7 Key Parameters you should look for, when buying the Stocks for Long Term Investment : 1. Share Holders Friendly Promoter. 2. High Corporate Governance. 3. Management Capabilities. 4. Long Term Tailwind for their Sector. 5. Strong Moat or High Entry Barriers. 6. Rock Solid last 10 years Financials. 7. Vision to Scale up globally.

7 Key Parameters you should look for, when buying the Stocks for Long Term Investment

Have you ever wonder about what might be the common findings in the Multibaggers Stories of stocks like Asian Paints, Astral Pipes, APL Apollo Tubes, SRF Ltd., Vinati Organics, LTI, Deepak Nitrite, Relaxo Footwear, Alkyl Amines Ltd., CDSL Ltd., PI Industries, KEI Industries, Polycab India Ltd., Divi’s Lab, Happiest Minds Ltd., Lal Pathlab Ltd., Gujarat Gas Ltd., Supreme Industries Ltd., Sumitomo Chemicals India etc.?

Well they all have:

- Trustworthy & Share Holders Friendly Promoters

- High Corporate Governance Standards

- Management’s Proven Execution Capabilities

- Long Term Tailwind for their Sectors to ensure Organic Structured Growth of the company

- Sector Leader either through Strong Moat of the Business or through the High Entry Barrier in Niche Category of Product or Services.

- Rock Solid Financials (Balance Sheet, Cash Flow, & Earning Statements)

- Vision to Scale up globally across the products & services range.

Trustworthy & Share Holders Friendly Promoters

It’s very important that you invest ONLY in companies with Trustworthy Promoters who not only shares their wealth by way of Dividends Distribution, Bonus Shares & Buy Backs from time to time, but also they don’t have any past legal or fraud issues with Related Party Transactions or involvement in any kind unscrupulous activity, to use public money for private gains.

Promoters must always come forward & share disclosure, whenever any, regarding any unexpected loss or under performance of the company due to any reasons, so that shareholders are always kept informed regarding their investment related returns potential in the nearby future.

Promoters MUST have excellent Capital Allocation strategies to execute along with their management team, which will ensure higher ROCE for their business, besides this following check list must be tick to decide whether the promoters are Trustworthy or Not:-

- Are there Part time Chairman, CEO, CFO or other Key Executives, too frequently?

- Is Salary & Perks of Company Auditor’s is Increasing Faster than the Company’s earnings growth?

- Is there any Unrelated Merger & Acquisitions with the parent company?

- Are there frequent resignations of the Directors, CFO, Company Secretary, Auditors in last one year?

- Is company doing Unnecessary Foreign Acquisitions?

- Is there continuous down grade in the company’s Credit Ratings?

- Is company showing major part of its earnings overseas in it’s Annual Report (as it is easy to book fake transactions in Tax-Free Jurisdictions)?

- Are there any Political Connections of the company promoters, especially if the company belongs to sectors like – Iron Ore mining, Oil & Gas, Realty & Constructions, Transport & Logistics, Liquor etc. ?

- Was there any Defaults related to interests payment in the past?

- Is the company’s auditor trying Financial Manipulation through Creative Accounting?(https://www.linkedin.com/pulse/creative-accounting-how-unravel-cooked-books-justice-egege)

High Corporate Governance Standards

Most of the Business in our country has issues regarding Financial Reporting & Accountability by the Board of the Directors. It has been observed very often (especially during the heavy liquidity in the market) that lots of IPOs start pouring into the market & most of them has common agenda to raise capital from the market at Higher Valuations by projecting the wrong picture of the company’s Performance & Profitability.

Bad Governance often also exemplified by allotment of promoter’s share at preferential prices disproportionate to the market value & thereby affecting minority shareholders’ interests.

Heavy share holding pattern of FIIs & DIIs is seen normally in the company’s with very high standards of corporate governance.

Companies which ensures that self-regulations are in place to prohibit activities like Insider Trades, are able to gain shareholders trust & thereby easily able to raise capital whenever required and hence sustained their business’s growth.

Clarity & Transparency play a vital role in keeping the benefits of all the share holders protected.

