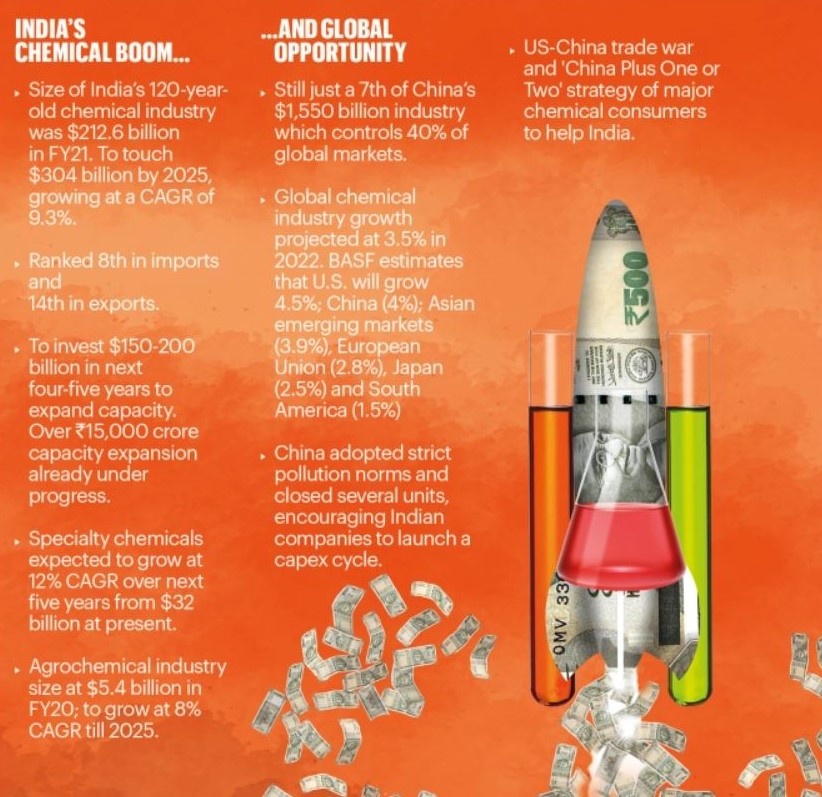

India’s $212 billion chemical industry is seeing unprecedented growth on the back of consumption economy, demand for niche products, rapid import substitution, and a Global Geo-Strategic demand shift from China due to supply-chain disruption (China+1 Strategy). Further, the challenge in Europe amid the war between Ukraine and Russia, has added on to such opportunities (Europe+1 Strategy) for the companies in this vast industry.

Within this Chemical Industry, Speciality Chemicals & Agro-Chemical Space has long-term structural growth for the reasons as cited above, along with stronger demand for their Niche products, opportunities in Contract Research and Manufacturing Services (CRAMS) and Import Replacement Prospects (focus on Backward Integration to reduce Raw Material imports) and Long Term Competitive Advantage due to stronger R&D capabilities are some of the reasons to believe that – These 6 Specialty Chemicals & 2 Agrochemicals Stocks has long runway of Growth.

Why these 6 Specialty Chemicals & 2 Agrochemicals Stocks has long runway of Growth?

The Long Term Tail Wind for the Entire Speciality Chemicals & Agro-Chemical Space.

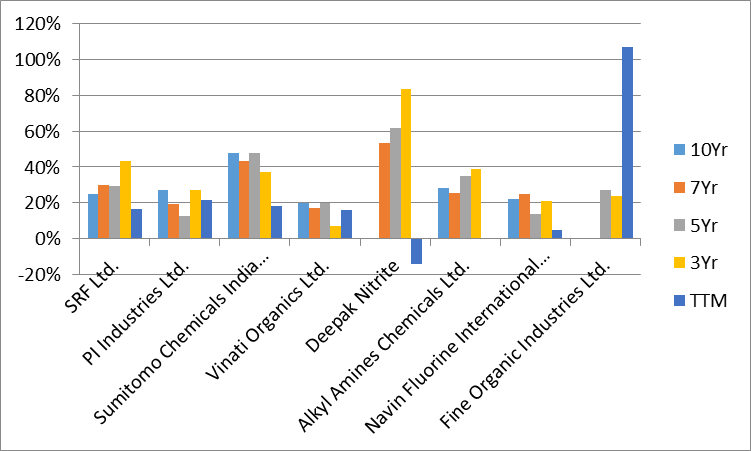

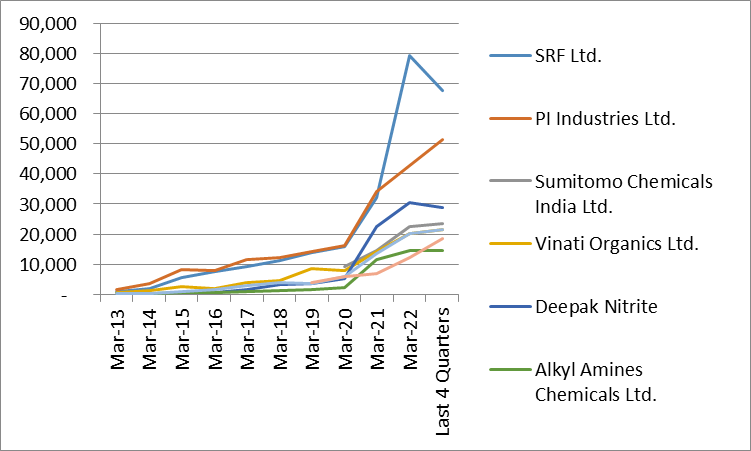

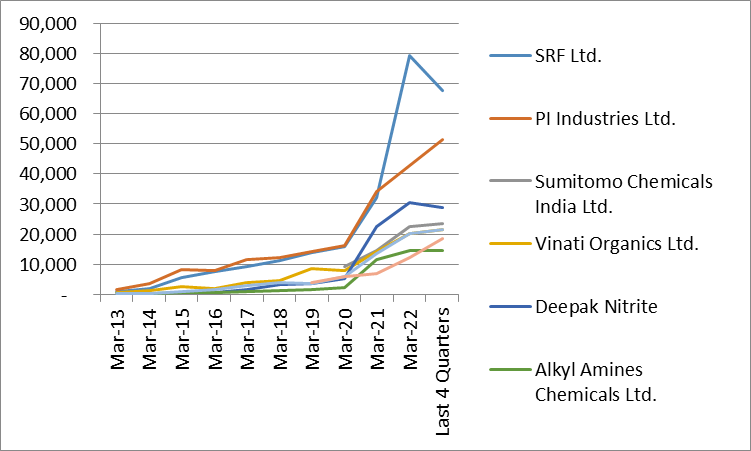

Given whatever has been cited above, it is not surprising to know that this sector has produced highest numbers of Multibagger Stocks in the past 10 years.

A lot of companies in the chemical industry uses crude and crude derivatives as input prices and those companies which are in the commodity chemical space are not able to pass on to the input cost price to their end customers. They are definitely going to see margin compression, but those companies which are in the specialty chemical space, where the products are used in small quantities for the specialized purposes (whether in FMCG or in Agro-chemicals or in Pharma Products or as Coloring Agent for Paints etc.) as such, these specialty chemical companies will continue to do well.

