SRF Limited is a chemical-based, Multi-business Conglomerate engaged in the manufacturing of Industrial and Specialty Intermediates. The Company is widely recognised and well respected for its R&D capabilities globally, especially in the Niche Domain of chemicals.

Company is a Market Leader in Most of its Business Segments in India, with a significant global presence. The Company has operations in 4 countries namely India, Thailand, South Africa, and Hungary and has commercial interests in more than 90 countries.

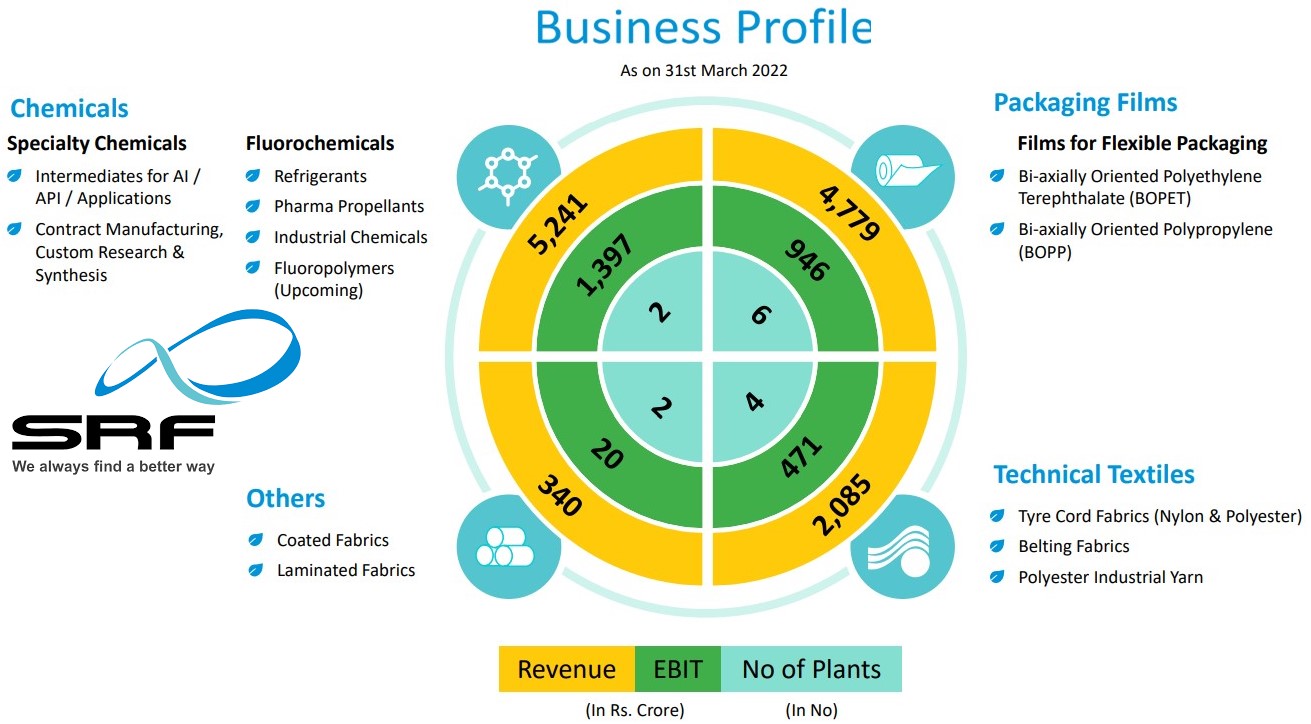

SRF classifies its businesses as Technical Textiles Business (TTB), Chemicals Business (CB), Packaging Films Business (PFB), and Other Businesses.

