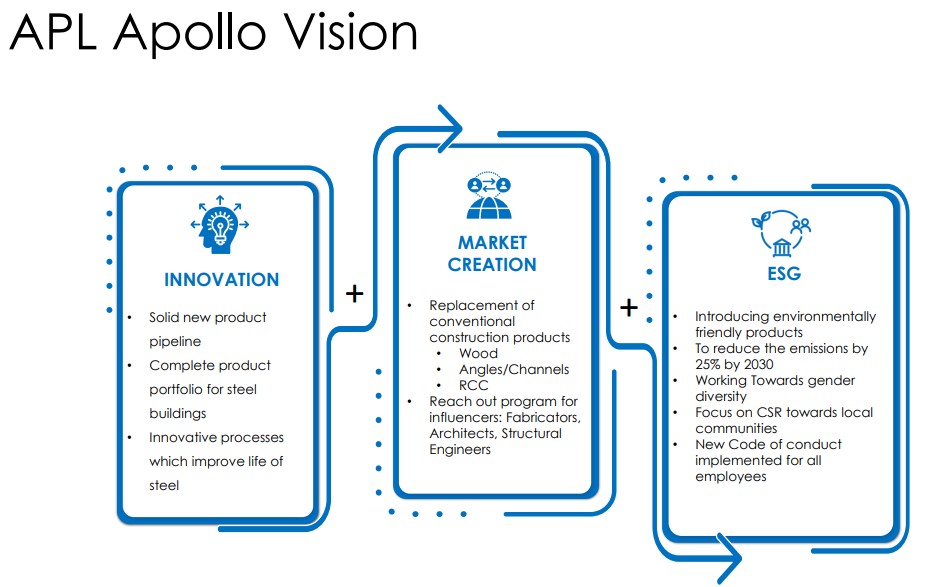

Three-Pronged Plan to :

1) – Grow Volumes

2) – Increase Margins, and

3) – Enhance Brand Awareness

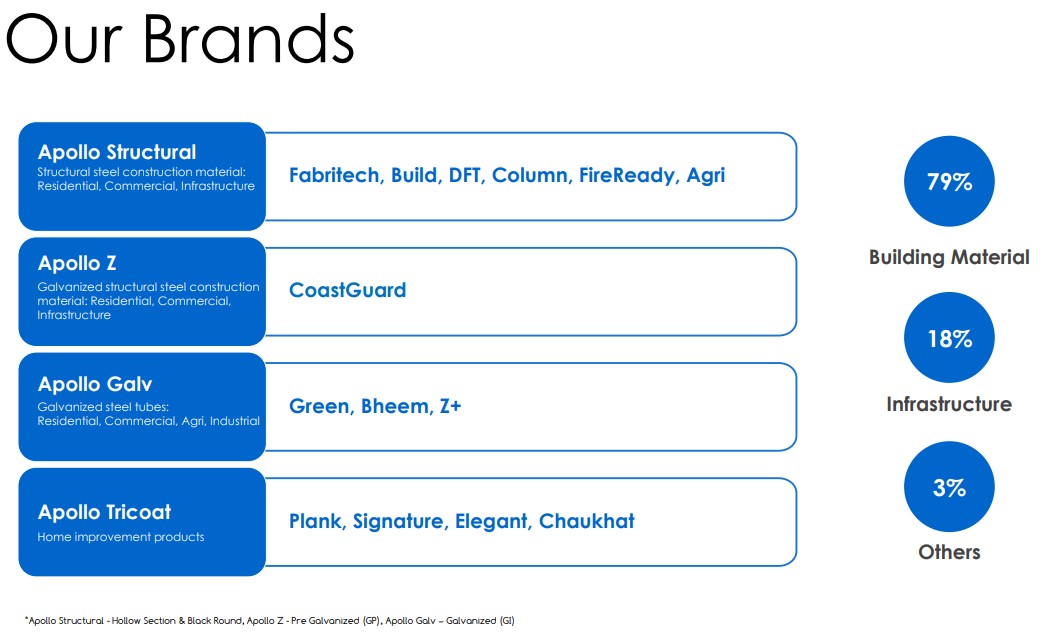

And accordingly they build a Unique Product Portfolio comprising of 4 Primary Products Categories, with different specification as per the needs of customer in each of these Primary Product Category.

These categories are:- Apollo structural, Apollo Z, Apollo Galv & Apollo Tricoat. These products find their use in buildings, houses, warehouses, factories, skyscrapers and Industrial & Agricultural activities.

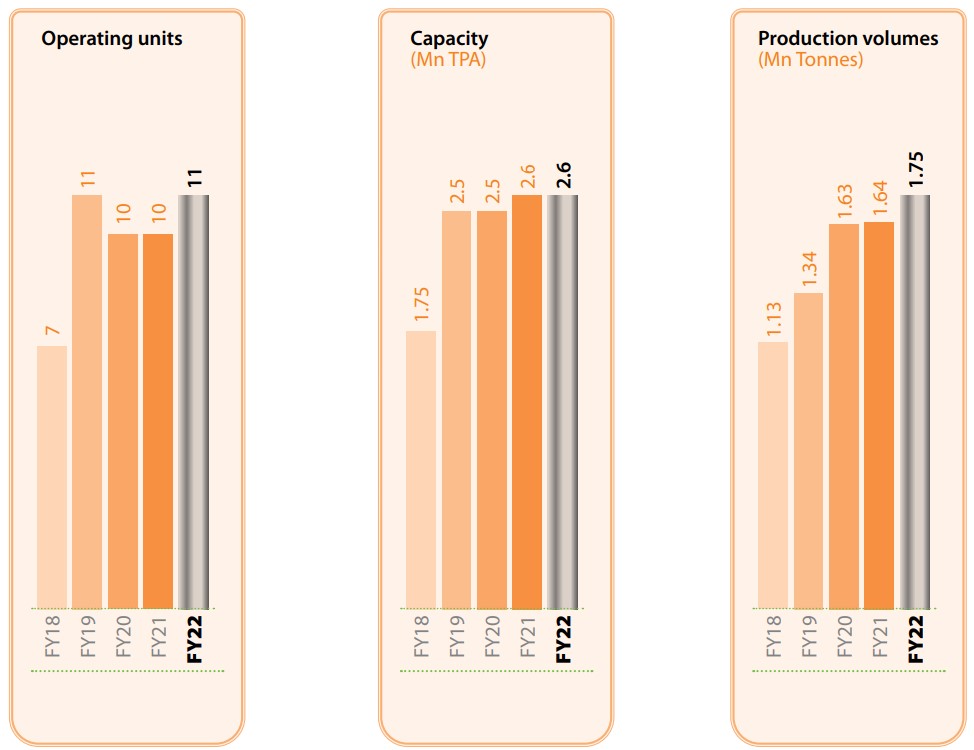

With “Economies of Scale” which APL Apollo Tubes Business inherently have, company has grown its Installed Production Capacity 31X in last 15 years and at present it have 11 manufacturing facilities across India, with a total manufacturing capacity of 2.6 mn TPA of structural steel products. This pan-India manufacturing presence, allows it to reach markets with speed and cost-effectiveness.

