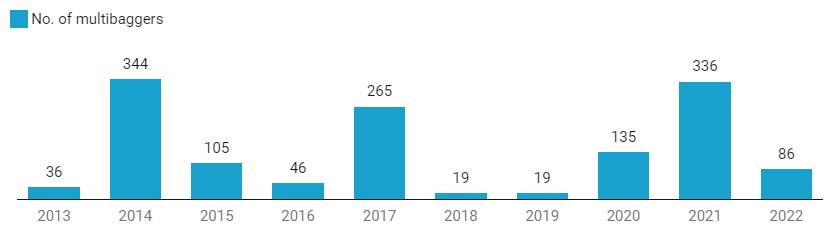

Who doesn’t get fancied by the ‘Next Multibagger’ Idea in the Stock Market! Luckily we had many in last 3 years, as there were 135 such Mutlibagger Stocks in the year 2020, 336 in 2021, and then 86 in 2022, which had a Market Cap of over Rs. 500 Crore then and has at-least Doubled the investor wealth in that particular year.

Diving Deep into the ocean of numbers, one can easily also find that there were at-least 7 such Multibagger Stocks which have given more than 2x returns for 3 years in a row! (source: https://economictimes.indiatimes.com/markets/stocks/news/multibagger-alert-these-7-stocks-surged-over-100-for-last-3-years-in-a-row/wealth-churners/slideshow/95932468.cms).

Further, i also looked for the stocks which otherwise has also given ~ 8x returns during the same period and later, i screen out rest to finally left with following 4 Stocks which i was interested in to apply my rules*, meant for selecting the Stock for Long-Term Investment (*Read: https://jyadareturn.com/7-key-parameters-you-should-look-for/):

1) – Aditya Vision Ltd (AVL);

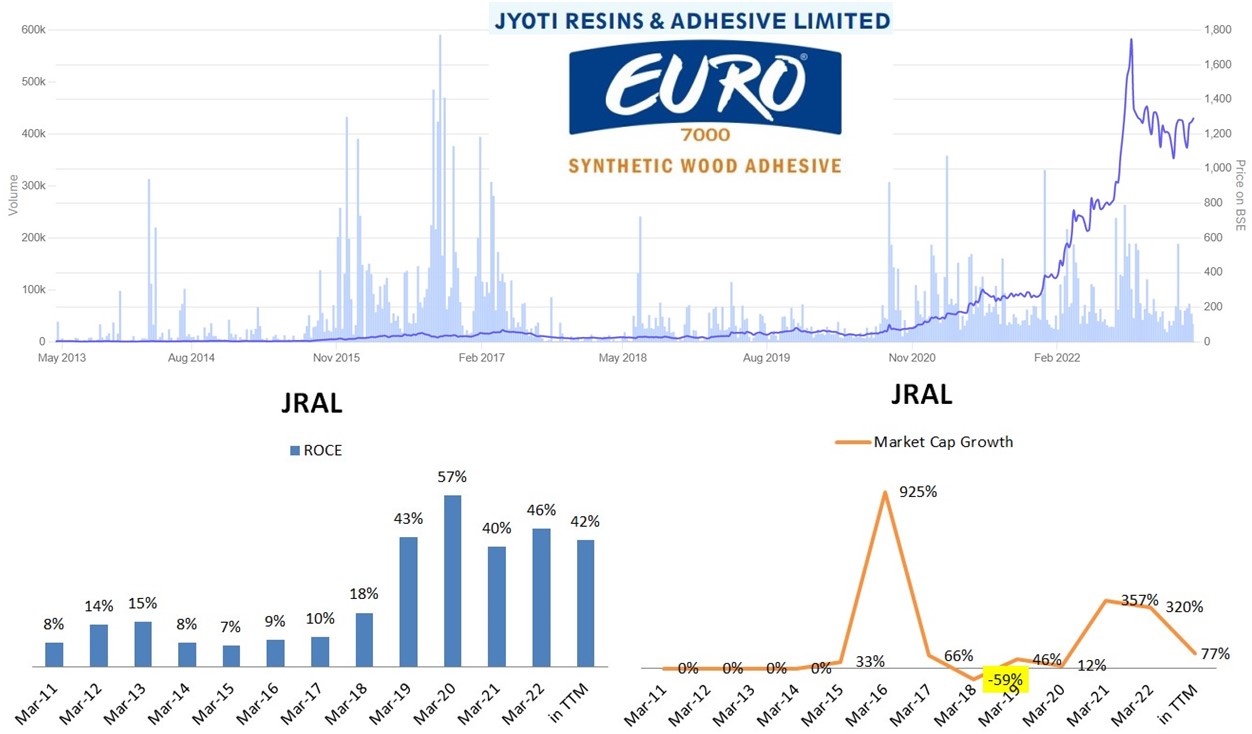

2) – Jyoti Resins and Adhesives Ltd (JRAL);

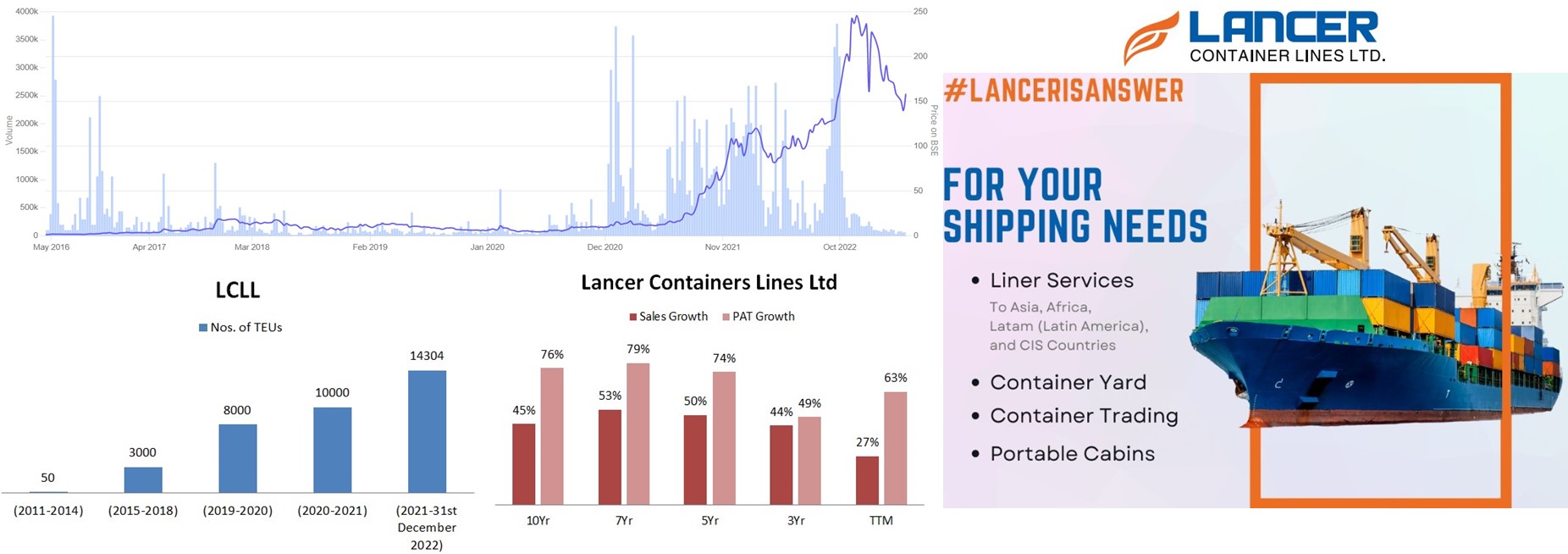

3) – Lancer Containers Lines Ltd (LCLL); &

4) – Hindustan Foods Ltd (HFL)

Do These 4 Multibagger Stocks Have A Business Moat And Competitive Advantage, To Sustain This High Growth Momentum in 2023 Also?