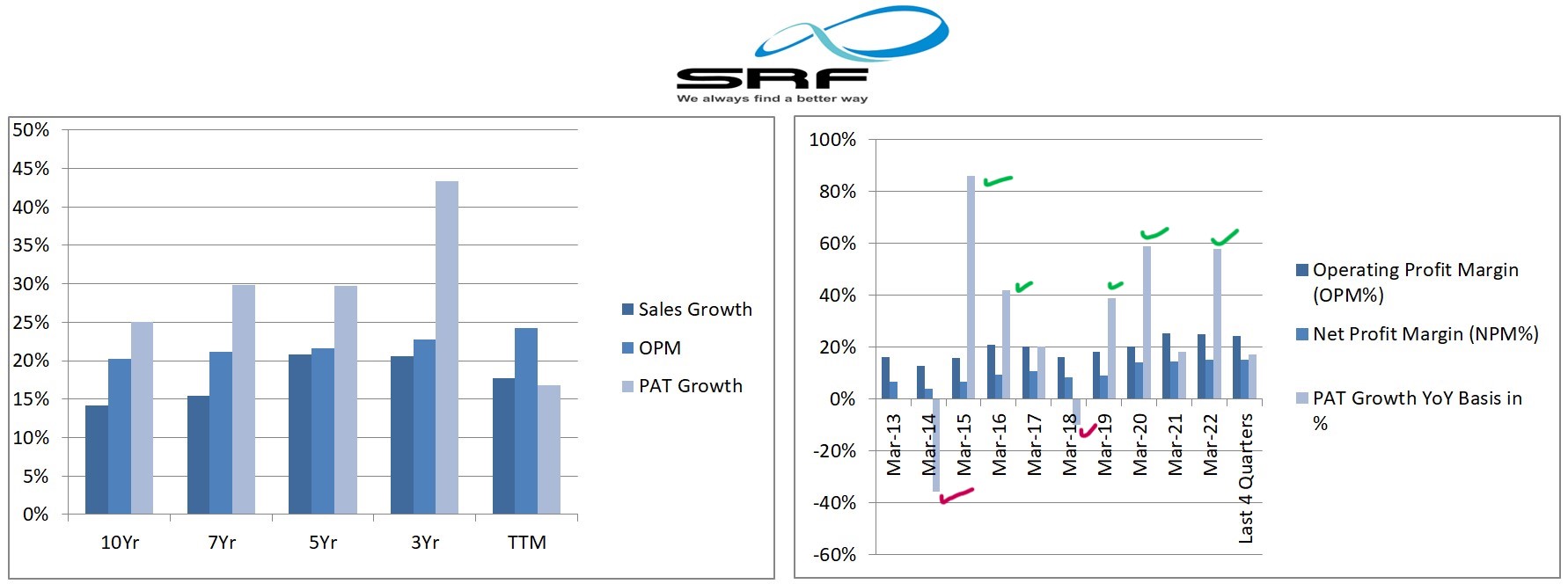

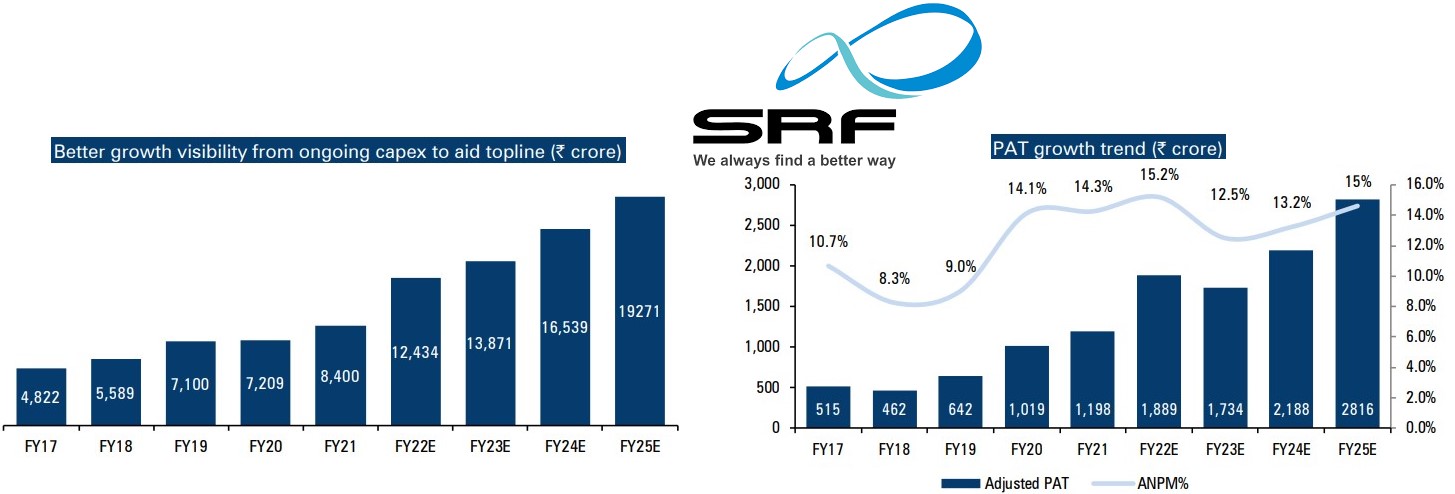

Capacity Addition in Specialty Chemicals such as Fluoro compounds, Vertical Integration, Low Dependence on the Crude Oil Derivative raw materials, Customs Duty Cut in the Budget for Fluorspar, Strong Demand for the Belting Fabrics, and the Infrastructure Push from the Indian Government, are some of the triggers which are driving its growth and same is also evident from the Company’s Financial Performance year after year, as the SRF has grown its Revenue & PAT at 21% & 43% CAGR respectively in last 3 years, Compared to the Growth at 14% & 25% CAGR in last 10 years, whereas it’s OPM Consistently remained between (20% to 24%) during these 10 years.

