Divi’s Lab is not only One of the Top 3 API Manufacturers in the World, but is also the World’s Largest Manufacturer in more than 10 Generic APIs including products like Naproxen, Dextromethorphan, Gabapentin, Levetiracetam etc.

Company has always been known for –“Being the Low Cost API Producer having Huge Economies of Scale to Grow, with Technical Know-How & Expertise in the Complex Chemistry, along with the Fungible Capacities. Besides that, the management who is known to Buck the Trend, is always Careful in Selection of the APIs & Process Chemistry, which they want to enter into”.

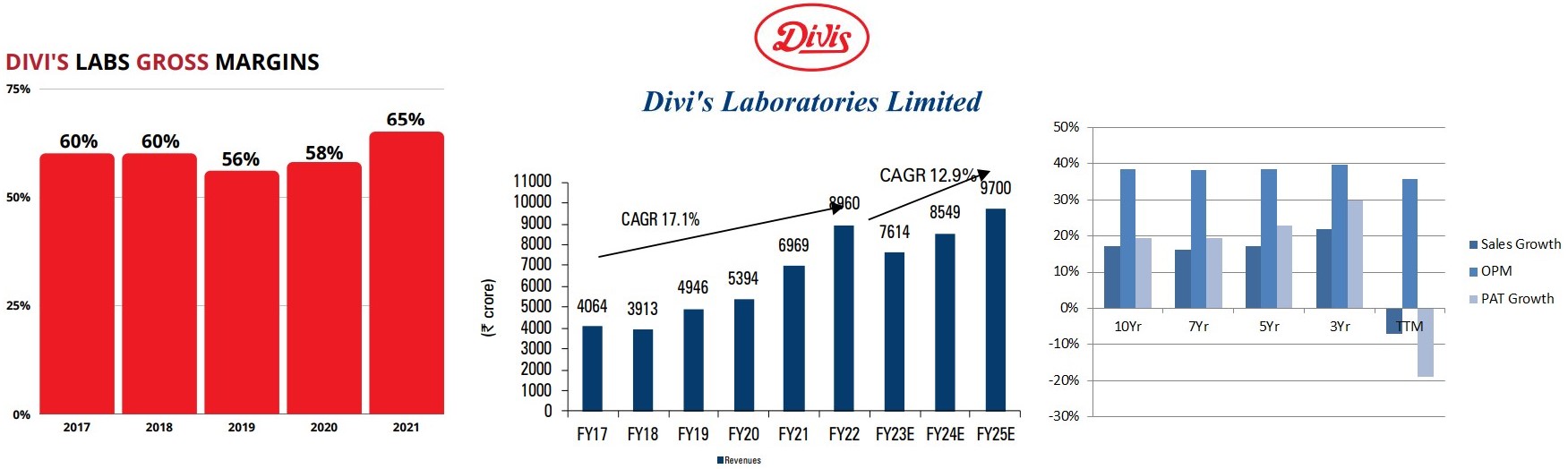

Owing to the said reasons, Divi’s Lab had ~ Plus 60% Gross Margins (mostly), ~ 38% of the OPM, and ~ 27% of the NPM from FY13 to FY22. Company’s Revenue has Grown at ~ 17.1% CAGR from FY17 whereas its PAT has grown at ~ 23% CAGR in the last 5 Years, despite factoring in 19% De-Growth in TTM.

But in FY23, Quarter after Quarter Divi’s Lab Gross Margins as well as NPM has deteriorated to an extent that, in Q3FY23 company has reported ~ 32% Fall in Sales Revenue and ~ 66% Fall in PAT on YoY basis, whereas its Gross Margin has Shrink to 56.7%.

