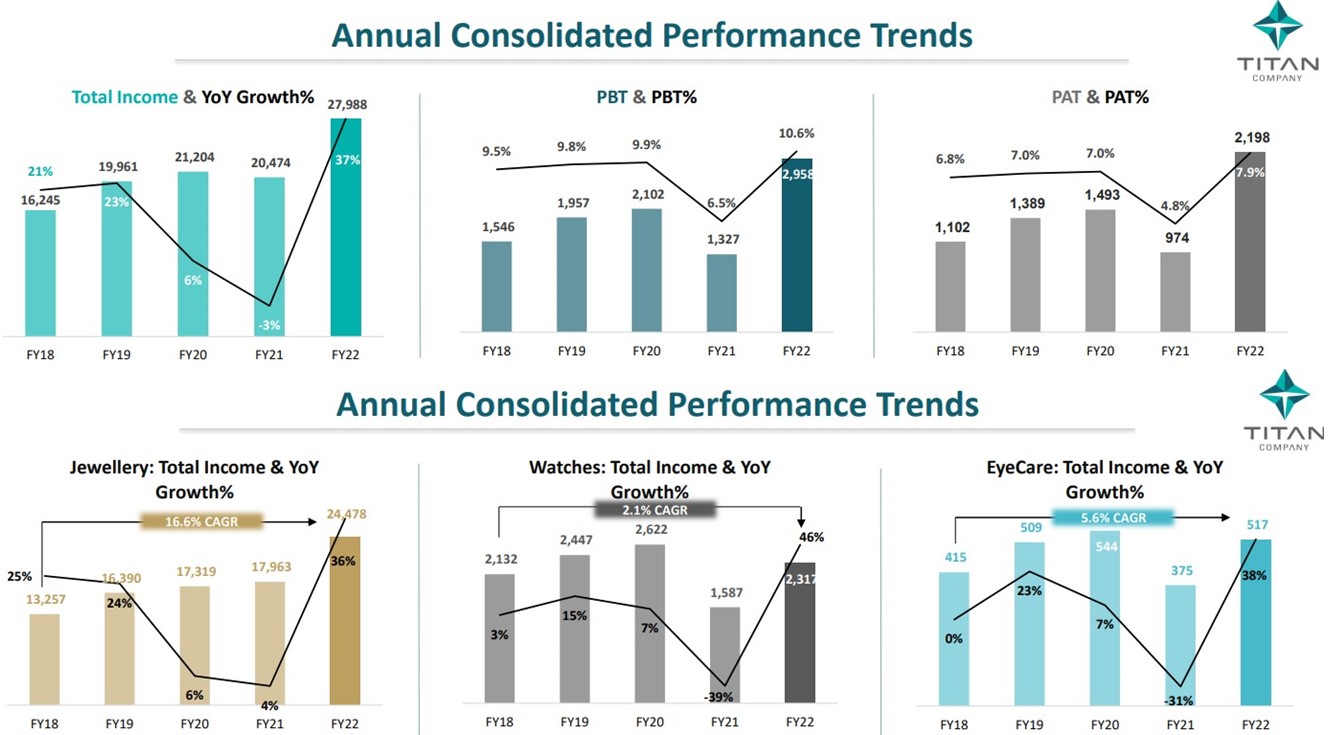

Titan Company is not only the Largest Jewellery Retailer in India but is also the World’s 5th Largest Integrated Watch Manufacturer. Barring FY21, which was impacted by the Covid19 Pandemic, Titan Company has Consistently Improved its Sales & PAT Growth in Last 10 years while maintaining the OPM at ~ (10 to 12%). Moreover, between FY19 to Q3FY23 Company’s Market Cap has Grown at ~ 25% CAGR.

1) -Leveraging Technologies to Create Innovative Product and In-House Designs through State-of-the-Art Manufacturing Facilities, thereby Enhancing the Value Proposition Offered to the Wide Segment of the Customers.

2) -Superior Customer Service

3) – Omnichannel Framework Enabling Seamless Offline & Online Customer Experiences.

4) – Growing Reach and Customer-Focused Campaigns, along with Multiple Brands to meet Different Aspirations in the Society, to Enhance the Customer Base Consistently.

5) – “Focus on Growth” in the Strategic Markets.

6) – Outsourcing of Jewellery-Making to Karigar Parks.

7) – Expertise in Manufacturing Processes of the Watches and Wearables.

8) – Efficient Working Capital Management.

9) – Prudent Hedging Policies.

10) – Expansion into the New Geographies.

11) – Scale-Induced Healthy Operating Leverage Gains.

12) – Better Product Mix.

13) – Widespread PAN India Network.

14) – Capability to Respond to the Customer’s Demands with Agility through Sustainable and Agile Integrated Supply Chain, Supported by a Strong Ecosystem of Artisans, Suppliers, Distributors, Franchisees and Vendor Partners and;

15) – The Trust & Transparency which Brand Titan Offers as a “Tata Product” in an Otherwise Highly Fragmented & Unorganised Gem and Jewellery Sector.

Are some of the reasons why Titan Company did not only Sustained the Consistent Growth, but has also rewarded its Long Term Shareholders by Turning their Rs. 1 Lakh Invested in 2002 to Whopping ~ Rs. 170 Crore in 2022, with Dividend as an Extra. (Source: https://www.livemint.com/market/stock-market-news/rs-3-to-rs-2535-titan-company-shares-turn-rs-1-lakh-to-rs-169-crore-in-20-years-11661745382863.html)

Titan – The Unstoppable Snowball Growing Bigger and Faster

The Key Differentiators that the Titan Company offers are – Exceptionally Designed and Crafted Collections, Products that Continue to be Industry Leading, Brand-Building Efforts that are Cutting-Edge, Exceptional Customer Experience at the Stores characterized by Warmth Displayed by the Store Personnel as well as Store Ambiance, Strong Digital presence through the Websites and various Social Media Channels, IT-led Analytics, Leveraging the CRM Platform to enable a Seamless Physical-cum-Digital (Phygital) Consumer Engagement, and the Continued Focus on Encircle – the Loyalty Program which is also growing well.

But how does this all started to have grown this Big?