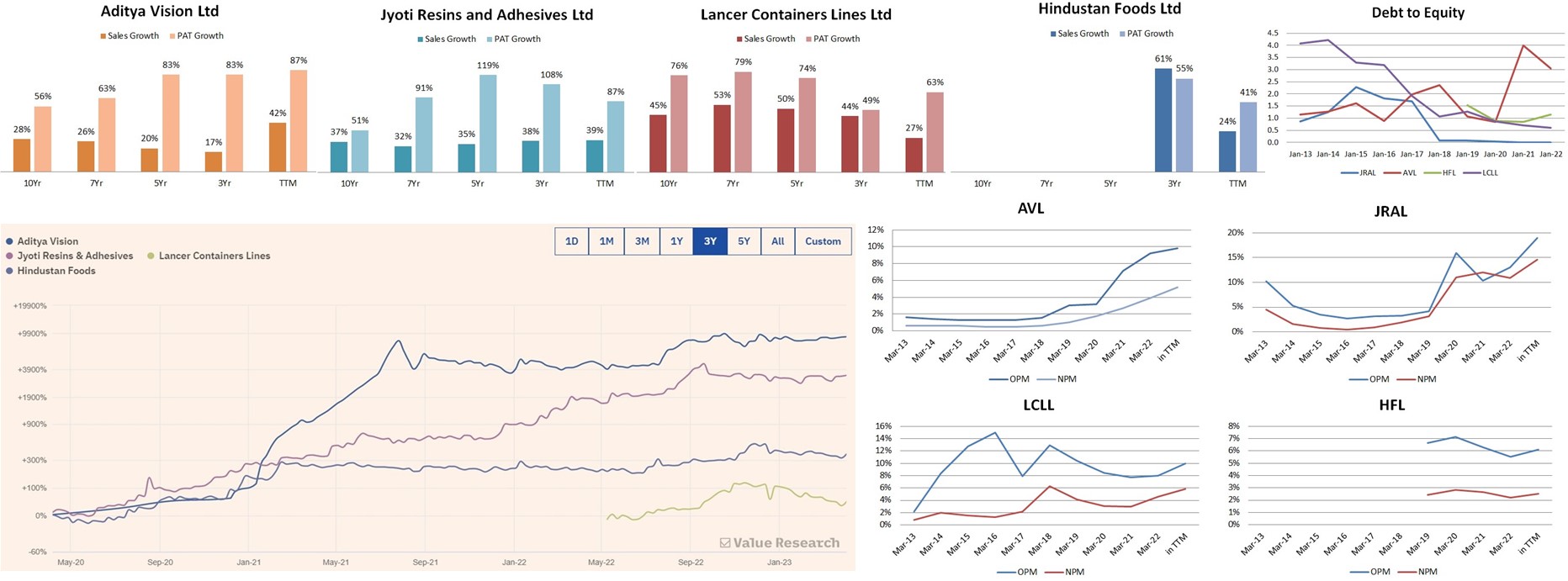

Barring Hindustan Foods Ltd (HFL), all the other 3 companies have a Market Cap of < Rs. 2500 Crore, as on date. Hence, Annual Sales in TTM of HFL is ~ Rs. 2520 Crore followed by AVL at ~ Rs.1276 Crore, LCLL at ~ Rs. 755 Crore, and JRAL at ~ Rs. 254 Crore.

| (In Crore) | AVL | JRAL | LCLL | HFL |

| Market Cap (as on 7th April 2023) | 1982 | 1553 | 974 | 6365 |

| Sales (in TTM) | 1276 | 254 | 755 | 2520 |

| PAT (in TTM) | 66 | 37 | 44 | 63 |

| Market Cap to Sales | 1.6 | 6.1 | 1.3 | 2.5 |

| Market Cap to PAT | 30 | 42 | 22 | 101 |

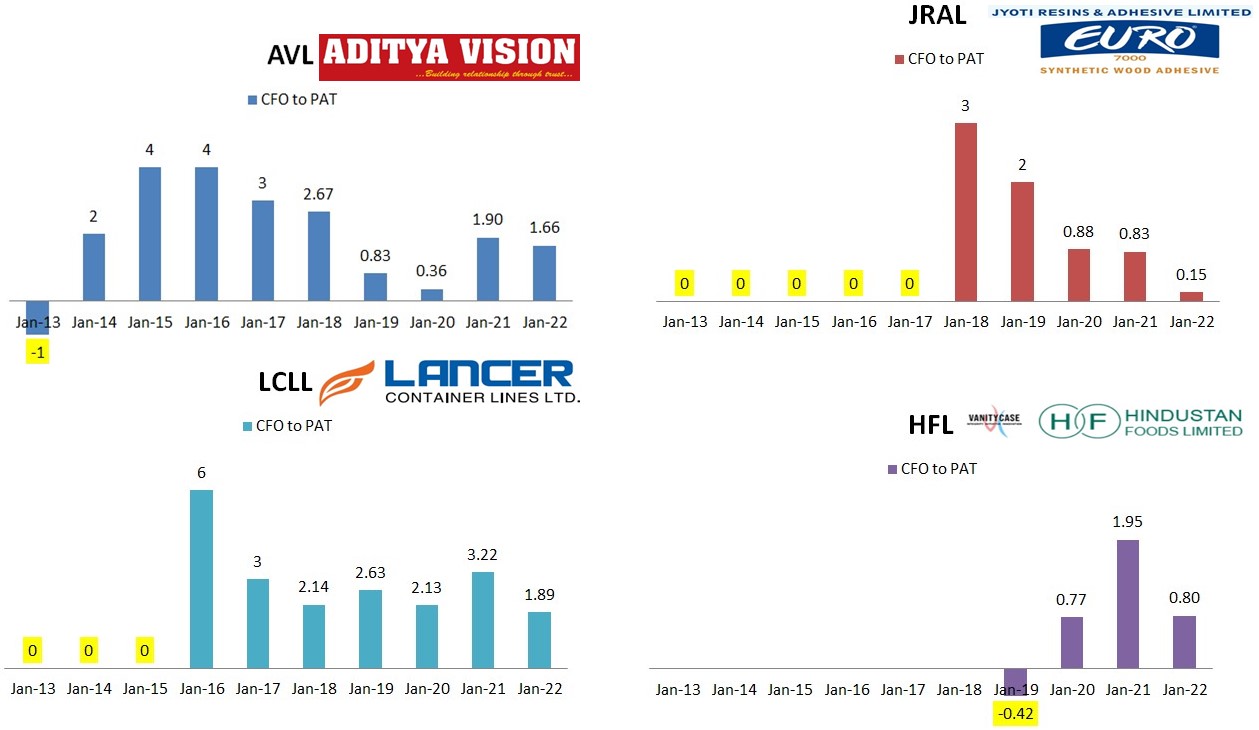

In proportion to a given Market Cap, LCLL have been able to generate Relatively Higher Revenue and PAT compared to rest of the other 3 companies. Even PAT conversion to CFO has been the relatively Better for LCLL, whereas JRAL has mostly Performed Poorly on this metric!

JRALs CFO remained lower Since 2020, mainly due to:

1) – Profit on Sale of Investment;

2) – Interest Income;

3) – Increase in Trade Receivables;

4) – Increase in other Current and Non-Current Financial Assets;

5) – Increase in Inventories;

6) – Decrease in Trade Payables;

7) – Decrease in other Financial Liabilities; &

8) – Decrease in Provisions

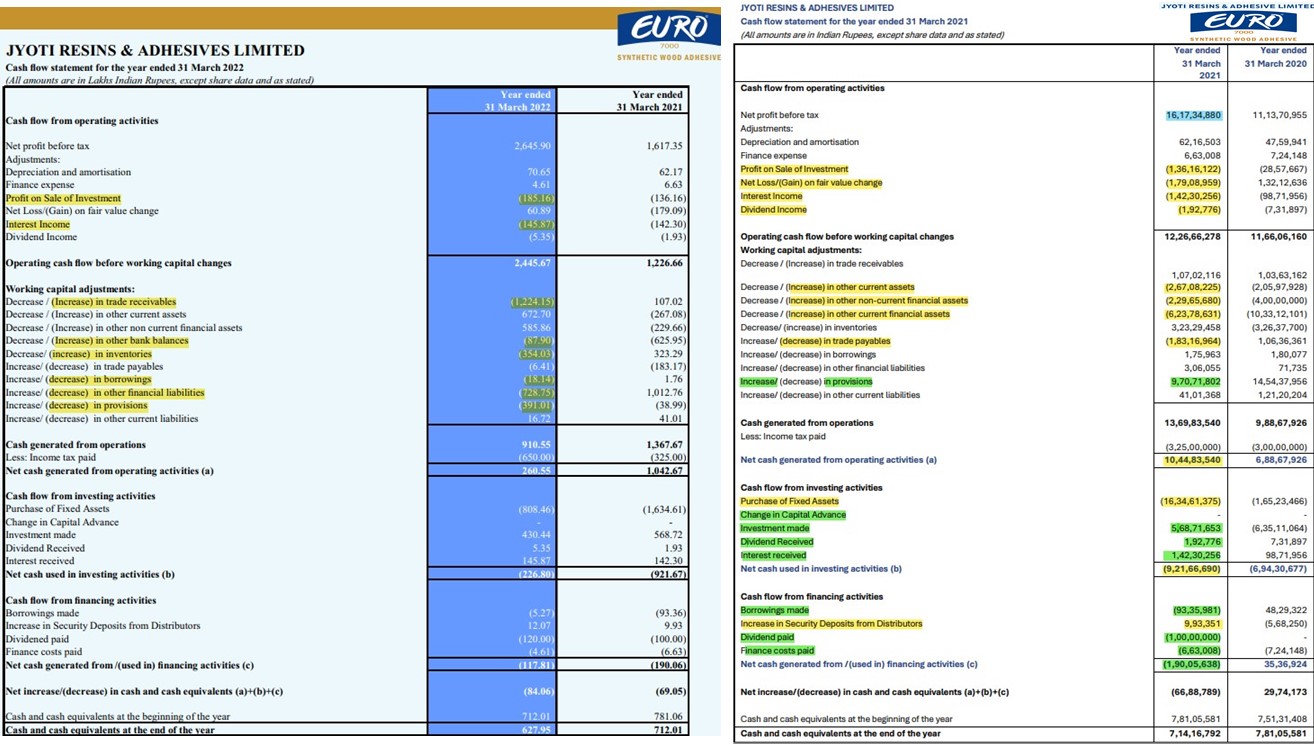

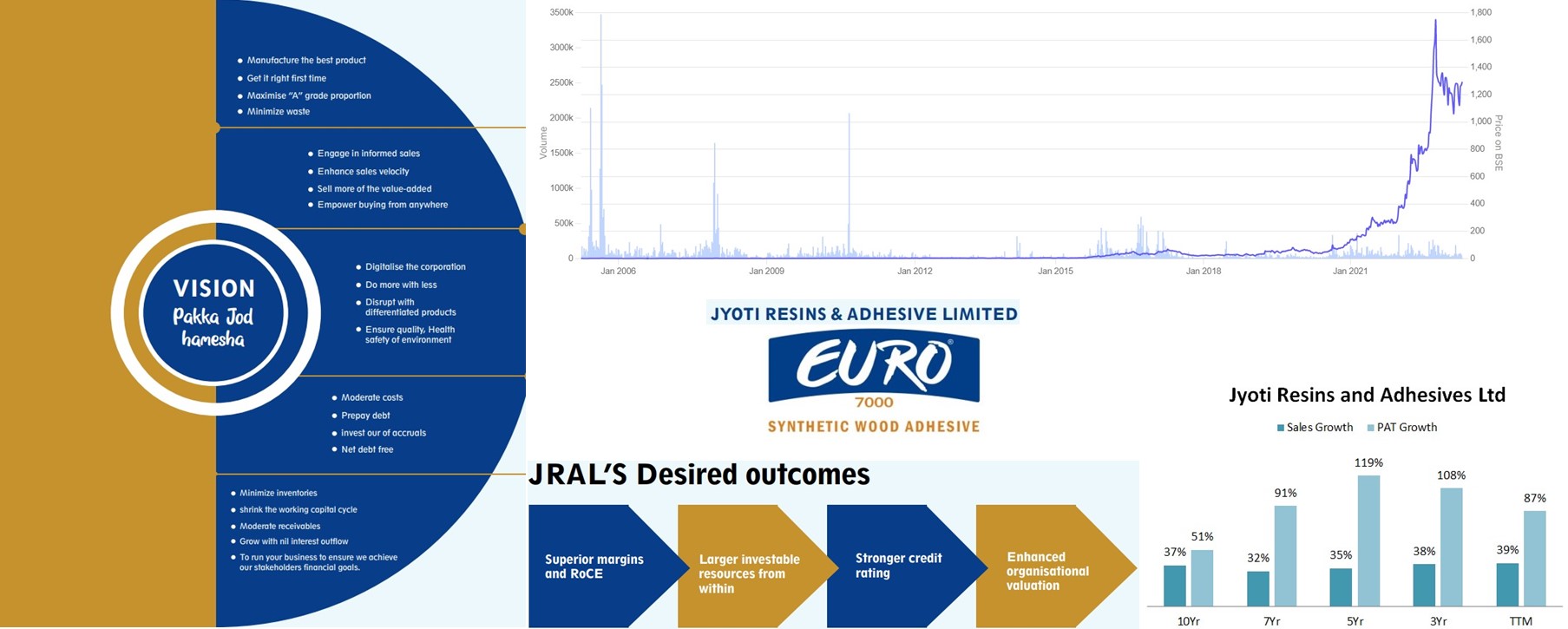

But despite of what has been mentioned above, JRAL is the only company out of the 4 in comparison here, which has Consistently maintained Sales Growth at over 35% CAGR in last 10 years, while Growing its PAT at ~ 51% CAGR during the same period. Not only this, PAT has grown at ~ 119% CAGR in Last 5 Years while the company remained almost Debt Free in last 3 years.

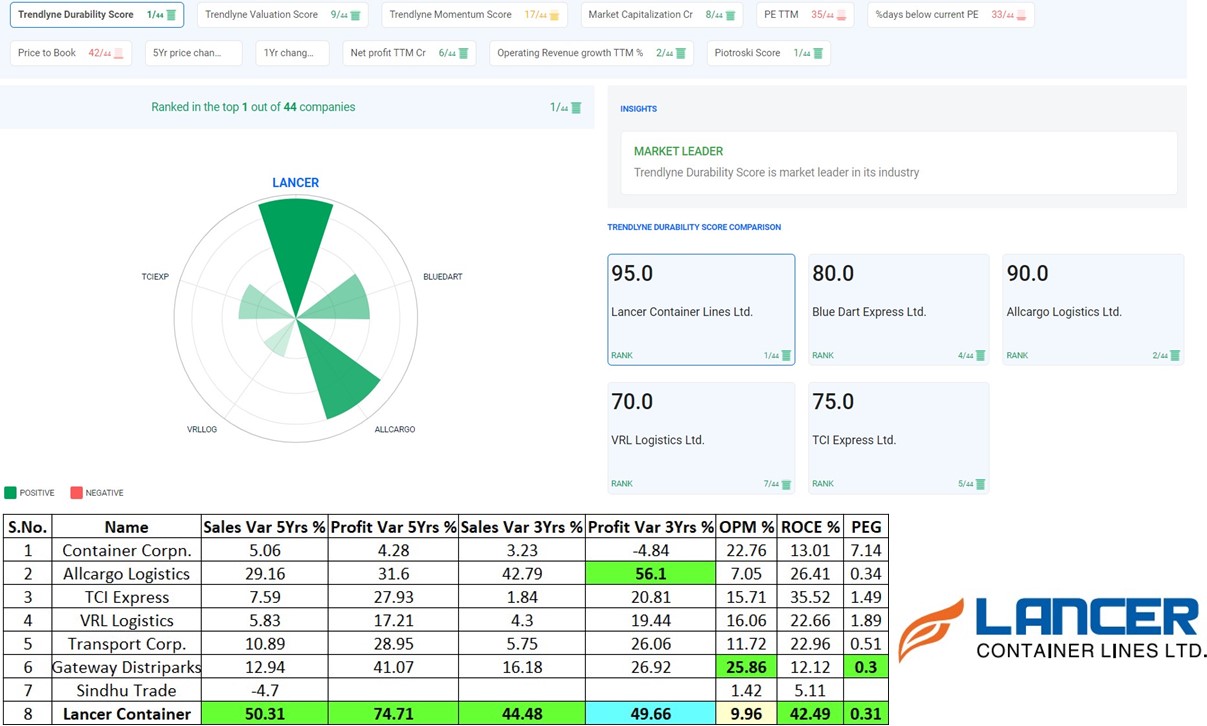

Even LCLL has been able to grow it’s Sales Revenue b/w 45 to 50% CAGR in last 10 & 5 years period, while the PAT has grown at ~ 75% CAGR during this period. This is Phenomenal Financial performance given that company has consistently reduced its Debt/Equity from 4.1 in March 2013 to 0.6 in March 2022.

Both AVL and JRAL has expanded their footprints exponentially to take advantage of the Economies of Scale so as to improve their OPM and NPM Consistently, Both has kept Fixed Cost under Control, and Both have Asset Light Business Model (almost).

The Only difference was that – whereas AVL used Higher Debt to fuel this growth momentum, JRAL has has increased Fixed Asset continuously in last 4 years by prudent capital allocation while simultaneously reducing the Working Capital Days and Cash Conversion Cycle Significantly. Moreover company has focused on getting more Cash Discounts by Upfront Payment to the vendors, hence reducing the Cost of Raw Material purchased. Thereby improving the Gross, as well as Operating Profit Margins Consistently.

LCLL is the Only company out of 4 in comparison here, which has generated Free Cash Flows every year since 2017 except the FY ended in March 2019. Besides, LCLL also operates as an Asset Light Business with a mix of 14,000+ Owned and Leased containers. Hence, given that company has a Short Cash Conversion Cycle of just ~ 30 Days along with Negative Working Capital Days, so the company’s internal accrual were sufficient enough to fund its high growth so far.

HFL on the other hand consistently having not only thin OPM of ~ 6% but its NPM is also just ~ 2 to 3%. Therefore to continue growing that fast, company needs higher volume growth consistently which in turn requires continuous Heavy Capex.

So amongst all the 4 Multibagger companies under comparison, HFL Capex requirement is the highest and as its CFOs are never sufficient to fund this Capex, so the company relies on Higher Debt to Sustain this Growth!

Hence compared to LCLL which generates Rs. 51 Crore of CFO with just ~ Rs. 31 Crore of Capex and Rs. 42 Crore of Debt, HFL on the other hand generates only Rs. 36 Crore of CFO with Capex of over Rs. 150 Crore and Debt of Rs. 351 Crore.

Surprisingly, for a company whose sales revenue is 3.33 times that of LCLL, generates just 1.43 times PAT, and 0.71 times CFO in comparison to LCLL and have only Rs. 43 Crore of (Cash + Investments) compared to LCLL’s Rs. 48 Crore of (Cash + Investments). I don’t know why its Stock is trading at over 100 P/E ratio!

So far JRAL and LCLL seems to be a Better choice for investment compared to AVL and HFL, but let’s deep dive further to analyse Business Strengths of Both, one by one, before reaching to any conclusion.

Multibagger Stock JRAL – Business, Moat, Competitive Advantage, & The Growth Triggers

JRAL is a manufacturer of Synthetic Resin Adhesives and it manufactures various types of Wood Adhesives (White Glue) under the brand name of EURO-7000, which it launched in 2006. It took almost 10 years for JRAL to expand its Manufacturing Capacity from 250 TPM in 2007 to 500 TPM in 2017, but later on not only did the company expanded its business to 13 states, but it has also expanded its capacity to 2000 TPM by August 2022 i.e. 4x in 5 years.

Euro-7000 has grown exponentially within last 5 years and is now the 2nd Largest Wood Adhesive (White Glue) Brand in India, in the Retail Segment.

JRAL today provides its services to 13 states in India through 28 Branches and 50 Distributors, catering to 10,000 Active Retailers and over 3 lakh Carpenters across India. A 300 Strong Sales Force plays a key role in this process.

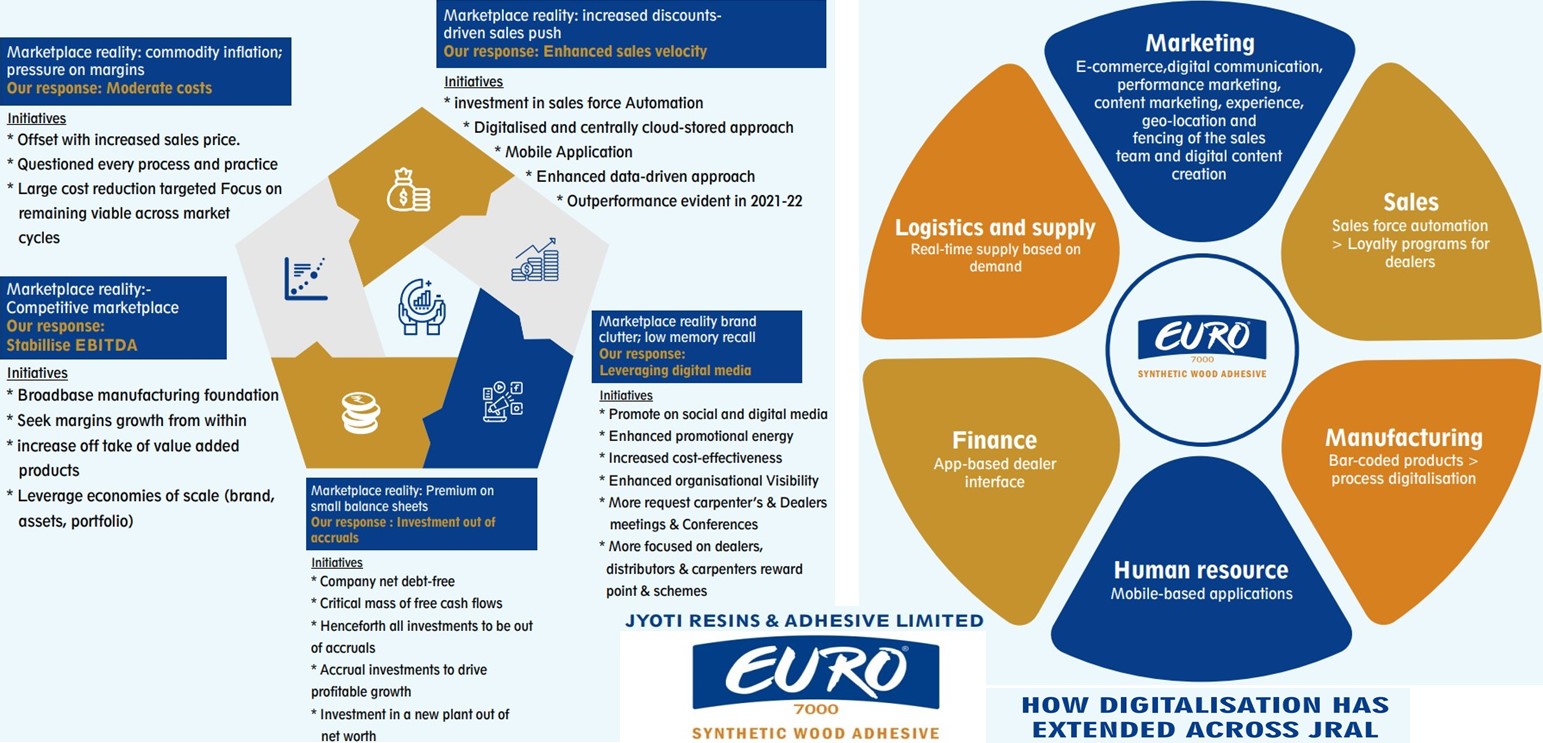

Company is currently operating at 50-60% capacity utilisation (at gross production levels) which is expected to move up with increasing penetration and demand for its products. Company has seen significant traction from its Digital advertisement campaigns.

JRAL imports raw materials from Several Countries, which are then processed and white glue is manufactured in their plant at Santej. The finished product is then packaged into Different Sizes starting from 500 gm upto 70 kgs. The products are then sold through a mix of Distributors, and Consignee & Sales Agents into the retail market (sold to dealers).

At a team level, the company has zonal managers, area managers, sales executives and business development executives. The Whole Chain works Cohesively towards the visibility, promotions, training of carpenters, use and applications, resolving customer issues, sales orders and processing, and other related activities.

The company also has an Efficient Carpenter Reward Model system, which is a loyalty program for carpenters. On every bucket / drums purchased by carpenters, they receive certain amount of points, which are then recorded by downloading and logging into the app designed by the company. Post a certain threshold; the carpenters can then redeem these points in return for gifts in several forms / modes of awards.

The company has well-established and Customised ERP software, which Integrates its Sales, Purchases, Distributor and Consignee Agent ordering, Billing Inventory, Receivables as well as the Carpenter Loyalty Programme.

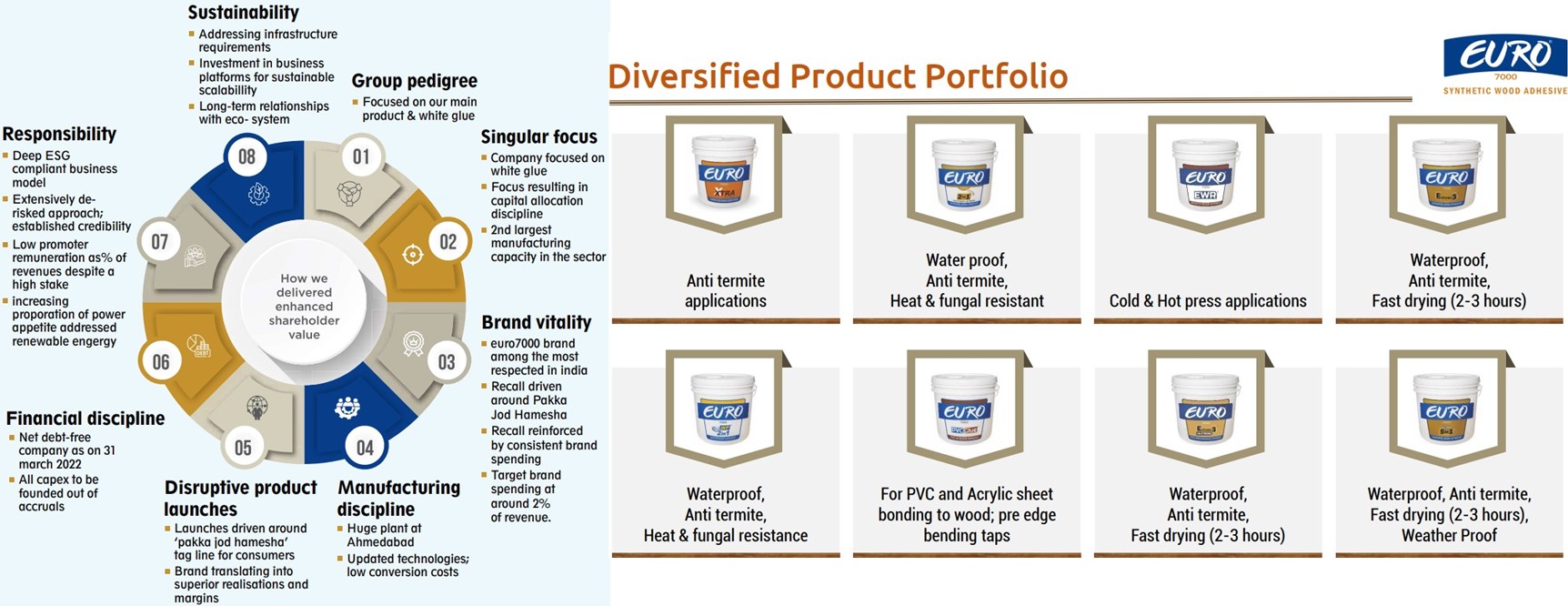

While going through the company’s Annual Reports i could clearly see that the management is focused on its Main Product i.e. White Glue and has done capital allocation keeping that in mind. As a result, JRAL now have 2nd Largest Manufacturing Capacity in the sector. Company did Consistent Brand Spending of ~ 2% of the revenue for years, which helped Euro700 to establish as a popular brand in 13 states.

Within White Glue Category, company launched various Disruptive Products to create a Diversified Product Portfolio. These launches were driven around the tag line ‘Pakka Jod Hamesha’ for company’s customers and eventually these efforts translated into Superior Realizations & Margins.

Company realized very early the importance of:

1) – Value-Added Products in its Portfolio Mix;

2) – Sales Velocity Improvement;

3) – Disrupting the Market with Differentiated Products and to Penetrate the Physical Market Deeper;

4) – Digitalisation of the company to:

i) – Manage Real Time Supply Based Demand;

ii) – App-Based Dealer Interface;

iii) – Sales Force Automation;

iv) – Empower the Customer to Buy Conveniently – Whenever and Wherever;

5) – Procuring High Standard Raw Material at as Low Cost as Possible and to Procure it Sustainably, along with a need of – Strong Warehousing Facility, Quick Delivery, Strong Technical Support, Best & Agile Customer Service etc. in its Business;

6) – Investing in Cutting-Edge Technologies to manufacture the Range of Products from a Single Location, so as to Maximise the Asset Utilisation while Reducing the Cost & Expenses;

7) – Moderating the Cost by – Prepayment of Debt, Minimizing the Inventories, Shrinking the Working Capital Cycle, Moderating the Receivables, and Prepayment of the Debt;

8) – Becoming Net Debt Free and to Fund the Capex through Internal Accruals only. Hence not only Driving the High Growth with Sustainability, but also Improving the Organisational Valuation and Credit Rating;

9) – Maximising “A” Grade Proportion while Minimizing the Waste, to manufacture enduring products that Moderates the Long-Term Resource Consumption;

10) – Investment in Business Platforms for Sustainable Scalability, and to Leverage the Economies of Scale (Brand, Assets, & Portfolio)

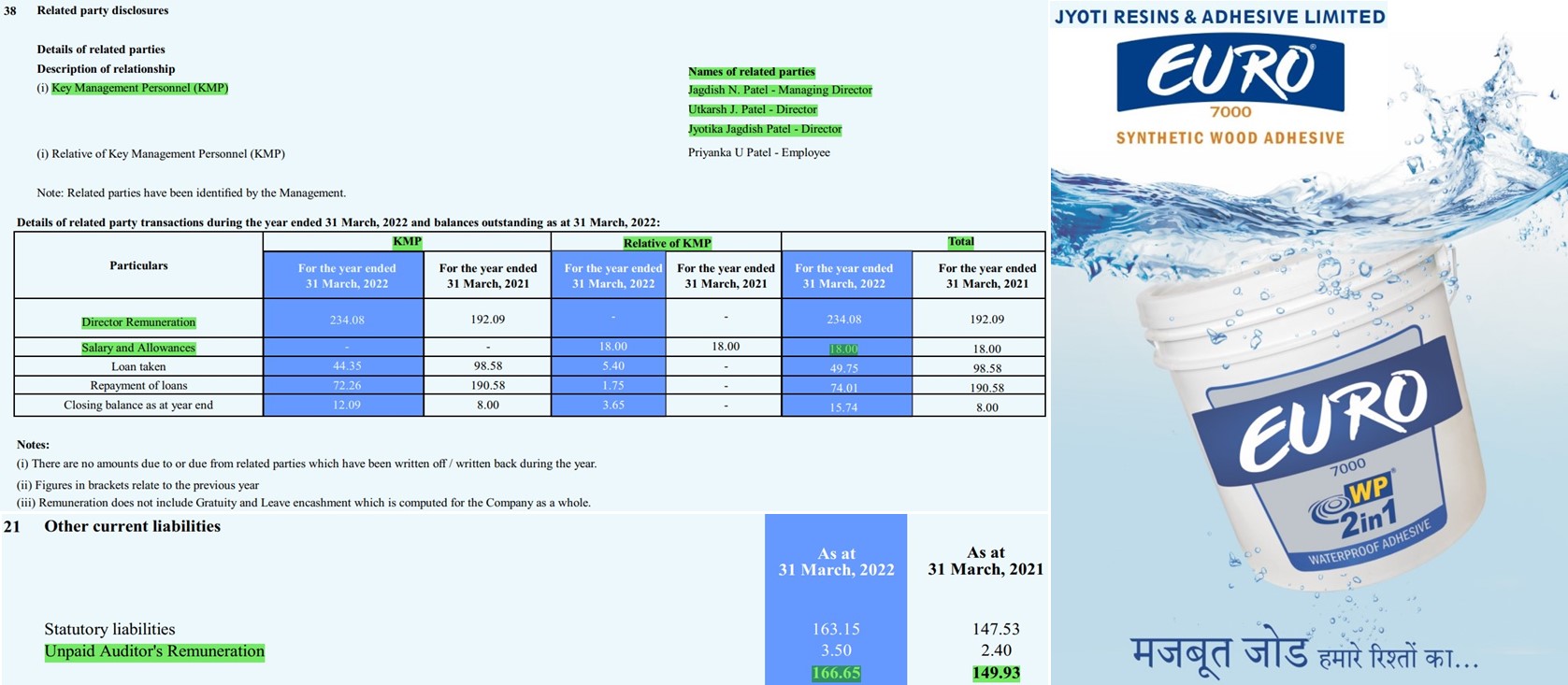

Besides, management is Shareholder Friendly and is keen & focused to Increase Shareholders Wealth, which may also be seen as:

1) – Paying Dividend consistently Since 2019 and Paid 75% Dividend per Share in FY22;

2) – Promoters continuously Increased their Holdings from 47.21% in March 2020 to 50.82% in Dec. 2022;

3) – Low Promoter Remuneration as a % of Sales Revenue e.g., In FY (2020-21) Directors Remuneration was 1.90% of the Revenue whereas in FY (2021-22) it was Just 1.29% of the Revenue. Besides Allowances remain Fixed at Just Rs. 18 Lakh during both the FYs;

4) – Even Auditors Remuneration has Increased from ~ Rs. 1.50 Crore in FY (2020-21) to ~ Rs. 1.67 Crore in FY (2021-22) i.e., Increased at ~ 11.15% against the Sales Revenue Growth of 80.2% during the said period;

5) – As a result of Company’s High Sales & Profit Growth with Consistently Improving Gross Margins, OPM, and NPM, JRAL Stock has given Multibagger Returns at 83% CAGR in last 10 years, 121% CAGR in last 5 years, and 216% CAGR in last 3 years.

JRAL Business doesn’t have any Entry or Exit Business, neither it has such a Strong Brand Moat as Pidilite does have in this sector, but despite that it has few Competitive Edge over others that helped it to grow that Faster, as mentioned above:

1) – Overall Manpower Costs is limited to just ~ 15-16% of revenues, whereas Selling and Distribution Expenses are maintained under 12%. Company’s Asset Turnover is at ~ 8x and it is amongst the highest EBITDA per tonne vis-à-vis Peers;

2) – Wide and Efficient Distribution Network of 10,000 Active Retailers and over 3 lakh Loyal Carpenters. Company have one of the Best and Highest Rewarding ‘Carpenter – Rewarding Model’ in the industry, through which Reward & Loyalty programs are devised state wise;

3) – Diversified Product Portfolio covering wide range of application and features, that are catering to the different substrates such as:Anti-termite, Water proof, Fungal & Heat resistance, Fast drying, High Fixing Strength etc.;

4) – Much Headroom still available for Growth through Expansion of the Footprint across the country and Globally. Besides, it can also leverage the Economies of Scale to move into the Adjacencies like Pidilite or Companies like Asian Paints and Astral Ltd. has already done Successfully – (read: https://jyadareturn.com/asian-paints/ & https://jyadareturn.com/astral/)

Believing in these possibilities, management is Confident to achieve Revenue Growth of Plus 30% CAGR for next 3 to 4 years, while Maintaining over 40% ROCE and Generating Free Cash Flow Consistently.

Multibagger Stock LCLL – Business, Moat, Competitive Advantage, & The Growth Triggers

Primary Business of LCLL is Ocean Transport Services of Intermodal Containers by Container Ships (NVOCC – Non Vessel Operating Common Carrier). In the Shipping Value – Chain, there are following stakeholders:

- Exporter/Importer – Who are Actually Selling/Buying the goods

- Freight Forwarders – Which act as an Agents for Exporters/Importers and Help them to Manage the Freight Movement

- Custom Handling Agents – for Processing Custom Related Documents

- Shipping Lines – Which actually Owns the Vessels that move the goods

- NVOCC – Which doesn’t own the Ships, but Owns/Lease the Containers that go on the Ship and Optimise the Inventory on the Ships

Hence, NVOCCs aggregate Demand from the Exporters and Package it efficiently into the Carriers. Since they only Owns the Containers, therefore they have an Asset Light Model.

Company provides a Highly Integrated Variety of Shipping Services with the help of Multiple Decades of Industry Experience and it generates revenue majorly from the Sale of Services ~ 98% whereas the Sale of Products i.e. Containers, constitutes only remaining ~ 2%.

In India, Services are rendered through Head Office and Branch Network, while in Overseas, Delivery of shipping services at destinations is through Overseas Agents.

Growth in this business is Driven mainly by Increasing the Number of Containers Consistently and LCLL has done the same, as its TEUs count has Increased from 50 in 2011 to 14,304 by 2022 end.

As on 31st December 2022, LCLL have a Mix of 14,304 Owned and Leased Containers, specifically TEUs, through which it is offering Services to 86 Ports, as well as Inland Destinations through 13 Offices in India and a Subsidiary in Dubai, Covering More than 30 Countries.

The principal geographies of operations are supported by a Network of Associates in the Indian Subcontinent, Southeast Asia, the Far East, MENA and CIS Countries.

LCLL provides services like NVOCC, Empty Container Yard, Container Trading, Freight Forwarding (Sea, Air, and Road), etc. in India as well as on a global basis. It owns a Container Yard spread over 20,000 square meter in Panvel.

Besides, Lancer also manufactures Portable Cabins (prefabricated structures) for use in places where permanent construction is Not Feasible such as Construction Sites, Factories, Security Cabins, Toll Booths, and other similar applications.

Some of the services, as shown below & highlighted, are High Stake Value-Added Services which LCLL provides to its Clients Globally.

The Indian Logistics Industry is highly Fragmented and Unorganized, with the organized players accounting for ~ 20% of the total market share in FY22, but Organized Share in India’s Direct Logistics is expected to Grow at a much faster pace to reach ~ 60% by FY26 end. Why?

The logistics theme revolves around formalization of the Indian economy, with GST being a big driver. Traditional logistics chain involved customers approaching the transporters who would coordinate with truckers through brokers, to transport goods and services. Brokerage charges tend to be ~ 3 – 8% of rates booked for the cargo.

Organized players have Eliminated the Broker and they are Directly reaching out to Truckers, leading to Improved Margins.

India’s Logistics Market is expected to expand at an annual CAGR of 8%, to reach USD 330 billion by 2025. This expansion will be supported by several factors, including the fast-developing E-commerce Industry, Impending Technical Advancements, and an Expanding Retail Sales Market.

As of now, the logistics sector is dominated by the Transportation which has over 85% share in value terms- its share is set to remain high for the next few years. The rest 15% share is borne by storage (Warehouse).

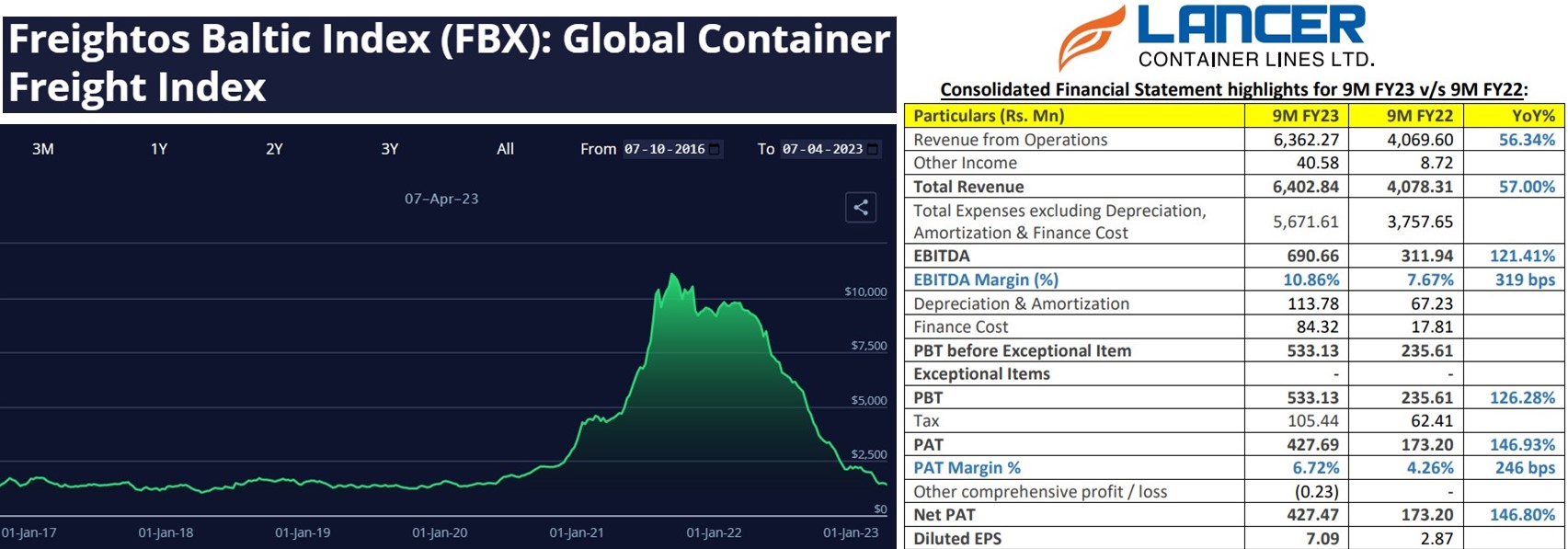

Container Shipping Companies’ Performance depends on the Container Freight Rates, which were Higher in 2021 and also till Mid – Feb 2022 due to Port Congestion stemming from the Prolonged Covid-19-related Operational Disruptions. Hence the Growth of the companies like LCLL was Stronger then.

Later, the Global Container Freight Charges Slides to the Pre-Covid19 Levels, but LCLL still able to Grow its Revenue for 9MFY23 at 57% compared to that of 9MFY22. Similarly compared to 9MFY22, EBITDA and PAT has grown at 121.41% and 146.93%. That’s Phenomenal to say the least! But How did Lancer manage to do that?

Revenue Growth was mainly Driven by the Robust Demand for Global Trade, Addition of New TEUs, Entering into the New Geographies, and High Capacity Utilization, whereas EBITDA has grown that high on the back of Strong Operational Performance, Efficient Cost Controls & Strategic Cost Rationalization, and Economies of Scale.

All this has led to Improvement in EBITDA Margins from 7.67% in 9MFY22 to 10.86% in 9MFY23 while PAT Margins has Improved simultaneously from 4.26% in 9MFY22 to 6.72% in 9MFY23.

To Continue on this High Growth Trajectory, company shall be adding 10,000 TEUs in the coming year FY24 to cater the Increasing Demand of the Shipping Containers in the Global Logistics Market. Besides the FCCB funds of US$100 million, for which Resolution was issued by the Board of Directors on 30th August 2021, will be Utilized for:

1) – Capex of Lancia Shipping LLC;

2) – Procurement of Containers to cater the Demand in the Middle East, Europe, and East Africa regions;

3) – Additionally LCLL have new business plans lined up in Africa for multiple projects catering to the Port Logistics, ICD Port, Warehousing, and Container Yard.

Further, EBITDA Margins are likely to remain high ~ 11% due to LCLL’s Volume Commitment with the Vessel Operators, to Negotiate on Slot Charges which is the Major Component of the Operational Cost.

Strengths & Growth Triggers –

As large corporations now prefer to focus on their core business activities, supply chain distribution gets outsourced to the intermediaries. This has resulted in a demand for freight forwarders, who operate in a highly cost-effective manner.

The consumer base of the sector, encompassing a wide range of industries including retail, automobile, telecom, pharmaceuticals, heavy industries, etc. attracts investments for the logistics industry.

Company has penetrated into the new geographies, mainly covering the European and Mediterranean region and in the same endeavor the company has set up a branch in the UK and Incorporated a Wholly Owned Subsidiary named LANCIA SHIPPING L.L.C in Dubai as it also seeks to explore these markets more aggressively and reducing dependence on the local agents to garner the business.

Company is having an Extensive Network of Agents throughout LATAM, and Lancer also holds an agreement with multiple South American freight forwarders from Mexico to Argentina, which in turn results to Global Outreach.

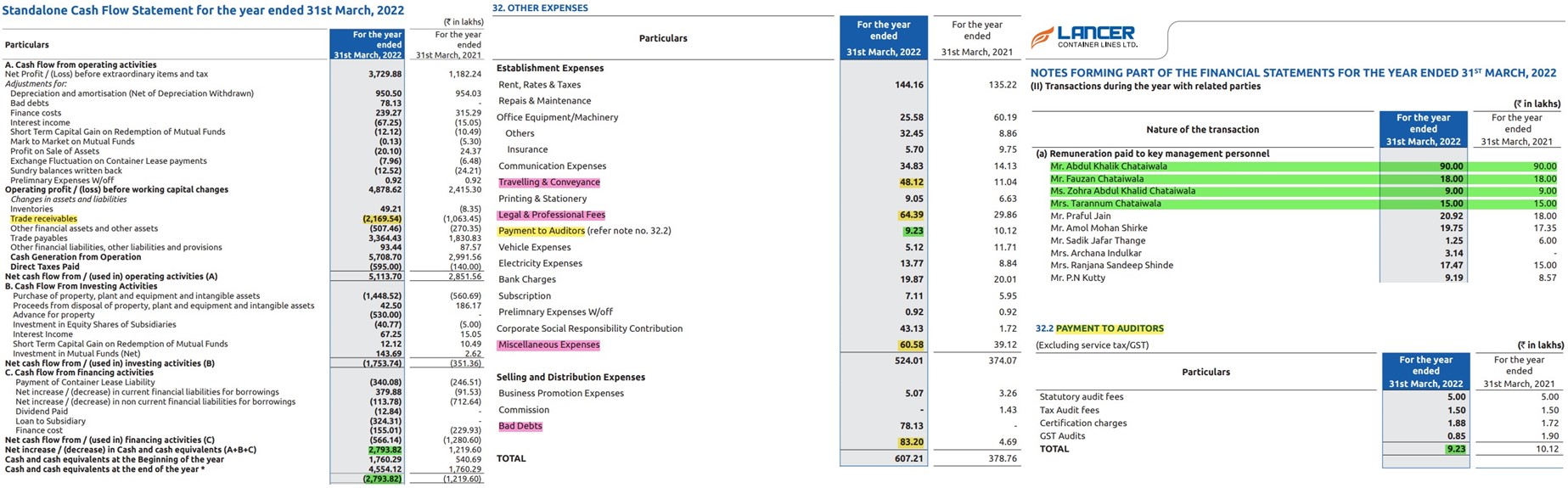

Remuneration of the Directors and His Family remains same as it was in FY (2020-21). Moreover, Remuneration of Auditors has fallen by ~ 8.8% although the company’s revenue has grown by 98.33%!

Risks & Threats –

The cost of operating at major ports has significantly increased after their privatization without any improvement in services or differentiators. The problem of insufficient container parking bays, truck docking stations, limited space for terminals and clearance processes leading to a delay impacting operating costs persists.

Any movement in the functional currency of operations of the Company against the major foreign currency may impact the Company’s revenue in international business. Any weakening of the functional currency may impact Company’s cost of imports and consequently the profit or loss.

Increase in Company’s Trade Receivables has almost Doubled compared to FY (2020-21), while the other expenses like Legal & Professional Fees, Miscellaneous Expenses, and Bad Debt has gone up Significantly in FY (2021-22) compared to what it were in FY (2020-21).

So Which May Be The Best Multibagger Investment Opportunity, Out Of The 4 In Comparison?

Clearly Both JRAL and LCLL have Stronger Revenue Growth Plans to remain on High Growth Trajectory through Strategic Expansion of Footprints, Widening of the Product Portfolio and Integrated Services being Offered, and Heavy Capex to fuel this Growth, which of course shall be funded through internal accruals mostly.

So they both have Multibagger Potential Growth Prospects in the near future too!

Management of both the companies seems to be Focused, Growth Hungry, and Shareholder Friendly. Besides, there wasn’t any major issue found regarding the Corporate Governance in either of the company.

Whereas AVL is likely to be facing lots of competition, from the likes of Reliance Digital; Croma; Vijay Sales; in addition to e-commerce online platforms like Amazon; Flipkart; Snapdeal etc., especially in the Tier1 and Metro Cities. Besides, as the company is growing faster than what it’s Business Sustainability and CFO allows, hence it will be requiring more & more Debt to fuel this Growth.

Therefore, it will also be interesting to watch how Successfully this company will be expanding its Business, beyond the present geographies of Bihar and Jharkhand.