Guess what could be the one strikingly common attribute amongst companies like Asian Paints, Astral, APL Apollo Tubes, KEI Industries, and Supreme Industries Ltd.?

All these 5 companies belong to the manufacturing theme and specifically to building materials segment in that theme. As the disposable income is rising, the consumer discretionary sector’s growth is expected to be strong. If that happens, then the building materials segment is going to be the beneficiary of this boom, for coming next 4 to 5 years.

Due to the government’s thrust on promoting Make in India and PLI schemes, and the global players’ preference for China+1 and willingness to look for Europe+1 on the back of rising energy costs and supply chain hurdles, manufacturing theme and hence the building materials segment in it especially, shall be the biggest beneficiary of such potential Growth Drivers and that is why these 5 Stocks still have lots of potential for the Huge Growth.

So why these 5 stocks still have lots of potential for growth?

The Tailwind to ensure Organic Structured Growth

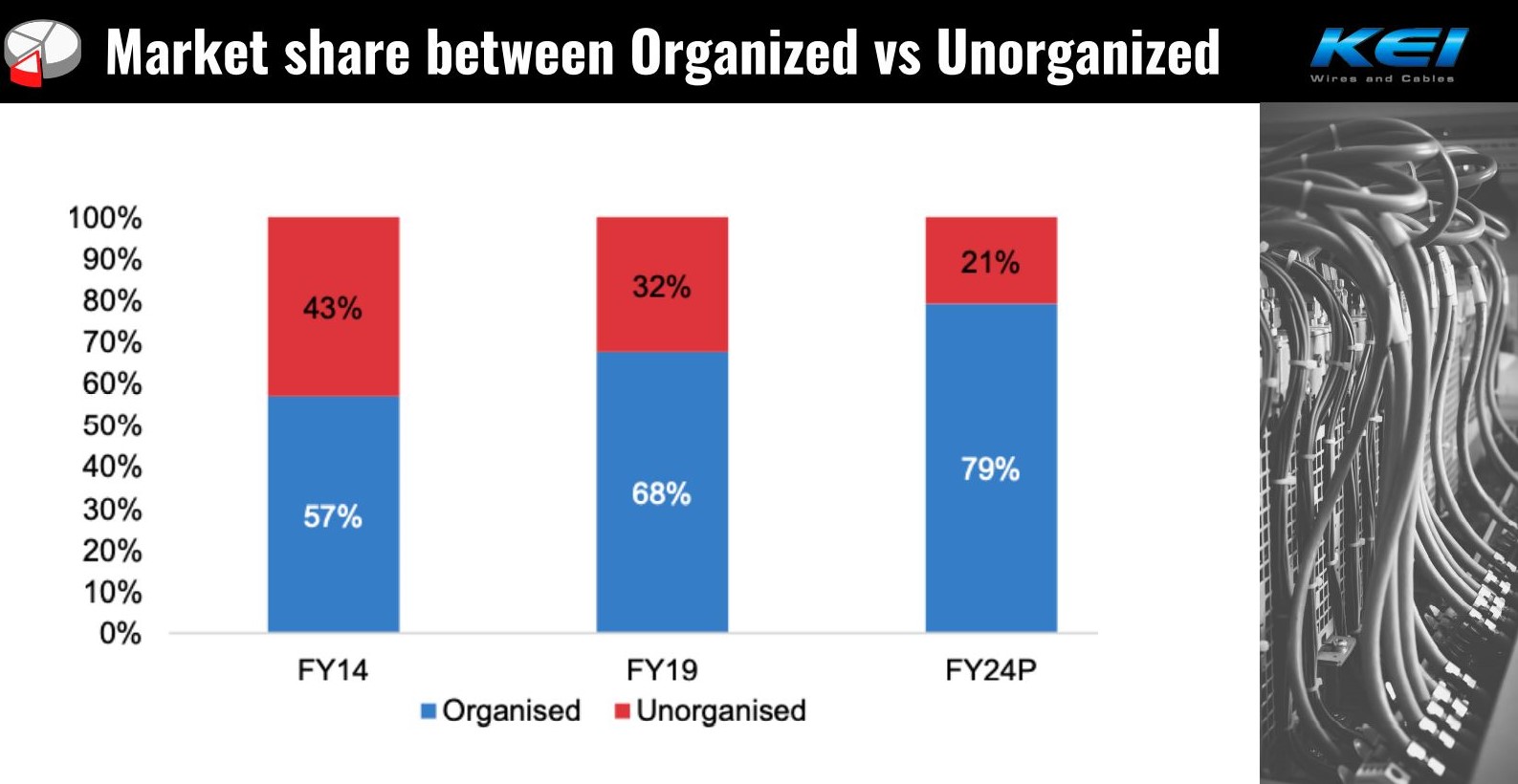

A lot of migration that used to happen to Tier-I or metro cities earlier, is largely not happening any more. Most of the people have been able to get work-from-home opportunities in Tier-II cities as well. Similarly, post GST as the formalisation of businesses across the various sectors becomes mandatory, most of the informal small players are forced to shut down their businesses. As such, the sectors leaders reaps maximum benefits & increases their market share exceptionally.

Beside that, there is opportunity in manufacturing theme both via import substitution as well as export perspective. As such companies in this sector are seeing the kind of export demand environment, which they have never seen before in their lifetime. Largely, the beneficiary of this particular theme is the building materials segment where the CapEx has already begun.

Additionally not only has the real estate cycle improved, but even the home improvement or a home refurbishment theme, which lied low for the last couple of years, has come out roaring. “People want branded goods, in terms of not only paints but also in terms of electrical goods and fittings and ceramics”. This as a sector probably would get re-rated as a proxy play for the real estate, as well as for the home improvement. https://jyadareturn.com/7-key-parameters-you-should-look-for/

Companies Individual Strengths to Sustain Exceptional Earnings Growth and Margin Expansion

Asian Paints in spite of having sale of 21k~22k Crore, still has volume growth of around 10 to 12%.

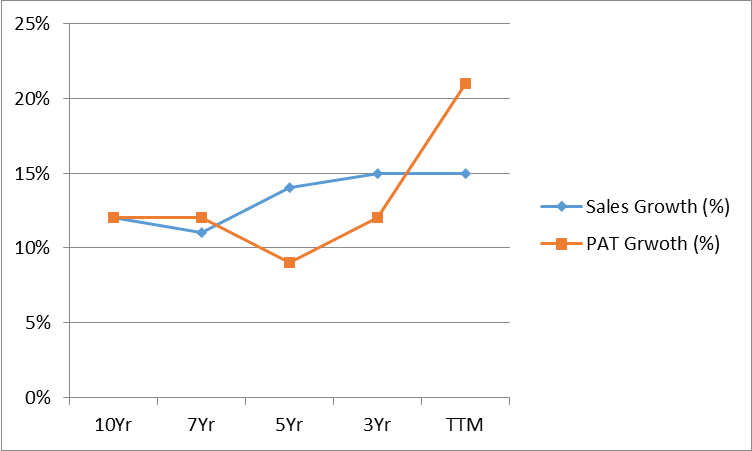

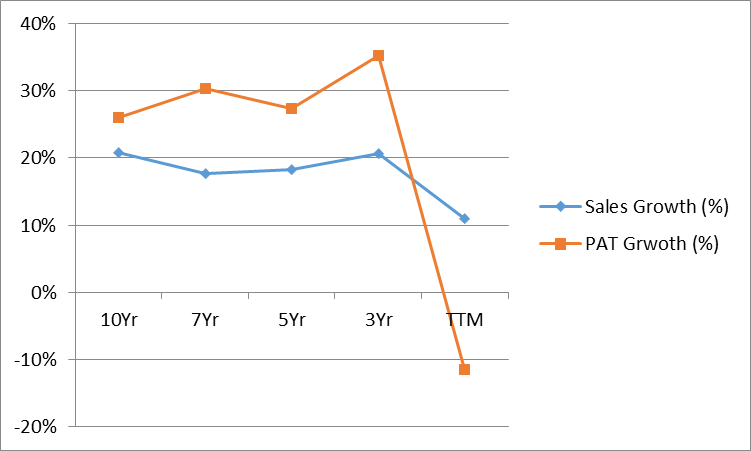

Astral Ltd. & APL Apollo Tubes Ltd. has grown their Sales Revenues at a Jaw Dropping CAGR of 23% & 25% respectively in last 10 years whereas the their Profits has grown at phenomenal CAGR of 29% & 27% respectively in same 10 years period.

