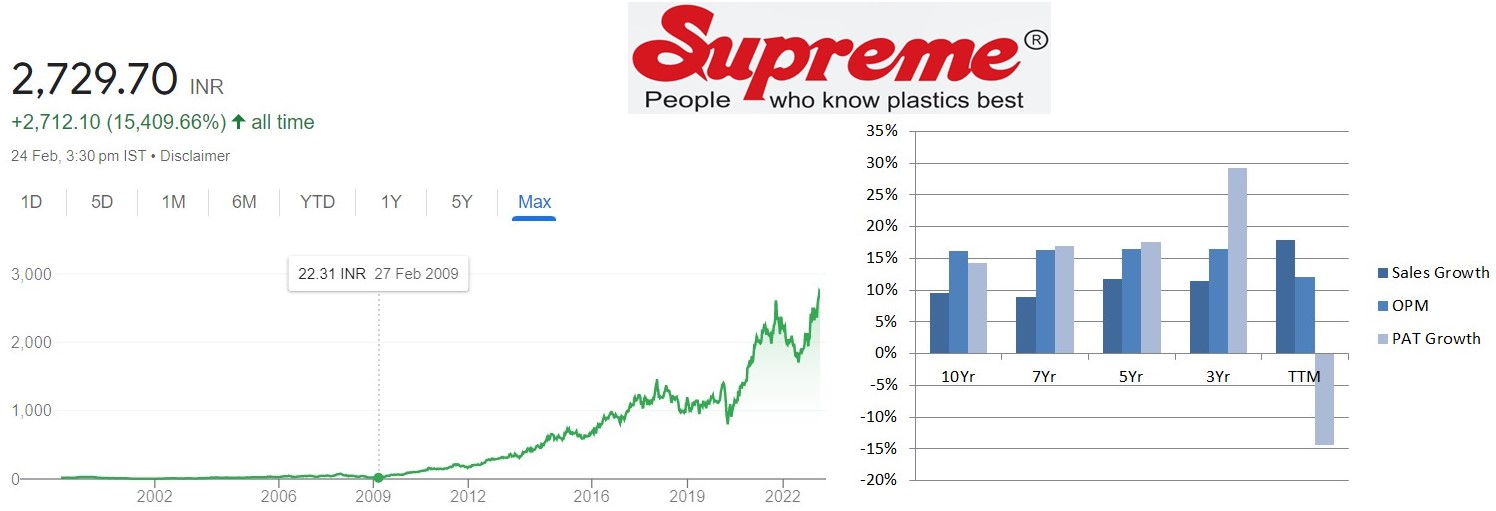

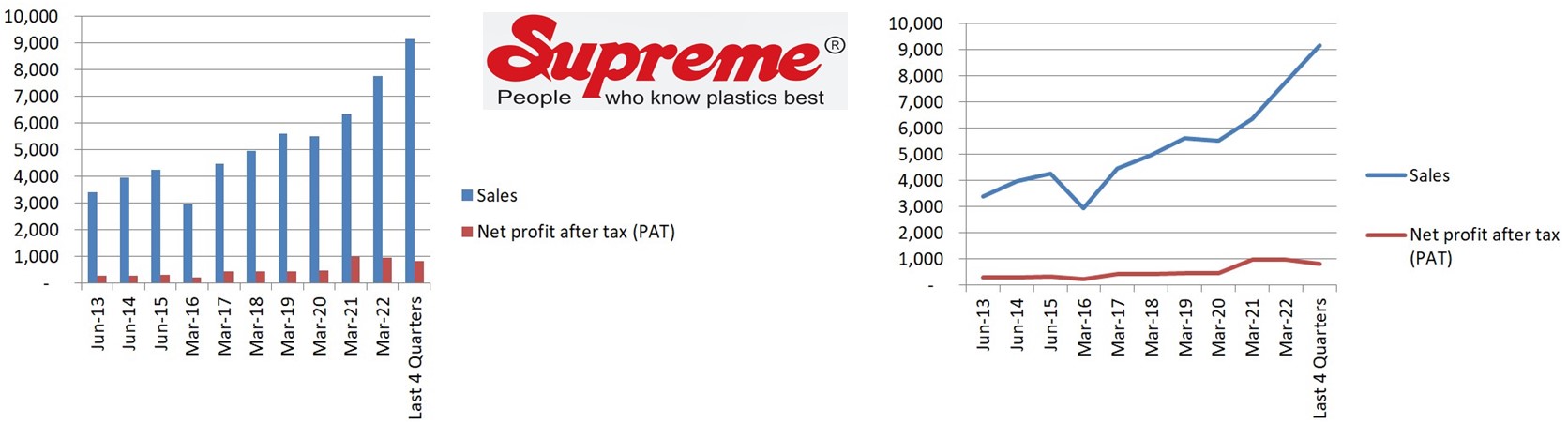

Supreme Industries used to have Net Profit of ~ 100 Crores Annually in 2009, But 14 years later, Today company makes ~ (800 to 900) Crore of Net Profit Annually. That’s a good number to say the least, but what’s more Surprising is the fact that company has given it’s Share Holders returns of ~ 125x during the same period!

It’s the Sustainability of the Sales and Profit Growth over the period of time, while maintaining OPM of ~ 16% consistently, that has resulted into winning the Trust of FIIs & DIIs and hence the increased exposure by them into this company, which eventually resulted into it’s PE Re-rating on the higher side.

For a company that has to face Fierce Competition to gain any market share from the Peers like Astral Ltd., Finolex Industries Ltd., and Prince Pipes & Fittings Ltd., such massive growth is just Extraordinary!