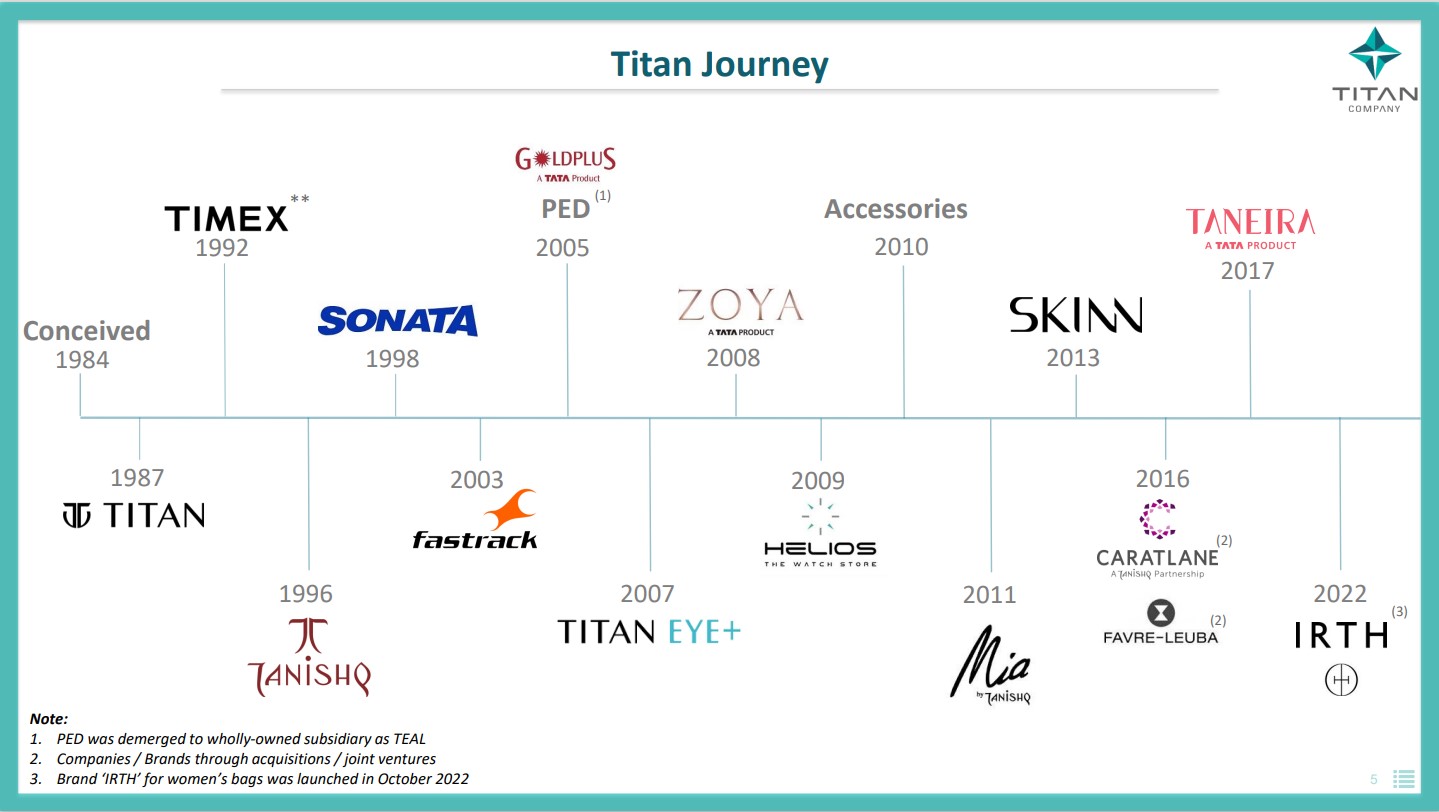

Company which has started with an objective to create Titan Watches for the mass segment, has eventually Expanded into Underpenetrated Markets (like Gem & Jewellery) and Created Lifestyle Brands across the Different Product Categories.

In 1990s, Xerxes Desai and the Titan team realized that Worldwide both Watches and the Jewellery were Sold and Exhibited Together. Even the event they used to visit then, was also called “The World Watch and Jewellery Show”.

Following this realization, Tanishq came into existence in 1996 which today has become the India’s Largest Jewellery Retailer whereas meanwhile Titan has become the 5th Largest Integrated Own-Brand Watch Manufacturer in the World.

Success in Watches & Wearables Segment along with the Huge Success in Jewellery Business Segments, has made Titan to think about other Lifestyle Optionalities like Eyecare, Fragrances and Fashion Accessories, and Indian Dress Wear to enter into, given the Massive Potential for Growth available in these Under Penetrated Segments too and along with the Opportunity to Leverage its existing Competitive Advantage of Strong Brand, Wider Distribution Network, and Capabilities to Innovate Superior Products through Existing as well as New Technologies.

Accordingly, Company has moved into Titan Eye+ in 2007, SKINN in 2013, Caratlane in 2016, TANEIRA in 2017, and IRTH in 2022.

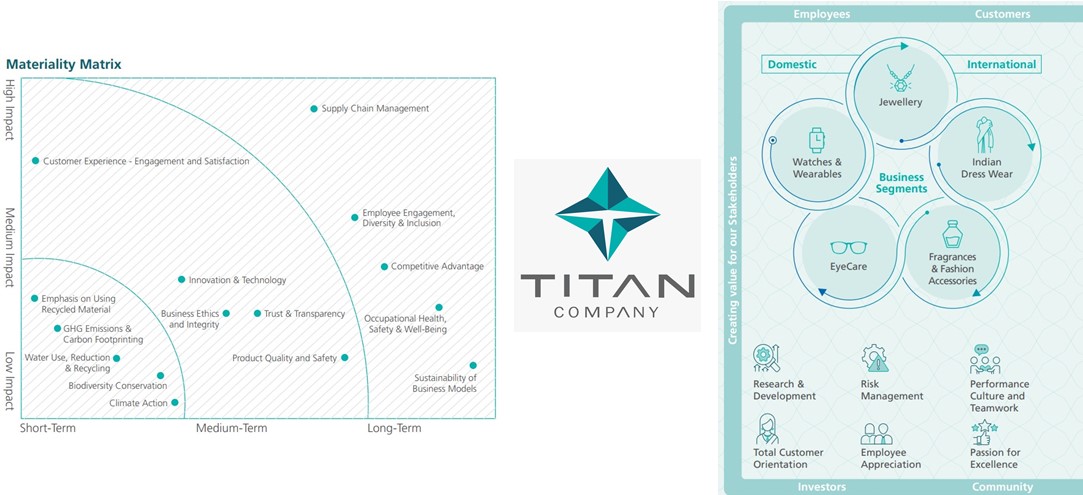

Titan’s – Business Segments

Company operates into 4 Business Segments:

1) – Jewellery

2) – Watches and Wearables

3) – Eyecare

4) – Fragrances and Fashion Accessories, Indian Dress Wear.

