Both the companies are Fastest Growing in their category; Both Dominate the Market they operate in; Both have either the In-House Manufacturing Facility or the extensive backward integration; both have highly efficient & robust Supply Chain Process & Broader Distribution Network; both have Economies of Scale; both have multiple competitive advantage due Moats & entry barriers to their Business; both have multiple triggers for accelerated growth due to country’s Consumption Driven Economy and Increasing Earning Potential & Purchasing Power of the Aspirational middle class. Keep reading to unfold the Growth Story & Future Prospects of Varun Beverages and Vedant Fashions, 2 High Growth Unique Monopolies.

Why & How did Varun Beverages and Vedant Fashions became High Growth Unique Monopolies in Indian Consumption Basket?

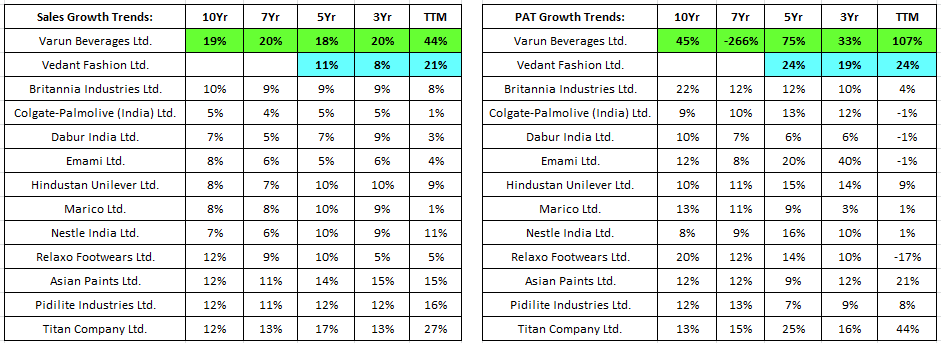

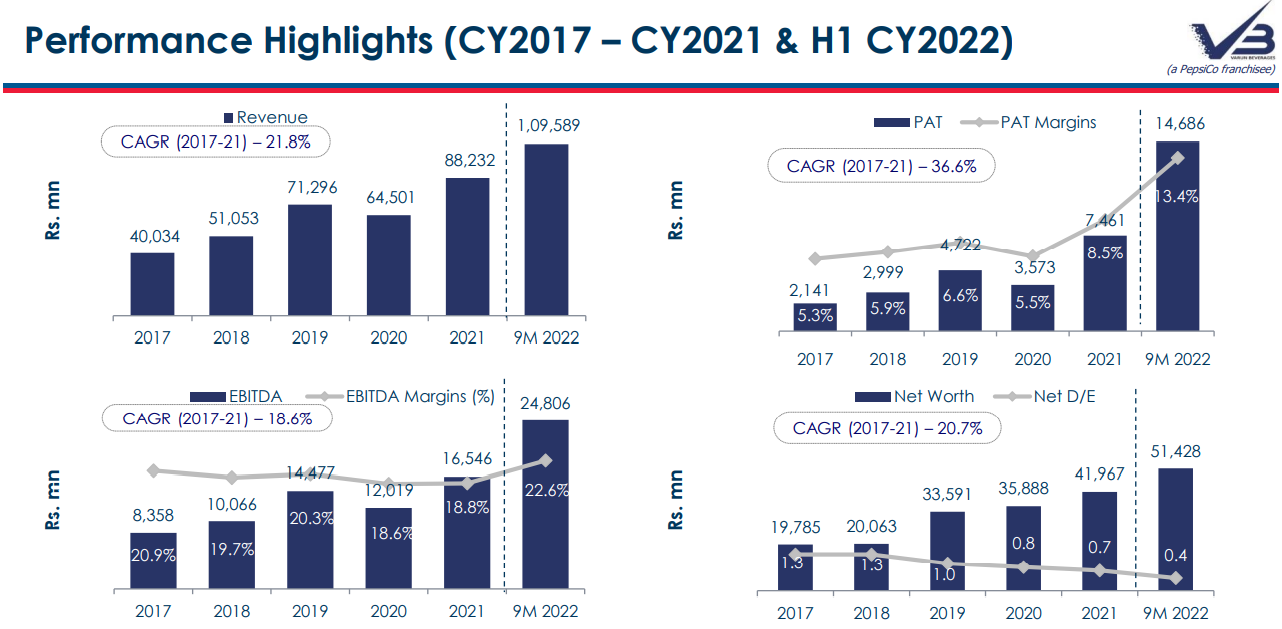

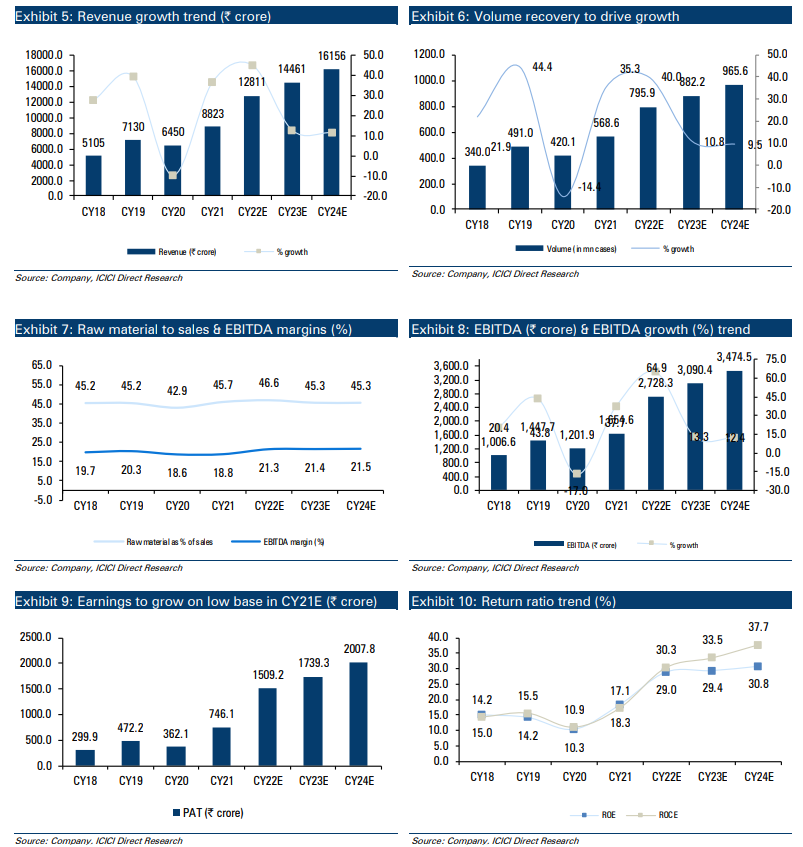

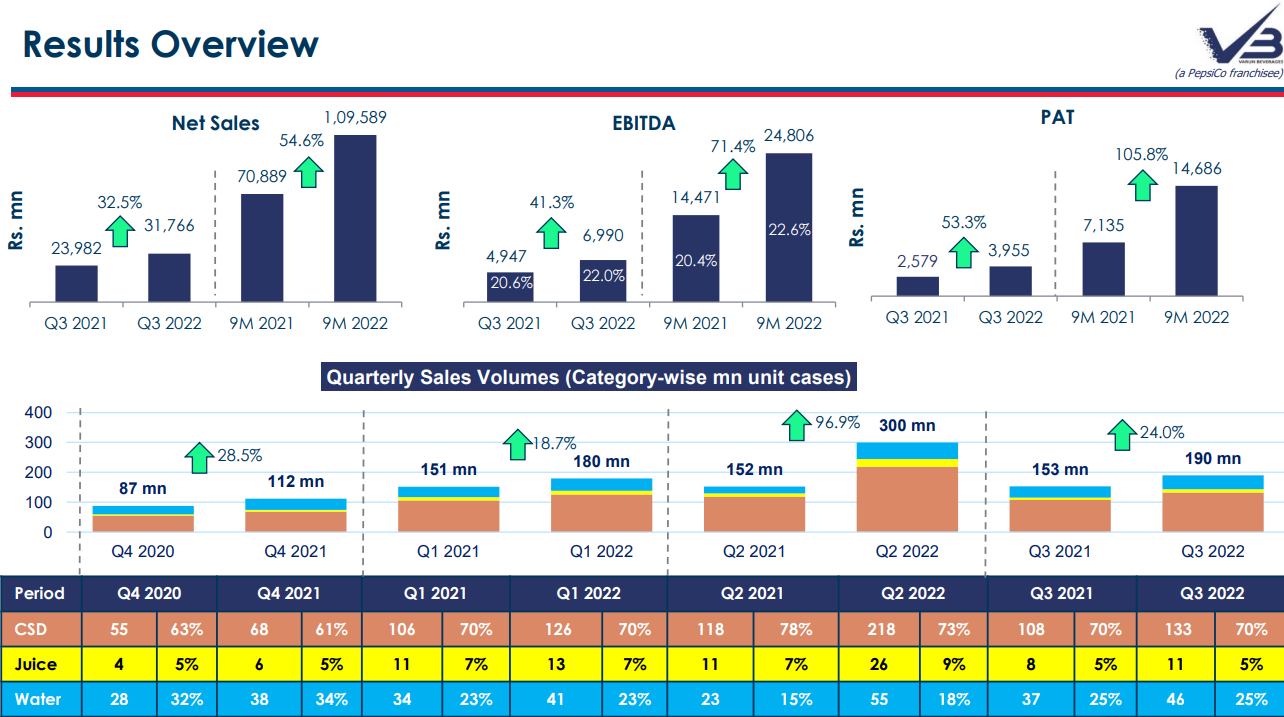