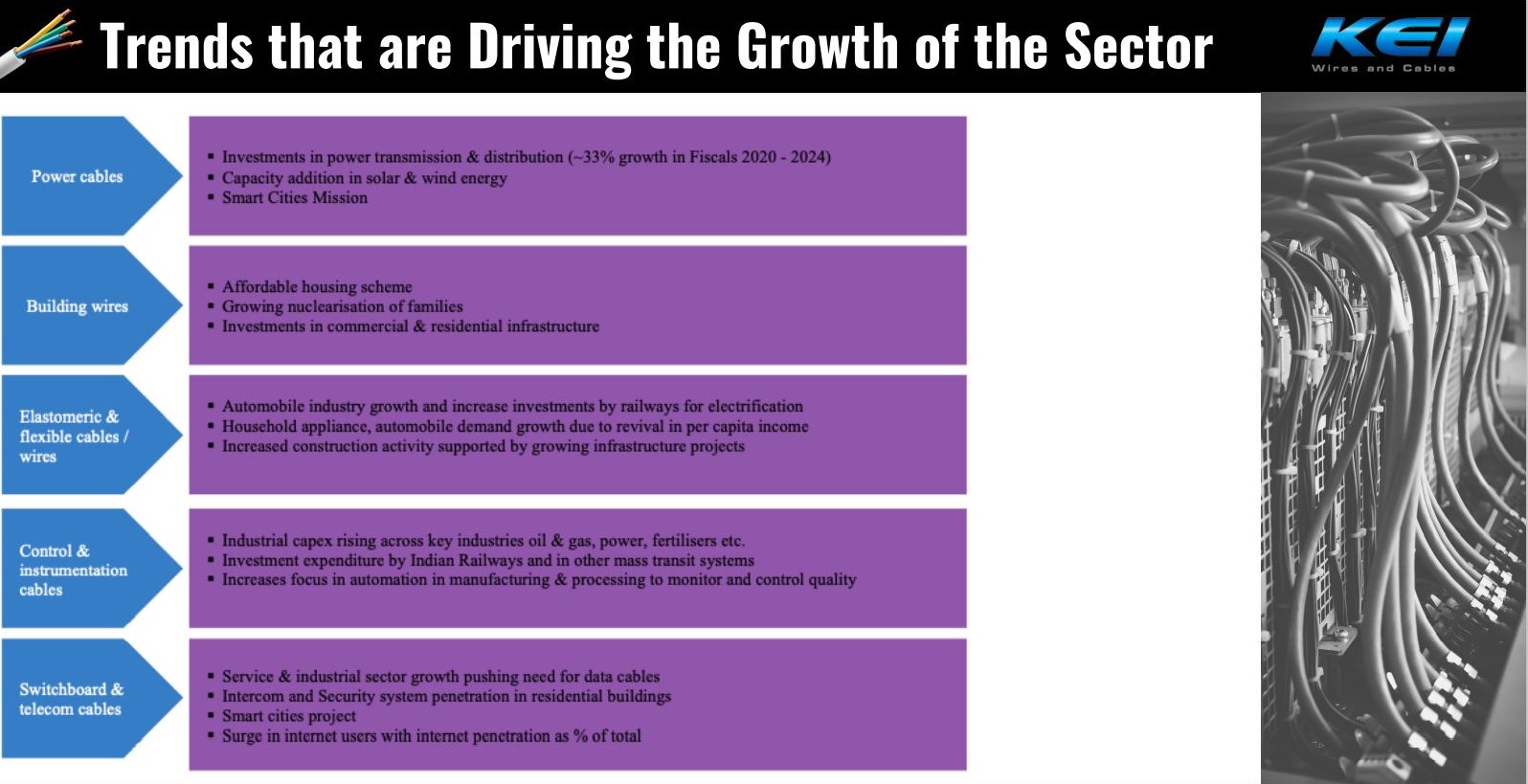

KEI Industries Ltd., Polycab India Ltd., Havells India Ltd. All Belongs to Cable & wire sector, which has 22% of Volume Growth from 2020 to 2022, in spite of the fact that the biggest sectors like Infrastructure & Real Estate, where cables & wires are mostly consumed, haven’t’ seen much growth.

So, what led to these successful stories (in brief)?

What Pidilite is to Carpenters, so is Asian Paints to Painters, Astral Ltd. to Plumbers and APL Apollo Tubes to Fabricators. These companies targeted to capture the perception of Carpenters, Painters, Plumbers and Fabricators respectively which then attracted the customers for these companies.