Management’s Proven Execution Capabilities

Management Execution Capabilities gets demonstrated by:

- How fast & how much has the company been able to grow its revenues in various categories of products & across the geographies. In short, has the revenues been increasing consistently in last 10 years or not?

If yes, than this shows that the management never fall short of the ideas to innovate & launch new range of products & services, or to scale up into new geographies, or to enter into new niche product category.

It also shows, with certainty, that revenues has either increased due to planned CapEx or through acquisitions & mergers or the company has taken over the bigger market share by eating up the share of its competitors. Sometimes, company also enjoys Pricing Power which helps in generating the extra revenues.

- Has the company been able to manage OPM in excess of 15% consistently in last 10 years & is it higher than the peers in its sector?

If yes, than the company has grown its Core Operations really well much better than its peers. If the sales revenue hasn’t increased but still the OPM is increasing, than the company has really managed its Cost of Goods Sold & Total Operating Expenses, to ensure consistently higher OPMs.

- Has the company been able to manage NPM in excess of 10% consistently in last 10 years?

If yes, than this means that the interest cost is either NIL or Low and/or the Tax Outflow has decreased over the period of time due to it’s lower tax liabilities (e.g. reduction in corporate tax or Import duty by the govt.)

- Is the 10 years cumulative CFO equals to/higher than 10 years cumulative PAT or is it Lower than it?

If lower, than either the cash is getting stuck in the working capital (inventory or trade receivables) or there may be higher non-operating/other incomes like interest income, dividend income, rental income and profits on the sale of investments etc. during past 10 years. (https://www.drvijaymalik.com/understanding-cash-flow-from-operations-cfo/)

- How much Free Cash Flow (FCF) did the company generated in last 10 years compared to cumulative 10 years CFO? (https://www.investopedia.com/terms/f/freecashflow.asp)

- *Most importantly, look at how the Compounded Sales Growth and Compounded Profit Growth have been in last 10 years, 5 years, 3 years & TTM for the company.

If the trend shows that the Growth is in Increasing both sales wise & profit wise, than the same will also be reflected in its stocks price returns on past 10 years period.

It may be noted that even if a company does better than the other company on OPM, NPM, FCF etc. fronts, than also it may be having inferior Compounded Sales Growth and Compounded Profit Growth trends in last 10 years, 5 years, 3 years & TTM, compared to the other company.