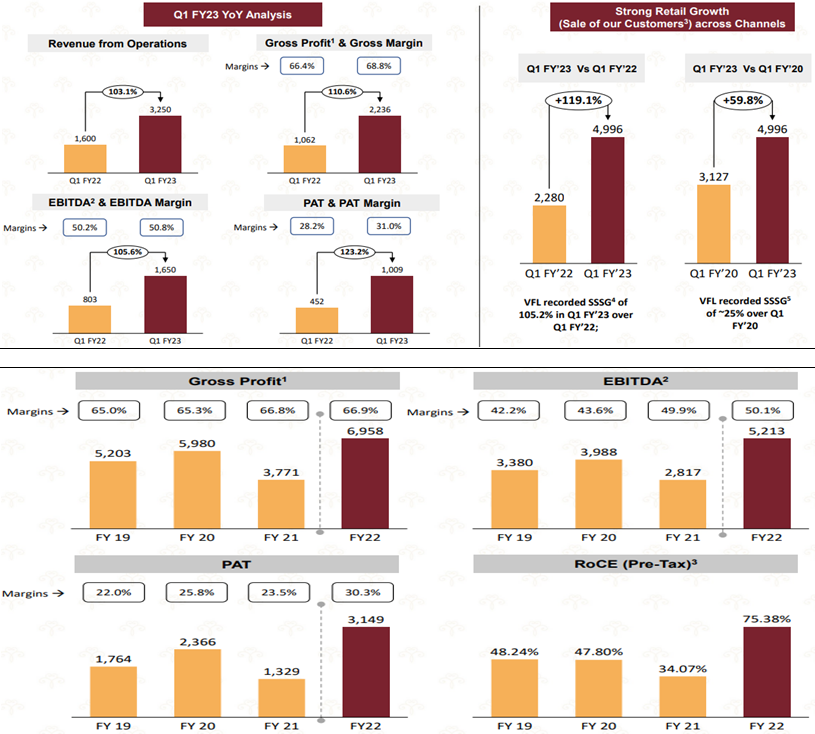

If we look at the Sales & PAT Growth trends of Varun Beverages Ltd (VBL) & Vedant Fashions Ltd (VFL):

We can easily acknowledge that both VBL & VFL are growing very fast in their respective categories, irrespective of the fact that VBL’s Market Cap & Sales is ~ Rs. 90,500 crore & Rs. 12,700 crore resp., whereas that of VFL’s is ~ Rs. 32,600 crore & Rs. 1225 crore respectively. Let us analyse their growth drivers one by one.

Varun Beverages and Vedant Fashions – How do they Dominate the Market they operate in?

VBL – The Undisputed Beverage Champion

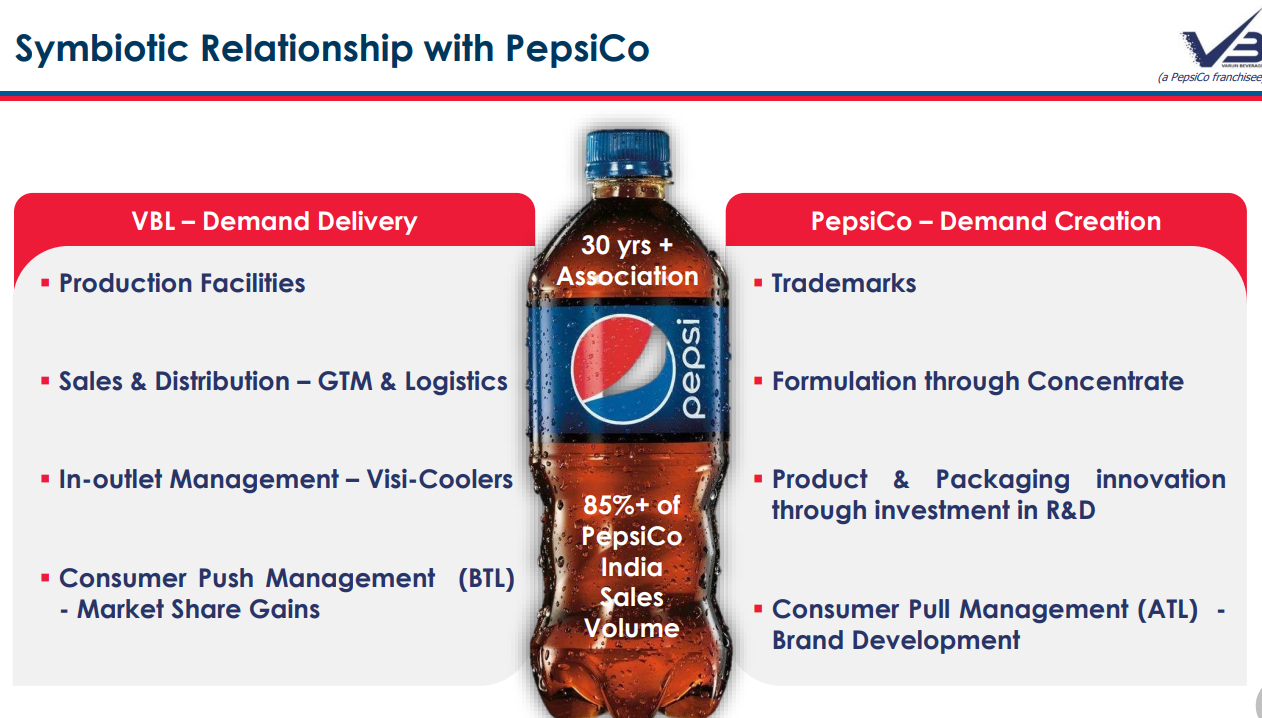

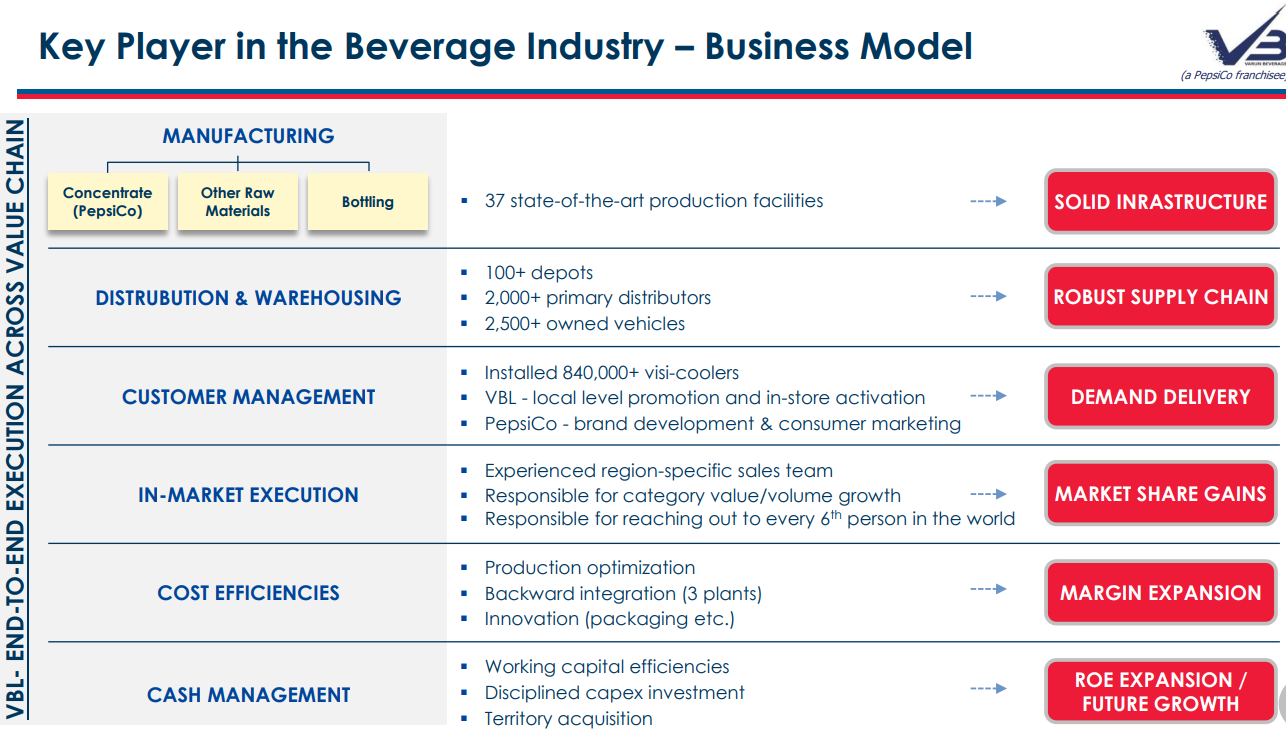

VBL is one of the Largest Franchise of PepsiCo outside US. PepsiCo offers Brands, Concentrate (Formula), and Marketing Support to VBL which in turn takes complete control of the Manufacturing and Supply Chain Processes & hence driving the market share gains, enhancing cost efficiencies, and managing capital allocation strategies.