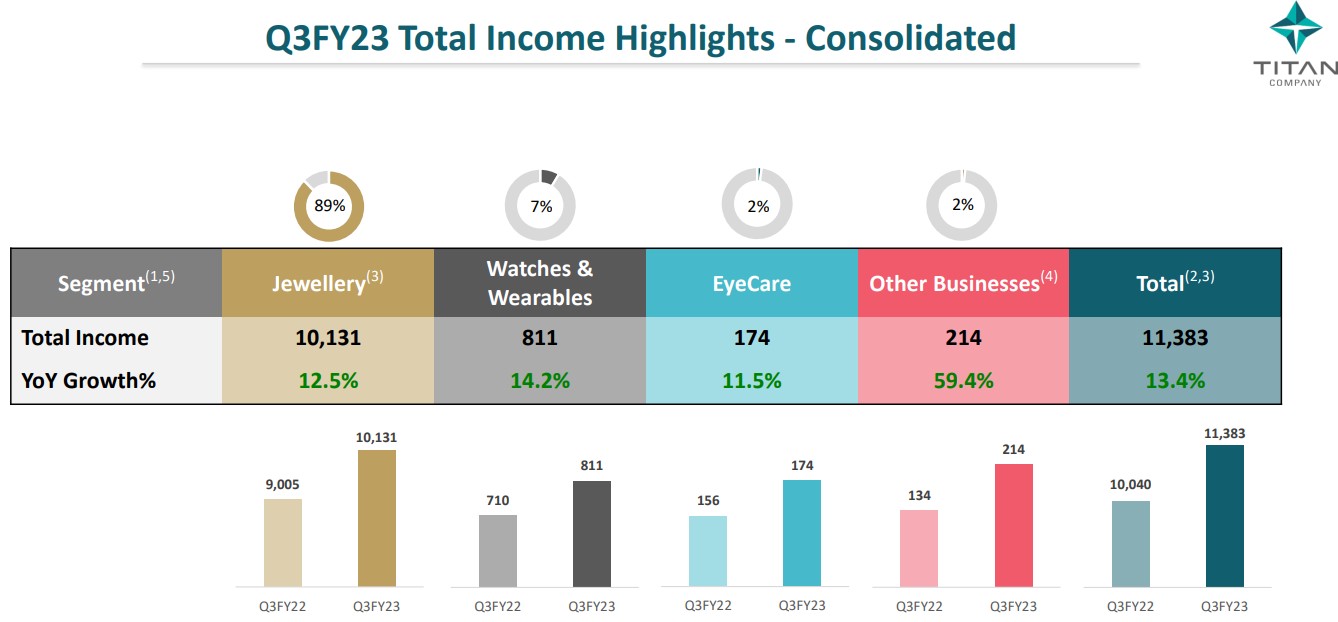

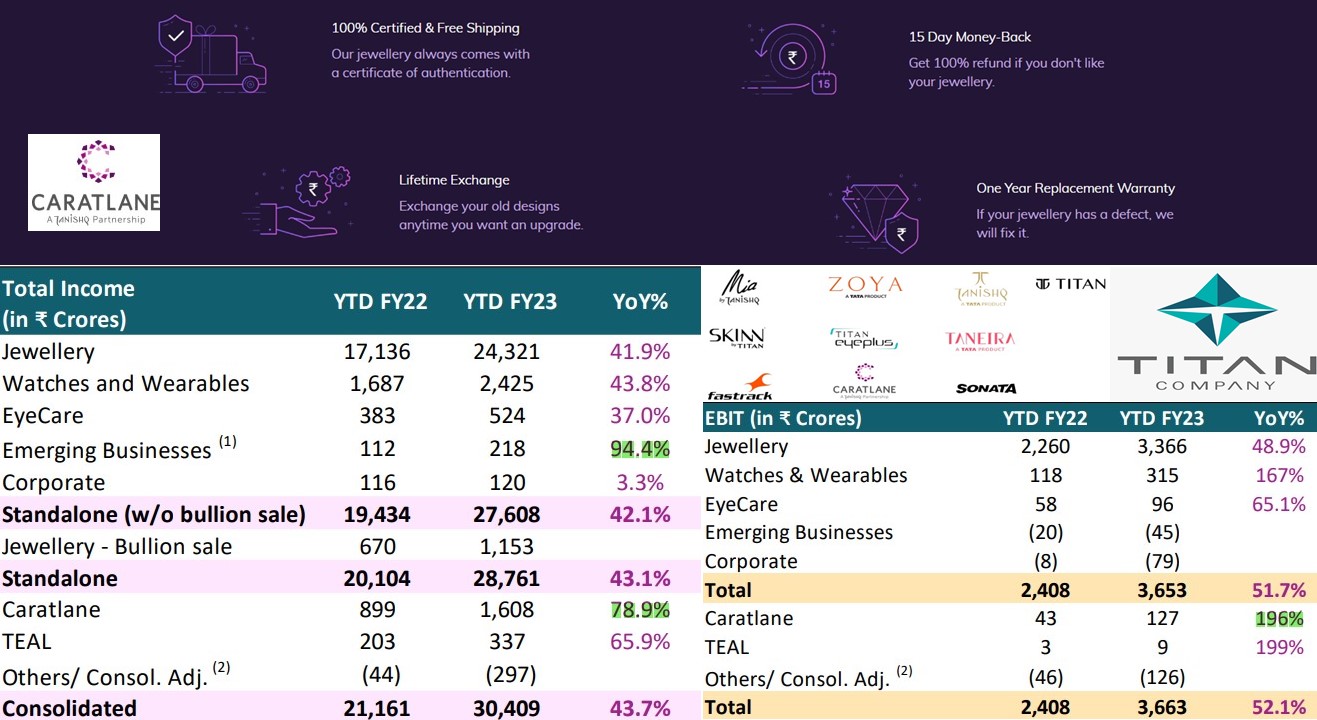

Most of the Products under various brands, caters to consumers mainly from Mid Market and Premium range. Jewellery Segment alone constitutes ~ 89% of the Total Income followed by (7% to 8%) from Watches and Wearables, 2% from Eyecare, and remaining (1% to 2%) from Emerging Business Segment.

Between FY18 to FY22, Company’s Total Income has grown at ~ 14.6% CAGR whereas the Income from Jewellery Segment has grown at ~ 16.6% CAGR, Income from Watches has grown at ~ 2.1% CAGR, and Income from Eyecare has grown at ~ 5.6% CAGR. This growth has further translated into PAT growth of ~ 18.9% CAGR during the said period while the NPM ranging b/w 7% to 8%, with exception of 4.8% in FY21, due to Covid19 impact.

This impact of growth in Jewellery segment was again evident in Q3FY23 also, when compared to Jewellery’s Segment YoY growth of 12.5%, Watches & Wearables Segment along with Other Business (Fragrances and Fashion Accessories, Indian Dress Wear – Combined) has grown at 14.2% and 59.4% YoY respectively, but still Total Income Growth has been ~ 13.4% YoY.

