Due to inflation, high raw material prices, and an increase in GST to 12% for footwear under Rs 1,000/-, the footwear market has seen a resistance from the consumers, as they have shifted towards the cheaper products

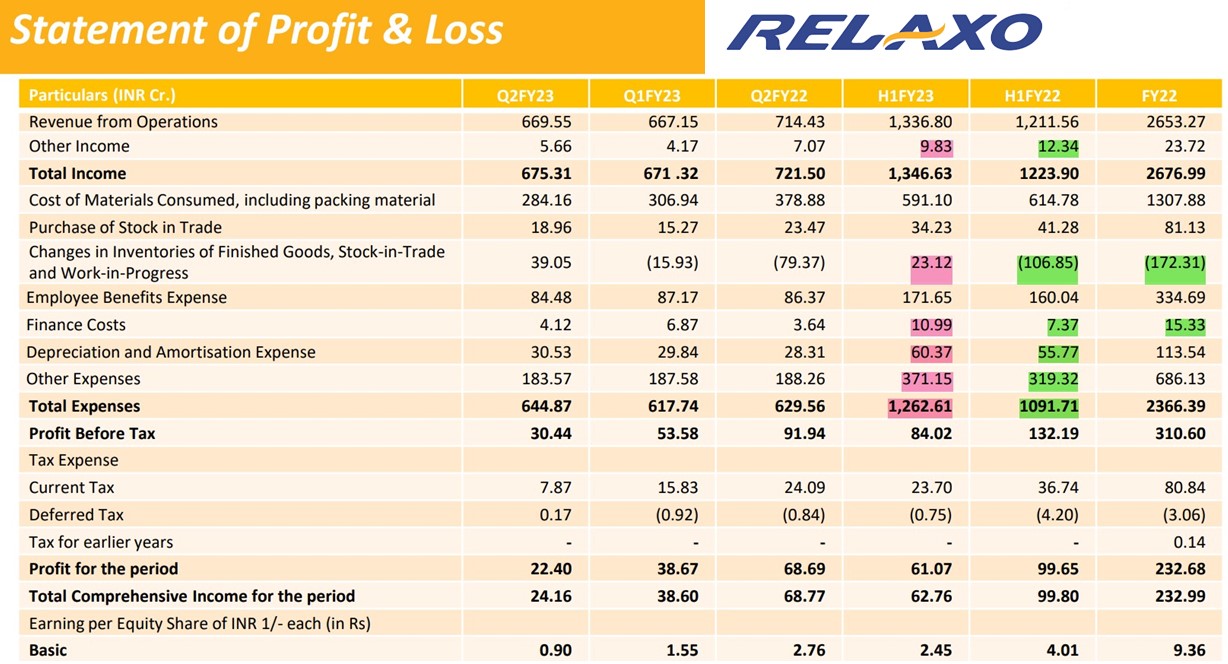

Relaxo Footwears being a dominant player in the open footwear space (with ~ 76% of sales) and given that more than 85% of Relaxo’s Portfolio falls under the Rs 1,000 category (as in H1FY22) has seen its revenue for Q2 FY2023 getting declined by 6.3% YoY, dragged by weaker volumes and price cuts in the mass footwear segment as the consumers has shifted to cheaper unbranded alternatives amid inflationary pressures.

Inflation has been the big killer of demand, especially in the non-urban areas (T-II & T-III towns), which actually is a big market for Relaxo Footwears Ltd.

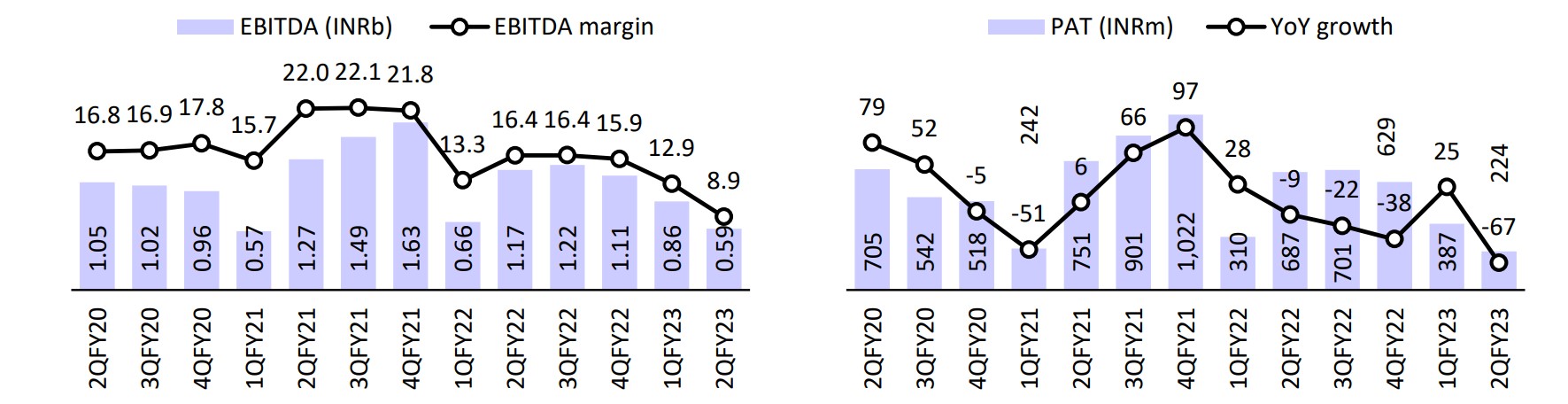

Consequently, Relaxo Footwears in Q2FY23 has posted its worst performance of the last 10 quarters as it could only sold 3.9 crore of pairs thereby registering Volume & PAT decline of 15% & 67% YoY, respectively.

But did Relaxo Footwear lose any market share to Campus Activewear in Q2FY23 or H1FY23? Answer is NO, although Campus Activewear Ltd. is a market leader in the Sports & Athleisure (S & A) Footwear Category with ~ 17% market share (as of FY21) and within this category it have been growing faster than the market, among all of its peers, with almost 2 to 3x the volume compared to the next largest competitor and hence, have grown @ 27% in the last 10 years.

So, is there any Threat to the Market Leadership of Relaxo Footwears Ltd. and will the Growth return in Q4FY23?

Relaxo Footwear’s Sales have Grown at 12% CAGR in last 10 years whereas its PAT has Grown at 20% in the same period and throughout this period, its OPM has remained in the range (11% to 21%) whereas NPM has remained in the range (5% to 12%).

Despite all the unprecedented challenges which Relaxo Footwears is facing at present, it’s TTM OPM & NPM are still at 14% & 7% respectively, whereas that of Campus Activewear are at 13% & 6% respectively in TTM – (Source: https://www.screener.in/company/RELAXO/).

