Tata Elxsi and Happiest Minds, will Stocks of these 2 Successful Digital Disruptors make a comeback in FY (2023-24)?

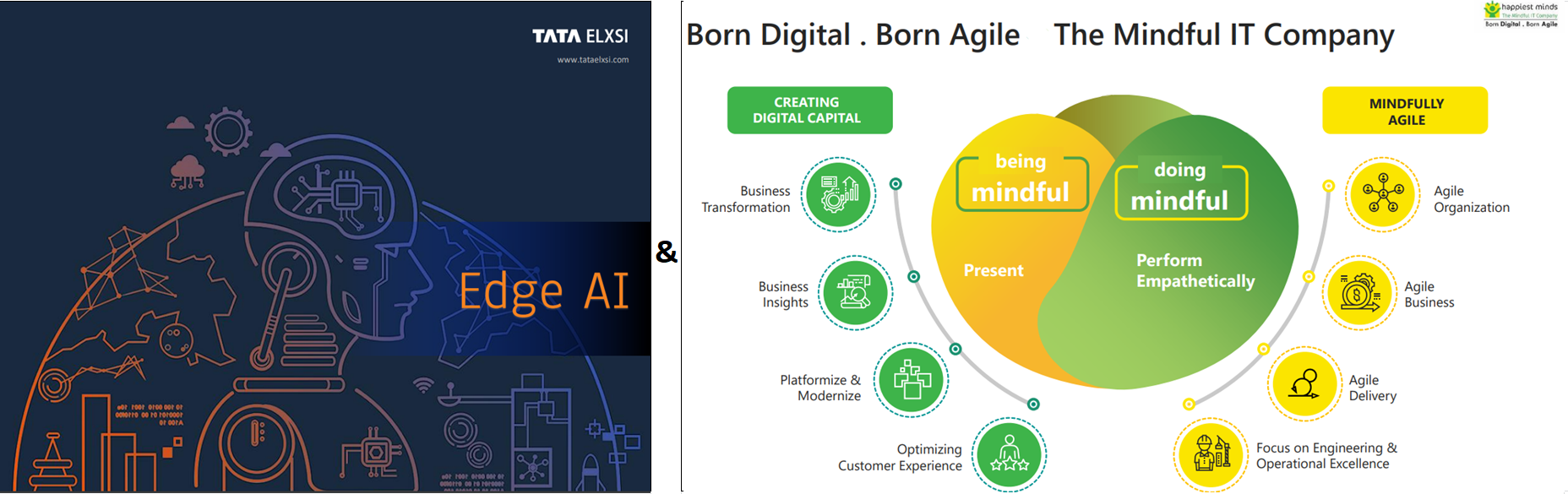

Both Tata Elxsi and Happiest Minds are in the Niche Business of providing Solutions & Services, for the Enterprise Digital Transformations and Next Gen Product & Platform Engineering through IoT (Internet of Things), Big Data Analytics, Cloud, Mobility, Virtual Reality, Cognitive Computing, and Artificial Intelligence (AI).

As by 2025, the enterprise digital spend is projected to be ~ 50% of the total technology spend, with the digital spending is expected to be growing at a healthy CAGR of 26.4% between 2021 to 2025, so there is a Strong Tailwind for both the companies given the diverse and differentiated multiple Industrial segments both the companies caters to. Both has been growing at faster growth rate compared to other IT companies because of which both the companies have been enjoying PE multiples of over 50+.

Whether the Correction of more than 40% from the life time high MP, is a Buying Opportunity or is Indicative of possible De-rating to the IT Sector itself (due to high anticipation of recession in developed economies like US and EU, from where both the companies gets there maximum revenue), we will come to know in this article. So, keep reading.