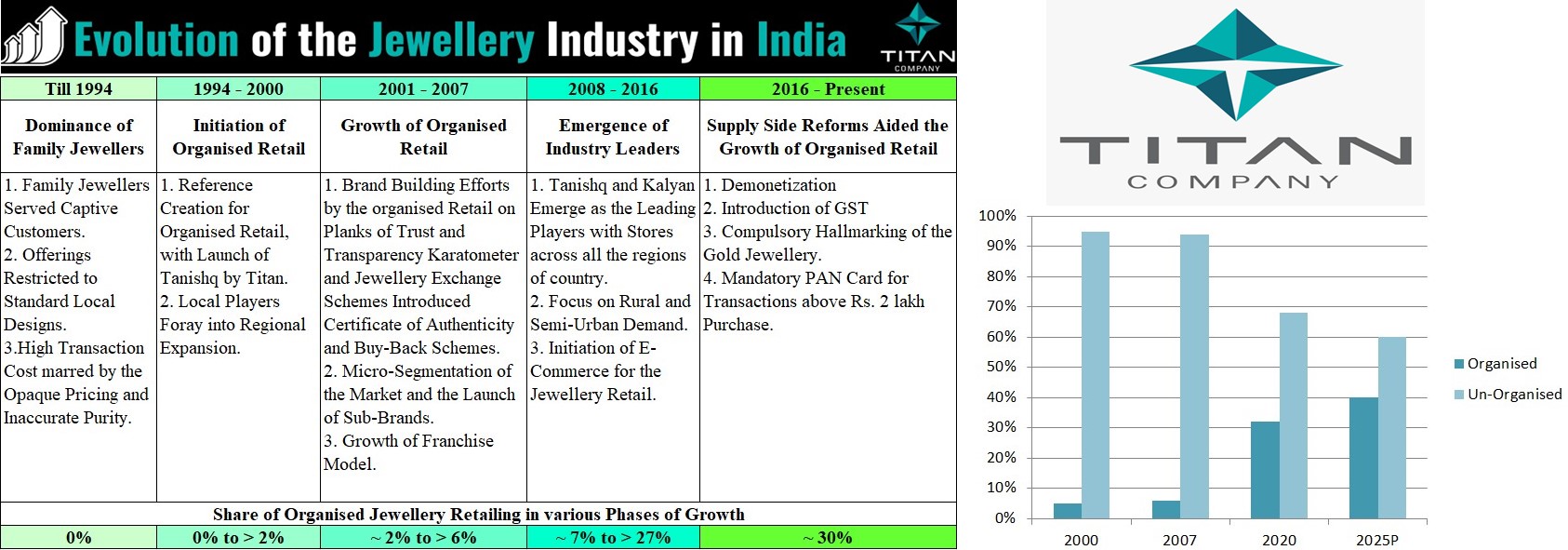

Titan’s Jewellery Segment – The Primary Revenue Generator

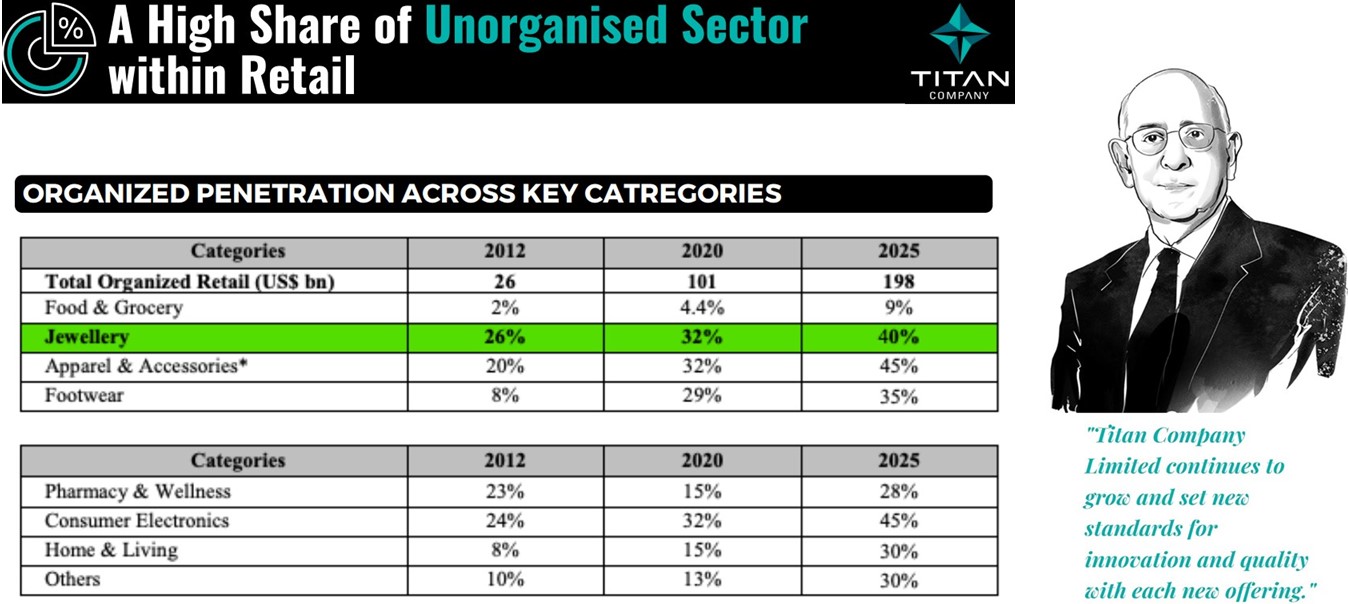

The Gem and Jewellery Sector contributes ~ 6 – 7% of India’s GDP. This sector earlier was Highly Fragmented and Unorganised with over 90% jewellers being family-owned businesses. The sector was mainly Artisan (karigar) Driven through traditional skill-based (handcrafted) manufacturing value chain, employing lakhs of people working in In-humane conditions with labour exploitation, in addition to poor labour and workplace practices.

Titan’s Interventions from over a decade has Transformed some parts of this sector and Influenced many more players to do so. The Objective was to bring the Transformation in a way jewellery manufacturing was being done in India then and Focus on the Inclusive Growth of all the Stakeholders in the Value Chain.

Along with Transforming the Lives of Karigars, the Business Benefits includes: 2X Productivity Increase for Karigars; YoY Business Growth for Vendor Partners; Enhanced Quality; Reduced Lead-Time and Inventory Levels; Enhanced Delivery Performance to the Customer; and New Capability Development.

Titan’s Jewellery Division was the first in the industry to Enable Gold Purity Testing in a Transparent manner (through the Karatmeter), which today has been the Trendsetter and the Industry has followed the suit subsequently.

Besides, Digital Transformation of Supply Chain has been one of the Major Focus areas for Titan, through which company has enhanced the Visibility and Automated the manual repetitive processes.

Today Titan is one of the Key Players in the Organised Sector with ~ 7% Jewellery Market Share, whereas the Organised Sector as a whole is ~ 35% of the Total Jewellery Market. This shows that Titan still have lots of Opportunities to Grow & Increase its Market Share further.

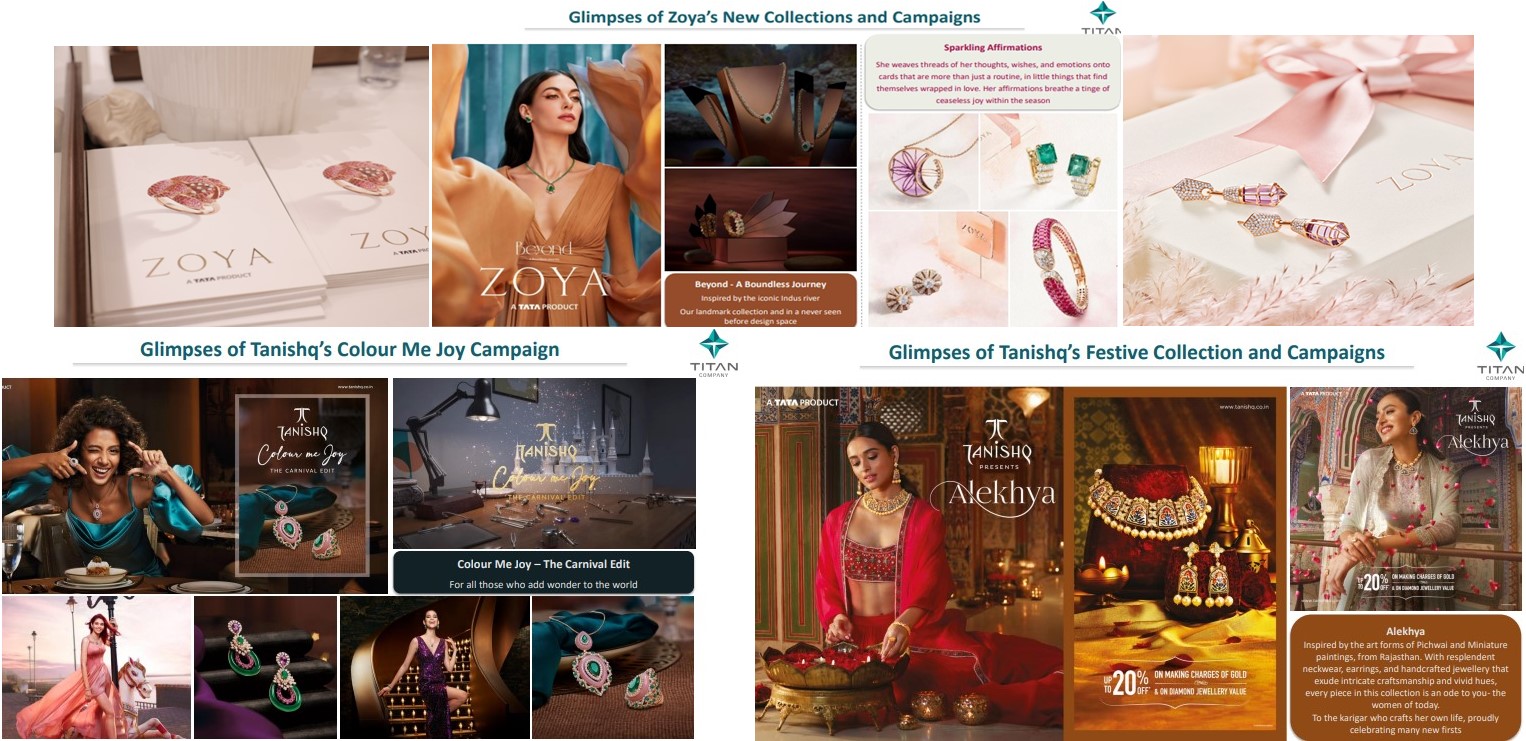

With Time, Tanishq has become Synonymous to Purity, Style and Design, whereas:

1) – Zoya has Established as a Luxury Brand offering Exquisite Jewellery in Diamonds and Precious Stones;

2) – Mia by Tanishq, Established as a Brand offering Contemporary Jewellery;

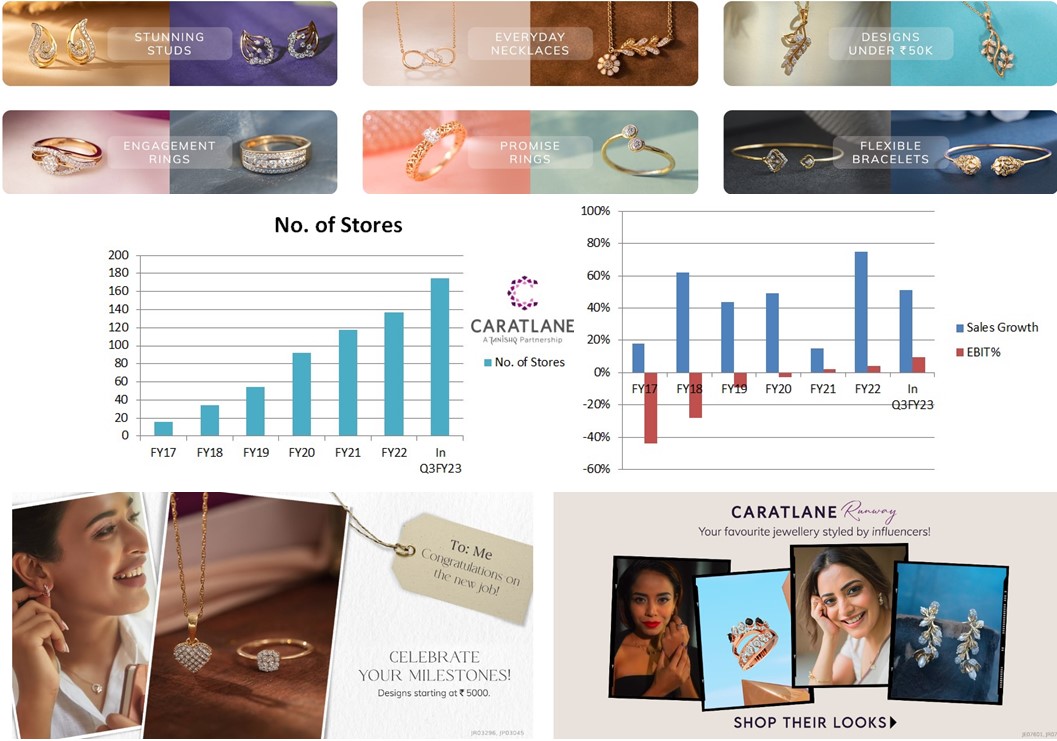

3) – And CaratLane has Emerged as an Omnichannel Brand for Modern Jewellery at an Affordable Prices.

These Brands are enabling Titan to serve Different Customer Segments and Requirements. With customers increasingly Pivoting towards Trusted Brands, these “Tata Products” have witnessed an acceleration in the Market Share Gain, despite the external operating challenges.

With Network of 685 Retail Stores, Presence in 247 Town @ Pan-India level, and a Mix of Company-Owned Stores and an Asset Light Franchisee Model, Titan has not only been able to achieve massive scale of expansion but has also been able to fund it mostly through internal accruals only.

Further, with ~ 16% Digitally Influenced Sale and > 40% Recycle Gold Usage, Titan has demonstrated its Operational Efficiencies. With its Regionalisation Strategy, company is now focusing more on Tier 2,3, & 4 Towns which will lead to Higher New Buyer Growth.

Multiple Initiatives such as Network Expansion, Regional Product Introduction and Culturally Relevant Marketing Activities based on Deep Customer Insights, along with Considerable Focus on Gold Exchange Programmes and Merchandise Infusion, are Together Yielding the Strong Growth in Strategic Market like Tamil Nadu, which is also one of the largest jewellery markets in the country.

Round the year New Innovative Product Launches with rolling out “Campaigns and Collections” marketing initiatives during Weddings and Festivities Seasons, has provided Thrust to Improve the Sales further.

Titan’s constant Drive to Strengthen Brand Engagement has helper it to capture high potential micro-opportunities from events like Olympics to occasions like Valentine’s day. Moreover, Company’s Golden Harvest Jewellery Purchase Plan continues to be a Key Contributor to the Revenue.

Given that CaratLane’s Omnichannel Framework is providing Versatile Options to the customers, such as the Try-at-Home feature, CaratLane Live (Video Assistance Feature), Easy Exchange and Delivery between 24-48 hours, and Online Shopping – Titan in terms of Digital Adoption, is Significantly Ahead of the Industry Practices in India. Therefore, company decided to continue investing in Augmenting its Digital Capabilities further.

Given the NRI/PIO audience is Strengthening their Connections with Indian Culture, Celebrating Indian Weddings, Festivals and Events with Great Enthusiasm and Splendour in their adopted land, Titan’s growth ambition now is to become the “Jeweller of Choice” among NRIs and Person of Indian Origin (PIO) markets. Accordingly, Company is Expanding into the New Geographies.

Company is also making its Brand Experience available across the New Formats. Accordingly, in FY22 CaratLane Opened it’s first-ever Airport Store at Bengaluru Airport, as company believes that its presence at this Busy and Popular Terminal will serve as “a Branding and Marketing Opportunity” thereby Promoting CaratLane among a more Diverse and Expanding Customer Base, while Generating Incremental Revenues.

Further Bengaluru is also the Ideal Geography to Test the Waters for Impulse Buying across this store format, before Scaling its Presence to more airports.

For Digitally-Savvy Young Customers, Tanishq Brand has initiated a New Pilot Offering Digital Gold, under which customers can Purchase Gold Online with an ability to Convert it into Jewellery at a Later Stage.