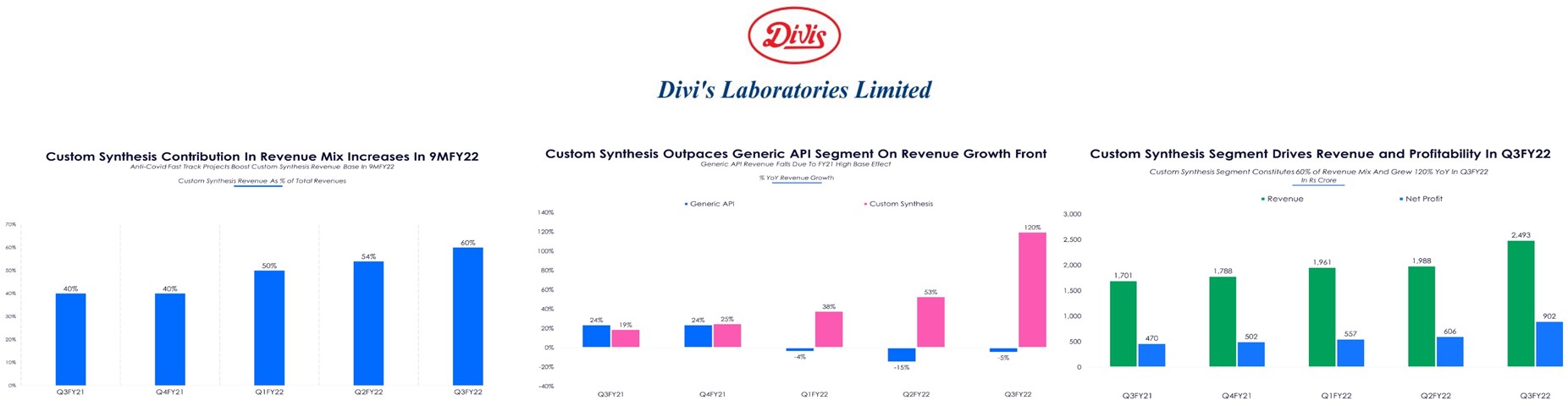

This Gross Margin Contraction and Operating Deleverage were mainly due to, Lower Contribution from Custom Synthesis and Drop in API Realizations. Sales contribution from the Custom Synthesis Segment was just ~ 43% in Q3FY23, which is a Significant Drop from ~ 60% of sales in Q3FY22.

Besides that, Absence of Sales of the High Margin Molnupiravir due to the changes in COVID-related Opportunities, Raw Material Prices Not getting Declined in sync with the API Prices, and Appreciation in the Cost of few Metal-Based Raw Materials, such as Lithium and Iodine, have resulted into Historically Low Operating Margins for Divi’s Lab.

Can it come out of this Challenging Time, once again like before, is what we will read in this article!

So, What Caused Top to Bottom Line De-Growth for Divi’s Lab in FY23 and What could be the Growth Drivers in FY24 & Beyond?

Divi’s Lab – Attitude To Buck The Trend

In 1990, Divi’s Lab was Launched as a consulting firm to guide companies like Natco Pharma, Alembic Pharmaceuticals and Doctors Organic Chemicals etc. on How to Develop the Efficient Processes in manufacturing of Bulk Drugs such as Ranitidine, Naproxen and Ibuprofen.

At Divi’s Laboratories, there is a method to the madness. Behind the sustainable High Growth, lies a meticulously laid-out plan, some hard decisions and the pluck to buck the trend. The belief is in doing less but doing it extremely well, like no one else does.

For instance, in the mid-1990s, when Indian pharma companies were pursuing formulations (medicines) with a fanatical fervour, Divi’s Lab stuck to the manufacturing of Generic APIs, Custom Synthesis or Contract Manufacturing for its clients, and manufacture of Nutraceuticals.

Back then Big pharma companies such as Merck, GSK or Pfizer among others, were reluctant to outsource projects to the Indian firms. Why? Because they were apprehensive that the Indian Firms Could Potentially Reverse Engineer their Patented Drugs and make Generics eventually.

Divi’s Laboratories being an Independent API manufacturer, were selling to everybody. So they were seen as playing Only a Complementary Role and Not a Competing one.

In the mid-1990s, as India became a signatory to TRIPS (Agreement on Trade-Related Aspects of Intellectual Property Rights), which meant that Commitment to Respect the Product Patents of the Innovator Company will goes without saying.

Divi’s Lab saw this as an Opportunity & Capitalize upon by Winning its First Deal of $2 million from GSK in mid-’90s. Since then, Divi’s hasn’t looked back.

Today, Divi’s Laboratories is the world’s largest manufacturer of Naproxen – a vital component of medicines used to treat osteoarthritis, with an estimated ~ 60 – 70% Market Share. Similarly, it has aced Dextromethorphan (with ~ 75% Market Share) – which is a cough suppressant, Gabapentin (~ 50% Market Share) – used in anti-depressants, and Levetiracetam (~ 65% Market Share) – which is used to treat epilepsy.

Divi’s Lab has held the Fort against the competition from the likes of BASF GE, Hoechst Celanese, Lonza Group AZ and DSM.

Divi’s Lab – Striving for Leadership Through Sustainable Chemistry

“We do not have a Wide Portfolio. As a company, Chemistry is our Strength and we Don’t Think about a product if we Don’t Believe that our Strength can be used there. We also look at how the market is! If there are already 20 players, there is no point in getting us in. Company doesn’t Believe in the Inorganic Growth, as it works based on the Demand and Hence, we don’t run after everything” – Kiran Divi.