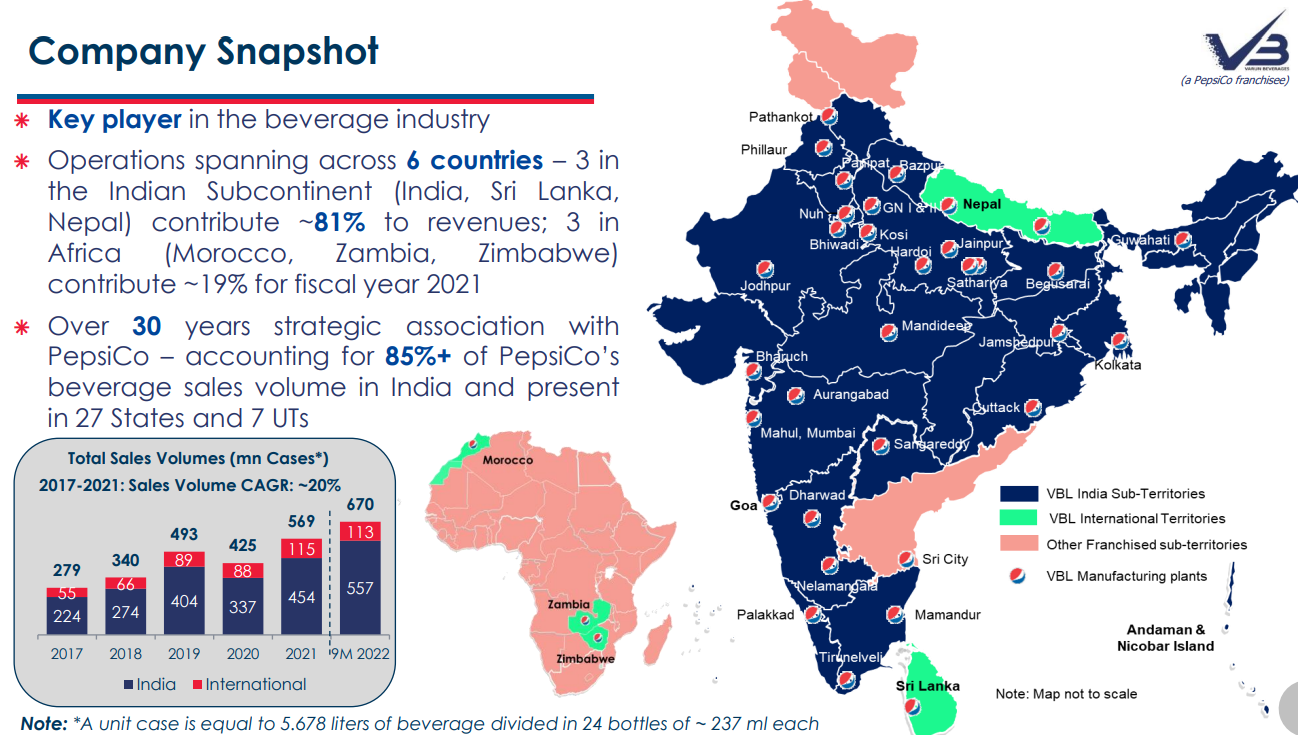

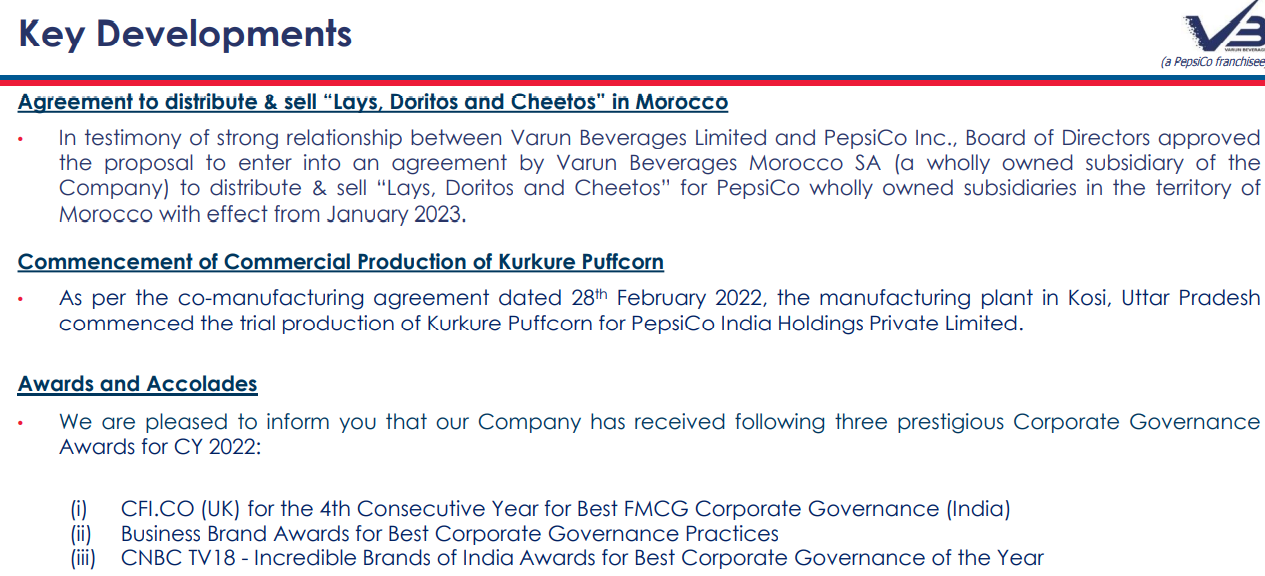

VBL over three decades has developed a significant and mutually beneficial business association with PepsiCo. VBL’s strong relationship with PepsiCo is reflected in the large number of franchisee territories and sub-territories granted/acquired by it over the years as it now covers 90% of India. Its share of PepsiCo India’s beverages volume sales has increased from 26% in FY11 to 85%+ now.

Besides India, it has been granted franchise rights for other South Asian and African countries. With end-to-end execution capabilities and presence across the entire beverage value chain, the company’s profile is not restricted to being just a bottler. VBL’s vast operational experience, established Backward Integration Facilities for production operational efficiency, widespread integrated distribution network and in-depth market knowledge lends significant value to the distribution and sale of PepsiCo products in India.

PepsiCo transferring its own bottling plants to VBL over the past few years bear’s testimony to the latter’s varied and rich track record. With PepsiCo’s best-in class portfolio, VBL is well placed to cater the changing consumer preferences.India’s young population, rising on-the-go consumption and improving retail network (with rapid electrification across country) offers a multi-billion-dollar opportunity for the beverages manufacturers.

VBL, with a monopoly of PepsiCo India’s beverage business, is a solid proxy play on the long-term growth story of the soft drinks category in India.

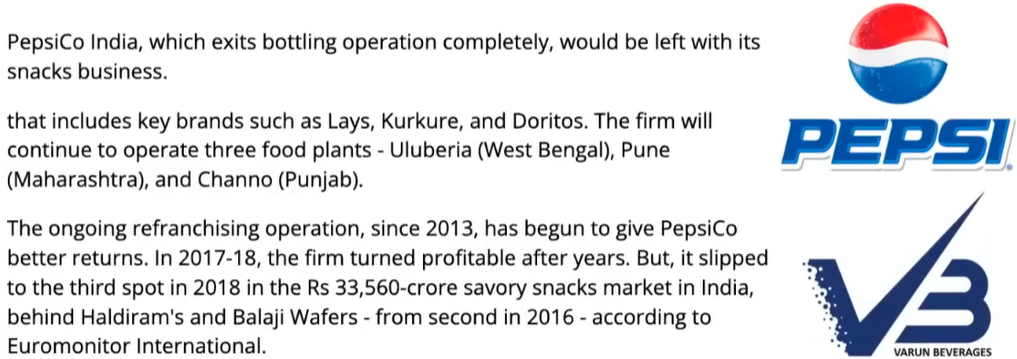

Why did PepsiCo gave Distribution & Manufacturing Rights to VBL?