So, How does SRF always find a way to Sustain its High Growth?

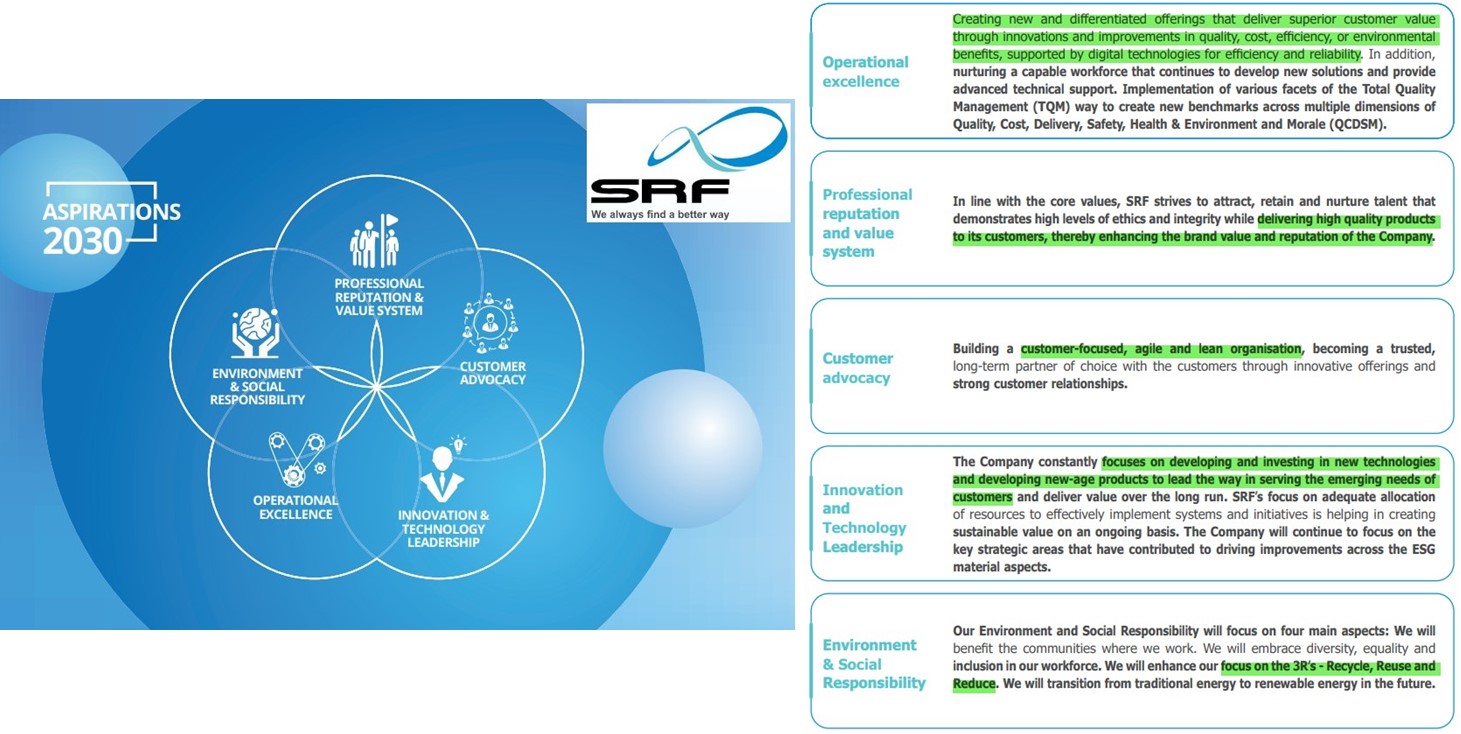

Sustainability is in SRF’s DNA and is reflected in every aspect of its business Functions and Strategies. Company combines the Strategic Focus Areas with its Aspirations, to Create a Roadmap for the Future and then follows the Practices and Measures, which Enables the Long-Term Value Creation for all of its Stakeholders.

SRF Launched ‘Aspirations 2030’ in March 2022 to guide its Strategic Focus area, guidelines of which gives the company a Clear View on what they Strive to Achieve in a Sustainable manner, so as to Create Long-Term Shared Value.

