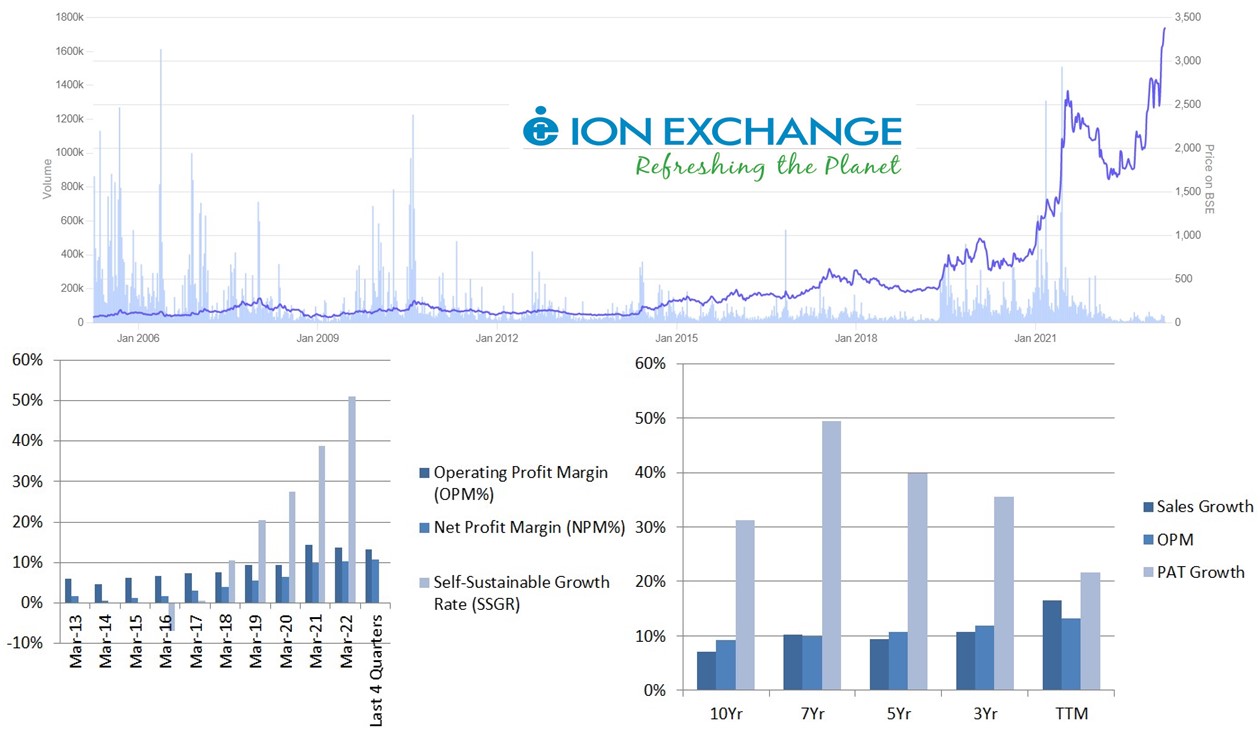

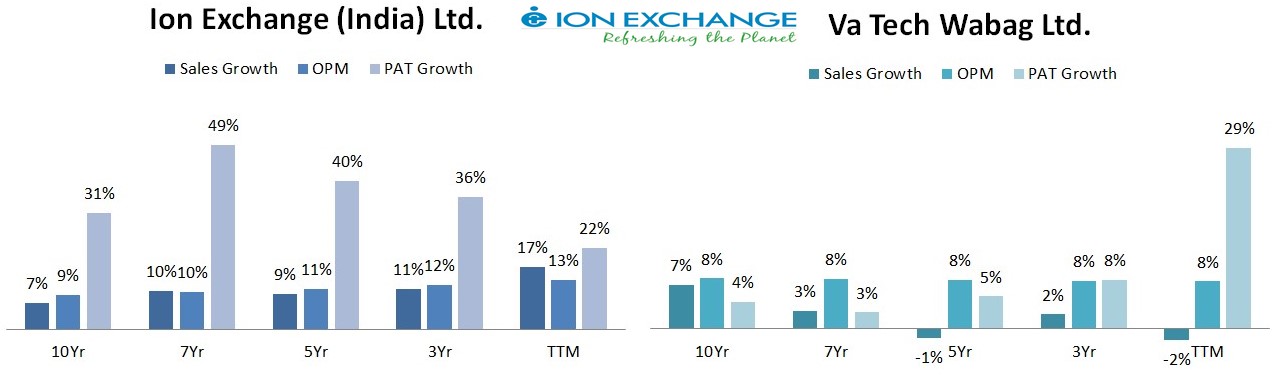

Between April 2005 to March 2014, Ion Exchange Share Price has Increased ONLY ~ 50% in 9 Years. Thereafter from April 2014 to 1st March 2023, Share Price has Jumped ~ 3600% i.e. 36x in < 9 Years. So, what’s the reason behind this Eye-Popping Multibagger Return, during the later 9 years?

Consistently Improved OPM from 5% in March 2014 to ~ 14% in TTM along with Consistent Improvement in NPM from 1% in March 2014 to 11% in TTM, In addition to Higher (~ 71%) Conversion of CFO to FCF, due to which not only the company’s Self Sustainability Growth has Improved Consistently from -7% in March 2016 to 51% in March 2022, but also it’s PAT has Grown at ~ 49% CAGR in last 7 Years!