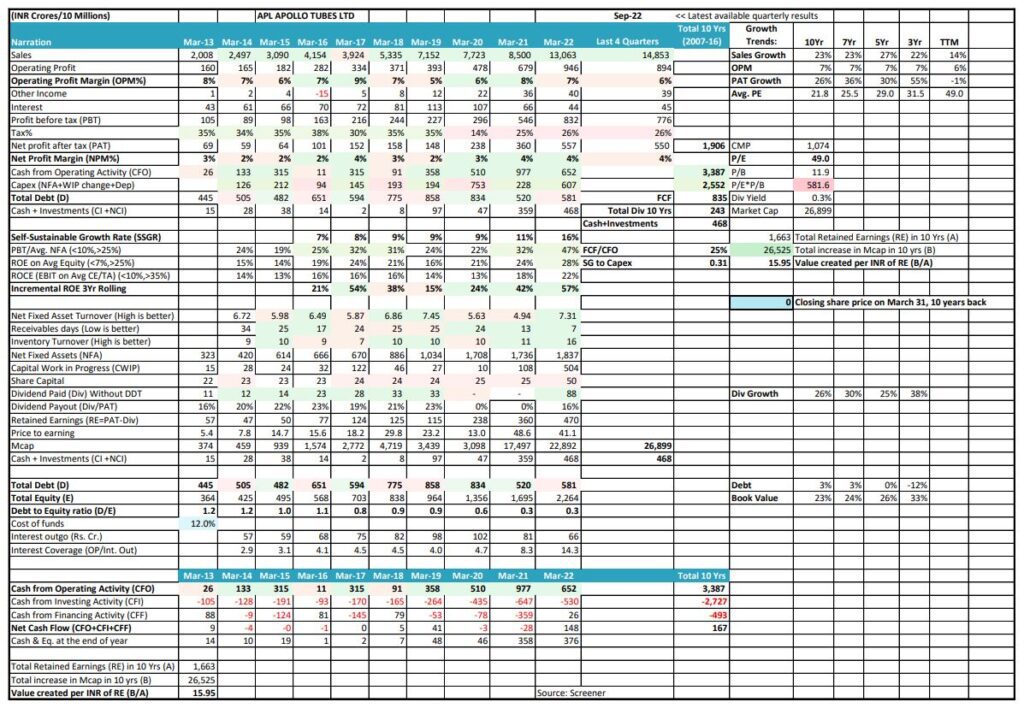

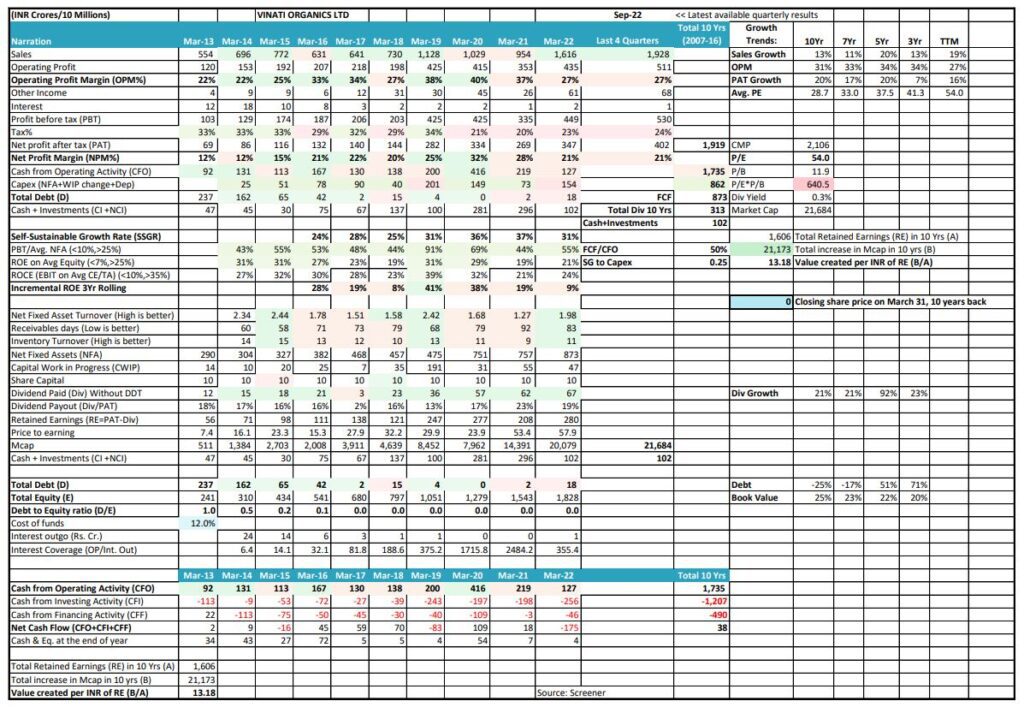

To illustrate the same, let’s take an example of APL Apollo Tubes Ltd. & Vinati Organics Ltd., Whereas Vinati Organics does much better on OPM, NPM and FCF metrics (see images attached) compared to APL Apollo Tubes, but still stock of later has given the returns at 51% CAGR on 10 years period compared to 43% CAGR return of the former in the same interval, due to its higher compounded profit returns (27% on 10 years) compared to Vinati’s 20% CAGR.

Long Term Tailwind for their Sectors to ensure Organic Structured Growth of the company

In the excel sheet attached, All the Outperformer Stocks has few things in common:

- They all have outgrown their sectors by huge margin.

- They consistently grown their Profits (EPS) higher compared to their Peers.

- They have either the Strong Brand Moat or there are High Entry Barriers to their Business.

- Their Growth is Organic & has Multi Decade Longevity to the products or services they are offering.

- And that the Promoters & the Management of the company are ambitious enough to scale up the business consistently over the years through heavy CapEx.

Now let’s look some of the facts which will hint about the Long Term Tailwinds for some of the sectors:-

IT & Technology Companies

Fortune 500 companies are spending heavily not only to digitise their business but also looking forward to spend on to new areas of technologies like Artificial Intelligence, Data Analytics, Data Science, Big Data, Machine Learning etc. so as make their businesses agile and cloud adaptive.