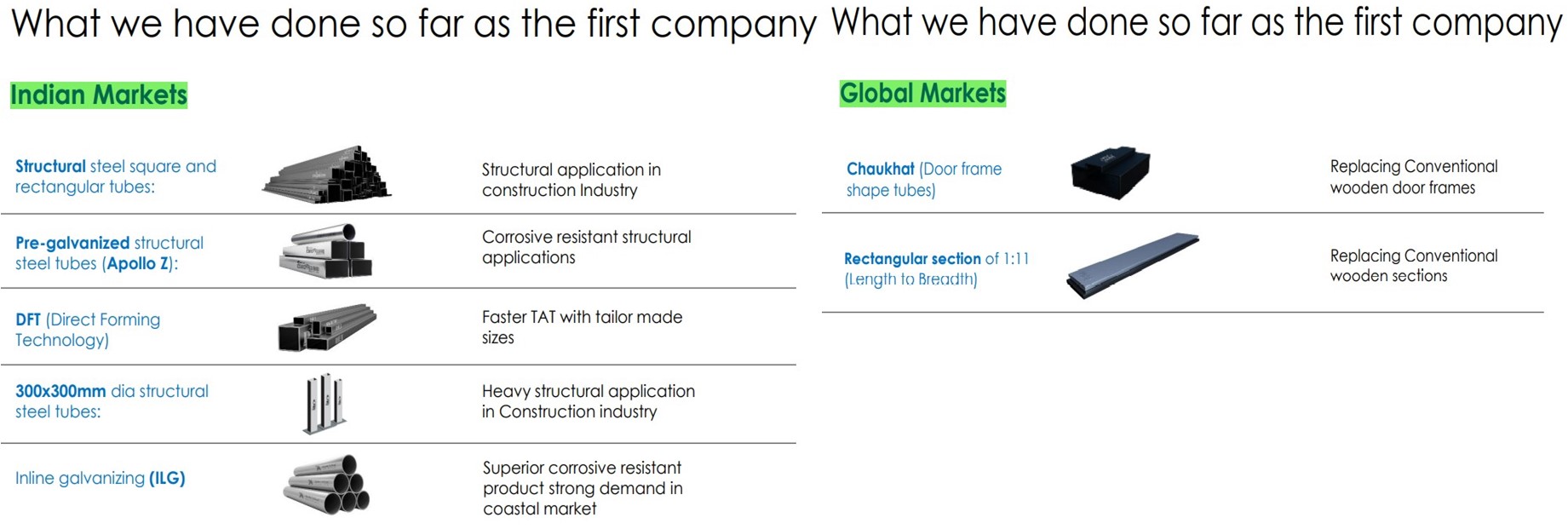

These in-house manufacturing facilities have the required cutting-edge technology and sophisticated equipments, allowing APL Apollo Tubes to deliver Niche & Value-Added Products, not only to the Indian markets but also to the global markets.

Being the First Mover to Innovate & Launch multiple products in both the domestic as well as the global markets, company has always remain a Disruptor in its business space & as such it reaps maximum benefits of the sector, compared to its peers.

APL Apollo Tubes has a Mission to become World’s only company to make steel tubes with size range of (10x10mm) to (1000x1000mm) and thickness range of (0.23 mm to 40mm) and to achieve that, company has a Vision regarding Innovation, Market Creation, and ESG.

With Robust Network of 800+ Distributors, 50,000+ Retailers, 200K+ Fabricators, Architects, & Engineers company makes its reach to Pan India based End Consumers, with whom it gets efficiently Connected Through IPL, Kabaddi League, Brand Ambassador Campaign, TV Commercials, Social Media and Company’s own B2C Tech App “Aalishaan”

APL Apollo Tubes – Disruptor Business Strategy

APL Apollo Tube consistently works upon:

1) – Market Creation;

2) – CapEx Plan for Value Addition;

3) – Distribution Enhancement and;

4) – Innovation

So as to:

i) – Keep exploring new optionalities to enter into and find new sources of additional revenues;

ii) – To further Broaden its Niche & Value-Added Product Portfolio;

iii) – To add more distributors, retailers, and fabricators so as to enter into new geographies and have last mile penetration;

iv) – To have the Edge of First Mover Advantage, over its competitors. APL Apollo Tubes already have 18 registered patents against its Niche products, which it is offering under 14 brands.