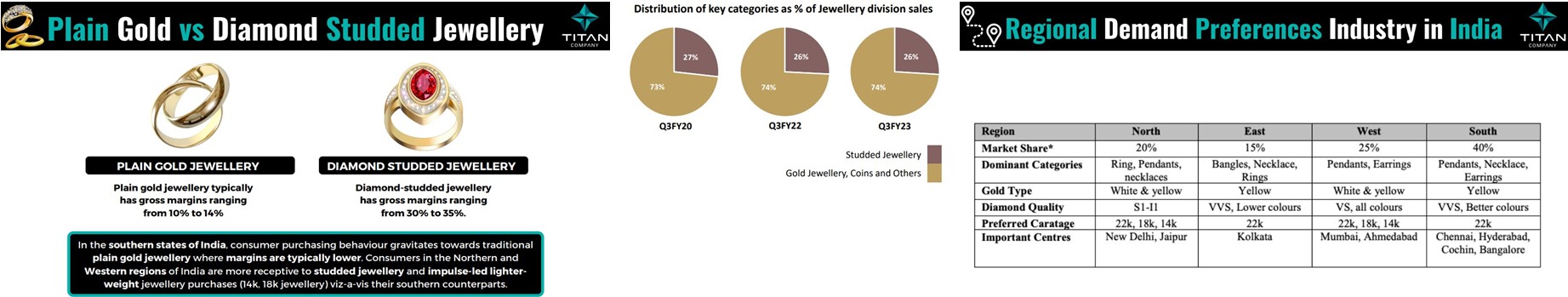

Compared to gross margins of (10% to 14%) from Plain Gold Jewellery, Diamond-Studded Jewellery has ~ (30% to 35%) of gross margins. Since, in last 3 years Studded Jewellery contributed ~ 26% of the Total Sales in Jewellery Division whereas Gold Jewellery, Coins & Others put together has constituted remaining 74% of the Jewellery Division Sales. Therefore, in absolute terms Gross Profit from Studded Jewellery is ~ 6% Higher than that of Gold Jewellery.

*Amid Inflationary Pressure on the Consumers in Lower Income Bracket, especially in Tier 3 & 4 towns, Average Ticket Sizes in FY23 saw Steady Improvement over same period in FY22, given the Larger Price Bands Exhibited Faster Growth than the Entry Ticket-Sizes, particularly in the studded category. Hence, contribution from the High Value Purchases Increased in the Overall Pie – To know more about* read: (https://jyadareturn.com/relaxo-footwears/ and https://jyadareturn.com/asian-paints/)

Since, market in North & West together constitute ~ 45% Market Share where 18k & 14k are Preferred Caratages compared to 22k Carat Gold, which is relatively in higher demand in East & South of India.

Therefore to deal with this, Titan Focused on producing Light Weight Jewellery to make it Budget-Friendly for its Potential Lower Income Customers, through development of New Hard Alloy and Product Design Re-Engineering, as there was an Unusual Spike in Prices of the Precious Metal and the Growing Customer’s Expectations for Value for Money Jewellery Products.

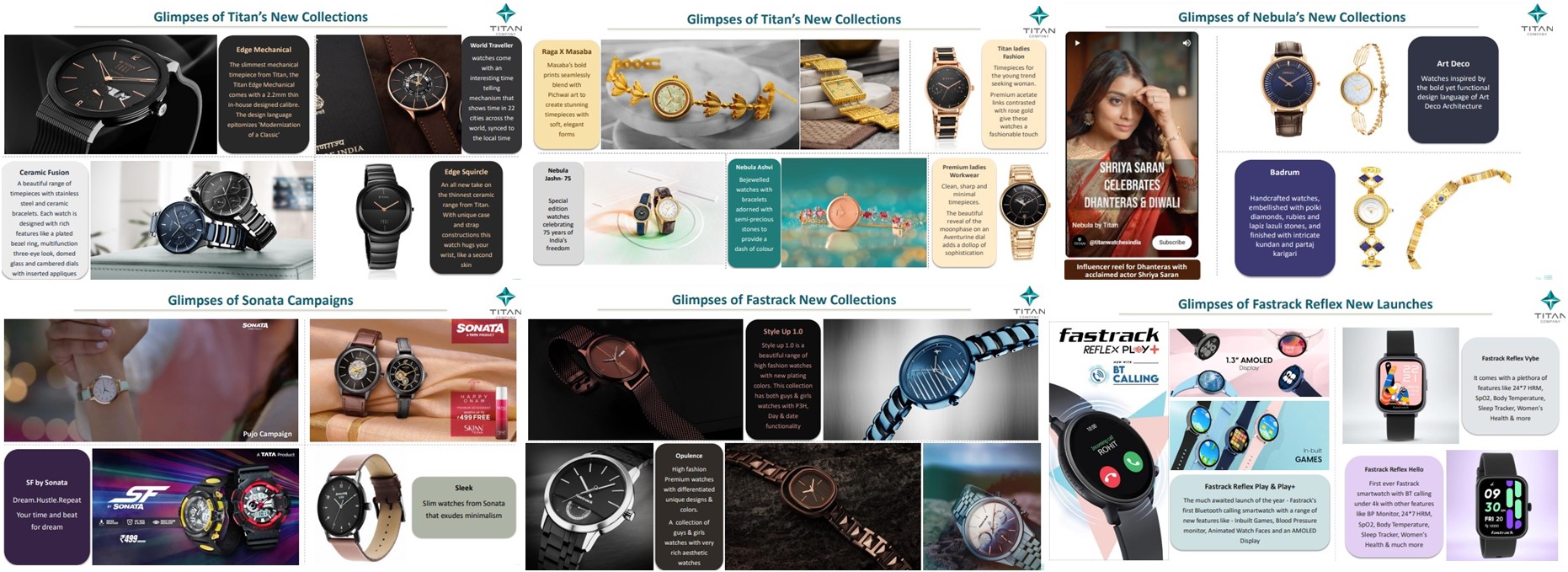

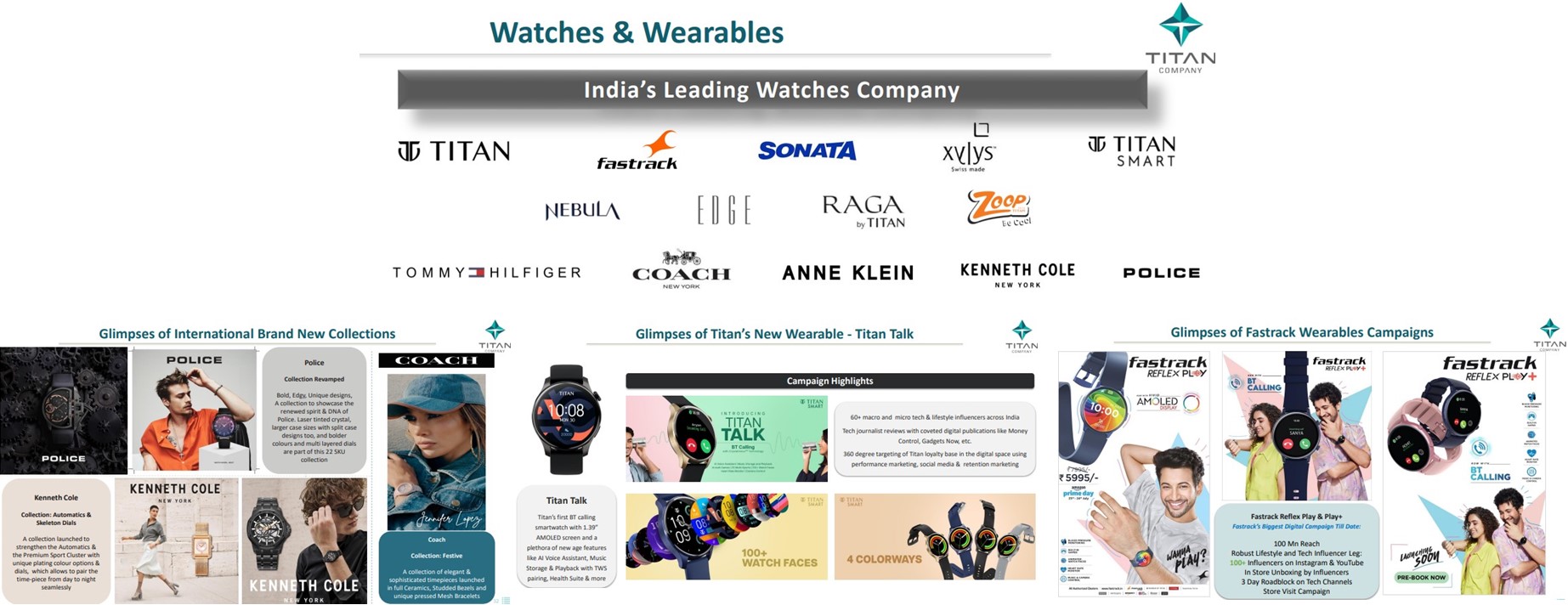

Titan’s Watches & Wearables Segment – Where Maximum Innovation Happens and Maximum Brands Exists.