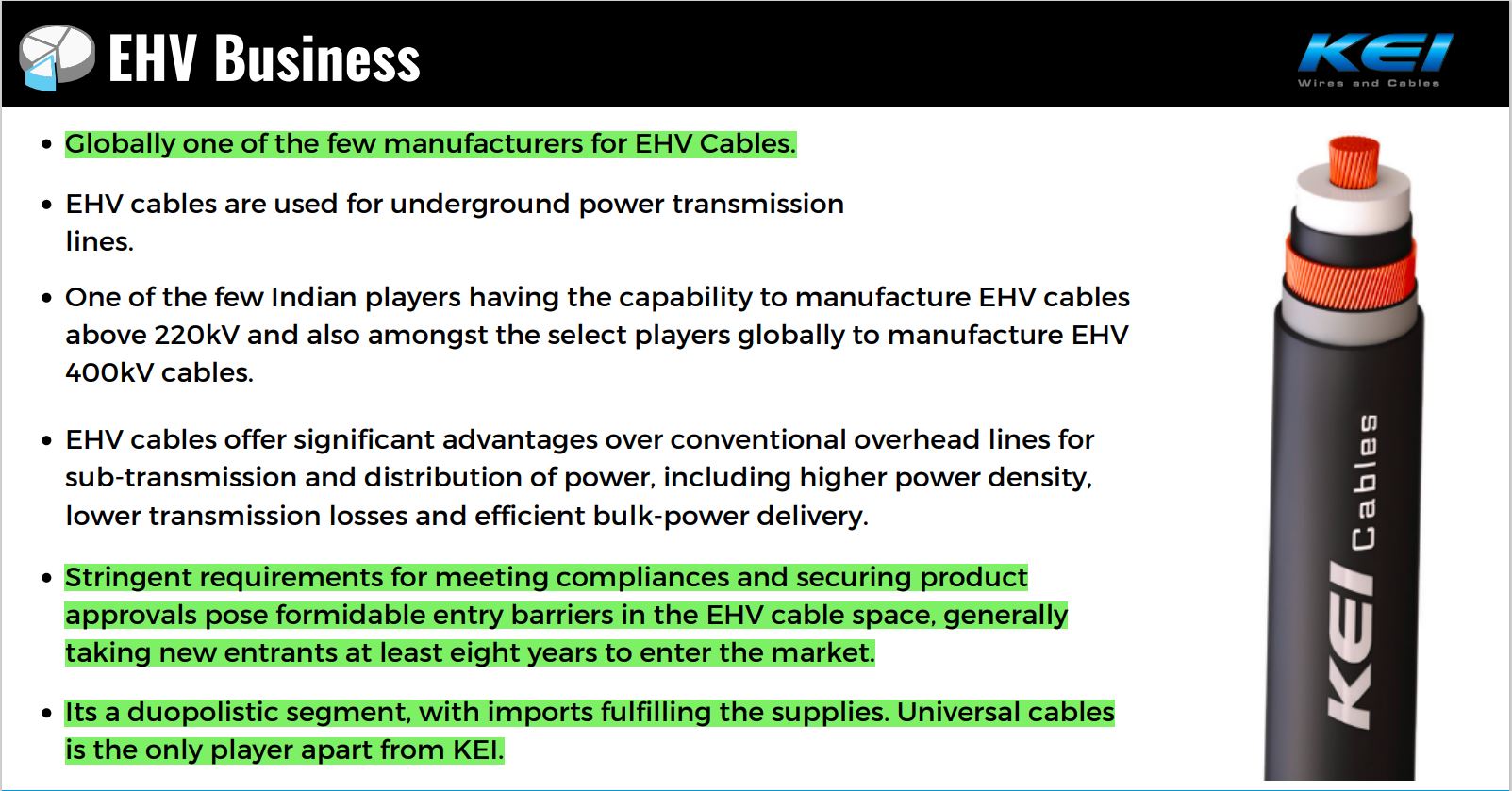

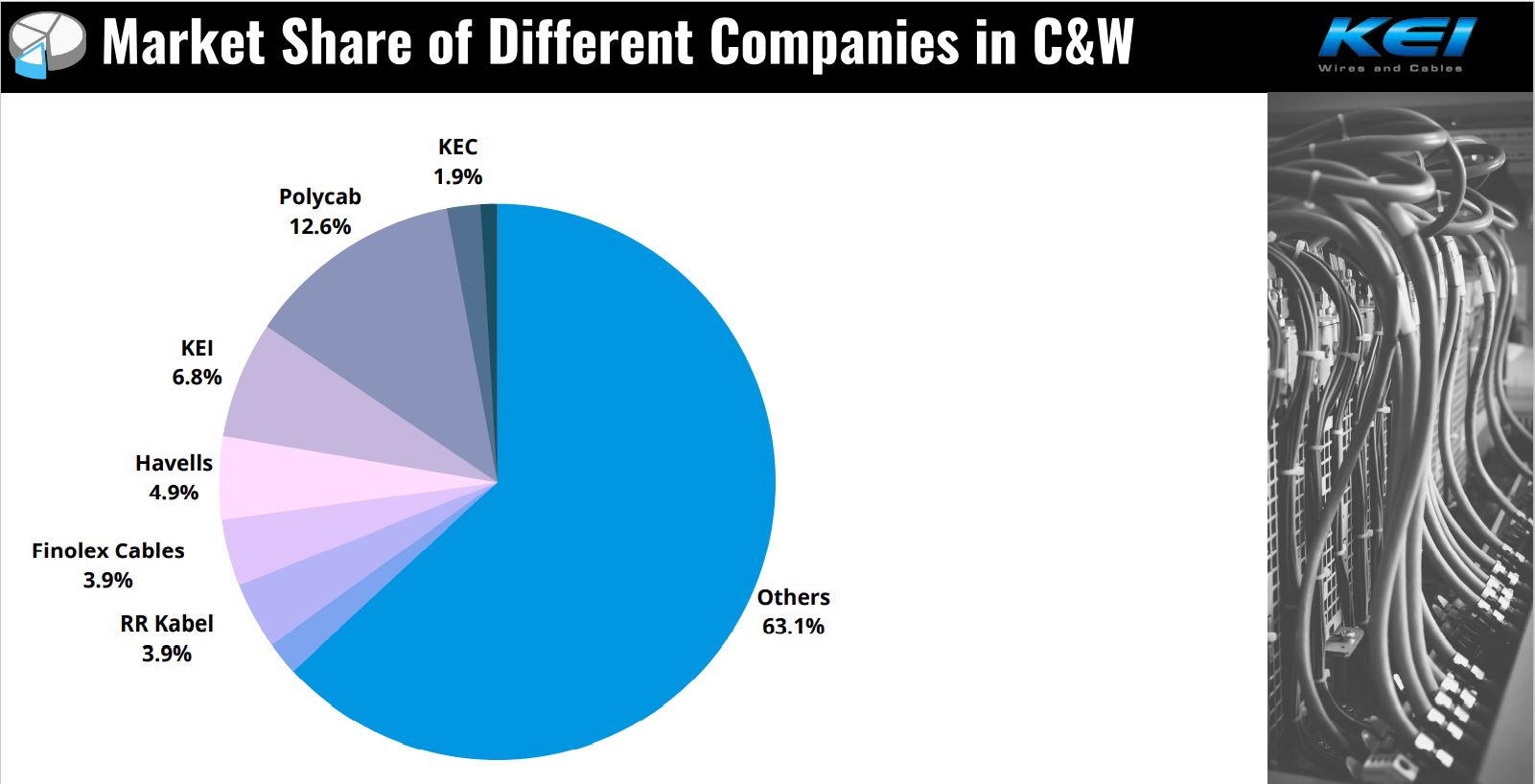

Whereas KEI’s 51% of revenue growth comes from Institutional Business alone for whom it makes extra heavy voltage cables which only 2 companies at present has got approvals to make in India one is KEI & another is Universal Cables Ltd. Even Polycab India Ltd. hasn’t got the same approvals at present, for which it has been trying for quite some time. So, KEI clearly enjoys that High Entry Barrier to its advantage.

Asian Paints, Astral, APL Apollo Tubes, KEI Industries, Polycab India, Supreme Industries etc. ALL has got Brand MOAT through which they enjoys Pricing Power, each one of them has Innovative or Unique Product Portfolio, each one of them either has their own Distribution Network or they deliver the product of ‘Distributors Choice’ to have PAN India presence, each one of them has consistently scaled up Production Capacities, and each one of them has Economies of Scale. https://youtu.be/cBw7RiO3H5k

Companies like Asian Paints, Astral, APL Apollo Tubes, KEI Industries, Supreme Industries Ltd etc. spent heavily on Brand Building & as such these companies has the Strong Brand Moats also, hence they can always protect their profit margins in spite of the rise in the raw material price due to inflation. These companies have won the trust of their customers over the time through their Quality products and as such their customers too are willing to pay an extra premium for these products.

This is how these companies have sustained consistently their business growth, as not only did these companies were able to achieve double digit volume growth but they also have been able to grow their profit at a CAGR of anywhere b/w 20% to 30% for more than a decade.

It’s just not possible for any new company to build the Brands of this much of credibility or to create such a strong product portfolio with such a huge scale of economies, in a short period of time. How will anyone have the replica for such a big Distribution Network across the length & Breadth of the country & beyond its borders? Let us look these companies one by one:

Asian Paints Ltd.

Set up in 1942, the Asian Paints group is the largest paint manufacturer in India also engaged in the business of manufacturing of varnishes, enamels or lacquers, surfacing preparation, organic composite solvents and thinners. It operates in 15 countries and has 26 paint manufacturing facilities in the world serving consumers in over 60 countries.

Besides Asian Paints, the group operates around the world through its various brands viz. Asian Paints Berger, Apco Coatings, SCIB Paints, Taubmans, Causeway Paints and Kadisco Asian Paints.

It also manufactures metal sanitary ware such as bath, sinks, washbasins and similar articles. Recently, company introduced Lightings, Furnishings and Furniture thus adding more products in the Home décor and Interior Design category.

The Undisputed Dominant Leadership in Paint Industry

Company is the 3rd Largest Paint Co. in Asia; 9th Largest Coatings Co. in the World. Has 50+ Years of Market Leadership in India and is Leading wallpaper manufacturer under the brand NILAYA. Company is 3x of nearest Competitor in India and is in Top 3 player in decorative paints in 12 of the 14 countries outside India. https://www.screener.in/company/ASIANPAINT/consolidated/

Paint Business

The group enjoys a dominant share of over 50% in the organized domestic paints market (the second-largest player has a market share of about 16%). In the decorative paints segment, which comprises about 70-75% of the Indian paints industry, the group has a share of about 60%. It also has a healthy position in the automotive industrial coatings segment with a market share of about 20%.

Kitchen business

The industry has been witnessing a shift towards branded modular kitchen solutions from local carpenters and interior designers. The Company forayed into the Kitchen business by acquiring 51% stake in Sleek in FY 2013-14. During FY 2017-18, the Company acquired the remaining 49% stake in Sleek from the previous promoters to make it a wholly owned subsidiary. There’s huge potential for Co. as the overall market in India is estimated to be worth more than 15,000 Crores and is a fragmented market with many unorganized players.

Bath business

Asian Paints forayed into the Bath business by acquiring the front-end business of Ess Ess in FY 2014-15. Over the years, the Company has expanded its network footprint as well as the range of products it offers.

