Being Inspired by Science, Innovation is a Way of Life at PI Industries Ltd and Promoting Innovation in Cleaner, Cheaper, and Smarter Chemistry – is what company has been doing for more than 75 years, to finally Emerge as an Integrated Life Sciences Company of a Global Stature.

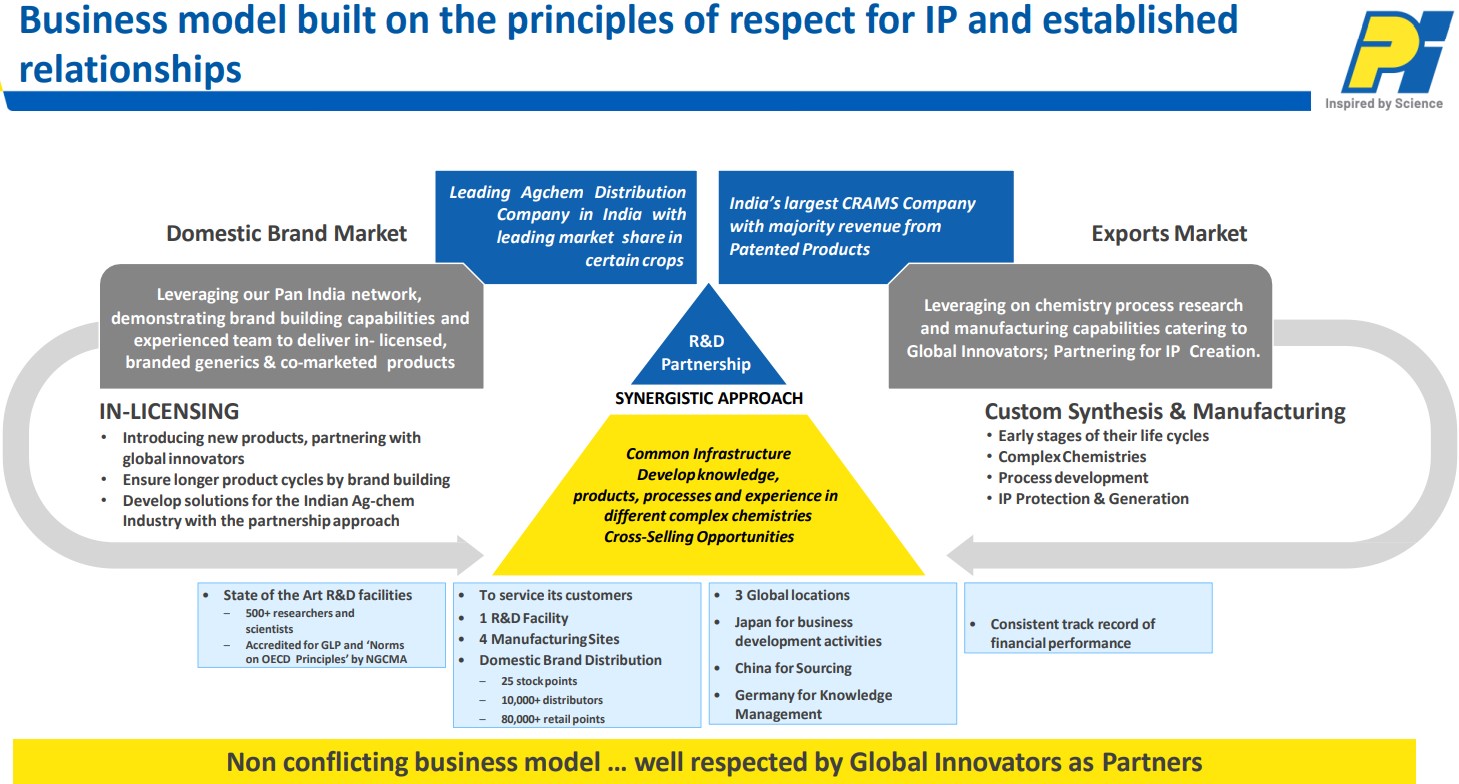

Company’s Ambition has always been to embark upon Rapid, Differentiated, Organic and Inorganic Growth, which is Resilient by being ahead Scientifically and Technologically. So today, PI Industries Ltd has become India’s largest CRAMS Company with ~ 90% CSM revenues coming from the Patented molecules, whereas ~ 70%+ Domestic revenues are coming from the In-licensed molecules.

PI Industries by adopting Innovative Technologies and thereby Creating an Edge over the Existing products, has developed the products which are now Brand Leaders through Differentiation in terms of Quality and Service. Hence, the Formulation Quality and Physical appearance are Markedly Different, than the Competing Same molecule formulations available in the market. Therefore, company is able to offer such Value Added Products to over 3 million Farmers.

