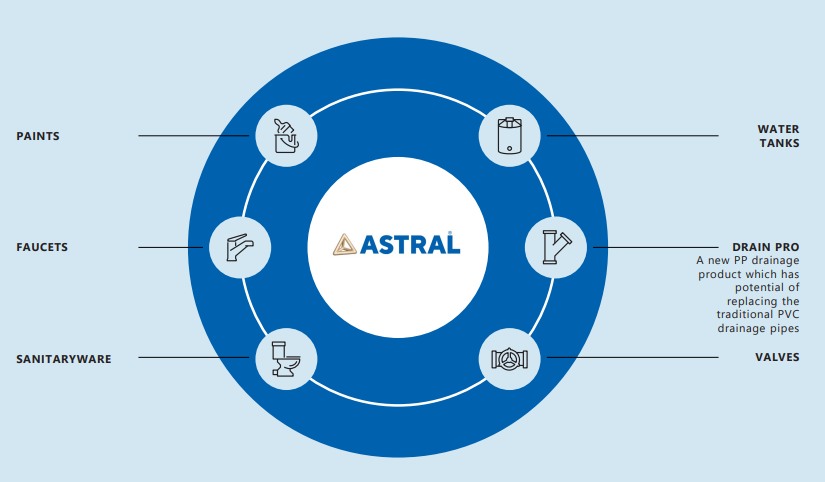

Astral Ltd. is a prominent brand name in the Indian home building material space. The Company is India’s leading manufacturer of plastic pipes, a well footed player in the adhesives business and is now making strong inroads in the paints, faucets and sanitary ware segments also, so as to Transform itself into a “One-Stop Solution” for the Building Materials.

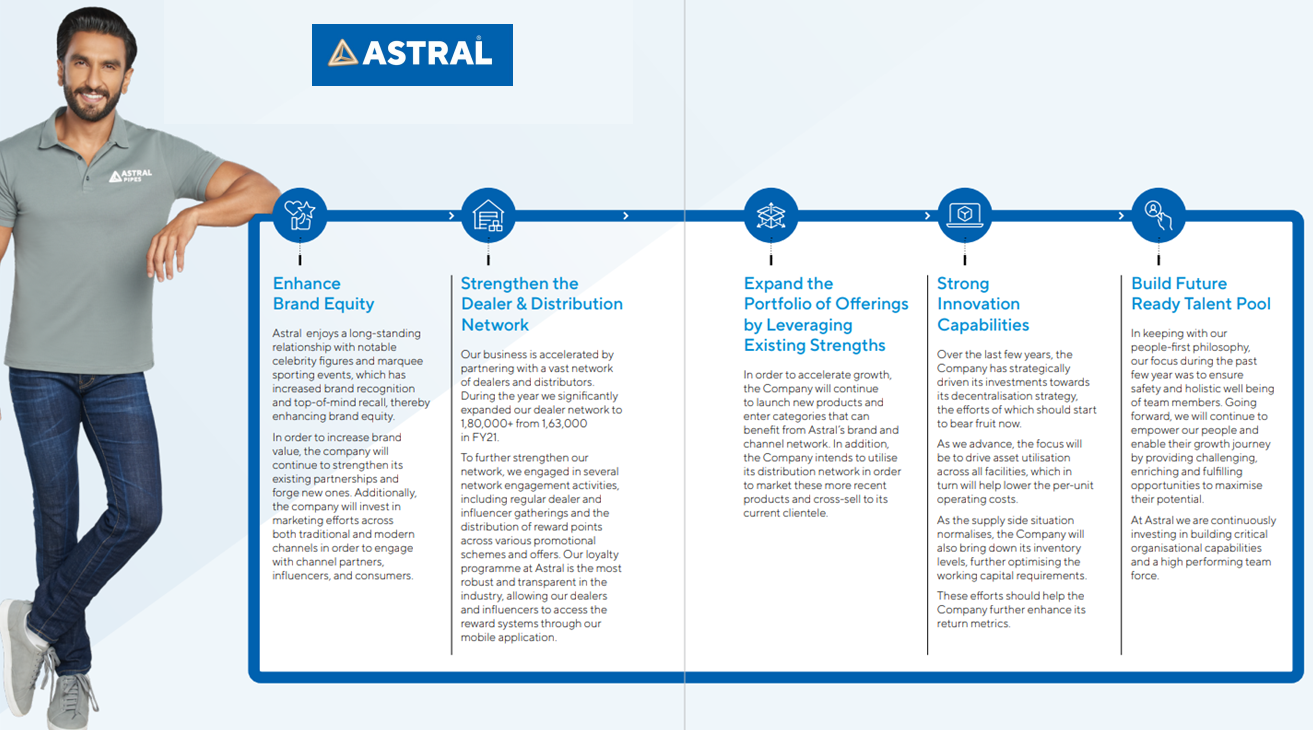

Company wants to Leverage its Large Manufacturing Footprint and Robust Distribution Network, along with – Experienced Leadership and Qualified Managerial Personnel, Marketing and Branding Acumen, Strong Balance Sheet & Cash Flows, Strong Innovation Capabilities, and Leadership in Piping Solutions – for its Future Growth & Expansion, so as to Sustain its High Earnings Growth in the future also, which has been growing ~ at 35% CAGR in last 4 years.

How Astral is “Expanding its Horizons” & How will it “Sustain 35% EPS Growth Rate”?