The Phenomenal Growth Story Of Rs. 5000 Crore Market Cap Company – Ion Exchange India Ltd.

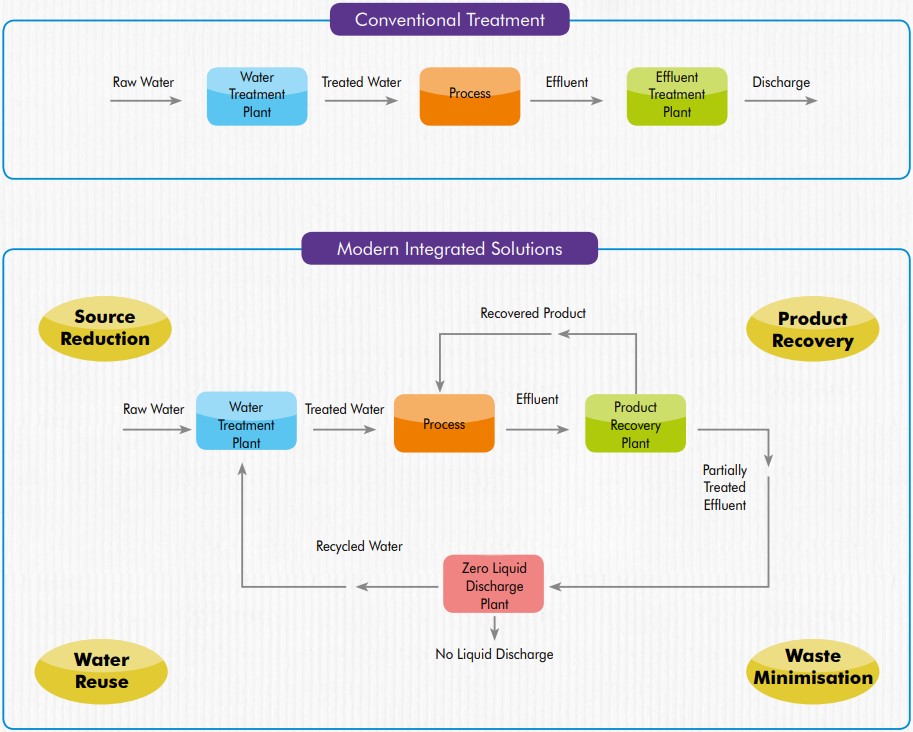

Ion Exchange offers a Wide Range of Solutions across the Water Cycle, from Pre-Treatment to Process Water Treatment, Waste Water Treatment; Recycle Zero Liquid Discharge, Sewage Treatment, Packaged Drinking Water, Sea Water Desalination, etc.

The company is also engaged in Manufacturing of Resins, Speciality Chemicals for Water and Waste Water Treatment, as well as in Non-Water Applications. The company’s Water and Environment Management Solutions Extends Beyond the Industrial Sector to Homes, Hotels, Spas, Educational Institutions, Hospitals, Laboratories, Realty Sector and Defence Establishments, for providing Safe Drinking Water and a Clean Environment.

Water is not only a Scarce and Precious Resource but is also an Essential component of Sustainability for almost Every Industry. Either as a Significant component of the Manufacturing Process, Or as a Critical Part of the Utility Application, Water needs to be Managed Effectively across the Value Chain for its Use in the Industrial Processes.

It is estimated that by 2030, Global Water Requirement will Exceeds Supplies by 40%. Moreover, the World Bank has indicated that India’s GDP Growth can be Affected Every year, Unless it Implements Effective Water Management Strategies.

Rapid Industrialization, Growing Population Coupled with Urbanization and Stricter Enforcement of the Environmental Regulations to Decrease Pollution and Conserve Diminishing Fresh Water Reserves, will lead to an Increase in Demand for Waste Water Treatment and Recycle Plants, across all the Sectors – Industries, Institutions, Homes and the Communities.

There is Growing Awareness among Corporates about the Importance and Benefits to Integrate Water Sustainability into their Strategy and Provide proper resources for Waste Water Treatment, Recycle and Zero Liquid Discharge. Globally, customers are increasingly showing preference for Integrated Water and Environment Management Solutions.

Export of Engineering Products, Customized EPC projects, Resins, Water Treatment Chemicals, Membranes and Service are Important Revenue Generators for the companies like Ion Exchange Ltd. Further, the race towards Carbon Neutrality, Net Zero Goals and Commitment of Nations to COP26 Emission goals, will Accelerate the Demand for Innovative, Efficient, and Green Technologies built on the backbone of Carbon Neutral Water Energy Nexus.

All this is likely to Drive the Demand for Innovative Water Treatment Technologies, Proven EPC plus O & M Capabilities of companies.

Thus, the Indian Water & Environment Industry is Projected to register a healthy Growth of ~ 8.5% CAGR during the Projected Period 2022 to 2026.

Therefore, Ion Exchange being a Pioneer in providing Advanced Water and Waste Treatment Technologies with Modern Integrated Water Management Processes, is Riding this Tailwind to continue on its High Growth Journey.

Ion Exchange – Leveraging More Than 5 Decades Of Experience, To Provide End-To-End Value Added Products & Solutions.

With 7 Manufacturing & Assembly Facilities across India, 2 In-House R & D Facilities, 2 Applications & Testing Centers, 36+ Sales & Service Centers, and 100+ Channel Partners – Company broadly operates into 3 Segments:

1) – Engineering – Here company provides Comprehensive and Integrated Services and Solutions in Water & Waste Water Treatment, including Sea Water Desalination, Recycle and Zero Liquid Discharge Plants to Diverse Industries.

2) – Chemicals – This segment provides a Comprehensive range of Resins, Speciality Chemicals and Customized Chemical Treatment Programmes for Water, Non-water and Specialty applications.

3)- Consumer Products – This segment caters to Individuals, Hotels, Spas, Educational Institutions, Hospitals, Laboratories, Railway and Defence Establishments, for providing Safe Drinking Water and a Clean Environment.

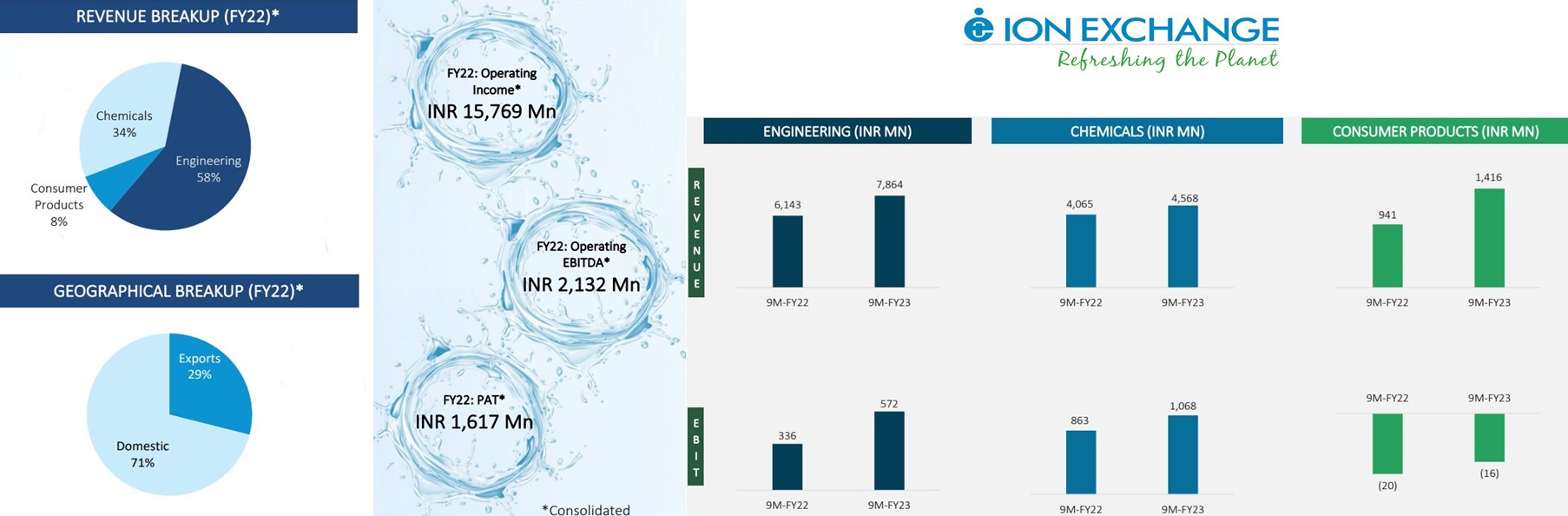

With ~ 58% Revenue Contribution in FY22 and 56% in 9MFY23, Engineering Segment stands out as the major revenue source followed by the Chemicals at ~ 34%, and finally Consumer Products ~ 8% in FY22. Company earns ~ 71% of this Revenue from the Domestic market and 29% from the Exports.

Ion Exchange – Strengths And Competitive Advantage

Company’s Customer Base is also Spread Over various industries like Oil & Gas, Steel, Auto, Capital Goods, Food and Beverages, Paper, Pharma, Chemicals and Cement. Hence this Diverse End – User Industry Base Protects the company from any Downturn in any of the Industry.

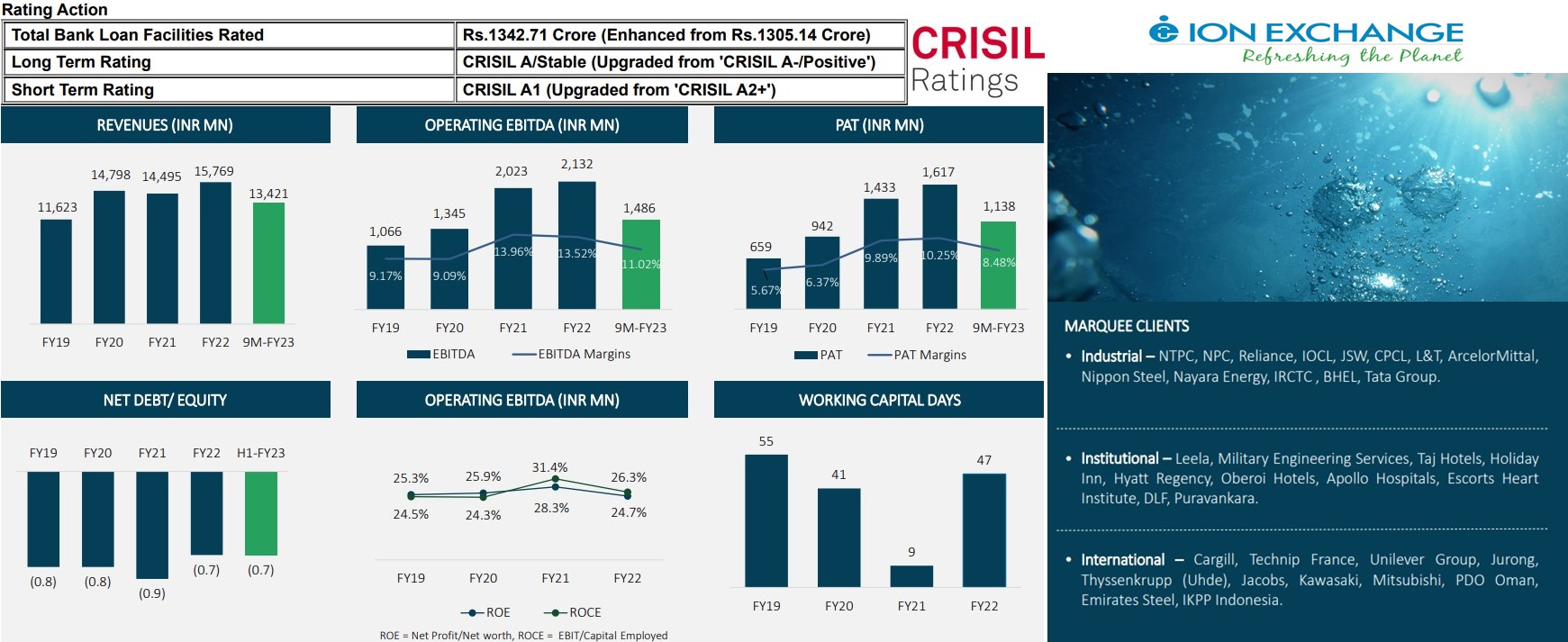

Sustained improvement in the Financial Risk Profile is evident in the Net Cash Accrual to adjusted Debt ratio of over 4 times in fiscal 2022 (which was 3.27 times in fiscal 2021) and the Stable Working Capital Cycle.

The Total Outside Liabilities to Net Worth (TOL/TNW) ratio came down to < 1.5 times as on March 31, 2022, from 2.86 times as on March 31, 2020, and should remain below 1.5 times in the medium term.

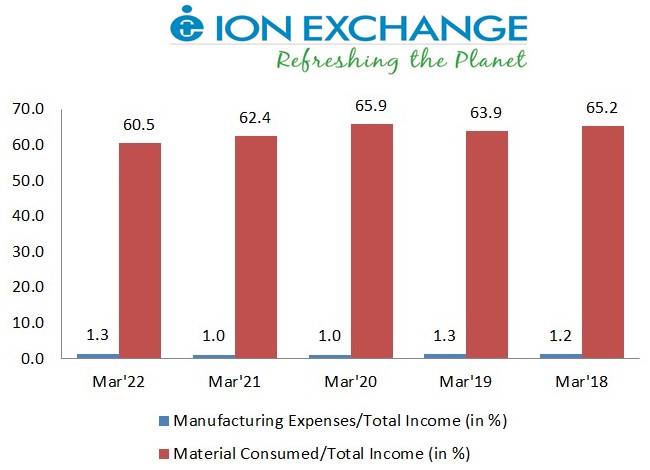

Due to Automated In-House Integrated Manufacturing Facilities with Backward Integration capability, company’s Manufacturing Expenses are Just ~ 1% to 1.3% of Total Income and it’s majorly the Raw Material Cost, which becomes the deciding factor for the Operating Profit Margins (OPM).

Despite Projected Capital Expenditure of over Rs 250 crore over fiscals 2023 to 2025, Debt may remain below Rs 100 crore, aided by Strong Cash Accrual. Liquidity is Adequately Strong – with Healthy Cash Accrual, Minimal Debt and Expected Improvement in the Working Capital Cycle.

Therefore, due to Established Brand of the Ion Exchange in Water Treatment Segment, it’s Diverse Product Mix, and Company’s Comfortable Financial Risk profile, CRISIL has Upgraded its ratings on the Bank Facilities to ‘CRISIL A/Stable/CRISIL A1’ from ‘CRISIL A-/Positive/CRISIL A2+’ – (Source: https://www.crisil.com/mnt/winshare/Ratings/RatingList/RatingDocs/IONExchangeIndiaLimited_July%2007,%202022_RR_294115.html)

Ion Exchange – Core Competencies Across The Business Segments

The Volume of water consumed at an Oil Well Site could Exceed the Volume of Oil or Gas produced by that Well. Cracking, Light Coking and Heavy Coking Consume ~ 0.34, 0.44, and 0.47 Barrels of Water per Barrel of Crude oil, respectively. Also, Gasoline Production consumes a huge amount of water at ~ 0.60 to 0.71 gallons of Water per gallon of Gasoline.

The Oil & Gas Industry also produces a Large amount of Complex Waste Water, which need to be Reduced for Re-use or Disposal.

Similarly, take the case of Pharma Industry which requires Customized Solutions for High Purity Water Treatment & Distribution along with Bulk Drug Purification, to Comply with say Stringent US FDA Regulations, Or The Pulp & Paper Industry which although generates ~ 14% of the Total Industrial Waste Water, but are mostly located in the areas that are already hit by the Water Scarcity Problem. Hence, the paper mill has to face the the challenge of Increasing the Production with Reduced quantities of Water available.

Even for a Automobile-Component Manufacturer, Whose Metal-Working facilities generates Large amounts of Oily Waste Water, it’s getting difficult to deal with the Water Scarcity Problem and Stricter Disposal Regulations at the same time. Therefore, they are not only moving away from the Physico-Chemical Treatment Process (which increases TDS level in the Effluent, making it difficult to treat), but are also looking for the Waste Water Re-use options.

Catering to the Needs and Demands from Diverse Industries, Ion Exchange offers a Value Proposition through its Cost-Effective Advanced End-To-End Integrated Services & Solutions in Water and Waste Water Treatment, so as to ensure Sustainable Water Source Reduction, Product Recovery, Waste Minimisation, and Water Re-use across the entire Water Lifecycle of the Manufacturing Processes, in the Industries served. Besides, this also Helps these Industries to:

1) – Adhere to the Pollution Control Regulations and contribute to a Cleaner Environment through Zero Effluent Discharge;

2) – Reduces the Operating Cost by Reusing the Treated water in the manufacturing process;

3) – Recover Valuable By-products, while Treating/Removing Complex Contaminants in the Process Stream. Hence Increasing the Process Efficiency, Reducing the Depreciation and Maintenance Cost, Improving the Performance across the Industry Value-Chain, and thereby Improving the Profitability, while meeting the Sustainability Objectives.