PepsiCo was not able to scale up its Distribution & Manufacturing in Beverage Segment in India and has remain in losses for 6 years (from 2013 to 2019), so PepsiCo decided to give VBL its Distribution & Manufacturing Rights as the former has shown willingness to invest in Distribution & Production Facilities and thereby to scale up Business to the geographies which were not reachable or profitable earlier, whereas PepsiCo wanted to get out of the Distribution & Manufacturing Business (in Beverage segment) in India.

PepsiCo will eventually became Asset-Light in Beverage segment, where it will be earning mostly through its Brand name (Trademark Licence) & Concentrate.

How VBL Gained Market Share thereafter?

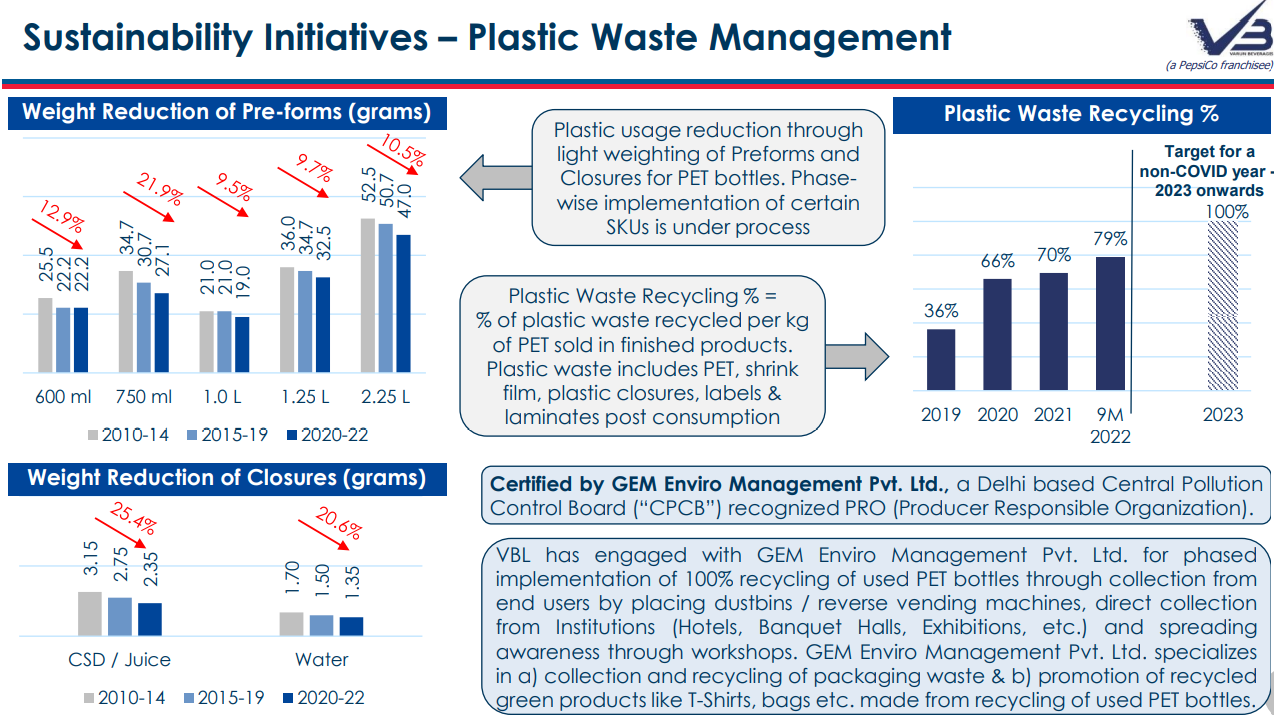

VBL has 37 state-of-the-art production facilities across 27 States & 7 UTs and also have backward integration (3 plants) for production of preforms, crowns, plastic closures, corrugated boxes, corrugated pads, plastic crates, and shrink-wrap films in certain facilities, to ensure operational efficiencies and high quality standards.

Further, through its robust supply chain across these 27 States & 7 UTs, VBL covers urban, semi-urban, and rural markets, addressing demands of a wide range of consumers. PepsiCo efforts for Brand development & Consumer Marketing were seamlessly complemented by VBLs customer management initiatives (like Installations of 840,000+ visi-coolers; local level promotion & in-store activation). All this together with IN-Market Execution helped VBL to gain the Market Share within last 5 ~ 6 years.

Why No One Else could come & challenge the VBL from Gaining the market share further?

Through its 30 years mutually beneficial business association with PepsiCo and Proven past track record of exemplary & successful execution, VBL has been able to extend its bottling agreement & trademark licence (from PepsiCo, for India) from 2nd Oct. 2022 to 30th Apr. 2039.

So, VBL not only have Licence Based Moat but also have Proprietary Asset Moat. Using these 2 Moats to its advantage, VBL over the years has converted its Business to Economies of Scale as now it has Production Facilities, Backward Integration, Robust Distribution Network and IN-Market Execution to ensure Demand Delivery, across the Length & Breadth of the country.

To replicate anything of this size & scale, is just formidable even if anyone has surplus capital & willingness to enter into the segment.

And even if that is taken care of, How will one buy PepsiCo trust for which VBL took almost 30 years? It is difficult, especially if Opponent is as strong as VBL:

VBL Multiple Growth Triggers – The Growth Engine

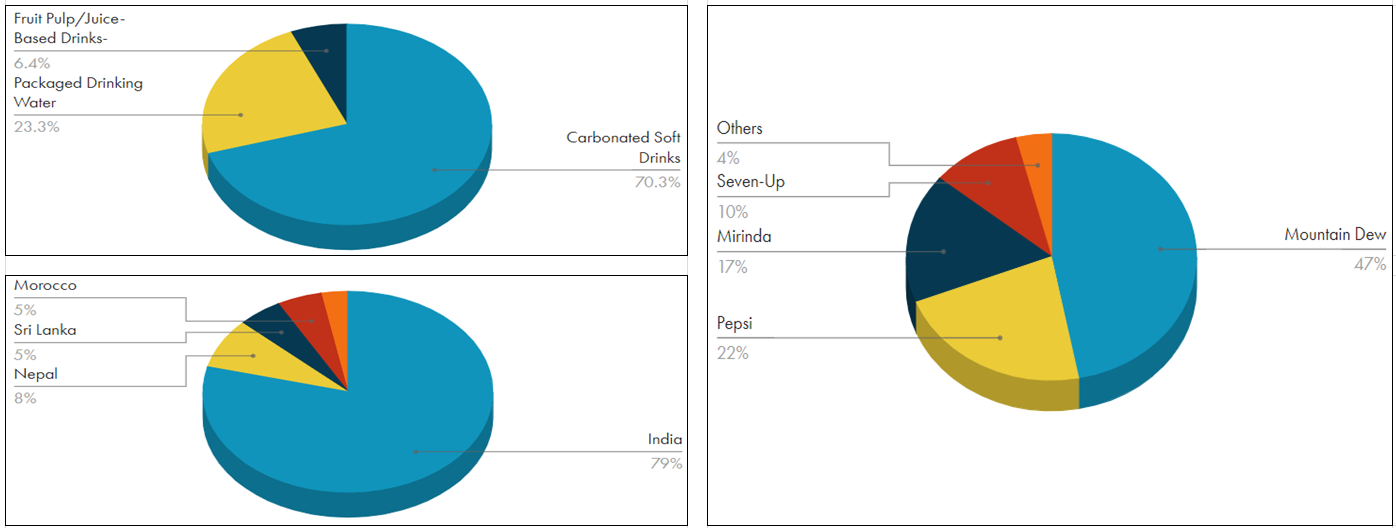

If One look at the Revenue Mix of VBL (as given below):

He/She may observe that around 70.3% of the Revenue is coming from CSD segment which is growing ~ (6% – 8%), whereas Fruit Pulp/Juice-Based Drinks constitutes 6.4% to the total Revenue & is growing ~ (20% – 22%). Due to better product mix, VBL is enjoying the higher realization.