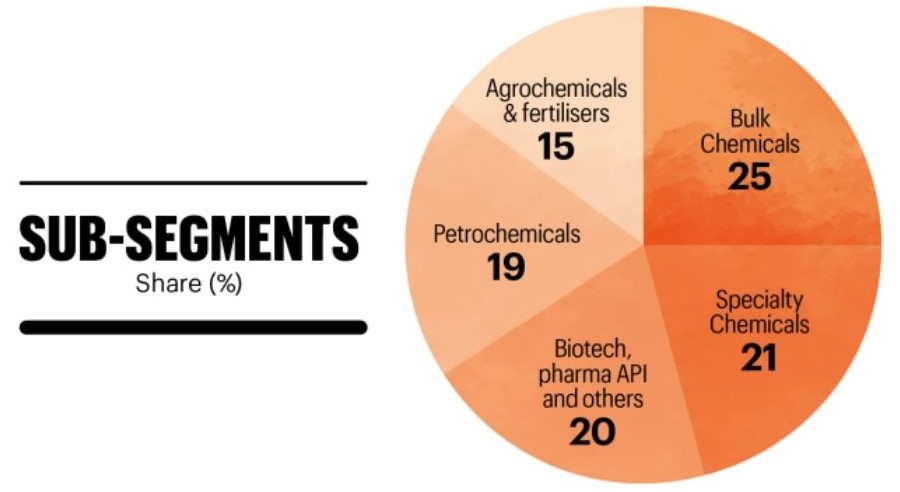

The growth of India’s consumption economy is evident in key sub-sectors of the chemical & petrochemical industry. Polymers, used to make synthetic cloth, polyethylene cups, fiberglass, plastic bags, paints and glue, grew at 9.89% CAGR in three years to FY21. Production of elastomers (synthetic rubber), used to make tyres, medical tubes, balloons and adhesives, grew at 4.85% CAGR. Production of pesticides grew 7.72%.

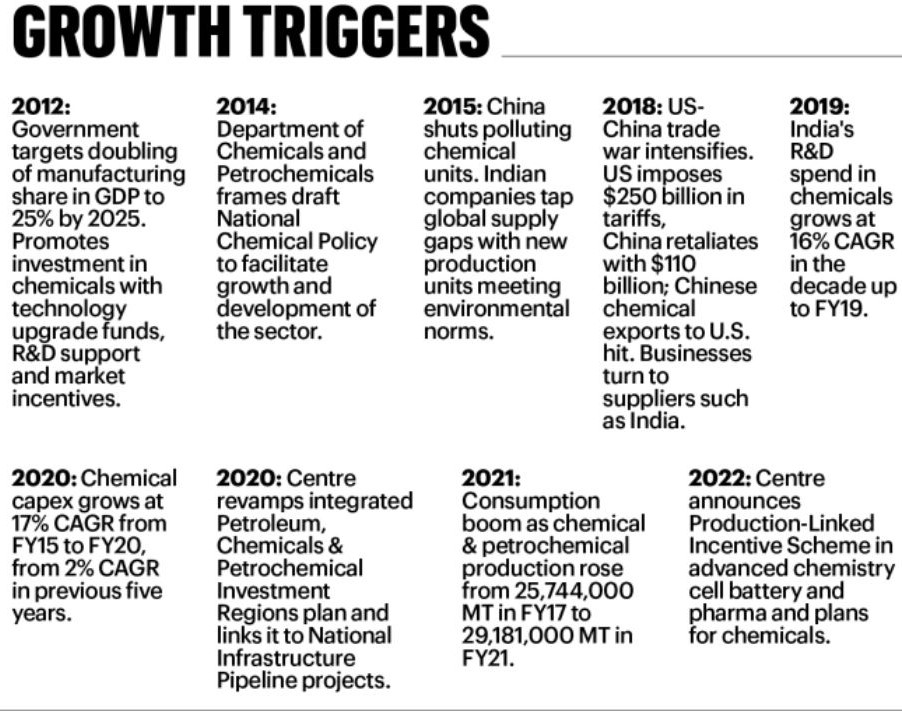

There has been Lots of “Growth Triggers” in last 10 years which ensured Organic Structured Growth of this sector, as a whole. Refer Pic below:(https://www.fortuneindia.com/long-reads/chemical-boom-billionaires/108815)

India exported an estimated ₹61,900 Cr worth of chemicals to Europe while imports stood at ₹39,100 in FY22. Bulk chemical exports were low, while overseas sales of organic chemicals were high. Speciality chemical manufacturers have been in focus, given the turmoil in the European chemical markets. Higher energy costs as well as lower availability of gas has had an impact on European manufacturers, leading to closure of many facilities in the geography and as a consequence, surge in chemical prices.

“A prolonged crisis, like elevated gas price, would compel European companies to start collaborating (technology transfer), to shift energy-/electricity-intensive chemicals, and consequently, speciality chemicals out of Europe and/or outsource more” – Indian chemical companies should benefit from such initiatives in the medium to the long term.

In short term, concerns about the weak demand environment due to destocking, higher input and logistic costs, and higher energy costs all may have a bearing on investor’s sentiment. Multiple headwinds including raw material inflation, increased energy and power costs, elevated logistics costs, and inventory destocking at customer’s end etc. may keep Margins under pressure for these companies too.

Off late, the correction in the commodity prices and softening of the crude prices has been leading to expectations of improvement in margins. High-cost inventories may still be there, but over the time some respite will be seen on the margins front.

Overall outlook remains positive for producers, and opportunities on contract manufacturing and outsourcing may also increase. Nevertheless, in the near term some impact slowdown may be felt. Indian manufacturers may see some softening of export demand in the near term in case of a recession.

The Indian specialty chemicals sector is well poised to capitalise on global tailwinds and expand its global market share to 7-8% in the next few years, from 4% currently, supported by the structural drivers, including China+1 strategy, import substitution, and opportunities emerging from the recent supply chain disruption in China. Agri-input companies are also well poised to reap benefits of high global crop prices, as the same would aid demand and support realizations. The volatility in equity markets this year, triggered by the hawkish monetary policy measures by central banks amid spiraling inflation have seen stocks in this space lose some sheen.

Thus, the recent correction in broader markets due to global geopolitical tensions provides a good opportunity to invest in – These 6 Specialty Chemicals & 2 Agrochemicals Stocks (which has long runway of Growth) as structural tailwinds for the sustained double digit earnings growth remains intact.

Beside this, India also has a robust ecosystem capable of producing chemicals at lower rates than the developed world. Availability of talent, along with academic and R&D support systems, has not been a problem till date.

The underlying demand continues to be very strong for this space, as such India’s chemical sector is expected to touch $ 304 Billion by FY25.

To know further on the importance of Long Term Tail Wind while buying the stock read – https://jyadareturn.com/7-key-parameters-you-should-look-for/

Promoters & Management who saw the Huge Potential for Growth and taken Early & Bold Steps regarding Capital Allocation accordingly.

The bold and early bets by the Promoters & Management of these companies, took India’s chemical sector from $178 billion in FY19 to $212.6 billion in FY21 (9.33% CAGR). Indian pharmaceutical sector, one of the main consumers of its chemicals, grew at 10.04% CAGR in three years to $54 billion in FY21. In comparison, India’s IT/ITeS sector grew at 6% CAGR, from $125 billion in FY18 to $149.2 billion in FY21.

IBEF says India’s chemical industry will hit $304 billion revenues by growing at 9.3% CAGR between FY19 and FY25, whereas Global chemical industry is projected to grow ONLY at 3.5% in 2022—with 4.5% in U.S., 4% in China, 3.9% in emerging markets of Asia, 2.5% in Japan and 1.5% in South America.

They saw the Huge Potential for growth & noticed the hindrances to achieve that growth, accordingly they acted upon. Some added new subsidiary to add on to the new products (which already has enormous demand for consumption in the country, but very few players to compete with) in their portfolio and did massive CapEx to install huge capacities (e.g. Deepak Nitrite).