So what are the Tailwinds for Astral, to Expand its Horizons?

Due to the government’s thrust on promoting Make in India and PLI schemes, and the global players’ preference for China+1 and willingness to look for Europe+1 on the back of rising energy costs and supply chain hurdles, manufacturing theme and hence the building materials segment in it especially, shall be the biggest beneficiary of such potential Growth Drivers.

Moreover due to GST implementation, as the formalisation of businesses across the various sectors becomes mandatory; most of the informal small players are forced to shut down their businesses. As such, the sectors leaders shall reap the maximum benefits & increase their market share exceptionally.

Besides that, there are opportunities in manufacturing theme both via import substitution, as well as export perspective. As such companies in this sector are seeing the kind of the export demand environment, which they have never seen before in their lifetime.

This as a sector probably would get re-rated as a proxy play for the real estate, as well as for the home improvement. (read: https://jyadareturn.com/why-these-5-stocks-still-have-lots-of-potential-for-growth/)

Strategic Investment to Build Capacities and Expand into High Growth Adjacencies

Astral Ltd. has grown its Revenues at a Jaw Dropping CAGR of 23% in last 10 years, whereas its PAT has grown at a phenomenal CAGR of 29% in the same period – reason being that, Astral has First targeted the High Growth Category of “Pipes & Fittings” and than Build a Formidable Structure of Manufacturing Footprint and Robust Distribution Network around it. Given that the Building Material Segment, which Astral operates in, itself provides:

1) – Economies of Scale to Grow Huge in a Category of Product, along with;

2) – Multiple Optionalities to enter into the Adjacencies, next to the existing category of the products.

So later, the Experienced & Professional Management ensured the Strategic & Timely Investments, through Prudent Capital Allocation, to:

i) – Build-Up Capacities Consistently;

ii) – Strengthened its Brand Positioning through Marketing & Branding Acumen;

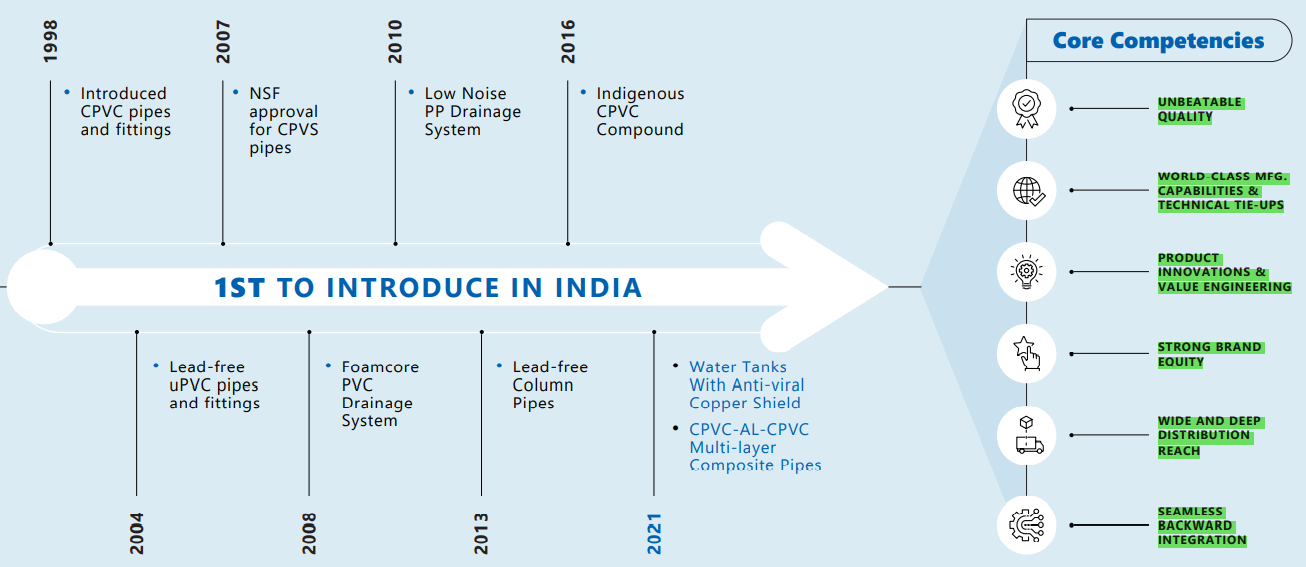

iii) – Constantly Innovate, through R & D and Technology, to achieve Product Differentiation and provide consumers Unique Value Proposition.

That is how they keep on expanding their Unique Product Portfolio, which is getting better and wider every year.

This way Astral Brand has became synonymous to Quality and company as such, have a track record of exceeding the customers expectations, almost every time.

What Pidilite is to Carpenters, Asian Paints is to Painters, APL Apollo Tubes is to Fabricators, so is Astral Ltd. to the Plumbers – Each of These companies “targeted to capture the perception of Carpenters, Painters, Fabricators, & Plumbers respectively“.