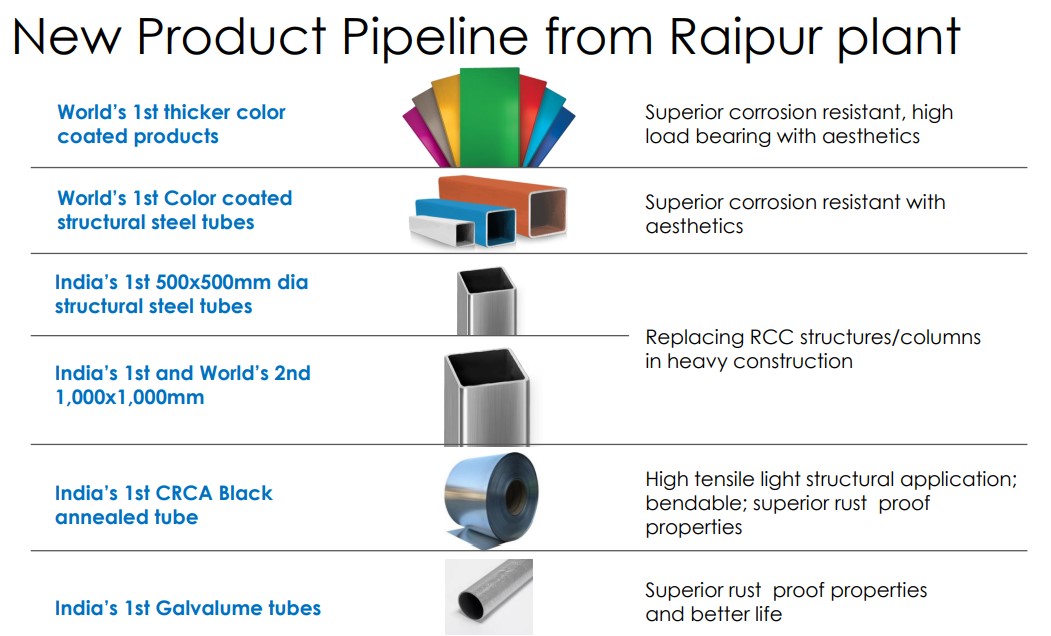

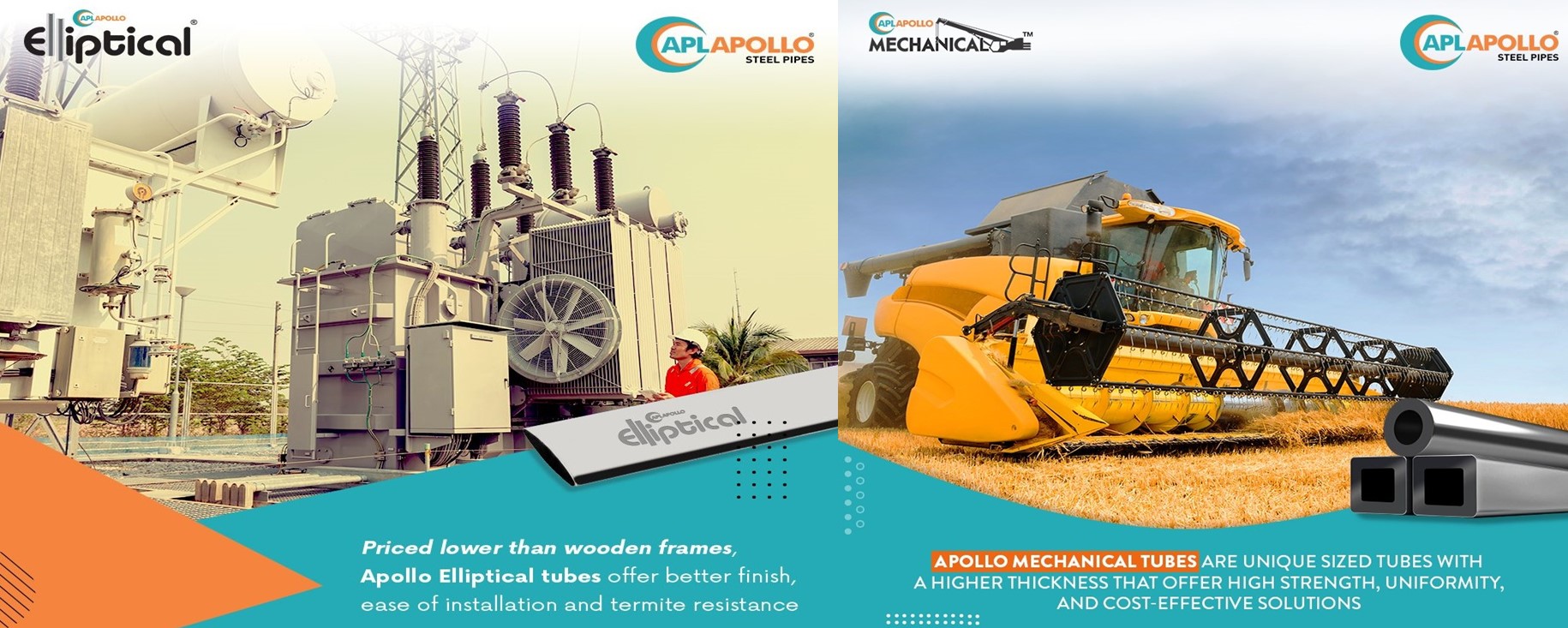

APL Apollo Tubes has emerged as the most innovative building material company in India. It’s innovation list includes the following:

1) – 1st to introduce structural steel square and rectangular hollow sections.

2) – 1st to introduce pre-galvanized structural steel tubes (GP).

3) – 1st to introduce DFT (Direct Forming Technology) – Customized sizes 6+ with superior finish and material saving of 2-10%.

4) – 1st to innovate readymade Chaukhat, Fence, Plank and Hand rails as Steel for Green Concept which replaced conventional wood application in building construction.

5) – 1st to introduce 300 x 300mm square and rectangular structural steel tubes.

6) – 1st to introduce 500 x 500mm square and rectangular structural steel tubes.

Going forward, APL has a slew of interesting innovative products to be launched over the coming years. They include:

- – 1st to introduce 1,000 x1, 000mm square and rectangular structural steel tubes.

- – 1st to innovate narrow and thicker colour coated galvanized sheets which will save more trees.

APL Apollo has developed the world’s first color coated thicker (>3mm) and narrow sections to bear more load, rust proof and more durable in infrastructural application vs conventional galvanized steel tubes.

Given that No product can replace the structural strength of the steel, most of the APL’s innovative products has Monopoly in the market where APL enjoys sheer Dominance due to its market share which it has been consistently increasing from 28% in FY17 to 55% in FY22.

Not only this there is wide gap between APL Apollo Tubes and its competitors, as even the player no. 2 & 3 have just 10% market share each.

Building relations with Distributors

APL Apollo has created the largest distribution network in its business space. Its expansive and entrenched network is its front face to the end consumers.

It works doggedly to grow the business of its distributors – through a wider range of products, faster deliveries, continued awareness efforts, innovative schemes, interesting reward and recognition programs and business policies that ensure that business is managed efficiently.

The result of its efforts is reflected in the rising sales volumes and the dominant market share in an increasingly competitive and dynamic marketplace.

Company launched its B2C App called Aalishaan, which makes it seamless for users to access an exclusive steel home décor library, with more than 300 designs and connect with the nearest fabricator, to submit steel furniture service requests and get them made at their doorstep.

Alignment & improvement

Over the years, the Company has continued to tweak its operations to align with market dynamism. It continues to shuffle and reshuffle products and production lines between its manufacturing facilities.

For e.g. the demand for its coated tubes, manufactured in North India, was mushrooming from the Western parts of India. APL Apollo prudently shifted it’s line from its existing facility to its facility in the West.

The Company continues to work towards improving man-machine productivity. For this, the operations team is focused on reducing things like the cutting cost of tubes, rejection rate, logistics coat, steel consumption and energy consumption.

APL Apollo Tubes – Strategic Capital Allocation & Improving Working Capital Cycle

APL Apollo Tubes market Share has increased to 55% in FY22, from 32% in FY18, whereas at the same time its Sales/Production Volume grew 1.13 mn tonnes to 1.75 mn tonnes.

Reason being:

1) – Instead of drawing Debt to fund Growth, APL Apollo chooses the more pain staking yet increasingly sustainable way – Internal Accruals. Hence company has focused on building its Cash Reserves, by Optimizing Costs, Increasing Sales of Value-Added Products and Collapsing its Working Capital Cycle from 48 days in FY18 to 7 days in FY22.

This sharp drop has made the entire business operations much more streamlined & efficient and significantly released the financial capital, which otherwise would have locked in the working capital. (Source: https://www.bseindia.com/bseplus/AnnualReport/533758/74442533758.pdf)

2) – Over the years, company reduced its Debt and Invested in Capacity Building Initiatives, with a skew towards Innovative Products. As a result, in last 3 years company repaid Rs. 5.8 billion of Debt and simultaneously Invested Rs. 11.7 billion for Capacity Addition. Therefore, ensuring that every rupee earned by it, is efficiently utilised in growing its business.

The Volume-Value Play increased the Cash Flow into the Company, which it deployed to retiring the Debt and further investing in capital projects to augment its capabilities. In doing so, it created a virtuous circle, that lowered the organisation’s debt burden and increases its cash war chest.

3) – APL Apollo Tube has lowest Debtor days in the Building Products Sector in India.