Ion Exchange – Few Examples From The Long Successful Journey

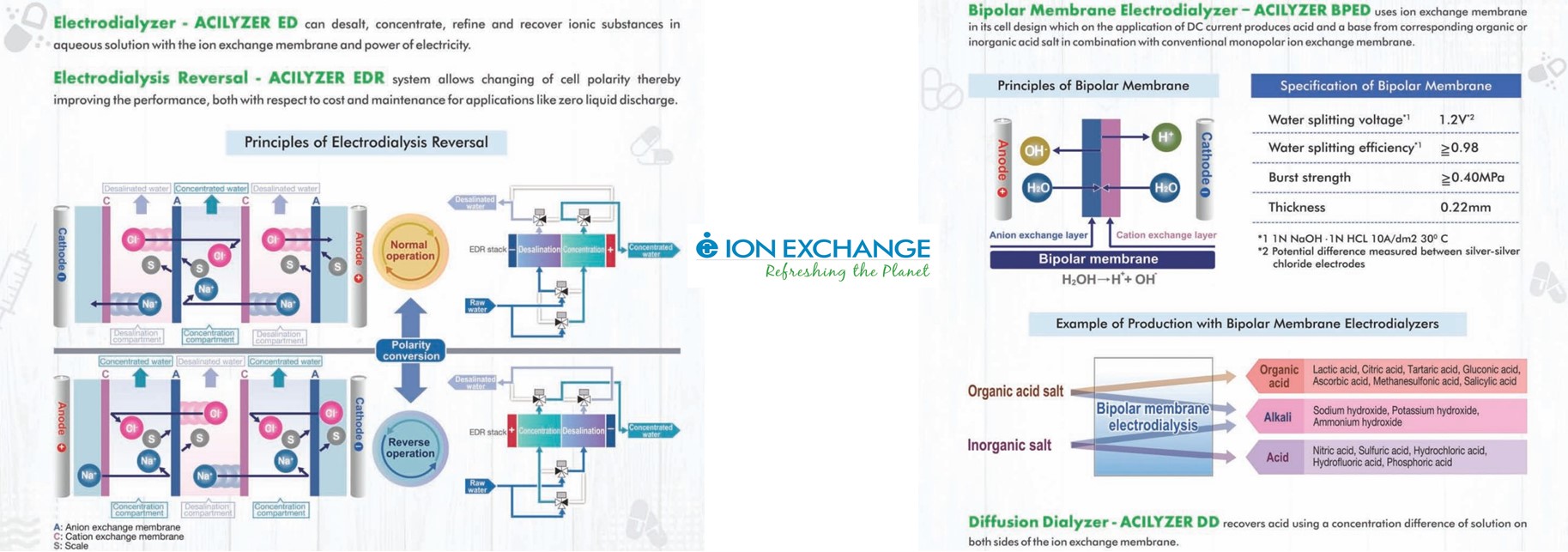

Like Ion Exchange Resins, Ion Exchange Membranes are Selectively Permeable to ions but are incorporated into Electrodialyzers, which are made up of Cathode & Anode for various Separation and Purification applications. These Ion Exchange Membranes in an Electrodialysis Process, do not require Regeneration and allow continuous service for an extended period of time.

Applications:

1) – Electrodialysis – Desalination of APIs, Bulk Drugs Intermediates, Amino Acids, Organic Acids and Carbohydrate solution.

2) – Bipolar Membrane Electrodialyzers – Production of Organic Acid from Organic Acid Salt and Acid/Alkali from Inorganic Salt.

3) – Electrodialysis Reversal – For De-salination and Zero Liquid Discharge.

Advances in Membrane Technologies like Ultra Filtration/Microfiltration, followed by Reverse Osmosis and Low Pressure Brine Concentrators, ensured TDS Reduction as per the Pollution Control Boards and simultaneously 90-95% water is also recovered in the Membrane Process itself.

Thus, use of Membrane Technologies ensures Source Reduction of Raw Water Consumption; Product Recovery (fibres, chemicals, emulsion, etc.), Reduced Effluent Quantity and Quality through Recycle and Re-use of Treated Paper effluents.

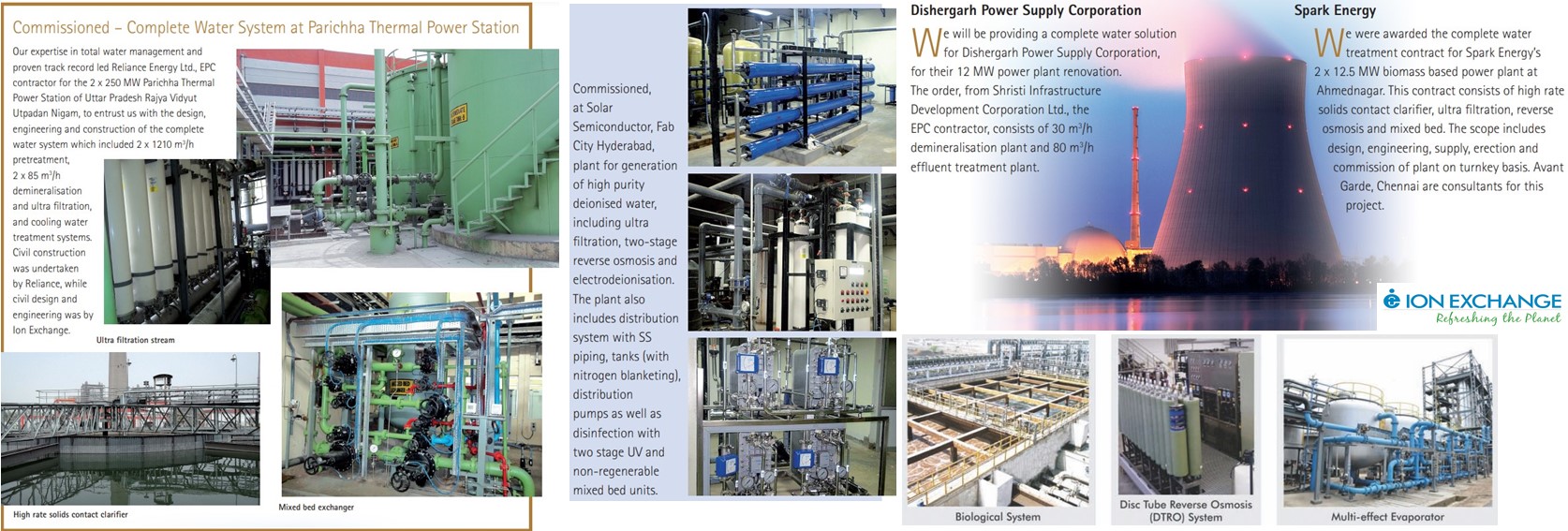

Water Treatment Plant (WTP) consisting of Ultra Filtration (UF), Two Stages Reverse Osmosis (RO) & Demineralization Plant (DM), Indirect Cooling Water (ICW) System along with Reinforced Cement Concrete (RCC) Cooling Towers, Industrial Water Filtration System, Side Stream Filtration System, DM Water Storage Tank, Cooling Water Blow Down Recycle plant based on UF & RO Systems, Water Conditioning/Chemical Dosing System (CDS) for the ICW circuit – are some of the Integrated Services and Solution which Ion Exchange Ltd. is offering to Capital Goods and Heavy Industries Like NTPC, Reliance Industries, SAIL, Spark Energy’s etc. to Reduce their Consumption of Water, Minimizing Waste Water & Recycling Water for Re-use in the Operations.

Ion Exchange – Growth Drivers In FY24 and Beyond

Ion Exchange has a Strong Visibility for the next 2 to 3 years in the Engineering Segment, given that the company’s Total Order Book is ~ Rs. 3650 Crores as on 31st December 2022 and is also having a bid pipeline of Rs. 8405 Crores.

Given that Ion Exchange receives ~ 10% of the Total Contract Value of an EPC project as an Advance, so the Working Capital Days & hence the Cash Cycle will also likely to remain Negative, assuming that the Engineering Order Book will keep on Increasing or at-least Sustains at the current levels.

Chemical Segment on the other hand, has witnessed Improved Margins aided by the Stability in the Input Cost during Q3FY23. If the Supply Chain remains Uninterrupted then, the Management expects EBIT Margins for the segment to remain ~ 24% or Higher, for the whole FY23, due to Improved Operational Efficiencies, Better Product Mix and Improvements in Controlling the other Cost on various fronts.

To Increase capacity, especially in Resin Division, Ion Exchange has been doing Moderate CapEx over the years. Further, there are plans to set up an additional Resin manufacturing facility, as a Greenfield Project.

In the Chemical Segment, Ion Exchange is not only continuously Upgrading its Product Mix towards More Value Addition, but is also in a process of Modular Expansion of Capacities for Specific Product Lines. Hence the management expect that from the current levels, company will be able to deliver almost ~ 50% of a growth, based on the current capacities.

The engineering segment typically has a higher COGS Structure compared to the Chemical segment – where the Cost Structure is more towards the Operation and other Expenses, So as the share of the Engineering Segment has increased to ~ 61% in Q3FY23 compared to ~ 56% last year, therefore the Gross Margins has come down accordingly during the quarter gone by.

In the Consumer Products segment, as the Ion Exchange is Investing More Capital to improve the Top Line Growth, therefore the EBIT Margin in this segment has seen the Decline of ~ 250 basis points. Here the company uses multiple Channels for Distribution, which includes Direct sales channel, Distributors, Online sales and also the Retail Chains, to Augment the sales in this segment.

Historically company’s Q4 throws relatively better Growth number, owing to much Higher level of Execution during this quarter. So going forward, better results in Q4FY23 are also expected.

Ion Exchange continues to Invest in people, in Systems and in Other Resources to ensure that the company is Geared Up to take on the Upcoming Opportunities in Green Technologies, due to various Initiatives taken by the Govt. like Atal Mission for Rejuvenation and Urban Transformation, National Mission for Clean Ganga, Jal Jeevan Mission and Community Drinking Water Schemes, which will help to contribute in the Growth of the Indian Water and Wastewater Treatment Industry – To know more about PLI Scheme, read:

(https://jyadareturn.com/supreme/ and https://jyadareturn.com/astral/)

Given the Structured Long Term Growth in the Infrastructure and Capital Goods Sector, after a Long Stagnant Period of over a Decade, an Upswing in the Earnings Growth has become Loud & Visible in these sectors.

Therefore, all these factors will Drive the Growth of company like Ion Exchange (India) Ltd. in FY24 & Beyond, given a Little Competition for the Company in the Water & Wastewater Treatment Industry!