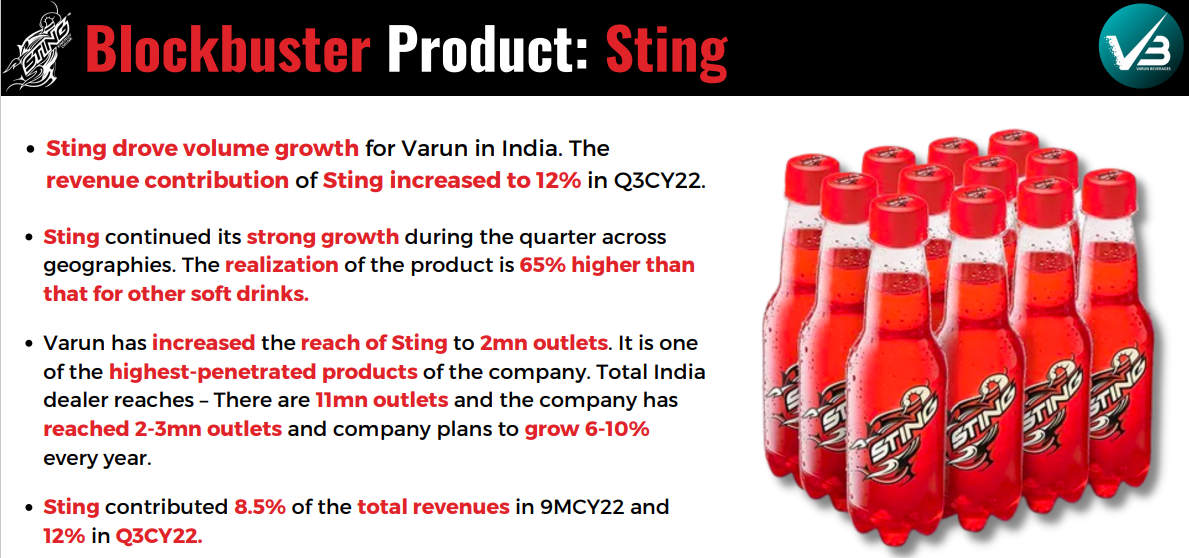

VBL started selling smaller SKUs of 250 ml energy drink brand ‘Sting’ and with strong growth in the energy drinks segment, the contribution of the brand Sting has been ~ 11% in Q3CY22 and 8.5% in 9MCY22. Sting realization has went up 65% compared to the CSD products. Further, Sting constitutes ~ 12% of the sales volumes of VBL & it has created market for the Value Added Drinks with High Gross & EBIDTA Margins, within a Fast Growing Category, because of which VBL has achieved ~ 200% of Volume Growth in last 3 years.

VBL already operating at 90% capacity utilisation and is in the process of setting up another 2 large Greenfield plants in Bihar & Jammu. In addition, VBL is also setting up 2 large Green field plants in MP & Rajasthan.

Further a Brownfield expansion is also underway at Sandila facility.

BY 2023, this CapEx would increase capacity by ~ 30% for Carbonated Soft Drinks (CSD) & Juices segment at a cost of Rs.1200 crore, which will generate incremental revenue of Rs. 2600 crore at optimum capacity utilization. VBL is also planning to double its capacity in value-added dairy segment by 2024.

Company has already expanded to > 3 million outlets of which 0.25 million are in the International markets.

Compared to other FMCG players, Volume Growth of VBL is very high around ~ 15% CAGR, due to its growing presence in the Under-Penetrated Territories like Bihar, Madhya Pradesh & Rajasthan where the Volume Growth has been around 40% ~ 45% in Q2 FY (2022-23).

To support this double digit volume growth rate, VBL is aiming at ~ (8% – 10%) Incremental Distribution Expansion every year.

As already shown above, VBLs Revenue has grown at ~ 22% CAGR (2017-21) in last 5 years, whereas its PAT has grown at ~ 37% CAGR, during the same period.

In Jun’22 qtr. revenue grew by 102% YoY on the back of 97% Volume Growth & 3% increase in price realization.In International Markets Zimbabwe, Morocco, & Nepal saw increase in the margins while Sri Lanka faced disruption due to local issues.

Beside ‘Sting’ in energy drinks, ‘Creambell’ in dairy based beverages is also getting the strong traction and is also driving the overall volume growth.

Clearly, VBL is trying to get Rights to Distribute & Sell as many of PepsiCo food products, as possible for it, as the size of this segment is even Larger than the Complete Beverage Segment itself. On the raw material front, PET resins prices have started softening, which would be reflected in margin, going forward. The company would be aiming to achieve and maintain 21% operating margins:

VBL not only increasing its Distribution Network, but also increasing per Capita Consumption by targeting the regions where its products are Under Penetrated and in addition to that, it is improvising to continuously improve its Operating Efficiency & Working Capital Cycle, despite being an Asset Heavy (Capital Intensive) Business because of which its NFAT mostly remains in the range (1.1 ~ 1.4) which is way lesser than that of the other FMCG or the Consumer Discretionary companies.

Based on the Financial Performance of VBL in past 5 years following Growth Trends on ‘Key Metrics’ are expected to remain for next ( 2 ~ 3) years:

VFL – The Undisputed Indian Wedding and Celebration Wear Brand

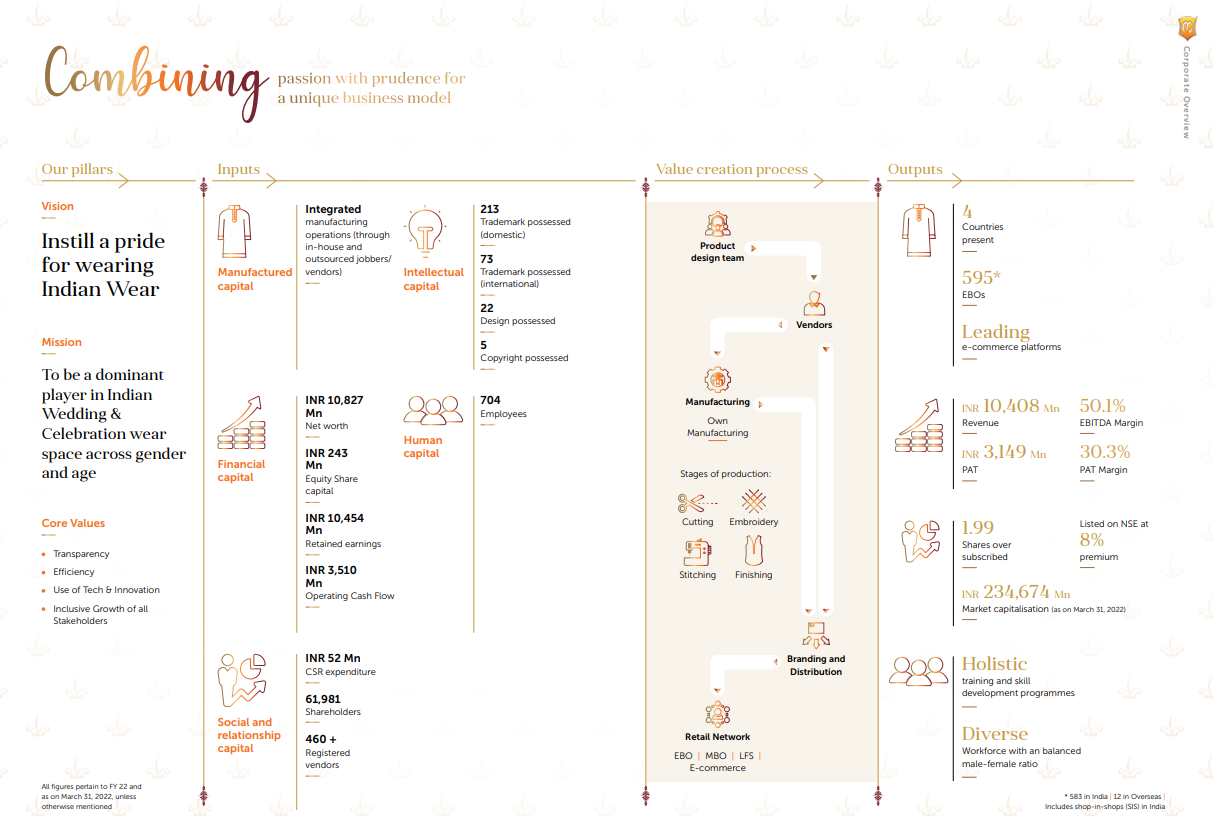

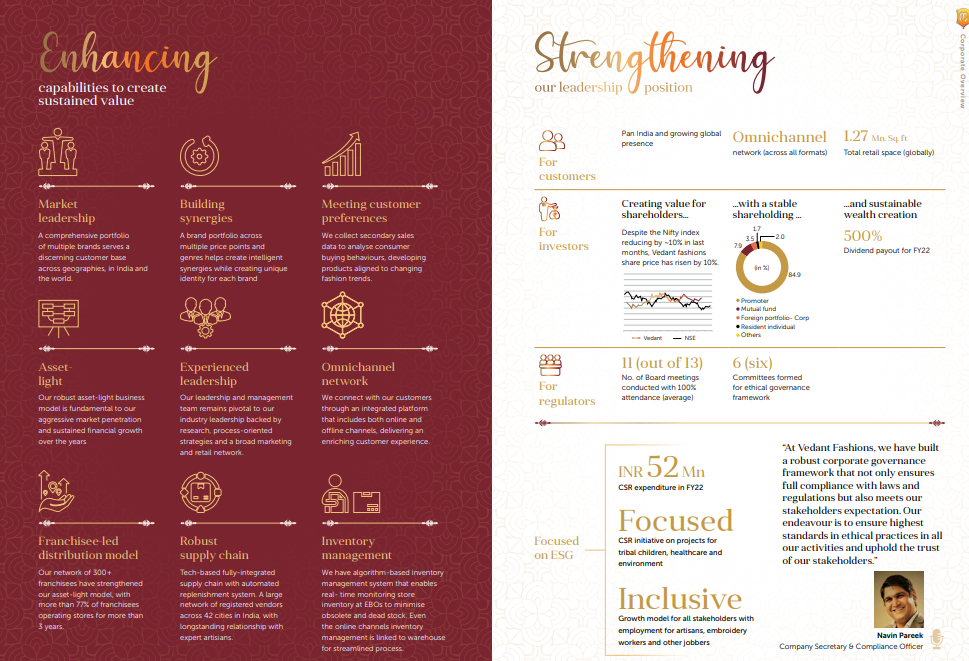

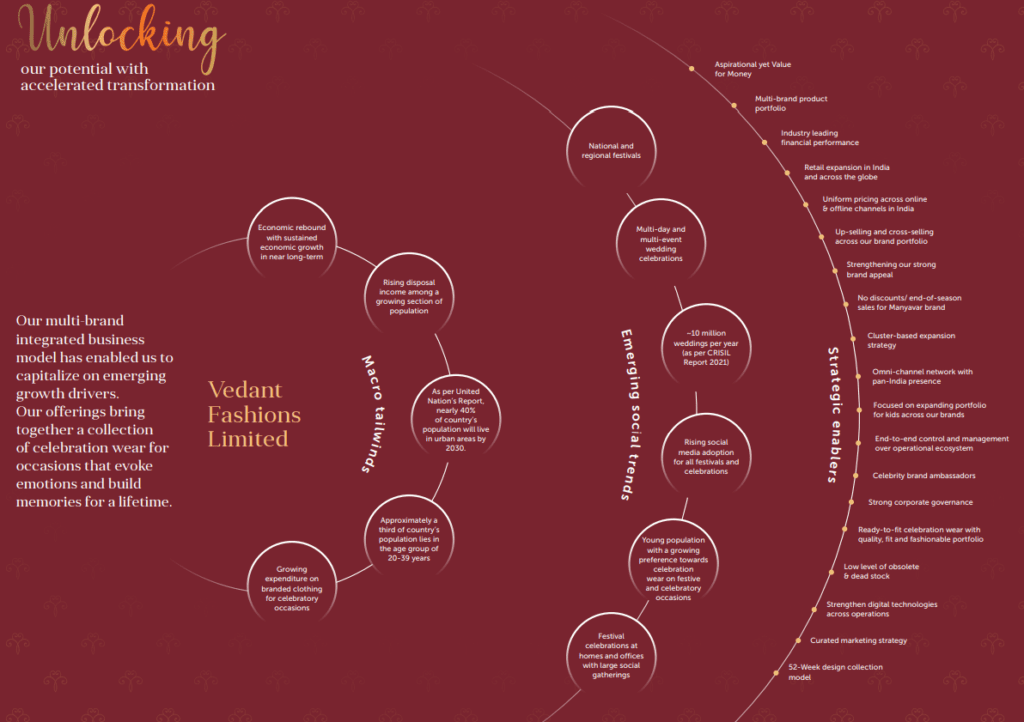

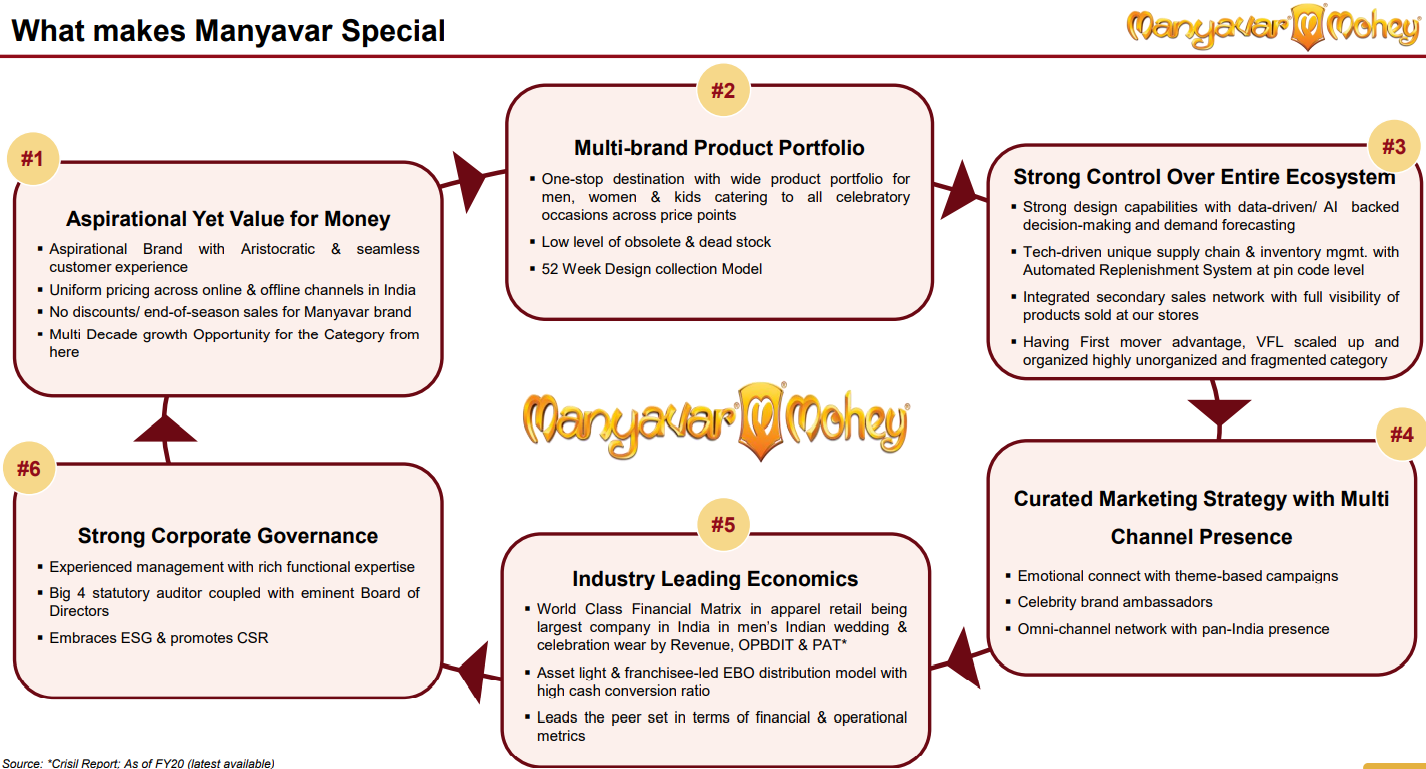

VFL is the largest company in India in men’s Indian wedding & celebration wear by Revenue, EBIDTA & PAT Margins. Its Manyavar brand is the category leader in branded Indian wedding & celebration wear market with pan-India presence, whereas with its brand Mohey, VFL is growing its presence in the women’s Indian wedding & celebration wear.

The company is a one-stop-shop destination, with a wide spectrum of product offerings for every celebratory occasion. Apart from flagship brand Manyavar (which caters to mid-premium price point), it is further enhancing its leadership in premium and value segment of men’s Indian wedding wear through its other brands ‘Twamev’ and ‘Manthan’.

Through its diversified portfolio of leading and differentiated brands, including acquisition of Mebaz in FY18 (established player in southern region), VFL is able to better cater to the needs of its customers and the aspirations of the entire family, yet remain value for money and service the varying financial budgets of Indian consumers.

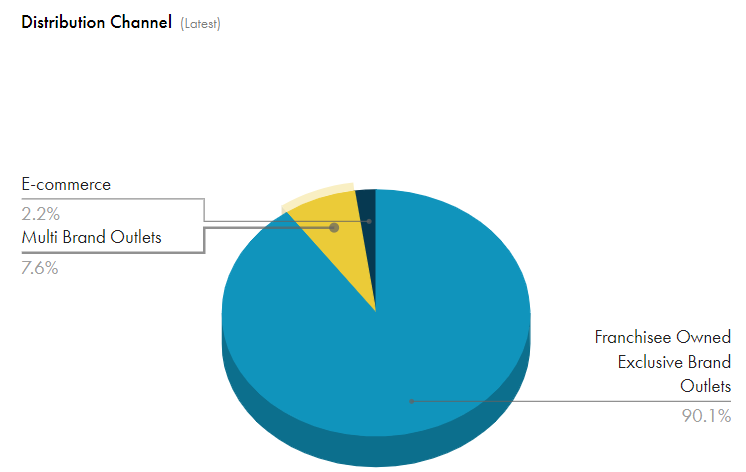

VFL has Omni-channel network of EBOs, MBOs, LFS & Online (own website, mobile app & leading lateral e-commerce platforms) through which it ensure aristocratic & seamless customer experience via aesthetic franchisee-owned EBOs, that contributes to ~ 90.1% of FY22 Sales. VFL has Retail footprint (FY22) of 1.3 mn sq. ft. across India (with 603 EBO’s* in 228 cities & towns in India) and Overseas (with total 13 EBO’s of which 5 are in USA, 1 in Canada & 7 in UAE).