Capacity Building

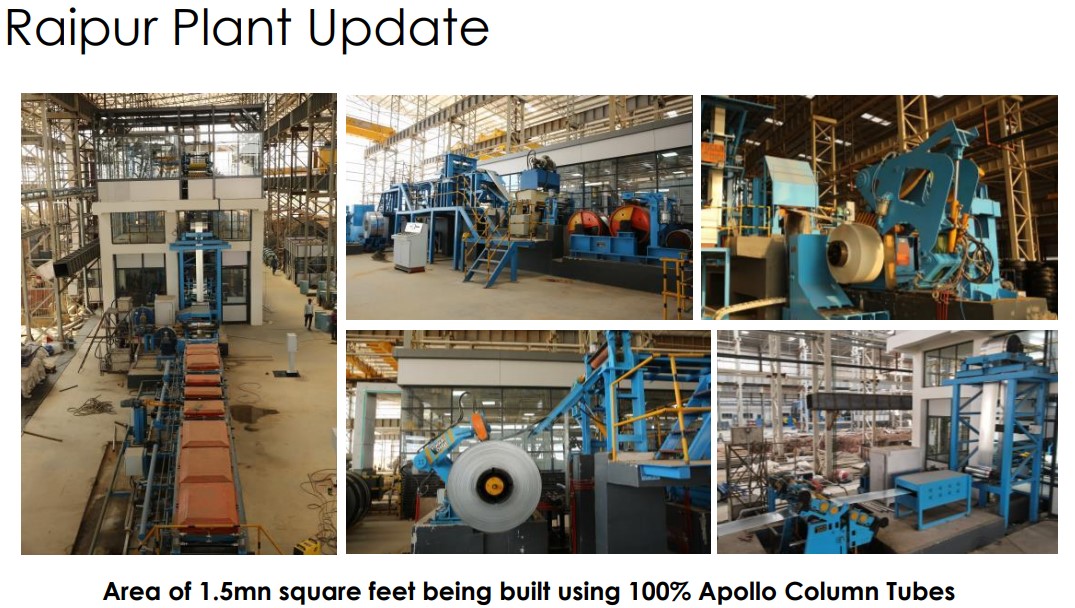

Raipur facility will focus on manufacturing value-added products, most of which are first-time products for the Indian markets. This 1.5 mn TPA mega project is expected to commence in a phased manner between FY23 and FY24.

As the Commercial production of the Colour Coated Tubes has already commenced at this Greenfield facility, so for this reason the Company has invested in novel technology – “Black Annealed Tubes and Galvalume Tubes”.

The trial production for Black Annealed Tubes and Galvalume Tubes is underway & the commercial production of these products is also expected to commence in Q3FY23.

In addition, the Company has budgeted Rs. 1,500 million for value addition at its operating units at Hosur and Secundrabad. Post commissioning of these projects, APL Apollo will have only widened its Competitive Moat in the Structural Steel Tube Market.

Total CapEx of Rs. 6.5 bn to be Funded from the Internal Cash Flows in FY (2023-24): APL Apollo is augmenting the capacities of valueadded products, which will uplift India’s structural tubes market and the Company’s position in it.

This is the CapEx Plan –

- – Residual CapEx in Apollo Raipur of Rs. 3 bn.

- – Value addition/ backward integration in Hyderabad/Hosur plants of Rs. 500 mn i.e. 0.5bn

- – Investment into value addition lines at other plants of Rs. 500 mn i.e. 0.5bn