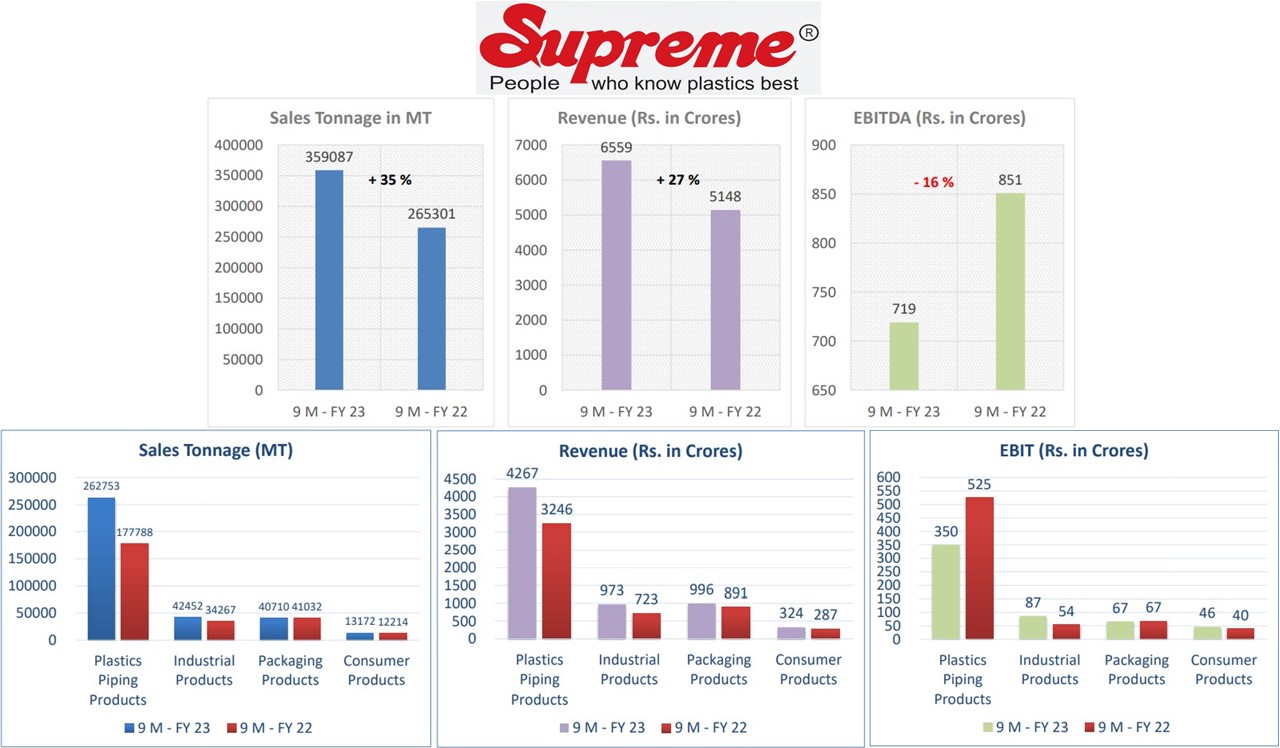

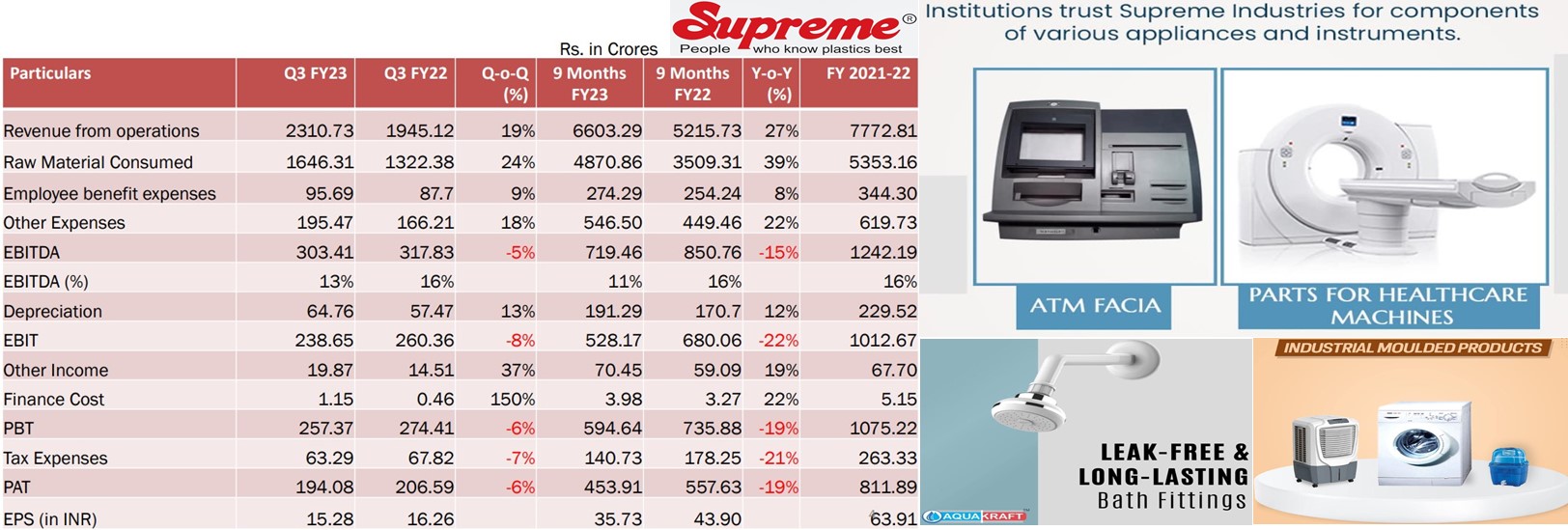

Despite all that, Supreme Industries has also been under going a phase of EBITDA and PAT De-growth continuously across all the 3 Quarters of FY23, even though there has been a Volume Growth of ~ 35% and Revenue Growth of ~ 27% on 9MFY23 basis. So, what led to this De-Growth of Bottom Line, despite having Growth both in the Volume and the Top Line?

We will read that in this article.