IT has become the core part of their growth engine. Companies realising that they need to invest into technology to drive their growth going forward or else, they could be left behind by competition. Therefore even if there is a slowdown in US or Europe for a while, then also this time Fortune 500 companies are unlikely to cut back on their IT budgets.

That is why Q2 FY (2022-23) results of the companies like LTI, Mindtree, LTTS etc. beats the market expectations as the Net Profit of these companies is still growing at (24% ~ 28.5%) whereas revenues has gone up (28% ~ 32%), during the times when these stocks has already corrected around 30% to 40% from their all-time highs in the beginning of 2022.

Chemicals Companies

India is the 6th largest producer of the chemicals in the world & its 80,000 commercial products can be divided into bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers etc.

India is a global leader in chemical exports and imports, ranking 14th in the exports and 8th in the imports. Domestic demand recovery and strong exports will drive a 50% YoY manufacturers’ CapEx in fiscal 22 to US$ 815-842 m and despite a drop in the demand for polymers (as a result of the COVID-19 pandemic) India is likely to witness growth to 32 m tonnes by 2030 in agrochemicals and pesticides.

To stimulate domestic agrochemical manufacturing, the government proposes to implement a production-linked incentive (PLI) scheme. The Department of Chemicals and Petrochemicals was given US$ 27.43 M in the Union Budget 2022-23.

It is expected that Speciality Chemicals companies may have aggregate growth of 34% in revenue & 40% increase in Operating Profit on YOY basis, whereas Net Profit may rise 42% YOY during FY (2022-23).

This sector is expected to remains in sweet spot owing to robust domestic demand, rising import substitution opportunities & a strong growth in exports. Further, growing costs within china due to environment-related issues, China plus One Theme along with the Government’s ‘Make in India’ initiative are some of the reasons that this whole sector looks attractive. Refer Quarterly result comparisons of Vinati Organics, SRF, Alkyl Amines Ltd., Deepak Nitrite Ltd.

Building Material Theme

Asian Paints in spite of having sale of 21k~22k Cr, still has volume growth of around 10 to 12%.

Astral Ltd. & APL Apollo Tubes Ltd. has grown their Sales Revenues at a Jaw Dropping CAGR of 23% & 25% respectively in last 10 years whereas the their Profits has grown at phenomenal CAGR of 29% & 27% respectively in same 10 years period.

KEI Industries Ltd., Polycab India Ltd., Havells India Ltd. All Belongs to Cables & Wires Sector, which has 22% of Volume Growth from 2020 to 2022, in spite of the fact that the biggest sectors like Infrastructure & Real Estate where cables & wires are mostly consumed, haven’t’ seen much growth.

So, what led to these successful stories (in brief)?

What Pidilite is to Carpenters, so is Asian Paints to Painters, Astral Ltd. to Plumbers and APL Apollo Tubes to Fabricators. These companies targeted to capture the perception of Carpenters, Painters, Plumbers and Fabricators respectively which then attracted the customers for these companies.

Whereas KEI’s 51% of revenue growth comes from Institutional Business alone for whom it makes extra heavy voltage cables which only 2 companies at present has got approvals to make in India one is KEI & another is Universal Cables Ltd. Even Polycab India Ltd. hasn’t got the same approvals at present, for which it has been trying for quite some time. So, KEI clearly enjoys that High Entry Barrier to its advantage. Asian Paints, Astral, APL Apollo Tubes, KEI Industries, Polycab India, Supreme Industries etc. ALL has got Brand MOAT through which they enjoys Pricing Power, each one of them has Innovative or Unique Product Portfolio, each one of them either has their own Distribution Network or they deliver the product of ‘Distributors Choice’ to have PAN India presence, each one of them has consistently scaled up Production Capacities, and each one of them has Economies of Scale.

Sector Leader either through Strong Moat of the Business or through the High Entry Barrier in Niche Category of the Product

In the pic above, companies like Titan Company, Asian Paints, Astral, APL Apollo Tubes etc. enjoys the Strong Brand Moats so they can always protects their profit margins in spite of the rise in the raw material price due to inflation. These companies have won the trust of their customers over the time through their Quality products and as such their customers too are willing to pay an extra premium for these products.