- – Innovative galvanized lines to improve efficiency of Rs. 1 bn

- – Two small greenfield plants of Rs. 1.5 bn

APL Apollo Tubes – The Formidable Moat

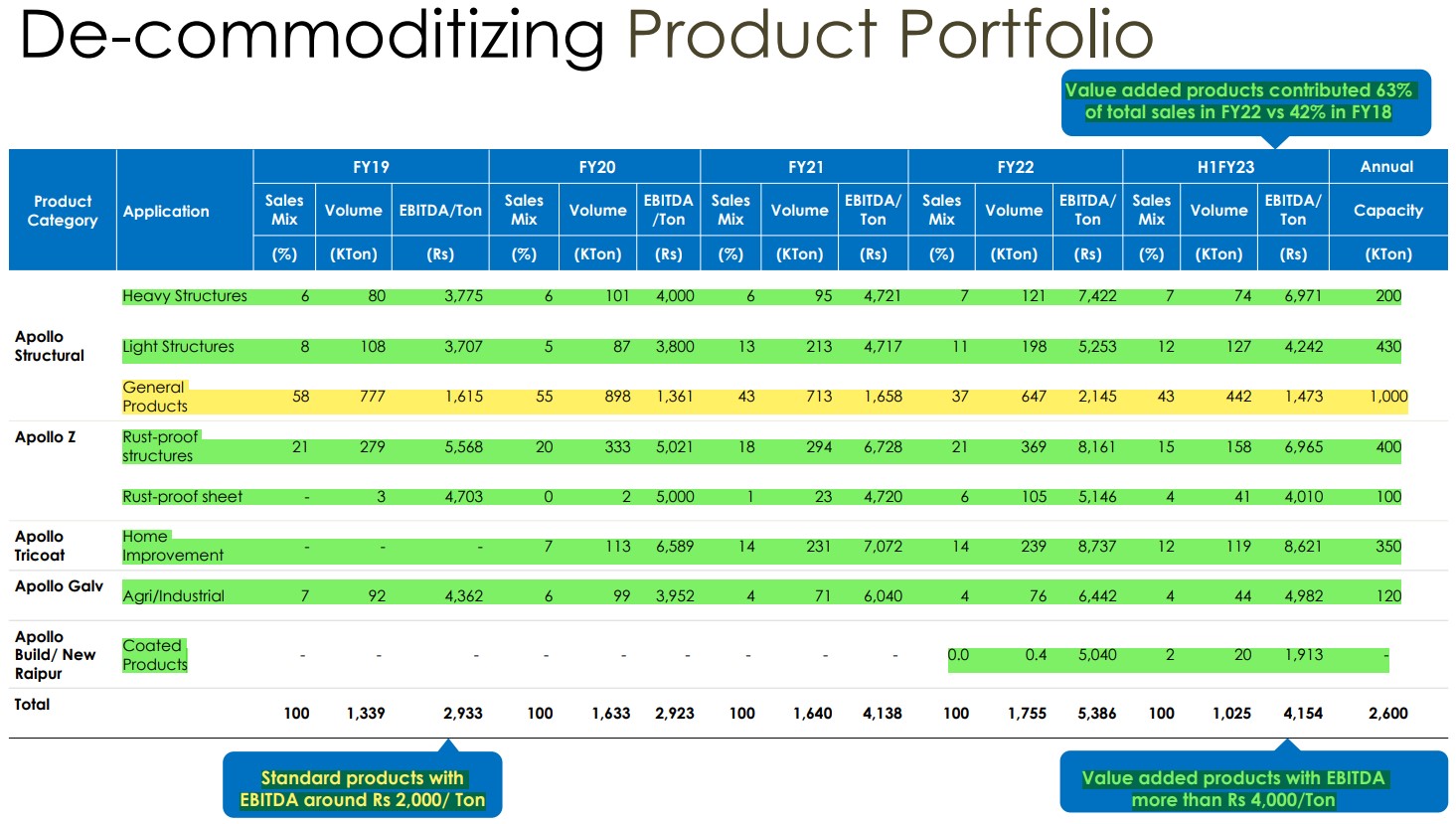

APL Apollo Tubes – “De-Commoditizing Product Portfolio” – The Maverick Approach

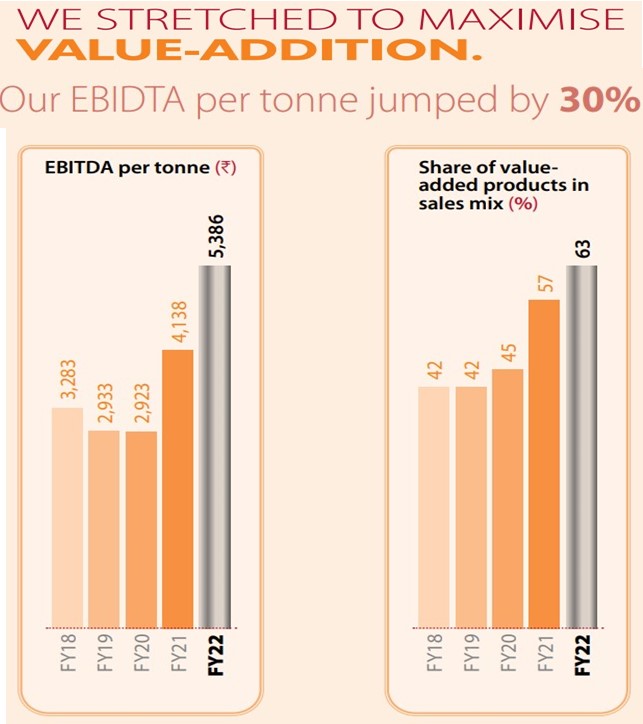

Compared to the EBITDA/Ton of ~ Rs. 2000 which sale of Standard/General Products generates, Sale of Value-Added Products generates more than ~ Rs. 4000 of EBITDA/Ton.

Hence APL Apollo Tubes has strategically & consistently Increased the Share of its Value-Added Products in its Sales Mix, from 42% (of sales mix) in FY18 to 63% in FY22.

Even in the Value-Added Products EBITDA/Ton varies from as high as Rs. 8621 for products meant for Home-Improvement Applications under Apollo Tricoat category, to as low as Rs. 4010 meant for use as Rust-Proof Sheet under Apollo Z product category, whereas remaining others fall in between.

APL Apollo Tubes in addition to above, have also increased its Installed Capacity to manufacture the Value-Added Products, where it has relatively higher advantage in terms of EBITDA/Ton for e.g. Annual Capacity to manufacture Home-Improvement Applications products under Apollo Tricoat category (Rs. 8621 of EBITDA/Ton) and Rust-Proof Structures under Apollo Z product category (Rs. 6965 of EBITDA/Ton) is ~ 350KTon and 400KTon respectively, which is way higher than the Installed Annual Capacity of 100KTon and 120KTon respectively in case of Rust-Proof Sheet under Apollo Z product category (Rs. 4010 of EBITDA/Ton) and Agri/Industrial Application products under Apollo Galv product category (Rs. 4982 of EBITDA/Ton).

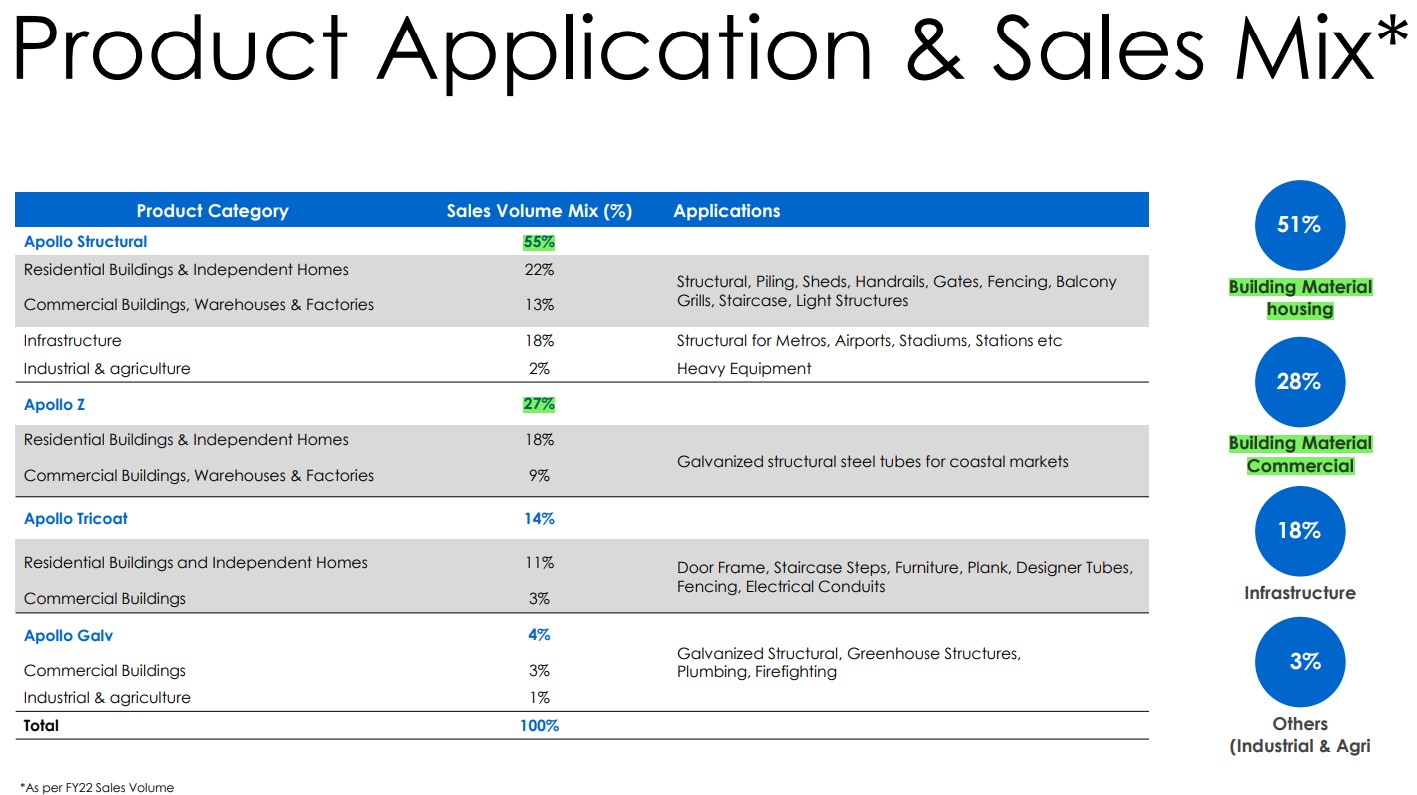

If we look at the Product Application & the Sales Mix of FY22, we may observe that 79% of the sale comes from the Building Material segment only and remaining 21% comes from the Infrastructure and others (Industrial, Agri etc.).

Therefore, APL Apollo Tube is actually a Proxy on the growth of multiple sectors, but mainly on Housing (Home Improvement specifically) and Infrastructure.

Not to forget that ~ 63% of this sale mix is constituted by the Value-Added products & only 37% is from the sale of commodity products. The Volume-Value Play is clearly very evident from 3 out of the 4 product category namely – Apollo Structural, Apollo Z, and Apollo Tricoat.

Out of 1.75mn tonne of total production which fully converted into sales in FY22 – 0.32mn tonne (18.29%) is Apollo Structural (Hollow Sections); 0.47mn tonne (26.86%) is Apollo Z (Pregalvanized GP); 0.08mn tonne (4.57%) Apollo Build (Galvanized GI); 0.65mn tonne (37.14%) Apollo Standard (Black Pipes); 0.23mn tonne (13.14%) Apollo Tricoat (Consumer Centric Products).