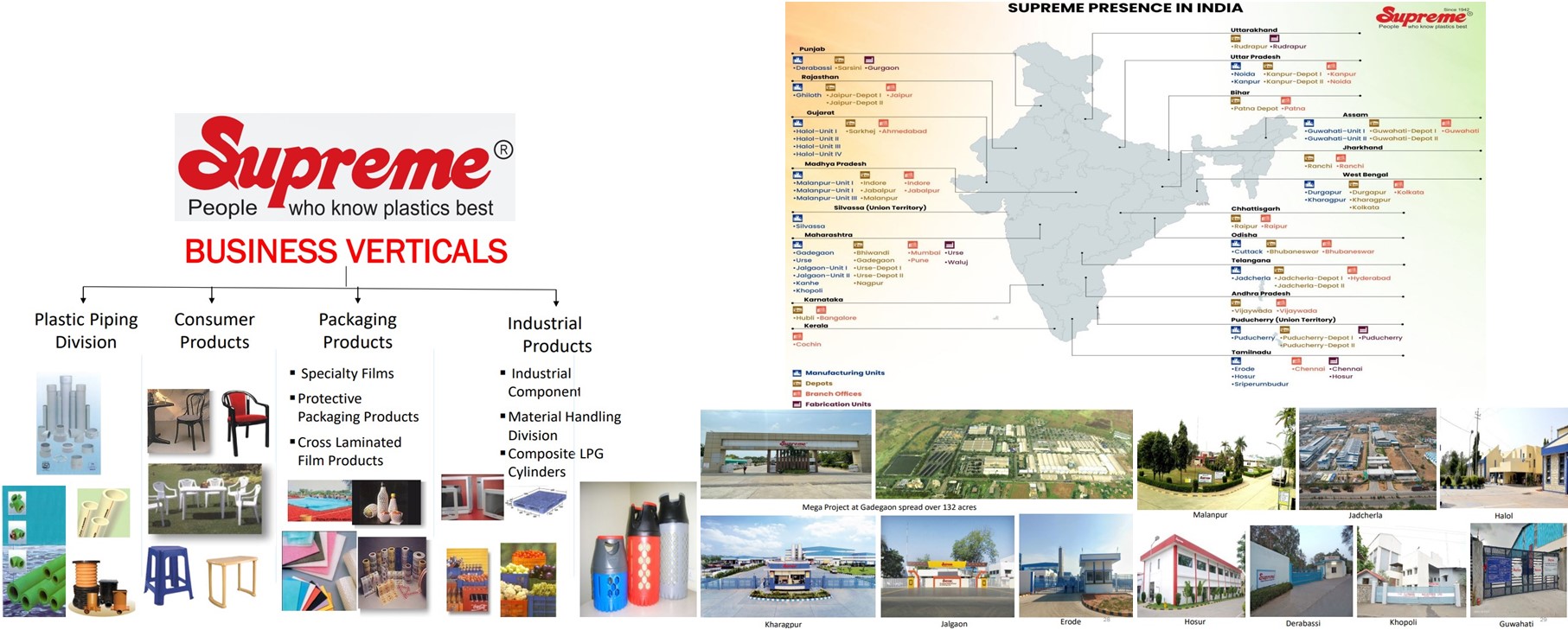

Supreme Industries – The People-Centric Product Portfolio, Catering To Various Segments Of The Economy

Since its Inception in 1942, Supreme Industries has created People-Centric vast Product Portfolio, catering to various Segments of the Economy and thereby Replacing the usage of Conventional Materials.

Supreme’s capabilities in R & D to Innovate High Quality Products, using State-of-the-Art Technologies, has enabled it not only to Diversify Revenue Model across the 4 Broad Business Verticals, but also to Expand the Business with the Spread of its 28 Manufacturing Facilities (whose Combined Asset Base is more than Rs. 3500 Crores) across the country.

With Time, Supreme Industries has gained Significant Market Share in each of these 4 Verticals through Strategic Expansion of not only its Brownfield, but also in the New Greenfield Projects, given the Strong Cash Flow which company always have to Fund these CapEx that Propelled its High Earnings Growth Trajectory.

Besides, Supreme Industries have:

1) – Pan India Distribution Network and Reach, with commitment to reach all the Tehsil areas of the Country. As on March 2022, company has 4053 numbers of Active Channels Partners and 36 Depots and Fabrication Facilities.

2) – Ability to Consistently Increase its Revenues from Speciality and Value Added Products

3) – Cost Efficient Raw Material Procurement Capability

4) – Invulnerability from the Import Substitutes, and

5) – Advantage of being the User of Diverse Polymers especially like Polypropylene (PP), Low Denier Polyethylene (LDPE) and Poly Vinyl Chloride (PVC), which provides the company ‘Economies of Scale’.

Hence today, Supreme not only have the Established Brand Equity but is also one of the Largest Plastic Processor in India, with a sale of above 4 Lakh MT annually.

