Stronger Diversified Portfolio of the Services & Skills across Wider market footprint, increase ability to deliver Larger & Significant Transformational requirements of the clients, stronger balance sheet to support investment on Platform, People & Client relationship, Huge Opportunity for Cross Selling & Up Selling for the Synergically Complementary entities, are some of the reasons Why LTIMindtree could be the Multibagger story for the next decade.

What is there in the Merger for the 2 Companies & Its Investors?

Let us look at some of the facts regarding the Two Companies –

| Key Points | LTI | Mindtree | Observations |

| Services Offered by the companies | The company provides a wide range of IT services such as application development maintenance (ADM), enterprise solutions, infrastructure management services, testing, analytics & artificial intelligence. | Business-led analytics solutions: Predictive analytics, Insights sandbox, Industry-specific analytics solutions, Value-led experimentation. Diagnostic and design: Discovering and evaluating the readiness of existing infrastructure to deliver high-quality analytics solutions. Operations Analytics: AI/ML model production, Deployment at scale, Continual optimization. Data analytics: Turning technology into business outcomes by delivering information management, business intelligence, and analytic solutions under one umbrella. | Both the companies are offering wide range of Diverse services to its Clients. So, Merged entity LTIMindtree will be providing all these services, as a Single Company. |

| Revenue Bifurcation – Industry Wise | Banking & Financial Services – 30%; Insurance – 16%; Manufacturing – 16%; Retail, Pharma, Cons. Goods – 11%; Hi-Tech, Media & Entertainment – 11%; Energy & Utilities – 10%; Others – 6%. | Banking, Financial Services, and Insurance -19.4%; Retail, CPG, and Manufacturing -18.6%; Travel, Transportation, and Hospitality – 15.9%; Communication, Media, and Technology – 43.5%; Healthcare – 2.6%. | Industry Wise Net will be Broader now & Revenue Bifurcation will be more Balanced & Diversified now. |

| Revenue Bifurcation – Service Wise | ADM & Testing – 35%; Enterprise Solutions – 31%; Cloud Infra & Security – 14%; Analytics, AI & Cognitive – 12%; Enterprise Integration & Mobility – 8% | Customer Success – 78.1%; Data and Intelligence – 6.8%; Cloud – 6.6%; Enterprise IT – 8.5% | More service Options will now be available to clients from a Merged Entity |

| International Presence & Geographical Distribution | The company has a presence in more than 30 countries in the world with 35 delivery centres and ~ 55 sales offices globally. In FY21, North America accounted for ~68% of revenues, followed by Europe (16%), India (8%), Asia Pacific (3%) and rest of world (5%). | Company has its presence across 24 countries and has offices in India, the United States, the United Kingdom, Japan, Singapore, Malaysia, Australia, Germany, Switzerland, Sweden, the United Arab Emirates, Netherlands, Canada, Belgium, France, etc. North America – 78.1% Continental Europe – 6.8% UK & IRELAND – 6.6% APAC & Middle East – 8.5% | Broader International Presence & Geographical Mix. |

| Client Profile & Revenue Composition | Presently, the company has ~450 clients out of which ~70 are included in global fortune 500 companies. As per FY21, It has 35 clients that pay in excess of 10 million $ and 18 clients that pay in excess of 20 million $ to the company on a yearly basis. | GlaxoSmithKline, Hermes, Lufthansa Cargo AG, Popular Community Bank, University of Florida and Zinnov. Top Client – 26.3%; Top 5 clients – 36.9%; Top 10 Clients – 45%; Top 20 Clients – 56.9% | Both the companies were having almost Different Client list, so now the Merged entity will be having bigger client pool to serve i.e. Huge Opportunity for Cross Selling & Up Selling. |

| Alliances and Partnerships | Over 400 Clients | Over 300 Clients | Merged entity will now be having all the benefits of wider Alliances & Partnership with companies such as Adobe, cisco, Guidewire, IBM, Microsoft, Oracle, PEGA, Salesforce, servicenow, snowflake, Mulesoft, etc. |

LTIMindtree will be the fifth-largest software company by market capitalization, so there are high chances for the merged entity to make it into Nifty50 List, beside this the combined entity is likely to close with revenues of $5.25 billion, including that of the engineering services under LTTS in this FY.

“We expect the revenue to rise to $6.2-6.3 billion next fiscal. LTIMindtree alone will have a top line of $5 billion. The internal target is to get at least 26% of the group’s revenue from the software verticals by FY26”- said A M Naik, group chairman of L&T and chairman of LTIMindtree.

“This integration is much more than just the coming together of two-highly successful companies. It is about turning the collective wisdom of the two companies into a much larger force for creating long-term value for all our stakeholders,”- said SN Subrahmanyan, CEO and MD of L&T.

LTI’s strengths are in enterprise Resource Planning, SAP, Automation and Banking, Oil & Gas, Financial Services and Insurance, while the Mindtree has its strength in Retail, CPG and Media, Travel & Hospitality and Technology. So, this kind of Diversification in the service portfolio of the merged entity LTIMindtree will not only aids to the better growth (than earlier) but also limits the impact of the business headwinds which may be there in the future say due to any possible recession in USA or Europe.

The integration would help the entity to win bigger bids as it is uniquely positioned to combine and scale up by competing for the larger deals and offers a greater ability to stick together for end-to-end offerings and deeper engagement, with the hyperscalers to generate the significant value.

The management is targeting double digit growth rates (of around ~ 15% in terms of PAT Growth) for the next five years for the merged entity.

Mindtree CEO Debashish Chatterjee will lead the combined entity as its MD & CEO and he said that -“Amid the proliferation of new business models and revenue streams in a rapidly converging world, LTIMindtree will help businesses proactively take on and shape the future by harnessing the full power of digital technologies. Armed with top talent, comprehensive offerings and a cumulative experience of more than five decades, LTIMindtree brings the diversity of scale and capabilities required to help businesses re-imagine possibilities, deliver impact, and get to the future, faster,” – https://economictimes.indiatimes.com/markets/expert-view/ltimindtree-has-a-great-opportunity-in-cross-selling-up-selling-creating-wallet-share-debashis-chatterjee/articleshow/95528279.cms?from=mdr

How has been the Business & Financial Growth of the Two Merged Companies?

Let us 1st compare the Financials & Business Growth of the Two Merged Companies –

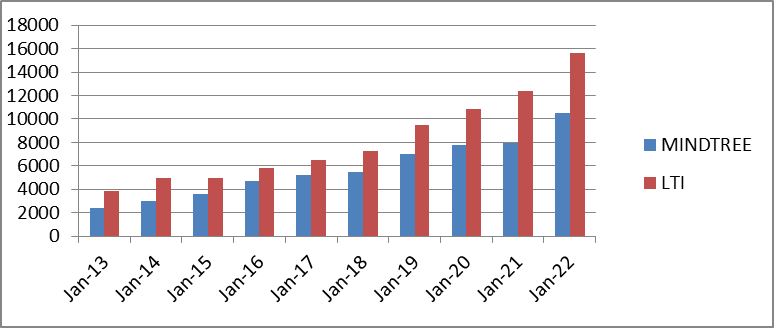

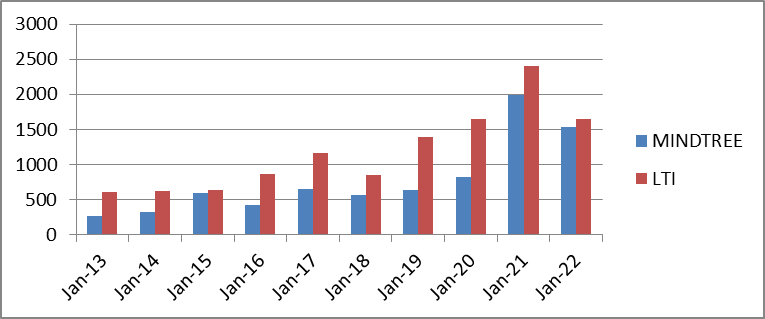

Revenue/Top Line –

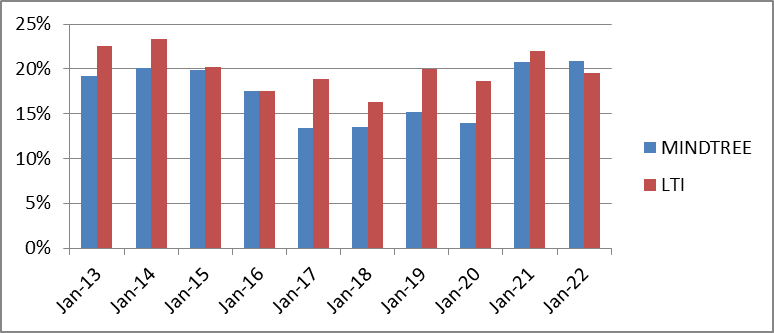

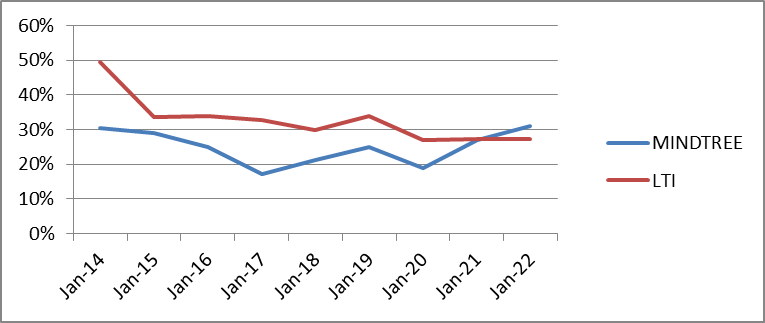

OPM –

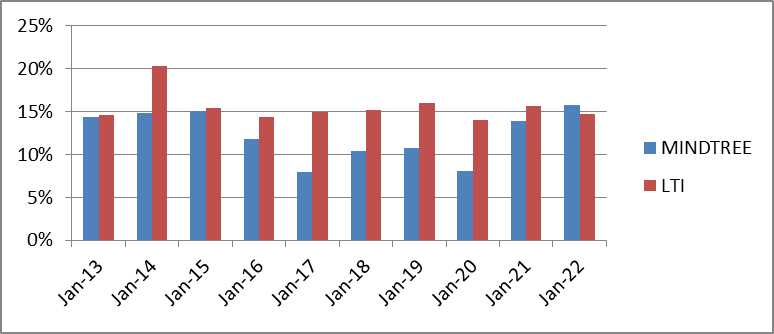

NPM –

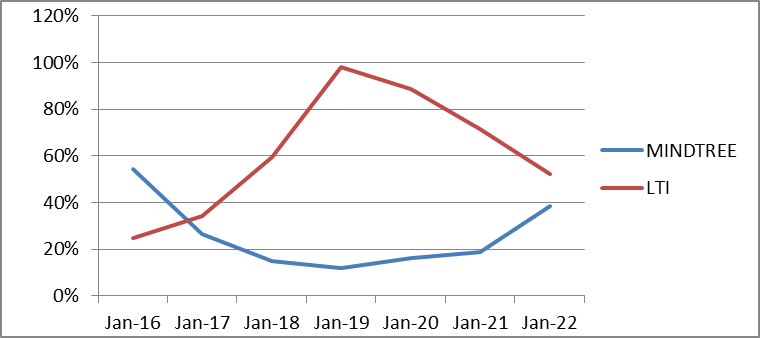

ROCE –

Self-Sustainable Growth Rate (SSGR) –

CFO –

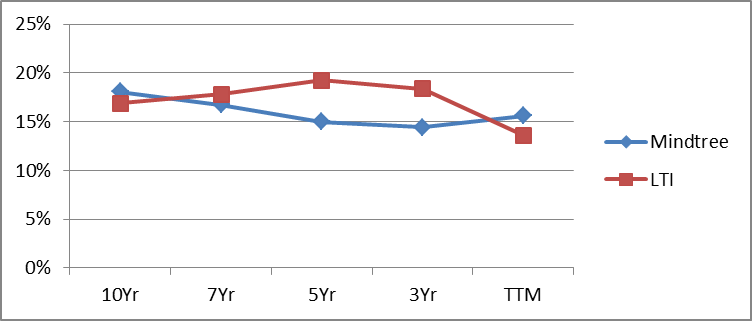

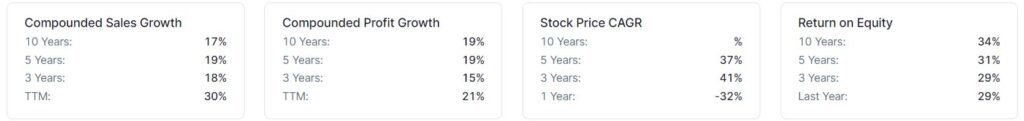

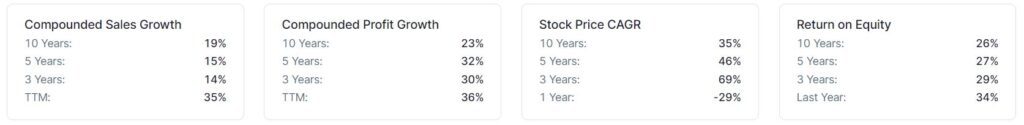

Sales Growth Trend –

Profit Growth Trend –

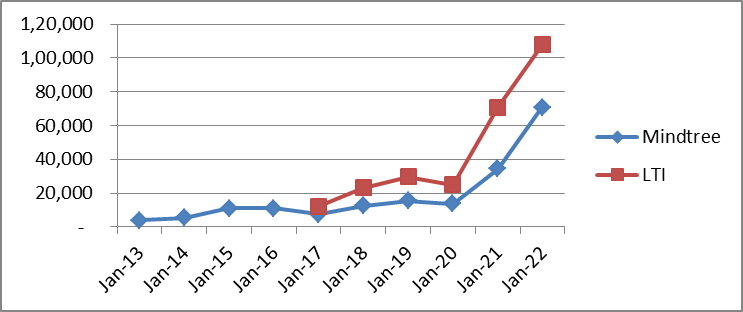

Market Cap Growth –

One can easily see that over the past few years Mindtree has performed better than LTI in terms of OPM, NPM, ROCE, SSGR, Sales Growth Trend & Profit Growth Trend and such, same has also been reflected in the Stock Price returns of the Mindtree in comparison to LTI. Whereas LTI has posted 23% increase in its consolidated net profit for the quarter ended in September 2022, Mindtree has grown its consolidated net profit at 27.5% in the same quarter. Overall, both the companies has been growing Faster compared to their peers in the same sector. Further, EBIT margins are expected to expand by 100bps to 18.1% in FY23 & than to 18.6% in FY24.

Long Runway of Accelerated Growth for the merged entity in the next decade.

Trustworthy & Shareholder Friendly Promoters along with High Corporate Governance Standards are 2 of the 7 Parameters which I believed in, as a Must before considering any share for the Long Term Investment (7 Key Parameters you should look for), Luckily LTIMindtree has got the DNA to meet these prerequisite conditions. Management is very much convinced with the natural Synergies b/w the service lines & the capabilities of the merged entities (e.g., LTI traditional stronger area has been supply chain transformations whereas Mindtree strength is in Customers Experience), But both the companies are focusing on end to end Digital Transformations. Synergies in Business Verticals as well as Geography Mix, helps them to complement each other growth aspirations.

“The Merged Entity LTIMindtree will have much more advantages than these companies individually had in the industry and besides that, LTIMindtree will still keep on getting benefits from the L & T Group Clientele worldwide, due to strong reputation of Brand L & T itself”.

Mergers will Create More Cost & Revenue Synergies eventually, to give boost to the NPM of the LTIMintree. The Combined Deal Pipeline worth US$ 3.6bn which reflects a Stronger Demand Outlook contrary to the apprehension of the Slowdown or Recession in US or Europe!

LTIMindtree is very clear on its Asset Allocation strategy as 35% to 40% of FCF will continue to be distributed as Dividend to its shareholders, ~ 30% may go in Acquisitions depending upon the potential of the opportunity available, and remaining 30% to 35% will remain as (Cash + Investment) on the balance sheet.

The Verdict on – Why LTIMindtree could be the Multibagger story for the next decade.

Fortune 500 companies are spending heavily not only to digitise their business but also looking forward to spend on to new areas of technologies like Artificial Intelligence, Data Analytics, Data Science, Big Data, Machine Learning etc. so as make their businesses agile and cloud adaptive.

IT has become the core part of their growth engine. Companies realising that they need to invest into technology to drive their growth going forward or else, they could be left behind by competition. Therefore even if there is a slowdown in US or Europe for a while, then also this time Fortune 500 companies are unlikely to cut back on their IT budgets.

Now whether LTIMindtree helps its Clients in improving the efficiency of their system to fund their Digital Transformations OR enhance their revenues otherwise through technology up-gradations, LTIMindtree will keep on getting work orders bigger than what LTI or Mindtree were getting as an individual entities. For example, even as the fears regarding Slowdown or Recession in US percolates through the FIIs, DIIs or the PMS owners, LTI announced 4 Large deals worth US$ 80mn in Q4.

LTIMindtree is looking at completing the Integration process & overcoming the merger related issues (if any) by the end FY (2022-23) itself & by then Cost & Revenue synergies will also be built to improve the OPMs of the company going forward in the next fiscal.

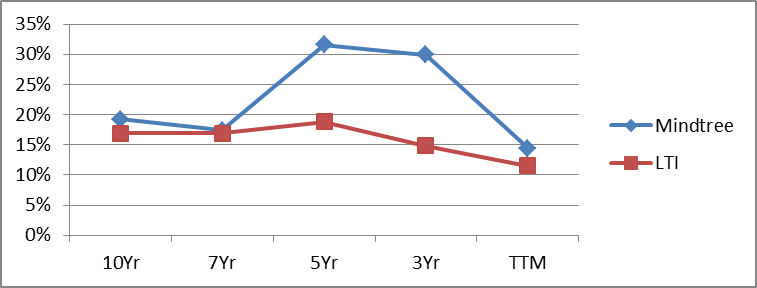

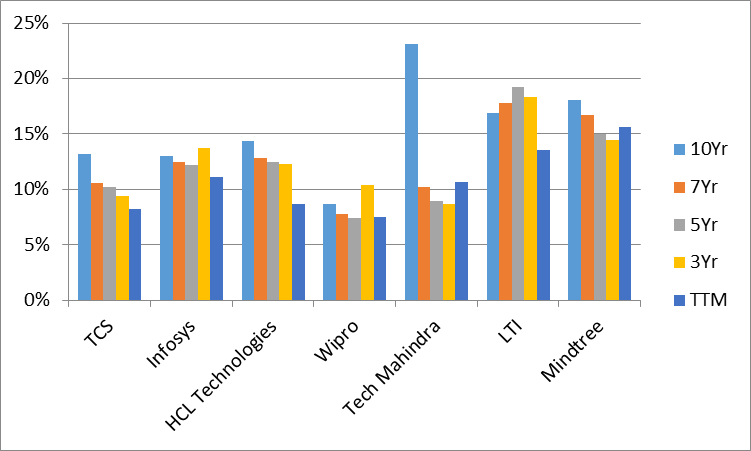

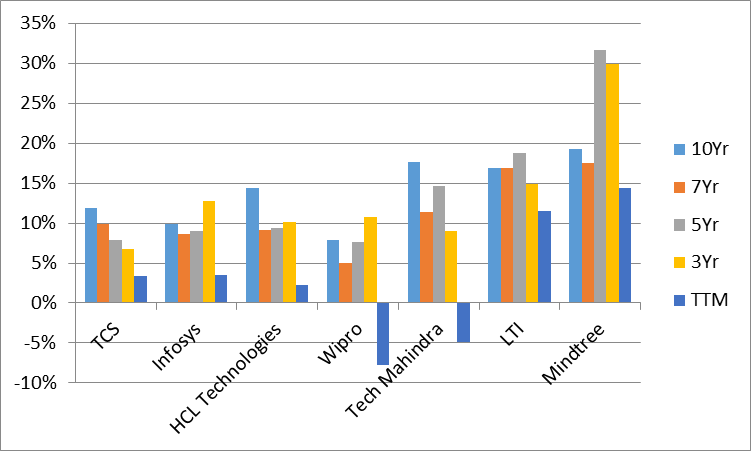

As now it is known that LTIMindtree will be the fifth-largest software company by market capitalization & sixth-largest by revenues, so let’s see how has been the “Sales Growth” & “Profit (PAT) Growth” Trends of Top 7 IT Companies (by Market Capitalization) in past 10 Years, 7 Years, 5 Years, 3 years & TTM Periods:

Clearly LTIMindtree Does Not Only have the Size & Scale Capabilities of the Giant IT Company but also has inherent drive for sustainable Higher Growth Rates both in terms of Sales & Profit Growth. You can bet your money on LTIMindtree, for Tension Free, Jyadareturns!

Frequently Asked Questions (FAQs)

What will happen to Mindtree shares?

As the Mindtree Share gets Delisted from the markets, each investor of Mindtree will now get 73 shares of LTI for every 100 shares in their Demat Account, which will eventually become 73 shares of LTIMindtree – the Merged entity. Regarding Fractional Entitlement of less than 1 unit of share you may read – https://www.bqprime.com/markets/lti-mindtree-merger-all-you-need-to-know-about-fractional-entitlement

Why did Mindtree and LTI merger?

Both are Synergically Complementary Partners who are Focusing Together on the Massive Potential Globally for the Digital Transformations. As this merger will give merged entity LTIMintree Stronger Diversified Portfolio of the Services & Skills across Wider market footprint, Increase ability to deliver Larger & Significant Transformational requirements of the clients, Stronger balance sheet to support investment on Platform, People & Client relationship, Huge Opportunity for Cross Selling & Up Selling for the Synergically Complementary entities etc. Hence, it will fulfill the Growth Aspirations of the companies.

Is Mindtree merging with LTI?

YES