‘Aspirations 2030’ stands on the 5 Pillars, through which SRF continuously Strive to be Known for its:

1) – Professional Reputation and Value System;

2) – Customer Advocacy;

3) – Innovation and Technology Leadership;

4) – Operational Excellence; &

5) – Environment & Social Responsibility (given company is manufacturing Industrial and Specialty Intermediates, on Large Scale)

SRF is looking at a number of Growth Opportunities from Import Substitution in the fluoro polymers space, Industrial chemicals (which would get the support from chloromethane expansion), and new business opportunity from Europe, due to disruption in Europe’s Chemical Industry amid geopolitical tensions there – To know more about Tailwinds read: (https://jyadareturn.com/specialty-chemicals-stocks-long-runway-of-growth/)

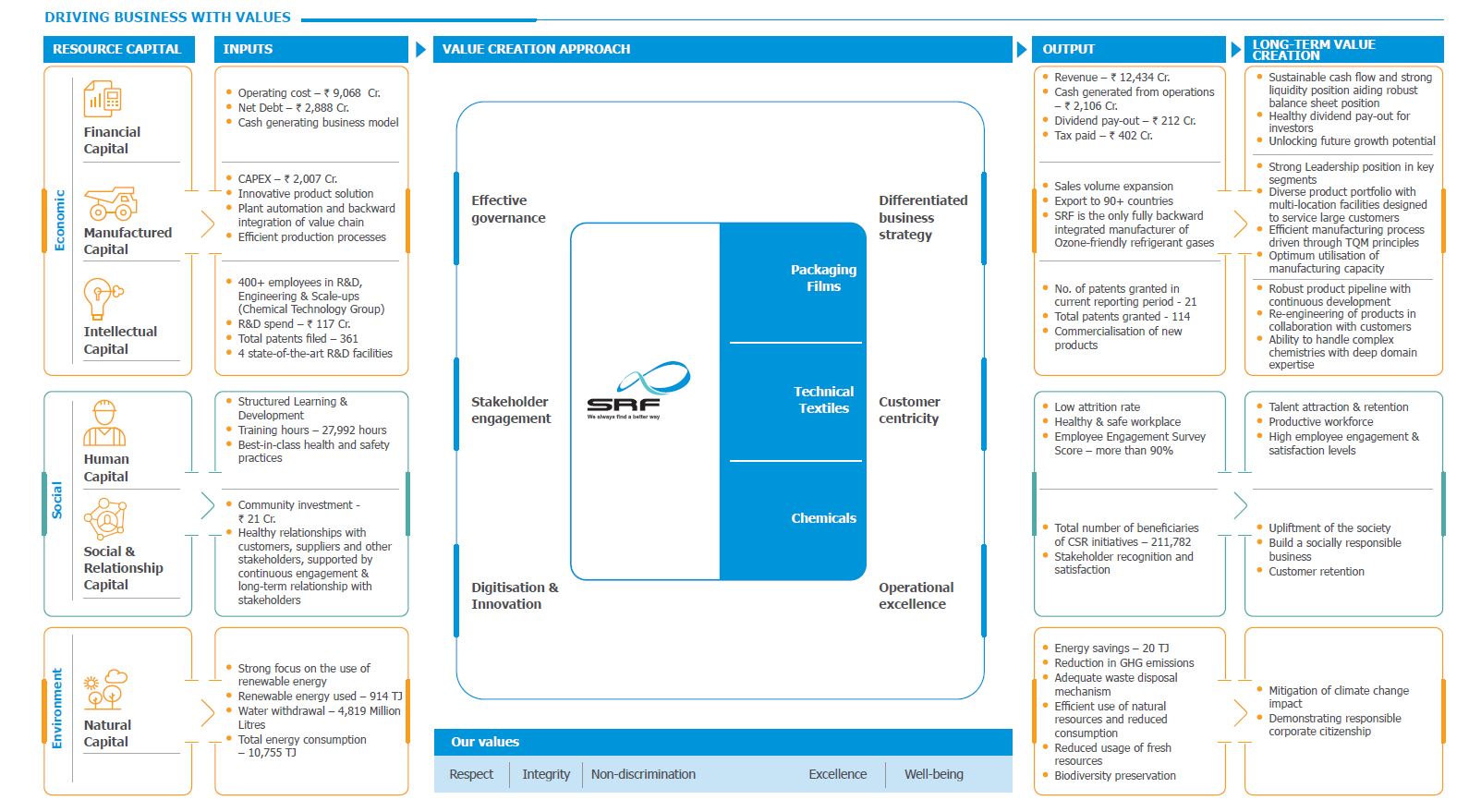

SRF Created Strong Base for Sustainable Growth & Value Through 6 Resource Capitals

SRF’s 3 Economic, 2 Social, and 1 Environment together makes its 6 Resource Capitals, which are an ideal blend of Top-Tier Talent, State-of-the-Art Manufacturing Capabilities, Cutting-Edge Technologies, World-Class R & D facilities, Strong Financials, Robust Governance Practices, and Transparency.