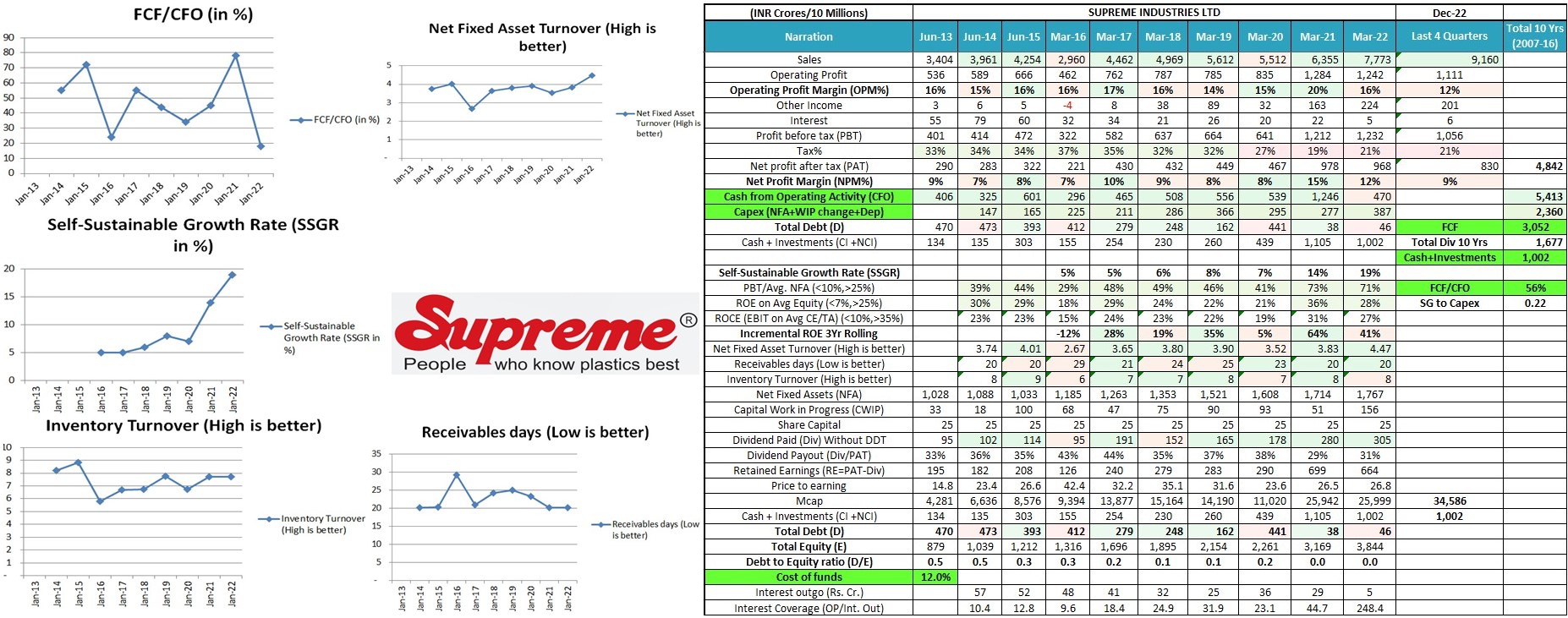

Despite running a Capital Intensive Business which requires regular CapEx for fueling the Growth, company’s Debt to Equity is almost ~ 0. Moreover, in last 10 Years there is not even a single year when the company has not generated the Free Cash Flow (FCF) and the on 10 years reference period, company has generated FCF at ~ 56% of the Cumulative CFO because of which, Supreme’s Self Sustainability Growth Rate (SSGR) has consistently been Increasing, since FY16.

The Company’s Working Capital Management involves well-organised processes, which facilitate continuous monitoring & control over the *Receivables, Inventories, & other parameters – (*To know more, read: https://jyadareturn.com/7-key-parameters-you-should-look-for/)

Although company has been expanding capacities in Strategically Chosen areas but at the same time, whenever required, it has also Divested and Closed Down Un-remunerative Product Divisions/Locations such as Supreme Oriented Films, Supreme Vinyl Films, Klockner Supreme Pentaplast, Food Service Ware Division, Khuskheda Unit catering to auto components, etc. to keep Liabilities under Control and the Cost Structure Optimized.

