Founded in 1989, Vinati Organics Ltd. (VOL) Integrated Business Model has helped it to transform from a single product company to one of the world’s largest manufacturers of key specialty chemical products, while serving the customers across the globe.

As a market leader for key specialty chemicals (especially for ATBS & IBB where it commands more than 65% of the global market share), VOL products play a very important role for several downstream industries. As such company is on the track to further expand its Niche Product Portfolio, which will enable Import Substitution and Create Superior Value for all the Stakeholders.

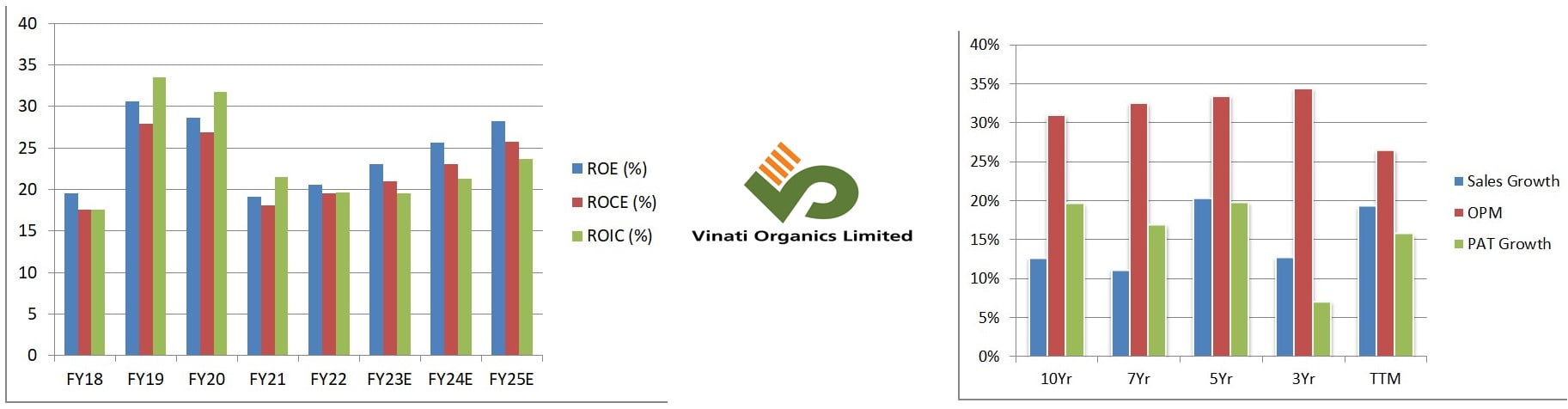

Vinati Organics is among the few companies in the sector with Sustained capacity expansion that too with Low-Gearing. This is a result of Prudent Capital Allocation and Disciplined Cost Management, resulting in High Cash Generation.

Hence company’s market capitalisation has grown by 49x between March 2012 to March 2022, while it was expanding its product portfolio through strategic CapEx all funded by the internal accruals.

It has become a consistently Free Cash Flow (FCF) generating Growth Engine which may last forever, given the multiple industries which VOL’s products caters to and the Structural Tailwinds to the Specialty Chemicals sector which Vinati Organics operates in.

Vinati Organics – Multi-Year Story of Amplifying the Value

Specialty Chemicals are the “low-volume high-value” products used across a number of consumer facing industries. They can be some kind of formulation or single chemical entities, whose chemical composition influences the end product.

Most specialty chemical formulations are ‘Patent Protected’ and not easy to replicate, which gives them the better pricing and higher yields.

Further, the Indian specialty chemicals industry (which accounts for ~ 20% of India’s Total $ 212 billion chemical industry) is expected to grow from ~ $40 bn. in FY 2020 to ~ $60 bn. in FY 2023 at a CAGR of 13%, outpacing the global average growth of ~ 5% CAGR.

Vinati Organics – Multiple Tailwinds to the Specialty Chemicals Sector

This unprecedented growth may be attributed to the Nation’s Consumption Driven Economy, Demand for Niche products, rapid Import Substitution, and a Global Geo-Strategic Demand Shift from China due to supply-chain disruption (China+1 Strategy). Further, the challenge in Europe amid the war between Ukraine and Russia has further added similar opportunities (like Europe+1 Strategy).

India is ascending as a preferred manufacturing hub including contract and custom synthesis for specialty chemicals, both for the domestic as well as international markets. There is a continuous evolution towards sustainable products and processes, circular economy and end of life material recovery.

As a result the industry is witnessing an increasing scope of servicing new sectors with products and solutions, along with an increasing need for specialty chemicals and materials…To know more about the Tailwinds read: https://jyadareturn.com/specialty-chemicals-stocks-long-runway-of-growth/

Vinati Organics – The Integrated Niche Business & The Competitive Advantage

Vinati Organics product portfolio comprises of 20+ products & it rank no.1 in the production for ATBS and IBB, where it commands more than 65% market share for both of these products. Further, the company has domestic leadership in Butyl Phenols, IB and HPMTBE.

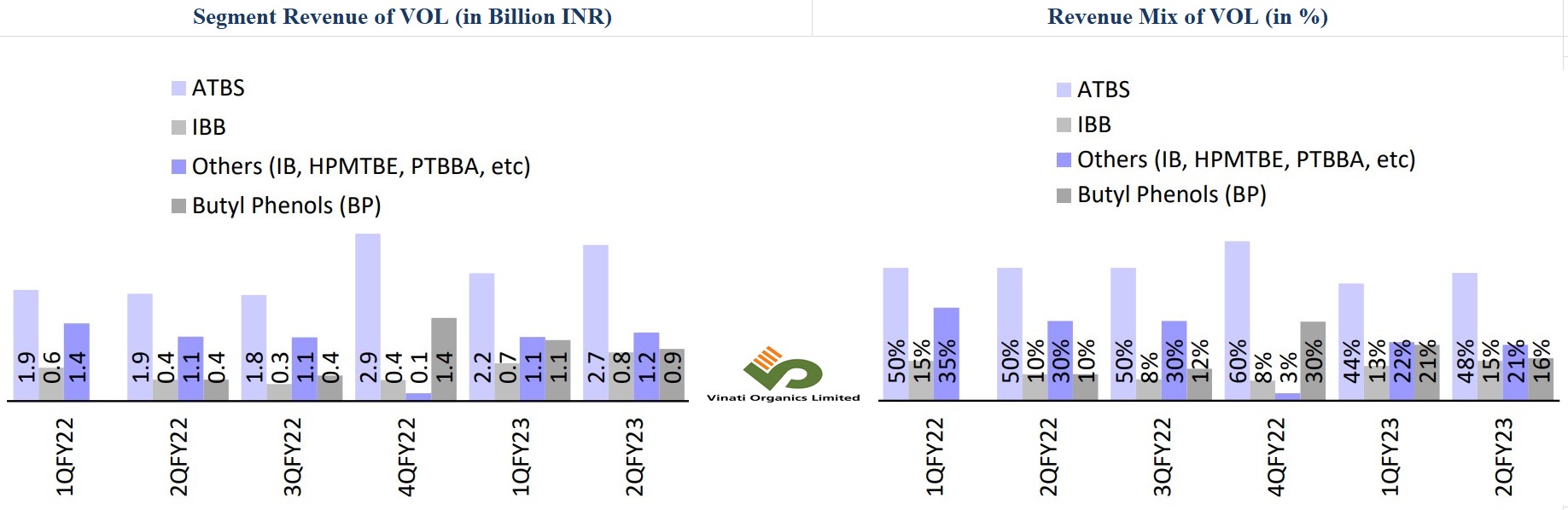

In terms of revenue contribution, ATBS constitutes ~ (40-50%) of overall revenue followed by IBB’s revenue of ~ (20-30%), while the rest is from the other segments such as IB, Butyl phenols and their derivatives.

Product Selection Criterion @ Vinati Organics Ltd.

To produce ONLY Niche chemical products with a target of 15-20% return on investment and a payback period of upto 5 years.

The process of production should be clean and green, with a potential to convert the generated residual waste into other products, thereby minimizing waste generated and also creating an additional source of revenue.

There should be a Barrier to Entry either through a Unique Process or through an Integration with the existing products (e.g. – Manufacturing of Butyl Phenol which uses IB as a raw material, that is already being manufactured by the company).

Company Targets Import Substitute Products (e.g. – Manufacturing of ATBS, Butyl Phenol, etc.) – Source: https://www.screener.in/company/VINATIORGA/

Accordingly Vinati Organics Ltd. have expanded its capacities in line with the market demand, strengthened its footprint in Niche segments and have curated an Exceptional product basket that holds a significant market share globally.

In addition VOL balance sheet continues to be strong with healthy cash flows, which can sustain its capital expenditure and future growth endeavours.

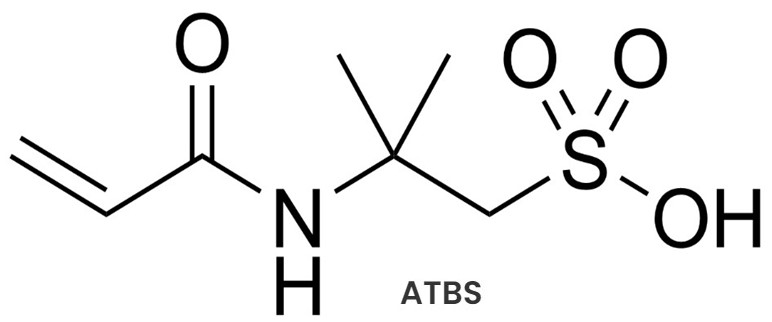

ATBS is a unique versatile compound having a variety of end-user industry applications such as in water treatment chemicals, paints & coatings, adhesives, textile chemicals and personal care. However, its most important use is in the enhanced oil recovery industry.

ATBS demand is likely to stay strong as oil drilling activities remain robust with the US, Europe and the world at large is trying to move away from their dependence on Russian oil and gas, after the Russia-Ukraine conflict started which created volatility in the global oil markets.

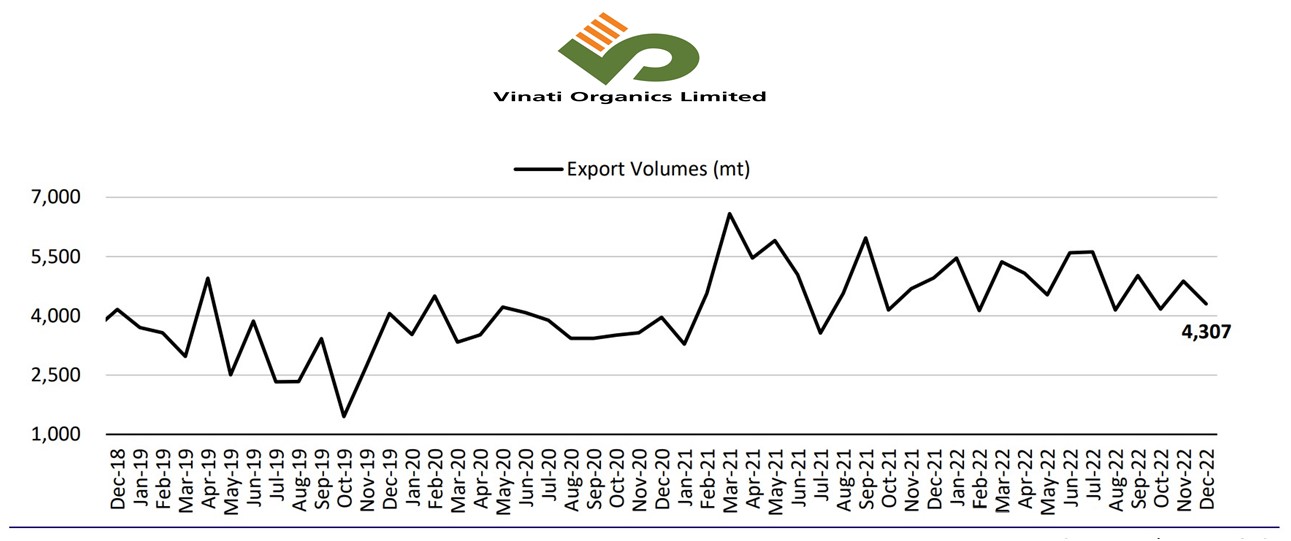

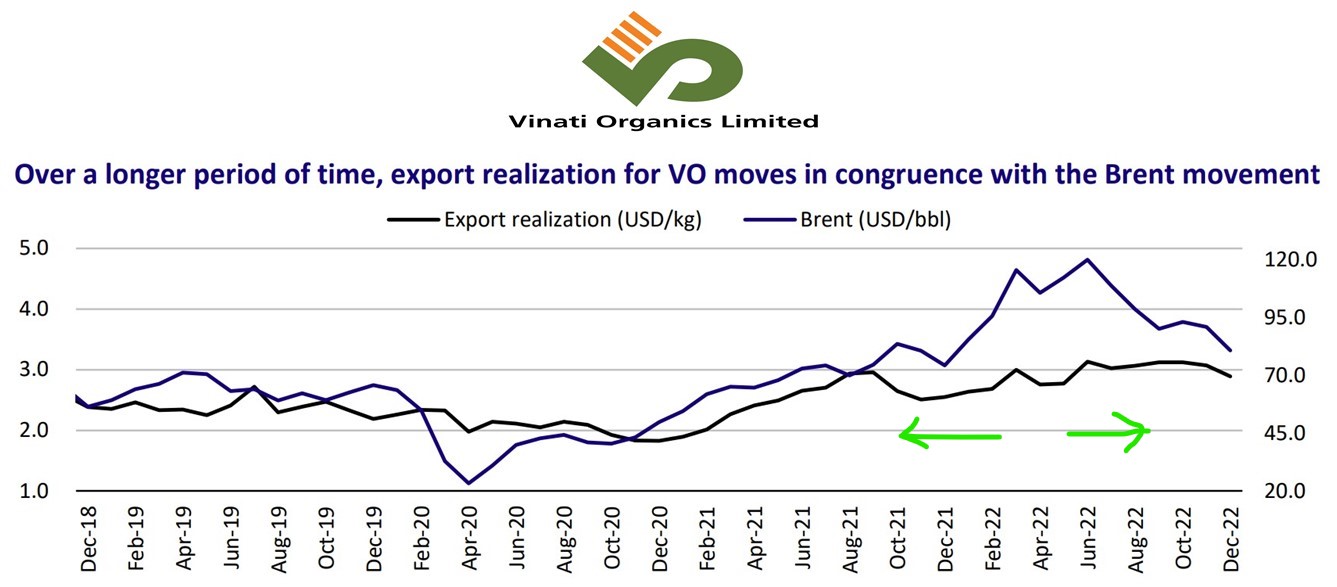

Overall Export Realizations for VOL stood at ~ US$ 3/kg in 3QFY23, flat v/s 2QFY23. During the same period, Brent has corrected 11% QoQ to US$ 88.4/bbl, but if we look at a much longer period, than the research suggests that the realizations did move in line with the Brent prices.

The global ATBS market stood at US$ 7.7b in FY21 and it is expected to increase to US$ 17b by the end of FY28, reporting ~ 12% CAGR growth during the period. In line with that, Vinati Organics has announced an expansion of its ATBS capacity by 50% to 60ktpa from current capacity of 40ktpa, which is likely to come online in 2HFY24. ATBS is the largest product of VOL and currently contributes ~ 48% to its overall revenue.

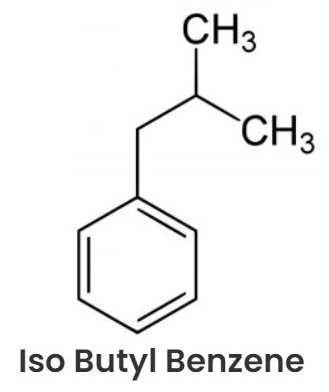

VOL also enjoys > 65% global market share in IBB, which is one of the main raw materials used in production of Ibuprofen. Demand for both remains strong, after a lacklustre FY21 and FY22.

Exports accounted for 69% of VOL’s overall revenue in FY22. Vinati Organics reported export sales of 13,359mt in 3QFY23, down 10% QoQ and 3% YoY. As average rig counts fell in North America during the said quarter, so that might have been one of the reasons for this decline, although Export sales for 9MFY23 at 43,353mt were similar to that of 9MFY22 level.

Though global oil market volatility persists due to concerns on both demand and supply, but in near-term ATBS demand should remain strong and VOL’s realizations would be healthy in the export market, given Brent is expected to remain within range of US$ 90 to 100 per barrel, between FY23 to FY25E.

MOAT – Vinati Organics are into the products where entry barriers are high, mainly due to the process and also due to the capability to scale up the volumes.

Synergies & Competitive Advantage

The merger with VAPL is expected to enhance Vinati Organics synergies further. Company’s existing integrated business model will further strengthen with the use of Butylphenols and IB for antioxidants – a Rs. 10,000 Crore market opportunity that VAPL addresses to.

Antioxidants present a huge market opportunity and post the amalgamation, VOL will be the largest or only manufacturer of some of the antioxidants in India. Optimum Capacity Utilisation level across plants remains integral to meet customer needs on-time and ensuring Economies of Scale. Further, company also optimise the utilisation of raw materials to avoid cost escalation!

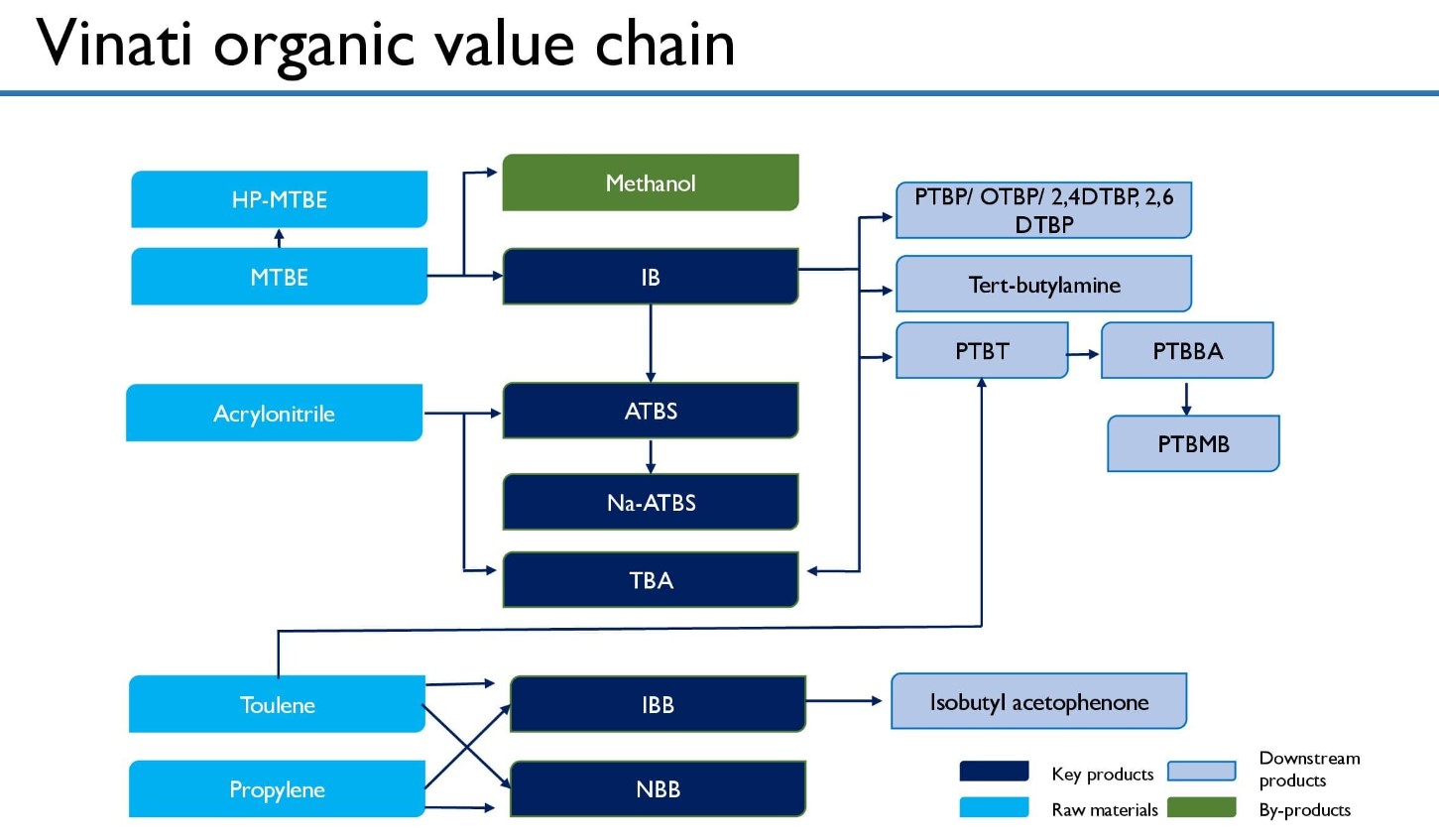

Vinati Organics – The Value Chain Key Niche Products

ATBS Vinati Chemical finds its applications mainly as following:

Oil Field applications: Due to its unmatchable thermal and hydraulic stability, tendency to increase viscosity and its divalent cation stability, make it an ideal solution for many oil field operations.

Latex and Adhesive applications: ATBS are known to achieve an exceptional latex stability in high-performance latex coatings. It improves the thermal and mechanical properties of adhesives and increases the adhesive strength of pressure-sensitive adhesive formulations.

Isobutyl benzene (IBB) 538-93-2 is widely used in the industrial manufacture of ibuprofen, an analgesic – anti-inflammatory, over the counter painkiller along with the commercial use is in the perfume industry.

Commercially sold IBB has a very wide range of impurities, depending on the purity level of the propylene used in the reaction with toluene.

Vinati Organics is one of the leading IBB manufacturer, supplying and exporting premium quality isopropyl benzene 538-93-2 with a record purity of 99.8% vis-à-vis the prevailing international standard of 99.5%.

N-Butyl Benzene (NBB), in large volumes, is used as a solvent in the manufacturing of alkyd resins, used in the coating industry. Whereas its Niche application is in the manufacture of n-butyl benzene sulphonic acid (NBBSA) – which has detergency properties useful in metal cutting fluids and metal cleaners.

On account of its high boiling point and stability at low temperatures, NBB is also used as a heat transfer fluid suitable for single fluid heating and cooling. Further, NBB is used as a plasticizer, surface active agent, and polymer linking agent.

n-TBAcrylamide (nTBA) is a monomer that is commonly found in plastics & polymers and is used in the production of various polymers & as an intermediate in organic chemical synthesis.

nTBA can be used for making polymers in various applications including:

1) – Personal Care

2) – Paper Industry – nTBA based retention aid enhances the flocculating tendency of pulp fibers, contaminants, and additives to inhibit the damage during drainage through proper machine wires or screens.

3) – Metalworking mist suppressant – It reduces the mist of machine fluids at the source by stabilizing them against break-up, through the extreme shear conditions that occur during metal working conditions.

4) – Thickeners – Used in thickening mixtures, aqueous solutions, or systems that show high performance even under high PH conditions.

Isobutene used in manufacturing iso-octane (the high-octane aviation fuel), butyl rubber, polyisobutene, resins, and copolymer resins with butadiene etc.

Other uses include use as a monomer or for manufacturing copolymer, for use in the production of synthetic rubber and plastics.

In addition, Isobutene is also used in lubricating oil additives, hot melt adhesives, sealing tapes, special sealants, cable insulation, polymer modifier, viscosity index improvers, films, and coatings.

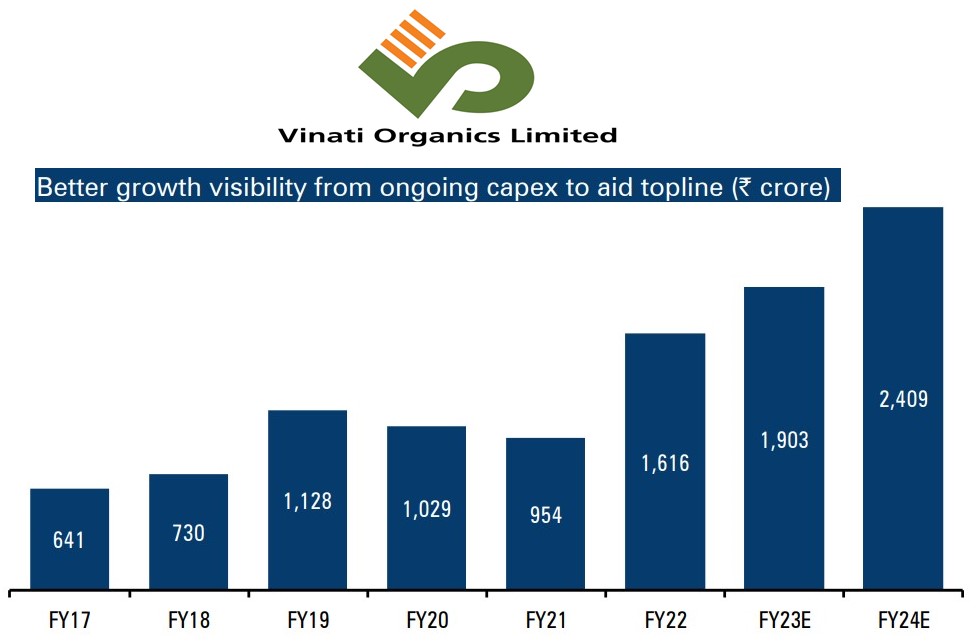

Vinati Organics – Performing Diligently to Amplify Value and Driving the Organic Expansion

Vinati Organics long-term relationships with its esteemed clients and the R & D expertise are other key strengths that make the foundation of company’s business more robust and resilient to the downside risks.

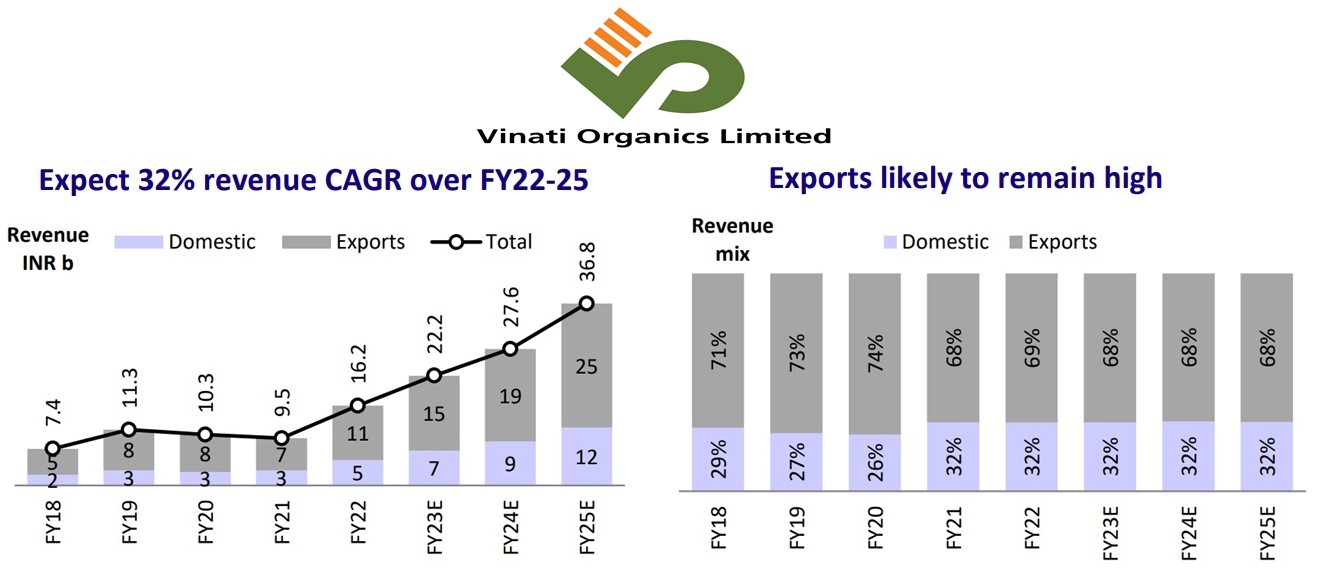

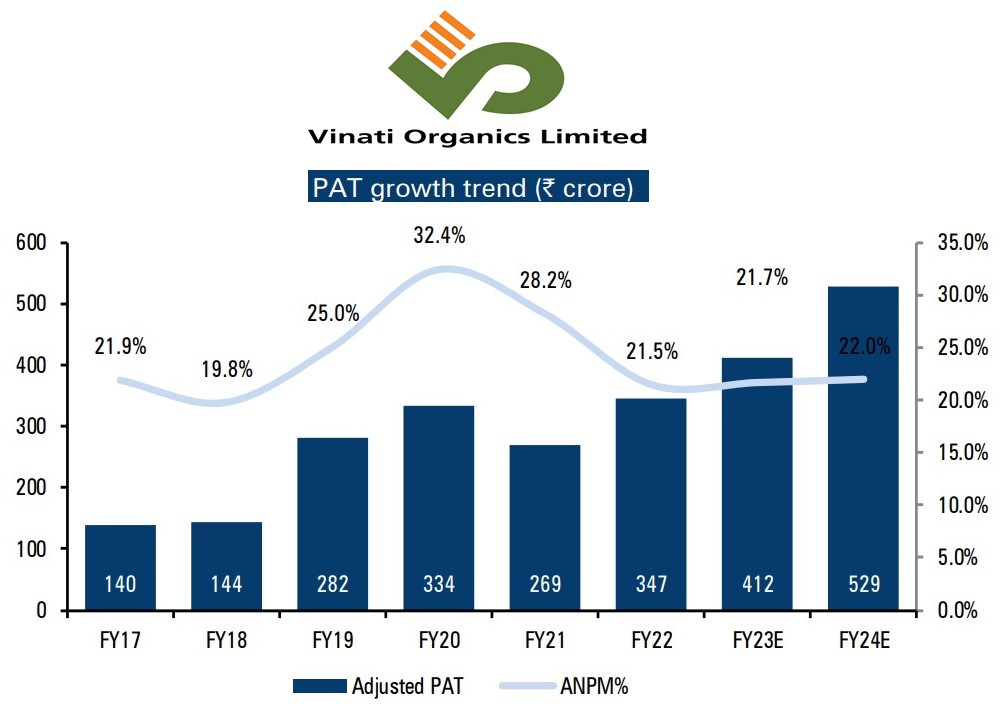

In FY22, Vinati Organics revenue increased by 69% while PAT grew by 29%. Revenue growth was mix of volume growth as well as price escalation due to increased cost. Company’s product portfolio is Niche and enjoys a massive Export Opportunity, which the government is encouraging significantly as part of the ‘Make in India’ initiative.

The ATBS capacity is to be expanded from 40000 MT to 60,000 MT, given the strong demand outlook for ATBS. The expansion would require CapEx of ~ Rs. 300 crore which would be funded through internal accruals and is expected to get commissioned by December 2023.

Additionally, Rs. 280 crore CapEx (including products like MEHQ & Guaiacol capacity of 2000 MT and Iso-Amylene with capacity 30000 MT) for Veeral Organics Private Limited has been commissioned and same is in ramp-up stage. These projects would drive the earnings growth, beyond FY24 for Vinati Organics Ltd.

Vinati Organics – Q2FY23 & The Road Ahead

Since key raw material prices are ruling at higher levels, passing on the input inflation led to better realisation growth for the key segments. Apart from this, better volume growth owing to gains in market share in segments such as – butyl phenols along with the higher demand of high grade ATBS, supported growth for the segment.

Moreover revival in the demand of IBB also drove the growth, to some extent, in Q2FY23 and company has not seen any slowdown in the demand even from the Europe during the quarter.

Butyl phenols are operating at 60% utilisation, while ATBS accounts for 50% of the total revenue.

OPM at 26.2% was down 234 bps YoY, primarily due to lower than-expected gross margin of 45% (down 408 bps YoY) probably due high-cost raw material inventory and higher-than-expected other expenses, primarily led by a sharp increase in power and fuel costs.

EBITDA/kg improved on both YoY/QoQ reflecting a favourable product mix and improved pricing. Resultantly, operating profit was up 39% & PAT was up 42.6% on YoY basis, given higher-than-expected other income during Q2FY23.

Vinati Organics – Summary on the Investment Theme for FY23 & Beyond

Vinati Organics operates in niche segments and have an exceptional product basket with a significant market share in its products globally. Hence, the company can generate significantly higher margin profile.

This coupled with a debt-free balance sheet, helps Vinati Organics to generate superior return ratios. Further, Vinati Organics is also expected to see increased volumes in ATBS due to capacity expansion, while IB (Isobutylene) volumes are expected to rise due to enhancement of capacity utilisation and a gradual ramp-up in utilisation levels for butyl phenols.

Therefore PAT Growth is expected to be ~ 19% in FY23 & ~ 28% in FY24 and so may be the ~ stock price appreciation from current levels.