In every decade (of last 40 ~ 45 years), Asian Paints has consistently grown its revenues at around ~ 12% CAGR.

The company directly supplies its paints to approximately 55,000 retail shops across India through a huge network of depots. Asian Paints has also partnered with retailers to offer customized services. Over the last few years, the company has added hundreds of “Colour Ideas” stores, where customers can get custom advice on paint solutions for their homes from an Asian Paint’s authorized colour consultant.

Besides this, Asian Paints has consistently innovated in consumer approach by introducing colour via concepts like Colour World (Paint mixing systems where customers can choose colours from a shade card and get the required colour mixed), Royale Play, where special effects are made through various painting tools, Kids World (Fun painting ideas for kid’s rooms) and Home Painting Services which is convenient and fast.

Owing to it’s Across the verticals Leadership, Well Established & Efficient Supply Chain Network, Strong Financials, Consistent demand in the rural & small markets, Global Presence, Strong Brand Moat & Competitive Advantage, Visionary Management with Proven & an effective track record, Huge Economies of Scale & Longevity of Growth etc. Asian Paints always enjoyed High P/E multiple compared to its competitors.

3 of the key Moats which Asian Paints have are:-

- They have built the perception amongst painters & influenced them like No other paint company could.

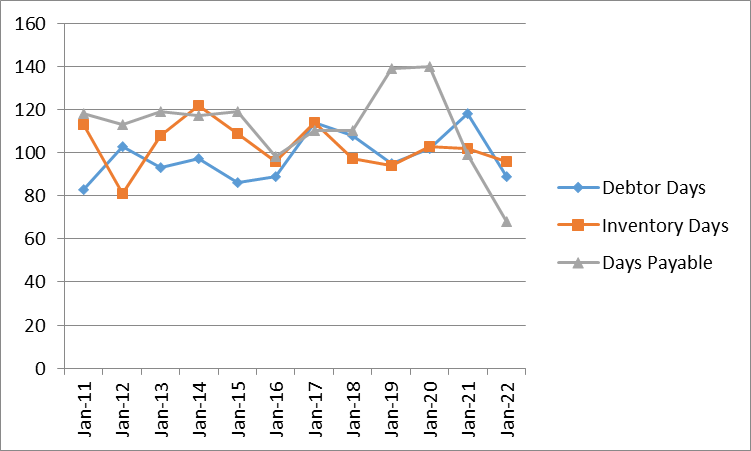

- Working Capital Management is Superior to others in their industry and this can be seen in their Inventory Turnover Ratio & Debtor Days. https://www.youtube.com/watch?v=a06obk2NLq4

- The Competitive Advantage of having Broad Network of PAN India Supply Chain & managing it efficiently 24 X 7. https://youtu.be/_SwQbgAuhc0

Revenue Breakup

Decorative Coatings – 83.70%; Industrial Coatings – 2.40%; International Operations – 11.60%; Home Improvement Business – 2.30%

Astral Ltd.

Piping Division (77% of revenues)

This is the main business of the company, it manufactures pipes and fittings for plumbing, sewerage, agriculture, industries, fire sprinklers. It also manufactures pipes for conduit & cable protection, ancillary products, urban infra and ducting. It also started manufacturing of water tanks from early 2021.

The company acquired 100% stake in Rex Polyextrusion Pvt Ltd in a stock and cash deal for ~150 crores. It makes corrugated and other plastic piping solutions.

Adhesives Division (23% of revenues)

Its adhesives business sells a wide range of products viz. Epoxy adhesives & putty, silicone sealants, construction chemicals, PVA, cyanoacrylate, solvent cements, tapes and other products.

The company entered into this business via acquisition of Resinova Chemie Limited and Seal IT Services. Resinova Chemie is situated in India while Seal IT is situated in UK and has presence in UK and USA.

International Presence

The Company has manufacturing presence in 3 countries with an export presence in 25+ countries. In FY22, it earned ~9% of its total revenues from foreign sales.

Manufacturing Capabilities

Capacity:-

Pipes – ~275,000 MTPA

Adhesives – ~96,000 MTPA

The Company owns a total of 18 manufacturing facilities in India and overseas. Its facilities are located in India, USA and UK. The capacity of piping division has increased nearly 90% since FY16. Its capacity utilization was ~57% in FY20.

Distribution Network

As per May 2022, the company has a distribution network of 2,500+ distributors and 1, 80,000+ dealers across India and foreign countries.

Expansion/ Forays

Faucets & Sanitary-ware

On 19th October, 2021, company announced

their decision to enter Faucets & Sanitary ware business. Market potential of this business is Rs.15, 000 Cr. and Mr. Atul Sanghvi, who resigned as CERA CEO in August 2021, is heading this division at Astral.

Paints

In April 2022, the company acquired 51% stake in Gem Paints Pvt Ltd under a scheme of arrangement for ~194 crores. It was founded in 1980 and has been involved in industrial and decorative coatings in South-India. It also undertook recent capacity expansion to expand capacity to 36,000 Kilo-litres.

Brand Promotion Initiatives

Astral has continuously invested in brand & promotional activities through Bollywood movies, associate sponsor of Indian Premier League teams among others. It also boarded Ranveer Singh (star) as brand ambassador of Astral pipes for 3 years. Sales/ brand promotion expenses accounted for ~3% of total turnover of the company in FY20.

4 reasons to remain bullish on Astral’s prospects in near future:

First, the demand for pipes is expected to jump due to a pick-up in construction activities and government emphasis on infrastructure.

Second, the EBITDA is expected to improve in 2023-24, supported by a better product mix.

Third, the company has also acquired a 51 per cent stake in Gem Paints, which has a strong presence in south India. It will help scale up Astral’s paints business and enable it to enter additional geographies.

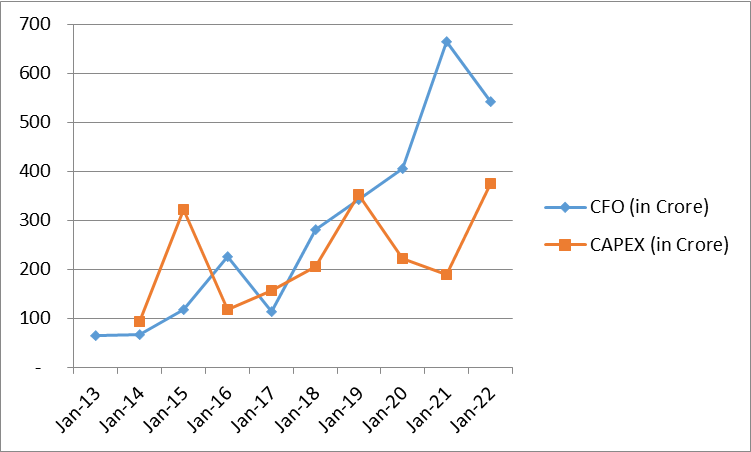

Fourth, the company has undertaken Rs.1, 000 crore of CapEx in the past five years, mostly for increasing manufacturing capacity.

Investment Takeaway

The plastic pipes business is cyclical business despite that, Astral Ltd. has grown it’s Sales Revenues at a Jaw Dropping CAGR of 23% in last 10 years whereas it’s Profits has grown at phenomenal CAGR of 29% in the same 10 years period.

Currently as the PVC prices are low, hence the current manufacturing cost is also quite low for the company. Therefore, as and when the PVC price will rise, Astral will be able to sell cheaply manufactured pipes at higher prices. Hence, the future margins may see an improvement.

In June 2022, the company announced its diversification plans. It entered into paints, sanitary ware, and faucets. It has also launched new products like valves and drainage products.

These products are likely to contribute Rs 15 billion to the sales revenue, over the next 5 years.

As a part of its diversification strategy, in May 2022 itself it has acquired a 51% stake in Gem Paints, which has a strong presence in south India.

APL Apollo Tubes Ltd.