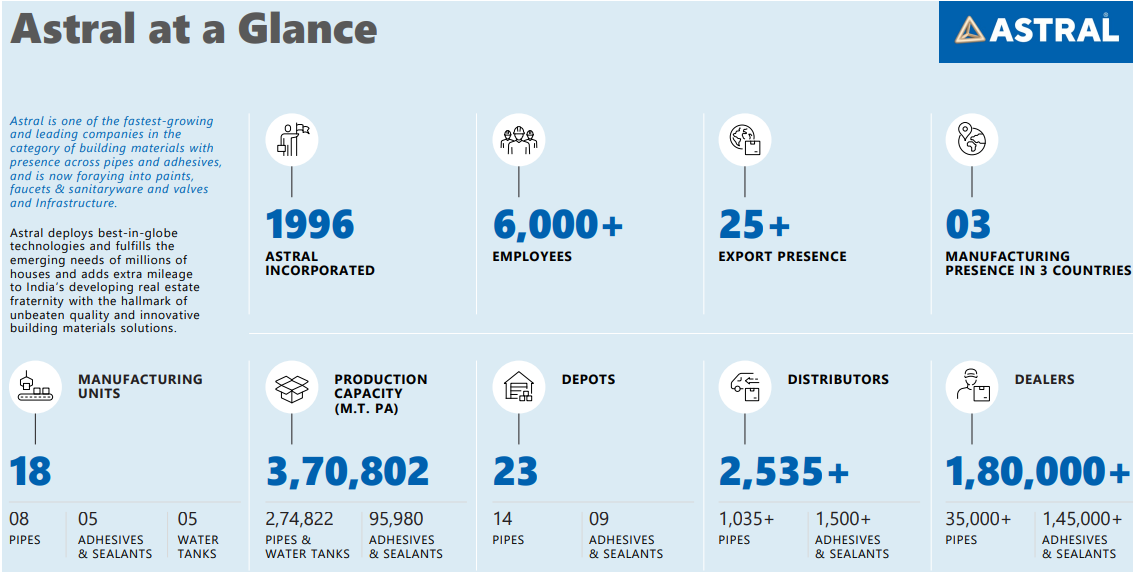

With Distribution Network of 1,80,000+ Dealers & 2,535+ Distributors and an in-house marketing team to service this extensive network of dealers and distributors, Astral has a strong Competitive Advantage. Many of these dealers and distributors have been affiliated with the Company for decades and this has contributed to its market Dominance.

The company has been strong in the West part of the country in the past. In recent years, the company has improved its position in the south and east, with new plants as a part of the Decentralization Strategy. Pipes and Fittings are a bulk item, with High Logistics Costs. As a result, a wide manufacturing footprint is needed, to provide high service levels to distributors and maintain low cost of operation.

Astral Ltd. – The Disruption Proof Business Model

To make Astral structurally, financially and operationally future-ready, company continued with the modernisation and de-bottlenecking journey for its existing facilities, by adding Innovative and Disruptive Products in its Pipes and Adhesives Categories.

Further, Astral acquired 51% controlling equity stake in the operating paint business of Gem Paints Private Limited. Strategic entry into the paints will give the company opportunity, to harness Synergies with the Existing Sales & Distribution Network and also with the Legacy of Astral’s Brand.

Astral’s go-to-market strategy will be to gradually scale up the new offerings, by focusing on the specific geographies and then eventually metamorphosing into a pan-India player. Company anticipate that these two new product categories, along with other newly launched products, will add ~ ₹ 1500 crores to their top line over the next 5 years, with no additional CAPEX. Gem Paints’ current capacity of 36,000KL allows for a threefold increase in sales, from its existing levels.

From June 2022, the Company has also started marketing faucets and sanitary ware under the brand name – “Astral”. The Company will operate in the premium economy segment in this product category and will kick start the operations, using an asset-light model and only announce CAPEX, once the Critical Sales are achieved.

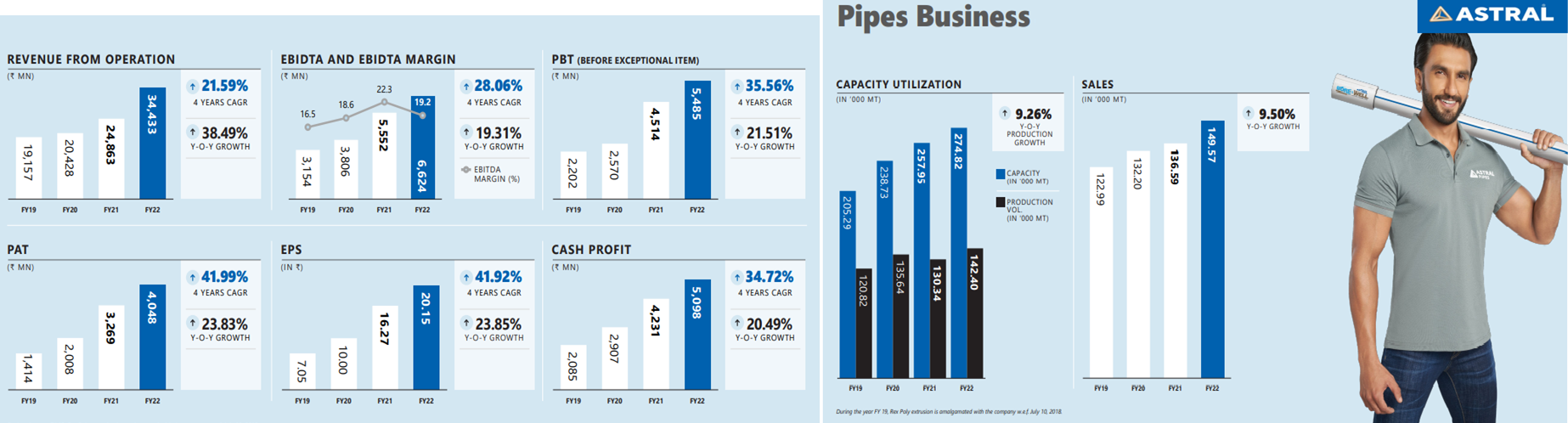

Company has been growing its Revenues (Top Line) at 21% CAGR in last 4 years and whereas PAT (Bottom Line) has grown at 35% CAGR, during the same period. This was a remarkable achievement, given the challenging operating environment which the company had to face through (like managing Supply Chain Disruptions, Volatile Raw Material Prices i.e. Input Costs, and multitude of COVID-19 constraints etc.) during the past 2 years.