Others made their manufacturing process more efficient to enhance the quality of their end product & bring it at international accepted standards. Not only this, they did backward integration to find import substitution for their raw material requirements. This allowed them to sell their product at much cheaper rates compared to what their competitors were asking for. As a result, loss making “Key Competitors” has to exit the market, which resulted in establishing almost the Monopoly (in some of the products) internationally (e.g. Vinati Organics) – “Niche specialty products have good prospects. With India growing faster (than other countries), chemical companies like ours are growing faster than other segments of industry,” says Vinati Saraf .

“Many players in India’s specialty, fine-chem and agro-chemical sector invested to build world-class manufacturing facilities. The results are showing in their current growth. A strengthened intellectual property regime also encouraged innovator multinationals, to look at India and work with companies like ours.” – says Mayank Singhal, vice chairman and managing director of PI Industries.

Disruption of global supply chains, first due to U.S.-China trade war and then Covid-19, also forced global players to look at alternative sources of chemicals to de-risk their businesses. India emerged a prime alternative ahead of Vietnam and South Korea. Many customers started asking Indian suppliers to scale up and start building products in their areas of strength. “The push is from customers in Europe, U.S. and Japan. They ask how dependent we are on China for raw materials. If assured of local production, they are open to signing multi-year contracts, which was not a norm in the past,” says Maulik Mehta, CEO and Executive Director, Deepak Nitrite.

Each company has Market Leadership in its own Niche Product Portfolio, World Class Manufacturing Facility, Intrinsic R & D Capabilities and Economies of Scale to Dominate.

Let’s see each company one by one:

SRF Ltd.

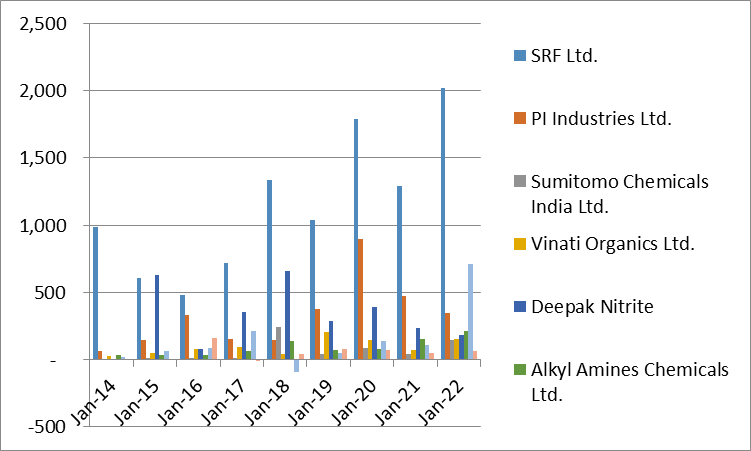

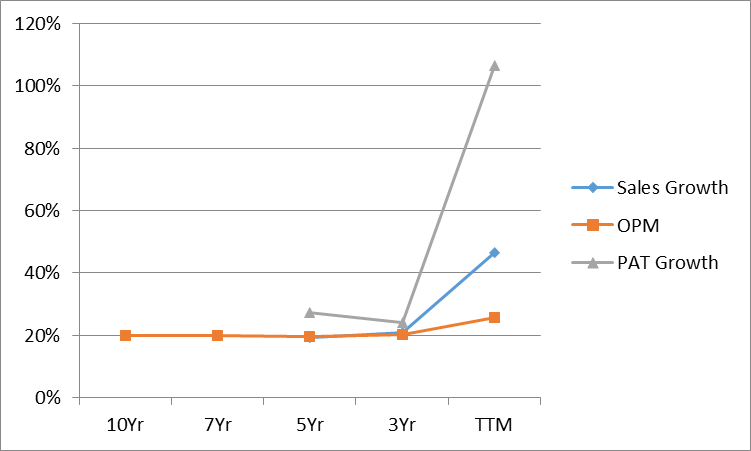

Chemical, packaging and technical textile major SRF, India’s largest specialty company, has also transformed itself through diversification. Capacity Addition in specialty chemicals such as fluoro compounds, Vertical Integration and Low Dependence on crude oil derivative raw materials are some which driving it’s growth. Its net revenue grew at 20% CAGR over three years to touch ₹12,321 crore in FY22.

In last quarter of FY22, chemical business expanded 36%, packaging films saw 42% growth while technical textiles grew 24%. It has lined up investment in excess of ₹5,000 crore over the next two-three years in chemicals and key chemical platforms like refrigerants, chloromethanes (used as reagent in chemical production), PTFE (used for industrial applications involving heat procedures) and packaging films. These investments include a new pharma intermediates plant for ₹190 crore, a 300 MTPA agro-chemical product plant in Dahej and an aluminium foil manufacturing facility for ₹425 crore. CapEx for FY22 alone was about ₹2,000 crore.

“Our expansion plans are a big part of our vision to become a strong force in the global chemical industry,” says Ashish Bharat Ram, chairman & managing director, SRF.

SRF Management intends to spend heavily on the chemical segment with CapEx plan of Rs. 12,500 Cr, which is 83% of total CapEx plan of Rs. 15,000 Cr over the next five years. Management sounded confident of growing consistently at more than 20% and sustain ROCE of 20%+ in specialty chemical business. The company is seeing a number of growth opportunities from import substitution in the fluoro polymers space (PTFE plant nearing completion by Q3FY2023), industrial chemicals (would get support from chloromethane expansion), and new business opportunity from Europe could emerge from likely disruption in Europe’s chemical industry amid geopolitical tensions.

High growth in the chemical business supported by high CapEx intensity, sustained strong margin for the technical textiles business, and focus on value-added products (VAP) in the packaging film business, would drive strong revenue/EBITDA/PAT CAGR of 16%/16%/19% over FY2022-FY2024 and healthy ROE/ROCE of 22%/23%. Investment in the right areas of the specialty chemical business would improve earnings quality and safeguard from cyclical packaging film margins.

SRF’s Superior earnings growth outlook, strong FCF generation, and robust balance sheet also justify its premium valuations, which has corrected by more than 20% recently.

Specialty chemical players witnessed robust revenue growth and sequential improvement in margin but the same still remain below on YOY basis, given the challenges of logistic and energy cost.

SRF has given bonus shares only once till date (on 13th October 2021) & the bonus issue of the company was in the ratio of 4:1, but still it has turned Rs. 1 lakh invested into Rs. 63 crore in just 23 years – (https://www.livemint.com/market/stock-market-news/multibagger-stock-turns-rs-1-lakh-to-rs-50-crore-by-giving-only-1-bonus-issue-11662307933377.html)

PI Industries Ltd.

PI Industries revenues are divided under 2 main categories. It earns ~76% of its revenues from active ingredients and intermediaries and ~23% of revenues from sale of formulations. Presently, it earns ~77% of its revenues from exports and rest 23% from the domestic sales – (https://www.screener.in/company/PIIND/consolidated/)

The company owns and operates 5 formulation facilities and 13 multi-product plants under its 4 manufacturing locations. The company commissioned 2 new multi-product plants in FY20.

The company operates an extensive distribution network with 9 zonal offices, 28 depots, 1500 experienced field force, 10,000 active dealer/distributors and more than 1,00,000 retailers spread across the country.The company is in a research intensive business. It has been investing 3-4% of its revenues in R&D activities.

The company’s R&D centre in Udaipur is spread over an area of 130,000 sq. ft. and provides excellent infrastructure and lab facilities for research scientists to carry out activities and specialize in the discovery space, including library synthesis, molecule design, lead optimization, route synthesis, biological testing and greenhouse testing.

The company has a strong export order book valued at $1.5 Billion (~10,000 crores INR) for the next 3-4 years.

It is the biggest producer of generic molecules like Profenofos, Ethion and phorate in India.

High Entry & Exit Barriers in CSM (Export Business) which PI Industries operates in – (https://youtu.be/ePofLFvhBd0), whereas in Domestics Business (which is in a “Fragmented Industry”) company has followed 3 Unique Strategies to compete in the industry:

- In-Licensing the Innovated Molecule

- Joint Ventures & Co-Marketing

- Creation of Branded Generics

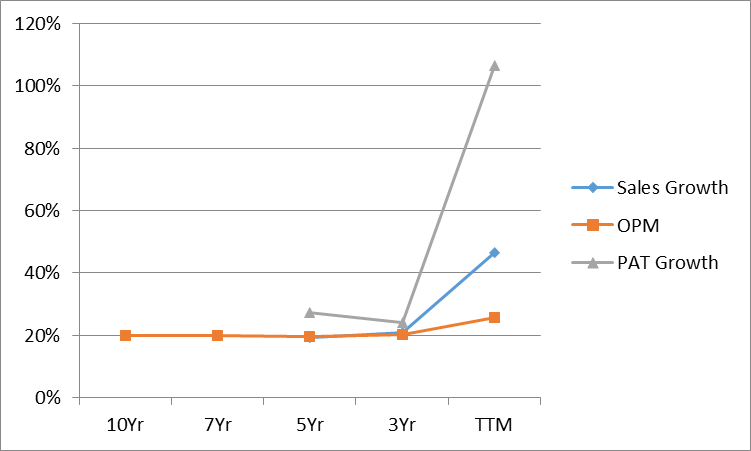

As a result their Sales Revenues & Profits has Grown Tremendously in last 10 years:

PI Industries is gearing up to seize future CSM opportunities in chemicals across non-agro offerings, including Pharma. Existing CSM business will support earnings and ROCE, despite the QIP cash weighing on the BS, pending investments in pharma M&A, and organic growth CapEx factors.

PI Industries Ltd. teamed up with 20-plus innovator multinational companies for custom manufacturing, synthesis and research.

“Our teams are engaged in discovering better and more efficient pathways to commercialize molecules for a global arena. Innovators across the world acknowledge this, with number of enquiries from existing and potential clients rising markedly,” says Mayank Singhal. The company has a pipeline of more than 40 products at different stages, of which more than 20% are non-agro-chem products, he says.

Company is on the track to complete most of its existing expansion plans by FY24, even though it has lined up new CapEx to ensure the future growth.

Demand for its Niche products remains strong and the management expects 2HFY23 to be strong too. Company posted solid earnings growth, headed by price hikes, high export growth, and margins improvement.

Company benefited from sustained price hike to its customers and higher volume supported by high global crop prices. This led to better-than-expected aggregate revenue growth and margin improvement (despite elevated input & logistic cost).

| Financials | Q2 FY2023 | Q1 FY2023 | % Change |

| Total Income | ₹ 1801.7 crs | ₹1570.8 crs | |

| Net Profit | ₹334.8 crs | ₹262.4 crs | |

| EPS | ₹22.06 | ₹17.29 |

| Financials | Q2 FY2023 | Q2 FY2022 | % Change |

| Total Income | ₹ 1801.7 crs | ₹1381.9 crs | |

| Net Profit | ₹334.8 crs | ₹229.6 crs | |

| EPS | ₹22.06 | ₹15.14 |

Sumitomo Chemicals India Ltd.

Sumitomo Chemical India Ltd. (SCIL) is one of the leading players in the industry which has a balanced portfolio of technical as well as formulation products along with backward integration for some products.

The Company is known for domestic marketing of proprietary products of its Japanese parent -Sumitomo Chemical Company Limited in agrochemicals, animal nutrition, and environmental health business segments. With the integration of Excel Crop Care Limited, the Company now has a strong portfolio of generics in addition to specialty products and a strong combined marketing network. With this integration, the Company has moved up several notches in the pecking order of the Indian crop protection industry.

Some of the Key Products of company are Glyphosate (Herbicide), Profenophos (Insecticide), Tebuconazole (Fungicides), Progibb (Plant Growth Regulator), and Chlorpyriphos (Insecticide).

Geographical Diversification FY22: Domestic: 78%; Exports: 22% & Geographic Diversification with Exports to over 60 countries

Agro business solutions breakup (FY22): Insecticides: 43%; Herbicides: 21%; Fungicides: 11%; Plant growth regulators: 9%; Metal Phosphides: 9%.

Generic: 70%; Specialty: 20%

Manufacturing and distribution network

They have 5 manufacturing facilities, 200+ Brands, 16,000+ Distributors, 60+ depots, 40,000+ Dealers, 25+/ 200+ Patents/Registrations and 700+ SKUs.

R&D

In FY22 Co. incurred a total R&D expenditure of 13 crore (0.4% of total revenue).The pipeline includes new combination products/pre-mixtures and Off-patent products currently under development.

CAPEX

Over FY 24-25, The co. has a 120 crore CAPEX plan, to manufacture other proprietary technical grade active ingredients products for our parent company SCC Japan and our global affiliates for 5 products.

Growth Strategies

Capacity Expansion: Invest ~15% of consolidated EBITDA every year for the up-gradation of manufacturing facilities and capacity expansion to cater to strong domestic/global demand.

Develop the brand by investing in marketing new and existing products and brands. Also, carry out on-field demonstrations, and provide training to farmers for building ground-level demand generation supported by digital marketing and Expand Export Business by Leveraging SCC’s Global supply chain and marketing network to drive exports.

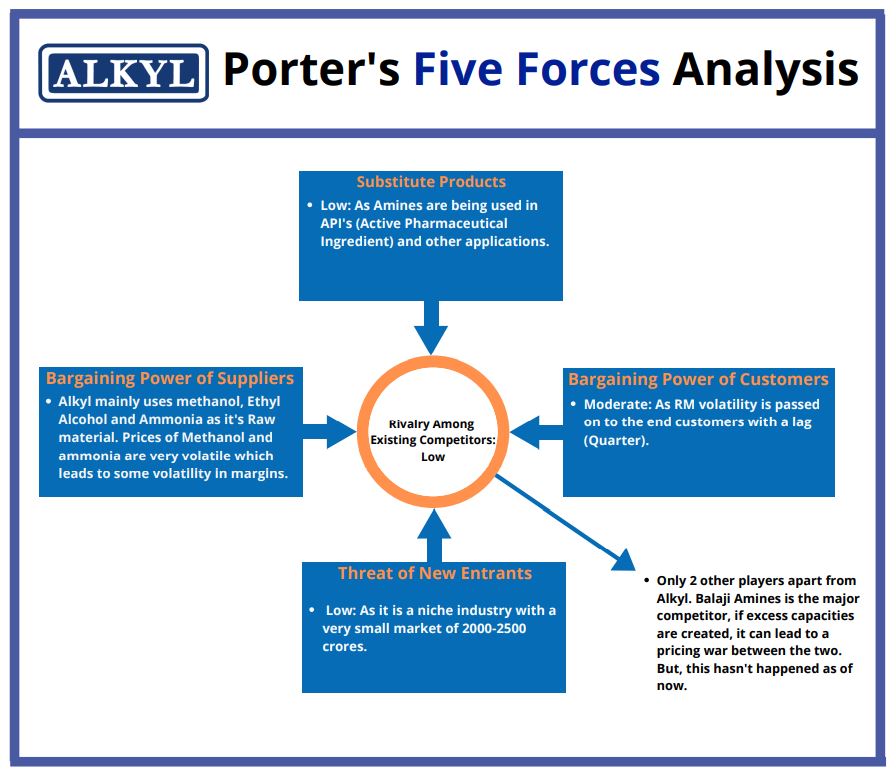

Alkyl Amines Chemicals Ltd.

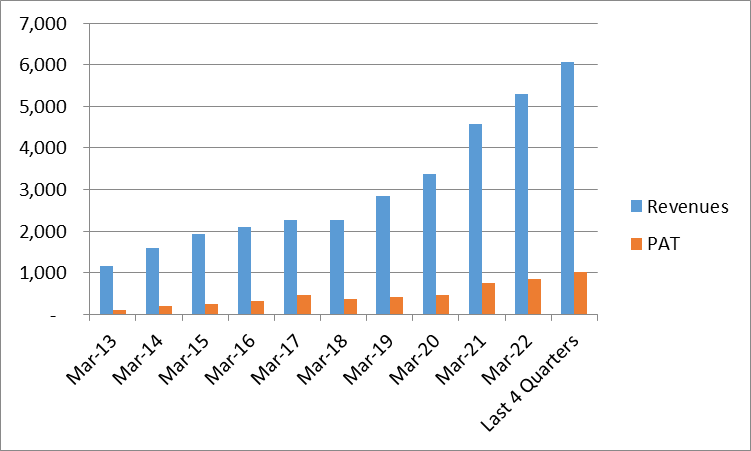

Alkyl Amines Chemicals has been a global supplier of amines and amine-based chemicals to pharmaceutical, agro-chemical, rubber and water treatment industries for three decades. Revenues grew at 22.16% CAGR in three years to ₹1,542.80 crore in FY22. But market capitalization zoomed at 104.39% CAGR.

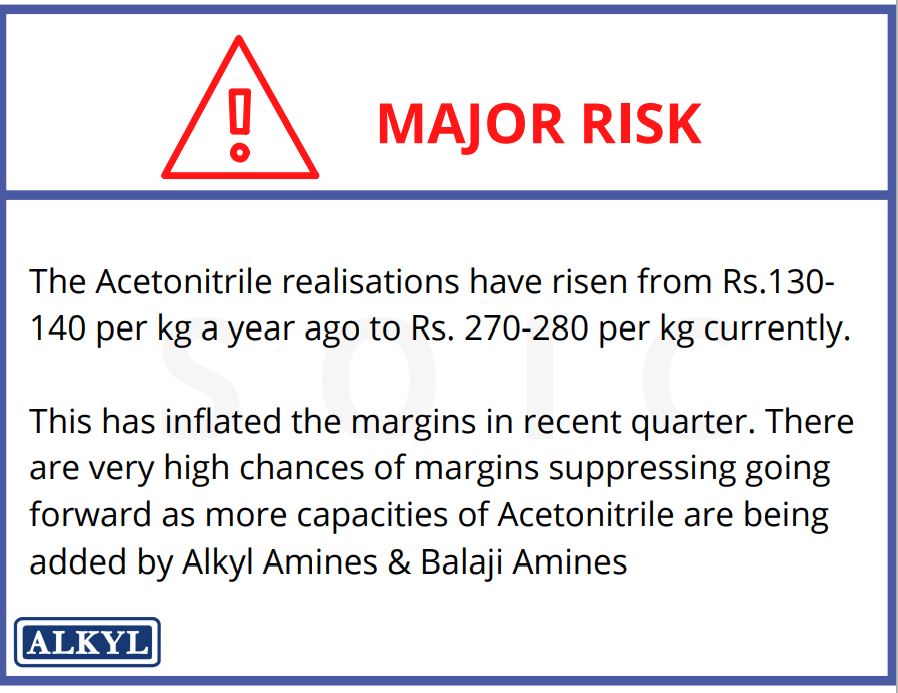

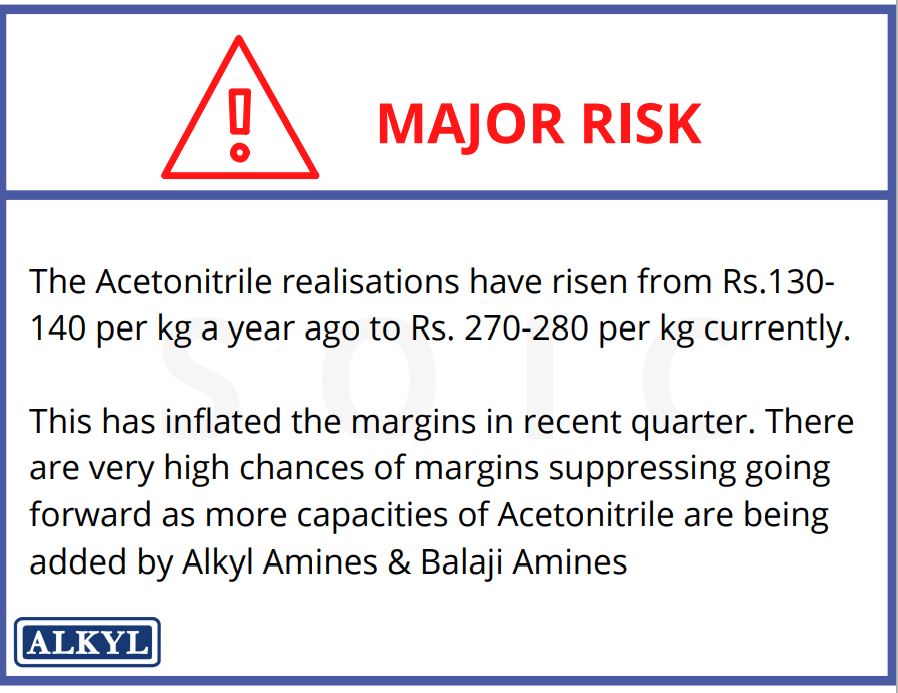

The company is investing ₹600-700 crore over next two-three years to build capacity in certain specialty chemicals. It recently commissioned a ₹160 crore acetonitrile plant (used to make pharmaceuticals, perfumes, rubber products, pesticides, acrylic nail removers and batteries) to expand capacity from 12,000 tonnes to 30,000 tonnes a year. It is also setting up a ₹350-360 crore aliphatic amines plant (intermediates and solvents to manufacture plastics, crop protection products, explosives, dyes, surfactants, catalysts and other chemicals.), which will increase capacity by 30%.

“Once our project at Kurkumbh (Pune) for manufacturing higher amines comes up by end-2022, it will be one of the largest in the world,” Yogesh M. Kothari, chairman and managing director – Alkyl Amines Chemicals Ltd.

Business Leadership: 100+ products, most developed in-house; Global leader in Ethyl amines; One of the leading players globally in DEHA; One of the largest producers of DMA-HCL; Leading producer of Acetonitrile with a unique process.

Diversified Product Portfolio

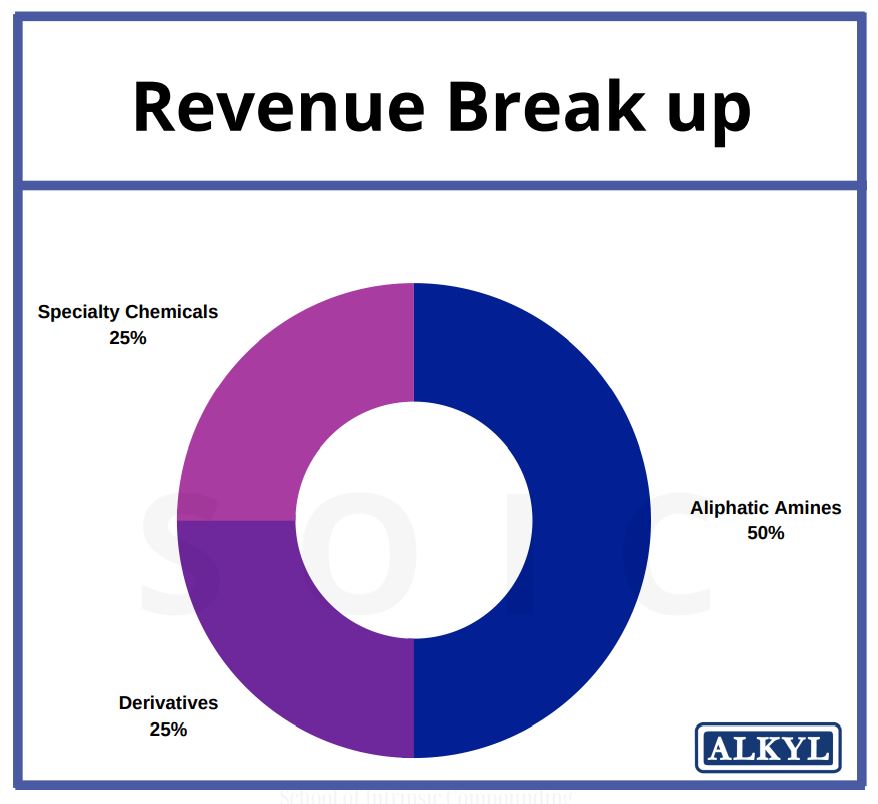

The Co. primarily deals in Aliphatic Amines, Amines Derivatives and Specialty Chemicals.

Amines are used in making the intermediate & API (Active Pharmaceutical Ingredient) in the pharmaceutical industry. In the Chemical industry, it is used in agro chemicals, speciality chemicals, fine chemicals and rubber chemicals. Amines are also used in water treatment & dyes.

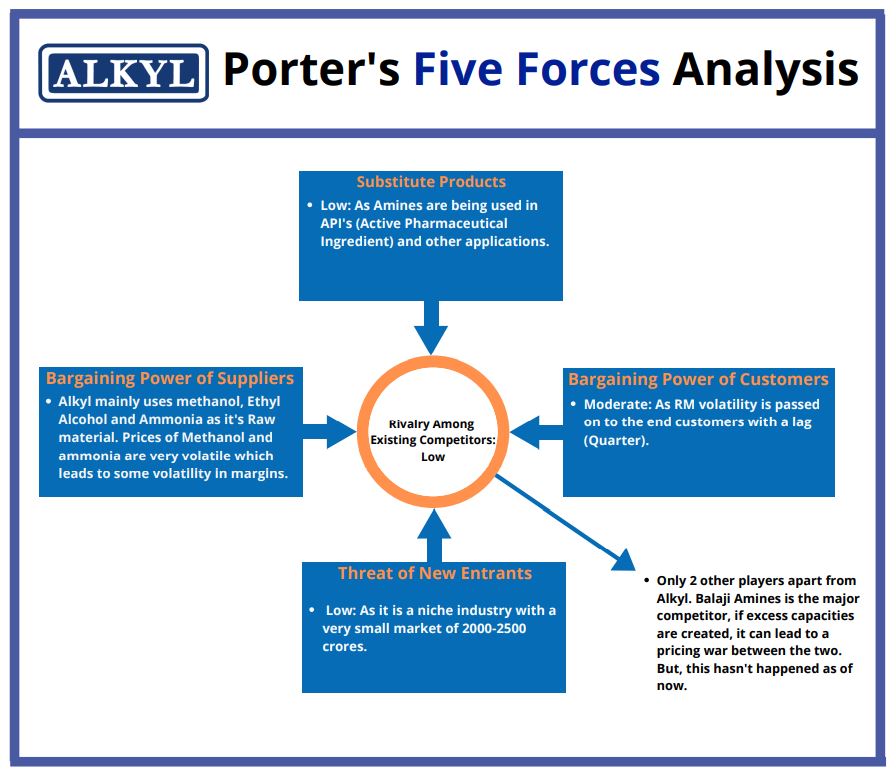

Barriers to Entry:

- High Fixed Costs

- Closely Guarded Technology

- Niche Product Offering

- Hazardous Products (Low Threat of Import)

Revenue Mix FY22: Amines and Amines Derivatives- 74%; Other Speciality Chemicals- 25%

Manufacturing Capabilities

The Company operates over 20 production plants in three manufacturing sites covering over 115 acres of land in the western states of Maharashtra and Gujarat in India. The aggregate installed capacity stands at 1, 58,000 TPA.

Expansion Projects

During FY22, a new Acetonitrile plant at Dahej was commissioned. The Company is in the process of setting up a new Amines plant at Kurkumbh, which is expected to be commissioned by March 2023. The intended incremental capacity is 35000 tonnes and a CapEx of Rs. 300 Crore has been undertaken. Additionally, it’s establishing 2 new speciality chemicals plants. The Company is also upgrading the equipment and expanding capacities at all three production sites.

The CapEx plans only move ahead when the previous plants are operating at optimum capacity and the company only moves ahead when it is sure of the future orders.

Shift to value added products:

Apart from manufacturing basic aliphatic amines like Methylamines and Ethyl amines, company has over the years also diversified into value added products like amine derivatives and speciality chemicals. These products find applications in end-user industries like Pharma (61%), Agro (6%), water treatment (5%), foundry (4%), dyes (3%) etc.

The company gets 60% of its revenues from the pharmaceutical industry. No single customer contributes >5% of Alkyl’s revenue. The company has over 350+ customers.

Focus

The Company continues to focus on sustainable growth by taking measures for increasing its market share of existing products and also introducing new products.

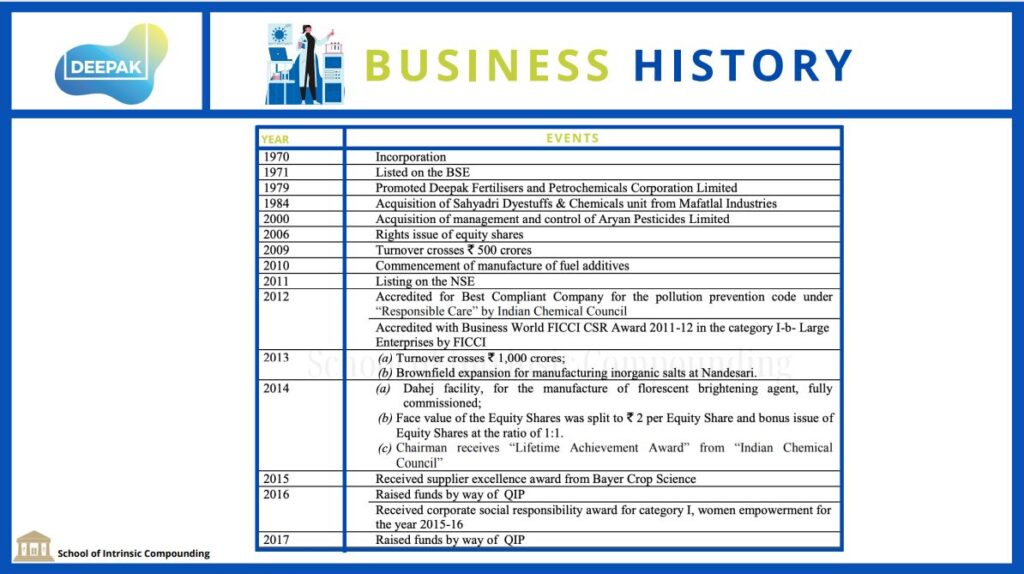

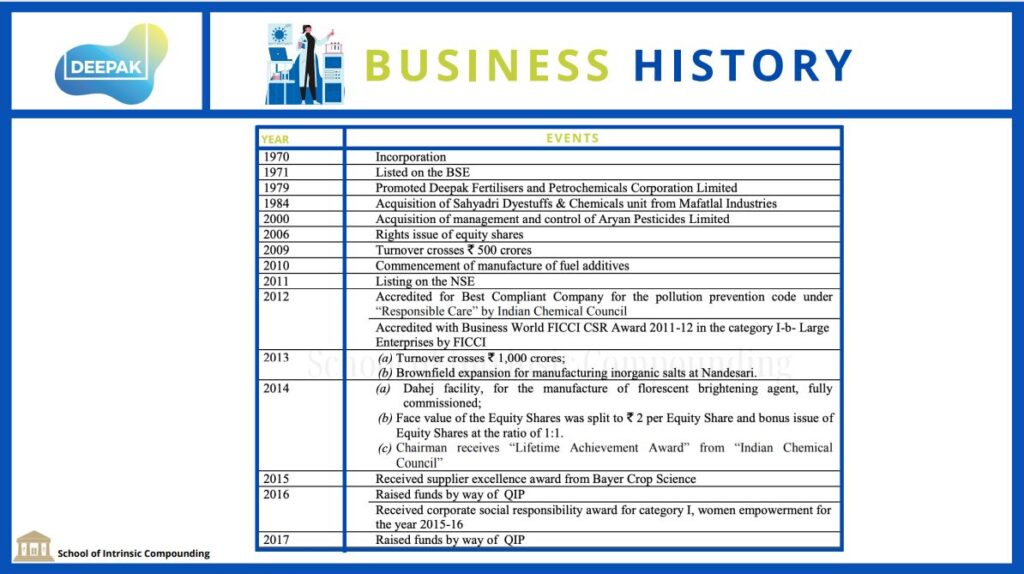

Deepak Nitrite Ltd.

In 2015-16, Deepak Nitrite, a five decades old basic chemical, specialty and intermediates major, was India’s leading producer of sodium nitrate, a preservative used in cured meat, bacon, medicines and industrial products like dyes. However, revenues were below ₹1,500 crore. Investor interest was limited. Market capitalisation was under ₹3,000 crore. Just then, Chairman and Managing Director Deepak C. Mehta floated a subsidiary, Deepak Phenolics, to make phenol, acetone and isopropyl alcohol (IPA), used in household cleaners, antiseptics, disinfectants hand sanitizers and detergents.

Public sector Hindustan Organic Chemicals and SI Group India were the only two rivals, with 30,000 tonnes capacity each, but India’s consumption was three times more at two lakh tonnes. Till 2018, Deepak Phenolics invested ₹1,400 crore to build annual capacity of two lakh tonnes phenol, 1.2 lakh tonnes acetone and 26 lakh tonnes cumene.

That changed its fortunes. With phenolics plants, net revenues grew more than four times from ₹1,651 crore in FY18 to ₹6,802 crore in FY22. Net profit rose 83% to ₹1,060 crore. Today, more than half the consolidated revenue comes from Deepak Phenolics. Deepak Nitrite is in the midst of an expansion, which includes doubling of IPA capacity to 60,000 MTPA, at a cost of ₹1,500 crore, says the company’s CEO and executive director, Maulik Mehta. Deepak Nitrite’s market capitalisation grew over seven times from ₹3,475 crore in FY19 to ₹25,951 crore on June 6, 2022.

Vinati Organics Ltd.

Vinati Organics Ltd. manufactures 25-plus specialty chemical and organic intermediates. Its promoter Vinod Saraf started Vinati Organics, a joint venture with Maharashtra government in 1989. The company started with Isobutyl Benzene (IBB), primary raw material for Ibuprofen, and then decided to make 2-acrylamido-2-methylpropane sulfonic acid (ATBS), which has wide applications as a dispersant in water chemicals and polymers for enhanced oil recovery.

Though it became a domestic market leader in IBB, revenues remained just over ₹60 crore. The problem was quality of ATBS. Vinati roped in a global consultant for suggestions to change manufacturing processes. Now, Vinati is the world’s largest manufacturer of IBB and ATBS, with 65% global market share. Lubrizol, the second-largest manufacturer of ATBS, stopped production a couple of years ago.

Today, just two-three companies make ATBS.

In FY22, it reported ₹1,615 crore of net revenue, from ₹641 crore in FY17, a CAGR of 20%. Market capitalisation grew at 33% CAGR from ₹4,624 crore to ₹21,301 crore. The promoter group, led by Vinod Banwarilal Saraf and daughter Vinati Saraf Mutreja, managing director & CEO, hold 74% equity.

“We saw a turnaround after roping in the consultant, who ensured ATBS quality, and exit of a key competitor,” says Vinod Saraf.

Vinati is investing ₹750-800 crore over two-three years to get into new product platforms such as ‘butyl phenols,’ used in perfumes, resins, agrochemicals and plastic additives, and ‘anti-oxidants,’ used in polymers, auto parts, farming and construction.

Vinati Organics (revenue up 74% y-o-y) reflecting price hike and ramp-up of new projects Aggregate OPM improved but still remain lower on y-o-y basis due to continued high raw material cost and logistic issues.

(https://www.youtube.com/watch?v=lOklLxWxJuM&t=15s)

Fine Organic Industries Ltd.

The 52-year-old Fine Organics Industry is a manufacturer of oleochemical-based additives used in production of cosmetics, lubricants and other chemical products. Its FY22 revenues were ₹1,876 crore. Revenues grew at 20.95% CAGR and net profit 23.99% CAGR to ₹259 crore in last three years. Market capitalisation grew at 48.07% CAGR during the three years to ₹12,309 crore, giving promoter families of Ramesh Shah and Prakash Kamat, who holds 75% stake, wealth of over ₹9,200 crore.

A Trend Indian companies have tapped is rise in demand for least polluting products. As such, most leading companies are investing heavily in – “Plants and R & D to develop Green Processes”.

Consumer Preferences are also tilting towards “Eco-Friendly & Biodegradable” options in for e.g. Food Packaging, as such it is driving demand for Ink & Coating additives. Similarly, there is rise in demand for “Natural” Cosmetics & Medicines.

In this context, Fine Organics has very strong claim to be the largest manufacturer of “Eco-Friendly” oleochemical-based niche additives in India. It is also among the six largest global players in “Eco-Friendly” polymer additives and among leading global players in “Eco-Friendly” speciality food emulsifiers.

It has Strong Moat of Technical Know-How and Quality Control, with High Entry Barrier for any new entrant to this sector, as not only years of R & D is required before entering into this sector but also:

- There is limited access to the intellectual property & Process Technology.

- Lengthy & Expensive customer product approvals.

- Strict Regulatory Requirements across the globe. (https://www.youtube.com/watch?v=DFkZ0kRK8qQ)

65% of its revenue comes from Plastic & Food segment. It has total operating plant capacity of over 1 Lakh Tonnes. Company is on track to add further 10,000 Tonnes of new capacity in Patalganga, which is likely to be commissioned by FY22-End & will target the Food Additives.

Its In-house capabilities regarding plant designing, leads to faster commissioning of new plant & lower CapEx requirement which results into higher financial return ratios.

Export Markets are doing relatively better & are expected to constitute around (55% ~ 60%) of sales in the near future. EBITDA which used to be around 22% ~ 23% before Covid19 pandemic has contracted to ~ 15%, owing to elevated raw material & Freight cost, accordingly contract cycle was kept shorter. Management believes that they will be able to pass the rise in Input-Cost to their customers.

Near term earnings growth is expected to be driven by Volume Growth from newly added installation capacities, Improved blended realizations, and Normalization/Shrinkage of the Input-Cost. (https://youtu.be/GvLEwp5HCzk)

Navin Fluorine International Ltd.

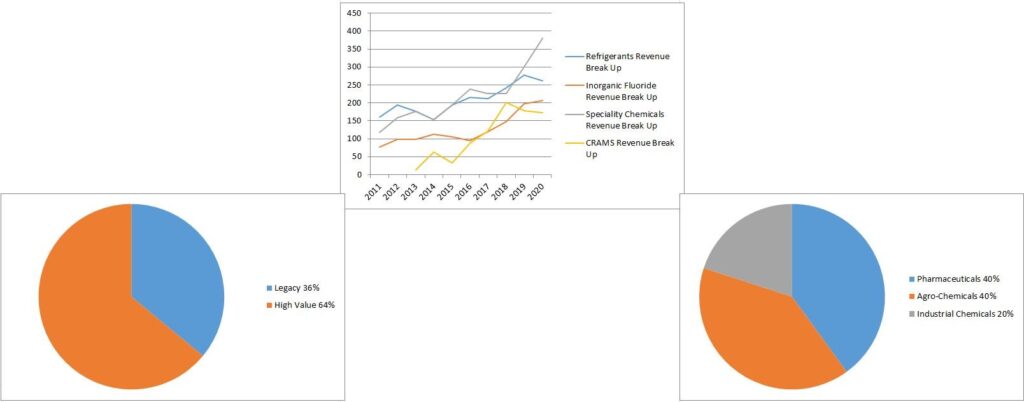

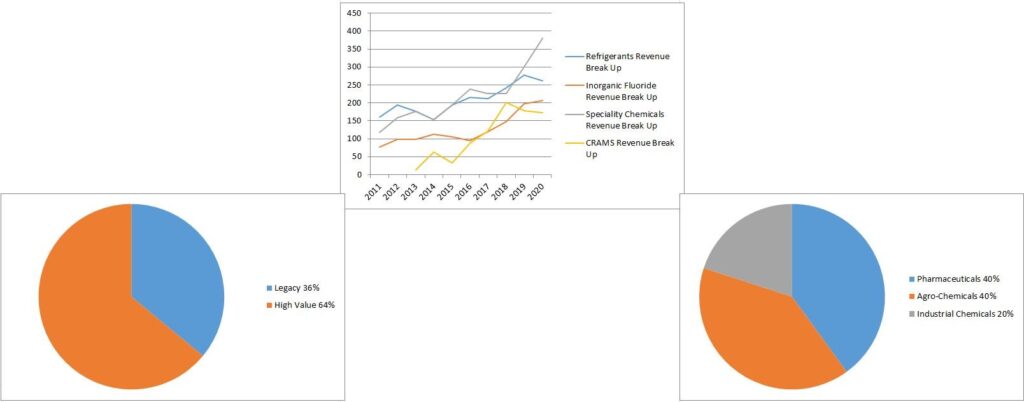

Revenue Break-Up Segment wise:

Specialty Chemical Vertical (~40%) – Company has been engaged in the specialty chemicals business for more than two decades. This division produces niche fluorine-based molecules that have downstream applications in crop science, pharma key starting materials, and industrial chemicals.

CRAMS Business Vertical (~21%) – Company ventured into contract research and manufacturing services for global clients in 2010. It provides its services to key downstream clients in innovator pharma and life sciences and agrochemicals space.

Refrigerants Vertical (~19%) – Company commenced this business in 1967 and has established itself as a respected global brand over the decades. It is the first producer of R22 gas in India. Its ‘Mafron’ brand is a market leader with a sustained aftermarket prominence.

It faces stiff competition in the vertical from Chinese manufacturers due to the abundant availability of fluorspar in China.

Inorganics Fluorides Vertical (~20%) – The company has one of the largest anhydrous hydrofluoric and diluted hydrofluoric acid manufacturing capacities in India with a portfolio with steady demand. It is a trusted supplier to various industries such as stainless steel, glass, oil & gas, abrasives, electronic products, life and crop science, and other industries.

Revenue Share from High-value Businesses

Company has seen a significant rise in revenues from its high-value verticals over the last decade. CRAMS and Specialty chemicals accounted for 61% of revenues in FY22 compared to only 27% in FY11.

Geographical Revenue Breakup

In FY22, exports and domestic sales both accounted for 50% of revenues.

Multi-Year Contracts

- In 2020, the company signed a 7-year contract of ~410 mn USD with Honeywell International Inc. for the manufacture and supply of high-performance products in the fluoro chemical space. The project requires CAPEX of ~440 crores and the commencement of supplies is expected from the start of FY23. [13] [14]

- In 2021, the company signed a 5-year agreement of a value of ~800 crores for supply of key agro-chemical fluoro-intermediate. It requires a CAPEX of ~125 crores and the supply is expected to commence from the end of FY23.

Capex – During the year, the Board of Directors approved capital expenditure of Rs. 75 Crores for debottlenecking of the cGMP3 plant which will increase the plant capacity. Additionally, the Board approved capital expenditure of Rs. 79 Crores for infrastructure development and capability up gradation at its Bhestan site

Capacity Expansion

During the year, the co. has undertaken a multi-purpose plant project, through its wholly owned subsidiary, requiring a CapEx of Rs. 195 crores. It has also undertaken a new fluoro specialty molecule project, which requires a CapEx of Rs. 540 crores to be funded by a mix of internal accruals and debt. The capacity is expected to come on stream by the end of CY23.

Focus

The Co. focuses on improving operational efficiencies, new product development, working on novel chemistry, and developing long-term partnerships.

Frequently Asked Questions (FAQs)

Which are the top Speciality chemical companies in India?

There are many to name, but these 6 speciality chemicals & 2 agro-chemicals stocks have a long runway of growth:-

1. SRF

2. Vinati Organics

3. Navin Fluorine

4. PI Industries

5. Sumitomo Chemicals India

6. Alkyl Amines

7. Deepak Nitrite

8. Fine Organic

Which chemical stock is best for long term?

There are many to name, but these 6 speciality chemicals & 2 agro-chemicals stocks have a long runway of growth:-

1. SRF

2. Vinati Organics

3. Navin Fluorine

4. PI Industries

5. Sumitomo Chemicals India

6. Alkyl Amines

7. Deepak Nitrite

8. Fine Organic

Why are chemical stocks rising?

Chemical Stocks are rising because of consumption economy of the country, demand for niche products, rapid import substitution, and a Global Geo-Strategic demand shift from China due to supply-chain disruption (China+1 Strategy). Further, the challenge in Europe amid the war between Ukraine and Russia, has added on to such opportunities (Europe+1 Strategy) for the companies in this vast industry.

Within this Chemical Industry, Speciality Chemicals & Agro-Chemical Space has long-term structural growth for the reasons as cited above, along with stronger demand for their Niche products, opportunities in Contract Research and Manufacturing Services (CRAMS) and Import Replacement Prospects (focus on Backward Integration to reduce Raw Material imports) and Long Term Competitive Advantage due to stronger R&D capabilities; (https://economictimes.indiatimes.com/markets/stocks/news/specialty-chemical-companies-earnings-may-surge-with-capacity-addition/articleshow/95812362.cms)