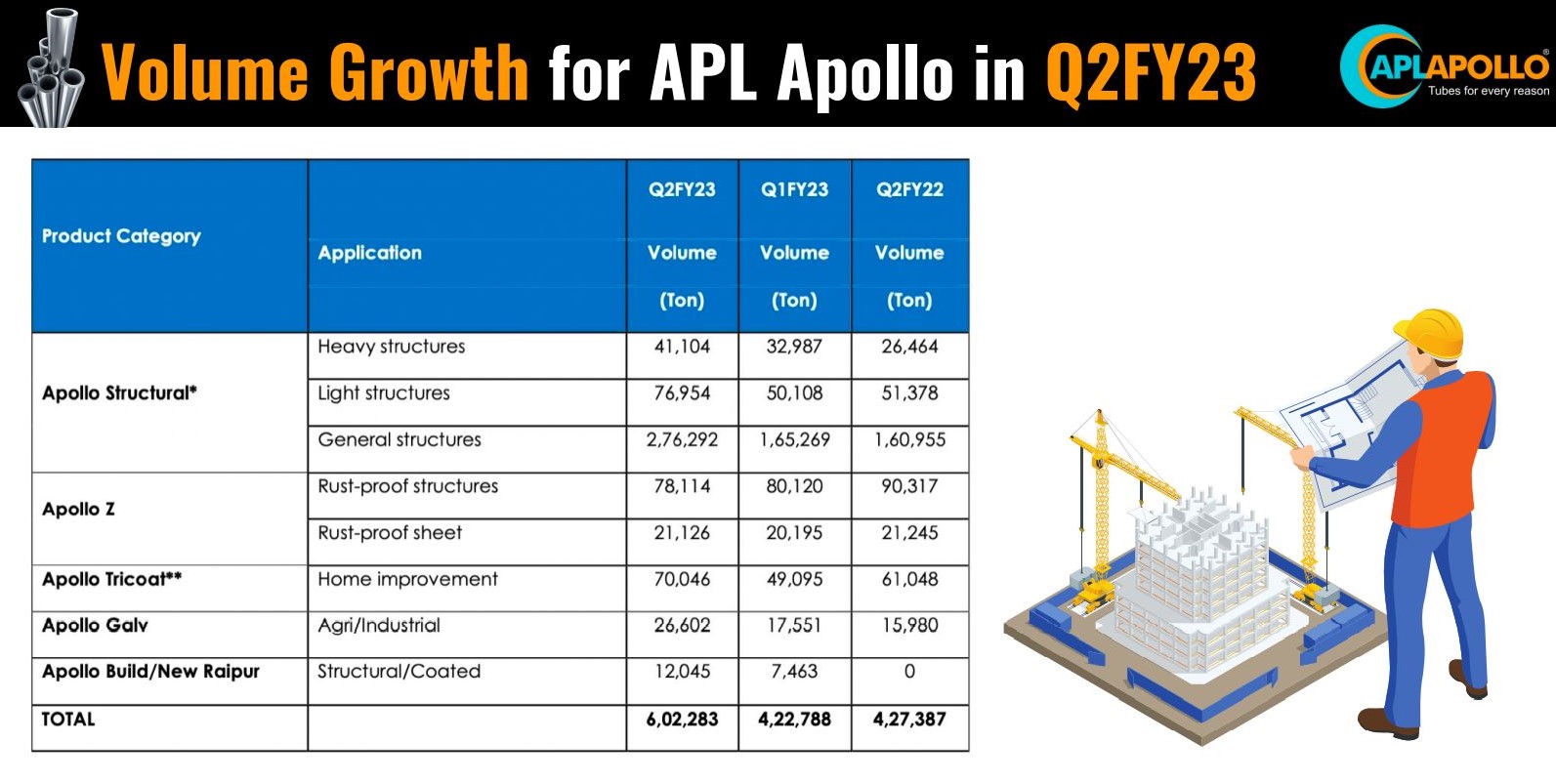

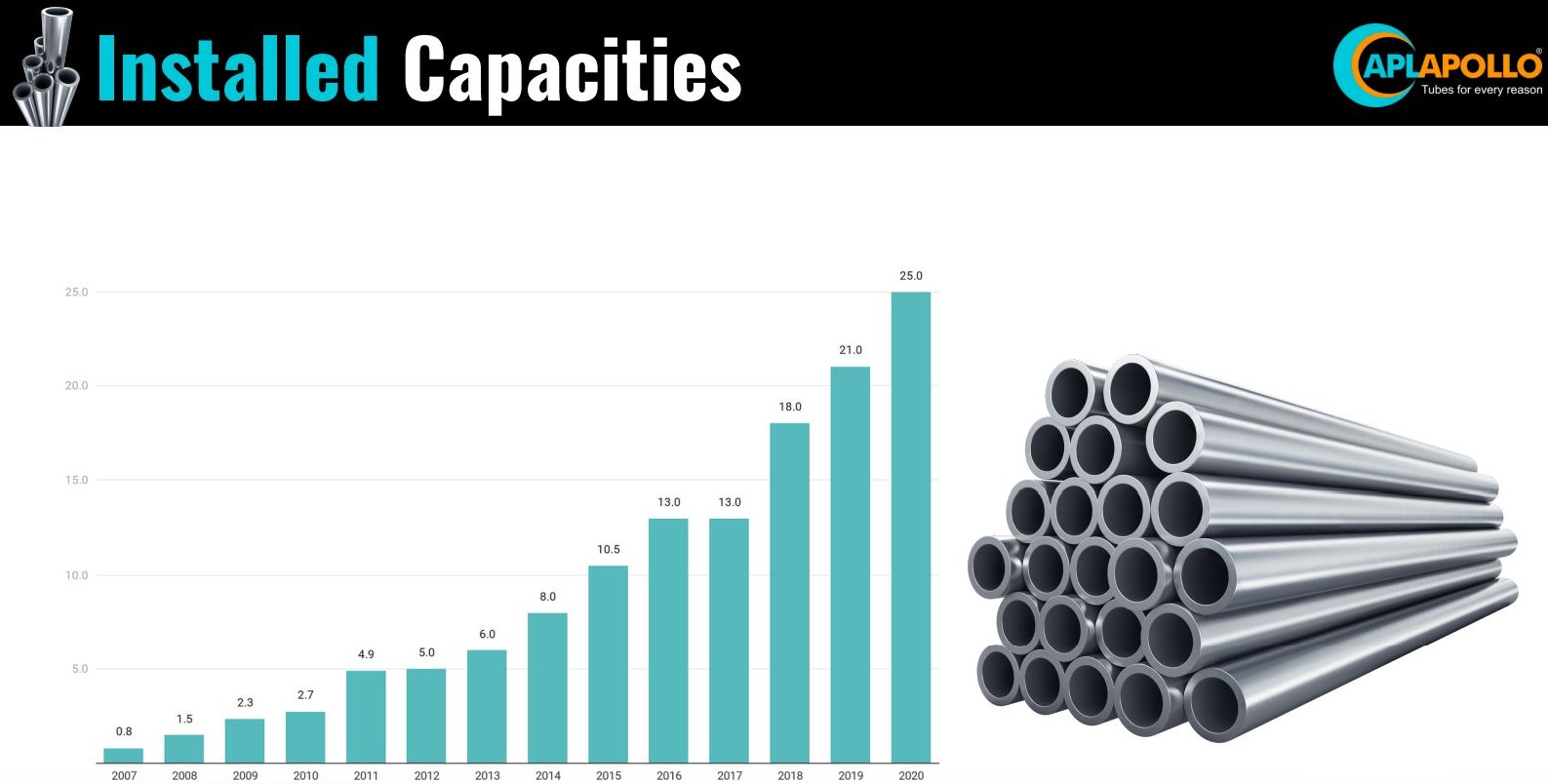

APL Apollo Tubes Limited (APL Apollo) is one of India’s leading branded steel products manufacturers. Headquartered at Delhi NCR, the Company runs 10 manufacturing facilities churning out over 1,500 varieties of MS Black Pipes, Galvanized Tubes, Pre-Galvanized Tubes, Structural ERW Steel Tubes and Hollow Sections to serve industry applications like urban infrastructures, housing, irrigation, solar plants, greenhouses and engineering.

Product Portfolio

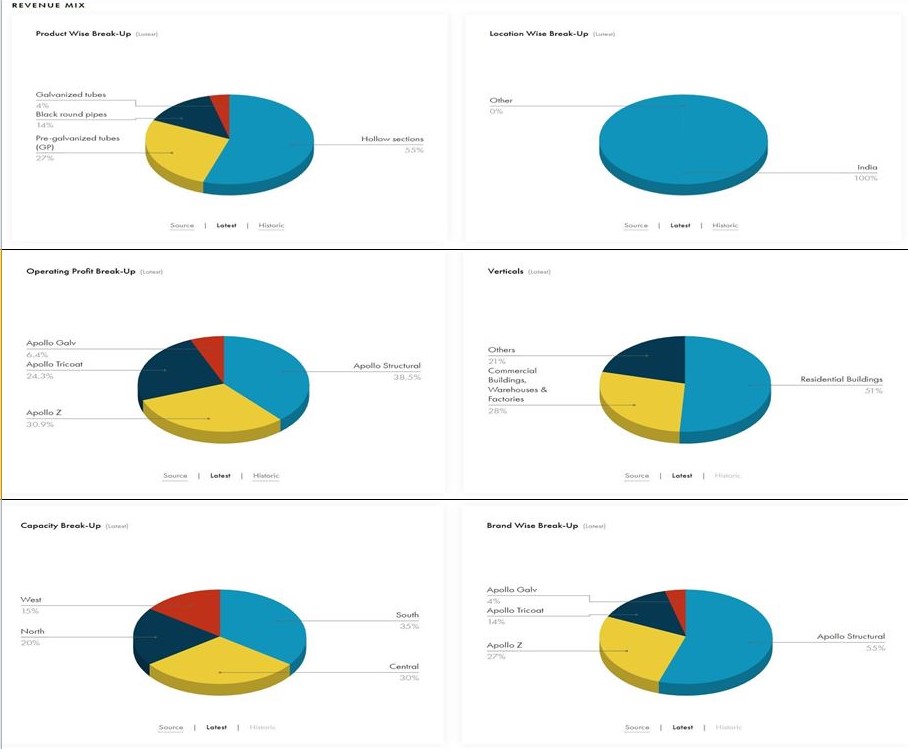

The company has well diversified operations with product portfolio comprising of 4 primary products with different specification as per the customer need in each primary product category. the categories are:- The categories are Apollo structural (63% of revenues), Apollo Z (18%), Apollo Tricoat (15%) & Apollo Galv (4%). The products find their use in buildings, houses, warehouses, factories, skyscrapers & industrial & agricultural activities.

Dominant Market Share

The company is the dominating player in the domestic market of steel construction pipes and presently commands a 50% market share in the same. Its market share has grown exponentially from 27% in FY16 to 50% in FY21.

Acquisition of Apollo Tricoat

In June 2019, the company acquired majority stake in Apollo Tricoat Tubes Ltd (BSE: 538566) through its wholly owned subsidiary Shri Lakshmi Metal Udyog Ltd.

Apollo Tricoat sells home improvement applications through its brands Tri-Coat, Plank, Signature, Elegant & Chaukhat & presently contributes 15% to company’s revenues.

Growth Drivers

Company seeks heavy growth opportunities in 4 plays. skyscrapers, infrastructure, airports & warehousing.

Distribution Network

Company has an established pan-India distribution network consisting of 800+ distributors & 50,000+ retailers & fabricators with a presence across 300 towns and cities across the country.

Manufacturing facilities

The company, with its subsidiaries, owns and operates 10 manufacturing facilities across the country. Its facilities are located in the states of Uttar Pradesh, Tamil Nadu, Chattisgarh Telengana & Karnataka.

It has a manufacturing capacity of 2.6 million tonnes which are geographically diversified with the South being at 39% followed by the West at 32%, the North at 26% and the East at 3%. Presently, it operates at capacity utilization rates of ~62%.

KEI Industries Ltd.

KEI manufactures cables and wires, with a product portfolio ranging from housing wires to Extra High Voltage (EHV) cables, and further diversifying into the Engineering, Procurement, and Construction (EPC) services for power and transmission projects.

It has a 5.2% market share in the total cables and wires industry and 7.3% in the organized cables and wires industry in FY 2018-19.

Products

It is a “one-stop solutions provider” for wires and cables, with the EPC sector further strengthening its position. Its product portfolio comprises of:

| Power Cables | Higher investments in transmission and distribution drove the demand for power transmission cables (1.1 KV onwards). Demand for extra high voltage (EHV) cables (66V onwards) increased because of higher power density, lower transmission losses, and efficient bulk-power delivery by higher voltage cables. Metro rail, high-end hospitals, hotels and shopping malls use 1.1 KV HFFR cables to ensure public safety. |

| Building Wires | Growing penetration of mobile phones and appliances in Indian households has led to an increase in the number of electrical points, thereby driving installation of building wires per households. FR cables account for the major share of the building wire segment’s demand, followed by FRLS cables and HFFR cables. |

| Solar Cables | An increase in solar capacity additions has increased the demand for solar cables used for connecting photovoltaic arrays with junction modules. |

| Control Cables | Growth in industrial automation across a wide range of industries, including automotive plants, steel, cement, oil and gas, power, pharmaceuticals, has driven the usage of control cables. |

| Flexible Cables | Growth in industrial automation across a wide range of industries, including automotive plants, steel, cement, oil and gas, power, pharmaceuticals, has driven the usage of control cables. |

| Fire Survival Cables | Fire survival cables are installed for feeding essential emergency services. These cables are used in escape route lighting, fire or sprinkler pumps, ventilation systems, pressurization systems, smoke extraction systems and fire alarm emergency systems, which are required to be in operation for reasonable time period even after the area has been exposed to fire. |

| Switchboard Cables | Growth in industrial automation across a wide range of industries, including automotive plants, steel, cement, oil and gas, power, pharmaceuticals, has driven the usage of control cables. |

Cables – Extra High Voltage (EHV) 9%, High Tension (HT) 14%, Low Tension (LT) etc. 42%.

House Wires and Winding Wires (HW and WW) 17.38% – House wires are used for wiring domestic and commercial buildings while winding wires serve a maximum range of submersible pump manufacturers and rewinders.

Stainless Steel Wires (SSW) 2.8% include covering welding wire, hard stainless steel wire, etc., for a wide range of applications.

EPC business – 16% – It offers turnkey solutions for large power and allied sector projects. It focuses on projects with significant cabling requirements to leverage economies of scale.

Manufacturing

It operates through 5 manufacturing facilities.

Expansion

To cater to additional demand for housing wires, it started commercial production of 1st phase of its new manufacturing plant at Silvassa in Dadra and Nagar Haveli in July FY 2019-20.

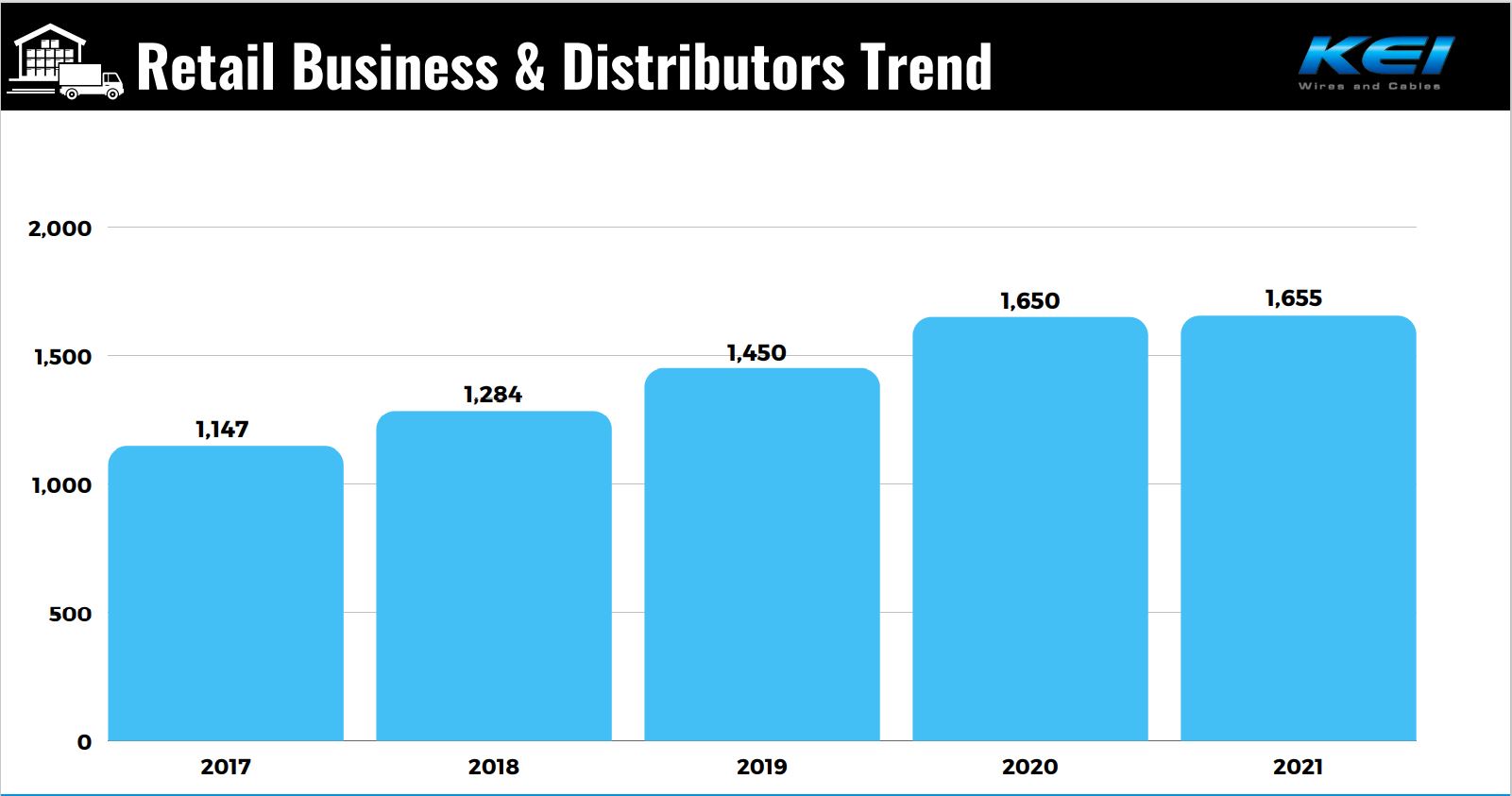

Distribution Network

It has 5000 channel partners, 38 branch offices, 22 depots, and 21 warehouses. Its retail segment has 1,650 distribution partners across India.

Customers

It addresses the cabling requirements of various sectors like Power, Oil Refineries, Railways, etc. HSBC, Infosys, etc. are some of its major customers.

Different Business Segments

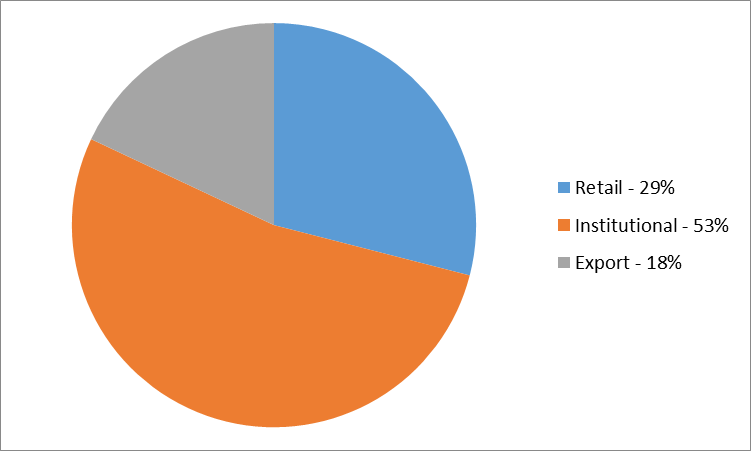

It caters to both-

1. The retail segment (29%): This comprises house wires, winding, and flexible wires, LT power cables, and HT cables.

2. The institutional segment (53%): This comprises EHV cables, HT and LT power cables, turnkey projects, and stainless steel wires.

Exports (18% revenue contribution)

It has a presence in more than 45 countries and exports EHV, MV, and LV cables to overseas customers.

Export sales in FY20 increased by 69% to Rs. 899 Crores from Rs. 532 Crores in FY19.

Recent Developments

It got a landmark order for the execution and supply of EHV cables of 400kV in FY 2020-21. This is the largest single order it received for 400kV cables.

Focus

It will focus on entering new geographies while also strengthening its presence in key existing markets such as the Middle East, Australia, etc.

It will focus on building a new authorized dealer and distribution network with an emphasis on both domestic and industrial cables and wires.

Gradual Shift of Market Share from Unorganised to Organised players in the Cables & Wires Industry

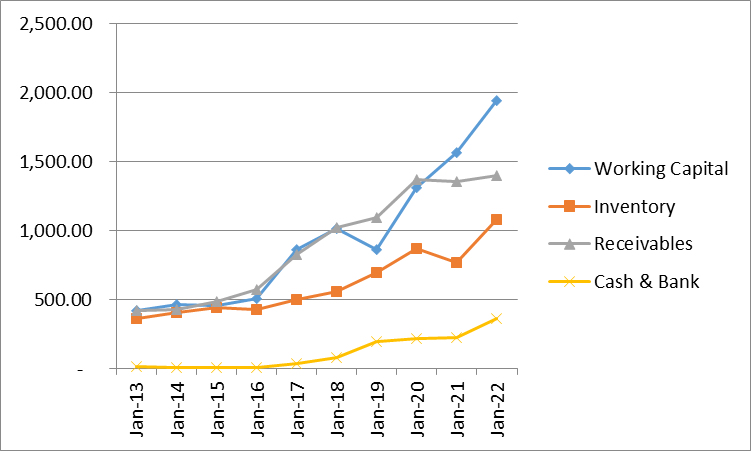

Levers for Working Capital Improvement

- Working Capital improvement with higher channel financing. (https://youtu.be/IDd0CUmUf7c)

- Increasing retail business which is lower in working capital needs.

- Declining EPC business which is high in working capital

Supreme Industries Ltd.

Supreme Industries is one of the leading plastic products manufacturing company in India having 25 manufacturing facilities spread across the country, offering a wide and comprehensive range of plastic products in India.

Business Verticals

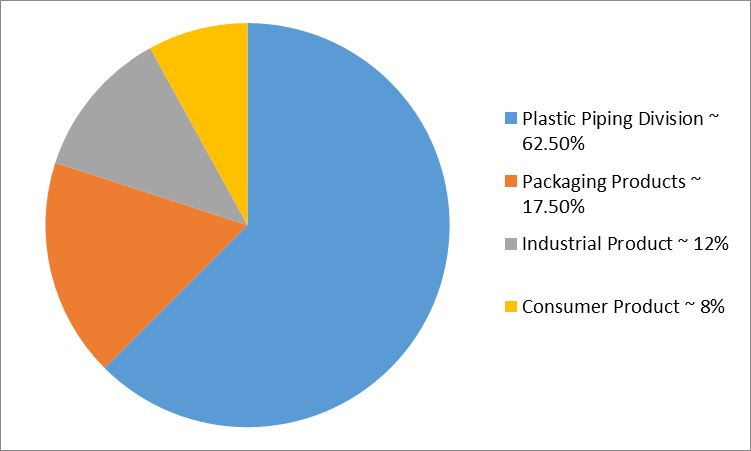

Company has four major business verticals namely Plastic Piping Division, Consumer Product, Packaging Products and Industrial Product:

Plastic Piping Division

This segment is the Major contributor of the revenue constituting 62.5% of the total sales and the major products sold under this division are PVC pipes, fittings, Toilet bath fittings, Moulded tanks and many more. The Company sold 3, 00,772 Tons of Pipe System making it as a market leader in this segment.

Packaging Products

This division contributed 17.40% of the total revenue. Flexible packaging film products, Protective Packaging Products, Cross Laminated Film products. The packaging division witnessed the highest growth of 15% attributed by strong demand from the Diary & Edible oil Industry.

Industrial Product

This Industrial division contributed 12%. Industrial Components, Material handling System and Pallets – Roto moulded crates, pallets and garbage bins and Composite LPG Cylinders are the products manufactured in this division catering to various Industries from Auto to Agriculture.

Consumer Product

The consumer product division contributed 7% with the highest profit margin among all the division. Furniture is the major products sold under this division and the product is sold through 13000+ retailers and the company is planning to add another 1500 in the coming year. The company is second largest player in the moulded Furniture with a processing capacity of 30,000 MT.

Manufacturing capacity

Supreme has 25 Manufacturing units spread across 12 different states. The company has increased its distribution network with 3567 partners across India. The company is also in the process of opening the first Plastic product complex in Telengana.

Expansion Strategy

The company is aiming to increase the share of the Value Added Products (products whose OPM is more than 17%). Currently VAP contributes 38% of turnover. Aim is to increase exports significantly over next 5 years which are at 3% currently. The company has envisaged (300-350) crores for expansion.

The company owns 30.01% stake in the Supreme Petrochemical and the company purchases various raw materials like polystyrene from the company.

The key triggers for future Growth:

- The government’s flagship ‘Nal Se Jal’ scheme (with an outlay of ~ ₹3 lakh crore over the next five years) is a big booster for the domestic plastic piping industry over the long term.

- Rising contribution of value added product in overall top line (increased from 35% in FY18 to ~38% in FY22) to keep EBITDA margin elevated.

- Company is planning a CapEx of ₹700 crore in FY23E to increase the manufacturing facility by 11% YoY to ~8 lakh tonnes and model revenue CAGR of 12% led by 17% volume CAGR over FY22-24E.

Supreme Industries’ Q2FY23 performance was weak on the EBITDA margin front. Inventory losses amid sharp fall in the PVC prices (fall by 40% from April 2022) has dragged consolidated EBITDA margin down to 7.1% (vs. ~15% pre-Covid margin).

The Encouraging Demand Outlook and Margin Tailwinds:

EBITDA margin is expected to bottom out in FY23 and shall be back to its pre-Covid level by FY24 onwards, supported by the followings:

- Stable PVC Prices.

- New Product Launches in the Value Added Products Segment.

- Improved Operating Leverage.

- Decline in Crude Oil Prices (from 122$/Barrel in June 2022 to 82$/Barrel at present)

The management expects strong demand of piping products from H2-FY23 led by the recovery in the rural demand & as such SIL’s piping segment may report a volume CAGR of 19% over FY22-24E supported by revival in agri, housing and infrastructure pipe demand.

Government sponsored schemes such as Nal Se Jal Mission, Swatch Bharat Abhiyan, sanitation, affordable housing, can be the key catalysts for SIL’s volume growth in the near future. Therefore, revenue & earnings may grow at a CAGR of 12% & 3% respectively, over the FY22-24E led by piping segment revenue CAGR of 12%. At present – “Inventory losses, led by a steep fall in raw material prices, curbed the profitability. Hence, the Gross, EBITDA and PAT margins shrank respectively 830bps, 906bps and 793bps y/y to 23.2%, 7.1% and 3.9%.” (https://www.livemint.com/market/stock-market-news/debtfree-multibagger-stock-turns-rs-1-lakh-to-rs-1-19-cr-should-you-buy-11662550501396.html)

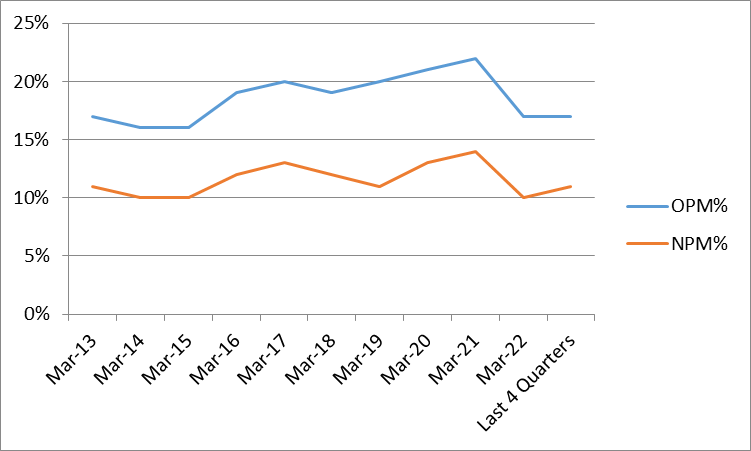

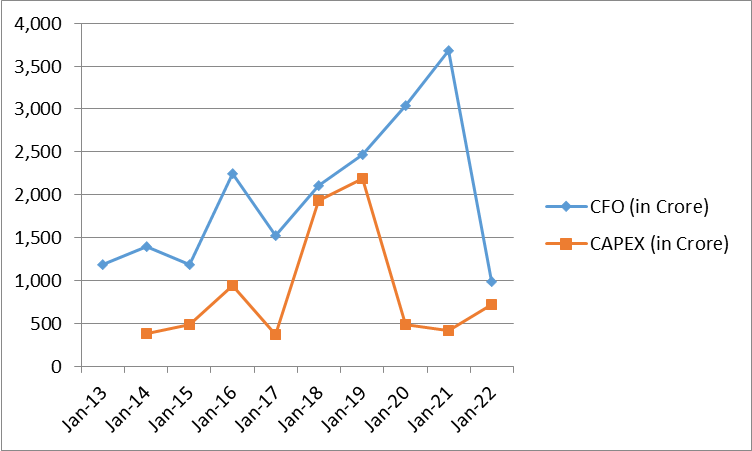

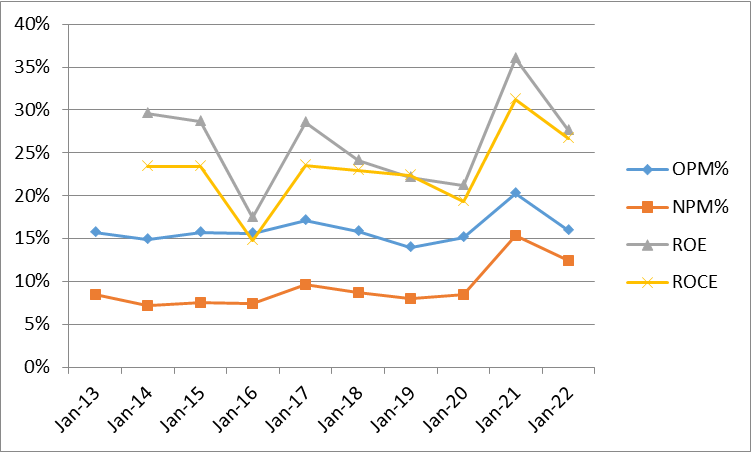

Company consistently generated FCF (FCF/CFO ~ 56% in 10 years), OPM in excess of 15%, NPM ~ (10% to 15%), ROE (20% to 36%) & ROCE (20% to 30%).

In fact, compared to 5 years & 3 years compounded Profit Growth of 18% & 34% respectively, stock price has given returns of 17% & 30% respectively in the same period. Therefore compared to its peers, SIL is fairly valued & still has lot of upside for good returns.

Frequently Asked Questions (FAQs)

Is Asian Paints good for long-term investment?

Asian Paints has got the Brand MOAT through which it enjoys Pricing Power; it has Innovative & Niche Product Portfolio. Company has wide & efficient Distribution Network and delivers the product of ‘Distributors Choice’ to have PAN India presence, and it has consistently scaled up Production Capacities, and has Economies of Scale.

Due its Strong Brand Moat, Asian Paint can always protect its profit margins in spite of the rise in the raw material price due to inflation. Company has won the trust of its customers over the time, through its Quality products, and as such customers also are willing to pay an extra premium for these products.

Is Astral a good buy for long term?

4 reasons to remain bullish on Astral’s prospects in near future:

First, the demand for pipes is expected to jump due to a pick-up in construction activities and government emphasis on infrastructure.

Second, the EBITDA is expected to improve in 2023-24, supported by a better product mix.

Third, the company has also acquired a 51 per cent stake in Gem Paints, which has a strong presence in south India. It will help scale up Astral’s paints business and enable it to enter additional geographies.

Fourth, the company has undertaken Rs.1, 000 crore of CapEx in the past five years, mostly for increasing manufacturing capacity.