The strong performance was driven by a mix of Volume and Realisation Growth, along with the Well Diversified Demand from across the geographies.

Despite holding higher Inventory throughout the year to alleviate Supply-Side Challenges, company Optimized its Working Capital Cycle by Reducing its Debtor Days from 32 days in FY21, to 22 in FY22. In addition, the Net Working Capital Days were also Decreased from 27 in FY21, to 21 in FY22.

Inflationary Pressures which began to build up in FY21 and has largely persisted throughout FY22 & thereafter also. As a result, Input Costs has touched all-time highs while exhibiting significant volatility in the interim. While most of the inflation was passed on to the end-user with a lag, company took a tactical call to face the inflation in specific categories, to strengthen its competitiveness and aggressively pursue market share.

This was also reflected in the company’s Operating Margin Decline in YoY basis. However, it was still better when compared to the industry margins.

Astral’s 7 High Growth Categories – Moat & the Growth Drivers

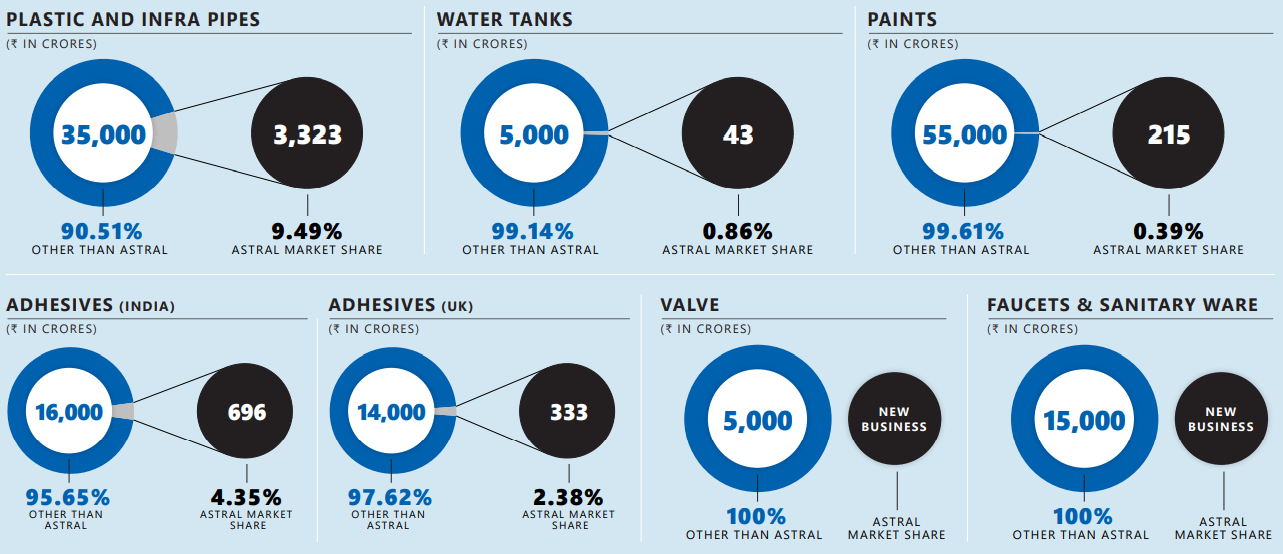

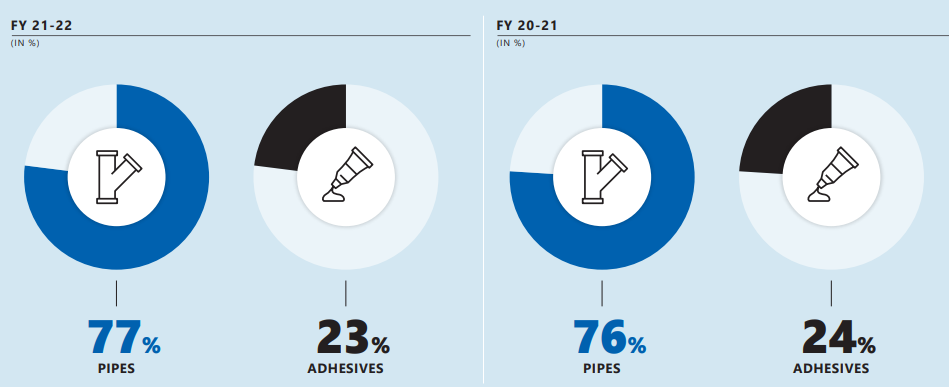

Company earns ~ 76.6% from its Piping Division whereas; remaining ~ 23.4% comes from its Adhesives Division. Piping Division constitutes ~ 80.6% of the total Operating Profit whereas, remaining 19.4% comes from Adhesives Division.

91% of the total revenue comes from India whereas remaining 9% comes from Rest of the World.