This Differentiated Business Strategy Complemented with the Digitization and Innovation helps SRF to:

1) – Expand Sales Growth & Cash Flow from the Operations Consistently, through Export to 90+ countries. Hence the Sustainable Cash Flow and Strong Liquidity Position are not only aiding to the Robust Balance Sheet, but also Unlocking the Future Growth Potential;

2) – Establish as the Only Fully Backward-Integrated Manufacturer of Ozone-Friendly refrigerant gasses. Hence, SRF have Strong Leadership position in the key segment;

3) – Have Diverse Product Portfolio with multi-location facilities, designed to service large customers;

4) – Have Efficient Manufacturing Process driven through TQM principles, thereby ensuring Optimum Utilisation of the Manufacturing Capacity. Recently, company has also won the prestigious Deming Prize for two of its businesses – namely Tyre Cord and Chemicals;

5) – Have Robust Product Pipeline with continuous R & D activity and Re-engineering of the products in collaboration with the customers. With 130 Patents already Granted to it, SRF’s Ability to Handle Complex Chemistries with Deep Domain Expertise, is clearly demonstrated;

6) – Have Focus on the 3R’s – Recycle, Reuse and Reduce. Hence, ensuring the Efficient use of natural resources and the reduced usage of fresh resources.

SRF utilizes its Financial Capital – which includes debt, equity financing and cash generated by the operations and investments, in various CapEx projects.

Since Investments are focused on the Expansion, bringing Efficiency and Upgrading existing equipment and infrastructure to create a Manufactured Capital. Therefore Huge investments, focused on the Sustainability and Innovation agenda for gaining a Competitive Edge, are required.

Accordingly Intellectual Capital is needed to do the Due assessment of the returns on investment, against the extent to which it might aid to the Business Growth.

Further, Natural Capital inputs such as raw materials, water, fuel and renewable energy, etc., are Critical to Operate Efficiently.

Hence Allocation of Financial and Human Capital to Secure Long-Term availability of these inputs is required, as a must.

SRF Competitive Advantage through these Resource Capitals

SRF emphasizes on: “Capitalising New Opportunities, Expanding Product Portfolio considering the Evolving Customer Expectations and Enhancing Market Presence, Implementing Differentiated Business Strategies, Prudent Capital Allocation, Optimum Utilisation of Natural Resources to Lower Operating Costs, Automate Manufacturing Processes and thereby Strengthening the Business Processes” – All that to aid in building a Sustainable Business Model.

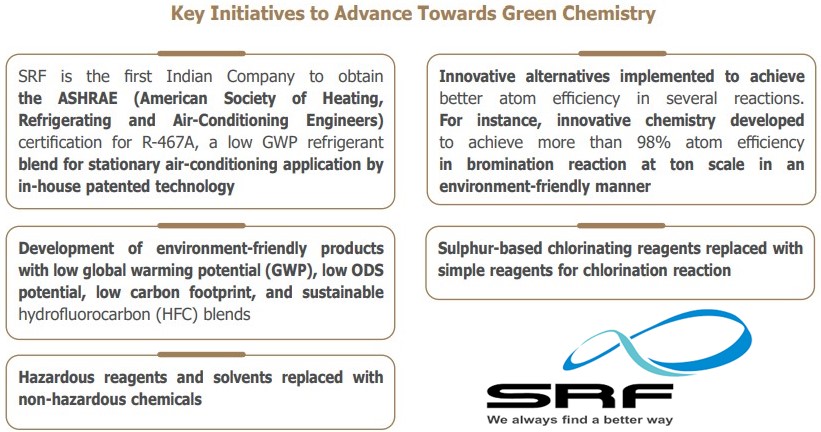

With emphasis on the principle of 3R – Reduce, Reuse and Recycle; SRF strive to operate in a ‘Closed-Loop’ through Circularity in Operations – e.g. Supplying fly ash Waste generated on the site, for Utilisation as Raw Material in the cement industries.

Company is continuously putting efforts on Local Sourcing of the raw materials and increasing the Use of Recycled materials in Production – e.g. recycled materials used as raw materials in Production Processes.

With the implementation of Total Quality Management (TQM) for meeting Evolving customer aspirations, SRF has Shifted the market dynamics by bringing systemic changes to Maximise Plant Efficiency and Deliver Diverse Solutions – e.g. TQM-led supply chain improvements, enhancement of internal process efficiency and building a skilled workforce.

The core of the TQM framework emphasizes a strong quality assurance system in each of SRF’s businesses, Spanning the full Product Lifecycle from product planning and R&D, through the development stages, setting up of facilities, raw material procurement, manufacturing operations and supply of the finished products.

SRF launched its first advanced course on Data Science, which is a part of SRF’s Strategic Digital Transformations through – Industrial IoT (IIoT), Machine Learning, and IT enablement to build capabilities in solving complex problems, both for managing routine operations efficiently as well as making quantum improvements.

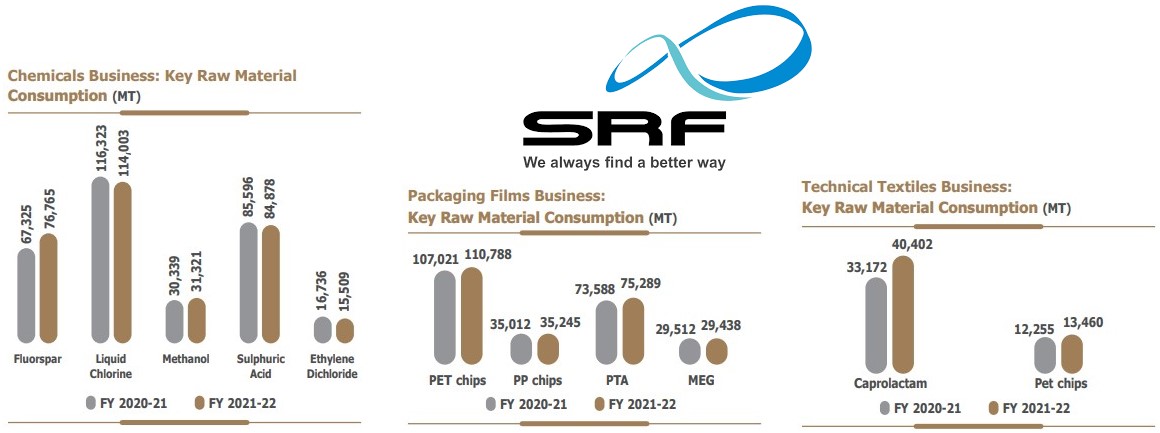

SRF strive for sustainable sourcing of the raw materials, focusing on minimum use of the fresh raw materials by recycling and reusing materials to the highest extent possible, through its product re-engineering and innovation. Hence, the waste generated at the source is also minimised.

Further, SRF sources its raw materials through a Broad Network of Suppliers and Vendors.

The Company has invested in the Futuristic and Scalable Digital Platforms to initiate Enterprise Transformation through Process Digitization and Digital Workflows, Analytics, Automation, and Cloud Product Suites.

This has helped in accelerating Strategic Decision-Making and Modernising the Company’s IT landscape and thereby giving a competitive edge to the company in the Evolving business market.

Key Focus Areas

Sales-Force Automation – SRF plans to implement Customer Relationship Management (CRM) across all manual sales management processes, to achieve complete digitalisation. This initiative has already been implemented in Technical Textiles Business and the plan is to scale it to other businesses in the future.

Digitalisation of Supply Chain – SRF plans to digitalise its Entire Value Chain, by increased supplier interactions, through a supplier information and engagement portal.

ERP Upgradations – To increase the operational effectiveness, the current ERP system is being updated with the introduction of new modules. This will monitor data and information in Real-time, ensuring Optimisation and Efficiency in operations.

SRF Diversified Business Portfolio Providing It Multiple High Growth Levers

Despite the ongoing COVID-19 pandemic After-effects, Widespread Supply Chain Bottlenecks, and Increasingly Higher Energy & Raw Materials prices, SRF still able to achieve Robust Operational and Financial Performance between FY21 to FY23. So, let’s find out the reasons behind this Sustainability of High Growth.

SRF – The Past (Performance in FY22)

In FY22, SRF’s Overall Revenue & PAT has grown @ ~ 48% & 58% respectively, wherein its Chemicals Business revenue has grown at ~ 43.8% compared to FY21.

Company’s Specialty Chemicals Business performed remarkably well in the year, driven by the stronger demand in both exports and the domestic markets. SRF enhanced its new product portfolio by introducing Anhydrous Hydrogen Chloride (AHCL) for pharmaceutical applications, which also helped it to expand and strengthen its customer base further.

Besides, SRF Pharma propellant Dymel® HFA 134a/P also witnessed a significant increase in sales, due to expansion into the new geographies.