For all these reasons, along with a Cash Surplus of Rs. 687 Crore even at the end of Q3FY23, CRISIL has Upgraded Supreme’s Bank Loan Rating to AA+/STABLE. As a result, company is able to meet its working capital requirements at an Optimum Cost of just ~ 12% through an easy access to Fully Unsecured Capital via company’s Multiple Banking Arrangement (MBA) with 9 banks.

Hence Leveraging the Trust, which company Builds through Sustainable Business and Lucrative Value Proposition.

Supreme’s Saga Of Organic Growth & Expansion In All The 4 Business Verticals

Company intends to use its Surplus Cash to continue to Grow Organically, while being open to Explore the Opportunities to Grow Inorganically as well, through rightful acquisitions.

Further whenever during the Extended periods of Ram Materials Price Fluctuations, situation like Large Build-up of Inventories along with Increased Debt on the company’s Book emerges, company utilises its Cash Accruals to meet the increased working capital requirements as well as it could also plan for its Material Procurement Optimally, which result into Uninterrupted Production and Supplies to the customers.

With its Prudent and Consistent Hedging Policy, Company has largely mitigated the Risk arising out of Foreign Currency Fluctuations.

Supreme’s Plastic Pipe Division contributes ~ 65% in the Total revenue of the company, whereas Industrial Products, Packaging Products, and Consumer Products contributes ~ (13 to 14%), (16 to 17%), and (5 to 6%) respectively.

In Plastic Pipe Division, company has launched over 9000 products replacing the Traditional Concrete & GI Pipes.

Supreme’s Industrial Products have Revolutionized the product development process, especially in the Appliances and Automobiles Industries. Besides that, these products are also finding their newer applications in ATMs, Washing Machines etc.

Given the advantage of increasing the Shelf Life of various products and Food items, company’s Performance packaging Films are finding their new applications in various segments like Consumer Durables, Automobiles, Footwears & Sports Goods, Insulation, Water-Proofing, and others.

Similarly, Supreme’s Cross-Laminated Films & Products finds their usage in Tarpaulin, Pond & Canal Lining, Shed Covers, Shelters, Fumigation of Food Grains. These products are also finding their new applications in Rainwater Harvesting, Vermiculture Compost Pits, etc.

With the Launch of Explosion Proof, Rust-Proof and Leak-Proof Composite LPG Cylinder, Supreme has truly carried forward its Brand Legacy by creating Safe and Convenient, Environment-Friendly products for the People.

The company is being Driven by its Accumulated Capitals, that has not only created Enormous Value for the stake holders but is also driving this Growth further in perpetuity.

Supreme’s Plastic Piping Division – The Alpha Vertical

Company is a Leader in the segment, as it has the Largest Product Portfolio, which is being continuously Expanded, to offer more systems as required by the market it caters to.

The Government at the Centre and States have put the priority focus on initiatives like: Jal Jeevan Mission (To provide tap connections to every household), Pradhan Mantri Awas Yojana (Housing for all), AMRUT, Swatch Bharat Abhiyan, Sanitation and Affordable Housing for all, along with the development of 100 Smart Cities all over India.

**All these initiatives are expected to give a boost to the growth of Plastic Piping System Division – (**To know more about the Growth Drivers in this Segment, read: https://jyadareturn.com/astral/)

Supreme has expanded its footprint in south zone for manufacturing of PVC Pipes, cPVC Pipes, Water & Septic Tanks; with facility in Jadcherla, Erode, and Cuttack. Plant at Kharagpur, with increased capacity of HDPE and DWC Pipes along with expanded capacity of Moulded Fittings, is operating at its Optimum Capacity.

Company now manufactures Roto Moulded Products at all the 4 geographies of the country.

To increase Water Tanks Business significantly, company is planning to serve directly to the retailers, from the respective factories at many places.

Premium range of Water Tanks branded as “Weather Shield” with added features such as superior thermal insulation etc., is gaining traction. Whereas in Economy range Water Tanks, company is planning to start the manufacturing of Blow Moulded Water Tanks at 2 of its locations in Assam and West Bengal.