APL Apollo Tubes – Revolutionizing The Indian Construction Industry

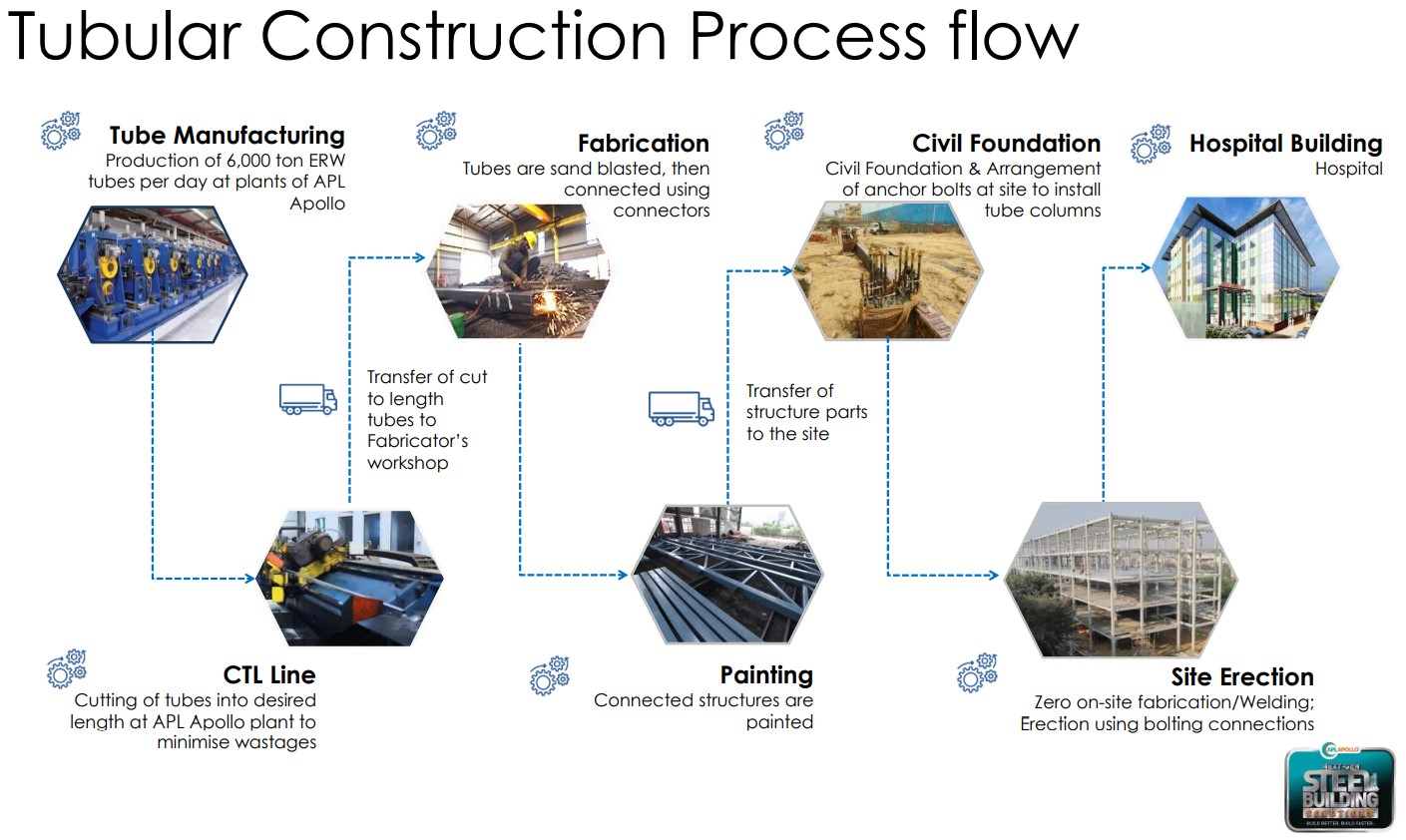

Tubular Technology – “The Game Changer Whose Time Has Come”. It is prevalent across the world, where the entire steel superstructure is made at the factories and then brought to the site & fitted. Same technology is now going to populate the India’s Skyline.

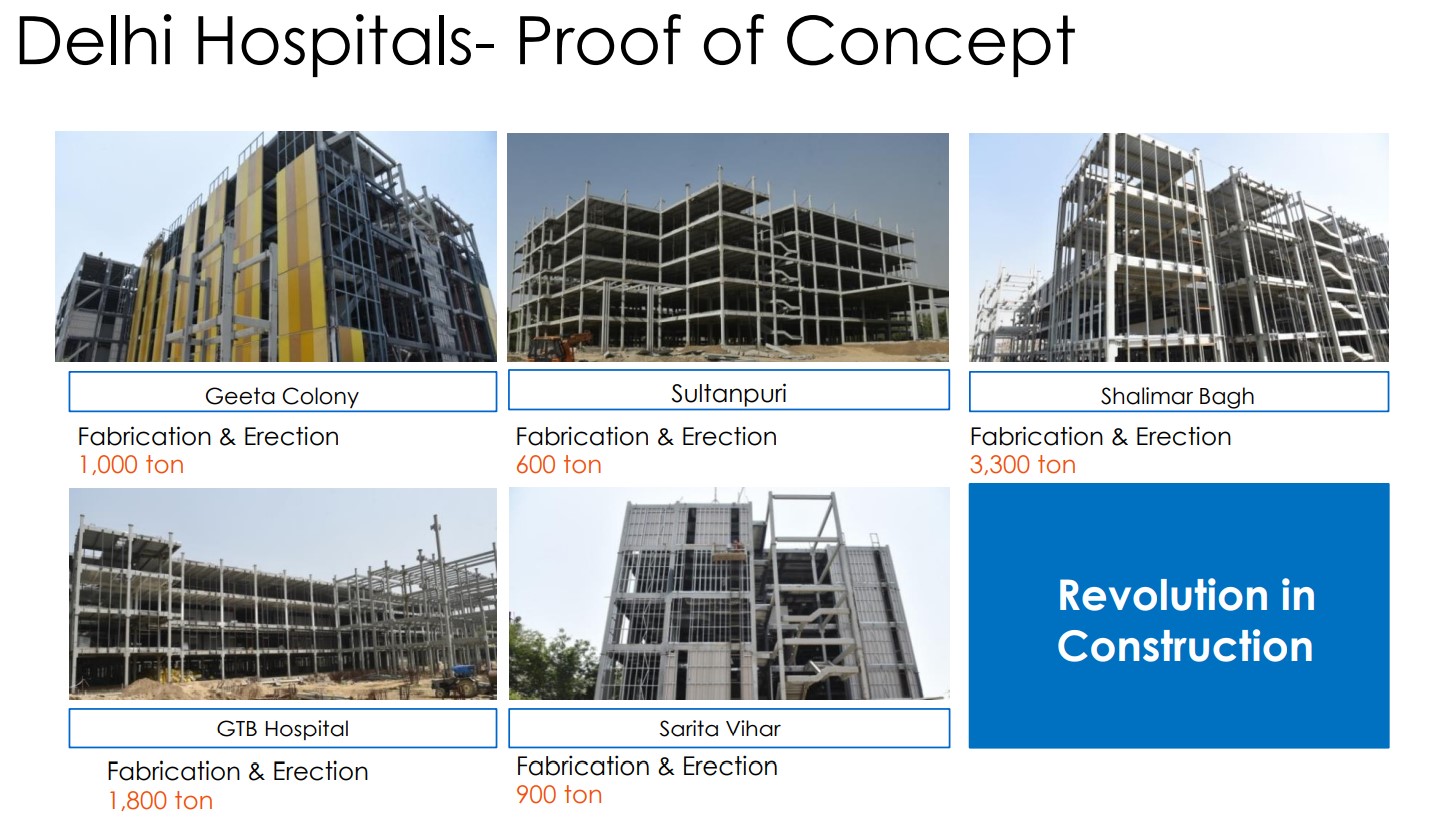

APL Apollo’s Revolutionary Journey has begun as it has received a 15,000 tonne Showcase Project, where its Products are going to be used in 7 Medical Buildings in Delhi for creating a 1.8 mn sq. ft. built-up area, using Tubular Technology.

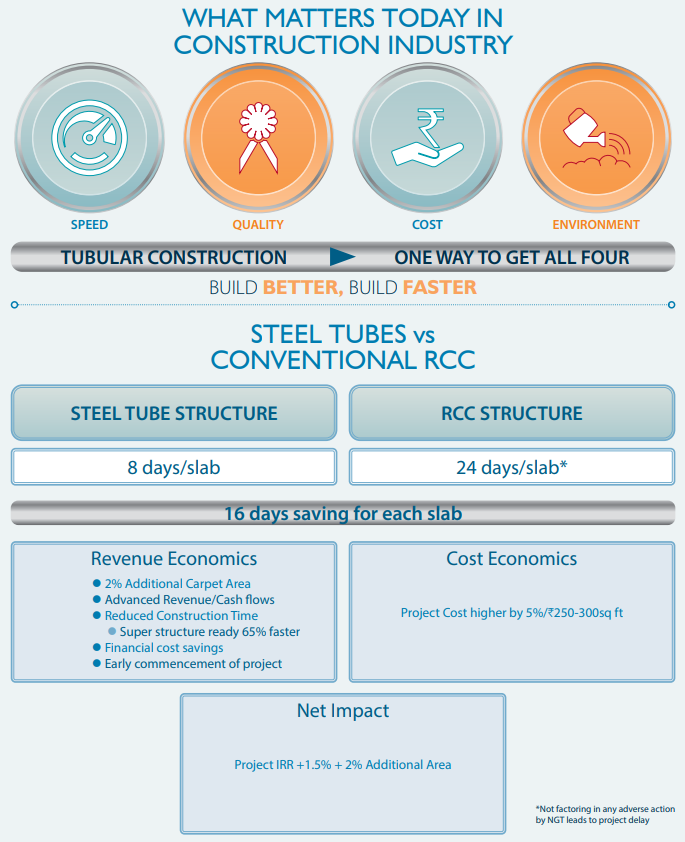

Speed – Quality – Cost – Environment are the 4 things that matters today in the Construction Industry, to Build Better & Build Faster! Steel tubes provides multiple benefits over the Conventional RCC as given below:

With 45 Projects of ~ 42 mn sq. ft. of built-up area in the pipeline, APL Apollo Tube is all set to garner the sale volume against 0.22 mn tonnes of the Heavy Structural Column Tubes Demand, in the very near future. So, how does Tubular Construction Process Flows?

These days almost all modern structures like airport terminals, modern buildings, warehouses, etc. use structural steel tubes extensively. This kind of tube has very high tensile strength and works very well against longitudinal stress, meaning it does not bend easily.

During construction, it provides greater durability than regular pipes and concrete. These tubes are corrosion-resistant. In terms of construction, structural steel tubes are very flexible to work with. As a steel material, it is very recyclable.

Using steel pipes can be very cost-effective because of the minimum requirement of the workforce and it’s cheaper than other materials. Also, it provides excellent protection to the materials running through it. Also, these tubes are light and consistent, so weight is not a concern anymore.

Infrastructure players are still waking up to the benefits of using these tubes in big construction projects, as a much better alternative to concrete-based structures.

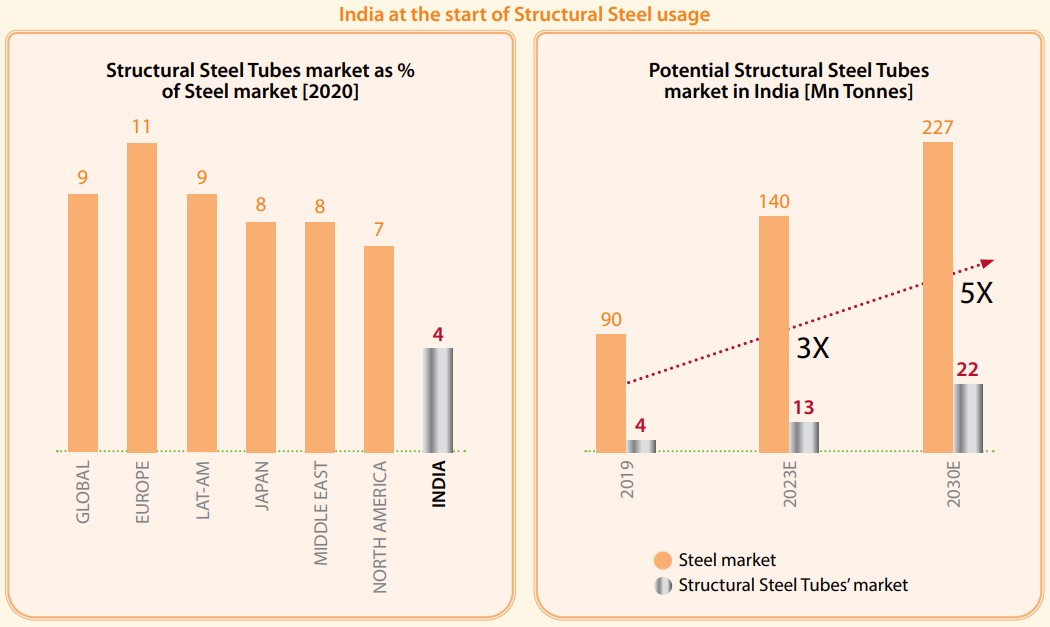

According to sources, 9% of total steel used globally is in the form of structural steel tubes. But in India, that number accounts for only about 4%.

APL Apollo Tubes – Growth Drivers and The Tailwinds

In India, housing construction is fueling the demand for structural steel tubes. Also, the Government’s push for infrastructure expansion and fast-track construction of large infrastructure projects like airports, is driving the demand for these tubes.

Warehouse creation is also fueling off-take. Moreover, the pandemic and the resultant labour shortage have pushed the construction companies to use these tubes – owing to their easily customisable nature.

India’s structural Steel Tubes market size is 4 mn tonne, out of a total ERW market size of 6 mn tonne (balance is water transportation).

Demand Drivers

The National Infrastructure Pipeline (2020-25) has envisaged a target investment of Rs. 111 trillion between 2020-2025. The Government will invest ~ Rs. 20-22 trillion annually, of which about 45% will come from the budgetary allocations.

To encourage infrastructure development, state governments will be given a 50-year interest-free loan of ~ Rs.1 trillion in FY22- 23.

HIGH-RISE BUILDINGS: India, to satiate the burgeoning demand for residential and commercial space will need to build between 700-900 mn sq. mtrs annually & the majority of this new development will comprise high-rise buildings.

