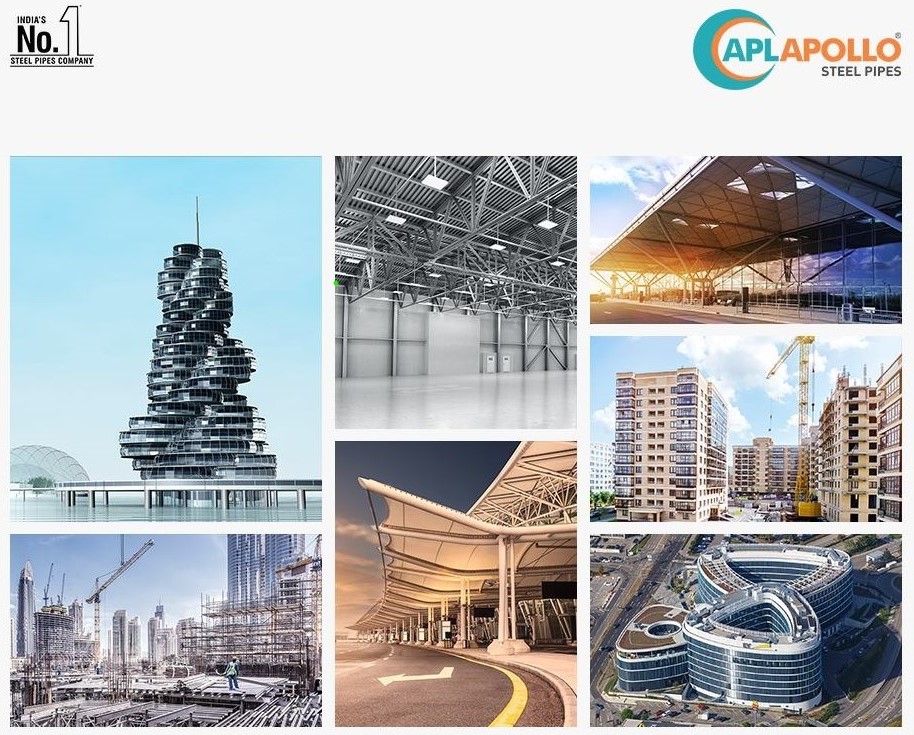

APL Apollo Tubes Ltd. has grown its Revenues at a CAGR of 25% in last 10 years, whereas its Profits have grown at a CAGR of 27% in the same period. Company has increased its Installed Structural Steel Capacity to ~ 31X in last 15 years.

Due to its Bargaining Power with the suppliers, company’s steel buying price is Minimum in the industry and as such it is Lowest Cost Producer. It’s a rare B2C business which is growing that rapidly, owing to its Robust Network of 800+ Distributors, 50,000+ Retailers, 200K+ Fabricators which help the company to churn Capital upto 8X in a year that helps them to generate higher ROCE.

With ~ 55% Market Share in the Structural Steel Tubing Industry, Multiple Competitive Advantages, and Ground Breaking Solutions with Innovative Range of 1500+ products under 14 Brands, Company is already on the Accelerated Growth Trajectory.

Tubular Technology, DFT (Direct Forming Technology) for Big Structural Products, ILG (In-Line Galvanizing) to replace traditional products, and Tailwinds for the sector which APL Apollo operates in, are going to be some of the key growth triggers which will ensure that this accelerated growth will sustain longer & beyond 2023.