There has been consistent demand for more-and-more complex molecules, which SRF’s In-house R & D team is able to fulfill on time, thereby giving SRF an overall edge in the marketplace.

Given the stronger demand scenario, company launched 4 new products in Agro-chemicals & 2 in the pharma segment during FY22. Moreover, company is also doing the CapEx:

1) – Of Rs. 200+ crore for setting up of dedicated facilities to produce Agro-chemicals Intermediates at Dahej, Gujarat and;

2) – Of Rs. 190 crore for setting up a Pharma Intermediates Plant (PIP).

In addition, company has also done large CapEx on Polytetrafluoroethylene (PTFE), chloromethane (CMS), etc.

SRF’s Fluorochemicals Business delivered a strong performance during the year, on account of higher volumes in refrigerants, blends, and chloromethanes.

SRF Packaging Films Business revenue has grown at 45.2% YoY, as both domestic and international facilities delivered the strong performance. Company has allocated a CapEx of Rs. 425 crore to set up an Aluminium Foil manufacturing facility near Indore in Madhya Pradesh, which is expected to be commercialized in ~ 20 months.

SRF new BOPP film line, which is currently under construction in Indore, is also on track and was expected to be commissioned in Mid of FY23.

Company’s Technical Textiles Business revenue has grown at 68.1% compared to FY21, on the back of highest-ever sales volumes from the Belting Fabrics and the Polyester Industrial Yarn segments. This strong growth has Partially Offset the Weak demand, for the Nylon Tyre Cord Fabrics.

In Other Businesses segment, SRF continues to maintain market leadership in the Coated Fabrics Business, with a high-volume share driven by improved sourcing initiatives and plant efficiency. In the Laminated Fabrics Business, SRF retained its price & volume leadership, with the facility operating at full capacity & achieving its highest-ever sales in Q4FY22.

SRF – The Present (Performance in Q3FY23)

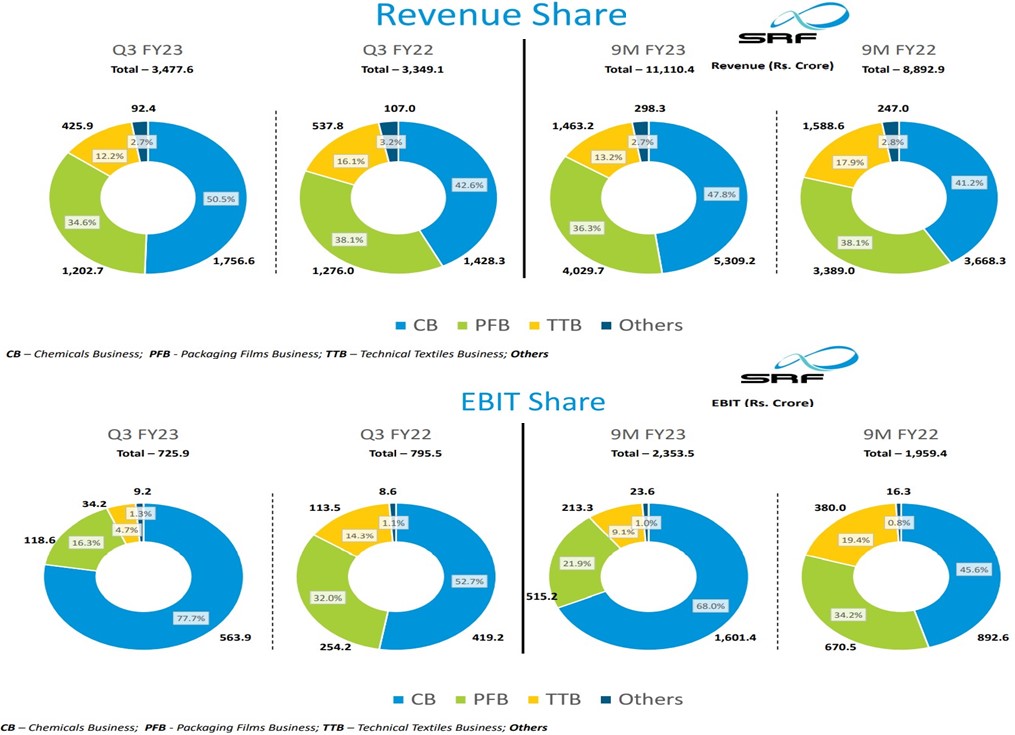

Out of Rs. 12,434 crore of Total Revenue which SRF generated in FY22, 42% is contributed by its Chemicals Business whereas, Packaging contributed 38%, and Technical Textiles & Other Business contributed remaining 20%.