Therefore, the Product Portfolio of Divi’s Lab includes ONLY a Very Selective 30 Generic APIs, that are Manufactured Commercially in 10’s to 100’s/1000’s of Tonnes each year, where they continues to be the largest API Manufacturer in the World. Moreover, Divi’s is One of the top 2 API manufacturers in the world, for 18 out of these 30 API Molecules.

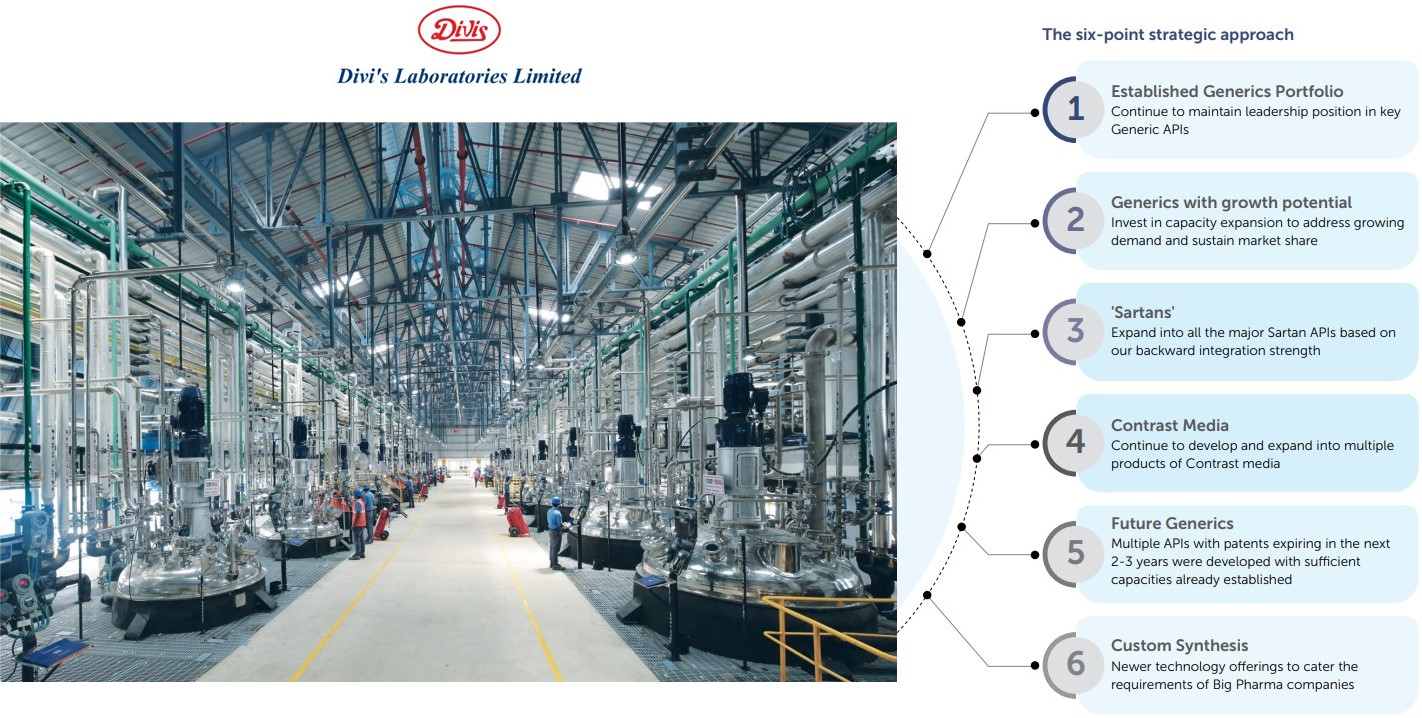

Divi’s Lab has achieved this leadership position because of various factors such as Backward Integration to Basic Starting Materials, Dedicated Production Blocks with Large Batch Sizes and Significant Capacity Creation – Ahead of the Time.

Company is a ‘Reliable supplier of APIs’ with Competitive Pricing and have Uniform Quality for all the customers around the world, by Continually Improving the Process and Engineering Efficiencies, while Implanting various Green Chemistry Principles simultaneously.

Similarly Divi’s Lab did not went for the acquisition of the Nutraceuticals Business straightaway, rather it Developed the Large Expertise in the field by revisiting the Chemistry Constantly, and thereby Expanding the Horizons for Growth Beyond the Large Volume Selective Generic APIs Business.

The entry took them longer than expected, but the experience which they gained has made them much stronger than their competition. As a result, today Divi’s Nutraceuticals Facility, at its Unit II Manufacturing Site, is an Integrated Facility for Production of Active Ingredients and Finished Forms of Carotenoids. The facility includes a Full-Fledged R & D, Application Testing, and the Support Facility.

Divi’s Lab is currently supplying most of the carotenoids to all the major food, dietary supplement and feed manufacturers around the world. The product portfolio includes a complete set of Carotenoids such as Beta Carotene, Astaxanthin, Lycopene, Canthaxahnthin etc. Moreover in vitamins like D3, K, and B12, Divi’s Lab has above 30% Market Share in the World.

In addition to the Standard Nutraceuticals Product Portfolio offering, Divi’s Lab also offers Customized ingredient solutions in liquids, beadlets and powder forms.

In Custom Synthesis, Divi’s Lab has Established relationships with 6 of the top 10 Big Pharma & 12 out of the Top 20 Big Pharma Companies across US, EU and Japan, are associated with the Divi’s Lab for more than 10 years.

Company is engaged in Custom Synthesis (Contract Manufacturing Services) of APIs and Intermediates for Global Innovator Companies, with a vast portfolio of products across Diverse Therapeutic areas.

Divi’s being a Core Generic API Manufacturer is Capable of Handling Highly Hazardous / Energetic Reactions (Handling of NBL/Cyanide/metals) and have Dedicated facilities for handling High pressure RXs up to 20Kg/cm2, Cyanations & Pyrophoric reactions.

Divi’s R&D team have over ~ 500 scientists specialized in Developing Innovative Processes and Continuously Optimizing them, to maintain Company’s Competitive Leadership Position.

Moreover, Divi’s manufacturing units have been inspected successfully many times by USFDA (Most recently in Jan 2020), EU authorities (Most recently in August 2019) and also by Japanese Health Authorities.

Strategy to Keep Product Mix Demand Centric, Across The Business Segments and Geographies, Made Divi’s Lab What It Is Today

Whenever sales and profits slumped and margins gone below the expectations, either due to – Heavy Weightage of the Low Margin Generic APIs in the Business Mix or the Custom Synthesis Segment Performing Poorly, Divi’s Lab did whatever was required to ensure the Sustainability of the Growth whether it was Prudent Allocation of the CapEx for required Capacity Expansion, or Strategy to Diversify Procurement of the Raw/Starting Materials to Reduce Dependence on the Specific Geographies, apart from adopting a Just-in-Time Procurement Philosophy.

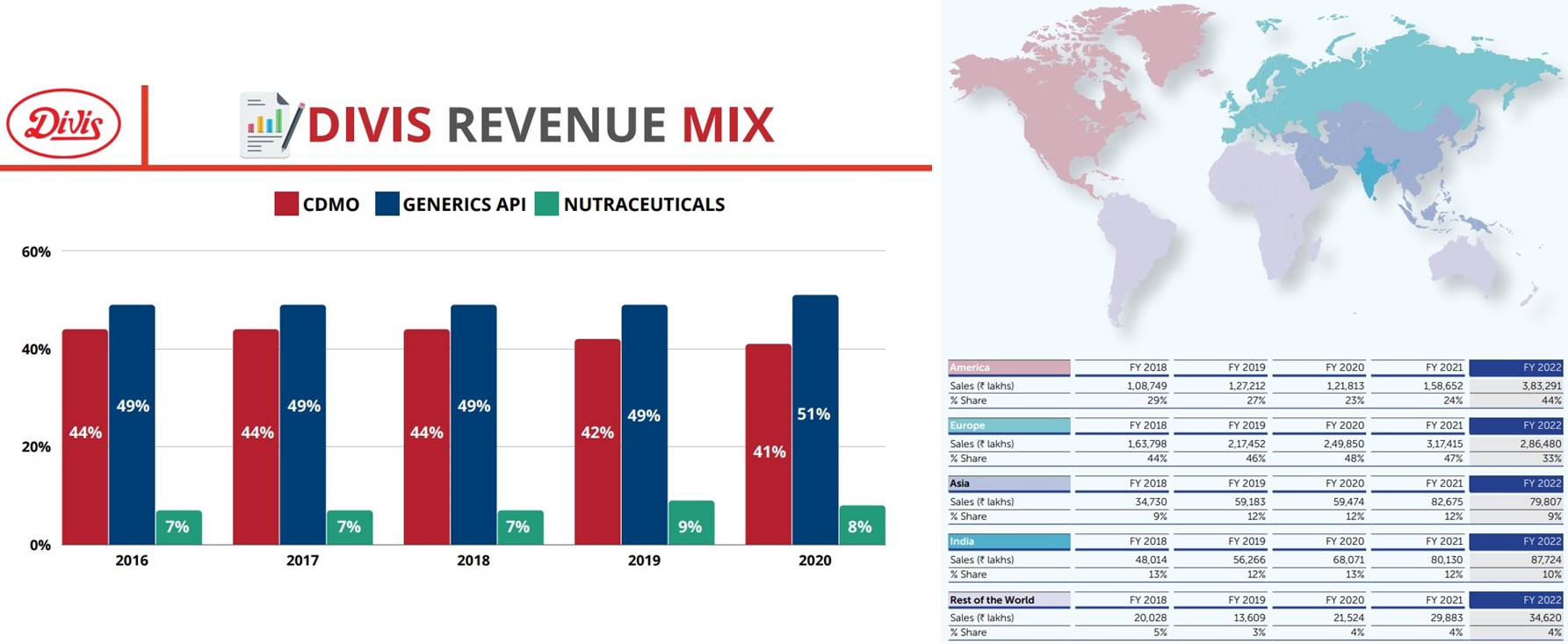

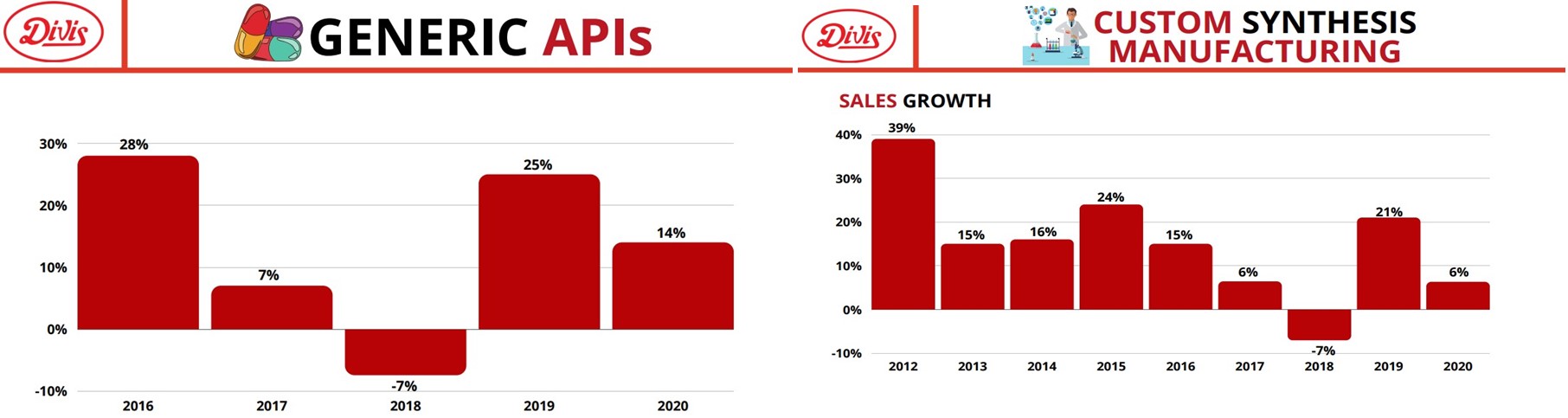

In addition, company was always exploring options for Backward Integration to produce some of the raw materials in its own units, along with the Implementation of the Green Chemistry Principles. Between FY16 to FY19, Generic APIs contributed ~ 49% to the Total Revenue but Divi’s Increased it to 51% in FY20, simultaneously Custom Synthesis segment which used to contribute ~ 44% has gone down to 42% in FY19 & then to 41% in FY20.

Divi’s Lab Anticipates the Traction across the segments & then accordingly decides upon its Product Mix. This strategy which mostly rewards the company (as in FY22, during which Growth in terms of OPM, NPM, & PAT on YoY Basis, has remained 43%, 33%, & 49.2% respectively for 10 years), has gone against the company in 9MFY23 given that the Generic API Portfolio is Still Witnessing De-stocking and Competition, leading to the Price Erosion, along with Significant Drop in Sales Contribution from the Custom Synthesis Segment.

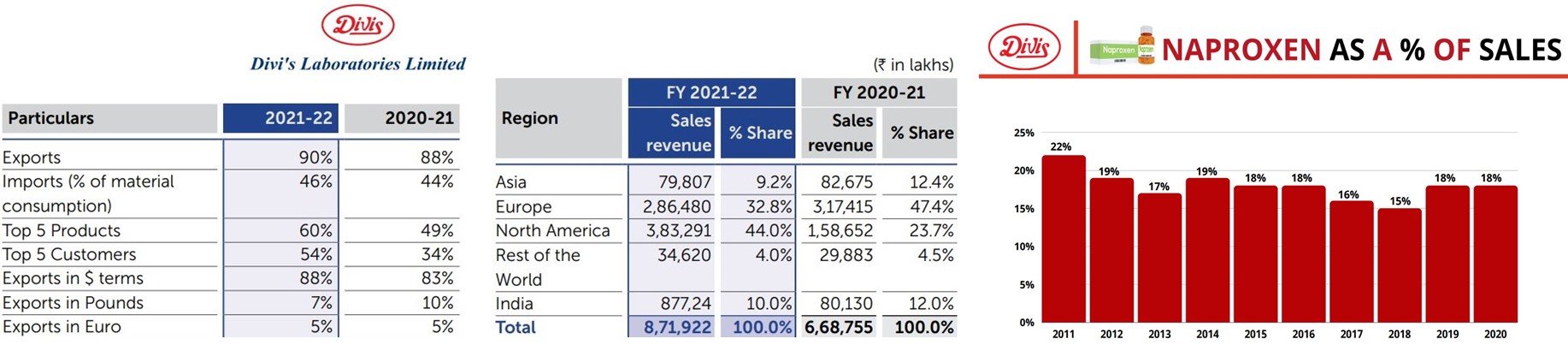

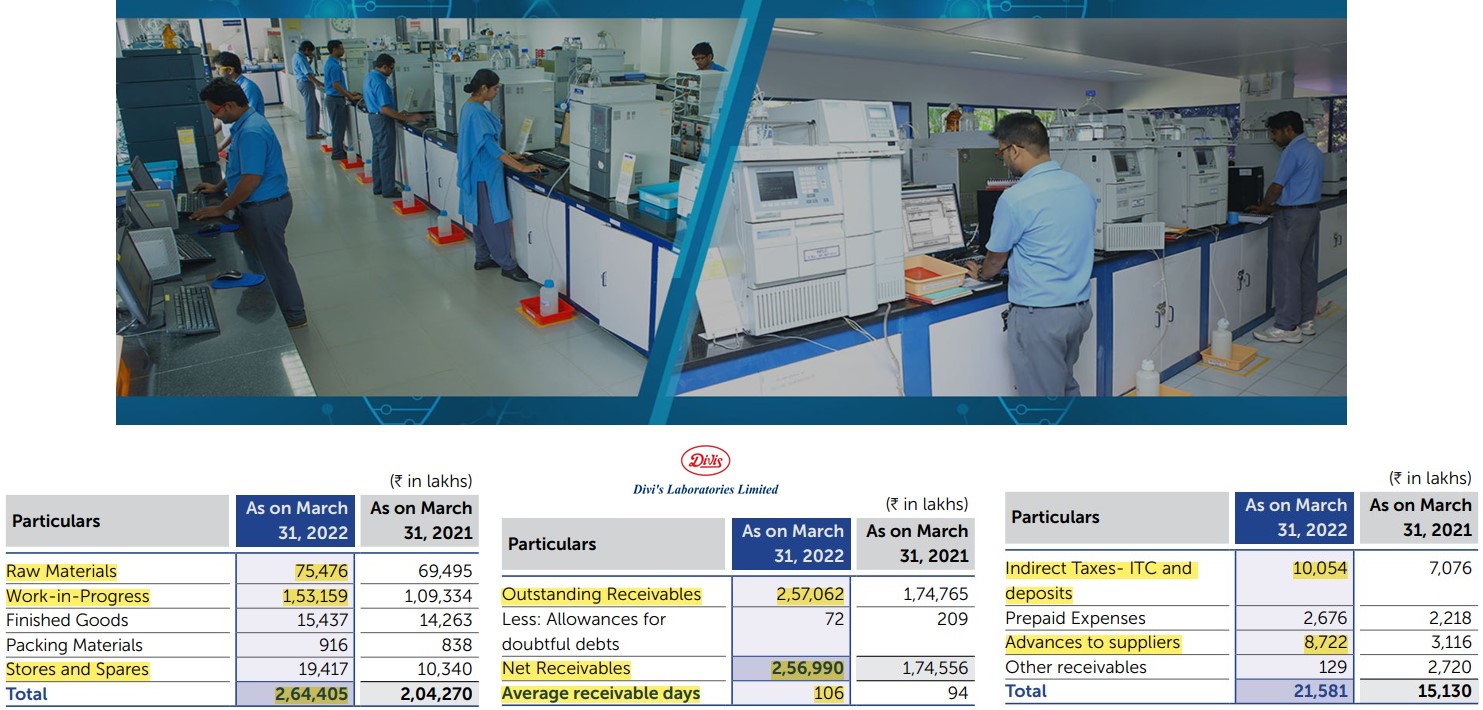

The revenue contributions from top 5 products (including Naproxen, Dextromethorphan, Levodopa, Gabapentin) has increased to 60% of sales in FY22 compared to 49% during FY21 whereas Naproxen alone has contributed ~18 to 19% of the total sales during FY20 to FY22. Similarly, top 5 customers contributed around 54% of sales in FY22, against 34% of sales during FY21. Hence, indicating increase in Both the Product & the Customer Concentration in FY22 (Source: https://www.careratings.com/upload/CompanyFiles/PR/04102022073602_Divis_Laboratories_Limited.pdf)

The Revenue Share from America has gone Down from 33% in FY17 to 23% in FY20 due to Stringent USFDA regulatory concerns, while during the same period the revenue share from Europe has gone Up from 40% to 47%, Due to Better Growth Opportunity from company’s European Business.

But opposite to this trend, company has again Significantly Increased its export exposure to US Market from 23% in FY20 to 44% in FY22 which continued to remain high in FY23 as well, given the Continuous Supply Chain Disruption, Energy Crisis, and Inflationary Pressure in Europe amid Russia-Ukraine escalated tensions.

Divi’s Lab – Challenges To Regain The Lost High Margins and The Growth Drivers Available To Enable It.

The Real Challenge for the Business is to remain Agile and Swiftly Respond to the Market Dynamics. For example when Gabapentin, where Divi’s has ~ 60% Market Share, was Outpaced by the Pregabalin’s Growth, company has moved into the manufacturing of the later to sustain its segmental growth.

Similarly, in the Present Uncertain Operating Environment with Runaway Inflation and Unprecedented Volatility in the Commodity Costs, Divi’s Lab has although shown Resilience and Adaptability to remain Focused on ensuring the Uninterrupted Supply of its products, But due to Lower Contribution from the Custom Synthesis and Drop in Generic API Realizations, company’s Top to Bottom Line has severely been Dented.

Divi’s Lab – Present Challenges & Their Likely Resolutions

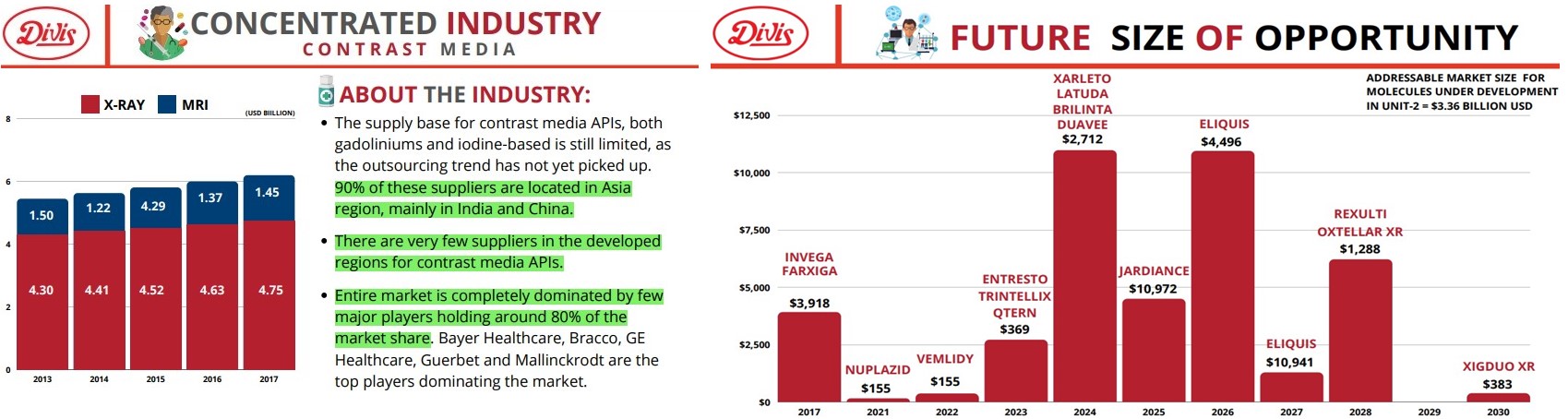

Divi’s Lab needs to find an Alternate High-Margin Niche Product which could give Similar Thrust to Sales & Margins as Molnupiravir did, during FY22. Sartans could be an answer to that, as Divi’s is trying to Expand into all the Major Sartans APIs, based on its Backward Integration Strengths. In addition, company continues to Develop and Expand into multiple products of Contrast Media too.

