Problem for Asian Paints has started from FY21, when the strong economic growth led by resurgence in goods consumption across categories (especially in the developed markets), coupled with the supply chain bottlenecks, has led to significant spike in inflation.

While the initial pick-up in inflation was led by demand recovery on the FY20’s low base, persistent disruptions in the global supply chain network have caused inflationary pressures to be more broad-based and persistent, running at multi-decade highs in almost all the major economies.

Given that material cost for Asian Paints, accounts for ~ 50% of total cost of sales, with titanium dioxide and crude-based derivatives comprising majority of total raw material cost, profitability in the non-decorative segment is susceptible to volatility in the raw material prices (Source: https://www.crisilratings.com/mnt/winshare/Ratings/RatingList/RatingDocs/AsianPaintsLimited_January%2012,%202023_RR_308786.html)

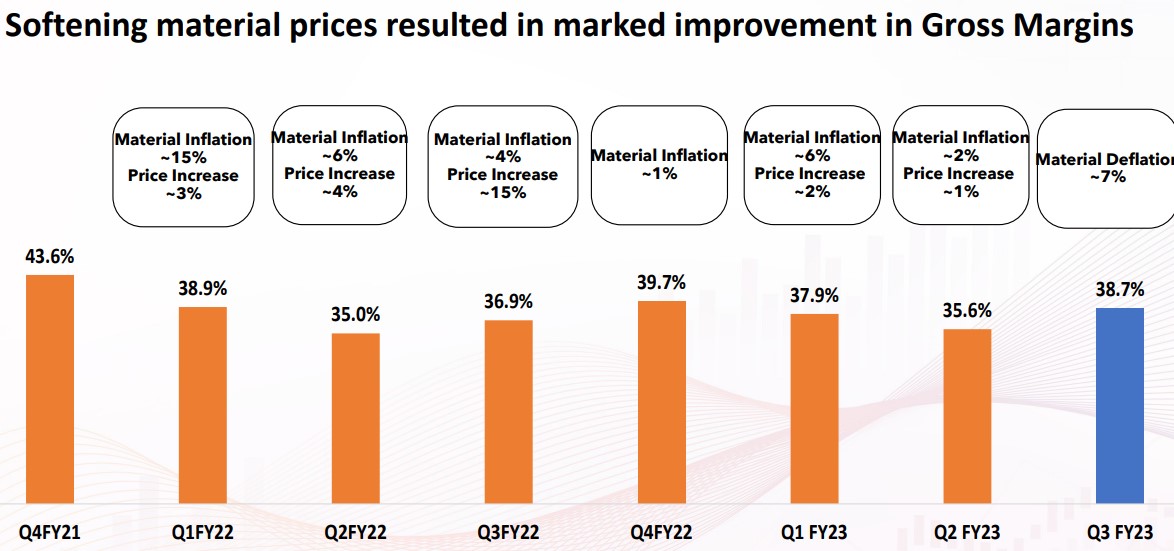

The adverse impact of sharp rise in raw material prices was visible not only during FY22 but also in first half of FY23, resulting in lower gross margins. Further, the organized paint industry is dominated by only few large players. There is competition from strong regional players too, especially in the mass-market products.

Consequently, while paint manufacturers like Asian Paints have the flexibility to pass on the Input Cost affects, their ability to absorb cost benefits and thereby materially increase margins, is limited.

This Confluence of Multi-Factorial Unprecedented Uncertainties has put even the Undisputed Paint Sector Leader in a Fix and in this article, we will read how well Asian Paints is prepared to deal with these Formidable Challenges.

So How Asian Paints going to deal with these Unprecedented Uncertainties & what will Drive the Value Growth?

For Asian Paints record inflationary pressure coupled with the COVID-19 challenges, has dented both top line & the bottom line. Supply chain disruptions, led by the lack of adequate shipping containers, added to the operating challenges.

Export-focused sectors have gained from the strong improvement in global trade as well as government initiatives that have pitched India as an attractive investment destination to the global corporations, who have been looking to de-risk their supply chains, as part of their China + One strategy.

However, an upswing in inflation across commodities and products has resulted in rising import bills and a depreciating rupee, which have compromised many of the import-dependent sectors. Policymakers in India will have to do a tough balancing act in trying to manage the downside risks to the economy, which is still recovering, while dealing with the inflationary pressures by moving away from the accommodative monetary stance of the last couple of years.

Businesses too will need to play this balancing act, addressing supply chain disruptions and inflationary concerns through innovative approaches and at the same time, entrenching the demand recovery.

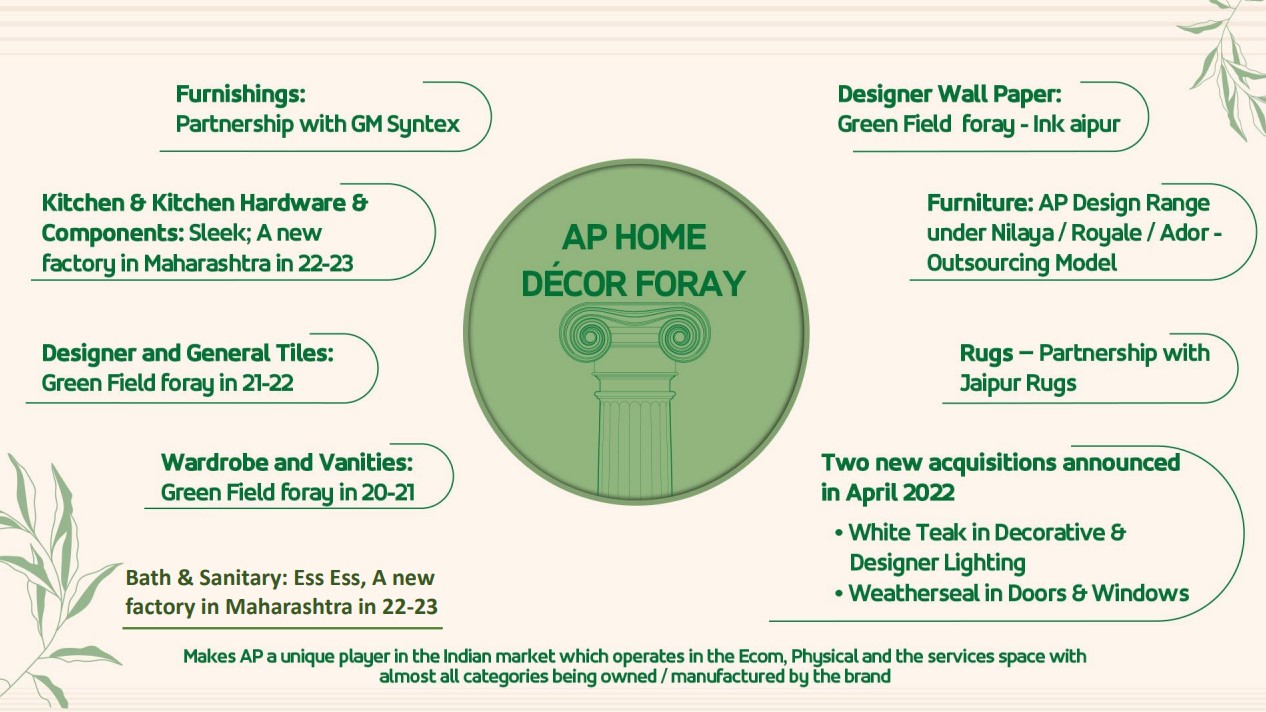

Through Evolution of Asian Paints, from ‘Share of Surface’ to ‘Share of Space’

Asian Paints now have one of the most inspiring and cutting edge décor engine ‘www.beautifulhomes.com’ where customers come in large numbers and find their inspiration in their Dream Homes.

In order to ensure that customers get the best from Home Décor, company have been able to expand ‘Beautiful Home Stores’ to various cities and now it have 38 stores functional in metros, T1/T2 Cities.

These one stop state-of-the-art Décor stores offer almost everything related to Home Décor with a world class phygital experience and an unparalleled inspiring consumer journey.

Company also have a world class Home Décor execution platform offering end to end personalised Home Décor.

Asian Paints – Decorative Business

As ~ 85% of the group revenue comes from this business segment so here the strategic pillars of growth were led by upgradations strategies and deeper penetration into smaller cities, setting up mechanisms to reach alternate channels, and increasing the depth in the distribution through targeted openings.

These strategies were strongly complemented by leveraging the brand strength and looking at product innovation to grow the premium and luxury product mix, especially across T1 and T2 cities.

Initiatives undertaken in the digital and e-commerce space to address the challenges posed by the pandemic, have ensured that the dealers, contractors, influencers as well as the consumers are able to access Asian Paints products and services in a seamless manner.

Asian Paints – Beautiful Home Service

The interior design and makeover service in India is still a largely unorganized space, with only a few organised companies entering the space in recent years. These players, however, deliver customers run-of-the-mill designs and similar looking homes, and that’s where Asian Paints Beautiful Homes Service comes in!

The key proposition of this service is personalised design and professional execution. Company ensure that it respect customers’ individuality and make designs that suit their needs.

Asian Paints – Waterproofing Service

This Category has provided a substantial impetus to the growth trajectory. Continuous new product launches & activation’s, and intensive contractor and retailer training, have enabled Asian Paints to double their revenues from this category across most of the markets* and ramp up their presence in a short duration.

Smartcare Waterproofing was a strong solution-oriented strategy which helped galvanise the overall growth of the business. The waterproofing and adhesives product categories, two of the company’s recent category expansions, continued to grow significantly ahead of the overall portfolio growth.

Asian Paints – Safe Painting Service

The ultimate benchmark for a professional painting experience and provides consumers peace of mind by following safety protocols at each step of the painting process. The service is now well spread across T1, T2, and T3 cities, reaching a multitude of customers.

Consumer expectations are rapidly evolving in this space, with more and more consumers looking at a complete painting solution – from consultation to final delivery of finish – through professional service providers.

Asian Paints – White Teak and Weatherseal

White Teak offering Decorative and Designer Lighting and Weatherseal offering uPVC Windows and Doors. Hence, Asian Paints gaining from the synergies of both.

White Teak generated revenue of Rs 29 crs during Q3 & 9MFY23 revenue of Rs 73 crs against full year revenue of Rs 58 crs in FY22.

Weatherseal generated revenue of Rs 7 crs during Q3 & revenue of Rs 15 crs for Jun’22 to Dec’22 period against full year revenue of Rs 14 crs last year.

Both businesses are benefiting from the integration with the Beautiful Homes Stores Network. These forays in the large Home Décor Space will further propel Asian Paints transition from ‘share of surface’ to ‘share of space’ and enable it to play a larger part in the “customer life cycle of home makeover“.

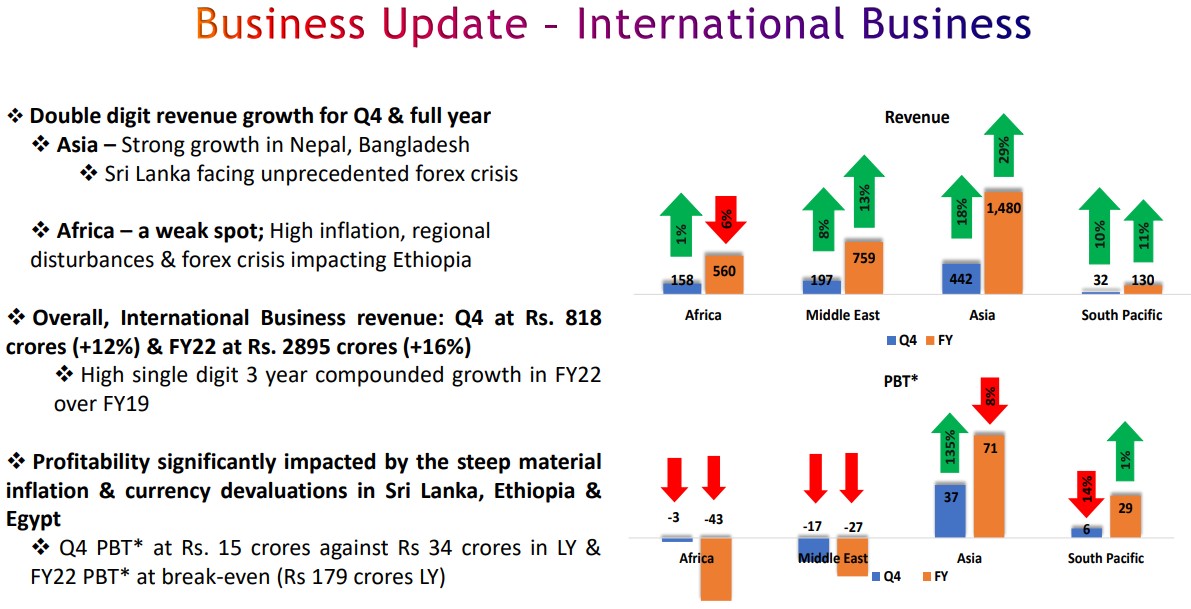

Asian Paints – International Business

This segment constitutes ~ 10% of the group revenue and company operates in 4 regions across Asia, the Middle East, South Pacific and Africa through 7 corporate brands viz. Asian Paints, Apco Coatings, Asian Paints Berger, Asian Paints Causeway, SCIB Paints, Taubmans and Kadisco Asian Paints.

Asian Paints concerted move to capture new network counters, enrol competition contractors and improve consumer mind share, has been its biggest growth driver. Growth in premium-luxury products played a pivotal role and enabled deeper shop-shares in existing critical and competitive retailers

(Source: https://www.bseindia.com/bseplus/AnnualReport/500820/73104500820.pdf)

During FY (2021-22), APL continued to focus on product value propositions and worked on launching/revamping products across markets, ensuring better quality and comprehensive offering to consumers.

The waterproofing category has provided a substantial impetus to APL’s growth trajectory, as it has enabled APL to double its revenues from this category across most of the markets*.

The Safe Painting Service rolled out in FY (2020-21) across most of the geographies, gained major traction in FY (2021- 22), which saw a close to 3x increase over the previous year.

Décor and Painting solutions offered under this umbrella have been well appreciated and have helped APL to create a strong differentiator vis-à-vis competition.

On-boarding of retailers and contractors was done swiftly, helping APL to create an unprecedented service revolution in the international markets.

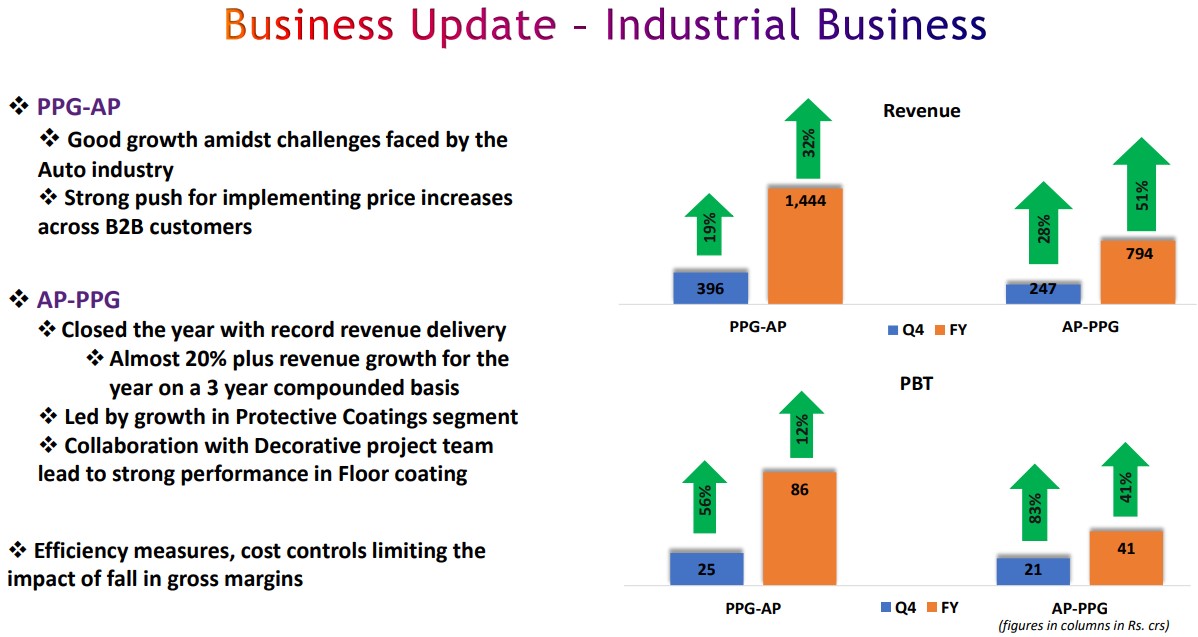

Asian Paints – Industrial Business

This makes ~ 2.5% of the group revenue and Asian Paints here operates in the Industrial Coatings segment through two 50:50 JVs with PPG Industries Inc. USA:

1) – PPG Asian Paints Pvt. Ltd. (PPG-AP) and;

2) – Asian Paints PPG Pvt. Ltd. (AP-PPG).

Of the total industrial paint demand, about 2/3 come from the automotive sector.

PPG-AP is the first 50:50 JV of the Company with PPG Industries Inc., USA. One of the largest industrial coatings suppliers in India, PPG-AP manufactures and trades in paints, coatings and adhesives and sealants for automotive OEMs, certain industrial segments, the automotive refinish segment, and packaging and marine segments.

PPG-AP registered double digit growth in sales driven by the growth in volumes in most segments. Further, it was able to successfully garner price increases with its key automotive customers, though with a considerable lag, which supported the topline growth to an extent.

The delay in closure of price increases, which was required to offset the impact of inflation, hurt business profitability. However, innovation in formulation, sourcing efficiency and other cost optimisation efforts helped minimise this adverse impact on profitability.

AP-PPG serves the non-auto industrial coatings market of India and is 2nd 50:50 JV with PPG Industries Inc., USA.

The JV operates in protective coatings, powder coatings, floor coatings and road markings segments, servicing customers in infrastructure, oil and gas, power and white goods sectors, among others.

Despite challenging environment, AP-PPG delivered record revenues FY22. Growth in the Protective Coatings segment was driven by new customer wins, strong execution of key projects and expansion of channel network.

Focus on new customer acquisitions and product portfolio enhancements contributed to the strong growth in the Powder Coatings and Road Markings segments. The Floor Coatings business gained significantly from the collaboration with the Decorative Business Projects team, leveraging its vast customer reach to solidify its position in the segment.

Swift implementation of:

1) – Price increase to offset the raw material cost inflation;

2) – Product Mix improvement and;

3) – Cost Optimization measures

Helped the business protect its margins.

Asian Paints – Kitchen & Bath Business

This business segment constitutes ~ 2.6% of the gross revenue and Asian Paints forayed into the Kitchen business by acquiring 51% stake in Sleek International Pvt. Ltd. (Sleek) in FY (2013-14). Later on, APL increased the stake to 100% in FY (2017-18). ‘Sleek by Asian Paints’ is present in both the Kitchen Components as well as the Full Modular Solutions segments.

Under the Kitchen Components segment, APL sell its own range of Kitchen Hardware, Kitchen Accessories and Kitchen Appliances through the B2B channel. Under the Full Modular Solutions segment, APL undertake Design-to-Execution of full kitchens through a strong network of franchisee owned showrooms across the country.

During FY 2021-22, Sleek clocked revenue growth of 54.8% despite disruptions. The growth was driven by strong performance across both the Kitchen Components and the Full Modular Solutions segments.

Asian Paints continued to expand its showroom network, on-boarding the right profile of concept-selling and service-oriented dealers. APL now have more than 250 showrooms, across the country, offering the full modular kitchen design and installation services.

This is an unparalleled network in this line of business in the country, and it offers APL a unique positioning from where to disrupt the market, with solutions that cater to varied customer requirements in the space.

Integration with the Beautiful Homes Stores Network as well as the Beautiful Homes Service Solution has also enabled Asian Paints to scale up the offering. APL have also taken new product initiatives in the Kitchen Components segment – introducing new profiles and sliding fittings, which have opened new avenues for it in the Kitchen Hardware Category.

This has helped Asian Paints to establish as a formidable player in a segment which traditionally was dominated by the European brands.

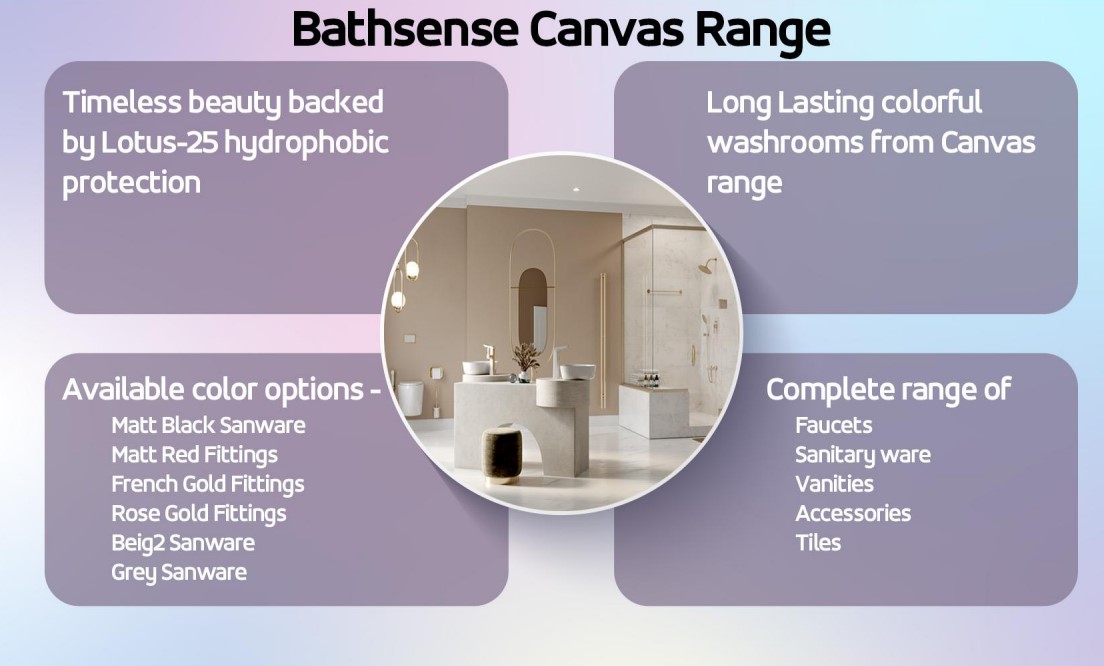

Bath Fittings & Sanitaryware business grew well during FY22 due to network leveraging and product expansion initiatives undertaken by Asian Paints in last couple of years. A range of new products including touch-free products in the CP fittings and sanitaryware space were launched during the year.

Concept products (CP) and fittings were launched under the CANVAS range – a unique range of products that provides the consumer the choice of coloured bath fittings and complements the sanitaryware of choice.

Products under CANVAS come with one-of-its kind Lotus 25 hydrophobic technology that provides long term warranty from scaling on the CP fittings.

The business also moved ahead with the launch of concept bathrooms under BESPOKE – which offers themes and designs for a full bathroom solution as a service to customers in select cities. The business made a strong impact in the Projects segment during the year, leveraging the strengths of the Decorative Business Projects team.

This has helped Asian Paints to make greater inroads in this category across a range of customers, including prominent builders and construction companies, while catering to the government infrastructure orders at an enhanced scale.

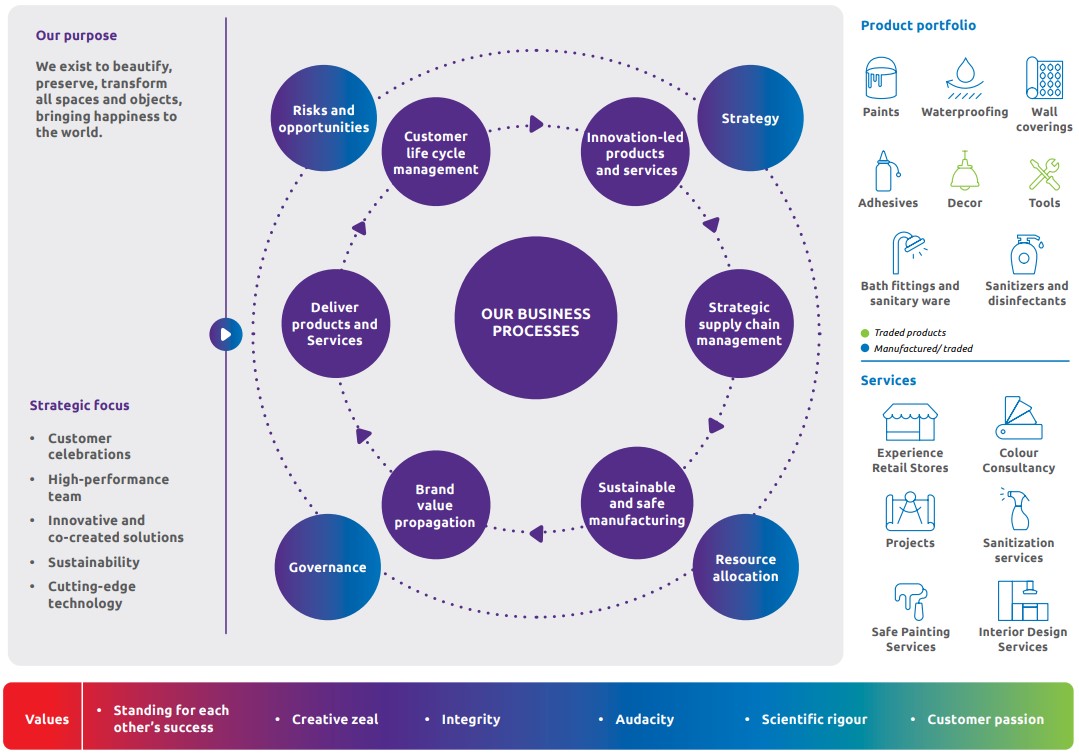

Through The Purpose & Strategic Focus of Asian Paints on its Business Processes

Throughout FY22 & First 9M of FY23, the industry experienced an unprecedented raw material cost inflation as well as uncertainty in the supply of the input materials, given the steep rise in ocean freight and the shipping delays.

So Asian Paints leveraged its highly integrated and digitised supply chain network of multiple manufacturing sites, vast and well spread-out supply points, and work culture of collaborative working with business partners (dealers, contractors, suppliers and other service providers) – to capitalise on the significant paint demand present in the market.

On the one hand, the Suppliers and Asian Paints Ecosystems merged together collaborating to Overcome the value chain disruptions through tripartite contracts, proactive and transparent information exchange.

On the other hand, the Asian Paints Supply Chain Team and the Sales & Marketing Team came together as one team to Dynamically Optimise available resources, to service the paint demand in context of the disrupted material supply, manpower constraints due to COVID infections, and local authorities restrictions which were preventing the operations.

Scenario-Based Planning, Inventory Optimisation and Staging across the chain, Deployment of Differentiated Distribution Strategies, New Models for Demand Estimation along with frequent reviews and dynamic procurement strategies, not only ensured that APL serviced the paint demand but also achieved the Highest ever Order Fill Rates.

Several initiatives utilising – Artificial Intelligence, Machine Learning and other Cutting-Edge technologies in the realm of planning systems and manufacturing – ensured cost optimisation, competitive advantage and flexibility in servicing the customer demand, while furthering the supply chain resilience.

An ahead-of-the-industry growth, especially over the last two years, has meant that Asian Paints have been able to enhance its capacity utilisation levels across the manufacturing plants, including at Mysuru and Visakhapatnam which were the latest to be commissioned with an installed capacity of 300,000 KL per annum each.

Asian Paints foray into the Home Décor business has enabled it to capitalise on the synergy between home renovation, new homes and home makeovers, thus allowing it to capture the customer lifecycle while retaining company’s core strength in the home painting category. The waterproofing and other admixtures sections have gained traction, while a strong uptick from the new launches in the premium space is also anticipated.

Cost optimisation to deliver Sustained Profits – Optimisation of product formulations and manufacturing processes to reduce costs, so as to generate higher savings to cushion the impact of the inflation.

At the same time, given the continued pressure of rising raw material prices, APL had to look at judiciously raising the prices of finished goods to protect the operating margins, taking utmost care not to adversely impact consumer demand in a significant manner.

Asian Paints resorted to some smaller price increases in the first half of FY22, whereas Significant price increases were taken in Q3FY22 to mitigate the continued inflation impact, which enabled it to improve the operating margins on the sequential basis.

Efficient Asset Utilisation and Working Capital Management – Asian Paints continued to drive higher utilisation at its recently commissioned large-scale manufacturing set-ups at Visakhapatnam and Mysuru, which offered them the benefit of lower operating cost per tonne of manufactured output.

APL consistently maintained a higher raw material inventory than the normal, to address raw material supply uncertainties on account of global supply chain disruptions as well as to contain the impact of rising inflation across key raw materials.

Simultaneously, APL also leveraged its forecasting capabilities to secure timely placement of raw material requirements and collaborated with the vendors to ensure their timely delivery for the processing.

To ensure No Loss of Sales amidst the uncertain customer demand, APL increased the finished goods inventory levels across its depots. This resulted in the overall inventory levels increasing by 1.7x compared to that of last year, but this enabled them to deliver industry beating revenue growth in a highly uncertain environment and hence minimise the impact of rising inflation.

On the trade receivable front, Asian Paints have introduced new credit terms for its dealer network leading to an increase in the average receivable days. Although at the same time, company had a continuous drive for recovery of overdue receivables from its dealers which resulted into considerable recovery from the debtors.

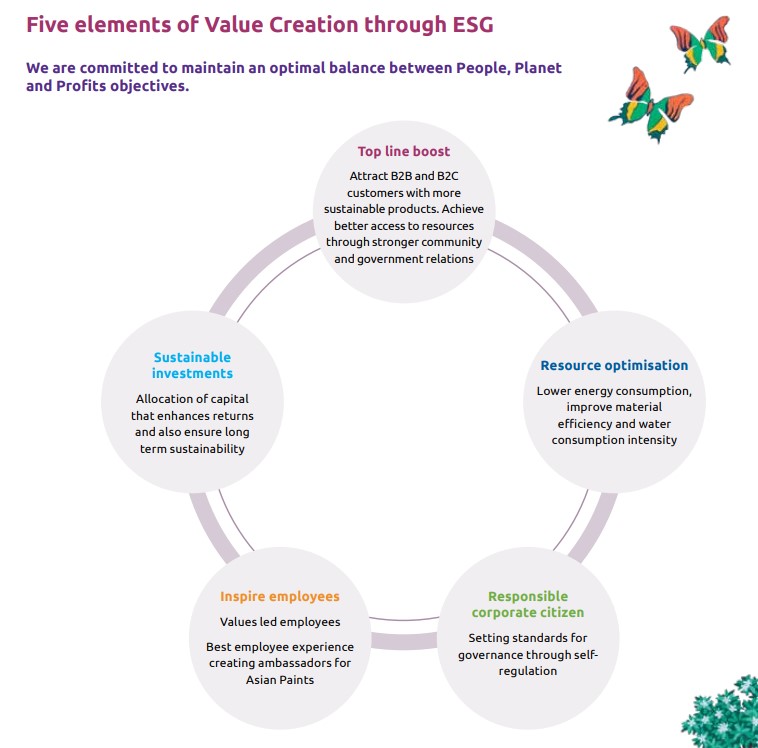

Effective Capital Allocation for the Future Growth and Sustained Return on Investment – The improved scale of operations, supported by significant revenue growth despite the challenges posed by current Unprecedented Uncertainties warrants continuous evaluation for investments in capacity expansion to support future growth needs.

At the same time, APL’s focus on innovation to bring out new product and service propositions and continuously enhance its customer engagement, requires sustained investments towards technology improvement in manufacturing, research & development, information technology, sustainability and so on.

Asian Paints aim to actively work on improving manufacturing asset utilisation, while simultaneously reducing fixed overhead costs, working capital, and energy and water usage. The key areas for improvement are:

i) – Material cost reduction;

ii) – Operational cost reduction;

iii) – Use of cutting-edge manufacturing technologies;

iv) – Data analytics

Use of cutting-edge manufacturing technologies – The focus on automation to improve the accuracy of production processes has enabled APL to deliver consistently and reduce waste. APL continuously adopted the latest state-of-the-art technologies which enabled them to drive greater efficiency in the supply chain, while delivering cost savings.

The latest technologies employed at manufacturing facilities provide APL feedback on the accuracy of material additions, adherence to recipe parameters, etc., which helped the company to optimise its manufacturing practices to best suit to cost reduction objectives.

During FY 2021-22, Asian Paints also implemented technologies which enabled visualisation of the bottlenecks, challenges faced in the manufacturing operations and so on, thus enabling quicker resolutions of problems.

To meet the ever-increasing demand, APL also use facilities of Outsourced Processing Centres (OPCs) for flexible production support. During FY 2021-22, company engaged with 28 OPCs to manufacture products sufficient to meet its needs and to produce quality products at acceptable manufacturing yields (https://jyadareturn.com/why-these-5-stocks-still-have-lots-of-potential-for-growth/)

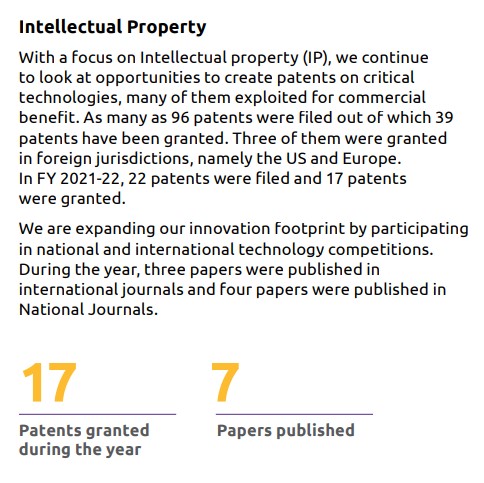

Asian Paints focus has been to develop differentiated products which are new to the industry in India / world so as to maintain its innovation quotient and technological edge in the market.

Therefore, APL has followed a Breakthrough Project Methodology which enables it to work backwards by:

1) – First visualising and finalising the expected outcome at the end of a definite period;

2) – Which is followed by defining the intermittent milestones required to achieve the same.

This has led to reduction in lead time required, from ideation to launch of the new products in the market.

Asian Paints have always been on the forefront in terms of leveraging technology for the business. This year too, it has continued to invest in digital technologies such as AI, ML, Robotic Process Automation (RPA), security systems and advanced analytics.

These technologies have been used to create immersive customer experiences, improve the operational productivity and aid better decision making.

Digital Interventions enabling Business

At Asian Paints, all innovations are conceptualized and implemented with the end goal in mind: a Superlative Customer Experience. With the focus on Décor, APL have enabled digital journey for its customers at company’s new Beautiful Home Stores.

APL have also enabled Beautiful Home Service (end-to-end Interior Design services) using technologies for digital lead management and 3D visualisation for interior design consultants and a digital execution platform to enable execution service as well.

Strengthening Supply Chain IT infrastructure

Asian Paints have been on the path of becoming “an Insight Driven Organisation” through Data Intelligence and have undertaken efforts to skill the workforce in this area. Initiatives taken include launching of a Supply Chain Control Tower – like capability to make the supply chain Agile and Responsive for various teams in Manufacturing, Planning & Distribution.

Also capabilities have been enhanced, such as incremental planning, deployed at the central supply chain planning processes through the use of a Cloud-Based new age incremental planning platform. This helps Distribution through:

1) – the Capability of Scenario Planning;

2) – The Capacity to Anticipate Demand Fluctuations and;

3) – Accordingly, to Better Company’s Service Levels.

Other benefits include Cost Saving due to Better Planning, Service Improvements, Productivity Improvement through NVA Reduction and Manpower Optimisation, Quicker Response Time, and System-Driven Processes & Workflows.

Through CapEx and Demonstrated Capabilities of Asian Paints

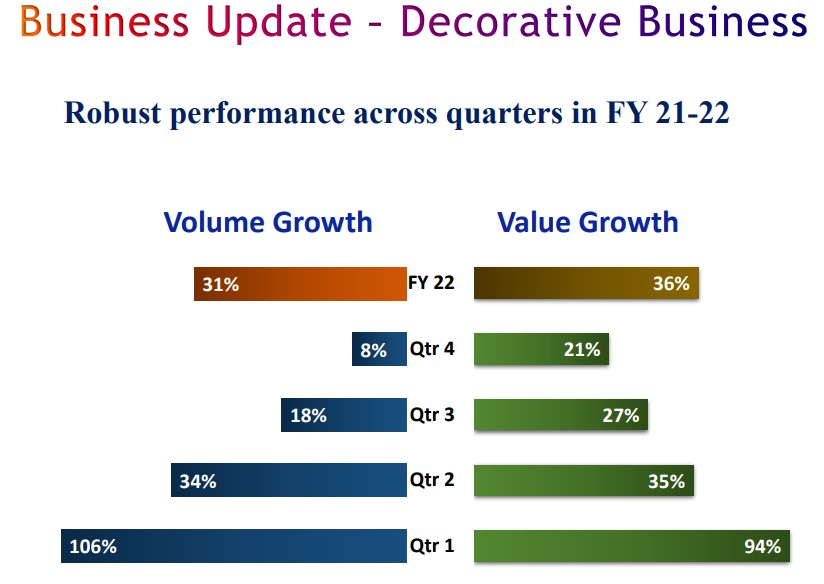

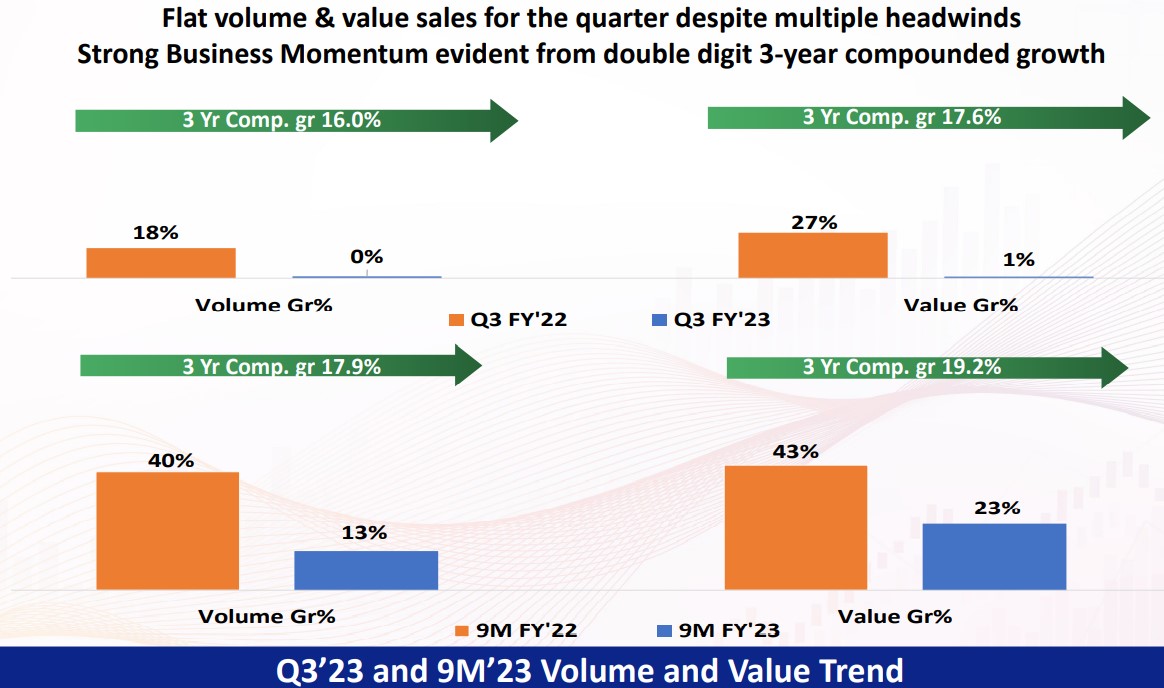

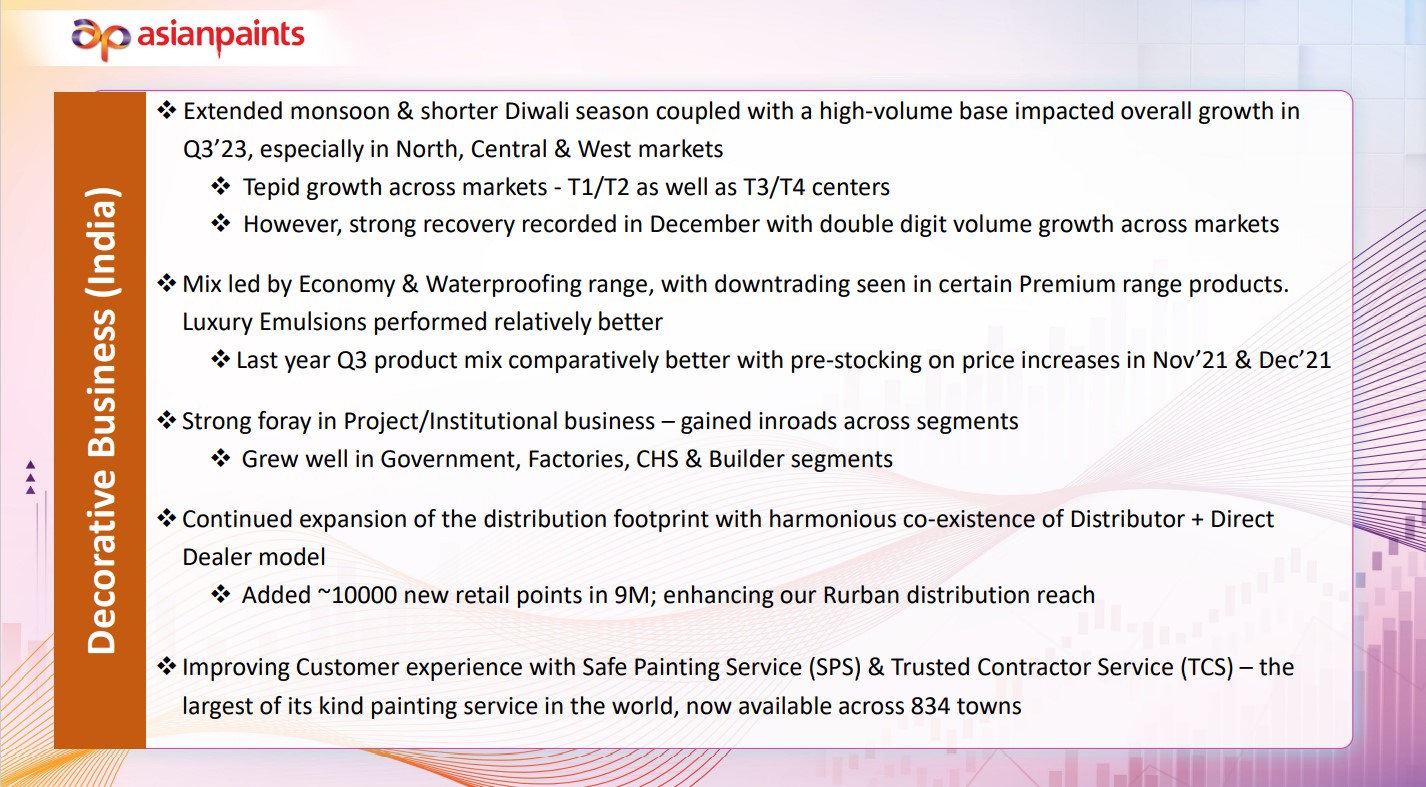

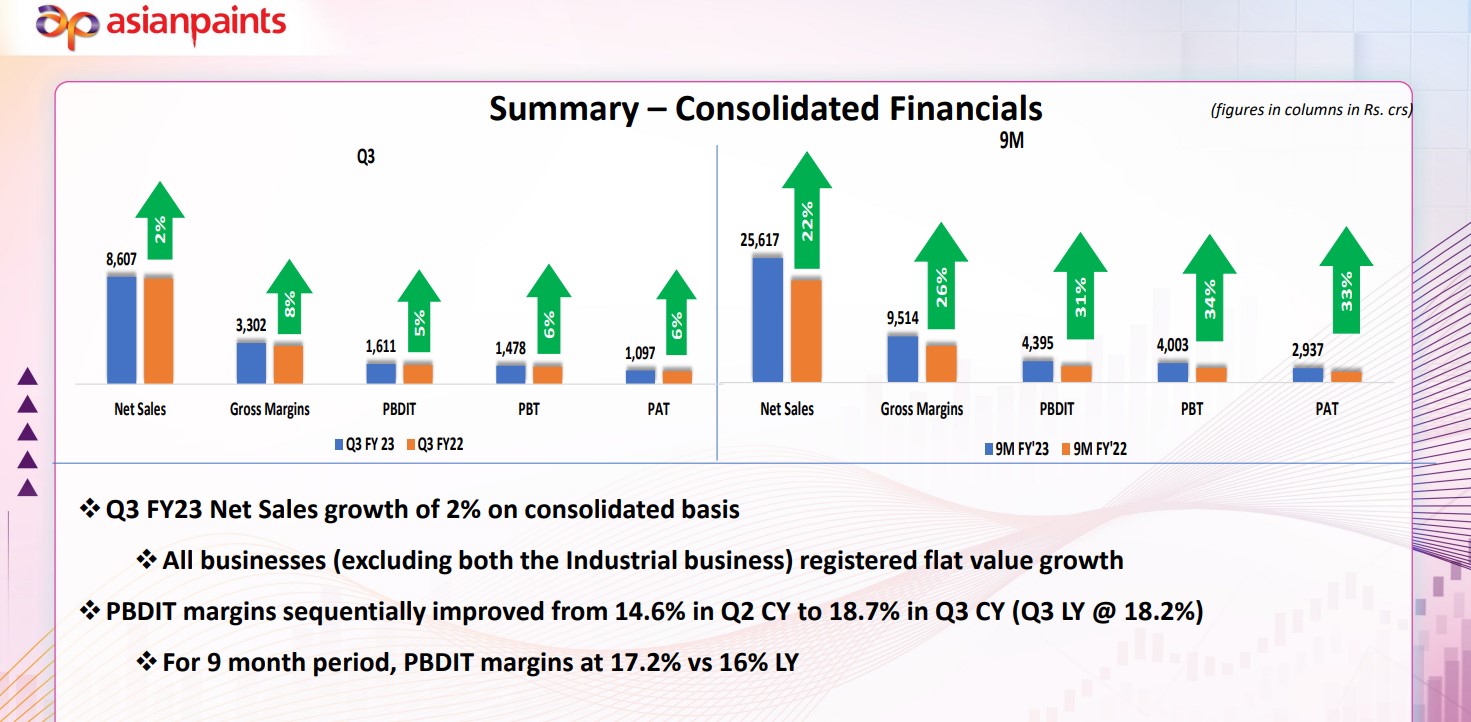

From 31% Volume Growth & 36% Value Growth which Asian Paints has registered in FY (21-22), company has registered only 13% Volume Growth & 23% Value Growth in 9MFY23.

Reasons being:

Q3FY23 Earnings Conference Call Highlights

Demand Outlook:

1) – According to the management, the company is seeing a demand recovery from December 2022 onwards as a result of easing inflationary pressure. The company is also witnessing double digit volume growth across its markets from December 2022 onwards.

2) – On the rural demand front, the management expects a boost in demand as a result of good monsoon along with increase in MSP.

3) – APL is also witnessing strong demand on the industrial paints front led by a demand recovery in the automotive segment.

4) – Institutional sales (government offices, housing societies contributes ~ 20% to overall sales) recorded healthy growth in 9MFY23. The company expects institutional sales to continue its growth momentum (double digit) in H1FY24 led by higher government CapEx on infra and uptick in real estate cycle.

Margins:

1) – The company has not taken any price increase in Q3FY23. There was a raw material deflation of ~ 7% resulting in an improved gross margin during the quarter.

2) – The management expects raw material prices to further soften in Q4FY23 leading to a further improvement in margin.

Network Expansion:

1) – In 9MFY23, the company has added ~ 10,000 new retail points.

2) – Asian Paints has a presence in 834 towns for its painting services.

Capex & expansion plans:

1) – APL’s total envisaged CapEx is Rs. 8750 crore over the next 3 years, out of which CapEx of Rs. 6750 crore was announced in Q2FY23 for brownfield and greenfield expansions for capacity enhancement, backward integration and acquisitions.

2) – The company announced an additional CapEx of Rs. 2000 crore in Q3FY23 to set up a new water-based manufacturing facility with a capacity of 4 lakh kilo-litre per annum.