Astral’s Pipe Business: Revenue has grown at 21.59% CAGR in last 4 years whereas; PAT has grown at 41.99%.

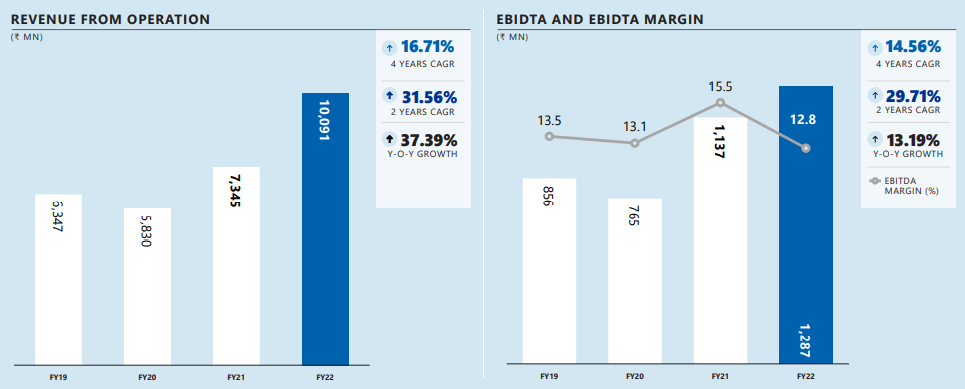

Adhesives Business: Revenue has grown at ~ 16.71% in last 4 years whereas EBITDA has grown at ~ 14.56% in the same period. Production Capacity in Pipes & Water tank is ~ 2, 74,822(M.T.PA) whereas in Adhesives & Sealant is ~ 95,980(M.T.PA).

Astral Ltd. has increased its Production Capacity by ~ 34% in last 4 years compared to Production Volume growth of ~ 18% in last 4 years. Therefore, company’s present capacity utilization is ~ 51.82% compared to 58.86% in FY19.

Astral – Expanding Horizons in the Plastic Pipes & Tank Business

The market for plastic pipes is valued at approximately ₹ 300 billion, with organised players accounting for ~ 65% of the market. 50-55% of the industry’s demand is accounted for by plumbing pipes, used in residential and the commercial real estate, 35% by agriculture, and 5-10% by infrastructure and industrial projects.

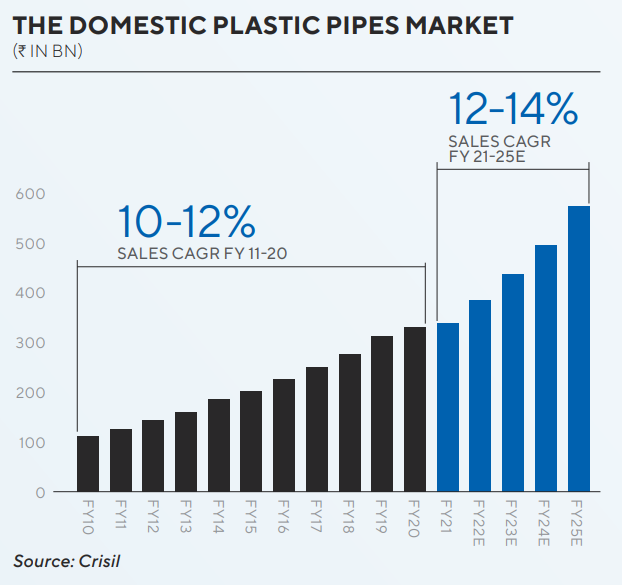

Due to the government’s emphasis on cleanliness and sanitation, affordable home building, and replacement and substitution demand, the domestic plastic pipes market grew at a CAGR of 10 to 12% between FY15 and FY20. Demand is anticipated to expand at a CAGR of 12 to 14% between FY21 and FY25, driven by increased investment in WSS projects, the substitution of metal pipes with polymer pipes, and replacement demand.

Depending on the application, plastic pipes, galvanized iron pipes, cement pipes, ERW pipes, and other materials are utilized. However, plastic pipes are gaining popularity and have become the material of choice due to the easy availability of raw materials, ease of use, lightweight, and ease of installation, longer shelf life, and lower cost.