The company generates healthy gross margins (~ 68.8 %+) with no end of season sale or discounts offered on MRP, as the Indian wedding and celebration market is relatively less price-sensitive compared to the casual wear.

VFL follows an asset light business model, with production outsourced on a job work basis. It operates a fully integrated supply chain with high-end quality control standards in the procurement of fabric and other essential components. Also, EBOs are predominantly franchise owned, enabling the company to be asset light and achieve healthy return ratios.

The Indian wedding and celebration wear market is pegged at ~ 1020 billion (15-20% branded penetration) while the branded space is expected to grow at a CAGR of 18-20% by FY25; Source: https://www.icicidirect.com/mailimages/IDirect_VedantFashions_IPOReview.pdf

VFL has registered 15% revenue and 31% PAT CAGR in FY17-20. With the company’s strong brand franchise, it looks to tap the large and growing Indian wedding and celebration wear market driven by increased spending.

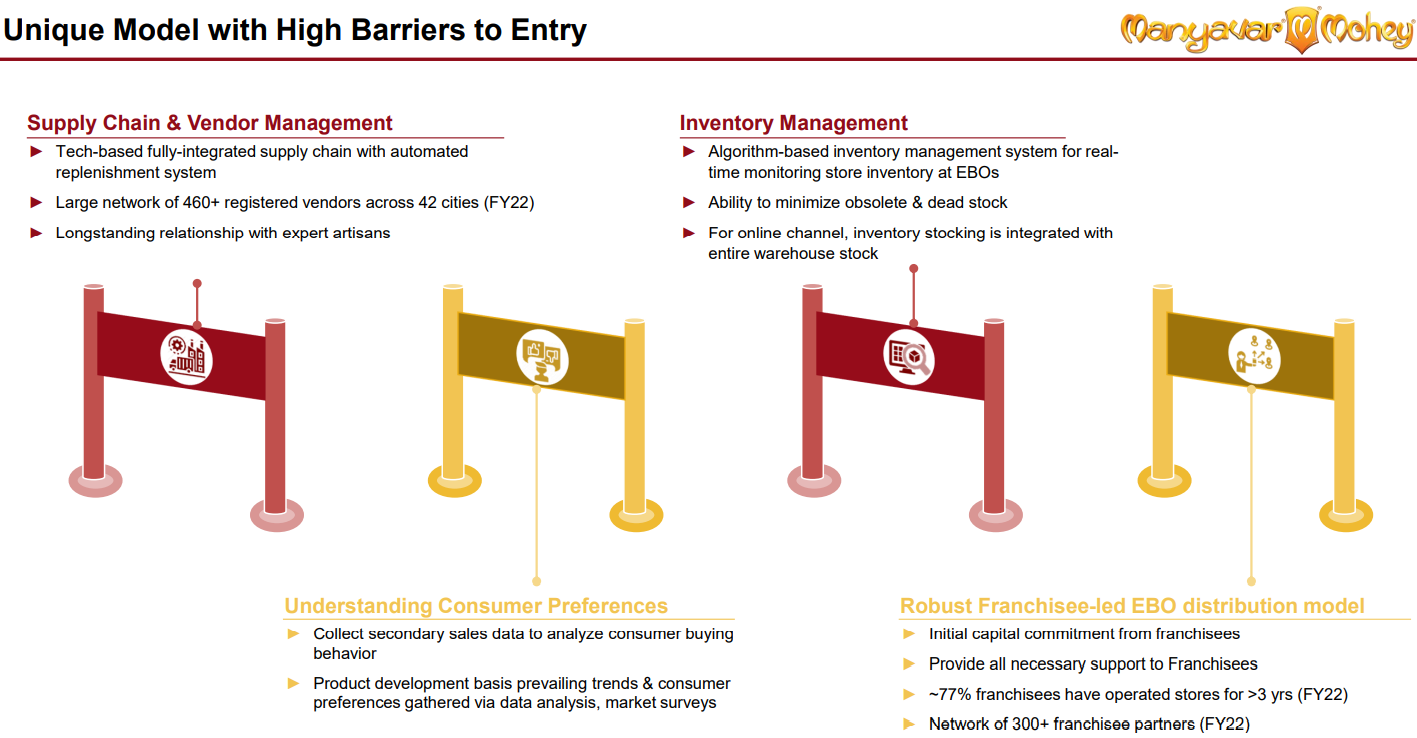

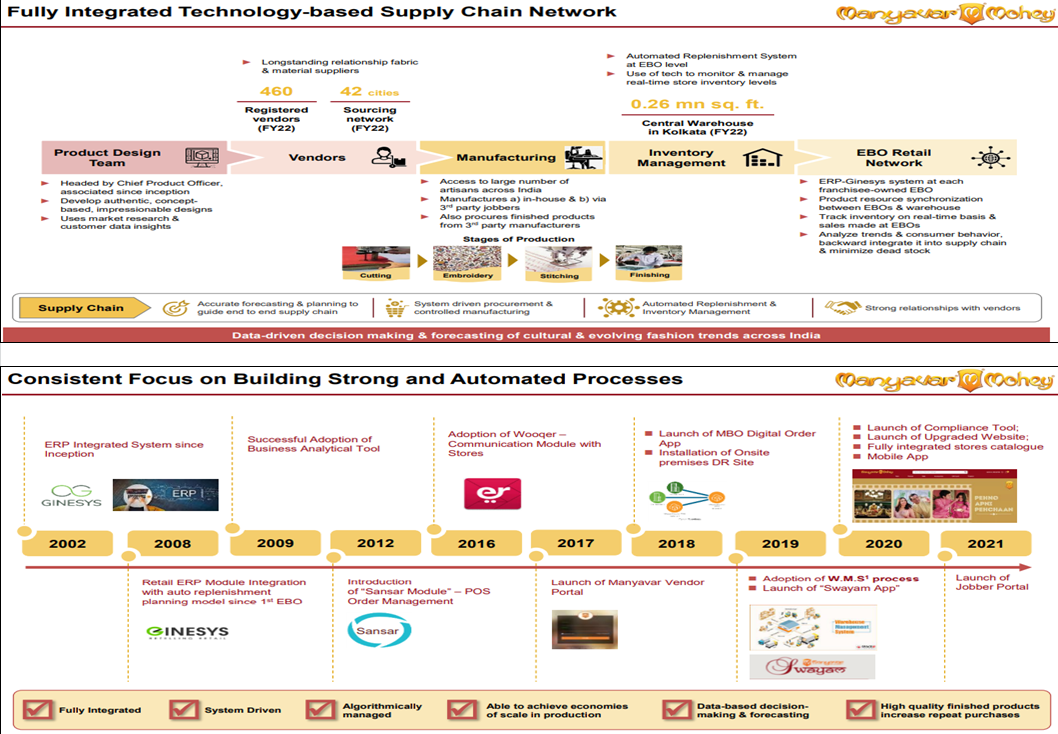

The company’s business model is driven by the strength of its system-driven technology infrastructure, its established systems, processes and longstanding relationships with vendors. The company operates a fully integrated supply chain with high-end quality control standards in the procurement of fabric, an essential component used for manufacturing its products. Manufacturing process includes the stages of cutting, embroidery, stitching and finishing.

While it carries out some production processes in-house at its factory, a large portion of manufacturing is also carried out by jobbers (also representing third party manufacturers), with whom VFL has longstanding relationships. The company retains control over entire supply chain by ensuring that various stages of production, including design conceptualization and finalisation, procurement of fabric, allocation of work, quality control and testing, and review of allocation of job are internally managed.

It has a central warehouse at Kolkata (~0.26 mn sq. ft.), which houses all its finished products (including finished products procured directly from third party manufacturers). It has a system-driven distribution, replenishment of inventory and manages the product portfolio through data-driven forecasting of evolving fashion trends across India.

So, What makes Brand Manyavar Special?

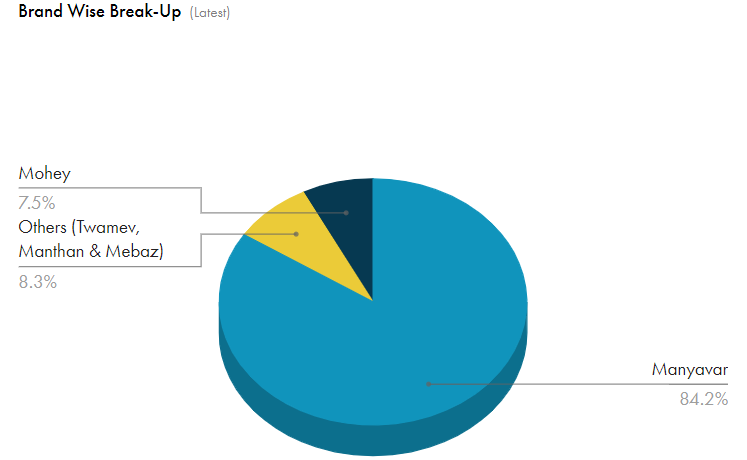

Clearly, Manyavar Brand constitutes 84.2% VFL’s Revenue for the reasons as shown below:

Why EBOs are so important for VFL’s Growth?