This is how these companies have sustained consistently their business growth, as not only did these companies were able to achieve double digit volume growth but they also have been able to grow their profit at a CAGR of anywhere b/w 20% to 30% for more than a decade.

It’s just not possible for any new company to build the Brands of this much of credibility or to create such a strong product portfolio with such a huge scale of economies, in a short period of time. How will anyone have the replica for such a big Distribution Network across the length & Breadth of the country & beyond its borders?

Contrary to these Strong Moats companies, are the companies like CDSL, IEX, Paushak, Gujarat Gas, (Alkyl Amines and Balaji Amines), KEI, Route Mobile etc. which either enjoys the monopoly or duopoly in the market, due to High Entry Barriers in their business. As such there isn’t much threat to their Growth due to competition.

Take the case of Gujarat Gas it is India’s largest player in City gas Distribution with 27 CGD Licenses across 43 districts in 6 states, similarly Paushak is India’s largest phosgene based speciality chemicals manufacturer.

Vinati Organics in IBB & ATBS, Fine Organics in Oleochemicals-based niche additives, Deepak Nitrite in (xylidines, cumidines, and oximes) are not only market leaders in India but are also one of the top global players in their industries. Similarly, PI Industries is the biggest producer of generic molecules like Profenofos, Ethion and Phorate in India. These companies heavily invest on R & D activities and earns majorly from their Niche products only.

Rock Solid Financials (Balance Sheet, Cash Flow, & Earning Statement)

Balance Sheet Analysis

- Net Fixed Assets (NFA) – Good companies consistently does capacity addition & thereby increases their Net Fixed Assets, this leads to consistently increasing Sales revenues. E.g., Astral Ltd. has increased its NFA from 109 Cr. in March 2011 to 1878 Cr. in Sept. 2022 i.e. 17.23 times.

- Capital Work in Progress (CWIP) – Increase in CWIP means that the company is executing any project/capacity expansion and once the under construction project is complete; it is shifted from CWIP to NFA.

- Share Capital – Increase in share capital over the years, which is not due to the Bonus Shares, represents dilution of the stake of existing shareholders. E.g., Share Capital of Asian Paints has remained at 96 Cr. from March 2011 to Sept. 2022, whereas that of Astral Ltd. has increased little from 11 Cr. in March 2011 to 15 Cr. in March 2020 and 20 Cr. in March 2021 & thereafter remains constant, reasons being Astral Ltd. has given Bonus shares on these 2 occasions.

- Dividend Paid Out – Company generating FCF may use it fully to re-invest in its core operations if the size of opportunity for growth is huge, else it may partly shares it with its shareholders.

- Retained Earnings (RE = PAT – Dividend) – If the Cumulative RE of the company over the period of, say 10 years, is less than the Increase in Market Capitalization over the said period of 10 years than, Company has created wealth for its shareholders, e.g. In case of SRF, company’s total RE in 10 last years was 5703 Cr. whereas its market Cap has Increased by 66,472 Cr. therefore, SRF created value of 11.65 for every INR of its RE.

- Price to Earnings (P/E) – this needs elaboration so use this link https://www.investopedia.com/terms/f/forwardpe.asp

- Cash + Investments – High Cash level is not a good sign as either it may be fictitious or the management doesn’t have the idea to allocate it. Prefer companies that frequently re-invest surplus cash on the balance sheet it in its core business.

- Total Equity – It includes paid up capital and reserves including RE’s. Compare the Increase in Equity with the RE for the year; they should approximately ~ be the same.

- Debt to Equity ratio (D/E) – More than this ratio it is important to check whether there is sufficient Interest Coverage & FCF. As there have been cases where the company had low D/E, but still faced financial stress as the Operating Profit & Cash was Not Sufficient to meet the debt obligations.

- Interest Coverage – It represent the servicing ability of the company for the total interest outgo, including P & L, capitalized interest.

Free cash Flow Analysis

- CFO – See whether CFO is in increasing trend or not in past 10 years. If CFO is frequently lesser than reported PAT, than the funds are getting stuck in the working capital.