With SRF’s continuous strive to achieve 5 ‘Aspirations 2030’ Goals and prudent allocation 6 Capital Resources, this exemplary performance continued even in FY23 also, as the company capitalized upon every potential opportunity which could drive its growth faster, by leveraging its State-of-the-Art 14 Manufacturing Facilities, In-House Backward Integrated Processes, Cutting-Edge Technologies, World-Class R & D facilities, Differentiated Business Strategy Complemented with the Digitization and Innovation.

Overall Revenue Growth in Q3FY23 was 4% YoY, led by the chemicals (up 23% YoY) but pulled down by technical textile (down 21% YoY), packaging film (down 6% YoY) and other segment (down 14% YoY).

EBIT from the chemical segment remained strong at 32%, while the same from technical textile, packaging film and other segments were relatively weaker at 8%, 10%, & 10% respectively.

PAT in Q3FY23 has grown only 1% YoY, as the finance cost increased 111% YoY due to higher CapEx investment.

Specialty Chemicals & Fluorochemicals Business

The growth from the chemical segment was driven by the new products witnessing significant traction and strong customer engagement on flagship and downstream products, ramp up of MPP4 facility in Dahej, Stronger demand for key products & downstream derivatives.

Apart from this, higher realisation growth and stable volumes in the HFC’s along with the pharma grade gas (Dymel HFA 134a/P), supported the overall growth.

Besides, Pharma Intermediate plant is also being commissioned which should be ramped up very quickly. The Board has approved a project to set up a dedicated facility to produce 300 MT per year of SS20 at Dahej, through CapEx of Rs.110 crore.

Fluorochemical business, which is backward integrated and PFOA free business, seen a healthy performance on account of strong traction into the domestic market for refrigerants, continues demand for Dymel @HFA 134a/P (pharma grade gas), healthy contribution from chloromethane and gradual ramp up of volumes of the recently commissioned facilities.

Company has not seen any major pressure in the prices of HFCs & the Outlook for domestic demand for HFCs remained strong along with traction from the US market. Since, the fluorochemical facilities are running well, full benefits of chloromethane plant should be available from Q4FY23. In addition, Specialty fluoropolymers has an overall capacity of ~ 4500 tonnes in Q3FY23.

PTFE plant is likely to be commissioned latest by Q1FY24 and the company expects likely ramp up within 6 months.

The board has approved a project for production of a range of specialty fluoropolymers, at a cost of Rs.595 crore, which includes PVDF and FEP and these chemicals caters to a wide range of industries such as battery, chemical, coating, solar, automotive and aerospace.

In Dahej, a new 20 MW mega power plant has been commissioned, which allows the company to optimise its power expenses.

Packaging Films Business

The segment faced several headwinds that impacted the performance during Q3FY23 including significant supply addition in BOPET, global demand Slowdown, Rising Energy Costs in Europe and Sharp Fall in the commodity prices.

Company believes that BOPP will start to improve in price from Q4FY23.

Energy cost in the US is witnessing some softness and expect a better performance in Q4FY23, while full benefit of the energy cost will reflect from FY24. Further, Aluminium Foil plant is likely to get commissioned in Q2FY24.

Technical Textiles Business The segment performance was impacted owing to the Subdued Demand for Nylon Tyre and Polyester Industrial Yarn.

SRF – The Future (Outlook from Q4FY23 & Beyond)

Specialty Chemicals

SRF is aiming on Moving up the value chain by accelerating qualifications of new molecules in Agro and Pharmaceuticals sectors, Simultaneously working on AIs to ensure a healthy product profile for the long term.

Key new product campaigns also coming up in the short term. Company is bringing ROI accretive projects involving complex chemicals and specialty products, for its global customers. In addition, Focus will be on to launch new products from MPP4.

Fluorochemicals

As Demand in the refrigerants segment is expected to remain strong in the near to medium term, therefore SRF Focus will be on expanding in new markets / geographies and product offerings, ramping up sales from the refrigerants, blends and industrial solvents.

Managing in-progress CapEx and ramp up volumes, to achieve high asset utilization along with Strong focus on effective resource utilization.

Packaging Films Business

Aluminium foil project in SRF Altech Limited remains on track. Company Focus will be on enhancing sales from the new BOPP film line in India and introduction of new value-added products.

Management Expects pressure on BOPET and BOPP film margins to continue in the short run. Hence, Focus will be on increasing pace of R&D efforts, sustainability initiatives, efficient cost structures and enhanced capabilities.

Emphasis will be there on tie-ups with strong regional channel partners, to enhance presence in the key strategic markets.

Technical Textiles Business

SRF is clear on having Higher Operating Leverage and Cost Optimization by Capacity Rationalization, across various manufacturing facilities in this segment.