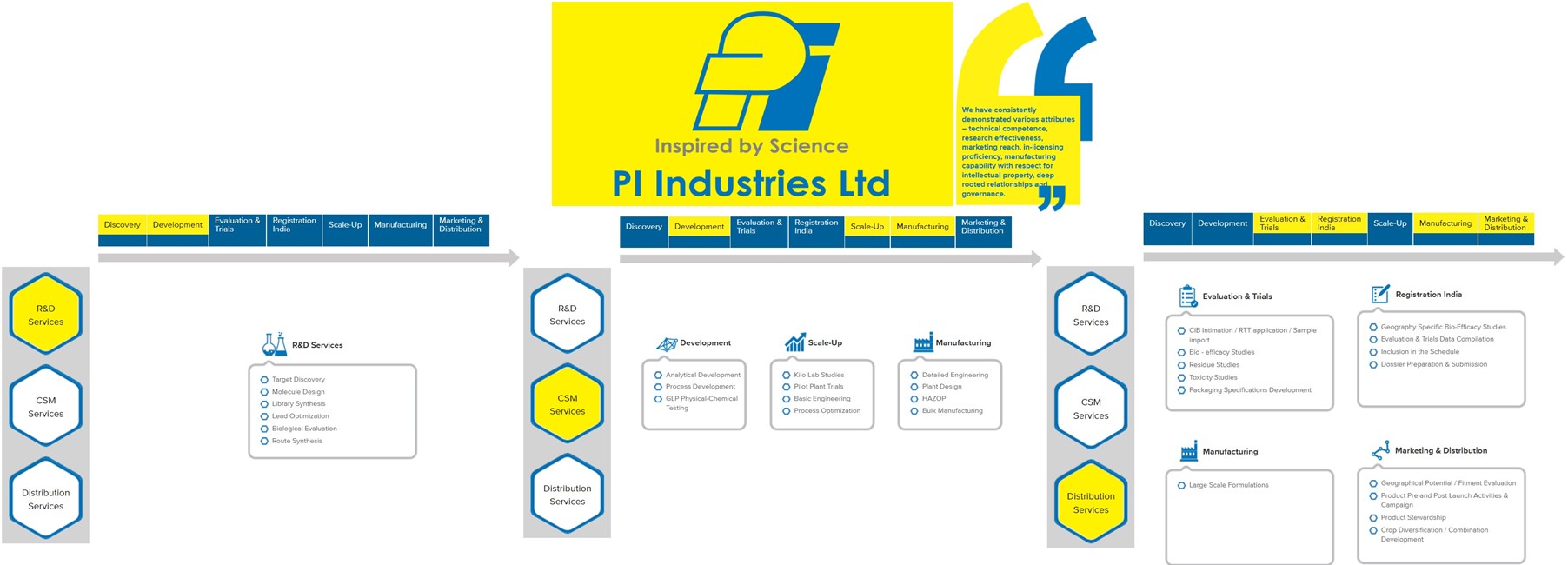

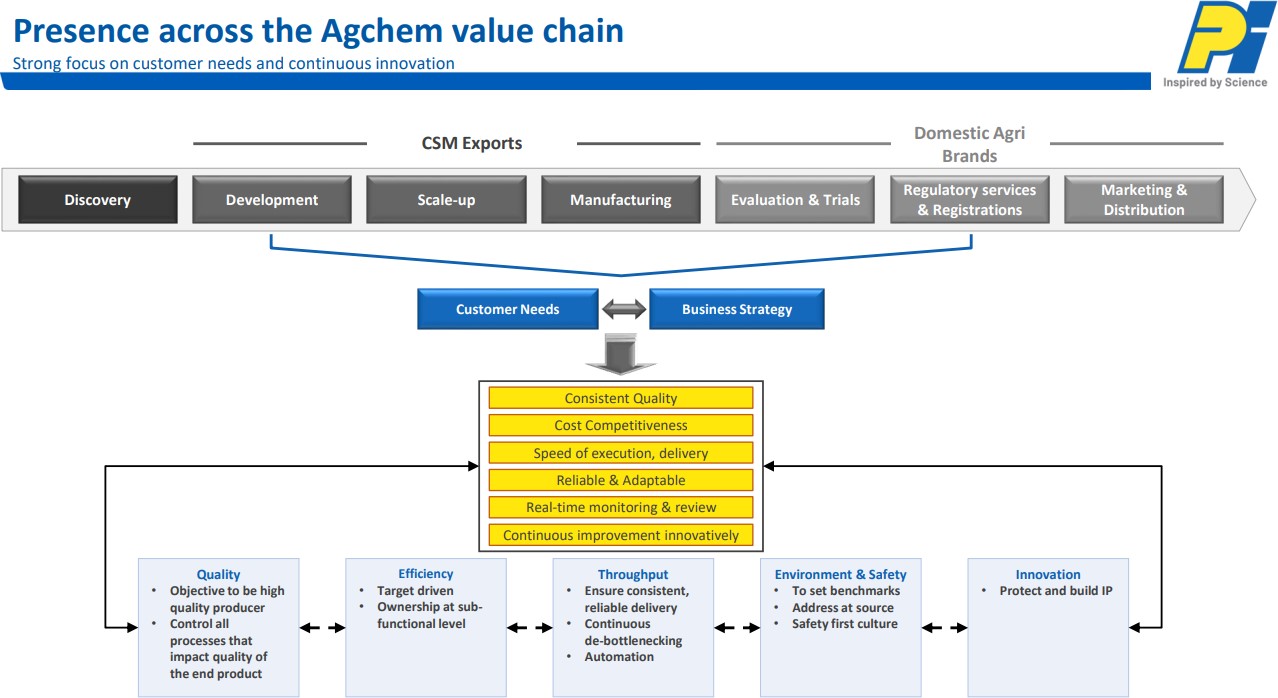

With its Complete Offering from Discovery to the Marketing, through a Robust Business Model Capabilities ranging from Synthesis of New-age Chemistry to Handling Multi-Step Complex Reactions, PI Industries Ltd. has become a Company with Infinite Possibilities!

PI Industries – Non Conflicting Business Model Driven By Multi-Pronged Growth Strategies.

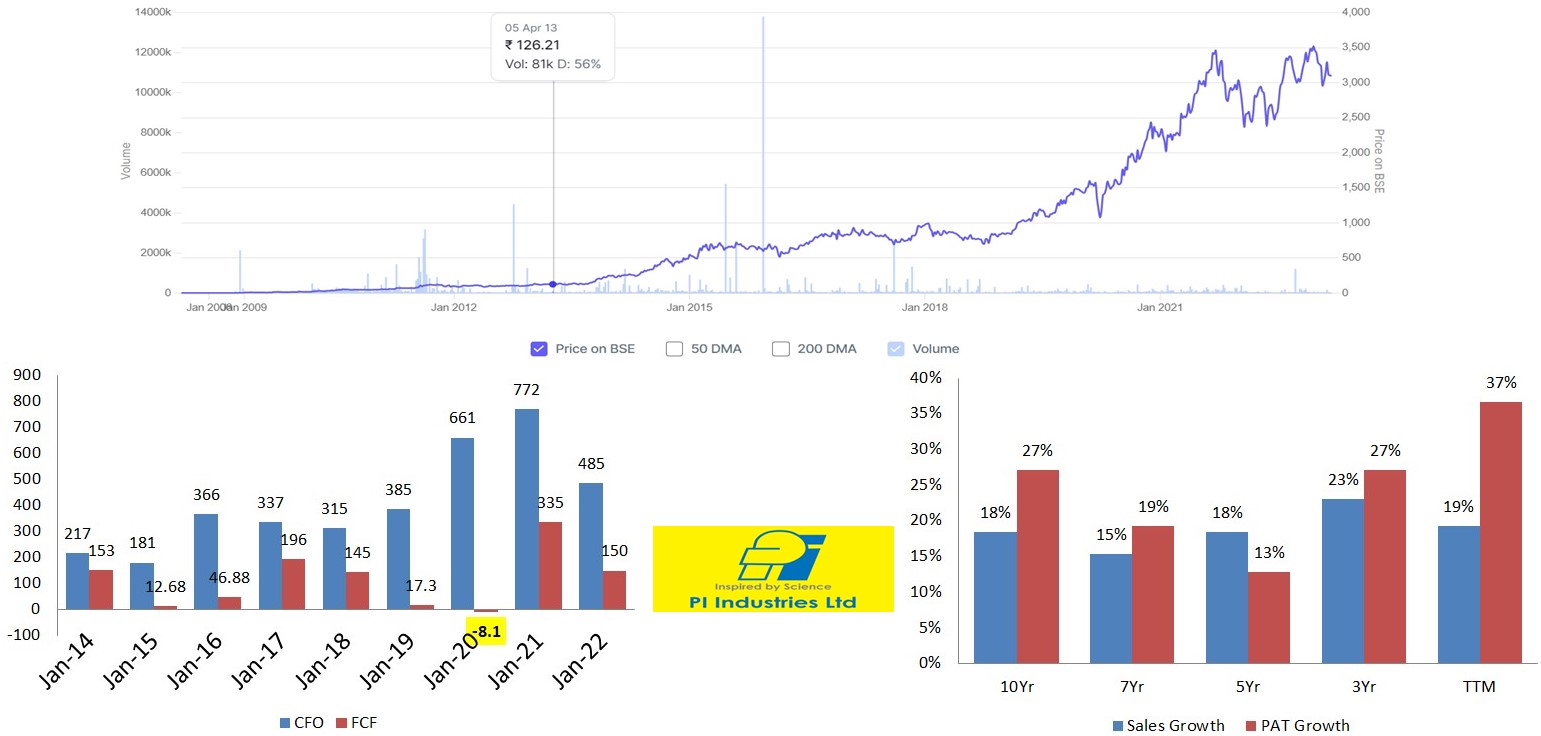

What used to be ~ Rs. 2 per Share way back in April 2005, has become ~ Rs. 3520 per Share in December 2022. In less than 18 years, PI Industries share price has multiplied ~ 1700 times. Further, in Last 10 years company’s sales has grown at ~ 18% CAGR whereas it’s PAT has grown at ~ 27% CAGR, while Consistently Improving OPM from 16% in March 2013 to 24% in TTM. That’s how Big the company has grown since 2005!

PI Industries through it’s Unique Business Model for providing Innovative Crop Protection Solutions to Farmers, is also Simultaneously doing the Custom Synthesis from Manufacturing to Co-Marketing & Distribution of the products, for its Global Innovator Partner Companies.

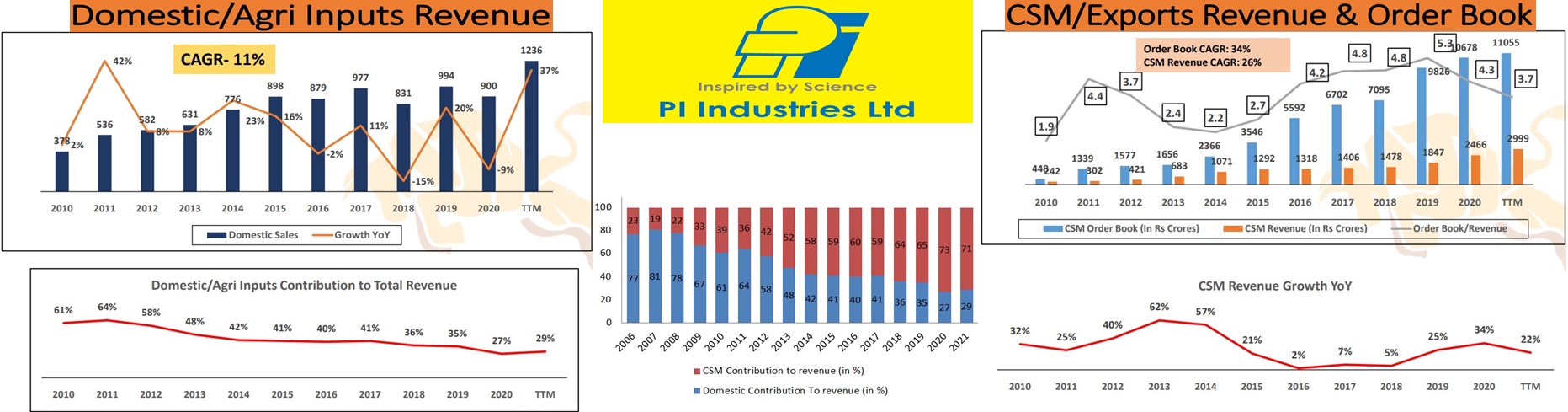

Company’s ~ 75% revenue comes from the Active Ingredients and Intermediates, whereas ~ 22.8% comes from the sales of Formulations and 2.3% from others. While Export contributes ~ 72.2% of the Total revenue, whereas Domestic Business constitutes remaining 27.8% of the revenue.

Revenue earlier used to be dominated by the Domestic Agri-Inputs, but in last 2 decades company has Shifted it’s Focus from this Domestic segment to CSM Export segment. Reasons being:

1) – Domestic Agri Business is Largely Dependent on the Monsoons. Hence this segment has High Cyclicality and Lower Revenue Visibility, as such.

2) – Besides, Low MSP of various Crops, Government Policies etc. also affects the Domestic segment.

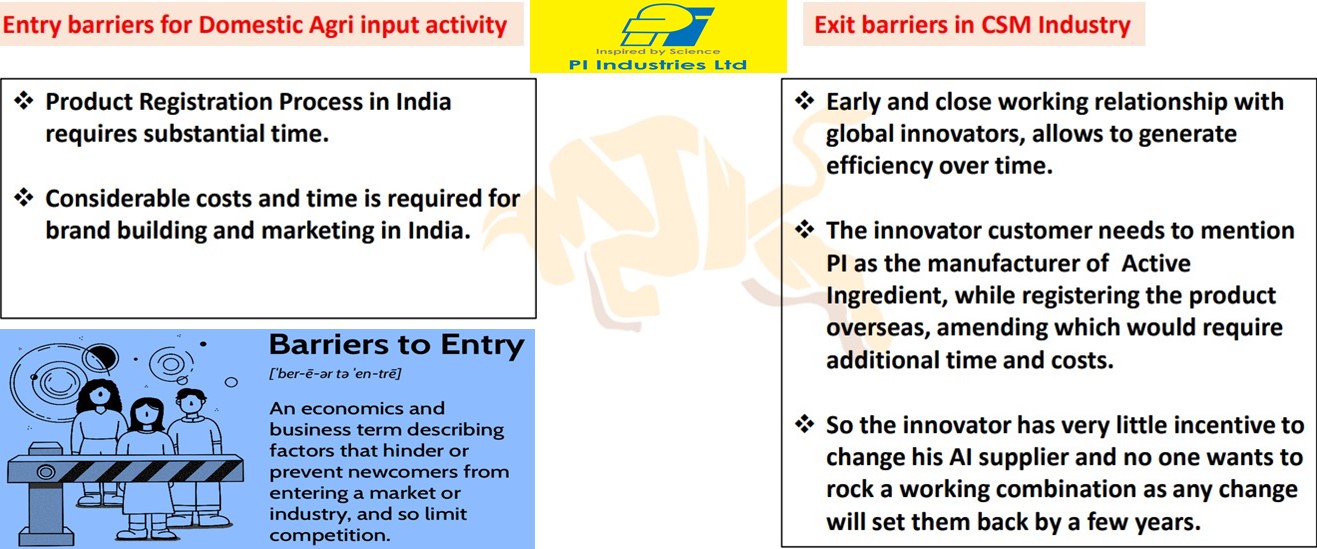

3) – On the other hand, in CSM segment PI Industries Manufactures High Value Complex Intermediates & API’s and Majority of the products are under Patents. Hence, More than 90% of the CSM revenues, comes from these Patented molecules.