- Capex (NFA+WIP+Change+Dep) – Compare Capex with CFO to see whether company is able to fund its capital expansion through its operating cash flow. Prefer companies that can show high sales growth without much Capex i.e., Not a capital intensive business model.

- FCF – avoid companies that are not able to generate FCF & see how the company further allocates its FCF? Does it Re-invest FCF to expand its core operations or promoters use it for their personal gains only.

Return Ratios

- ROCE {EBIT/ (Total Assets – Total Current Liabilities)} – prefer companies whose ROCE is higher than its Cost of Borrowing Capital. (https://getmoneyrich.com/cost-of-capital/) ROCE does not consider profit margins alone, but also considers the amount of capital utilised for those profits to happen.

It is possible that a company’s profit margin is higher than that of another company, but its ability to get better returns on its capital may be lower.

- Operating Efficiency Ratios

- Net Fixed Turnover Ratio – High NFAT shows that company is using its Fixed Assets very efficiently and does not require to do lot of Capex.

- Receivable Days – Lower the receivable days better it is for the company to collect cash faster and thereby reduce the short term working capital liability to run its day to day business activities.

- Inventory Turnover Ratio – Lower IT ratio either is a sign of weak sales or company is accumulating a lot of inventory. It could indicate problem either with retails chain’s merchandising strategy, or inadequate marketing.

A low IT ratio can be an advantage during periods of Inflation or Supply Chain Disruptions, if it reflects an inventory increase ahead of supplier price hikes or higher demand.

Other Ratios & Metrics

- Cash Conversion Cycle – This metric takes into account the time needed for the company to sell its inventory, along with the time required to collect receivables and the time company is allowed to pay its bills without incurring any penalty.

A company can acquire inventory on credit, which results into accounts payable and similarly a company can also sell products on credit, which results in account receivable. Therefore, cash isn’t a factor until the company pays the accounts payable and collects the accounts receivable. Timing is thus an important aspect of cash management.

Essentially, CCC represents how fast a company can convert the invested cash from start (investment) to end (returns). The lower the CCC, the better it is.

e.g., CCC for Astral Ltd. is 20.5 Days whereas for APL Apollo Tubes it is Just 2.65 days and for Alkyl Amines Chemical it is 36.2 Days (compared to 106 days for its competitor Balaji Amines)

- Piotroski Score – https://www.investopedia.com/terms/p/piotroski-score.asp

Vision to Scale up globally across the products & services range

Promoters & Management team should aim to become truly global, high-performing organisation through innovation and delivering unmatchable quality products and services to its customers and thereby attaining highest leadership position in the industries, they operate in.

They should be passionate to get recognised for the excellence, governance, customer delight, & building long term relationship with all their partners, including shareholders.

Their values must define their conduct with customers, partners, shareholders, employees, and the society.

Frequently Asked Questions (FAQs)

What should I look for when buying the stocks for long term investments?

You may look at these 7 key parameters before buying a stock for long term investing:

Trustworthy & Share Holders Friendly Promoters

High Corporate Governance Standards

Management’s Proven Execution Capabilities

Long Term Tailwind for their Sectors to ensure Organic Structured Growth of the company

Sector Leader either through Strong Moat of the Business or through the High Entry Barrier in Niche Category of Product or Services.

Rock Solid Financials (Balance Sheet, Cash Flow, & Earning Statements)

Vision to Scale up globally across the products & services range.

What is ROCE?

It equals to {EBIT/ (Total Assets – Total Current Liabilities)} – prefer companies whose ROCE is higher than its Cost of Capital. ROCE does not consider profit margins alone, but also considers the amount of capital utilised for those profits to happen.

It is possible that a company’s profit margin is higher than that of another company, but its ability to get better returns on its capital may be lower.

What is Cash Conversion Cycle?

This metric takes into account the time needed for the company to sell its inventory, along with the time required to collect receivables and the time company is allowed to pay its bills without incurring any penalty.

A company can acquire inventory on credit, which results into accounts payable and similarly a company can also sell products on credit, which results in account receivable. Therefore, cash isn’t a factor until the company pays the accounts payable and collects the accounts receivable. Timing is thus an important aspect of cash management.

Essentially, CCC represents how fast a company can convert the invested cash from start (investment) to end (returns). The lower the CCC, the better it is.