AIRPORT INFRASTRUCTURE: The Airports Authority of India (AAI) has estimated a cost of Rs. 250 bn for developing new airports and expanding/ upgrading existing airports over the next 4-5 years.

Additionally, 3 Public-Private Partnership airports in Delhi, Bengaluru, and Hyderabad have undertaken expansion plans to the tune of Rs. 300 bn by the year 2025.

ORGANISED WAREHOUSING: According to Knight Frank Research, Indian e-commerce is to occupy most warehousing spaces in the next 5 years from FY 2022 – 2026 at 9.1 mn sq. mts, 165% more than the preceding period of FY (2017 – 2021), while annual warehousing transactions will grow at a CAGR of 19% to 7.08 mn sq. mts in FY 2026, from 2.95 mn sq. mts in FY 2021.

Vertical Agriculture – Green Growth

In India, this kind of farming is primarily polyhouse-based farming which facilitates higher productivity and yield of vegetables and fruits. Additionally, Smart Hydroponic farms use vertically stacked growing beds, which occupy less than 1% of the space, otherwise needed for the similar output.

Smart farms promise reliable pricing, predictable returns and significantly higher returns since the produce can be grown indoors, all year long. While traditional farming takes 45-60 days – from growing seeds to harvesting – smart farming does that in only 25 days.

APL Apollo Tubes – Financial Numbers & Risk Management Framework

“Today I am looking at 2025, by then I aim to be at the 4 mn tonne Sales mark with a 5 mn tonne Capacity mark and generating an EBITDA of Rs. 20 billion” – APL Apollo Tubes Ltd.

Come what may APL Apollo Tubes knows how to grow organically & attain earnings objectives, across the economic cycles, to sustain EPS growth of +30% along with ROCE of ≥ 30%.

Compared to FY21, FY22 Sales Volume grew by 7% (with the highest ever volume of 1.75 million tonnes), EBITDA Increased by 39% and PAT by 55%. Average EBITDA per Tonne Improved to Rs. 5,386 from Rs. 4,138 per tonne, in the previous year, owing to the sharpened focus on value addition, brand building etc.

Company’s Value-Added sales mix improved to 63% from 57% in FY21, due to exceptional growth in Coated Tubes and Heavy Structural Tubes.

Coming to performance in H1FY23:

APL Apollo Tubes posted sharp volume growth of 41%/28% YoY to 0.6mt/1mt in Q2FY23/ H1FY23, led by strong growth across the product categories (except for Apollo Z, where volume de-growth of 11% YoY in Q2FY23 was seen).

With robust volume show and potential ramp-up at new 1.5 mtpa Raipur plant (expected to be commissioned in Q3FY23), APL would be able to comfortably achieve volume growth of ~ 37% for FY23. Raipur plant is important for APL, as it would drive both volume and value growth (innovative products colour coated tubes, heavy structural tubes and colour-coated sheets with much higher EBITDA margin of Rs. 6,000-8,000/tonne) for APL – (Source: https://bsmedia.business-standard.com/_media/bs/data/market-reports/equity-brokertips/2022-10/16654578500.10151800.pdf)

Management had earlier guided for 32% volume CAGR over FY22-25E and targets to more than double its EBITDA to Rs. 2,000 crore by FY25.

APL reported super strong sales volume growth of 42% QoQ to 602 KTon, although VAP mix declined to 54%, compared to 62% in Q2FY22.

APL’s management expects the primary structural steel tube market to reach 6mtpa by FY25 (vs 3 mtpa currently), as volume would shift towards primary market from the secondary as the price gap has narrowed down significantly.

Also, steel tubular technology is gaining acceptance in construction projects (net benefit of +1.5% project IRR and +2% additional carpet area).

With existing capacity utilisation of 78% (based on H1FY23 volume) and upcoming 1.5 mtpa new Raipur plant – APL is well placed to capture growth opportunities, as primary structural steel tube market is expected to almost doubles in size and rising applications of steel tubes for construction across airports, warehouses, high-rise buildings etc.

Raipur plant to improve volume/margin further and help EBITDA to jump by over 2x by FY25: Management expects that ramp-up at this plant would drive up volume to 4 mt by FY25 (32% CAGR over FY22-25E), improve VAP mix to 70-75% and more than double its EBITDA to Rs. 2,000 crore by FY25 (vs Rs. 945 crore in FY22).

For ensuring this anticipated growth to materialise, APL Apollo Tubes has Risk Management Framework for “Ring – Fencing the business prospects” from Visible & Potential Uncertainties:

| Risk Type | Mitigation Measure |

| GROWTH RISK – Business growth is essential for sustaining it’s ambition of delivering value to stakeholders. | APL Apollo has registered healthy business in each of the previous five years despite significant headwinds in India and across the globe. Further, the Company continues to launch new products which have the potential to spur business growth over the coming years. |

| CAPACITY RISK – Lack of capacity to manufacture existing and new products could hamper value-addition and business growth. | APL Apollo has continued to invest in capacity addition through the brownfield and Greenfield initiatives. Its Raipur plant, the single largest such facility in India, will only manufactures value-added products – significantly strengthening the Company’s aspiration for value-drive growth. |

| PORTFOLIO RISK – Competition will degrade premium products to standard products over a period of time. | APL Apollo’s ability to absorb new technology that allows it to introduce novel products, this strength allows the Company to stay ahead of the competition. It also ensures that the revenue contribution from value-added products continues to increase. |

| DEBT RISK – A high debt burden would impede the Company’s ability to undertake growth initiatives. | APL Apollo enjoys a Net Zero-Debt position. Further, the growing cash flow from operations owing to its healthy y-o-y growth makes the Company increasingly liquid. The Company has financed its new Greenfield facility at Raipur through internal accruals |

| IDEATION RISK – There is a need to develop novel products and solutions that provide a long-term edge. | APL Apollo has successfully developed a new concept – developing pre-fabricated structures using its tubes. This new concept is expected to revolutionise the construction sector. |

| DEALER & CUSTOMER CONNECT RISK – Strengthening relations with dealers and the end consumer is essential for growth. | page 66 of – https://www.bseindia.com/bseplus/AnnualReport/533758/74442533758.pdf |

| DEALER ATTRITION RISK – The loss of dealers could hamper the sales of the product and provide an opportunity for competition to enter | page 66 of – https://www.bseindia.com/bseplus/AnnualReport/533758/74442533758.pdf |

APL Apollo Tubes – The Verdict on Future Growth

Rising application of structured steel tubes in construction projects is expected to expand the share of structural steel tubes in India’s steel consumption to 10% by 2030. This would expand India’s structural market to 22 mt by 2030, which implies robust 17% CAGR over CY19-30E.

Hence APL Apollo Tube is well placed to grab this massive volume opportunity, given presence across India, spare capacity (utilisation rate of 78%) & further capacity expansion to 4mtpa (from 2.6 mtpa currently), and new innovative product launches (colour-coated tubes and heavy structural tubes).

Additionally APL’s recent project win to supply structured steel tubes for construction of 7 hospitals is Delhi is an indication of shifting trend from RCC structures to the Steel Structures, given several benefits which includes better project IRR, Lower construction time and Higher carpet area. Thus, there is a scope for further Market Share Gain from current level of 55% and Superior Volume CAGR of ~ 28% over FY22-25E.