Not only this, barring FY22 & FY19 Relaxo has generated FCF in last 10 years, whereas Campus could generate FCF only once in FY21 since FY(2017-18).

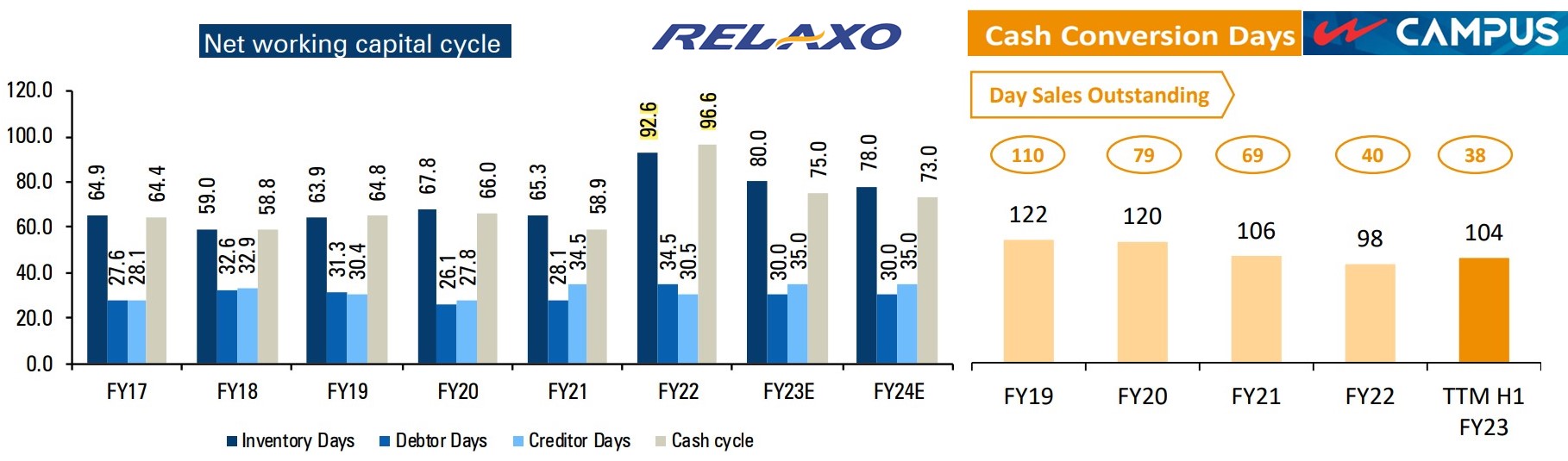

With just 34 Debtor Days & 82 Working Capital Days in FY22, Relaxo Footwears Working Capital Cycle Still seems better than Campus Activewear for which both are respectively 41 & 113 days, although Campus Activewear has shorter Cash Conversion Cycle (CCC) of 138 days compared to Relaxo’s CCC of 170 days – (Source: https://www.screener.in/company/CAMPUS/). So then what went wrong in FY23 for Relaxo Footwears especially?

Unprecedented Multiple Headwinds for Relaxo Footwears Business since FY22

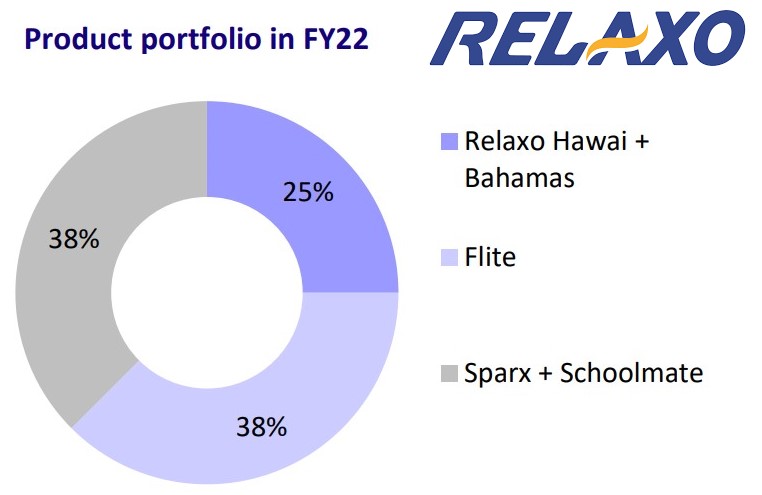

Inflationary Pressure in addition to global Supply Chain Disruption have been detrimental to the entire Footwear Industry, but Increase in GST from 5% to 12% on Footwear Under Rs. 1000/- has especially Killed the demand of mass segment products of Relaxo Footwears, as this segment constitutes ~ (38 + 25) = 63% i.e. 2/3rd of its Total Business (in whole FY22).

Inflation has affected the Purchasing Power of rural market more than the Urban India, as a result there has been a shift in consumer habits as they have moved towards cheaper alternative, at the cost of quality.

This prompted the company to take an aggressive price correction in September 2022 to remain competitive in the current market. This price specialization approach has been welcomed by distributor and customer, which would help the company to clear high-cost inventory in Q3FY23 and ultimately improve its volume number going ahead.

The performance remained subdued mainly on account of fall in volumes in Q2 FY23 in the categories serving the masses, whereas the degrowth in EBITDA was mainly due to steep increase in raw material prices.

Unprecedented Extreme Volatility in Key Raw Materials of Relaxo Footwears

Relaxo’s Hawaii Slippers are ~ 20% natural rubber and ~ 80% ethylene-vinyl-acetate (EVA) polymer, which determine the properties of the footwear – whether it’s durability or the comfort. Similarly, other Key raw material (RM) are PVC, low density polyethylene, polyurethane (PU) etc. which are used for manufacturing of both Open Footwears (which constitutes ~ 80% of revenue) and the Closed Footwears (which constitutes remaining ~ 20% of revenue).

EVA which is a major raw material for Relaxo Footwears (as ~ 50 to 60% of the revenue, as in H1FY23, comes from the EVA-based products) has seen extreme volatility in prices, as the prices has increased from Rs. 120/kg to Rs. 300/kg and then declined to Rs. 160/kg between May 2021 to March 2022 and then moved up again to Rs. 200/kg in FY23.

Relaxo Footwears consume ~ 1,000 tonnes of EVA Polymer per month i.e. 12,000 tonnes yearly; due to the said extreme volatility of EVA between May 2021 to March 2022, average per kg cost of EVA in FY22 was as high as Rs. 220 which used to be ~ Rs. 120 per kg till April 2021. Hence, cost of single RM has jumped by Rs. 120 crore which increased further, as the average per kg cost of EVA has increased to Rs. 240 during H1FY23 – (Source: https://www.bseindia.com/xml-data/corpfiling/AttachHis/7abab3f7-18a7-4e13-8f80-05ff5379eaf9.pdf)

Since, Relaxo Footwear consume such a huge quantity of RMs (including EVA) to manufacture ~ 17.5 crore of Footwear Pairs (as in FY22), company has to import most of the raw material…why? Because Local Sources of RMs providers may only fulfill the requirements of small manufacturers and if Relaxo go to these market to procure its RMs than the rate will get Out of Control as the company would be requiring ~ 1,000 tonnes of EVA on monthly basis.