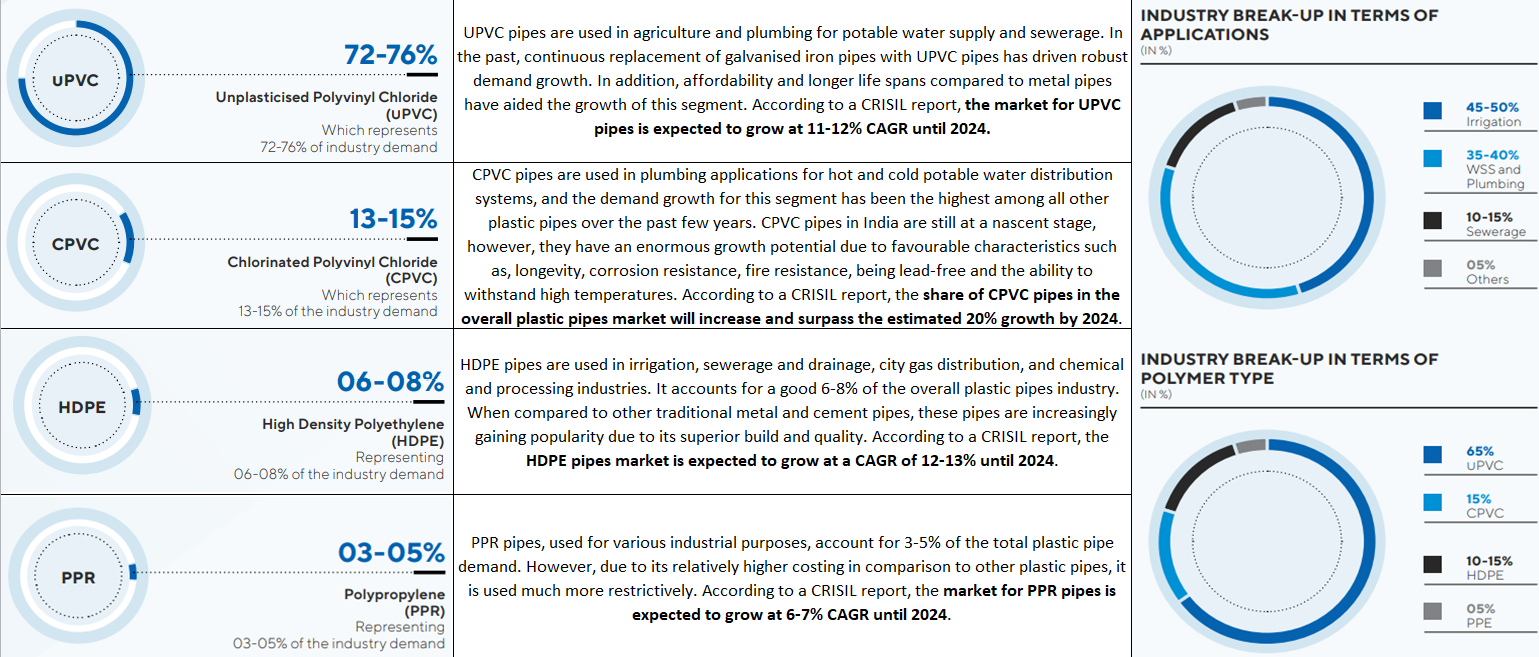

Plastic Pipes are made up of 4 key types of Polymers:

i) – uPVC: This type of pipes represents ~ (72 – 76%) of the Industry Demand and the market for uPVC pipes is expected to grow at ~ (11-12%) CAGR until 2024.

ii) – CPVC: This type represents ~ (13-15%) of the Industry Demand and the share of CPVC pipes in the overall plastic pipes market will increase and surpass the estimated 20% growth by 2024.

iii) – HDPE – This type represents ~ (6 – 8%) of the Industry Demand and the HDPE pipes market is expected to grow at a CAGR of 12-13% until 2024.

iv) – PPR: This type represents ~ (3 – 5%) of the Industry Demand and the market for PPR pipes is expected to grow at 6-7% CAGR until 2024.

Tanks – With unorganised regional firms servicing 70% of the industry, water storage tanks in India is a ₹ 45-50 billion market opportunity growing at a 5-6% CAGR. The rationale for regional players’ domination in this category is the product’s voluminous nature, which adds high freight costs during transit.

However, the major Indian pipes businesses’ expanding their manufacturing base, which has resulted in pan-India presence with overlapping effective distribution networks, bodes well for the prominent pipe players.

DEMAND DRIVERS

Value Migration – One of the most significant shifts in the pipes business over the last decade has been the large-scale migration from metals to polymer-based pipes in most applications, which is especially true in the case of building industry’s plumbing and pipe applications. With the introduction of polymers such as CPVC for hot and cold-water plumbing, fire-fighting, and industrial fluid transportation, this progression has enabled for more research and development in specialized products by organised companies for specific applications. The CPVC industry, which presents a technological barrier to entry, is providing an opportunity for branded competitors to further enhance their market share.

Low per capita consumption of PVC – Compared to the global average of 6 kg, India’s PVC consumption per capita is ~ 2.4 kg. However, India’s consumption per capita is further expected to increase and approach the world average, driving growth in product consumption.

Substitution and replacement demand – Plastic pipes have several advantages over metal pipes. Plastic pipes have hastened the replacement of metal pipes due to their superior qualities and inexpensive pricing. In addition, the increase in the availability of raw materials (PVC, PE and PPR) following the commissioning of new petrochemical facilities in India is expected to further support the plastic-pipes industry going forward.

Investments in end user segments – Among factors that will boost the demand, increased spending by state governments and municipal corporations to improve accessibility of water for a burgeoning population is the most critical one. Further, the heightened government thrust on irrigation, urban infrastructure and real estate, is the second most critical factor for demand growth.

URBAN INFRASTRUCTURE – Schemes such as the Swachh Bharat Mission, Jal Jeevan Mission, AMRUT, and metro projects, are expected to drive the demand for pipes drastically. Urban infrastructure spending is expected to reach ₹ 2.9 lakh crore from FY21 to FY25, a 1.35x increase over the previous five fiscal years.

Half of the money is expected to go towards WSS projects, which will primarily be led by state governments and funded by the central government through initiatives such as the Jal Jeevan Mission, AMRUT and Swachh Bharat Mission. Following WSS, metro construction will attract the most investment in urban infrastructure development.

Astral – Expanding Horizons in Adhesives & Sealants Business

Adhesives

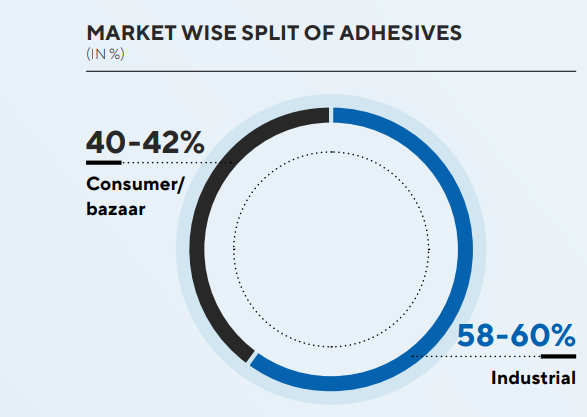

The ₹ 134 – 136 billion (FY21) domestic adhesives and sealants market is segmented as follows:

1) – Industrial adhesives and sealants; and

2) – Consumer and bazaar adhesives.

The industrial division serves B2B industries such as packaging, footwear, paints, and automotive, among others. The retail section serves industries including furniture/woodworking, building construction, arts and crafts, and electrical fittings, among others.

The ₹ 53-55 billion (FY21) consumer adhesives market grew at a CAGR of 8-10% between 2015 and 2020, propelled by the rapidly expanding furniture business and rising income levels, which led to a rise in interiors demand.

The consumer adhesives market in India is expected to grow at a 9-10% CAGR between FY21 and FY26.

Product wise split of Consumer Adhesives:

Based on technology, the consumer adhesive market can be divided into water-borne, solvent-borne, reactive, and hot melt adhesives.

Water Borne – Due to its increasing use in the woodworking and furniture industries, PVA (poly vinyl acetate), a water-based adhesive, dominates the market with ~ (26 to 28 % of revenue).

Solvent Borne –

i) – PVC solvent cement is a solvent-based adhesive used in the irrigation and building construction industries to join PVC pipes and it constitutes ~ (10-12% of revenue).

ii) – SBR (styrene butadiene rubber) is used in foam and mattress applications as a sprayable adhesive & it constitutes ~ (7-8% of revenue).

iii) – Chloroprene rubber is used in a variety of applications ranging from woodworking to leather to foam applications, accounting for ~ (12-14% of revenue).

Reactive –

i) – Epoxy adhesives dominate among reactive adhesives (15- 17%). These are also utilised in the furniture, woodworking, and tiling sectors due to their resilience to water and fire, as well as their durability.

ii) – Cyanoacrylates are used to connect polymers, metals, and rubbers & makes ~ (12-14% of revenue).

iii) – Silicone sealants account for 12 to 14% of the consumer adhesives market. Due to their water-resistance, they are commonly used for basic domestic repairs particularly around sinks and pipes.

DEMAND DRIVERS

Rising demand for wooden furniture the furniture industry in India uses a variety of adhesives, such as PVA, SBR, chloroprene rubber, cyanoacrylates and epoxy. The market is anticipated to be driven by a number of variables, including increasing urbanisation, a growing preference for more modular and compact furniture, and a rising need for durable and hybrid furniture. According to a CRISIL report, the demand for wooden furniture is expected to grow at a CAGR of 10-12% from 2021 to 2026.

Increasing demand for non-hazardous, green and sustainable adhesives – Hybrid adhesives are widely being used by adhesive end-user sectors, as an alternative to solvent-based adhesives.

Increasing demand for electronics – Adhesives are used in a variety of applications in the electronics sector, including conformal coatings, terminal electrode protection and surface mount device bonding etc. The electronics industry is one of the fastest-growing in India and is expected to grow at ~ (19-24%) over medium term.

OUTLOOK – The consumer adhesives market in India is expected to grow at a 9-10% CAGR between FY21 and FY26, owing to economic recovery and growth in end-user sectors.

Astral – Expanding Horizons in Paints, Drain Pro, Specialized Valves, Faucets & Sanitarywares

Astral has invested ~ Rs. 1000 Cr in CapEx in last 5 years & the utilization of the same will be in the coming few years. Therefore, the company is confident that it will be able to grow not only in its existing product portfolio, but also projects additional revenue of Rs. 1500 Cr in the next 4-5 years, from the following new products & categories:

Astral looking at ~ 7.5% CAGR growth for next 5 years, in its new paint Business which it enter into, to Leverage its existing:

i) – Common Dealers;

ii) – Common Customers;

iii) – Legacy of Brand “Astral”

As all these advantages allows the company, to rapidly scale up the operations in its Paints Business.

Astral Drain Pro is a cutting-edge, three-layer PP SWR system that is an ideal replacement for conventional drainage systems.

Astral Pipes has forayed into manufacturing Specialized uPVC and CPVC valves for household plumbing and Industrial applications. This range of valves is designed specifically to impart additional strength and to improve overall functionality. This aesthetically designed range is 100% traceable and is tested on European testing machinery.

Astral’s Outlook for Growth, Optionalities available, & the Risk Management

As the overall industry growth of +10% for Both the Pipe and Adhesives Sector is expected, so Astral is expecting to grow at ~ 15% CAGR for next 5 years, given:

i) – The Shift from unorganized to organized sector;

ii) – Higher growth from recently launched products;

iii) – New product launches;

iv) – Decentralization of manufacturing plants;

v) – Entering new geographies;

vi) – Continued addition of new dealers, distributions & Plumbers in the Astral Family;

vii) – Good support from the UK & USA markets.

Besides, Optionalities like –

i) – Huge Cash on books of ~ Rs. 642 Cr will help the Company to grow organically and inorganically;

ii) – East India plant represents a strong option value over the next 5 years;

iii) – 2 additional new pipe locations, Sangli and Aurangabad, can increase market shares in Maharashtra and Southern Indian markets, over the next 5 years;

iv) – Launching a few new products in Adhesive & Sealants segment under a different chemistry, that along with existing products will double the Company’s revenue within the next 5 years;

v) – Existing standalone Pipes Business (current Market Share of 9.49%) likely to Double its revenue over 5 years.

Astral Ltd. adopt an independent and comprehensive strategy, to manage risks and safeguard the business. This approach enables them to continuously identify and assess risks, as well as implement the necessary mitigation measures to eliminate or limit their impact on the business. The robust risk management framework – allows the company to create and protect value for its stakeholders, while ensuring a robust financial performance:

| NATURE OF RISK | IMPACT | MITIGATION STRATEGY |

| Commodity Risk | Unanticipated fluctuations in commodity prices and supply may have an effect on business margins and the capacity to service demand. Input prices have experienced significant fluctuations over the past few years | The Company has well-defined norms for building strategic inventory positions as a hedge against price volatility. Company purchases commodities in line with business requirements and in accordance with inventory policy and does not encourage speculative buying or trading of any commodity either in physical form or in exchanges. |

| Competition Risk | Increase in the number of competing brands in the marketplace and aggressive pricing by competitors could create a loss in market share | The company has strategically diversified its product offerings and entered newer categories (such as paints, faucets, and sanitary ware) in order to reduce the likelihood of market disruption by competition. The company firmly adheres to its policy of prioritising volume protection over short-term profitability. In addition, the company continues to invest in brand-building initiatives to ensure a strong brand recall among customers. |

| Supply Chain Risk | Inability to obtain or procure products from our suppliers and vendors in a timely and cost effective manner could materially impact our operations | The company works closely with its suppliers to ensure supply reliability and business continuity. In addition, the company has established a reliable network of alternative suppliers to ensure supply chain diversification and reduce the risk of over-dependence. |

| People Risk | Attrition of key talent may adversely impact the Company’s ability to pursue its growth strategies | To attract and retain the right talent, the company fosters a culture of diversity, inclusion, and transparency while also providing a challenging and rewarding work environment. The company also ensures that compensation and other benefits are periodically aligned with industry standards. The Company has also issued ESOPs to retain the right talent and align the long term interest of the employees with the organisational goals. |

| Safety Risk | The Company’s manufacturing processes necessitate employee interaction with plant, machinery, and equipment, all of which pose an inherent risk of injury | The plants of the company are designed to ensure inherent safety in accordance with various applicable standards. In addition, the company adheres to highest safety standards and ensures the highest operational standards for material handling at the plant. |

| Foreign Currency Risk | Fluctuations in foreign exchange rates may result in price volatility of raw materials, thereby negatively affecting the company’s operations | The company consistently follow policy defined by board which help the company in getting average rate of currency and mitigate the risk. |

| Risk Of Change in Consumer Preference | A shift in consumer preference can adversely impact the demand and in turn the business performance. | The company monitors signals to identify emerging consumer trends and swiftly responds with innovative product offerings. The company continually reviews its product portfolio in order to introduce new products that meet consumers’ ever changing demand. |

| Obsolescence Risk | A product, process or technology used by the Company may become obsolete and decrease the brand’s competitiveness in the market | In addition to conducting regular product portfolio reviews and market research to track current trends, the company invests in emerging technologies to create a first-mover advantage and differentiated offerings. |

Astral’s Current Challenge to Sustain its 35% EPS Growth Rate

Challenges in Q2FY23 –

Astral’s consolidated revenue declined 2.4% YoY in Q2FY23, on an unfavorable base. Piping revenues declined 10.6% YoY, as a result of muted demand.

Adhesives & Paint revenues were up 27% YoY, led by consolidation of paints business. On a three-year basis, pipe revenue grew at ~ 17% CAGR, led by volume CAGR of ~ 5.6%. The adhesive segment grew at ~ 24% CAGR, supported by launches of new products and addition of dealer networks in the new geographies.

The quarter witnessed significant volatility in the PVC prices, which led to the Inventory losses of ~ Rs. 45 Cr. Lower gross margins coupled with higher A&P spend, led to a fall in EBITDA margin by 534 bps YoY (187 bps QoQ) to 12.3%. As a result of lower topline and EBITDA, PAT declined ~ 48% YoY.

(Source: https://www.icicidirect.com/mailimages/IDirect_AstralPoly_Q2FY23.pdf)

The management expects Inventory loss to continue to a smaller extent in Q3FY23 also, due to continuous softening of PVC prices.

Margins in the adhesive segment also remained under pressure due to higher chemical prices. However, the management expects expansion of margins from Q3FY23 onwards.

What Astral Going to do, in Short –

Measures like Capacity addition, Launch of New Products (water tank, valve) and Diversification in Sanitary ware and Paint business, are going to Drive the Overall Revenue CAGR @ ~ 22% in FY22-24E.

Price Hike, Improved Product Mix (launch of High Margin Valve Business) will help in recovery of EBITDA margin, from FY24E onwards. Further, Astral will not be doing any additional CapEx in FY23, other than the Maintenance CapEx.