4) – The Innovator companies spends on the R & D activities and Discover a molecule, which they Outsource for it’s Manufacturing to companies like PI Industries, so as to Reduce their Costs. Since It takes anywhere between 1 to 3 years, from the Inquiry to Commercialization phase, so once the molecule gets Commercialized, PI gets the order either for Intermediates or for the API’s and it generates revenue at Higher Growth Rates.

In addition, company also have an Opportunity to provide Additional Services like Development, Manufacturing and Scaling-Up the Manufacturing Process.

5) – For every molecule, Global Innovators have only 2 Suppliers (including PI Industries Ltd) because this business involves a Lot of Trust and Respect for IPR. Therefore today PI have Long-term Relationships, with 20+ Global Innovators, built on IP protection. This commitment from the Innovator Companies, helps in not only Safeguarding PI’s Interests, but also provides it a Revenue Stability!

6) – Given that the Company’s Order Book is Executable in 3-5 years and the Orders are Characterized as Take or Pay. So even if the order does Not get Fulfilled, then also the PI Industries Ltd gets Paid. These favourable T & C’s of the CSM Contracts, gives PI’s its Better Revenue Visibility!

CSM Business is the Key Differentiator for the company, although PI has also focused on the manufacturing of In-Licensed Products in the Domestic Agri segment, given the High Margins which these Patented products generates, for which the company has been given “the Exclusive Rights to Manufacture” from the Innovator company.

This is a Win-Win Situation, where the Large MNCs Innovator companies get access to make their Reach in the Big Indian Market, whereas PI Industries simultaneously gets an opportunity to Mint Money by Selling these Patented Products!

PI Industries – Combination of Differentiators, Ultimate Infrastructure, and Formidable Customer Value Proposition

Company has World-Class State-of-the-Art R & D Lab at Udaipur, with a Strong Team of 500+ research scientists. It has more than 50 work-stations, with Complete Online Utilities, to support a Wide range of chemical reactions. Lab has Fluorination facility, Flow Chemistry and Vapour phase Chemistry, along with Real Time Data Capturing with Automated Jacketed Reactors.

Besides, there is a Kilo Lab with Distillation facilities to Establish Recycling of solvents etc. along with a Flexible reactor set up to facilitate quick change over, and a Pilot plant with facilities to carry out various reactions and processes like crystallization, filtration, vacuum distillation, continuous distillation, evaporation etc.

A Dedicated team of highly qualified Engineers manages the Kilo Lab & Pilot Plant, round the clock.

For Commercial Production, PI Industries has Fully Integrated State-of-the-Art Manufacturing Facilities at 3 different locations namely GIDC Panoli-1 (PNL1), Panoli-II (PNL2), and SEZ – Jambusar (JMB). There are 15 Fully DCS Automated Multi-Products Plants (MPPs) at JMB, with latest technology of Foundation Fieldbus (FF) and Remote Input/output (RIO). The installation of RIO which is a combination of Yokogawa, Japan and Turck, Germany at PI is the biggest in Asia at present!

With commitment to provide highest priority to Sustainable Development, these sites have number of installations like Rotary Kiln Incinerators, Fume Incinerator for Off-Gases Incineration, ETP, STP, RO and scrubbers etc. at relevant places, to Comply with all the Environmental Norms.

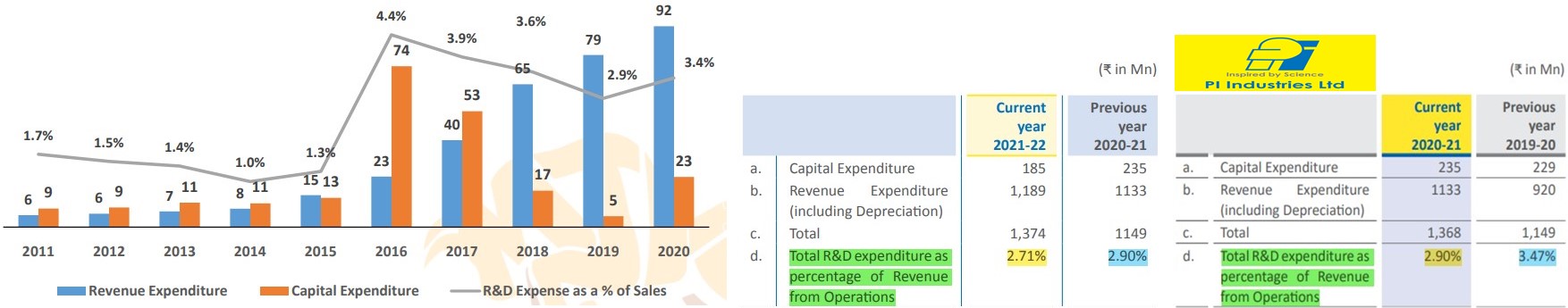

Company spends ~ 3% to 4% of its Revenues from the Operations on the R & D activities, to provide Sustainable Solutions by Early Adoption of Cutting-Edge Sciences/Technologies and hence, Creating Transformative Solutions in Life Sciences.

PI Industries offerings across the Value Chain Driven by Strategic Partnership – Company offers Integrated and Innovative Services, to provide Comprehensive Solutions by Partnerships and Relationships, which is built on IP protection, with 20+ Global Innovators. With its Deep Understanding of Indian Agriculture, Brands, and Reach with the Indian Farmers, PI has leveraged the Indian Agro Market!

PI Industries – Leveraging Range Of Expertise From Synthesis Of New-Age Chemistry, To Handling Multi-Step Complex Reactions

“Nature Inspires Science. Science Inspires PI” – Both PNL and JMB sites has State-of-the-Art Hydrogenation Facility, with Fully Automated System having Highest Safety from its Installation to the Operation. There are scope to run 8 no’s of Hydrogenation reaction Simultaneously, which is one of the Biggest Installation in India.

Critical reactions like Grignard using Mg metal, Darzen Condensation using Na Metal, Cyanation using Sodium Cyanide, Chlorination using chlorine liquid or by usage of reagent like Thionyl Chloride, Sulfuryl chloride, Dry HCl etc., and Bromination in Large Capacities – runs on regular basis in various plants with State-of-the-Art Technology.

Alkylation – using Isobutylene Compressed Gas, from a dedicated storage facility, runs both at JMB and PNL facility, in Complete Automation Mode.

Whereas Amination – using Liquid Ammonia, from dedicated storage tank, runs at JMB facility using highest level of Automation.

High Pressure Air Oxidation and various Catalytic Reactions are carried out in many areas on a regular basis, to produce Newly Patented Molecules in the manufacturing site.

PI Industries Product Chemistry Capabilities Extend to providing Comprehensive Analytical and Synthesis services for the Specialty Chemicals, Pharmaceuticals and Agrochemicals Industries.

PI’s areas of expertise includes – Method Development and Validation Studies, Product Stability, Purity Analysis, Impurity Profiling, 5-Batch Analysis, Impurity Standard Synthesis, Isolation and Characterization leading to “Analytical Master Standard Repository Generation”.

PI Industries – Discovery, Development, and Scale-up Driven Accelerated Growth

Scientifically R & D Projects on Plant Diseases, Animal Pests and Weed Control, involves – Chemical Synthesis from Discovery to Scale-up, Analytics for Structural Elucidation, Quantitation as well as Preparative Purification and Separation, Molecular Design and Modelling, Classical Biological Testing (in vitro lab, in vivo lab, greenhouse and field) supported by Biochemical and Molecular Biology Research, and by Formulation Development – Everything is Connected by an Integrated High-End Electronic Data Documentation and Management System, which helps PI Industries in Identifying the Cost Improvement Opportunities.

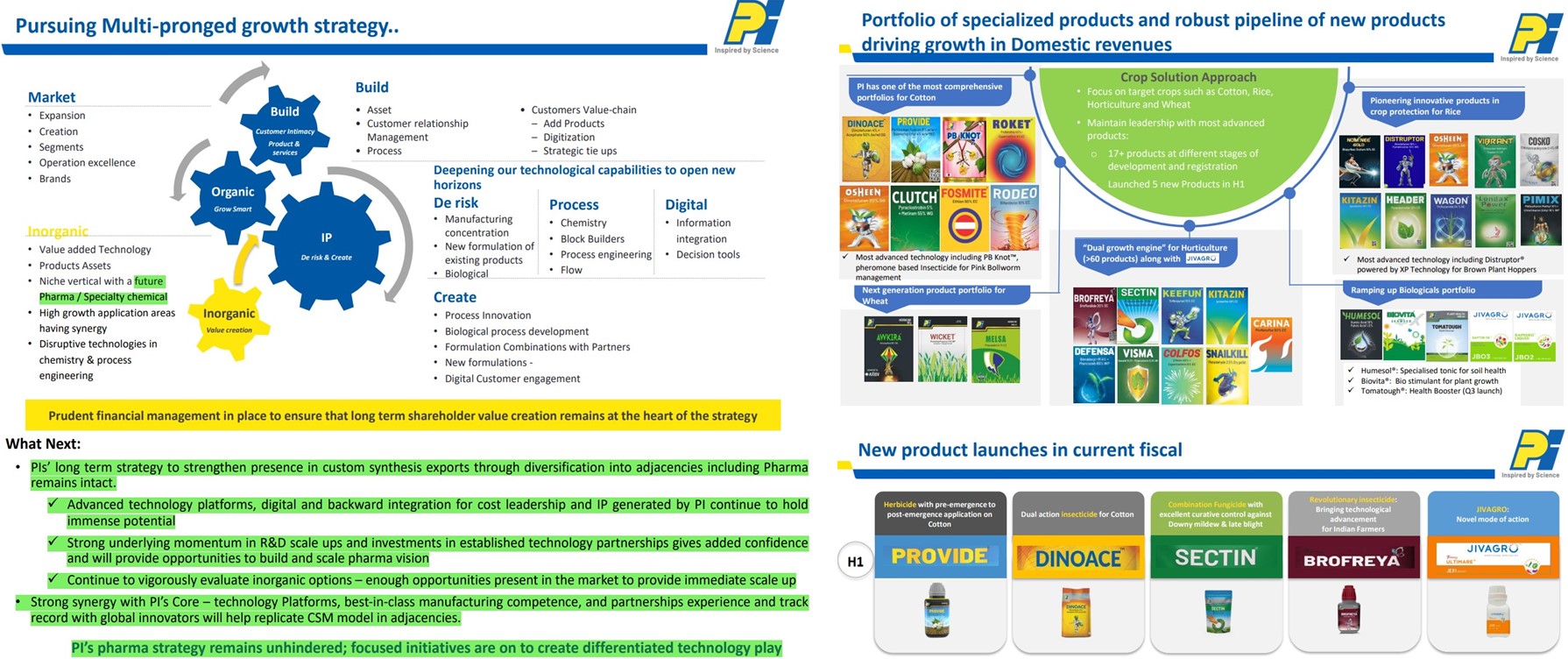

With 130+ Patents Filed, > 40 Products at Different development Stages, 15 New Business enquiries in H1FY23 out of which > 25% are from Non-agchem, 17+ Products at Different Stages of Development & Registration, Launch of 5 New Products in H1FY23, and 9 New Molecules Commercialized in FY22 – Company has not only build a Strong Product Portfolio of Market Leading Brands, but is also now foraying into the Electronic Chemicals and Pharma Space.

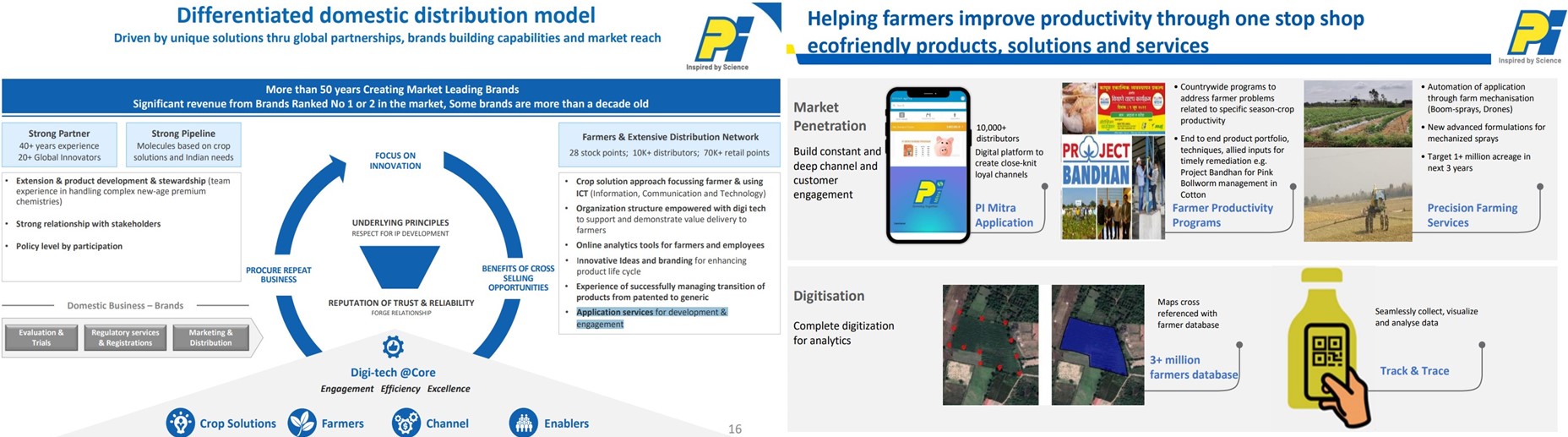

PI Industries – Differentiated Domestic Distribution Model

With 10,000+ Channel Partners, 80,000+ Retailers, and 28+ Stock Points PI Industries has an Extensive Distribution Network through which company’s Innovative Products have reached to over 3 millions Customers, from all over the country.

Farmer Centric-Crop Protection Solutions, Organization Structure Empowered with Digi-Tech to Support and Demonstrate Value Delivery to Farmers, Online Analytics Tools for Farmers, Innovative Ideas and Branding for Enhancing Product Life Cycle, Experience of Successfully Managing Transition of Products from Patented to Generic, App Based Services (PI Mitra Application) for Deep Channel and Customer Engagement, Countrywide Programs to Address Farmers Problems related to Specific Season-Crop Productivity, End to End Product Portfolio, Techniques & Allied Inputs for Timely Remediation, Automation of Application through Farm Mechanisation (Boom-sprays, Drones), and New Advanced Formulations for the Mechanized Sprays – are some of the outcomes of Differentiated Domestic Distribution Model.

PI Industries – Competitive Advantages And Growth Levers

1) – Company’s Differentiated Business Model through which it:

i) – Focuses on Selected and Patented High Margins Innovative In-Licensed Products, in the Domestic Agro Business;

ii) – Gets the Patented Molecules from the Global Innovators, right from the Early Stages of the Life Cycles of these Molecules, for Providing the High Margins Custom Synthesis Manufacturing, Development, Marketing, and Scale-Up of the Manufacturing Processes.

2) – Long Term Relationships With Global Innovator MNCs & Strong Brand Building Capabilities – PI Industries has been associated with some of the Top Global Innovator MNCs for more than 40 Years and it took PI almost 15 to 20 years, with each of these MNCs, before it could win the Trust of these companies and becomes the Numero Uno choice for these Global Majors;

3) – Well Established Distribution Network & Strong IT Infra – In last 10 years, PI Industries has more than Doubled its Retail Touch Points from 35,000 to ~ 80,000+, whereas nos. of Distributors has gone up to 10,000+ from ~ 8,500 in 2013.

These Channel Partners along with PI’s Strong and Experienced Field Force Visits the Villages and Farmers Regularly to conduct 1 on 1 and Group Meetings, Impart Knowledge and Training on Improved methods of Agriculture, to Increase Yield and Productivity.

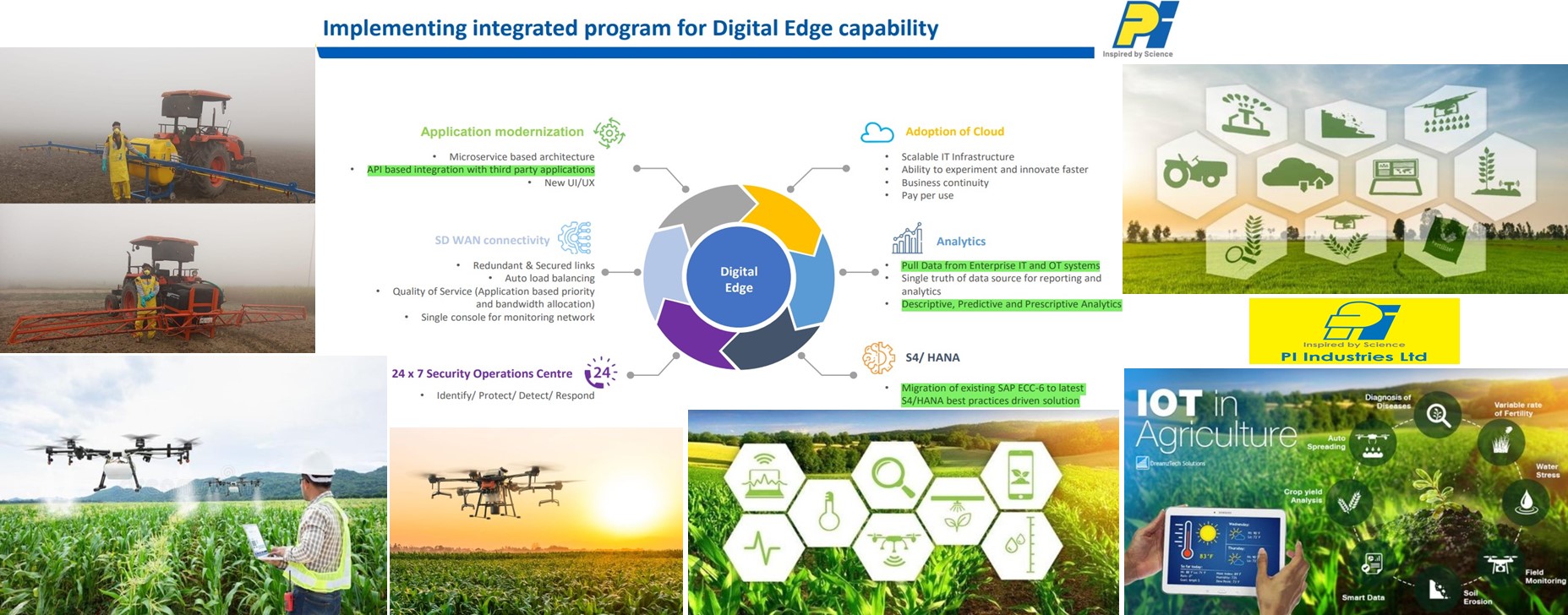

PI Industries is one of the First Indian Company in Agchem Space to implement SAP, besides this segment has also adopted multitude of Digital Tools to Virtually Connect to Channel Partners & Farmers. PI has Integrated newly acquired company Jivagro Ltd, with it’s Digital Eco-system, which includes myPI (company’s corporate Intranet), IT Service Management, Success Factors, Agri Digital Platform, LIMS etc.

Company adopted CIGMA to assist it in the Fine Chemical Business, from Enquiry to Commercialization Stage and Launched mPower for Field Force Management and CRM. Later the Channel Order Module was also added to mPower Platform, allowing PI’s Channel Partners to Directly Place and Track their orders via their Mobile Application (PI Mitra).

PI’s SAP ARIBA (an End Digital Procurement Platform) helps it with functions such as Vendor On-boarding, Selection & Assessment, Strategic Sourcing, Negotiations and Payments.

PI’s R & D Platform – Electronic Laboratory Notebooks (ELN), has been augmented to include a variety of Protocols and Workflows, involving a number of Trials and Studies. In addition, a number of AI based tools and technologies have also been implemented, for Specific requirements of the company’s scientists, to aid in Faster Decision Making and Shortening of the Project Lifecycles.

Recently in FY23, company has also added:

i) – Adaptive Controls to Optimize Yield, Quality, Energy & Throughput;

ii) – Sensor-based Data Capturing KPI Monitoring in Utilities;

iii) – Fleet of 300+ advanced Boom Sprayers &;

iv) – Also Piloting Drone application.

4) – Entry & Exit Barriers in the Industry

5) – Strategic Acquisition & Continuous Expansion – Since PI’s Domestic Portfolio is Majorly into Rice, Wheat etc. so company acquired Isagro in 2019, as this business was Mainly into Fruits & Vegetables. Given that the Capacity Utilization at the time of acquisition was only ~ 30%, so there was Huge Headroom available for the Improvement. Therefore, PI decided to Increase this Utilization to > 90%, so as to Triple the revenue generated within next 2 years i.e. by the end of FY22.

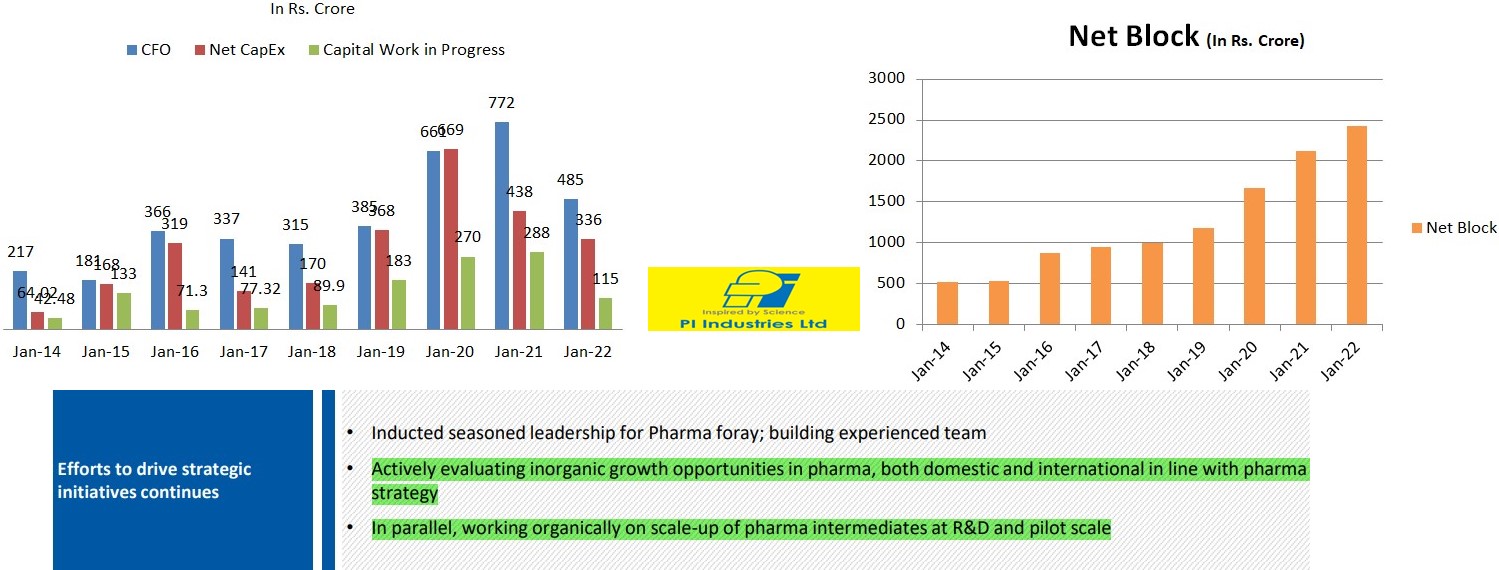

Besides, With Surplus Cash of ~ Rs. 2321 Crores at the end of H1FY23, PI is Continuing to Identify and Finalise Value Accretive Inorganic Growth Opportunities, through Acquisitions, in line with the Company’s Long Term Strategy!

PI Industries have been continuously Incurring CapEx, to support its Growth. Whenever, company gets a Confirmed Order from an Innovator, it Starts Building the Capacity basically via Multi-Product Plants (MPPs). Continuing with same, Total CapEx for H1FY23 is ~ Rs. 120.4 Crores, which is in line with the Expansion Plan.

PI Industries – What Will Drive The Growth In FY24 & Beyond?

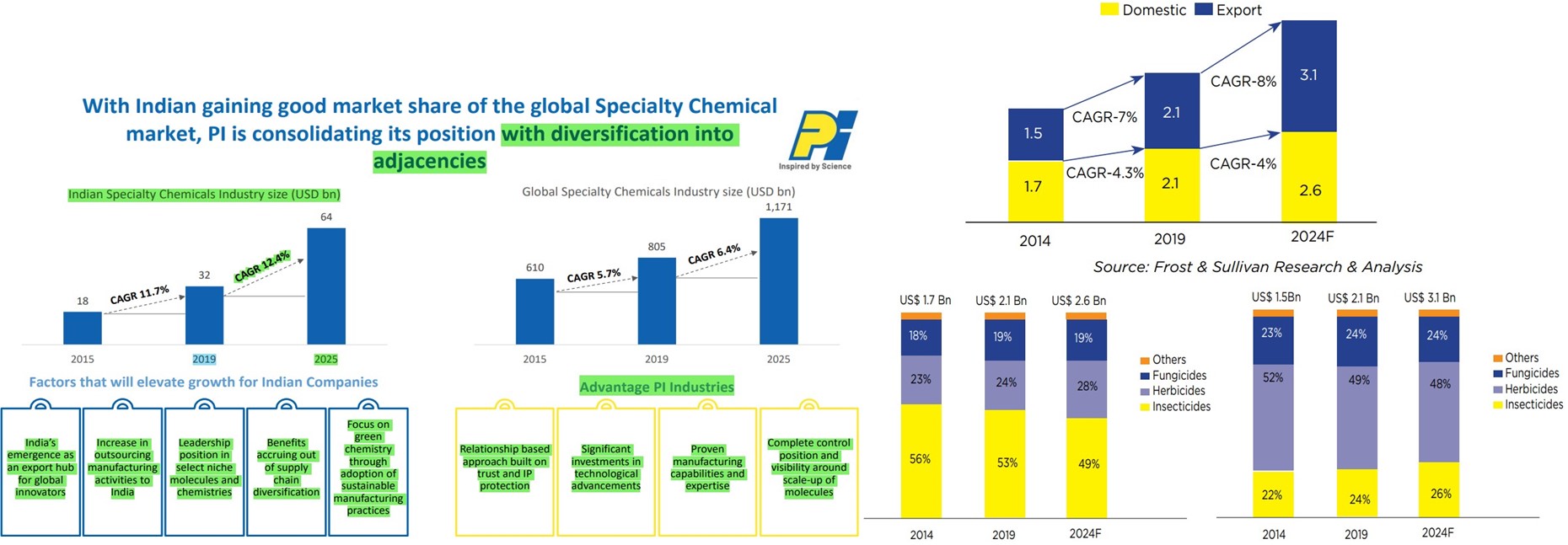

India ranks as 5th Largest Producer, 4th Largest Exporter and 13th Largest Importer of Agrochemicals in the world. Valued at $2.1 billion in 2019, Indian Crop Protection Chemicals Market is estimated to grow by 4% annually to reach $2.6 billion by 2024, whereas India’s Crop Protection Chemicals Exports are Projected to Grow to almost 55% in the year 2024 (By Value).

The prospect of the sector is promising given the low penetration of the agrochemicals in India at 0.4 kg/ha as compared to up to 13 kg/ha in US, Japan, China etc.

Favorable factors such as Regulatory Compliance, R & D Capability, IP Protection, Low Cost Manufacturing, Government Support, and the Scale and Maturity of the Indian CPC Industry, shall Power India to gradually Expand its Share in the Global CPC Domain – (To know more read: https://jyadareturn.com/specialty-chemicals-stocks-long-runway-of-growth/ and https://jyadareturn.com/srf/)

As the Commodity Prices are Expected to remain Robust, owing to Rising Global Demand, and Strong Demand for Insecticides, Fungicides, Herbicides and Bio-Nutrients during 9MFY23, so PI Industries is Confident of Delivering 20%+ Revenue Growth in Q4FY23 also, with Continued Improvement in Margins and Returns, given that the Indian Specialty Chemicals Sector itself is expected to grow at ~ 12.4% CAGR till 2025, whereas Agchem Space is expected to Grow at ~ 4% for the Domestic Market and at ~ 8% for Exports, till FY (2024-25).

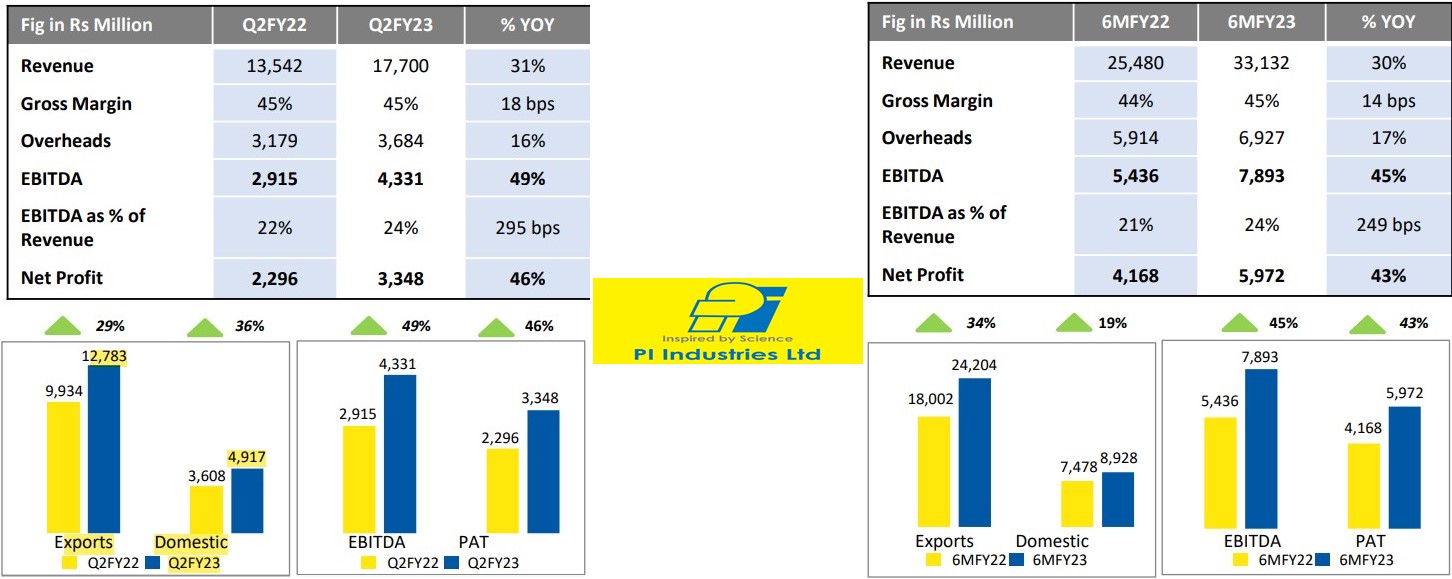

Strong Financial Performance of PI from Q2/H1FY23 also continued in Q3FY23, as the company has seen YoY Revenue Growth of 19%, EBITDA Growth of ~ 40%, and PAT Growth of whopping 58%, while the company’s Order Book has swelled to US$ 1.8 billion!

Total Revenue Growth was mainly Driven by 23% Revenue Growth in the Exports, which constitutes ~ 72.2% of the total revenue, although Domestic revenue has increased Only ~ 2% as the Institutional Sale remained Subdued, during Q3FY23, due to Higher Channel Inventory. Besides, growth of certain Generics has also been Muted due to Adverse Weather Conditions.

Exports revenue growth of 23% was Driven by the Volume growth of ~ 9% and Price & Currency growth of ~ 14%. New Innovative Agri-Brands Launched recently, has also contributed to this growth.

PI’s Gross Margin has Increased by 47% Partially due to Cost Pass Through and Favourable Product Mix, whereas EBITDA has Increased by 40% mainly due to Operating Leverage Benefits and Tight Control on Fixed Overheads. PAT Growth of 58% is Attributable to this EBITDA growth only!

Due to Higher EBIDTA and Efficient Net Working Capital Management, not only did the Working Capital Days has reduced to 90 days, vs. 103 days on 31-Mar-22, but the Cashflow from the Operating Activity for 9MFY23 has reached Rs. 995.10 Crore which is the Highest Ever CFO, since the inception of the company, even if considered on Full Year basis!

Also the Inventory levels has Reduced in terms of Days of Sales to ~ 81 days, in line with the Higher Revenue and Adequate Safety Stock to Avert Supply Chain Disruptions.

Company’s CapEx estimate of Rs. 500 Crore for the whole FY23, is still in line with its Plan.

The share of Non-Agchem enquires has rose to 25% of the total, which is going to Increase further, as per PI’s Strategic Diversification and Expansion into the Adjacencies. PI Industries aims to Commercialise up to 4 to 5 New molecules each year and to leverage this momentum, it will Accelerate the Capacity Expansion further!