Supreme introduced 66 nos. of varieties in Injection Moulded Pipe Fittings during FY22, which has broadened the Total Product Portfolio in Plastic Pipe System to 9108.

Supreme’s Specialized Valves such as Butterfly Valves, Swing Check Valves, Ball type non-return Valve etc. which are made of specialized materials to ensure reliability & longer life, have been designed for different applications like – Industrial, Agriculture and Plumbing segments, are receiving positive response from the market.

The AQUAKRAFT Bath Fittings Portfolio has reached ~ 175 items, where the Company is aiming to introduce many more new products, along with some premium ones. The Bath Fittings sales during FY22 grew by 30% YoY. In FY23, Company added 4 new systems in this division viz. Electrical Conduit system, Hoses (Garden and Pressure), PEX Pipe system and Olefins Moulded Fittings (Compression and Electro fusion), thereby Expanded the Product System count to 35.

The Company extended welfare measures to its influencers and has started monitoring data of retailers who buy regularly through its distribution channels. There are now more than 41,000 retailers connected with this Division on a Regular basis.

Post revision of IS-15105, CPVC has been considered as an alternate material to metal system, for use in Automatic Sprinkler Fire Extinguishing System. As a result Maharashtra, Karnataka and Gujarat have already started using the CPVC Fire Sprinkler System. Hence the demand for company’s FlameGuard CPVC Pipe System is growing rapidly in these regions.

But the system has limited success in a part of the country, where MS Pipe is still considered as material for installation in the Sprinkler System instead of GI Pipe. As the cost of MS Pipe is ~ (20 to 25%) less compared to GI pipe system, so to make Price More Competitive compared to MS Pipe made Sprinkler System, company has started using its own in-house compound.

At present the Company is dependent on the Import of metal insert fittings and the solvent cement. Hence the company is exploring the ways to manufacture this solvent cement also Locally.

Supreme’s Industrial, Packaging, and Consumer Products – 3 Verticals With Multiple Growth Drivers

In Washer Segment, Supreme is Shifting from Semi-Automatic to Fully Automatic Machines due to higher demand in the later. To reduced cost in the Industrial Product Division through Improved Capacity Utilization, company focused on its Cost Management “Rainbow Project”.

Looking at the positive demand scenario in various sectors of Appliances like Washing Machines, Air Conditioners, Coolers and Refrigerators, segments where the Company has good presence, Supreme have invested in the Capacity Expansion at various locations.

Demand recovery in Auto sector has also helped in the revenue growth of this Division, with significant demand up stick in the Segment coming from the Passenger and Commercial Vehicles. Company Expects Business Scenario to remains Bullish in Medium to Long term with business friendly Govt.’s PLI Scheme, which was launched both in Automotive and Consumer Appliances Sectors.

Accordingly it has planned need based Capacity Augmentation, to handle the projected increased demand going forward.

With very positive vibes visible in the Automobile & Engineering Sectors, Major Auto OEM’s are marching ahead with expansion in the Capacities for Electric Vehicles. As these Industries are Key Drivers of Demand for Supreme’s MHD’s Industrial Crates, therefore company will be adding new models for the Industrial Electric Vehicle Space.

The Company’s constant focus to enhance customer reach, service and educating the targeted audiences for both Injection and Roto Pallets has Yielded Surge in the Exports Gains, as the company has registered impressive growth both in Injection Moulded Regular repeated use Pallets, as well as one time use Export Pallets.

Besides, company is also Expanding the Roto Moulding Pallets Infrastructure at its Jadcherla Unit, due to Strong Volume and Revenue Growth for Roto Pallets, given the Regular Higher Demand coming from Pharma and the Foods Industry.

In the Dairy Segment Products, company has Grown at ~ 90% in terms of Value and ~ 60% in terms of Volume, in FY22. Supreme Industries seems Confident that this Momentum of Growth will continue in FY23 & 24 also, as the Company has Expanded its segment business in South and Western States.

Similarly Strong Traction and Volume Growth have also been seen:

1) – For Crate Models, suiting E- commerce and Retails Operations.

2) – For highly cost effective Injection Moulded Dustbins.

3) – For Soft Drink and Beverages Bottle Crates.