EBOs contribute 90.1% of VFL’s Revenue because at present there are 603 EBO’s* in 228 cities & towns in India. This is more than 20 times the number of EBOs which any nearest competitor in the VFL’s category owns.

This way VFL has dominated the peers by creating perfect example of Economies of Scale at almost every Unit level, where just by sheer massive number of EBOs (which it opened all over the country, over the period of time) Sales of VFL is more than 10 times that of nearest competitor.

So, what just seems to be ~ (8% – 9%) spends on Ads & Brand Marketing for VFL may actually be ~ Rs. 100 crore deal against a Yearly Revenue of ~ Rs. 1225 crore, is almost a impossible amount to spend on Ads for peer having total yearly sale of ~ Rs. 100 crore.

So, what has been the Growth Strategy for VFL?

What makes VFL a Unique Monopoly in its Business Category?

VFL has multiple competitive advantages over its peers (which already mentioned above) & in addition to that, there are following Entry Barriers for any new entrant having both surplus capital & the willingness to enter into the VFL Business Category of Wedding and Celebration Wear Brand:

To know more on why Multiple Competitive Advantages, Business Moat, High Entry Barriers, Economies of Scale, and Tailwind to the sector itself is Necessary to ensure Longevity of Organic Structured Growth of the company, read the following:

1) – https://jyadareturn.com/7-key-parameters-you-should-look-for/

2) – https://jyadareturn.com/specialty-chemicals-stocks-long-runway-of-growth/

3) – https://jyadareturn.com/why-these-5-stocks-still-have-lots-of-potential-for-growth/

4) – https://jyadareturn.com/havells-vs-polycab/

VFL Fully Integrated Technology-based Supply Chain Network helped it to:

- Do Accurate forecasting & planning, to guide end to end supply chain.

- Take Advantage of System driven procurement & controlled manufacturing.

- Have Automated Replenishment & Inventory Management.

- Build Strong relationships not only with its employees but also with fabric & material suppliers and with large number of skilled artisans across India (e.g., Chief Product Officer in Design Team, is associated with VFL since inception).

Through its ERP-Ginesys system at each franchisee-owned EBOs, VFL has been able to:

- Establish Product resource synchronization between EBOs & warehouse.

- Track inventory on real-time basis & sales made at EBOs.

- Analyse trends & consumer behavior, backward integrate it into supply chain & hence, minimize the dead stock which otherwise may hit its profitability badly.

Whereas through its Consistent Focus on Building Strong & Automated Processes, VFL has been able to:

- Algorithmically managed its Sales, Inventory, Operational activities and hence the Working Capital Efficiency.

- Take Data-driven decision & do forecasting of cultural & evolving fashion trends, across the country.

- Create High quality finished products, which increase repeat purchases.

- Achieve “Economies of Scale” in production.

Varun Beverages and Vedant Fashions – What will Drive their Future Growth Prospects?

For VBL: Entering into the new geographies & under penetrated regions and establishing the production facilities along with the extension of its Robust Supply Chain Networks there, will boost the sales volumes.

Further, Increasing the concentration of NCSD, Juices (Energy & Sports Drinks like Sting, Gatorade etc.) & Value-Added Dairy Products like Creambell will help VBL to further increase its Sales Growth & PAT Margins.

If VBL able to get more of the PepsiCo “Food Products” rights for Manufacturing & Distribution (other than Lays, Doritos, Cheetos, Kurkure Puffcorn) than it will further expand the Topline & also improve the net realization for VBL given the better Margins in “Food Products” segment compared to Beverage Business.

For VFL: Like Titan Company’s Tanishq Brand in Jewellery is ‘Online Disruption Proof Business’ so is VFL’s Manyavar Brand at Present.

Given India’s ‘Consumption Driven Economy’ where Private Final Consumption Expenditure is around (55% ~ 56%) of India’s GDP & presence of Growth Driver’s like Increased Spending of Aspirational Middle Class on Celebration Wear during Weddings; Festivals; Social gatherings; & Corporate Parties, Branded Apparel segment is expected to grow at a CAGR of ~ (12% – 14%) up to FY25, therefore VFL is destined to Grow at Gross Profit Margin of ~ 70% and PAT Margins of ~ 32%, given that there has been continuous improvement in its Gross Profit Margins; EBITDA Margins; PAT Margins since FY (2018-19), as shown below:

Specifically, Men’s Indian Wedding & Celebration Wear Apparel Retail Market size in Branded (i.e. Organised Player) is expected to grow at a CAGR of ~ (18 – 22%) to become almost ½ of the Total Market size in FY25, from 1/4th of it in FY20. If that projection from Crisil is to be believed in than Brands Manyavar, Twamev, & Manthan are going to get Bigger & Better, with certainty.

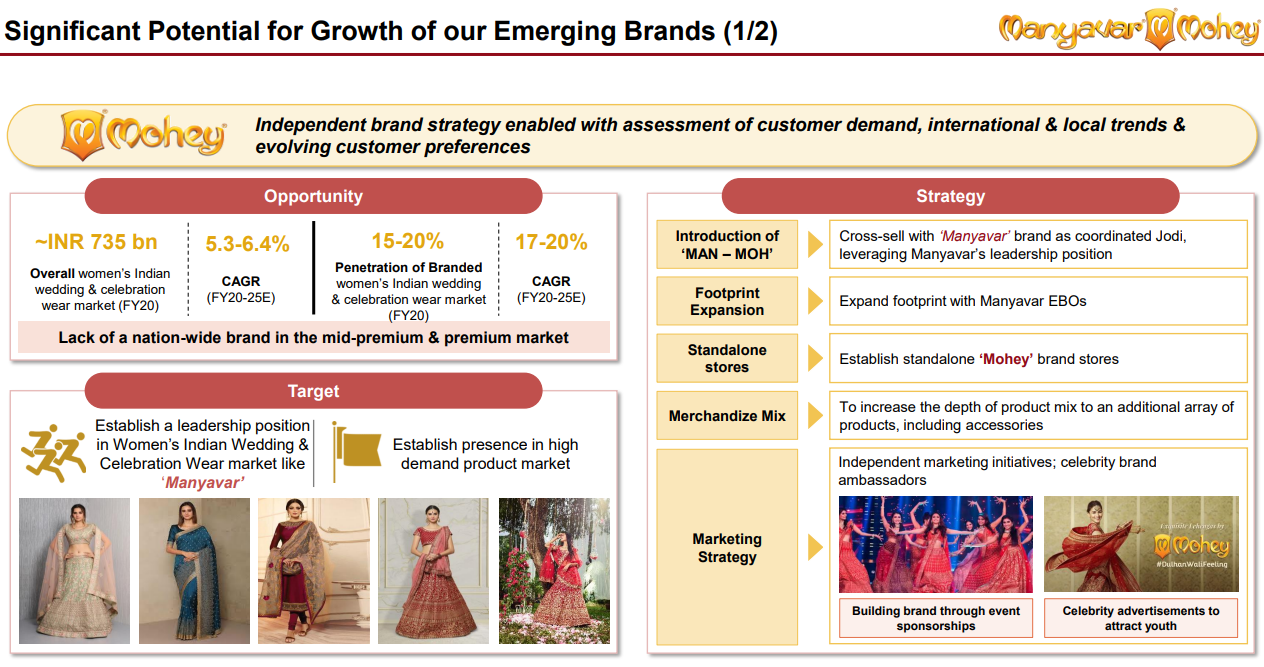

Similarly, Women’s Indian Wedding & Celebration Wear Apparel Retail Market size in Branded (i.e. Organised Player) is expected to grow at a CAGR of ~ (17 – 20%) to become (27 – 30%) of the Total Market size in FY25, from (15-20%) in FY20, which means Brands like Mebaz and especially Mohey, are going to get Bigger & Better.

Through acquisitions, VFL aims to leverage its existing strong cash position towards the synergic opportunities and seamlessly integrating the acquired brand with the ecosystem of its existing brands, thereby facilitating an increase in profitability margins and achieving economies of scale.

Through focused marketing campaigns, the company aims to establish a bond with its customers at an emotional level, and project an underlying core message with shared values through distinctive marketing, advertising and customer engagement initiatives. It intends to continue to enhance the brand recall of products through the expansion of footprint as well as use of targeted marketing initiatives including digital marketing campaigns, television advertisements, brand ambassador content and outdoor advertising.

Significant Potential for Growth for Brand ‘Mohey’:

Significant Potential for Growth for Brand ‘Twamev’ and ‘Manthan’: