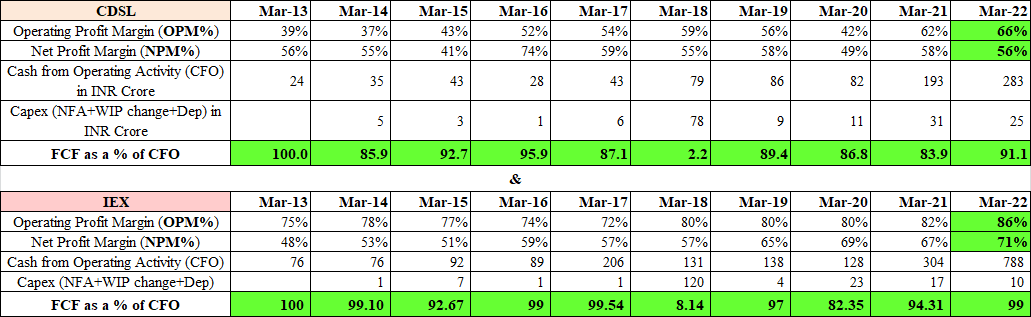

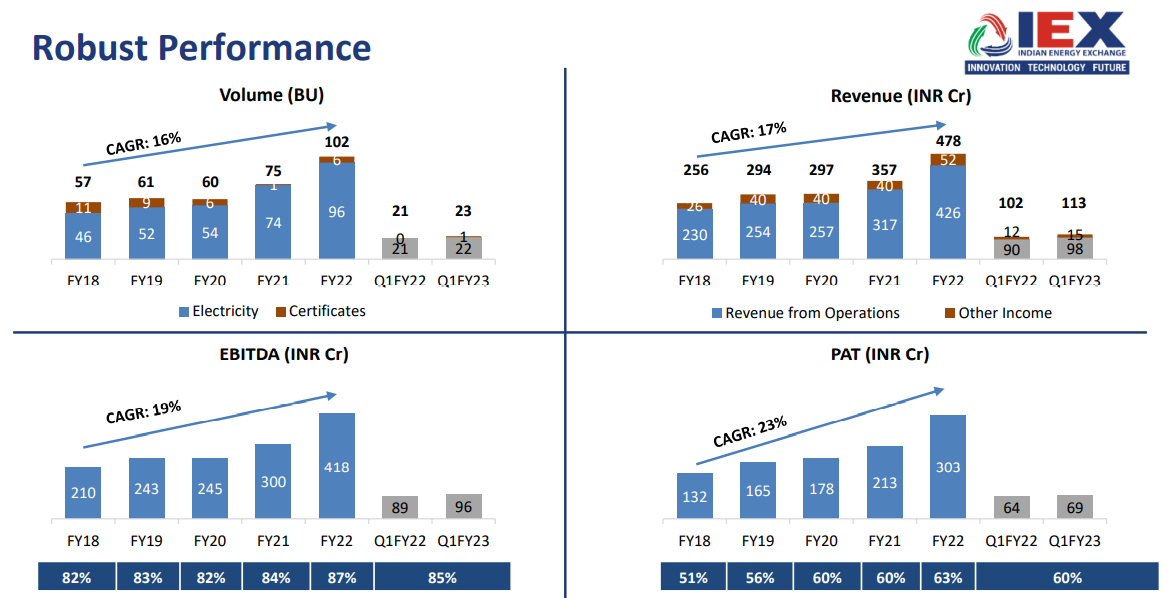

Both IEX and CDSL are like Toll Collectors on the Growth of Others, both are Asset Light Compounder Business where OPM & NPM are as high as 84% & 71% for IEX (in TTM) and 62% & 52% for CDSL (in TTM) resp. and simultaneously as the CapEx requirement is very low compared to the CFO, hence EBITDA conversion to Free Cash Flow (FCF) is very high for both of these companies. (Source: https://www.screener.in)

IEX in the Short Term Power Contracts has ~ 90.2% Market Share (as in Q2FY23) whereas, CDSL has ~ 71.6% Market Share with 73 mn BO accounts (as in Q2FY23), Both the companies have multiple Tailwinds for Growth, Both the companies have multiple Optionalities in their business given so many inherent adjacencies to enter into.

Favorable Govt. Policy and Regulation Environment for both the companies that has Triggered multiple avenues for the sustainable higher growth for the multiple decades, Both are the only listed Dominant Monopoly in their respective business.

And in spite of all that has been mentioned here, stocks of both the companies have corrected ~ 55% (in case of IEX) and ~ 35% (in case of CDSL) from their all-time high which they hit almost a year back.

In this article, we will know how & why all that has happened and what is the future of both, IEX and CDSL.

Why IEX and CDSL has Multi Decade Runway of Opportunities?

Value Proposition the two companies offers –

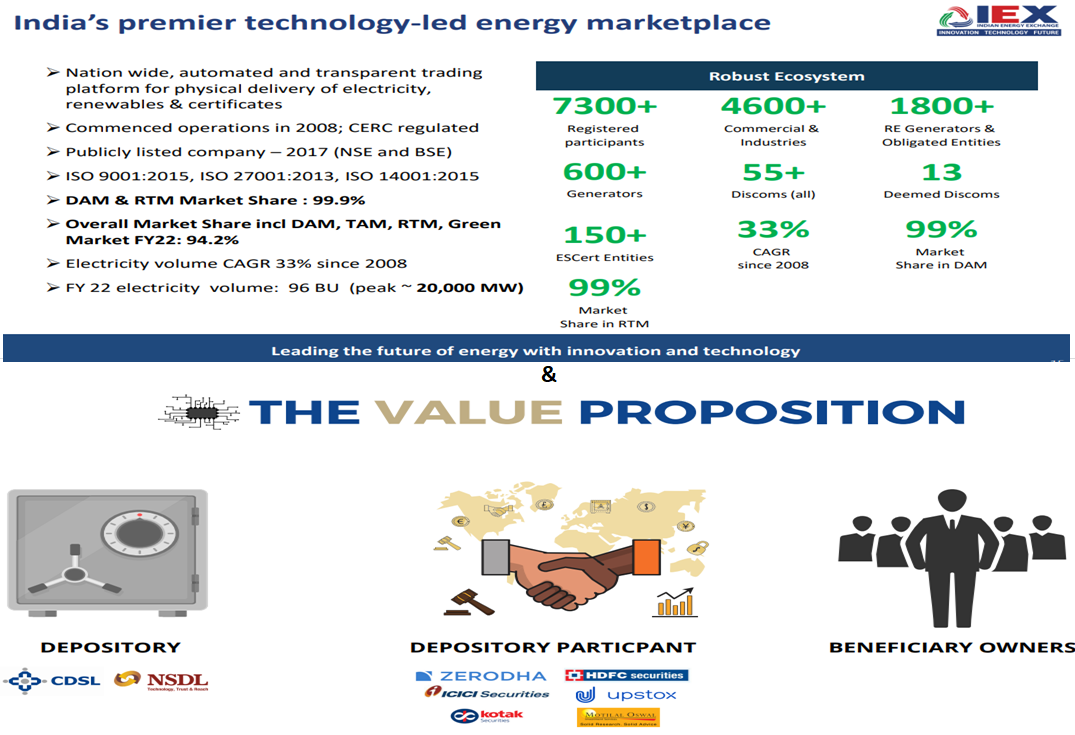

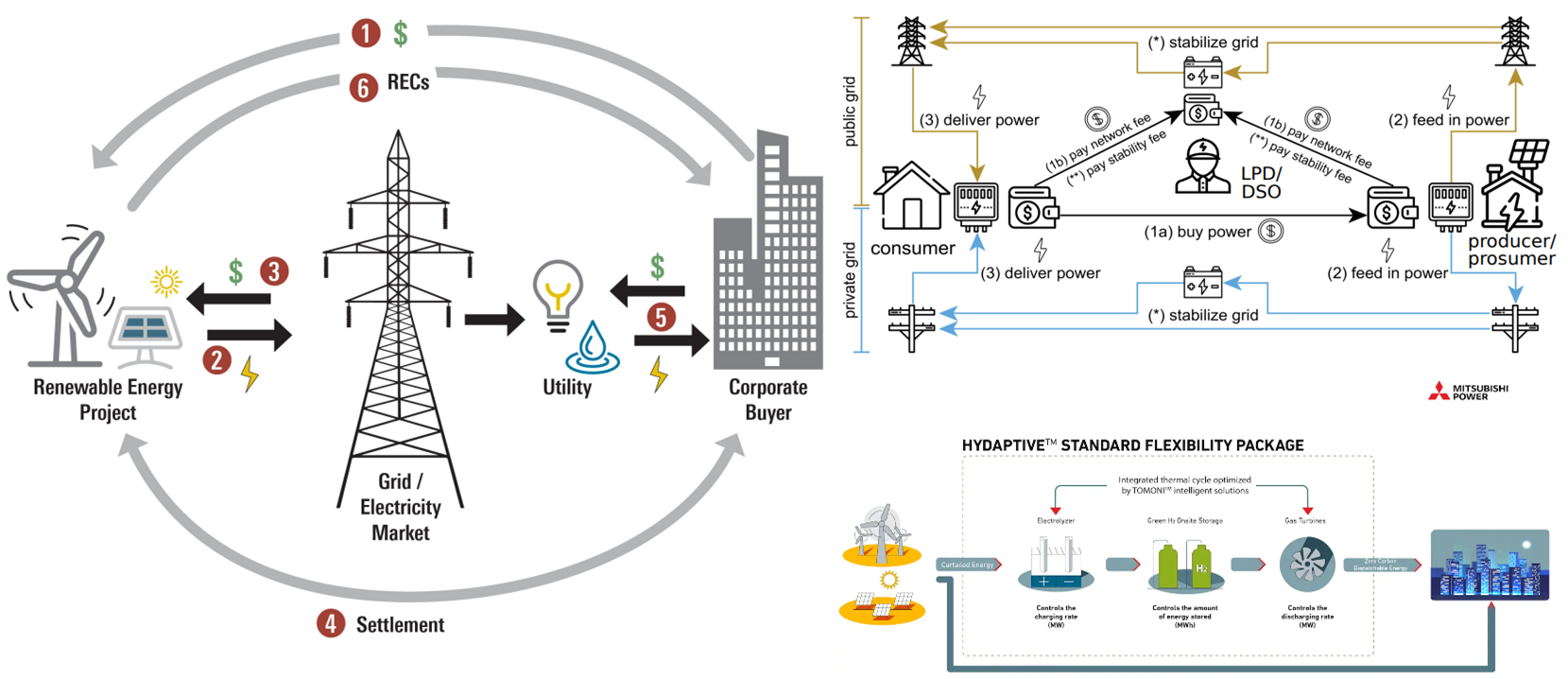

IEX is India’s premier energy exchange providing a nationwide, automated trading platform for physical delivery of electricity, renewable power, renewable energy certificates and energy saving certificates. The exchange platform enables efficient price discovery and increases the accessibility and transparency of the power market in India, while also enhancing the speed and efficiency of trade execution.

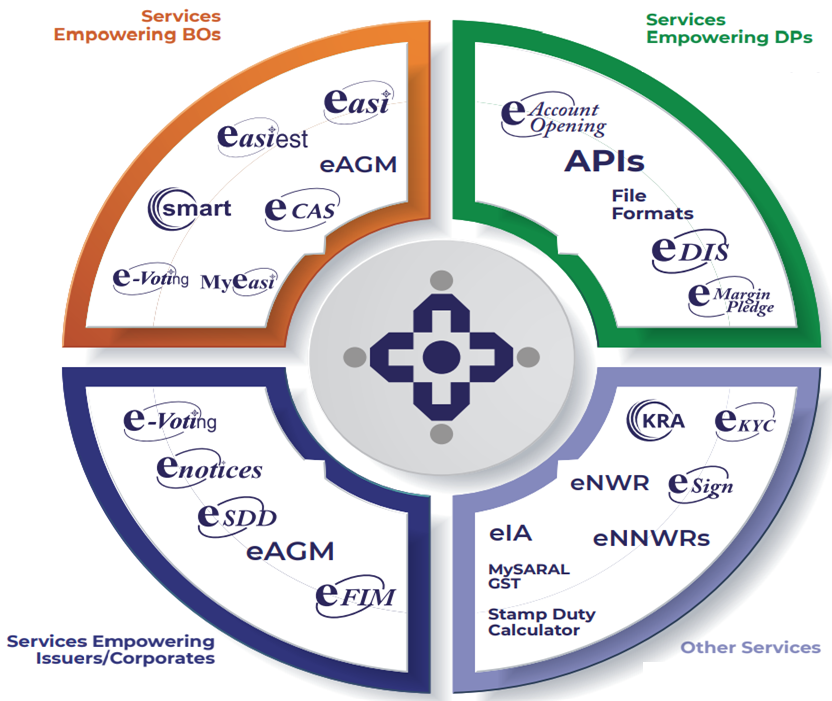

CDSL is a Market Infrastructure Institution (MII), part of the capital market structure, providing services to all market participants – Exchanges (BSE & NSE), Clearing Corporations, Depository Participants (DPs), Issuers and Investors.

It is a Facilitator for holding of securities in the dematerialised form and an Enabler for securities transactions. The company facilitates holding and transacting in securities in the electronic form and facilitates settlement of trades executed on stock exchanges. These securities include Equities, Debentures, Bonds, Units of Mutual Funds, Certificates of Deposit (CDs), Commercial Papers (CPs), Treasury Bills (TBills), and others.

Besides this, it provides Value Added Services like e-Voting, M-Voting, Myeasi Mobile App and e-Locker.

IEX and CDSL – Business, Growth Drivers, Tailwinds, and the Competitive Advantages

IEX – “Building a Sustainable and Efficient Energy Future”

Electricity is the main enabler for the Economic and Industrial Growth. It will play a dominant role in meeting the nation’s ambitious target of becoming a $5 trillion economy by the year 2026-27. In FY 22 power demand and consumption soared to new highs of 1,374 BU, an increase of 8.1% YoY, after two years of slowdown. The months of April and May 2022, saw an all-time peak demand of 207GW and a consumption rise of 18.6% YoY.

An expanding economy, population, urbanization, and industrialization will further drive up the power demand and consumption. In fact, the increasing focus by the Government of India on electrification, from cooking, to railways, and to vehicles, will all contribute significantly to an increase in power consumption in the country.

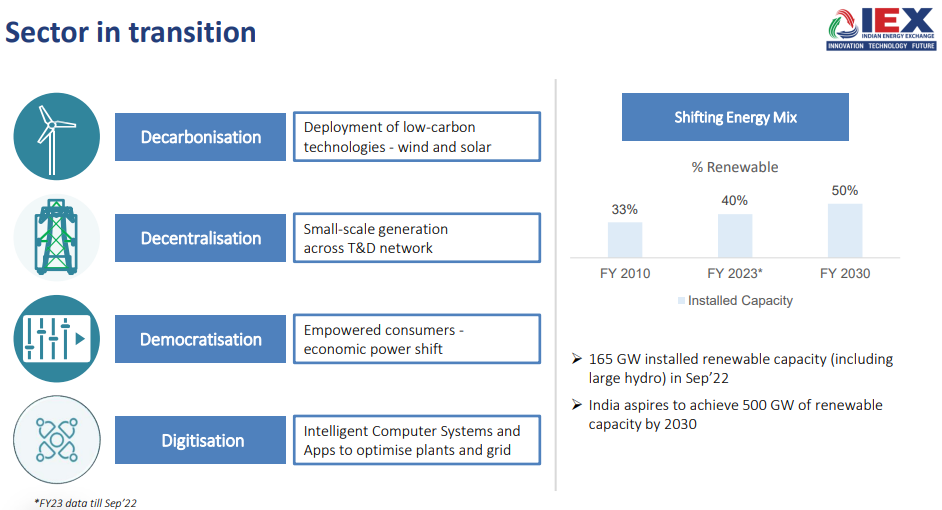

It is expected that the electricity sector will record a growth of ~ 8-10% annually for the next 10-15 years. India is also undergoing an energy transition, driven by renewable. In context of the commitments made by the Honorable Prime Minister at the COP26 Summit last year in Glasgow, India will achieve a target of 500 GW of non-fossil fuel-based generation capacity by 2030.

The present renewable capacity at 165 GW (as on 30th Sept. 2022), is ~ 41.4% of installed capacity of 408 GW. To reach 506 GW by 2030, India needs to adopt market models to facilitate capacity deployment.

Globally, we have seen that countries with higher renewable share in their energy mix have leveraged energy markets. India is a large country with diverse electricity generation and demand.

Power markets are key in managing the intermittencies, by efficient integration with conventional power and enable the most efficient matching of demand and supply.

India is moving towards a system which will integrate – distributed generation, supply chain automation, low carbon products and technologies, providing greater choice to consumers.

In this journey, technology driven solutions which Exchange Markets will provide, underpinned by Artificial Intelligence, Machine Learning and Blockchain, innovative products and services such as Peer to Peer Trading, decentralized RE hybrid models for battery storage, and other emerging trends, will support acceleration of India’s energy shift.

CDSL – “Empowering diversified Investors through Voice of Atmanirbharta”

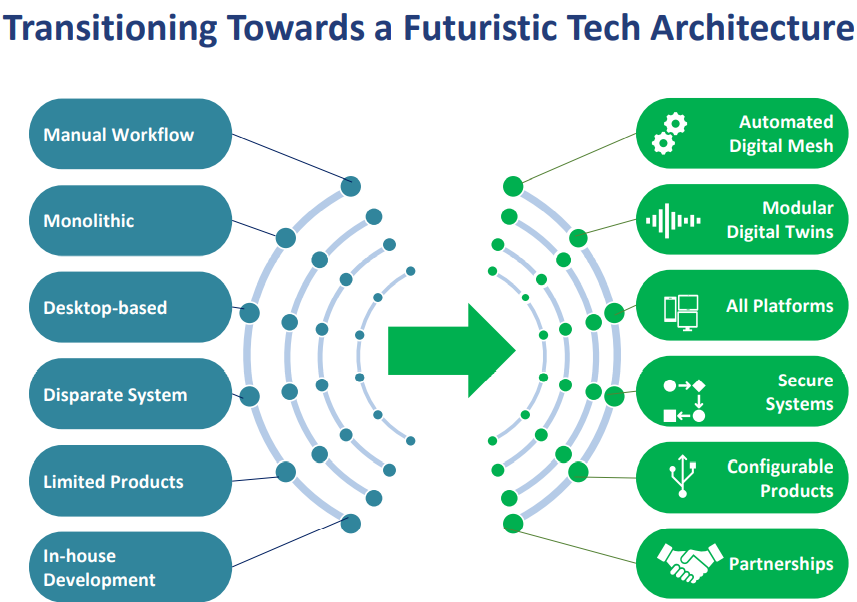

CDSL strives to conduct operations efficiently while ensuring that the processes are faster, secure, and transparent.

Today, no matter which part of the country you are based in, you have the tools and expertise to open and operate a Demat account from the comfort of your home and within a short time.The availability and simplification of digital investment & trading platforms have eased the on boarding process of investors.

CDSL is addressing the changing concerns & market challenges, as we evolve with digitization and provides reliable solutions with Convenient-Dependable-Secure ‘e-Services’ accessible to its investor community.

IEX and CDSL – The Monopoly Business & its Challenges

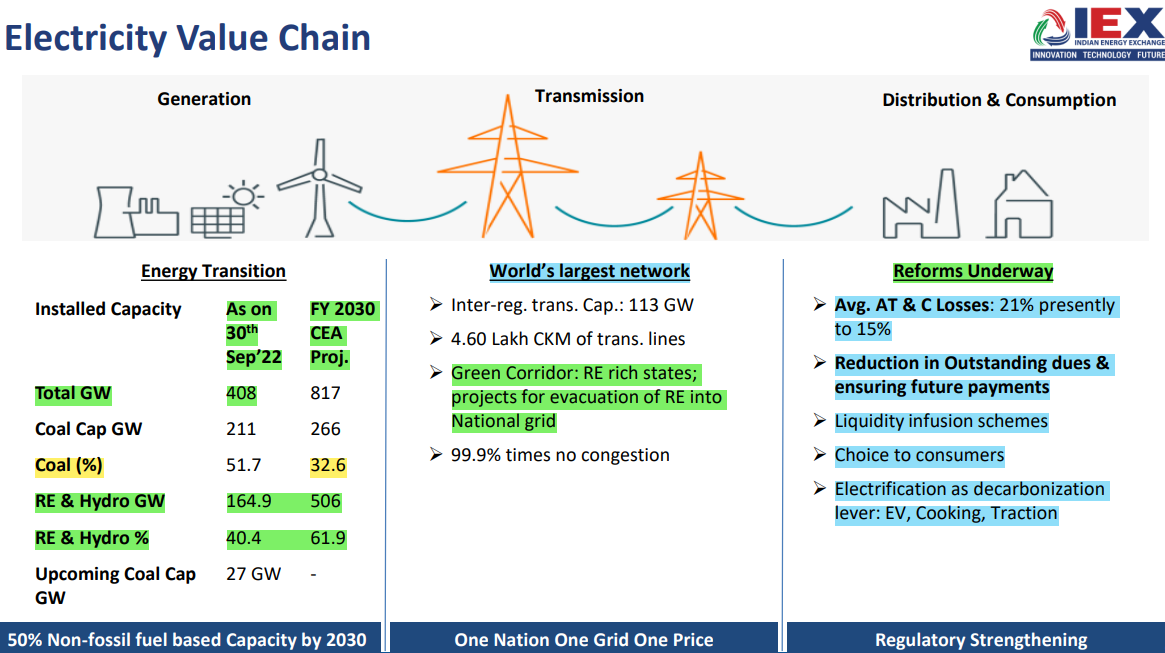

IEX – If we look at the Electricity Value Chain (as given below):

We may note that, going forward Industry Focus is going to be on:

1) – Increasing RE & Hydro (Non-Fossil Fuel) Based Installed Capacity to ~ 61.9% of the Total Capacity by 2030.

2) – For achieving this Target, Green Corridor Project for evacuation of RE into National Grid will be expedited for realizing vision of having – “One Nation-One Grid-One Price”.

3) – Simultaneously, Regulatory Strengthening will be required to ensure Reforms Underway, shall get effectively implemented.

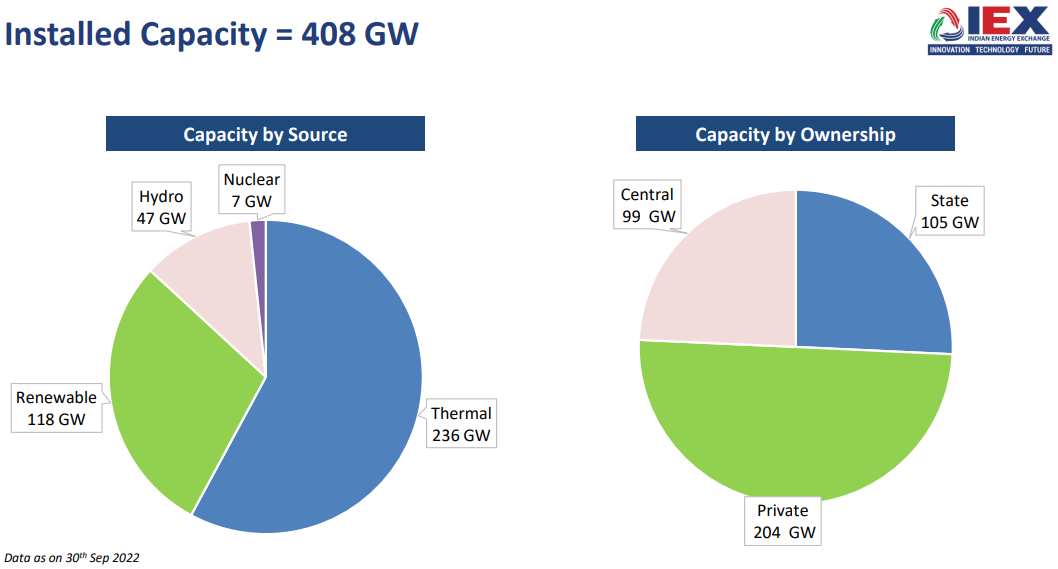

Installed Capacity has grown at 7% CAGR compared to the Demand/Generation, which has grown at 5% CAGR, in last 10 years. Current Installed Capacity of 408 GW is having following Break-Up Source & Ownership Wise:

IEX as a Power Exchange (PX) operates in an Industry, whose Sector construct is such that:-

1) – 85.9% of the Total Generated Power (Thermal + Renewable + Hydro + Nuclear) is sold through Long-Term (i.e. up to 25 years) Power Purchase Agreement (PPA) as on 30th Sept. 2022.

2) – And the remaining 14.1% of Total Generated Power ONLY is being sold through Short Term Power Contracts (STPC), which further gets Break-Up into 3 Broad Transaction Categories as following:

i) – Bilateral Type (for a period of < 1 year) – This Category makes ~ 4.5% of the Total Generated Power and coverage is through Bilateral & Banking Transactions.

Bilateral Transactions are further divided into 2 sub-types namely:

a) – Direct – whose share is ~ 1.5% of the Total Generation

b) – Trader – Its share is ~ 3% of the Total Generation.

ii) – Exchanges (like IEX) {which operates for real time (1 hour) to 11 days} – This Category makes ~ 7.7% of the Total Generated Power and from Efficient Price Discovery to Physical Delivery of the electricity, this trade execution happens through various products like Day Ahead Market, Real Time, Intraday, Contingency, Term Ahead, GTAM, GDAM, and Certificates, which exchange like IEX offers.

iii) – Demand Side Management (DSM) – This Category makes ~ 1.9% of the Total Generation and coverage is through Deviation Settlement/ Unscheduled Interchange.

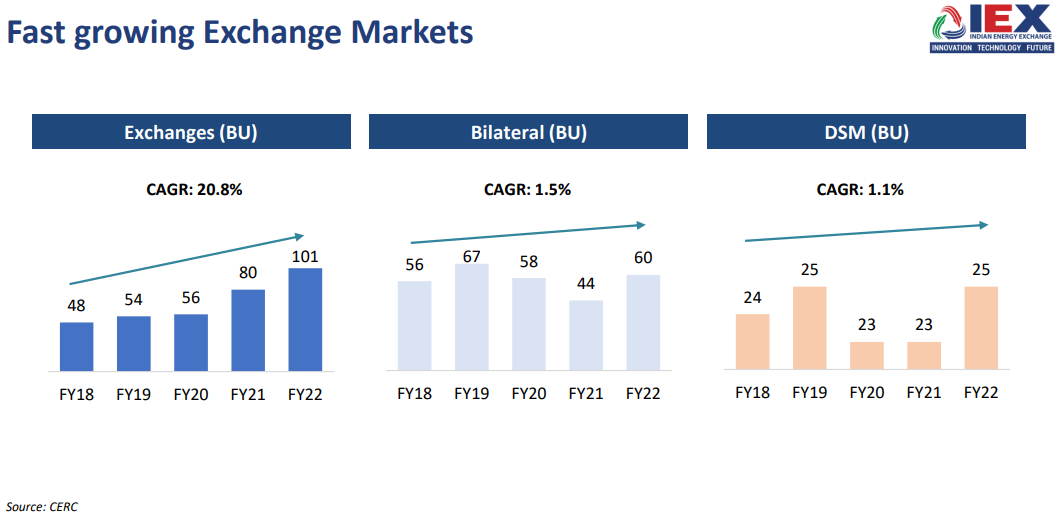

Total Power Generation in FY22 was 1,320* BU (*Excluding Renewable Power) by volume, of which 187 BU was Sold through various Short Term Contracts. Out of this 187 BU, Volume Wise Break-Up across the 3 Broad categories was as following:

i) – Bilateral share was 60 BU

ii) – PXs (Power Exchanges) was 102 BU

iii) – & DSM was 25 BU.

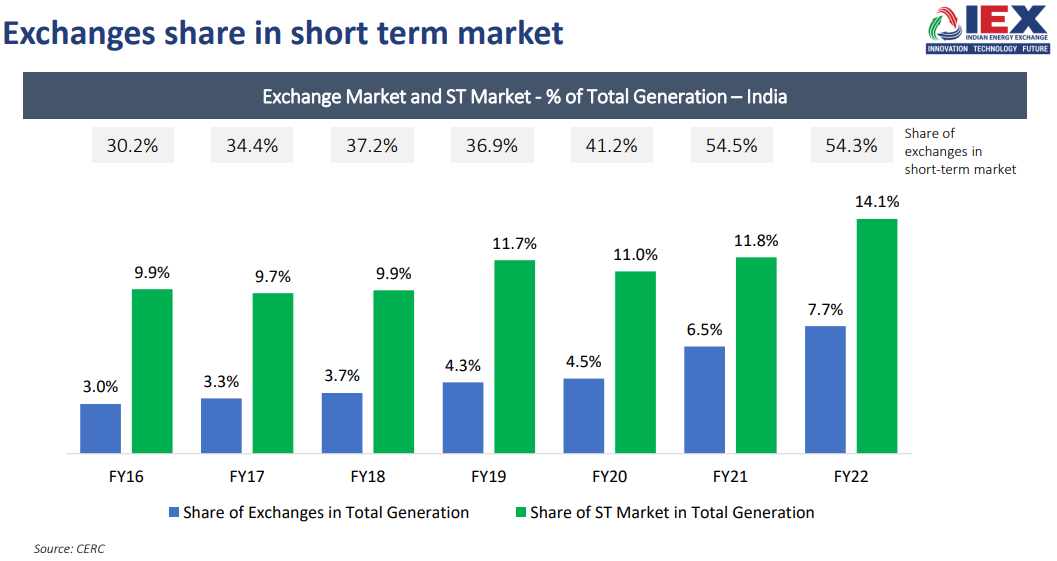

In Last 10 years while the Short-Term Power Market has witnessed 2X growth, Power Exchanges have grown 7X. Similarly, since FY16 to FY22 share of Power Exchanges (PXs) in Short-Term Market has Increased consistently from 30.2% in FY16 to 54.3% in FY22:

Power Exchanges (PXs) has Outgrow massively compared to rest of the 2 Categories in Short-Term Markets (i.e. Bilateral and DSM) in last 5 years:

PXs Market Share in Total Power Generation in developed economies is in the range of 30% – 80%, whereas in India it is just ~ 7.7%. Therefore, there is an immense potential for PXs to grow in India.

Electricity Growth Drivers –

1) – High GDP growth of ~ 8% expected to drive electricity

2) – 17 of 20 world’s fastest growing cities in India

3) – FY22 energy consumption growth has been 7.8% YoY

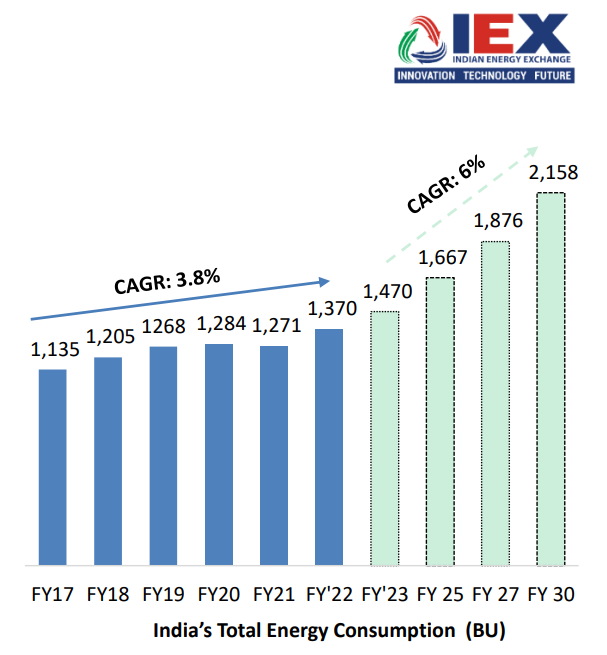

4) – Power Demand Projection for FY 23-30: India’s Total Energy Consumption (BU) expected to grow at CAGR of 6%

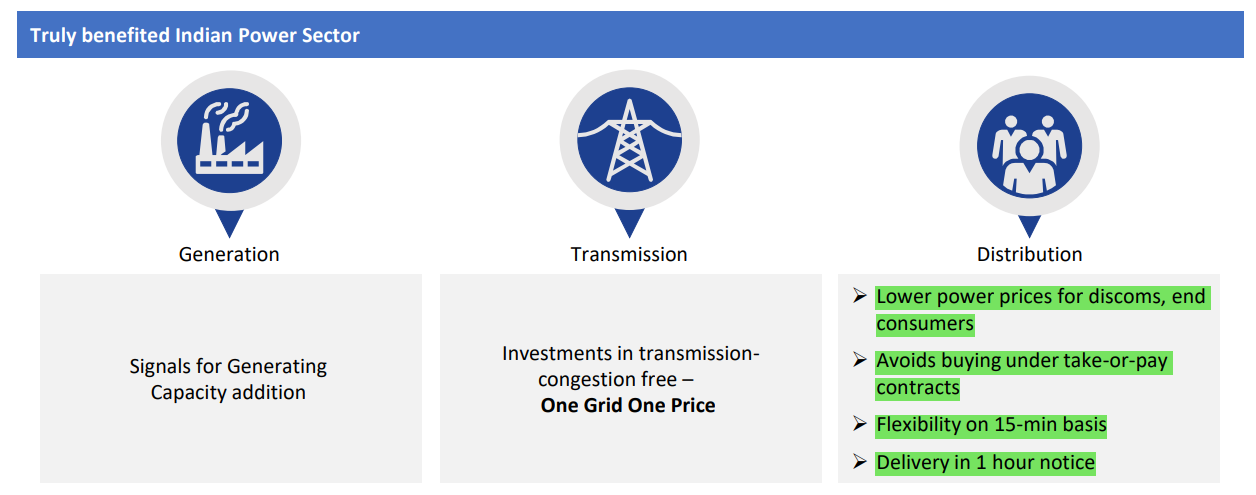

IEX Provides:

i) – Benchmark prices for all the electricity transactions

ii) – Transparent Mechanism for the Price Discovery

iii) – High liquidity on exchange has ensured lowest cost and assured supply. All this has Truly Benefited Indian Power Sector:

IEX Market Segments:

Day Ahead Market (DAM) – IEX allows its participants to transact electricity on a 15-minutes block basis, a day prior to the delivery of electricity. The buyers and sellers submit their bids electronically and IEX matches the bids on double-sided auction mechanism with a uniform market clearing price.

Green – Day Ahead Market – Green Day ahead Market allows anonymous & double sided closed collective auction in renewable energy on the day-ahead. Bid categories for Buyers & Sellers – Solar, Non-Solar and Hydro.

Term Ahead Market (TAM) – range for buying/selling electricity for a duration of up to 11 days. It enables participants to purchase electricity for the same day through intra-day contracts, for the next day through day-ahead contingency, on daily basis for rolling seven days through daily contracts.

Real-Time Market (RTM) – The Real-Time Market launched in June 2020, allows the distribution company to continuously balance their power demand supply requirements towards facilitating efficient renewable energy integration. The market segment features collective auction every 30 minutes with 48 auction sessions in a day.

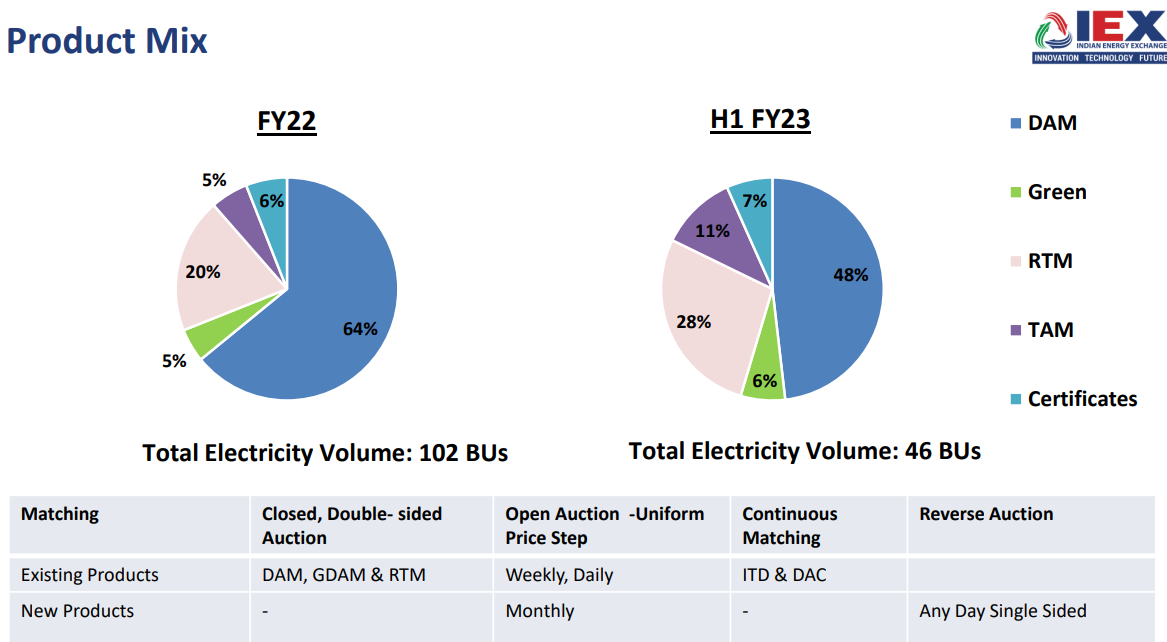

The technology architecture allows seamless and highly automated power auctions and highest availability, since inception. In financial year 2022, the market constituted 20 BU volumes representing 20% of the total volume of 102 BU.

Renewable Energy certificate (Rec) – Rec market facilitates transaction in environmental attributes. The Renewable Energy (RE) generator can opt to get RECs against the green attributes of their generation. These generators can sell RECs through the exchange.

Until August 2020, the Exchange-based power markets only offered trade in Renewable Energy Certificates (RECs). Entities on the demand side were procuring renewable energy mainly through long term PPA contracts to fulfill their Renewable Purchase Obligations, mandated as per the Indian Electricity Act, 2003.

This changed in August 2020, when the Central Electricity Regulatory Commission approved trading in renewable energy with Term-Ahead contracts on the power exchanges, paving way for the establishment of a first-of-its-kind “Green Market” in India.

Energy Saving certificates (Eserts) – ESCerts are the tradable certificates under the Perform, Achieve, Trade Scheme of Bureau of Energy Efficiency, a market-based mechanism to incentivize energy efficiency in large energy-intensive industries.

RTM commenced in June 2020, the Green Term-Ahead Market (GTAM) commenced in August’ 2020, while GDAM commenced in October 2021. Together these three market-segments offer demand-supply-imbalance management through various delivery-based contracts ranging from half hourly auctions (RTM) to trade on a Day-Ahead (GDAM) as well as Term Ahead contracts that extend up to 11 days (GTAM).

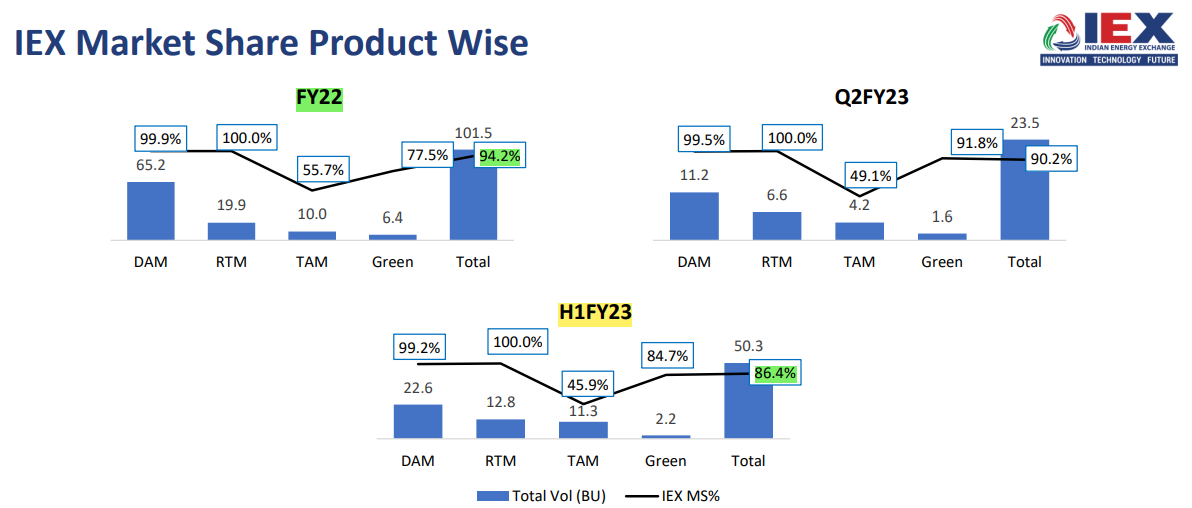

Although PXs makes ONLY ~ 7.7% of the Total Power Generation Transactions (by Volume in BU) as on 31st March 2022, but this is ~ 54.3% of the Overall Short-Term Market and IEX Market Share was ~ 95% in this Power Exchange (PX) Market in FY22, which in H1FY23 fall to ~ 86.4% because of:

1) – Temporary Shift in Volume from DAM to DAC (Day Ahead Contingency) segment was observed due to –

i) – Firm tie up due to uncertainty of availability in peak hours

ii) – Double charging of transmission charges in collective transactions

2) – Volume likely to shift to DAM/RTM with improvement in supply & implementation of sharing regulation.

IEX’s such high Dominating Market Share in PXs Market is due to its ~ 100% Market Share Dominance in Products like DAM and RTM, which it continues to maintain even in H1FY23, in spite of fact that IEX was unable to garner the volumes, due to unfavorable macros.

To understand what affects the Volumes and hence, Market Share of IEX in Short-Term Power Market, we need to understand how the:

1) – Coal Prices affects the IEX Business.

2) – & How the Policy and Govt. Regulations affects the IEX Business.

Whenever there is less demand for electricity (for e.g. during COVID pandemic, power generating facilities were not operating at full capacity due to lock down and simultaneously, Industrial Demand for electricity was also at bare minimum due to same lock down reason) but excessive supply of the coal, then the Electricity Supply is also Surplus, But its Demand is Low in the Market.

In such situations, average electricity price also remains low and in downward trend only, if such macro-economic factors remain unchanged for a while. Under such situations, low electricity prices provides a good opportunity for the DISCOMs (Electricity Distribution Companies) to Buy electricity on IEX Platform through their Short-Term Contracts, thus giving IEX Trading Volume enough reasons to go through the roof.

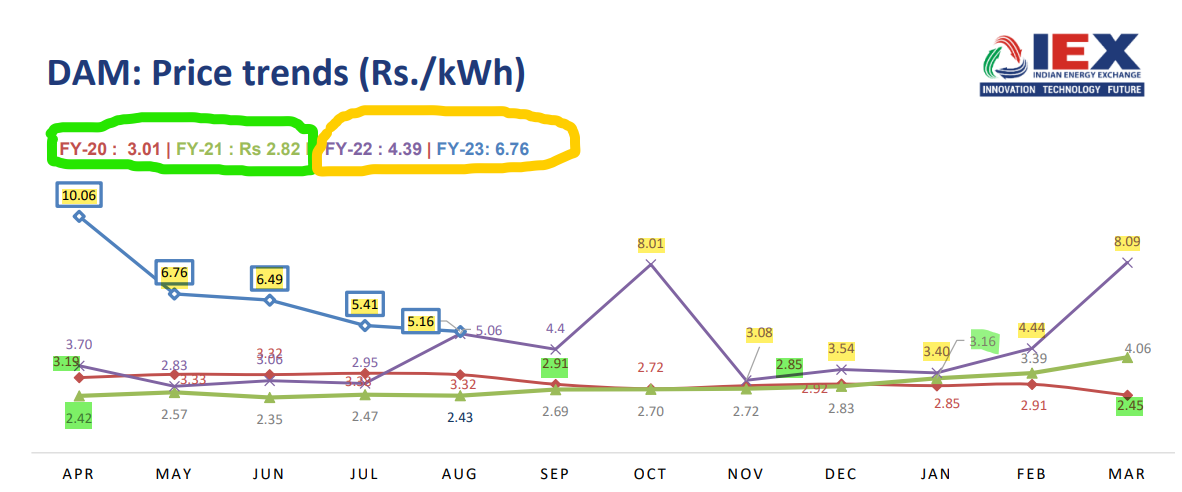

One may notice that:

1) – Monthly average DAM price increased significantly in Oct 21, Mar – Jun 22 due to energy crisis.

2) – Similar trends observed globally due to severe energy crisis led by increased demand and supply chain disruption.

3) – Lower prices in last 3 years helped DISCOMs, to optimize their power procurement cost.

4) – Recently in July/Aug’22, increased renewable/hydro generation and monsoon has resulted in lowering of prices at IEX.

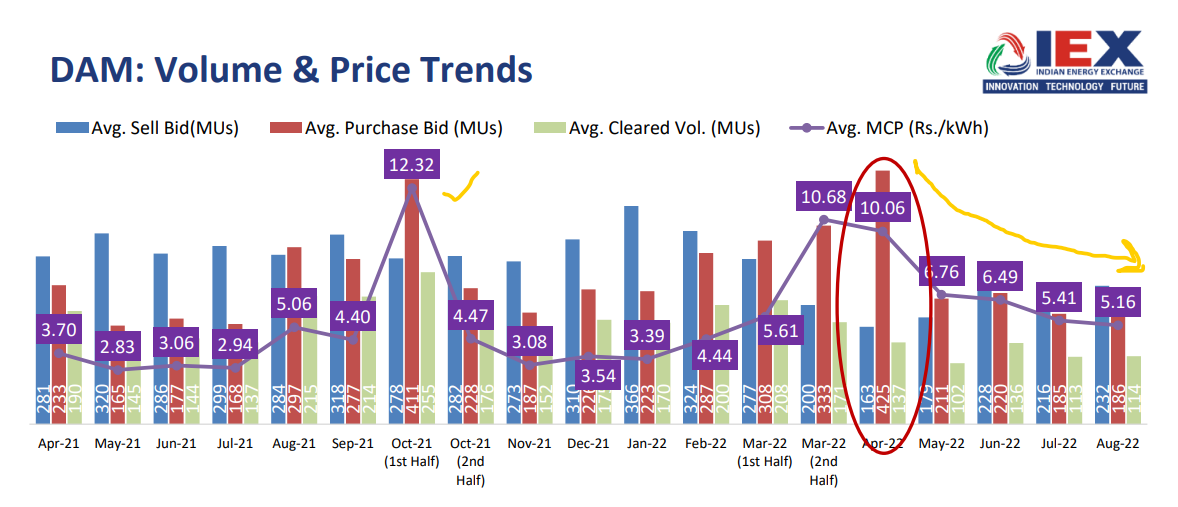

Similarly, we may also see from the Volume and Price Trend that:

Higher prices resulted in reduction in:

i) – OA volume without captive – till Jul’22 dropped by 58%

ii) – Significant reduction in optimization volume by DISCOMs – Gujarat, Andhra Pradesh, Maharashtra, Punjab, Haryana

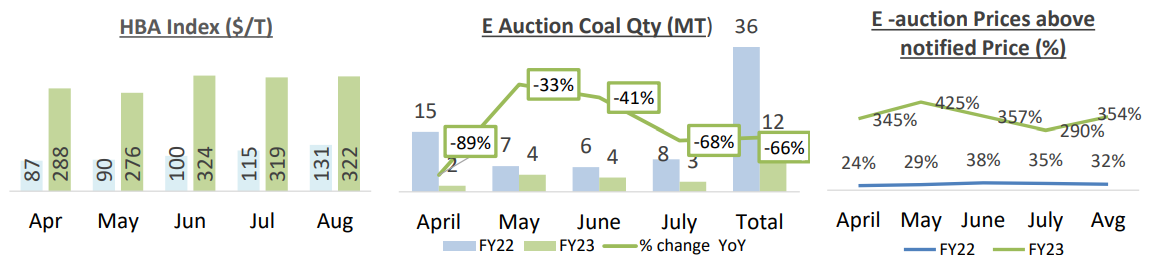

How the Supply Side Constraints leading to high price discoveries? – Reason being “Geo-Political factors” which have impacted the international coal and electricity prices worldwide.

One may conclude that:

1) – International Coal prices have shot up by more than 192% YoY basis.

2) – Variable cost of imported coal- based generation has increased over 100% from Rs. 4.5/kWh to Rs. 9/kWh.

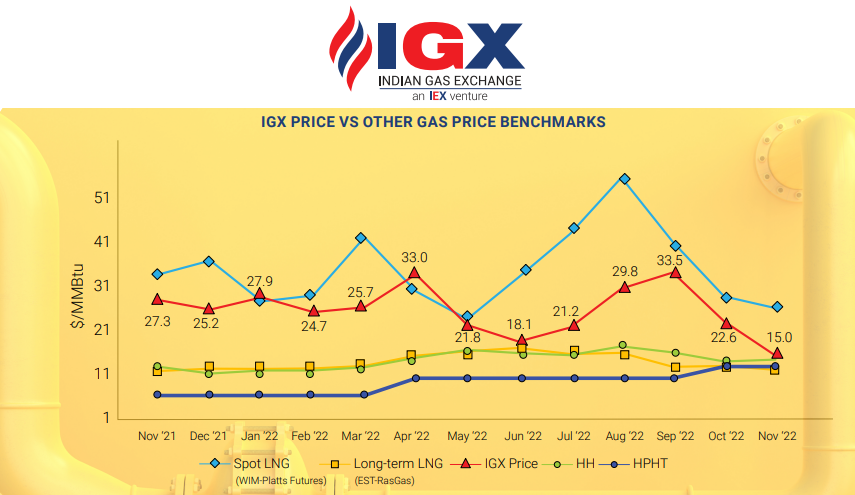

3) – LNG price increased to record high level of 54$/MMBTU, 200% inc YoY.

4) – Special forward e-Auction for Power Sector discontinued, Coal available under common e-Auction for all sectors incl. Power.

5) – Quantity offered through e-auction has reduced to 12 MT from 36 MT, reduction by 65% YoY.

6) – e-Auction Prices increased 350% over notified prices in FY23

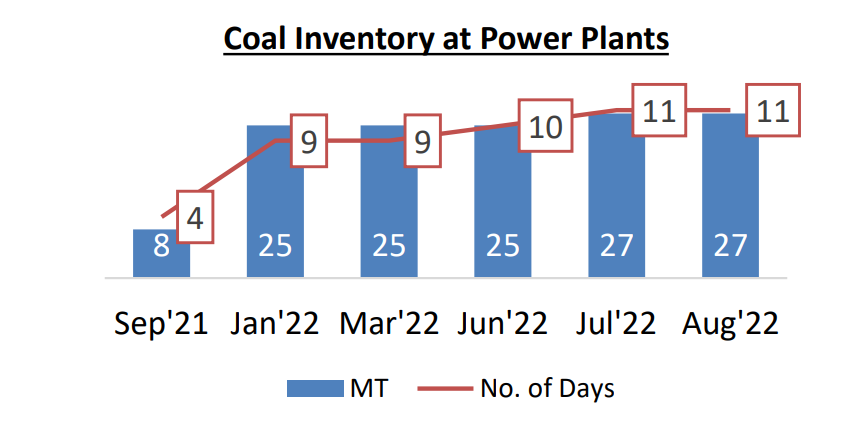

Coal supply & Inventory –

1) – Coal production increased by 26.5% YoY and dispatch to power sector increased by 21.3% in first 4 months of this fiscal FY (2022-23), whereas coal generation has increased at a lower rate of 16%.

2) – Captive mines production increased by 66% YoY in first 4 months.

3) – Coal production generally goes down during July/Aug – no impact this year. July’22 and Aug’22 production increased by 12% and 9% YoY resp.

4) – As inventory at power plant has increased, MoP has eased coal import norms – hence, No additional import.

5) – Coal position expected to improve in short to medium term:

i) – Mines and Minerals Act, 1957 amended to allow sell up to 50% of their annual production after meeting the requirement of the end use plant.

ii) – 100% FDI allowed for commercial mining; auction process of 46 blocks completed.

iii) – CIL has offered 20 discontinued coal mines for re-opening on revenue sharing basis.

Price – Volume Outlook –

Easing supply constraints:

1) – Improvement in coal production and higher inventory will result in increase in sell, by both DISCOMs & IPPs.

2) – IPPs sell will provide Round the Clock supply, resulting in better availability & lower prices in peak hours.

3) – Lower prices will lead to increase in DISCOMs Buy, as they will bid to optimize/ replace costlier power.

4) – Open Access clearance will increase with softening of prices.

GNA implementation –

1) – Implementation of GNA will lead to avoidance of duplication of transmission charges in DAM/RTM.

2) – DAC volume will shift back to DAM/RTM, where IEX command close to 100% market share.

Policy Advocacy to Enhance Liquidity in the Spot Market –

1) – Pool based CfD (Contract for Difference) mechanism for RE capacity addition through the market.

2) – Merchant RE capacity addition – 25% merchant capacity in all PPAs.

3) – Unallocated power of the Central Generating Stations, should be sold through exchanges.

4) – No renewal of existing PPAs after completion of 25 years & sell through the market.

5) – Allow aggregators to participate in the spot markets & offer fixed price contract to industrial consumers.

6) – Generators (including renewable) can buy from the market for promoting efficiency.

7) – Implement Gross Bidding on a voluntary basis.

8) – Exclusive coal auction/allocation for Merchant Capacity.

9) – Capacity Market to comply with resource adequacy obligation.

CDSL – “Empowering #Atmanirbhar Niveshak”

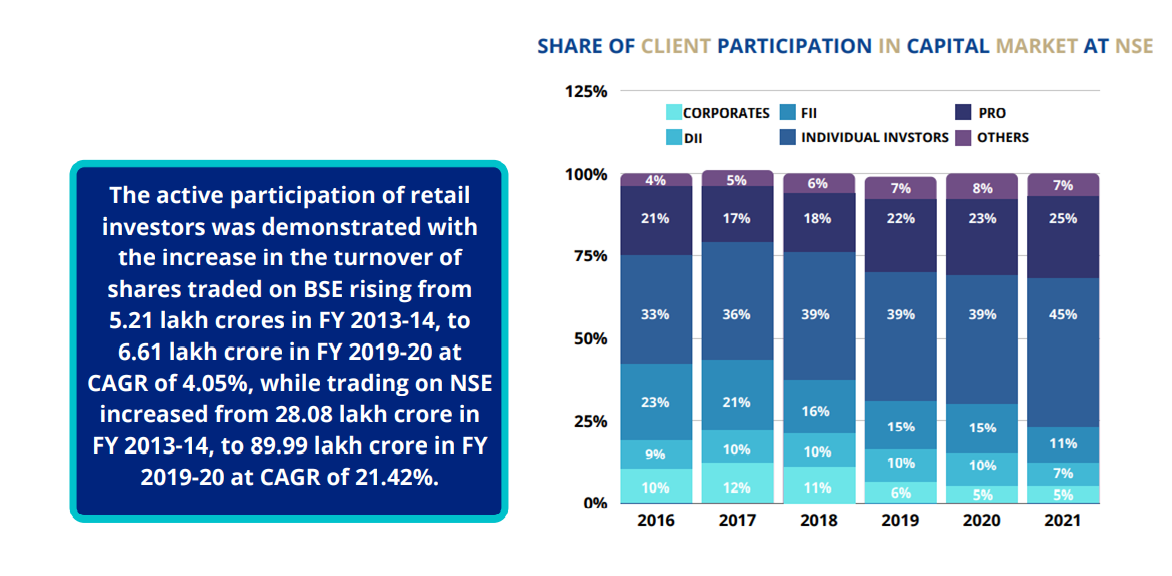

Depositories remain a structural play in the Indian Capital Markets, benefiting from the Higher Retail Participation, which has been demonstrated by the Depositories also as they have grown at ~ 15% CAGR during FY (2016-22), specifically trading on NSE has increased at ~ 21.42% CAGR between FY14 to FY20.

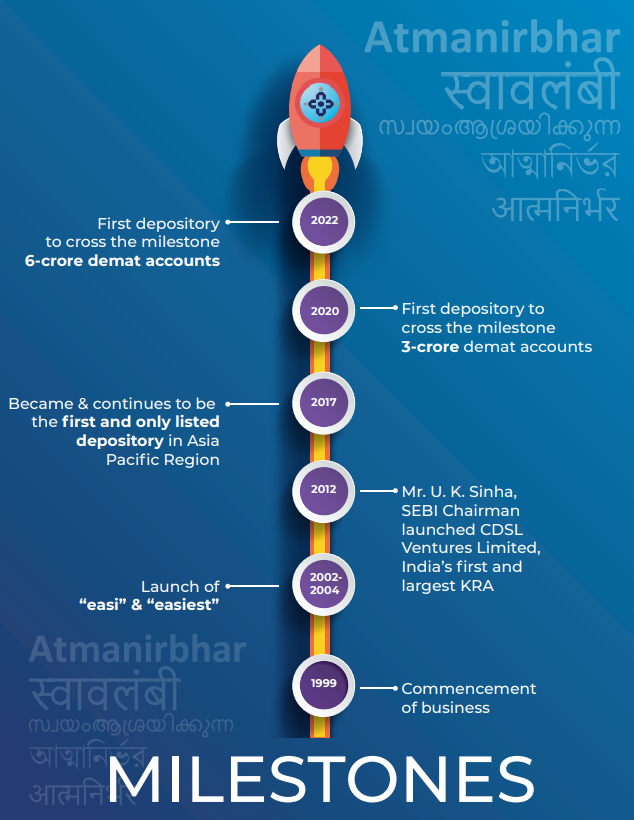

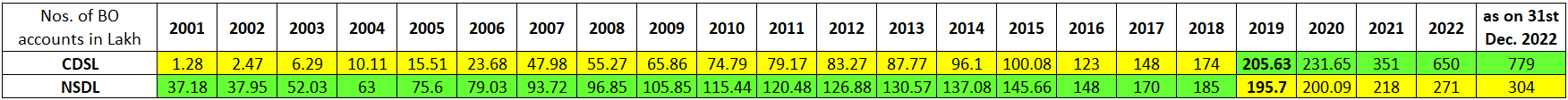

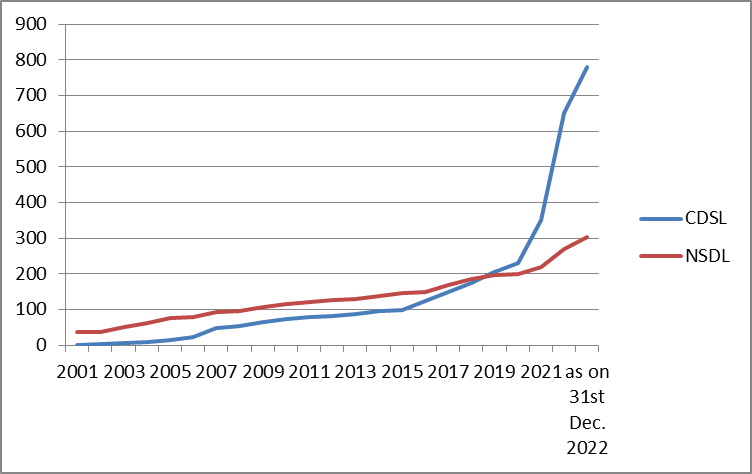

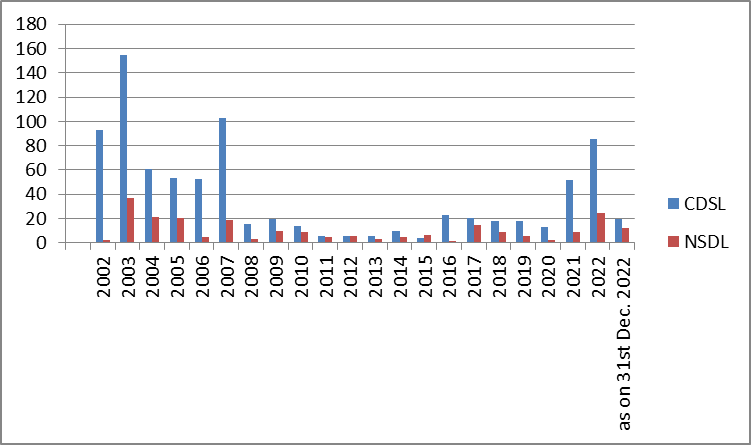

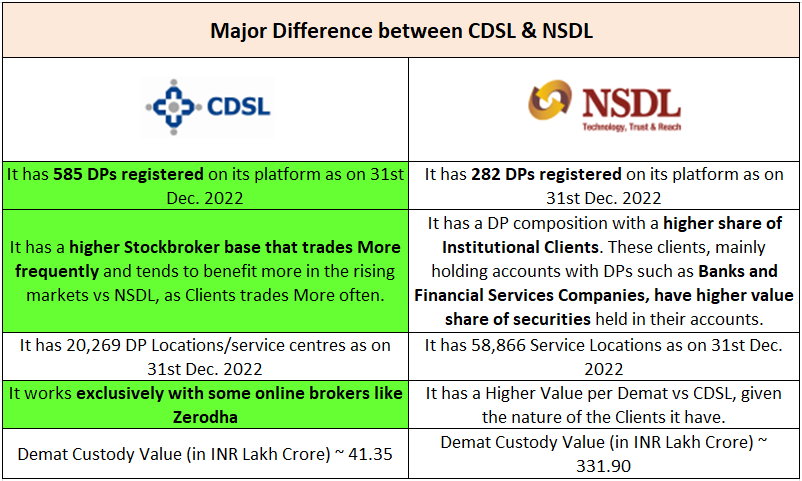

Since its inception in 1999, CDSL has consistently gained Market Share from its Non-Listed Sole Competitor NSDL. In this Duopoly Depository Business, CDSL has proven itself to be a Disruptor, not only for the Capital Market but more so for NSDL.

Even Yearly Incremental Market Share Gain (in %) has been much Higher in case of CDSL, when compared with NSDL:

WHY IS CDSL GAINING THE MARKET SHARE FROM NSDL ?

1) – The Cost of setting up a DP account with CDSL is more attractive than that with NSDL.

2) – The Minimum Net requirement for starting a DP account with CDSL is Rs.2 crores Vs Rs.3 crores for NDSL.

3) – Deposit requirement for CDSL is 50Lakhs, which is half of NSDL’s requirement of Rs 1crore.

4) – CDSL has a Centralized Server Model that requires no upfront investment (i.e. Plug & Play kind of Set Up) Vs Setting up On-Premise Servers to connect to, in case of NSDL.

5) – CDSL offers a Tariff based on Slab System Vs Costly Fixed Rate Structure for NSDL.

6) – The Difference in the End Customers for both the CDSL (Stockbrokers who trades More frequently and tends to benefit more in the rising markets) & NSDL (Institutional Clients who mainly holding accounts with DPs such as Banks and Financial Services Companies).

With ~ 72% Market Share (as on 31st Dec. 2022), CDSL Operates under 3 Business Segments:

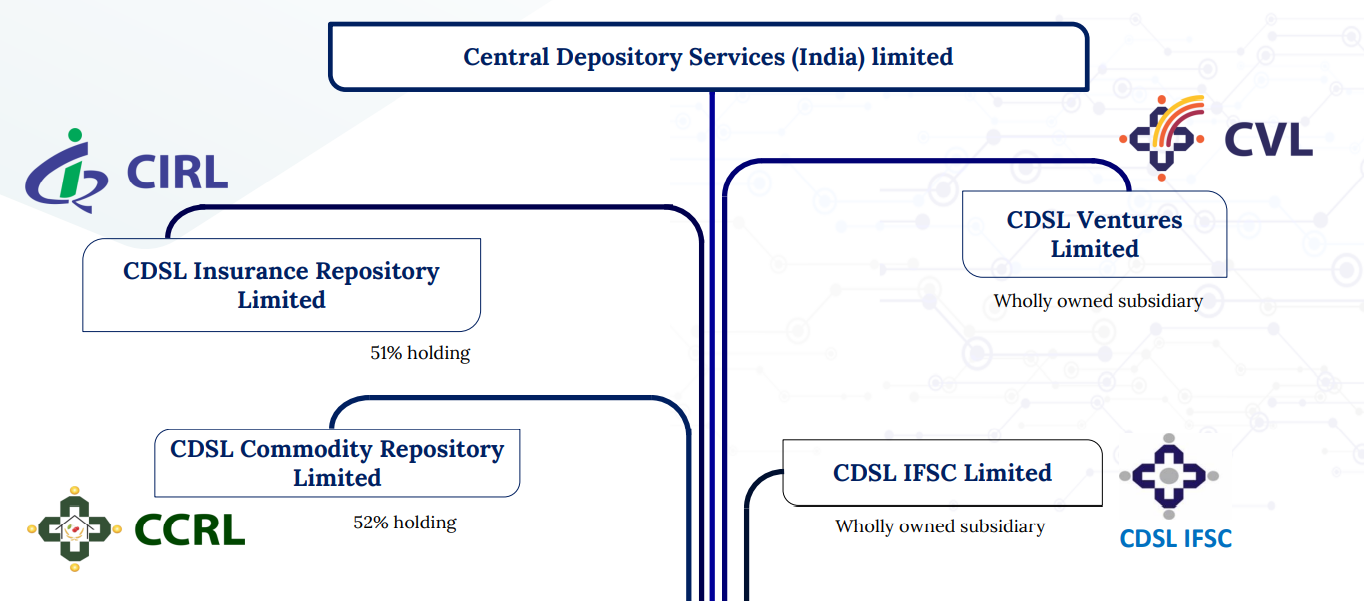

1) – Depository (makes ~ 78% of the Revenue, as in FY21) – Dematerialisation, Re-materialization, Holding, Transfer and Pledge of Securities in electronic form and e-Voting services.

2) – Data Entry and Storage (makes ~ 21% of the Revenue, as in FY21) – Centralised record keeping of KYC document of capital market investors.

3) – Repository (makes ~ 1% of the Revenue, as in FY21) – Provide facilities to Policy holders/Warehouse receipts to keep Insurance Policies/Warehouse receipts in electronic form and to undertake changes, etc.

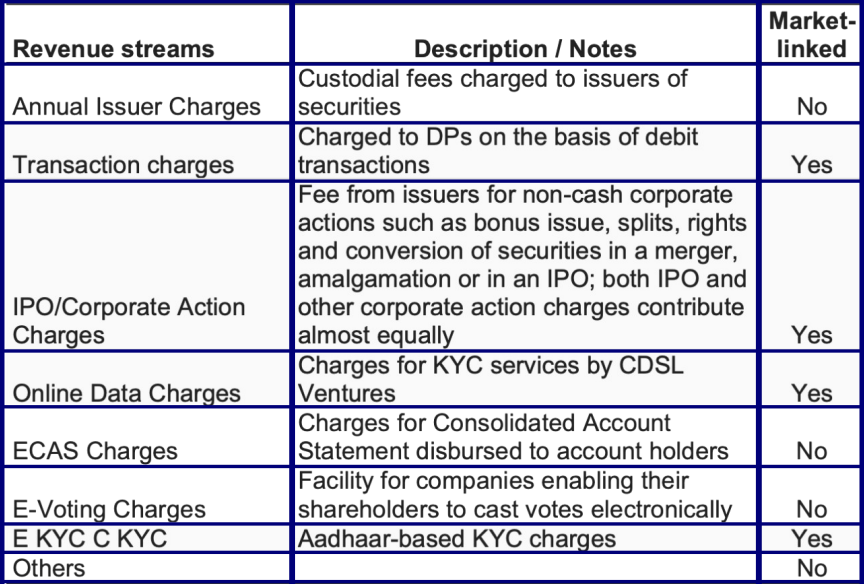

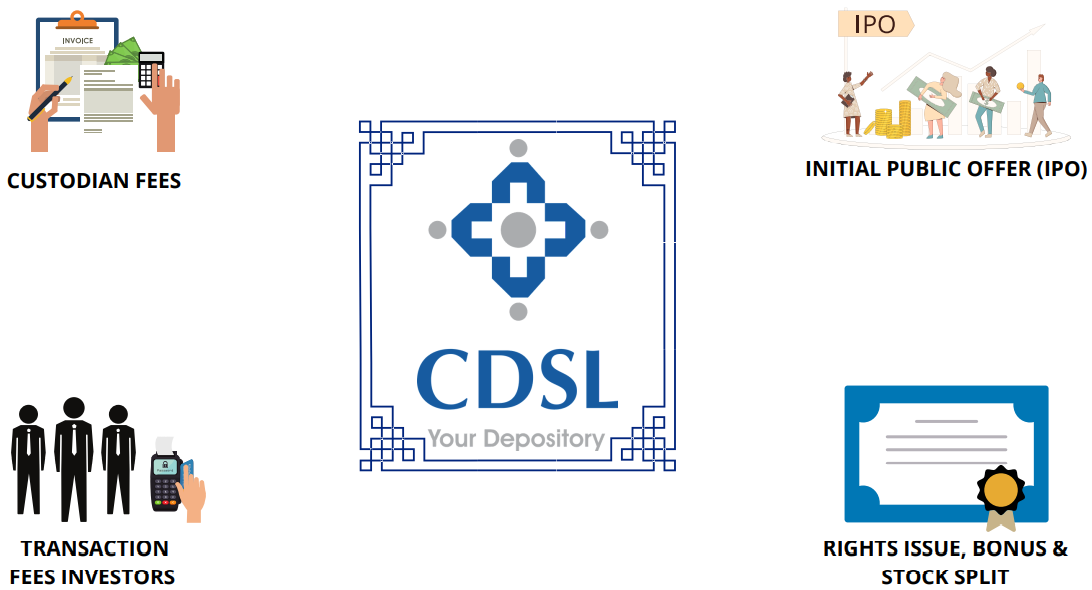

Through these product offerings, CDSL generates Revenues mainly under 8 Streams:

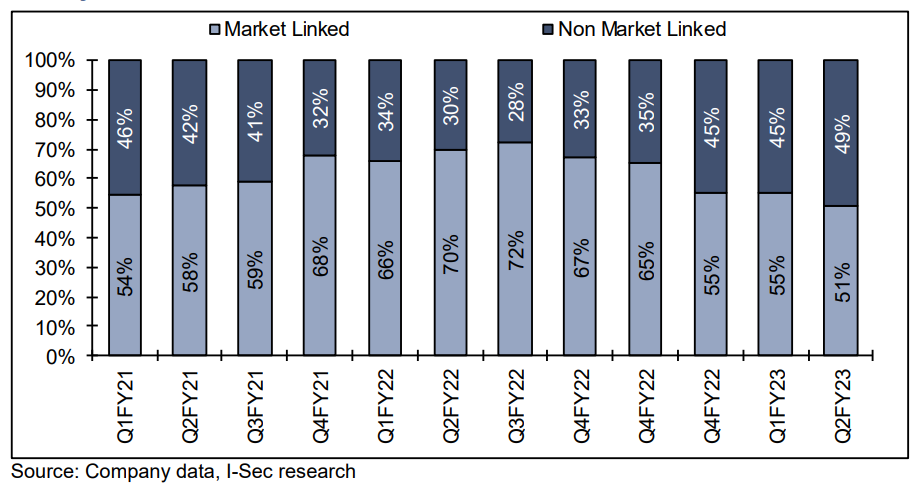

CDSL Market Linked Revenue has been ~ (50 – 72%) in last 3 years and whenever there is higher liquidity in the market (due to “Bull Run”), CDSL Market Linked Revenue has increased sharply.

For this reason CDSL Business is Shallow Cyclicality in Nature, although the growth in Indian Capital Market is of Structural Nature. Therefore, in longer term this Structural Trend for Growth may also be seen in CDSL’s financial performance.

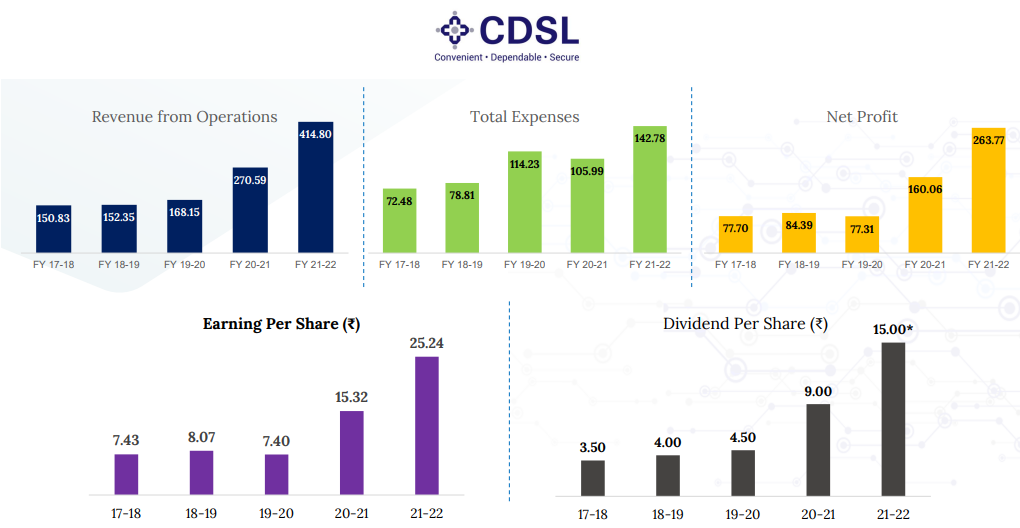

Due to Asset Light Compounder Business of CDSL, CapEx requirement have always been very low compared to the CFO company generates, hence EBITDA conversion to Free Cash Flow (FCF) has been consistently very high for it almost ~ (85 – 92%). Simultaneously, due to its High Operating Leverage Business, Fixed Cost (like Employee Cost and Expenditures/Investment in IT System) has almost remained Fixed even as the revenues has increased manifold over the years. Therefore, its OPM & NPM has consistently increased over the years & is currently as high as 62% & 52% respectively.

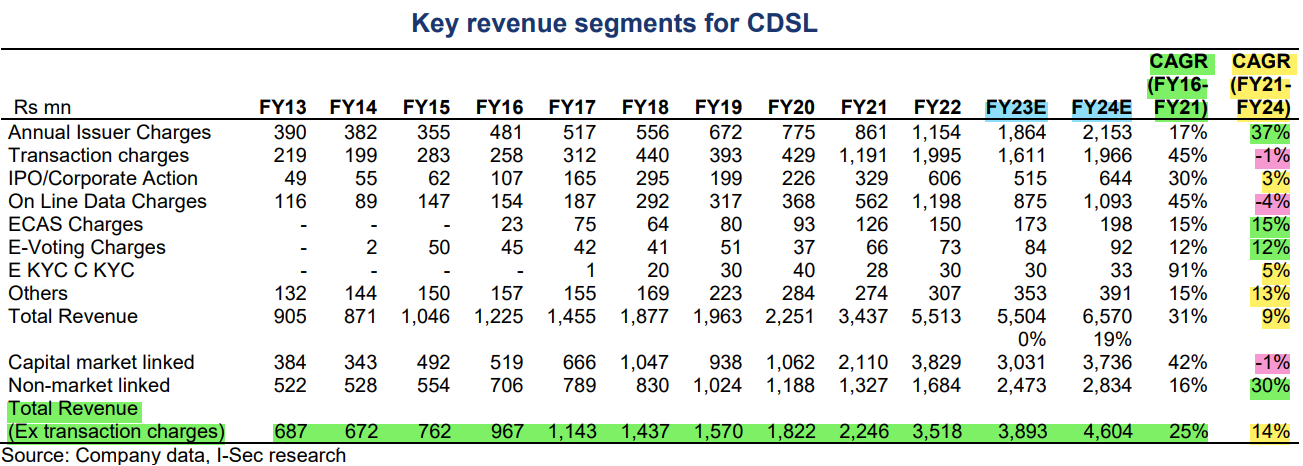

So barring the fluctuation in the market linked revenue constitute, rest of the revenue streams are likely to grow at-least at the Depository Market Growth Rate. Projection for the earnings growth is also very much in-line with these assumptions, as between FY13 to FY22 Revenue from Capital Market Linked Portion has grown ~ 10X whereas the Non-Market Linked Portion has only grown ~ 3.2X, despite of the fact that ‘Annual Issuer Charges’ being a Non-Market Linked Constitute, is still an annually recurring revenue which gets incremented periodically due to charges revision after every few years :

Depositories like CDSL and NSDL earns the revenue from a listed company throughout its Time-Line on the exchanges i.e. right from the listing of a company on the exchanges through IPO, to its Delisting from the exchanges for any reason. Therefore, CDSL is like a Toll Collector on the Growth of Indian Capital Market, which itself is in a Long-Term Structural Growth Trend.

Additionally, CDSL is a Proxy on the growth of its DPs like Fin-tech Brokers e.g. Zerodha, Angel Broking etc. (as they are exclusively working with CDSL). Given the Switching Cost for these DPs is very high, due to in-built exit barrier in the CDSL Business (imagine the kind of Disruption these Fin-tech Brokers might have to face if they decide to Shift from CDSL to NSDL, given the huge amount of Critical Data of these companies are available with the CDSL!).

Due to High Operating Leverage Business, with the High Fixed Cost like:

- Employee Cost

- Expenditures/Investment in IT System

Right from the starting of the business, the new competitors will have to beer the losses for many years, before being able to win sufficiently large pool of the customers, so as to start generating the profits.

Therefore it’s very difficult for any new potential competitor to make entry into the Depository Business & take away market share from the dominant player like CDSL, although SEBI has already removed the Competition Regulation in FY (2017-18), thereby allowing other interested parties also, to come & Open up their Depository Business.

Interestingly, nobody dared to have tried! So is the Competitive Advantage which CDSL have, that protects it from any likely Moat attack.

(To know more about Importance of Competitive Advantage and Business Moats read: https://jyadareturn.com/7-key-parameters-you-should-look-for/ & https://jyadareturn.com/varun-beverages-and-vedant-fashions/)

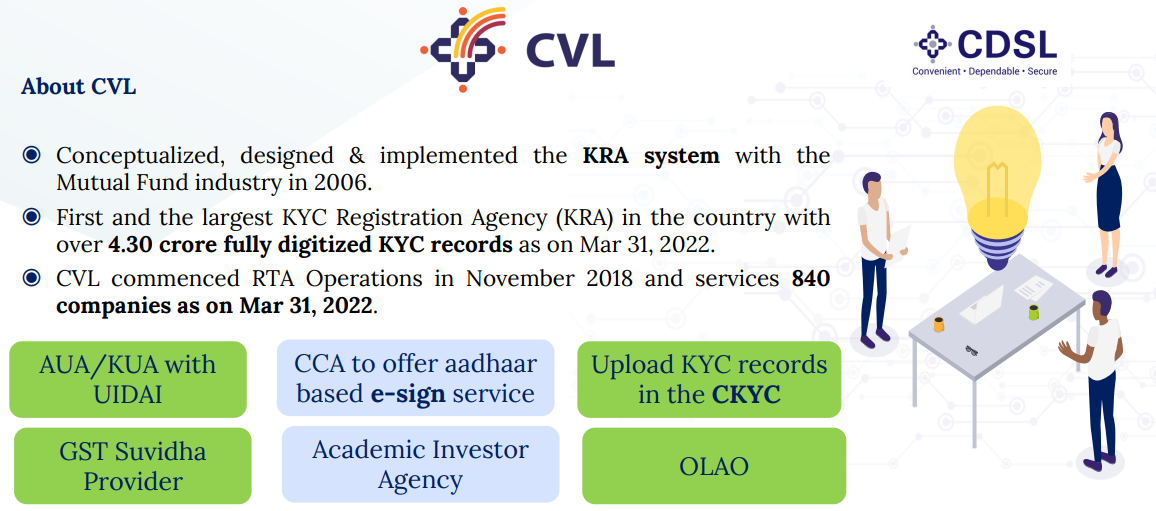

CVL began its journey in 2008 by handling Customer Profiling and Record keeping of Mutual Fund Investors on account of the PMLA Act, related KYC requirements. After the introduction of the KRA regulations in 2011, CVL was the first entity to register as a KYC Registration Agency (KRA) with SEBI.

As a KRA, CVL provides fully digitized KYC services to all intermediaries in the Capital Markets. CVL holds over 4.60 Crore fully digitized KYC records as on 31st Dec. 2022. CVL is also offering the following, as part of its service portfolio:

- CKYC supporting services: CVL assists intermediaries to become CKYC supporting services compliant by facilitating upload of KYC documents to CERSAI.

- Aadhaar based eKYC services.

- Aadhaar based esign services.

- Registrar and Transfer Agent services (RTA).

- PMJJBY services: Maintaining a Claim Repository and performing dedupe activity for claims under PMJJBY scheme.

- GST Suvidha Provider Services for filing GST Returns.

- Processing and handling Refund payments to investors.

- Academic Depository: Digitizing and hosting academic awards to enable access by Students and Verifiers.

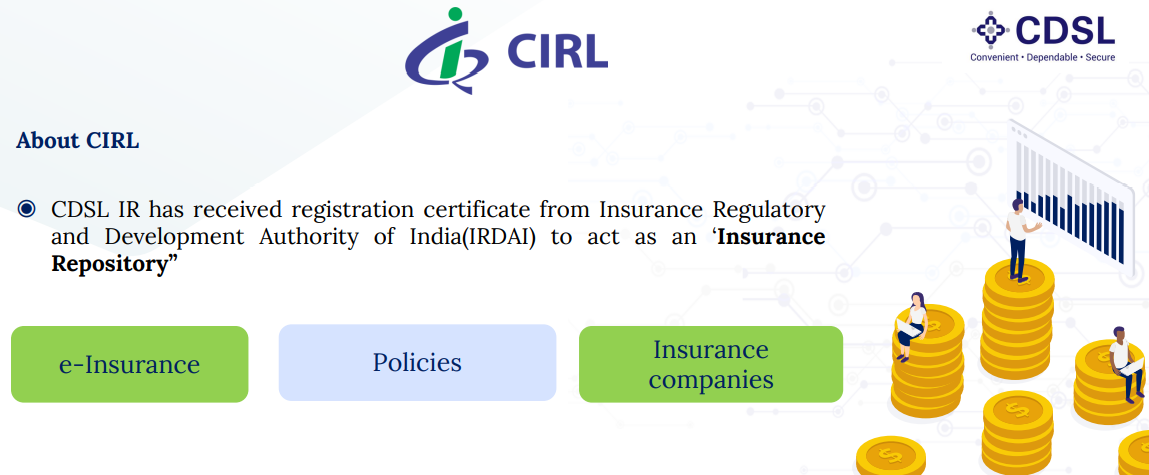

CIRL has been promoted by CDSL by subscribing to 51% of the CDSL IR’s Paid-up Equity Capital of Rs.30-crores. Insurance Companies from Life and Non-Life sectors hold 45.75% of the CDSL IR’s Equity Capital and the balance 3.25% is held by CDSL’s wholly owned subsidiary company – CDSL Ventures Ltd. (CVL).

The objective of setting up an Insurance Repository is to provide policyholders a facility to keep insurance policies in electronic form in ‘e-Insurance account’(eIA) and to undertake changes, modifications and revisions in the eIA account/ insurance policy with speed and accuracy, in order to bring about efficiency, transparency and cost reduction in the issuance and maintenance of insurance policies.

CCRL facilities ownership and transfers of commodity-assets electronically. Towards this demat accounts are opened for various customer groups like farmers, Farmers Producer Organizations (FPOs), processors, manufacturers, traders etc. to obtain electronic Negotiable Warehouse receipts (eNWRs) or electronic Non-negotiable Warehouse Receipts (eNNWRs). To read more visit: https://www.ccrl.co.in/whyus.html

CDSL may be considered as an Infrastructure provider for multiple industries. It has Economies of Scale in its KYC segment business named CVL, whose ~ 85% revenue comes from FETCH (utility from which any CDSL registered broker can fetch the existing KYC record from CDSL) & remaining 15% comes from the new BO accounts, while creating their KYC details for the 1st time.

Huge Optionality for it in Insurance business segment CIRL, where they De-materialise the physical copies of Insurance, which is still Not Mandatory in India. CIRL has ~ 5.5 lakhs E-Insurance accounts as in 2021.

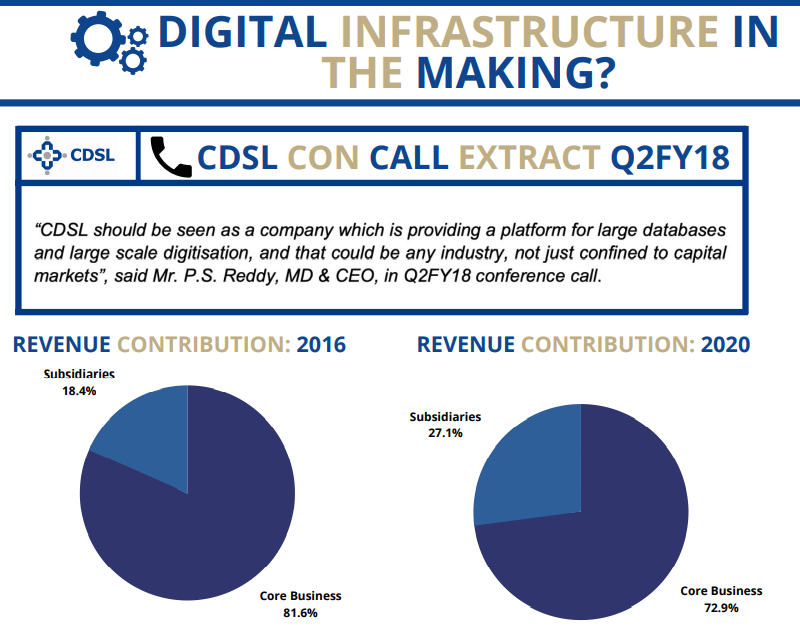

CDSL’s sales from its subsidiaries is ~ 30% (in 2021) & subsidiaries may provides an Ultimate Optionality in Business, if it actually becomes “Digital Infrastructure of Sorts”.

IEX and CDSL – Growth Triggers for Long Runway of Opportunities

For IEX –

Favorable Policy and Regulatory Environment to ensure Resource adequacy, promote RE, hedging opportunities leading to deepening of Markets:

➢ Draft National Electricity Policy 2021 has targeted to deepen the spot market – introduce suitable market mechanism including capacity market, to do away with the present rigidity of long term PPA.

➢ Draft Electricity Act Amendment Bill 2022 has proposed to introduce multiple DISCOMs in a supply area which will promote private participation, increase DISCOMs viability and competitive procurement through Exchange.

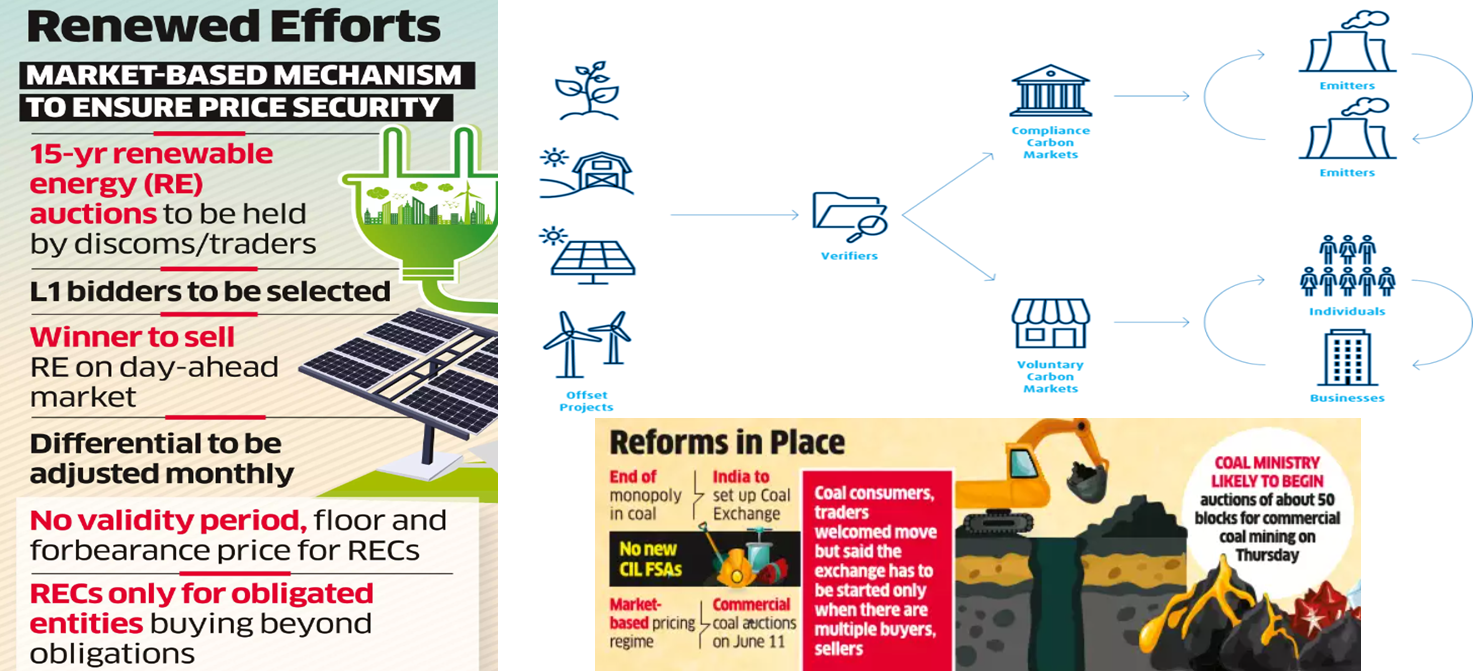

➢ Energy Conservation Act Amendment Bill 2022 has proposed to establish Carbon Market in the country. Bill has already been passed in Lok Sabha

➢ Draft Electricity Amendment Rules 2005 has proposed procurement of RE through Central Pool mechanism (leading to increased liquidity).

➢ Introduction of Electricity Derivatives: CERC and SEBI are also working towards introduction of Electricity Derivatives in the Commodity Exchanges viz. MCX etc.

Major Positive Regulatory Updates w.r.t Power Markets in FY22 –

➢ Late Payment Surcharge and Related Matters Rules 2022 – GenCos are free to sell un-requisitioned power through Power Exchanges, without obtaining any consent.

➢ GNA Regulations will streamline the network access & transmission charges being paid by the participants, so it is Beneficial for the Exchange.

➢ Draft – Sharing of Inter State Transmission Charges & Losses, will ensure avoidance of duplication of the transmission charges. This will lead to shifting of transactions from DAC to DAM/RTM.

➢ Green Energy Open Access Rules 2022 – will reduce OA threshold from 1 MW to 100 kW for green energy open access.

New Business Initiatives

IEX has been working pro-actively to commence other new market segments such as Ancillary Markets, Capacity Markets, Long Duration Contracts, Gross Bidding Contracts, etc. and remain optimistic about commencing these in this financial year 2023.

IEX is also exploring opportunity to launch India’s first Carbon Exchange.

Renewable through Markets – Merchant RE

➢ IEX has been working with SECI & Deloitte, to conduct feasibility study of Market based models for RE capacity addition. (https://economictimes.indiatimes.com/industry/renewables/mkt-based-model-in-the-works-for-renewable-energy/articleshow/83348704.cms)

➢ The study results shows that, market based RE models can command an IRR of 18%-20% V/s SECI bid projects having IRR ~ 12%- 14%.

Carbon Markets

➢ Govt. aggressively working to introduce compliance Carbon Market in India. IEX working closely with Govt. agencies like BEE, major Carbon Exchanges, and potential players in this space.

➢ IEX has appointed consultant to explore the business diversification opportunities in the Carbon Ecosystem.

Coal Exchange

➢ Ministry of Coal has appointed consultant for finalizing framework for coal exchange in India.

➢ IEX is working with MoC, to explore options for setting up Coal Exchange.

Future Opportunities –

Virtual PPA’s

➢ VPPA is a financial instrument used by buyers and sellers to hedge cost of electricity.

➢ The buyer is not obligated to undertake direct physical delivery of electricity from the seller.

➢ The seller sells the power generated at Exchange & undertakes realization from Exchange.

➢ Bilateral settlement takes place w.r.t. contract price and buyer gets green attribute.

➢ IEX is working with corporate houses and players like Amazon, Google etc. to implement such models.

P2P Trading

➢ P2P trading of electricity is emerging in different parts of the world due to increasing number of Prosumers.

➢ IEX through its MoU Partners ISGF & Power Ledger, Australia has been jointly exploring P2P opportunities.

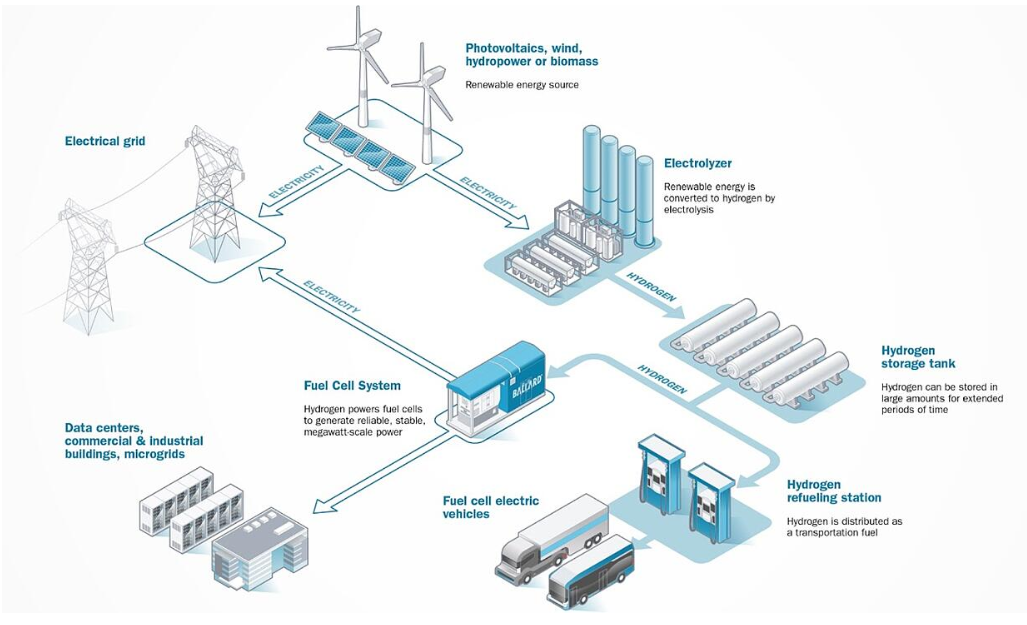

Green Hydrogen & Battery Energy Storage System

➢ Green markets of Exchanges (GDAM/GTAM) can be leveraged to procure RE power for green hydrogen production.

➢ Grid scale BESS are expected to play a crucial role in large scale RE integration (CEA: 27 GW by 2030).

➢ IEX working with SECI & MNRE to promote use of Market options for storage tenders – Recently SECI’s storage tender of 500 MW provides for 40% open capacity which can leverage Power Exchange’s market.

➢ Storage system will provide liquidity in the peak hours.

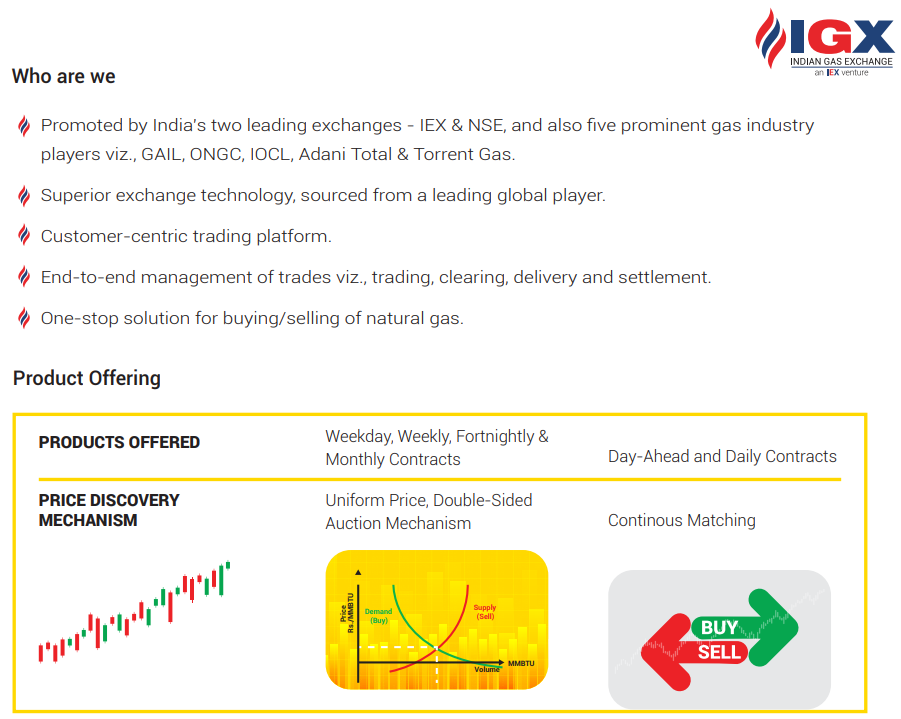

IEX launched the first gas exchange IGX in India, on June 20 and it is India’s first automated national-level trading platform for physical delivery of the natural gas.

The Exchange aims to:

1) – Promote and Sustain an efficient and robust gas market ecosystem.

2) – Create a neutral and transparent market place operating under the Petroleum and Natural Gas Regulatory Board.

3) – Feature multiple buyers and sellers for trading of natural gas in spot and forward contracts at designated physical delivery points

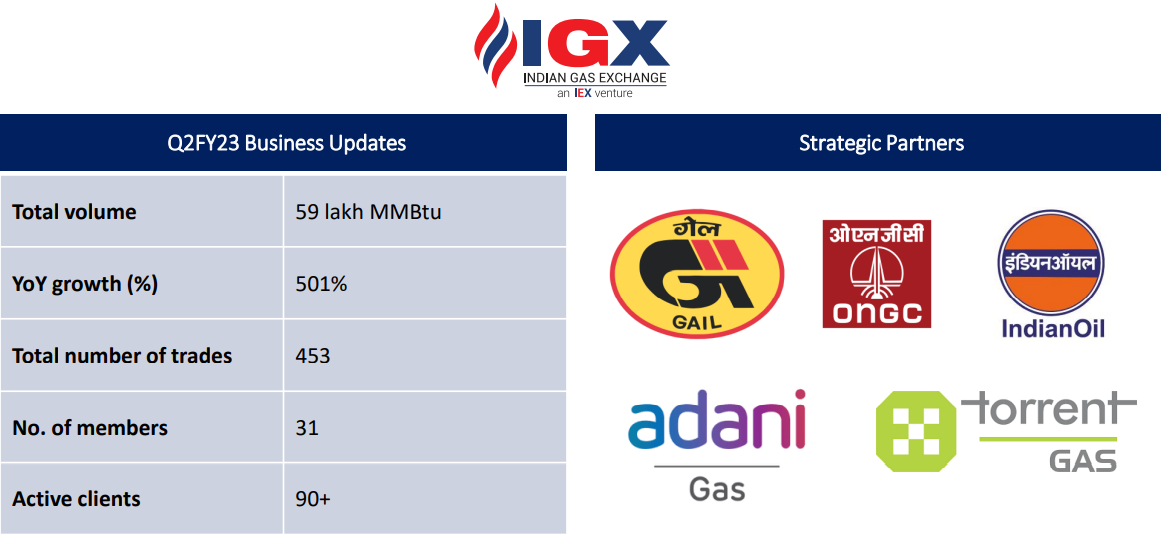

IGX Total Traded Volume for FY22 was at 1, 21, 51,150MMBtu ONLY, whereas it traded a record 1,14,53,200 MMBtu of gas volume in November 2022 alone.

This amounts to a massive YoY growth of 1,359% compared to 7.85 Lac MMBtu traded in November 2021 and a 179% MoM growth over October 2022. This was also the first time that IGX crossed 100 Lac MMBtu trade volumes in a single month, with the record single day trade of 46.8 Lac MMBtu. So, who are IGX anyway?

And What Value Proposition do IGX have to offer to the market participants?

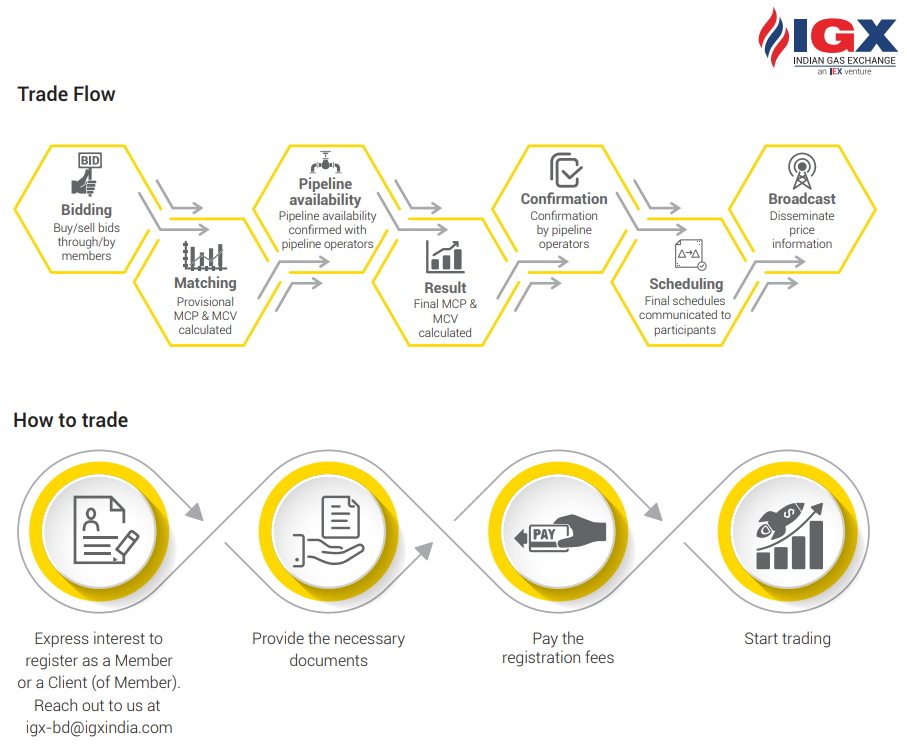

But How the Trade get executed on IGX Platform?

That’s OK, But how has been the Gas Price on IGX Platform compared to other Gas Price Benchmarks?

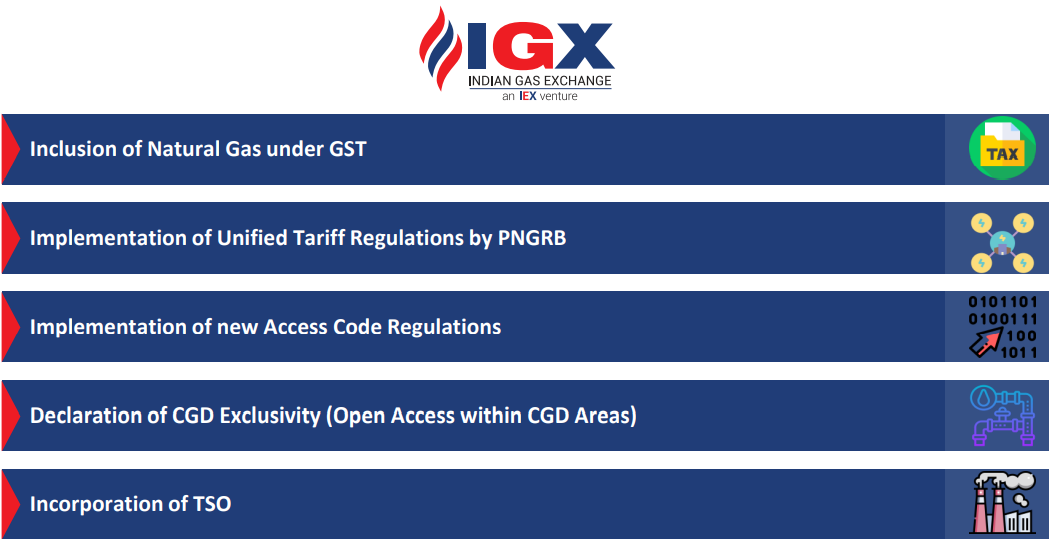

PNGRB has brought out amendments in the Natural Gas Tariff – Authorization and Capacity Regulations & accordingly, Unified Tariff Regulations will get implemented with effective from 1 April 2023.

IGX investors include NSE (26%), GAIL (5%), ONGC (5%), Torrent Gas (5%), Adani Total (5%), and to IOCL (5%) in FY22.

Opportunity for IGX –

Growth in Gas Demand will lead to opportunities for Gas Exchange & Other Stakeholders

➢ Government’s vision of increasing share of Natural Gas in total energy basket from ~6.3% to 15% by 2030, will increase gas consumption in the economy from current 160 MMSCMD to 500+ MMSCMD.

➢ with completion of 11th CGD bidding round > 90% population will be covered in next 6 years.

➢ LNG terminal capacity is expected to grow from current 42.5 MMTPA to around 72 MMTPA in 3 years.

➢ Transmission pipeline network is expected to grow from ~20,000 km to around 35,000 km by 2023.

➢ Presently out of 160 MMSCMD of gas consumption ~85 MMSCMD is imported through short term.

Hence, Development of robust infrastructure along with ramp up in gas demand shall enable short term trading of gas in India.

Key Gas Market Enablers are:

For CDSL –

Given that the CDSL is an Infrastructure provider company for the multiple industries and that the revenues from its Subsidiaries Business is also growing consistently, there are Multiple Optionalities available for it to Grow due to:

1) – Pledging Platform: Shares will be formally pledged with the likes of CDSL and NSDL. These players charge small fees.

2) – Commodity Repository.

3) – Dematerialisation of shares of unlisted companies (e.g. ~ 80k to 85k companies yet to be De-materialised their Unlisted shares, whereas CDSL has De-materialised ONLY ~ 1650 companies share in FY21) as well as of Insurance Policies.

4) – Single Demat account.

5) – National Academic Depository Digitization of Academic Certificates.

Due to its Leadership (in a duopoly) in terms of the number of demat accounts (CDSL’s market share stood at ~ 72% as of Sep’22), Growth Optionalities for its digital platforms (e.g. Demat, Insurance Policy and Repository, KYC etc.), Steady Non-Market Linked Revenues (e.g. Annuity Issuer Charges), and Good Mix in terms of Market Linked and Non-Market Linked Revenues (which stood at 53% and 47% respectively in H1FY23), CDSL enjoys relatively Higher Valuations.

CDSL has registered two years of solid growth (>50% YoY), which may get moderate ~ 12% CAGR over (FY22- 25E) due to the high base effect and slowdown in the market-linked revenue (which is ~ 51% in Q2FY23 ). However, the regulatory requirement for compulsory Demat of insurance policies (effective Dec-22 for new policies) provides immense revenue opportunity.

IEX and CDSL Financial Strength – “The Past, Present, & the Future”

Q2FY23 Results: Quiet quarter due to unfavorable macros

1) – Revenue for the quarter came in at Rs. 95.2 crore, down 13.8% YoY. IEX’s total volume for Q2FY23 was at 23,117 MUs vs 25,856 MUs in same quarter last year and 23439 MUs in Q1FY23, hence there is a De-growth of 10.5% YoY and 1.3% QoQ. Declining volumes were due to CERC imposing a capping of Rs. 12 on all the segments of power exchanges.

2) – IEX registered an EBIDTA margin of 82.9% vs 82.4% QoQ, due to higher other expenses.

3) – Tracking its operating performance, IEX ended the quarter with a PAT of Rs. 71.2 crore vs Rs. 69.1 crore in Q1FY23, that too including the impact of other income of Rs. 18.6 crore in Q2FY23.

4) – During the quarter, electricity volumes on the exchange De-grew 10.5% YoY with 23.1 BU volumes traded vs 25.8 BU in Q1FY22. The volume comprised 19.7 BU in the conventional power market, 1.5 BU in the green market segment. On the REC front, total 19.14 lakh certificate were traded.

5) – On June 27, 2022, IEX successfully launched the much-awaited longer duration contracts up to 90 days on the exchange, but has failed to garner volumes due to high coal prices, which are forcing sellers to avoid long term contracts.

6) – Improvement in coal production and higher inventory is expected to result in increase of sale by both DISCOMs and Independent Power Producers (IPPs). IPPs sale will provide round the clock supply resulting in better availability & lower prices in peak hours.

7) – The government is aggressively working on introducing Compliance Carbon Market in India and IEX is working closely with government agencies like BEE, major carbon exchanges, potential players in this space.

8) – Temporary shift in the Volume is seen from DAM to DAC segment – due to firm tie-up, due to uncertainty of availability during peak hours, and double charging of transmission charges in collective transactions; but volumes are likely to shift to DAM/RTM with the improvement in supply & implementation of sharing regulation.

9) – Various government policy advocacy to enhance liquidity in the spot market. GNA regulation, sharing regulations, grid code, late payment surcharge rules and sale of non-requisitioned power on the exchanges will help deepen the power markets.

10) – Electricity consumption grew 3.8% in the last five years and is expected to further increase by 6% in the next 8 years. An increase in demand will lead to an increase in volumes on the exchange IGX.

11) – Total number of participants at the gas exchange has increased to 31 with the addition of four new members: OPAL, HPCL, SHELL and GSPC.

12) – The government’s vision of increasing share of natural gas in total energy basket from ~ 6.3% to 15% by 2030, will increase gas consumption in the economy from current 160 MMSCMD to 500+ MMSCMD.

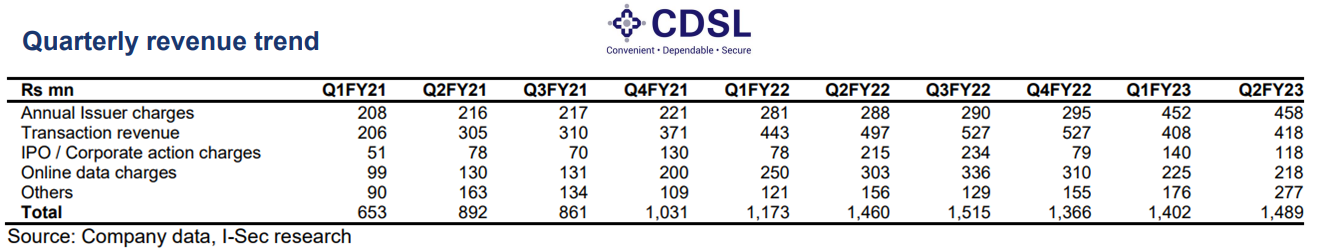

If we again look at the last 3 years Quarterly nos. then we may notice:

Transaction revenues remained steady in Q2FY23 in line with capital market activity – Revenue grew 6% QoQ driven by:

a) – 1.3% growth in annual issuer charges;

b) – 2% growth in transaction charges; and

c) – 57% growth in other revenues (e-CAS, e-Voting, etc.)

IPO corporate action charges declined 15.7% QoQ, Online data charges fell 3% due to lower KYC record creations and fetches. Overall flattish revenues are expected in FY23E and thereafter, ~ 20% growth in FY24E is expected. Hence growth likely to be ~ 9% for FY(2022-24).

These revenue estimates may also get increases, if there are any price revisions in the annual issuer charges or due to increased revenues from other growth Optionalities (like Insurance Repository, GIFT City etc.). Further, single-digit revenue CAGR for market-linked revenues is also expected.

Other highlights of Q2FY23: Pledge income in Q2FY23 was Rs. 35mn, whereas e-Voting / e-CAS income stood at Rs.140mn / Rs. 50mn respectively. Management indicated that currently no formal talks are going on to increase issuer charges.

Costs are likely to remain high due to Investment in Technology and Personnel – In H1FY23 total cost was Rs1.2bn vs Rs1.8bn in FY22, after factor-in operating costs of Rs. 2.3bn / Rs. 2.4bn for FY23E / FY24E. Accordingly, EBITDA margins of 57.3%/63.5% are expected in FY23/24. It is expected that during FY22-FY24E – revenue / EBITDA / PAT may grow at a CAGRs of 9% / 6.6% / 7.2% resp.; this takes into account a dip in FY23E revenue, due to lower transaction income. (Source: https://trendlyne.com/posts/3808279/h1-performance-increasing-demat-count-underlines-steady-earnings-potential-despite-market-volatility)