In Composite LPG Cylinder Division, Existing production line is running at full capacity and primarily catering to the Rs. 170 Crore order received from IOCL in FY22. Commissioning of the new line Doubling the capacity is completed and the same is under trial runs now.

Industrial Component division has also received LOI of ~ Rs. 45 Crores for supply of Electronic Voting Unit Components and VVPAT, in addition to the earlier order of Rs. 76 Crores.

Protective Packaging Division is closely working with Customers and Developing New Applications for varied industries, keeping their need in mind. Division is Focused to grow in Volume, do Value engineering and Adopting new technologies in manufacturing, to Drive Improved Profitability. Continuous growth is Witnessed in Defence, Export and Insulation Business during FY23.

Performance Packaging Film Division is working extensively on developing Special Structure Films to meet newer applications and customer requirements, along with continued Efforts to enter new territories in Export Market and Increase the Customer Base, for Better Realization and Profitability.

In Consumer Products Verticals, focus is on Expanding the Distribution Network and Customer Reach.

Similarly, In Cross laminated Films Business Thrust during FY23 has been on Promoting Non-Tarpaulin Products, Finding New Applications, Targeting New Customers in existing markets & on Reaching the New markets. To achieve these Objectives, company has taken part in several exhibitions to Show Case its products.

Supreme’s Hurdle – Present Headwinds, EBIT & Bottom Line Margins Contractions, And The Business Outlook In Near Term

Despite having 35% Volume Growth and 27% Revenue Growth in 9MFY23, Supreme Industries EBIT Margins has shown De-Growth of 22% and PAT has shown De-Growth of 19%, even after Discounting the growth of 19% in Other Income, 22% Advantage of Finance Cost and 21% Reduction in the Tax Expenses of the company, during the said period!

Reason being, in 9MFY23 company’s Raw Material Expenditure has gone up by 39% due to Steep Rise combined with High Volatility of the Raw Materials, mainly PVC. Even this seems to be Justified, given that the company has sold 35% more Plastics Goods in 9MFY23 compared to 9MFY22. Hence, to Sale more company has to Procure more of the raw material proportionately.

That’s OK, But as the Prices of Polymers (RM), especially PVC Resin, has gone down between (28% to 46%) since the beginning of FY23 till November 2023, before rising a bit thereafter. So that has resulted in the Substantial Inventory Losses, part of which although is recovered during the December 2023 and further Recovery is Expected to happen in Q4FY23.

In short, First the company could not pass on the effect of Increased Cost of RMs, and Second it has also Suffered the Substantial Inventory Losses till November 2023!

Besides, simultaneously Increase in – Employee Benefit Expenses by 8%, Other Expenses by 22%, and 12% Increase in the Depreciation Cost, has combinedly been Detrimental for the EBIT and PAT Margins to an extent that since FY16, this may be for the 1st time that the company might be staring at a Severe PAT De-Growth of ~ 20% for the complete FY23, as the Total PAT for FY23 is likely to remain Under Rs. 800 Crores.

The Prices of PVC are expected to remain Affordable and Range Bound going forward, whereas the Recovery of Inventory Losses also likely to get completed by FY23’s end. So, the company expects to regain its Healthy EBIT and PAT Margins from Q1FY24 onwards.

Besides, the New Greenfield Plants at Guwahati and Erode have already gone into the Commercial Production, whereas plant at Cuttack is likely to Commence Production from February 2023.

All the Brownfield Expansion of Capacities and Range of products, are working smoothly. Besides, company’s newly introduced Olefins Fittings and PEX Piping System are getting encouraging response from the market and are poised for good growth in the time to come.

Moreover Company has also launched Cable Shield Conduit System in January 2023.

So with all above projects and expansion in place, company Expects to achieve Volume growth in excess of 35% in this segment, during current FY23.

The Company’s Capex Plan for the FY (2022-23) of about Rs. 700 Crore including carry forward commitment of Rs. 280 Crore, is Progressing with a little Delay from the envisaged schedule. This Entire Capex is being funded through Internal Accruals only.

In view of all the above, company is Hopeful of Achieving Good Business Growth Both in Volume and Value Terms, at-least from Q1FY24!