Besides that, Divi’s Lab is also aiming to Capitalise Upon Multiple APIs whose Patents are going to get Expire in next 2-3 years, where company has already Established Sufficient Capacities.

For last 2 years, company invested on Debottlenecking, Capacity Expansion and Backward Integration, to achieve Scale and De-risk External Raw Material Dependence. Divi’s Agile Business Model and Stable Supply Chain, ensured Minimal Business Disruption and Uninterrupted Supply to its customers, across the Globe.

But Divi’s Lab Working Capital Cycle has remained Elongated at 208 days during FY22 against 203 days in FY21. This was primarily due to High Inventory and Receivables Days. The company undertakes ‘Campaign Production’ of Large Volume Products like Naproxen, Dextromethorphan and Gabapentin by running their plant at Full Throttle, following which the company then stocks these products and thus Freeing the Multi-Purpose Plants, for Producing Other Products.

Hence, the company in general has a trend of High Inventory Holding Period. The collection period is high, since the company needs to allow Credit Period as per industry norms and to maintain client relationship.

Prices of some base metals such as Lithium and Iodine have multiplied several times since last year and the company anticipates that, this trend is likely to persist in FY24 also.

Therefore, to deal with this problem Divi’s Lab is coming up with the New Technologies in the Backward Integration Processes like the Flow Chemistry, Vapour Phase Chemistry, Lipid Liquid, Solid Liquid, Electrochemistry etc. and hence company’s dependency on N-Butyl Lithium and other metals & solvents should come down, given that through this New Swing Technology several of the company’s raw material solvents could be Reused.

Similarly, Energy Cost had also gone up 2 to 4 times between FY (2022-23) and company is trying to mitigate the impact of it by turning its operations to become More Energy Efficient.

Further, Sales Growth from Custom Synthesis Segment has Historically been fluctuating in last 10 years and usually goes in cycles of Uptrend Followed by a Downtrend. For e.g. in FY20 company’s PAT was ~ Rs. 1372 Crore with ~ 25% NPM but as Divi’s Lab has taken up several expansion plans with Fast-Track Projects in the following years, its PAT went up Significantly to ~ Rs. 1955 Crore in FY21 and then to ~ Rs. 2929 Crore in FY22, with NPM going up from 25% to 28% in FY21 & then to 37% in FY22.

Divi’s lab believes that this time too, it will be able to turn around the things in its favour within 4 to 6 Quarters from Q2FY23, given multiple huge opportunities in custom synthesis where this time most of the opportunities are in Phase-2 & Phase-3, hence their commercialization to meaningful gains may not take as longer as it would be otherwise in Phase-1 opportunities.

Divi’s Lab – Huge Opportunity for Growth

Indian Pharma Industry is estimated to be valued at US$ 49 billion in FY22, with ~ 9% growth compared to FY21. In the same period, export market stood at ~ US$ 23.3 billion. Pharma sector recorded good exports performance in 2021-22 too, along with a remarkable growth of almost US$10 billion in 8 years.

Moreover, India is Highest Contributing Market for Export to North America, followed by African Countries & third comes Europe.

In order to Stay Competitive amongst its peers in Europe and US, Divi’s Lab lays great stress on leveraging its Inherent Skills and Strengths in Chemistry by building Strong Customer Relationships, supported by Cost Competitiveness and Fast Delivery Structure.

Since, Risks relating to the Regulatory Compliances to USA & Europe Markets are Inherent to the Company’s Business, so Divi’s has put in place appropriate systems, processes, operations and procedures to Monitor and Ensure Consistent Practice for the Evolving Compliance Regime.

Divi’s Lab has filed multiple DMFs in the regulated market, targeting the products worth $20 -$25 billion which will go off-patent between FY23 to FY25 and the commercial benefits from some of these opportunities, are expected to materialise from FY24.

The Near-Term Growth is likely to come from the Contrast Media Molecules, which are used in MRI scans, Commercial Production for which is Expected to Roll Out in Q1FY24.

Company’s Current Investments on Creating Capacities for New Generic Molecules that are going Off-Patent and on Contrast Media & Sartans, is likely to Drive the Growth beyond FY24. Moreover, by then present issues like Destocking of APIs, High-Cost Inventory and Elevated Raw Materials Prices, shall also gets Resolved.

Given the said Opportunity Size and Re-investment Moat, which Divi’s have in their Business, company is expected to Grow its Revenues ~ 13% upto FY25 and hence, is hopeful to regain 60+ Gross Margins again in FY24 – To know more on Moat, read:(https://jyadareturn.com/7-key-parameters-you-should-look-for/)