Titan has a Strong Portfolio of Leading In-house as well as International Brands, offering customers a great variety of Styles and Trends at various price points. Titan, the Flagship Watch Brand, covers majority of the Domestic market share in the organised watch market. Other major In-house offerings include Fastrack, an independent youth brand offering Fashionable Products at Affordable Prices, and Sonata – company’s Economy Price Brand catering to the demands of Value Segment.

Titan provides an Unparalleled Post Sale Services, testimony to which can be seen from the fact that company’s Nebula Watches come with a Lifetime Warranty.

Innovations were driven across Analog watches and Smart watches as there are considerable market opportunities for both these categories. Titan launched several new analog collections such as Titan Solidarity, Edge Ceramics, Octane Aerobatics, Ladies’ Edge and Unending Beauty, and Raga Silver to cater to different lifestyle segments. Similarly, company’s New launch of ‘Titan Smart’ Watch is Alexa-enabled which includes features such as heart rate, sleep and stress monitors, VO2 measurement, multi-sport modes, SpO2 monitor, and women’s health monitor, among others. Titan Smart Pro, offering features such as GPS, AMOLED Display, Health suite, has also received a good response from the customers.

With 953 EBOs, 8,500 MBOs, Presence in 293 Towns @ Pan-India Level and Presence on e-commerce channels along with company’s website, Titan is driving an Omnichannel Strategy to respond to the constant evolution in consumer behavior by Integrating the Physical Stores with its Online Presence.

To Enhance Customer Experience various initiatives were undertaken including – Social Media Launch for Titan World Channel and Scaling Up of Helios on all the Social Media Platforms, Personalized reach out to Encircle Customers, Nebula Trunk Shows, Milestone Birthday and Anniversary Reach Out, Customer Surveys & Feedback Sessions, etc.

The Wearables Division launched new audio accessories under the Fastrack Reflex Tunes Brand with key features like ANC (Active Noise Cancellation), ENC (Environment Noise Cancellation) and Enhanced Battery Life for a much Better User Experience. With the help of these new launches in both Watches and Audio accessories, the Division registered a growth of 68% in FY22.

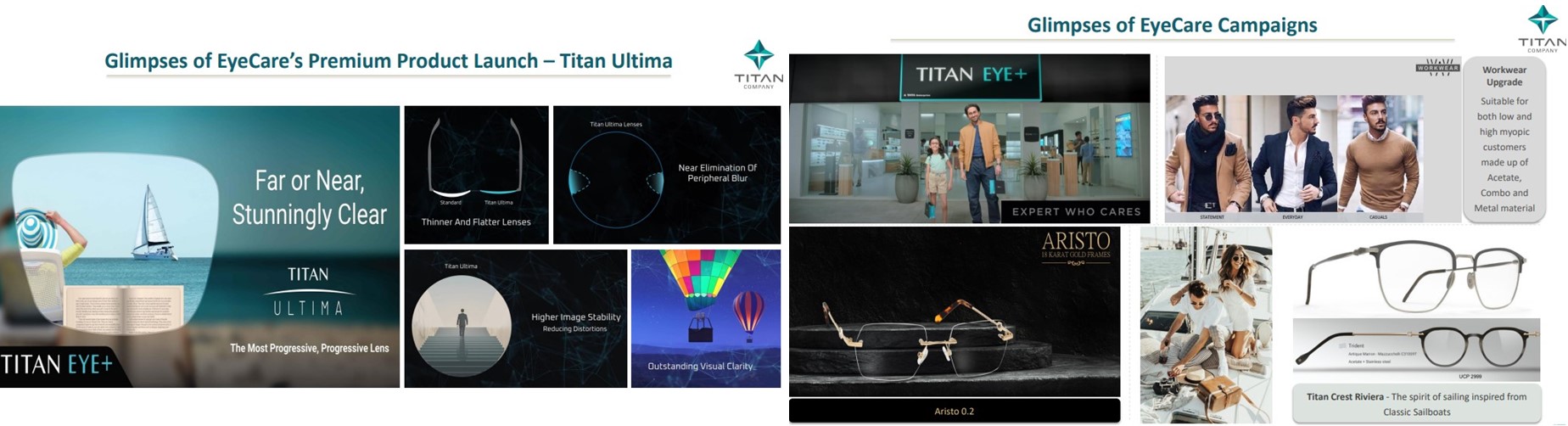

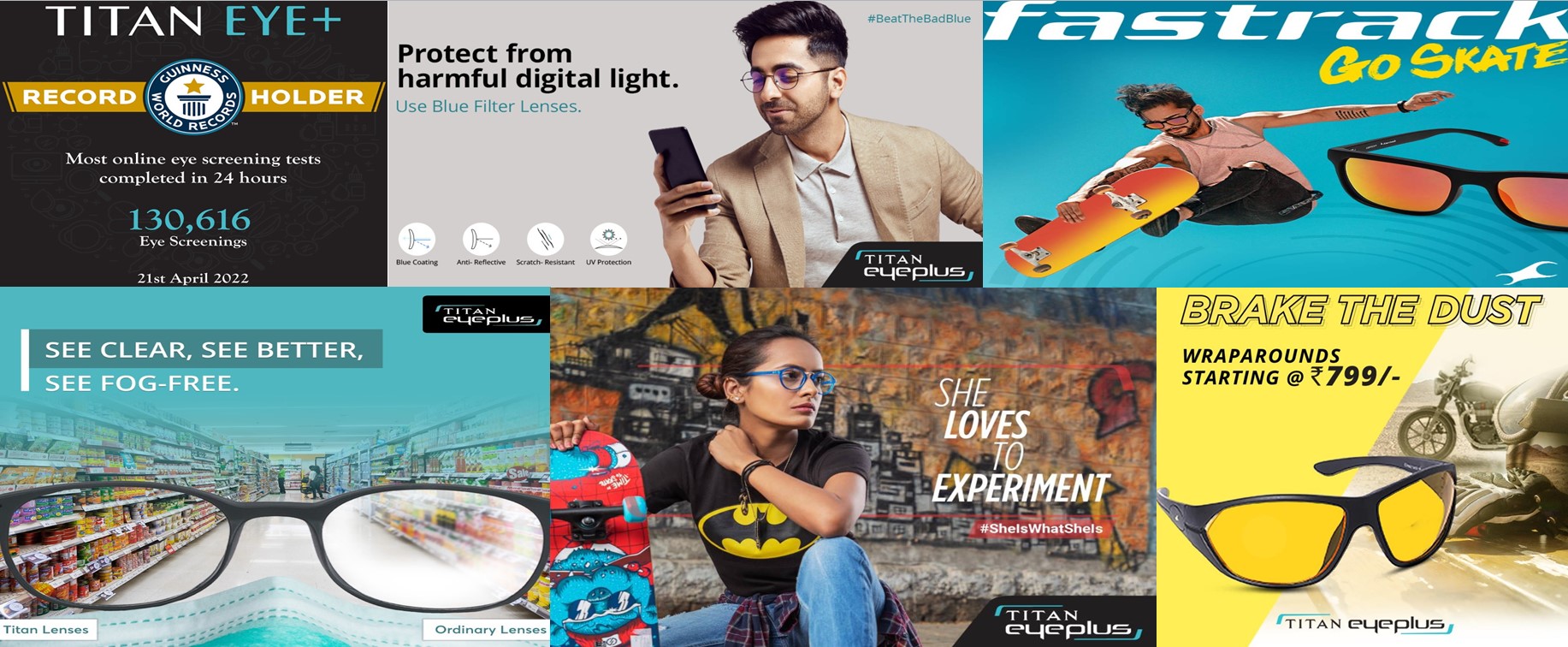

Titan’s EyeCare Segment – Where Significant Expansion Is Happening Due To Immense Opportunity