Therefore Relaxo has to maintain at-least 6 months Long Supply Chain for these Costly imported RMs, so as to ensure that there is No Disruption in the manufacturing process. Due to such long supply chain, company did carried its costly inventory through these period of extreme volatility where company might have also purchased some quantity of RMs (like EVA) at rate as high as Rs. 300 per kg, owing to this high cost inventory – cost of goods sold (COGS) per pair that used to be ~ Rs. 60 to 65, has increased to an all-time high of Rs. 88 per Pair (up 25% YoY) in Q2FY23.

Further management expects old inventory to be exhausted by December, which could further lead to deterioration in gross margins in Q3FY23 as well, due to correction in ASPs (Average Selling Prices).

Earlier Relaxo Footwears purchase department was able to predict on what will be the price of EVA in next FY, but now due to this extreme volatility it is not even able to tell what is going to be the price of material in the next Quarter.

Local Unbranded Small Players Eat Into Relaxo Footwears Mass Segment Business

The performance in Q2FY23 has remained subdued mainly on account of Fall in the Volumes across the categories serving the masses, which falls under Rs. 1000 category and constitutes ~ 60% of the Relaxo’s Total Revenue in H1FY23 (although it was more than 85% in H1FY22) and mainly covers EVA-based products under brands like Bahamas, Relaxo Hawaii, & Flite (EVA category).

Given the affordability issues with the Relaxo’s mass customers (due to Inflationary Pressures), a transient shift was seen from Relaxo’s mass segment products towards Unbranded Local Cheaper products, as customers were ignoring the quality of products & not getting bothered on whether the product will last long or not.

In such extreme volatile environment of RMs, products of the Local Unbranded Players are not only cheaper but also below the Relaxo’s Cost of Production in the mass segment category given their access to the Local Cheaper RMs Sources which were offering EVA at just ~ Rs. 160 per kg to the small manufacturers, compared to Relaxo Footwear average rate of Rs. 240 per kg, which it imported from the international market.

Due to this, Local Unbranded Players got the temporary Competitive Advantage over Relaxo Footwear and accordingly they have taken away Relaxo’s market share from the mass segment category.

Relaxo Footwear taking Extended Price Corrections to Stay Competitive & Survive the Volatility

To survive the challenging time and stay relevant in the market, Relaxo Footwear has taken Price correction of ~ (15% to 20%) in September 2022, across the Open Footwear Category’s EVA-based products under the brands Bahamas, Relaxo Hawaii, & Flite (EVA category) where it has seen Value Degrowth of ~ 20% especially in Relaxo Hawaii.

This Cautious Call for Price Correction was not based on the Relaxo’s production cost, but on the market conditions so as to maintain market share, although in the process bottom line (PAT) has & will get dented, but company may be able to revive its subdued Sales Volume from Q4FY23.

Given Relaxo Footwears supply chain is Long of ~ 6 months, so this Price Correction is likely to stay extended till Q3FY23 as by then all the costly inventory will get flushed out and Normal Gross Margin may appears to be returning, although management likely to remain watchful on the affordability of the mass segment and will accordingly take timely corrective actions.

So,where has been the Growth during these Challenging Times for Relaxo Footwears

Relaxo Footwears Brand Sparx is performing well as the demand for Sports and Athleisure (S & A) category continues to be strong. The brand contributes ~ 41% to the total revenues, with Closed Shoes contributing ~ 60% & Open Sandals contributing remaining 40% and together both are growing at ~ 30% in terms of Volume.

Moreover, sports shoe has around 800+ ASP whereas sports sandal ASP is around 500+ and Average ASP in Sparx stood at ~ Rs. 450.

As the customer preference lies more in the Mid-Premium and Premium segment than in the Mass segment, so given the current capacity of sports shoes/sandals is almost fully utilised (capacity: 50000 pairs per day), hence the management has proposed to add another 50,000 sports shoes capacity per day to cater to this strong demand.

The plant is expected to be operational from April 2023. For the Sparx brand, company is looking to expand presence in the north and eastern region as the brand has already good foothold in the southern and western regions.

Further, as the company is expanding the capacity therefore it will have different portfolio, especially SMUs for e-commerce and differentiated products for the offline so as to have control over the prices.

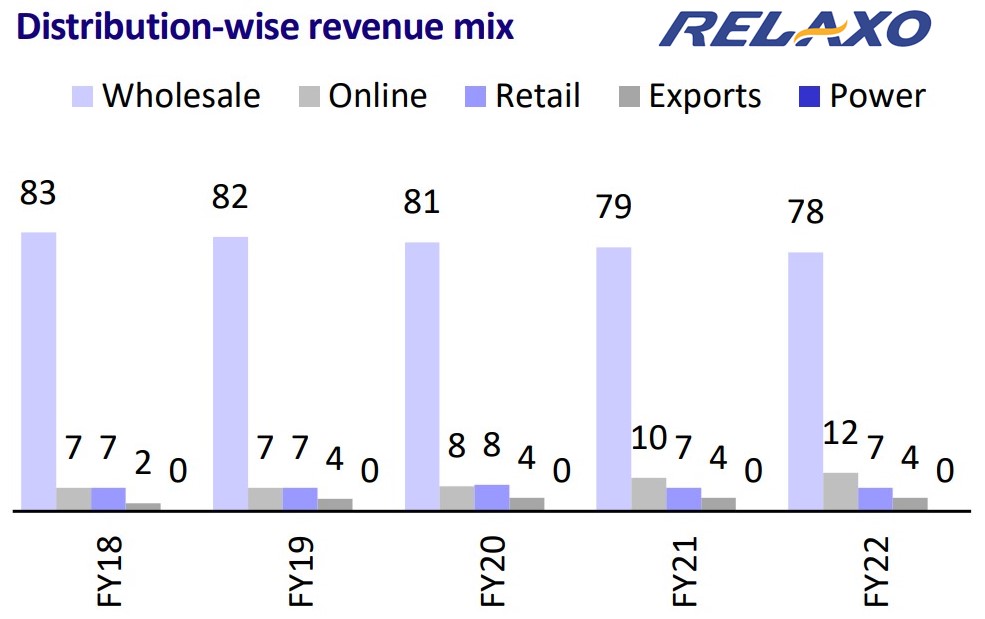

Relaxo Footwears have ~ 60,000 Wholesale Outlets and also have Geo-Tagged ~ 100,000 outlets, in which 10,000 outlets will be covered through Sparx.

In FY22 Relaxo Footwears 12% of Total revenue came through Online Sales, but for Sparx this contribution from Online was even more than 25%. Company expects to increase the Online Sales to ~ 15% in next 2 to 3 years.

Did Relaxo Footwear Lose any Market Share to any of its Competitors in H1FY23?

Relaxo Footwears have more than 300 sales officers visiting their ~ 60,000 outlets routinely, through which company keeps a track of its primary sales, the secondary sale, & the shelf space and accordingly it has found that the volume degrowth in Hawaii and EVA category during Q2FY23 has happened, as the shelf space has been taken over by the Unbranded Unorganized Players, due to the competitive lower price which they offered to the customers, looking for the cheaper products in the mass segment, during recent unprecedented RMs price volatility and existing Inflationary Pressures.

Despite of that, Relaxo haven’t lose any Market Share to any of its Competitors, including Campus Activewear Ltd.

Strengths and The Growth Drivers for Relaxo Footwears & Campus Activewear

Relaxo Footwears Market Share in the organised, Non-Leather footwear category stands at ~ 20% and Despite selling ~ 17.5 crore pairs in FY22, Relaxo’s current market share is Still < 10% of the Total Footwear Market.

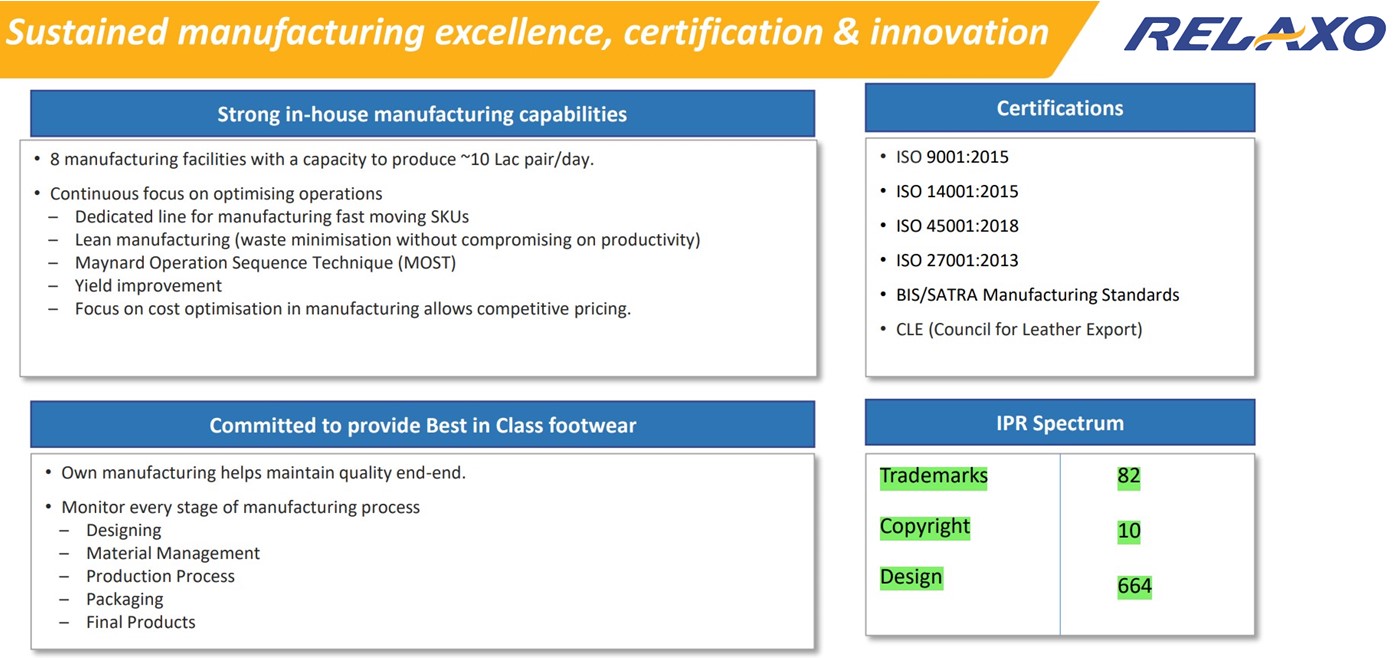

Relaxo Footwears have 8 manufacturing facilities with a capacity to produce ~ 10 Lac pairs/day, where it uses:

1) – Lean Manufacturing Methodology (Waste Minimisation Without Compromising on Productivity);

2) – Dedicated line for manufacturing fast moving SKUs;

3) – Maynard Operation Sequence Technique (MOST).

This Focus on cost optimisation in manufacturing, allows Relaxo Footwears to have competitive pricing for its products in the market. In FY22, the company has initiated DMS 2.0 (Distributor Management System) for effective channel management and reseller engagement strategies. Further, company also have a competitive advantage of having 82 Trademarks, 10 Copyrights, and 664 Designs.

Given its Robust Balance Sheet, complemented by the Wide Distribution Network, Better Sourcing Capability and the Strong Brand Patronage, there is enough headroom for the long-term growth and further market share gains.

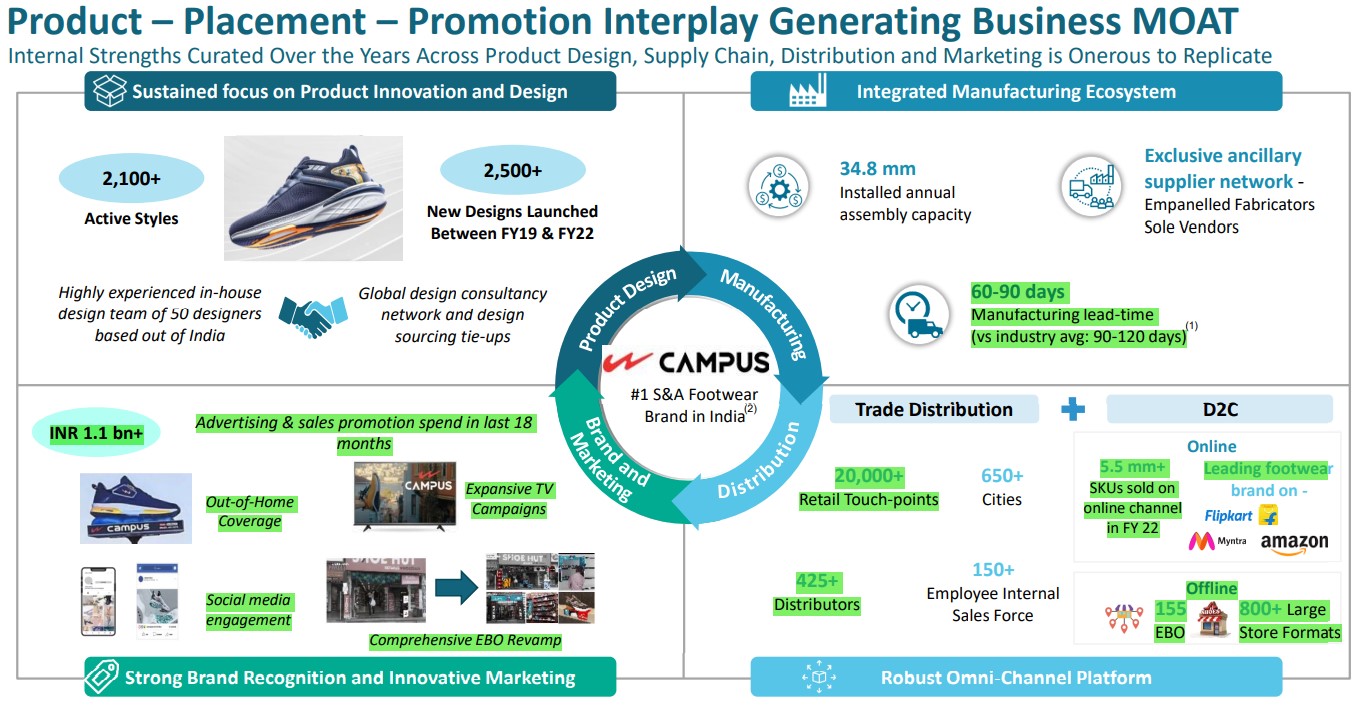

Campus is No.1 Sports & Athleisure (S&A) Footwear Brand in India with ~ 17% market share (as of FY21) and Annual Assembly Capacity – 34.8 mm pairs. All of its processes from Product Conceptualisation to Product Launch are typically managed within 120-180 days.

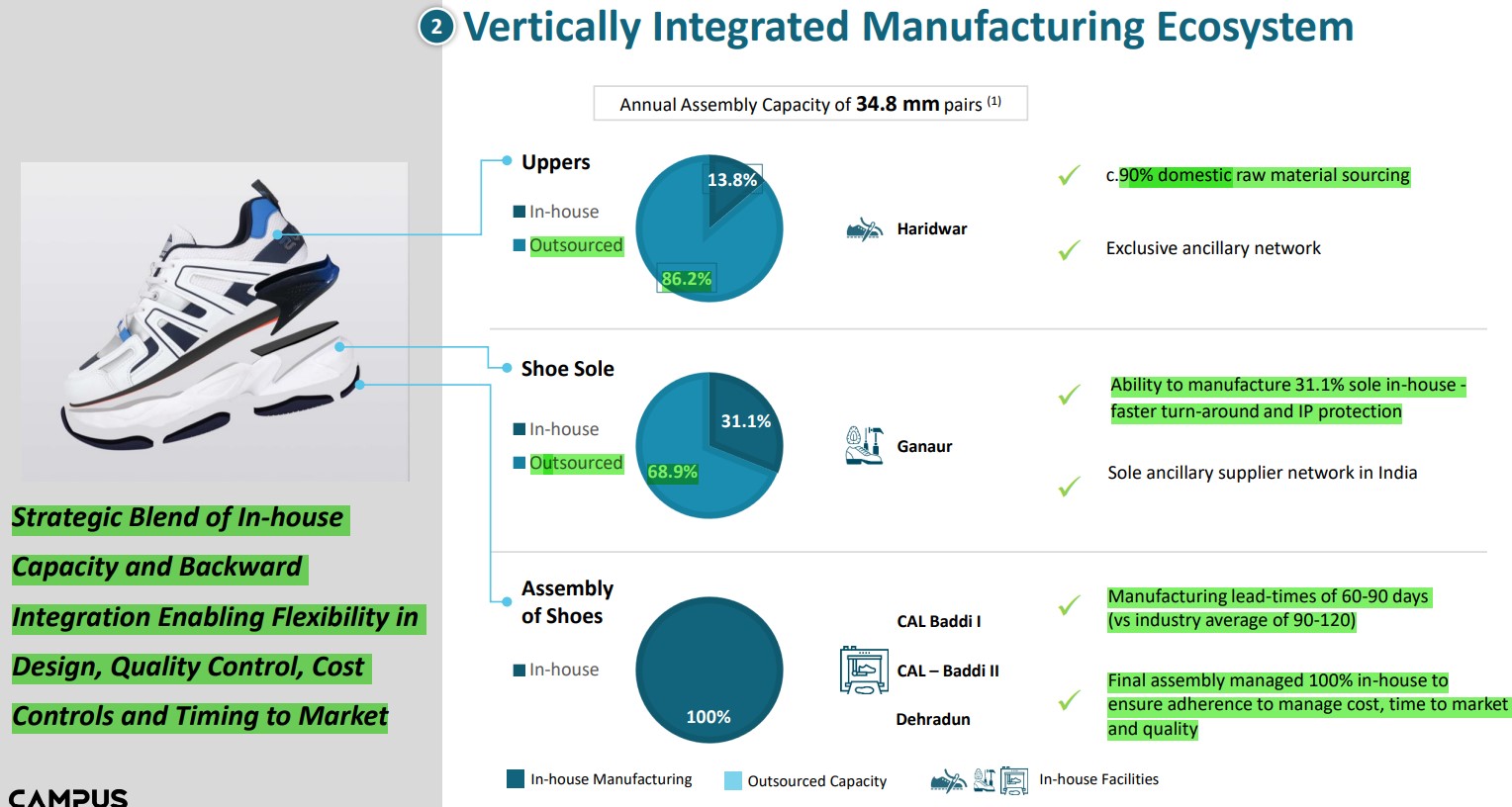

Company’s Strategic blend of In-house Capacity and Backward Integration is enabling its flexibility in Design, Quality Control, Cost Optimisation and Timing to the Market.

Key Pillars of Campus Business MOAT

1) -Superior Product Innovation and Design Capabilities: Deliver New and Differentiated Offerings for the Indian Market through Nimble, Fashion Forward and Segmented Approach to Curate its Product Lines.

2) – Vertically Integrated Manufacturing Ecosystem

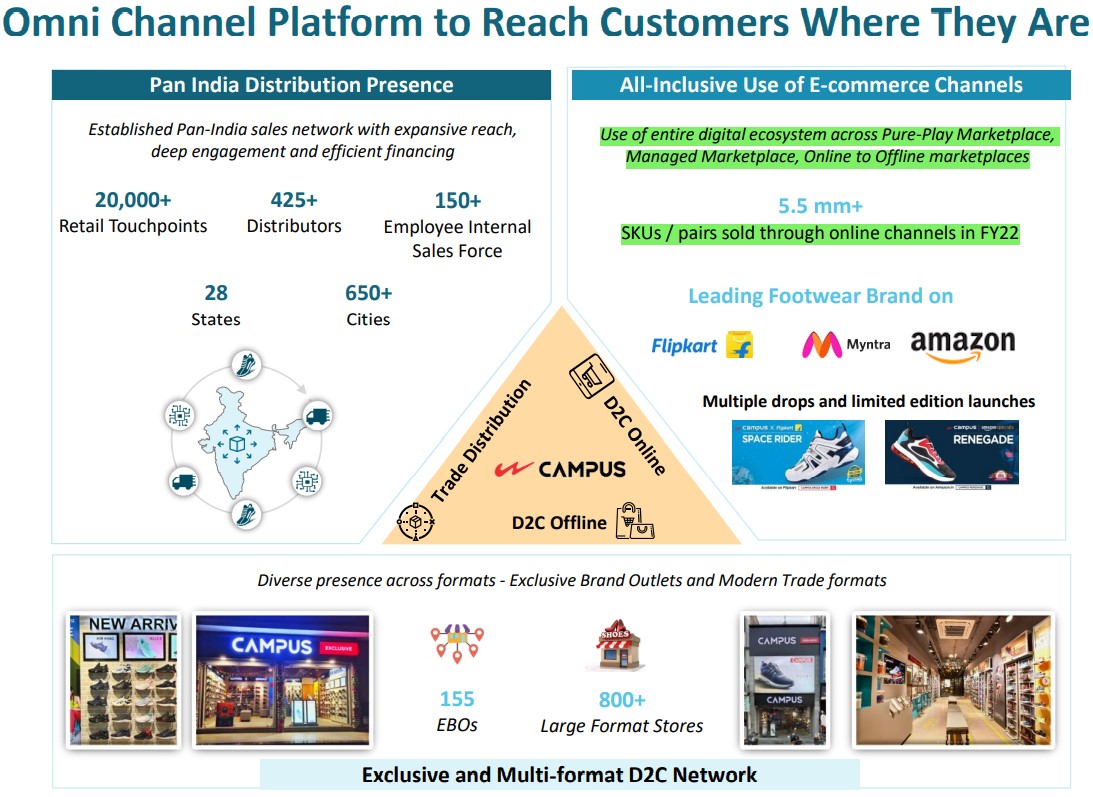

3) – Omni-Channel Customer Experience

4) – Innovative Marketing Capabilities: Pivoted away from stand-alone Trade Channel-Oriented Marketing to Consumer-Oriented Marketing techniques

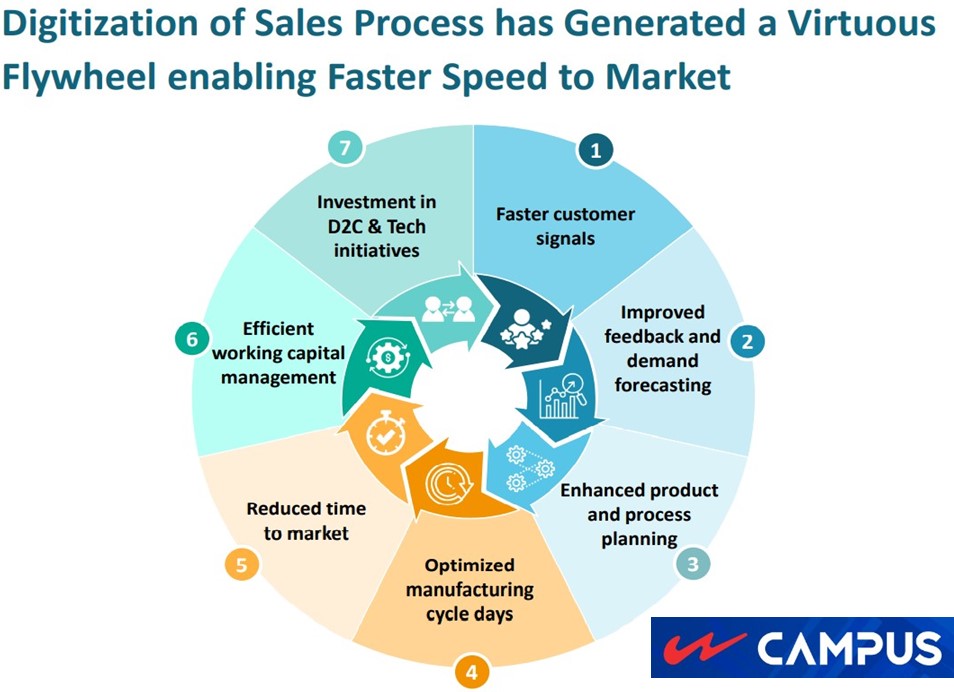

5) – Digitization of Sales Process: Campus Data Centric Approach allows it to understand Consumer Demand Trends, Design & Colour Preferences, Response to New Designs & Price Movements across the Categories on an On-going basis.

Digitization of Sales process has Enabled Faster Speed to the Market, Better Merchandising, and Greater Efficiency in Design, Manufacturing and Sale.

In last 6 Quarters whereas Working Capital Cycle of Relaxo Footwears has deteriorated due to Longer & Disrupted Supply Chains, Increased Cost of Production, and Volume De-Growth in the Mass Segment which also happens to be its major source of revenue contributing ~ 60% to the revenue, whereas Campus Activewear has shown Consistent Improvement in its Cash Conversion Days since FY19.

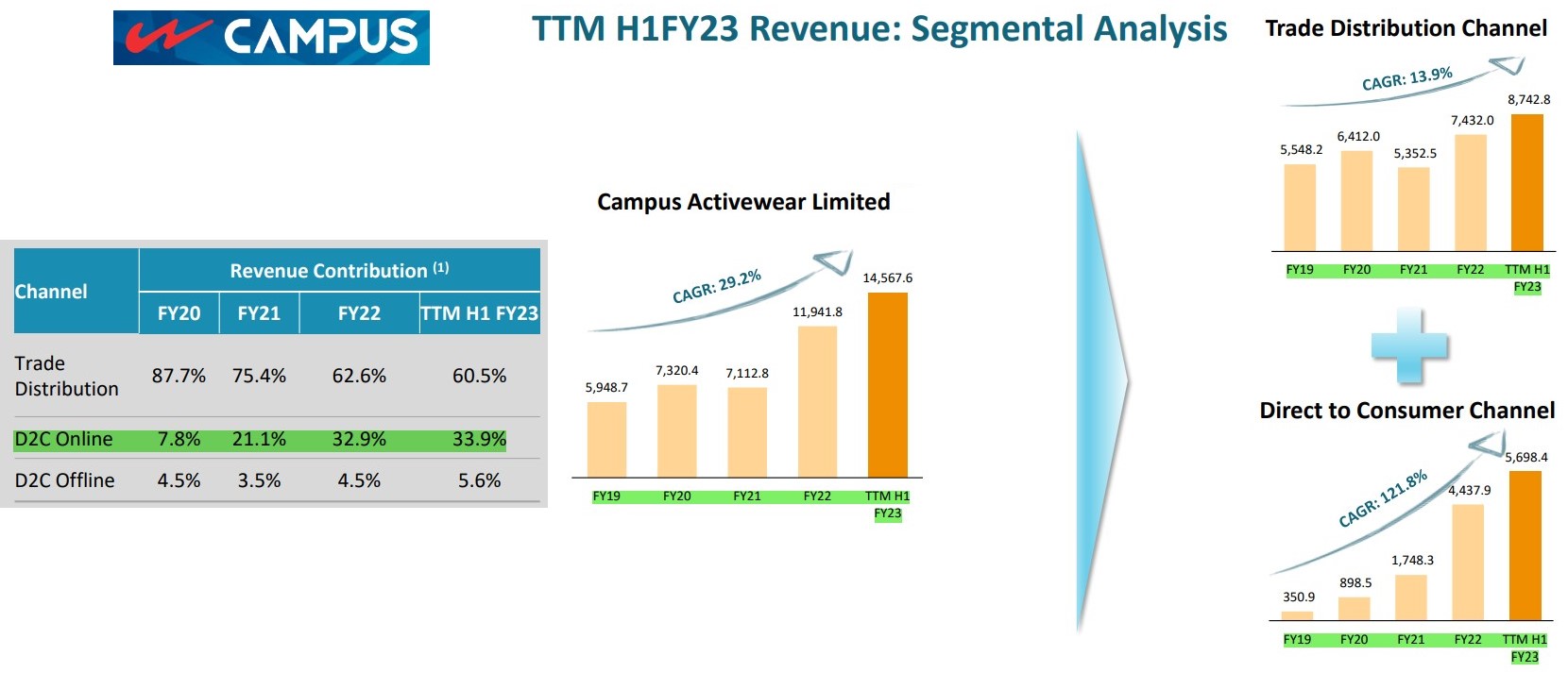

Moreover Campus has seen both Revenue & PAT growth in both FY22 and TTM in H1FY23, due to continues strong demand for its S & A products along with the growth of 39% of Sales through Trade Distribution Channels and 150% Growth in Sales on YoY basis, in FY22, from Direct-to-Consumer (D2C) Channel, as the company has Strategically & Consistently Shifted its Sales from Trade Distribution Channels and simultaneously increased the Sales Constitutes from D2C Online Channel, given the Higher Growth in the later channel.

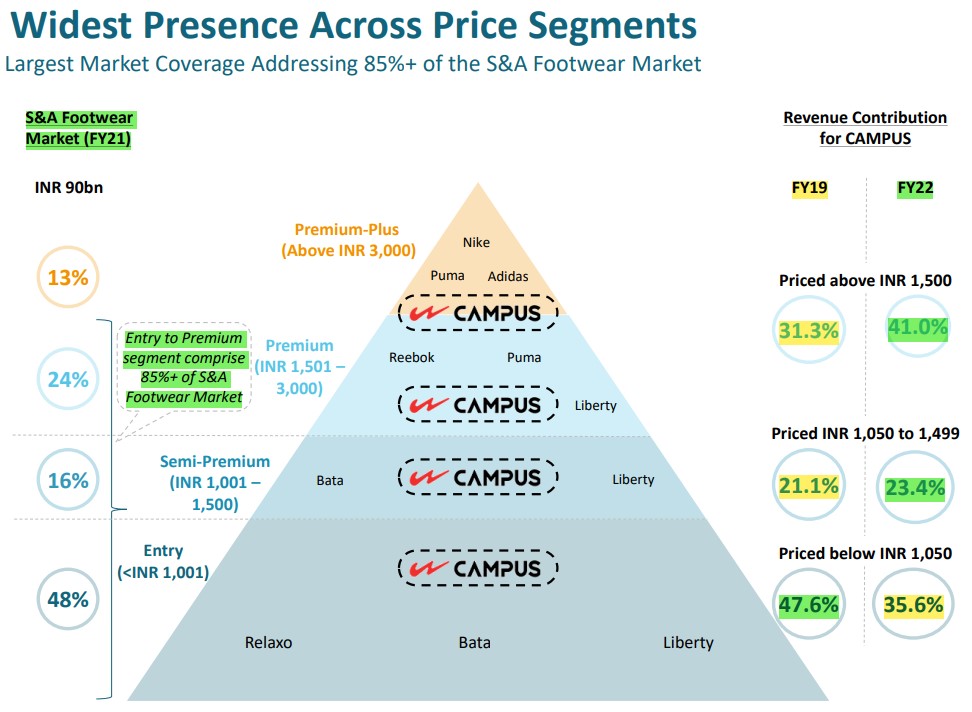

Compared to Relaxo Footwears major revenue contribution of ~ 60% coming from the mass segment (i.e. under Rs. 1,000 product category), Campus Activewear has just 48% revenue contribution at entry level (i.e. < Rs. 1001 Category) and remaining 52% is coming from (Semi-Premium + Premium + Premium-Plus) categories combined.

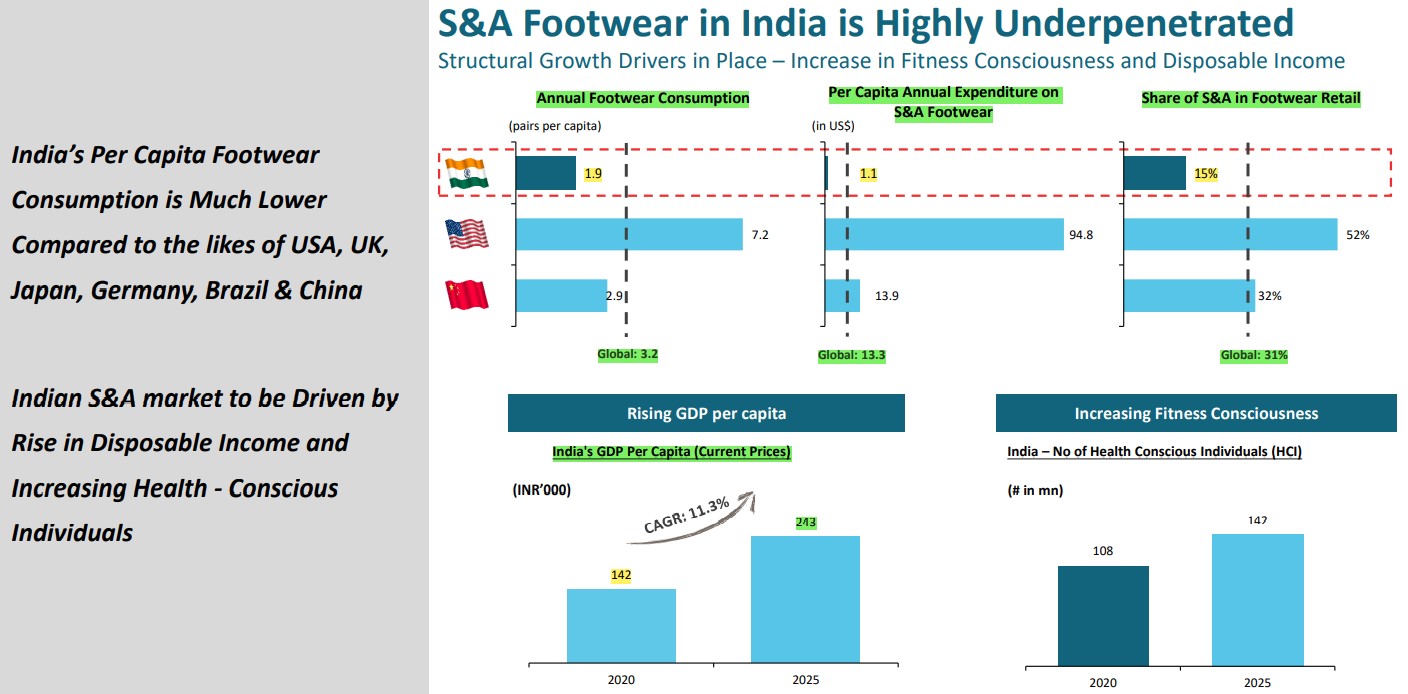

Moreover, the negative impact of Inflationary Pressure which is clearly & loudly seen in the mass segment category was not seen in the Premium or even the Semi-Premium segment as these products mainly have their demand from the Urban India where the impact of inflation on the purchasing power of the customers, hasn’t been much.

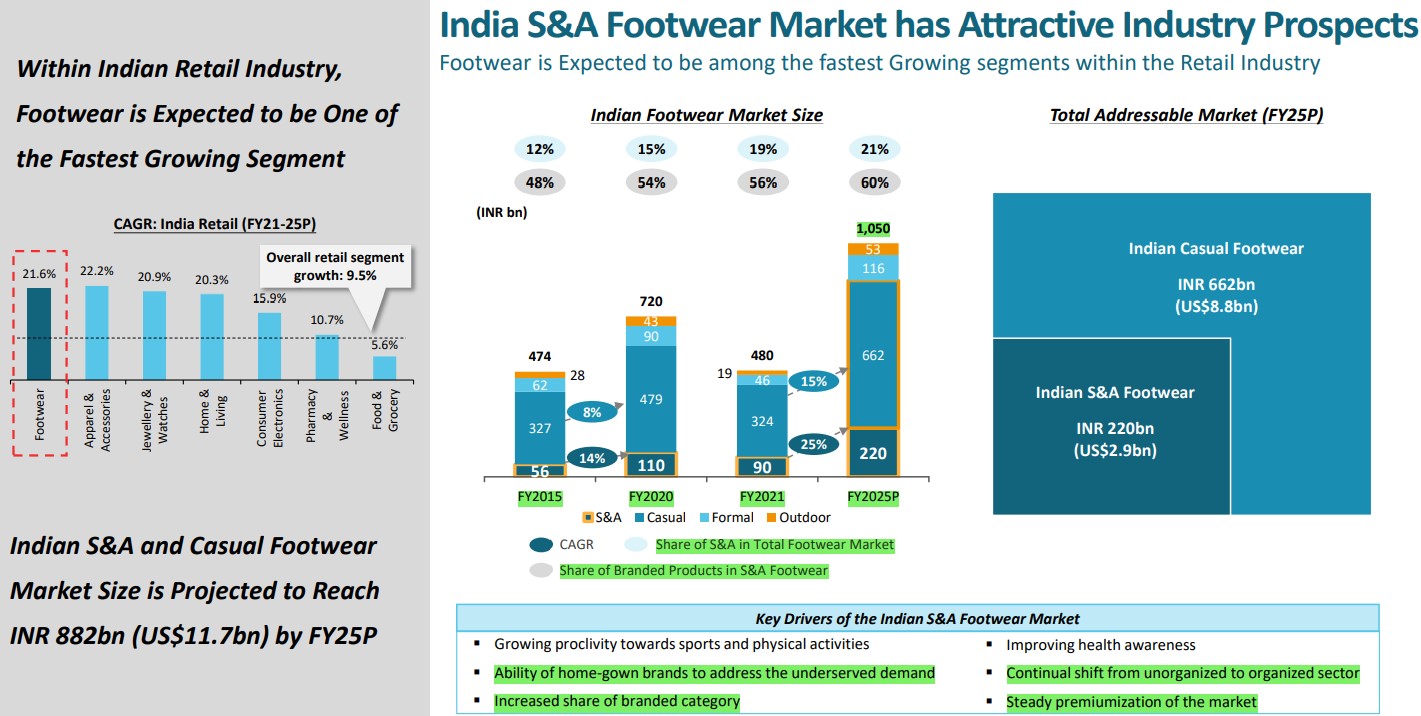

Within Indian Retail Industry, Footwear is Expected to be One of the Fastest Growing Segment as it may grow at ~ 21.6% CAGR between FY21 to FY25P, within this Footwear Segment Sports & Athleisure (S & A) is expected to grow at ~ 25% during the projected period, whereas other categories (Casual + Formal + Outdoor) are expected to grow combinedly at ~ 21% CAGR between FY21 to FY25P – To know more about Indian Consumption Growth Opportunities, Read:

i)- https://jyadareturn.com/why-these-5-stocks-still-have-lots-of-potential-for-growth/;

ii)- https://jyadareturn.com/specialty-chemicals-stocks-long-runway-of-growth/

Therefore, Both Relaxo Footwears and Campus Activewear still have enough headroom available for the Long Term Organic Growth.

Given that:

1) – The share of (S & A) category in the Total Footwear Market has consistently increased from 12% in FY2015 to 19% in FY2021 and is further expected to increase up to ~ 21% by FY2025P and;

2) – Share of Branded Products in this (S & A) category has increased from 48% in FY2015 to 56% in FY2021 and is further expected to increase up to ~ 60% in FY2025P.

Campus Activewear Ltd. has Strong Growth Drivers available at-least till FY2025 and for these reasons, even Relaxo Footwears is also aiming on expanding Sparx’s (Relaxo’s S & A Brand) capacity by 2x from 50,000 pairs/day at present, so that the revenue contribution of ~ 41% from Brand Sparx may increase further, thereby increasing mix of the Closed Footwear category in its overall product portfolio, which at present is Just ~ 20%.

For this reason, management has already guided an annual CapEx outlay of Rs. 800-1,000 million.

The size of the Opportunity to grow big is so Huge in the Indian Footwear Market, across the product categories whether it is mass segment or the Semi-Premium & the Premium Category, that it can easily accommodate Not only Relaxo Footwears Ltd. and the Campus Activewear, but also many other Organised Branded Players, provided they too have similar Competitive Advantages and Business Moats, as these 2 Big Players have.