Titan Eye+ is India’s Largest Optical Retail Chain and Sells eyewear products under Titan, Titan Glares, & Fastrack Brands and also offers International Brands. Company’s In-house Brands offer great Value for Money, as the products are manufactured at its Own Integrated Lens and Frame Facility. Company have tied-up with Sankara Nethralaya, among the leading ophthalmic institutions worldwide, for the training of staff and optometrists.

The opportunity for the EyeCare Division is immense, as ~ 40% of the Indian Population needs Vision Correction; however, only one third have adopted a solution due Lack of Awareness amongst many. Titan through Eyecare wants to make reach to these Potential Customers.

The EyeCare Division’s commitment to “Eyecare” has led it to focus on “Correct Selling” – a process of dispensing the appropriate solution at the right price. This approach aims at allowing the customer to make well-informed purchase decisions, thereby creating a strong price-value equation.

Some of the Noteworthy Innovations which EyeCare Division made recently are:

1) – Indigenously designed Smart Wearable “Titan EYEX” through the Design Excellence Centre which received great customer reviews.

2) – Launched “ClearSightZ Lenses” with 8 in 1 features. Its key feature of Zero Residual Colour makes it unique.

3) – Introduced “GenXT” Lenses made for millennials, who have higher exposure to Digital Screens and “Office Pro” Lenses apt for office usage.

Company is giving Significant Thrust on Expansion through the Ecolite Model under which the Retail Store count has reached 863 across 354 Towns in the country.

The launch of Titan Eye+ App has given a Big Boost to company’s e-commerce sales. In addition, Titan has also launched Neo Progressive Lens and Computer Glasses, exclusively for the e-commerce channel.

Development of Resistance Coating in “ClearSightZ” lens for High Usage and Focus on Prescription for Ophthalmic Lenses to Enhance Business revenue through Mass Customization, are some of the initiatives that worked for the growth of the segment. Besides that, the EyeCare division has taken a lead through – Computerised Operations in Supply Chain by implementing Warehouse Management System (WMS), initiated Interactive Voice Response (IVR) for engaging retail stores and associates on supply and delivery part, thus enhanced Speedy Logistic Operations.

Titan’s Emerging Business Segment – Which Will Drive The Growth Faster

Titan’s Brands SKINN and Fastrack offer perfumes at an Attractive Price Points to make Fragrances Affordable for Aspirational Customers. SKINN fragrances are crafted in France by Celebrated Perfumers and distilled from the finest ingredients. These fragrances are sold through Titan World Stores, key departmental chains and e-commerce. Since Perfume Category in India remains Under-penetrated, hence these Brands present a Massive Opportunity for the Democratisation of Fragrances and Scaling this Business Segment.

The Fragrances & Fashion Accessories Division’s (F&FA Division) Customer Value Proposition to offer the most desirable fragrances at affordable pricing, continues to Evoke Good Response from the Customers.

This Category is Expected to grow at a Minimum of 10% CAGR till 2027. The Masstige segment in fine fragrances contributes 25% to the overall category in departmental stores and is expected to grow to ~ 1.5 times in FY23.

The key task for the F&FA Division is to work on developing the market for fine fragrances given the consumer sentiment of “looking good and feeling good”, Driven by Growing Aspirations of the Millions of Youth, Armed with Higher Disposable Income.

Titan organised “Wear your Attitude” campaign along with the Trendy, Fashionable Designs pitched Women’s Bags, to the Target the Audience by highlighting their Brand Vision. This category is expected to grow at minimum ~ 12% CAGR till 2027.

The consumer Opportunity is very large as they are Under-Served in terms of Style, Design and Purchase Preferences. In this category, ~ 65% of the consumers prefer to Buy Organised Brands through Online and Department Stores due to availability and options.

Sarees comprised ~ 40% of the women’s ethnic wear market. This Industry is Highly Fragmented and Unorganised with an Informal Supply Chain. Authenticity of Material and Transparency in prices is very weak, Despite being a highly penetrated category.

Wedding-related purchase accounts for ~ 40% of the Business and Sarees continue to be a key part of the trousseau – To know more, read: (https://jyadareturn.com/varun-beverages-and-vedant-fashions/)

Titan’s Growth Drivers to Make It 2.5x In Size, By 2027

Titan aims to have (15-20) Global Jewellery Stores (in geographies like UAE, Qatar, Oman, New Jersey, Dallas, Houston, Chicago etc.) which will Start Functioning in next 2 to 3 years.

Company’s Intention is to Grow the Jewellery Business Segment by 2.5x within next 5 years (i.e. by 2027), Driven by 4 Brands — Tanishq, Mia, CaratLane and Zoya. Tanishq will continue to open ~ (35 – 40) new stores every year, while CaratLane might be opening up another (50-60) stores every year, for next (2 – 3) years. Simultaneously, Mia will be adding ~ (40 – 50) stores for next 2 years.

Zoya, which added 2 stores during FY23 so far, may see more additions in Metros and Tier-I cities.

Further, with rapid expansion of CaratLane whose Income is Growing exponentially with Consistent Improvement in EBIT Margins since FY17, the Overall Income Growth in Jewellery Segment is expected to remain ~ 20% for next 5 years.

Management’s focus on Operating Leverage-Led Margin Expansion is Encouraging and More Sustainable in the Jewellery segment, where Titan now has ~ 7% Market Share.

Since the Market Size in Women’s Bag Segment is ~ Rs 5,000 crore and given that this market is Highly Fragmented and Unorganised, so with its 2 Brands – Irth and Fastrack, company aims to achieve an Ambitious Target of Rs 1,000 crore of revenue from this segment alone, by 2027.

As there are about 550 million people who need eye correction or lenses, while only 170-180 million are served, and that too largely by the Un-organised sector with substandard quality. Therefore even in Eyecare Segment too, Titan aims to capitalise upon this Opportunity by Opening Up as many as Stores as possible so as to reach 1,000 Stores target by FY23 end, given that there are already 858 Titan Eye+ and 5 Fastrack Stores in the country.

As the Indian Dress Wear Category has Market Size of ~ Rs 50,000-crore, which along with the Ethnic Wear becomes as large as Rs 1 Trillion Size Opportunity. Therefore, Titan is expecting Taneira to Emerge as a Large Driver of Growth in the next 5 years, given that even this segment is also in an Unorganised Sector and company already have 32 stores in 15 cities, which it plans to further expand up to ~ 50 stores in 50 cities, by as early as FY23 end.

Titan’s CFO thinks that – what Tanishq did to the jewellery industry, Taneira has the potential to do the same to the Saree and Ethnic Wear Industry.